Global Spunbond Market

Market Size in USD Billion

CAGR :

%

USD

13.18 Billion

USD

21.65 Billion

2024

2032

USD

13.18 Billion

USD

21.65 Billion

2024

2032

| 2025 –2032 | |

| USD 13.18 Billion | |

| USD 21.65 Billion | |

|

|

|

|

Spunbond Market Size

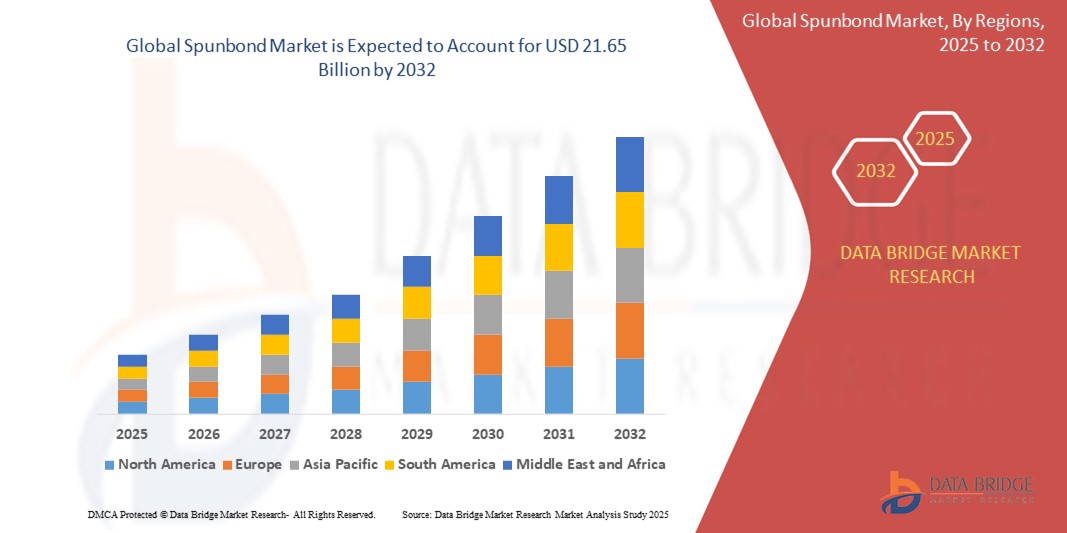

- The global spunbond market size was valued at USD 13.18 billion in 2024 and is expected to reach USD 21.65 billion by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is largely fuelled by the increasing demand for nonwoven fabrics in hygiene products, medical textiles, agriculture, and packaging industries, along with advancements in polymer processing technologies that enable the production of high-performance spunbond materials

- Rising awareness of health and hygiene, especially in the post-pandemic era, has significantly accelerated the demand for spunbond fabrics in applications such as surgical masks, disposable gowns, and filtration products, contributing to sustained market expansion

Spunbond Market Analysis

- The global spunbond market is witnessing robust expansion owing to its widespread adoption in disposable hygiene products such as baby diapers, adult incontinence products, and feminine hygiene items. The superior tensile strength, durability, breathability, and lightweight properties of spunbond fabrics make them highly suitable for these applications

- In addition, the growing demand for cost-effective and eco-friendly alternatives in industrial and medical textiles is contributing to market growth. The spunbond process offers a high production speed and uniformity of web formation, which enhances efficiency and material quality

- North America dominated the spunbond market with the largest revenue share in 2024, fuelled by strong demand from the hygiene, automotive, and construction sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global spunbond market, driven by rapid industrialization, expanding hygiene product manufacturing, and increasing investments in nonwoven technologies across countries such as China, India, Japan, and South Korea

- The fine denier PET segment dominated the market with the largest revenue share in 2024, driven by its superior mechanical properties, lightweight structure, and excellent breathability, making it a preferred material across hygiene and medical applications. Its compatibility with high-speed production processes and cost-effectiveness has led to widespread use in disposable products such as surgical gowns, diapers, and face masks

Report Scope and Spunbond Market Segmentation

|

Attributes |

Spunbond Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Spunbond Market Trends

“Increasing Demand for Biodegradable and Sustainable Spunbond Nonwovens”

- The global push toward eco-friendly products is driving demand for biodegradable spunbond nonwovens across industries such as hygiene, agriculture, and packaging

- Manufacturers are increasingly using bio-based polymers such as polylactic acid (PLA) to develop spunbond fabrics that align with sustainability goals

- Environmental regulations and corporate sustainability commitments are encouraging the use of renewable raw materials in nonwoven production

- The trend is shaping innovation strategies, with companies expanding their green product portfolios to meet consumer preferences

- For instance, Freudenberg Performance Materials launched sustainable spunbond fabrics for hygiene and medical use, highlighting the shift toward biodegradable alternatives

Spunbond Market Dynamics

Driver

“Growing Adoption in the Hygiene and Medical Sectors”

- Spunbond nonwovens are widely used in diapers, sanitary products, and medical disposables due to their softness, breathability, and strength

- Increasing global health awareness and hygiene standards are driving demand for high-performance nonwoven materials

- The pandemic highlighted the need for reliable medical PPE, significantly boosting spunbond usage in masks, gowns, and drapes

- Aging populations, especially in countries such as Japan and Germany, are fueling the consumption of adult incontinence and hygiene products

- For instance, Berry Global expanded its spunbond production lines during the COVID-19 crisis to meet the soaring demand for protective medical fabrics

Restraint/Challenge

“Volatility in Raw Material Prices”

- Spunbond fabrics primarily rely on petroleum-based polymers such as polypropylene and polyester, making the market sensitive to oil price fluctuations

- Price instability affects production costs, limiting profit margins for manufacturers and impacting the overall market stability

- Supply chain disruptions caused by global crises or geopolitical conflicts can exacerbate shortages of essential raw materials

- Smaller players face difficulty competing with larger firms in managing cost shocks and maintaining price competitiveness

- For instance, In 2022, global polypropylene prices surged due to supply shortages and rising crude oil prices, significantly affecting nonwoven manufacturers' cost structures

Spunbond Market Scope

The spunbond market is segmented into three notable segments based on type, nylon raw material, and application.

• By Type

On the basis of type, the spunbond market is segmented into fine denier PET and nylon. The fine denier PET segment dominated the market with the largest revenue share in 2024, driven by its superior mechanical properties, lightweight structure, and excellent breathability, making it a preferred material across hygiene and medical applications. Its compatibility with high-speed production processes and cost-effectiveness has led to widespread use in disposable products such as surgical gowns, diapers, and face masks.

The nylon segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its high tensile strength, elasticity, and resistance to abrasion. Nylon spunbond fabrics are increasingly used in industrial and automotive sectors due to their durability and flexibility. The segment is also gaining traction in specialty applications such as composites and technical textiles, where performance and resilience are essential.

• By Nylon Raw Material

On the basis of nylon raw material, the spunbond market is segmented into adipic acid and caprolactam. The caprolactam segment held the largest revenue share in 2024, owing to its extensive use in producing nylon 6, which is widely adopted in applications requiring durability and chemical resistance.

The adipic acid segment is expected to witness the fastest growth rate from 2025 to 2032, due to its role in nylon 66 production, which offers superior heat resistance and mechanical properties. These raw materials are critical to enhancing the performance of spunbond nonwovens used in demanding industrial environments.

• By Application

On the basis of application, the spunbond market is segmented into automotive, filtration, rubber belting/hoses, rubber transfer molding, embroidery/apparel, composites, carpet/rugs, agriculture, electrical and electronics, textile, home furnishing, tapes/adhesives, and others. The hygiene and filtration segments lead the market due to high demand for single-use and protective products.

The automotive and composites segments is expected to witness the fastest growth rate from 2025 to 2032, driven by the need for lightweight, high-performance materials. For instance, spunbond fabrics are used in car interiors for acoustic insulation and reinforcement. Similarly, in agriculture, spunbond fabrics are increasingly used for crop protection due to their breathability and UV resistance.

Spunbond Market Regional Analysis

• North America dominated the spunbond market with the largest revenue share in 2024, fuelled by strong demand from the hygiene, automotive, and construction sectors

• Manufacturers in the region benefit from well-established production infrastructure and advanced R&D capabilities, supporting innovation in nonwoven applications

• The presence of key players and increasing preference for eco-friendly, lightweight materials in diverse industries have further accelerated market penetration

• Moreover, the surge in demand for disposable medical supplies and filtration products post-pandemic has solidified the region's leadership in the global spunbond market

U.S. Spunbond Market Insight

The U.S. spunbond market accounted for the largest revenue share within North America in 2024, driven by high consumption across healthcare, agriculture, and industrial sectors. The country's robust manufacturing base and increasing investment in sustainable nonwoven technologies support market expansion. Rising demand for products such as surgical masks, wound dressings, geotextiles, and automotive insulation is contributing to steady growth. In addition, favorable regulations promoting recyclable materials and strong logistics infrastructure are enabling companies to meet domestic and export demands efficiently.

Europe Spunbond Market Insight

The Europe spunbond market is expected to witness the fastest growth rate from 2025 to 2032, propelled by growing environmental awareness and regulatory support for nonwoven recyclability. Countries such as Germany, France, and Italy are witnessing high adoption of spunbond materials in agriculture, personal care, and packaging. The demand is especially high in reusable shopping bags, automotive underbody shields, and crop covers. Moreover, stringent EU policies targeting single-use plastics are encouraging the development of biodegradable spunbond alternatives across industries.

Germany Spunbond Market Insight

The Germany spunbond market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country's advanced manufacturing capabilities and sustainability goals. The automotive and construction sectors in Germany are increasingly turning to spunbond for insulation, interior linings, and filtration due to its durability and lightweight nature. Germany’s leadership in engineering innovation also supports the development of customized spunbond solutions for industrial and technical applications.

U.K. Spunbond Market Insight

The U.K. spunbond market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for sustainable and disposable products across healthcare and hygiene sectors. The expansion of the medical textile segment, particularly in wound care and surgical apparel, is driving usage of spunbond nonwovens. Furthermore, the U.K.’s emphasis on environmentally friendly packaging and insulation materials in construction is boosting market traction. Government-backed policies encouraging the reduction of single-use plastics are also creating growth opportunities for spunbond-based alternatives in retail and industrial applications.

Asia-Pacific Spunbond Market Insight

The Asia-Pacific spunbond market is expected to witness the fastest growth rate from 2025 to 2032, attributed to rising urbanization, population growth, and industrial expansion. Countries such as China, India, and Japan are witnessing increasing demand for spunbond in personal hygiene products, agriculture, and construction. Government initiatives promoting sanitation and healthcare infrastructure development are boosting the adoption of nonwoven materials. Furthermore, low production costs and abundant raw material availability position APAC as a key manufacturing hub for spunbond exports.

China Spunbond Market Insight

The China spunbond market held the highest revenue share in Asia-Pacific in 2024, backed by large-scale production facilities and strong domestic consumption. The country’s extensive use of spunbond in baby diapers, feminine hygiene, and medical supplies is a major growth driver. In addition, China’s support for smart manufacturing and rapid development in the e-commerce sector are increasing demand for protective packaging and geotextiles. The presence of prominent local manufacturers and continuous technology upgrades enhance China’s dominance in the regional market.

Japan Spunbond Market Insight

The Japan spunbond market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's strong focus on innovation and quality in the nonwoven sector. High demand from the personal hygiene and automotive industries, along with rapid advancements in spunbond production technology, is shaping the market landscape. Japan’s aging population is contributing to increased use of medical and adult incontinence products made from spunbond. In addition, Japanese manufacturers are investing in eco-friendly and recyclable nonwoven solutions, aligning with national sustainability goals and consumer preferences for high-performance, low-impact materials.

Spunbond Market Share

The Spunbond industry is primarily led by well-established companies, including:

- Huahao Nonwovens Co., Ltd. (China)

- DuPont (U.S.)

- Asahi Kasei Corporation (Japan)

- Mogul Co., Ltd. (Turkey)

- Yaolong Spun bonded Nonwoven Technology Co., Ltd. (China)

- Quanzhou Golden Nonwoven Co., Ltd. (China)

- TORAY INDUSTRIES, INC. (Japan)

- Berry Global Inc. (U.S.)

- Cerex Advanced Fabrics, Inc. (U.S.)

- Radici Partecipazioni SpA (Italy)

- Kolon Industries, Inc. (South Korea)

- APEX Nonwovens (U.S.)

- SHINKONG SYNTHETIC FIBERS CORP (Taiwan)

- Wenzhou Superteng Nonwoven Technology Co., Ltd. (China)

- Hadtex (Turkey)

Latest Developments in Global Spunbond Market

- In March 2024, Fibertex Nonwovens, a subsidiary of Schouw & Co., announced a significant investment of USD 47.82 million aimed at expanding production capacity at two of its plants in the U.S. This strategic move highlights the company's commitment to meeting growing market demands. In addition, Fibertex is allocating an equal investment for capacity enhancements in its European facilities located in the Czech Republic and Turkey, further solidifying its global presence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Spunbond Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Spunbond Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Spunbond Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.