Global Sputtering Equipment Cathode Market

Market Size in USD Billion

CAGR :

%

USD

1.92 Billion

USD

2.73 Billion

2024

2032

USD

1.92 Billion

USD

2.73 Billion

2024

2032

| 2025 –2032 | |

| USD 1.92 Billion | |

| USD 2.73 Billion | |

|

|

|

|

Sputtering Equipment Cathode Market Size

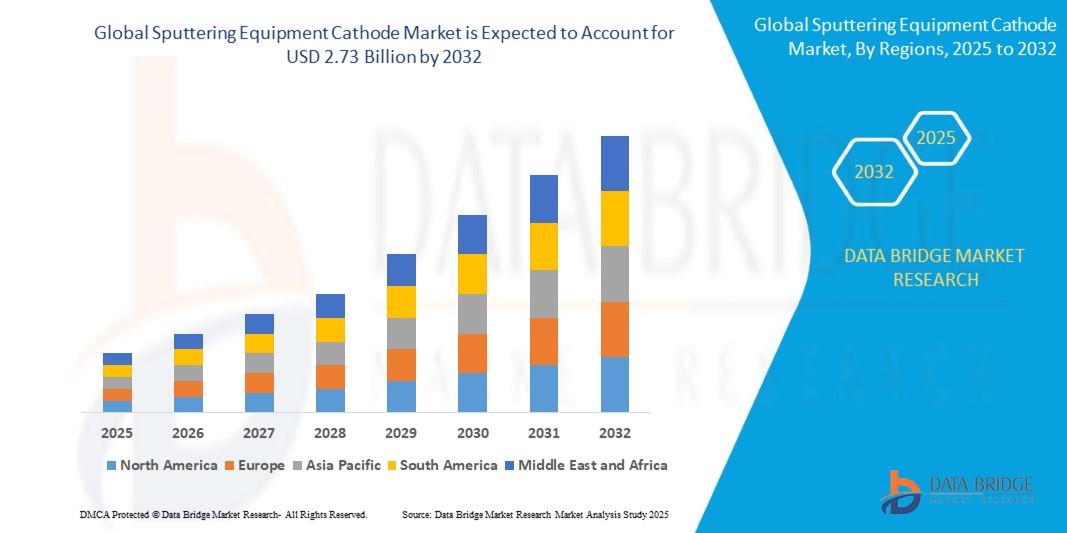

- The Global Sputtering Equipment Cathode Market size was valued at USD 1.92 billion in 2024 and is expected to reach USD 2.73 billion by 2032, at a CAGR of 4.52% during the forecast period

- Market growth is primarily driven by the increasing demand for thin-film deposition technologies across multiple high-tech industries, including semiconductors, electronics, solar energy, and optical devices. The need for high-performance coatings, improved material efficiency, and precise surface engineering is fueling adoption of advanced sputtering equipment cathodes worldwide.

- Additionally, the expansion of the global semiconductor and display panel manufacturing sector, particularly in Asia-Pacific and North America, is bolstering the demand for reliable and high-yield sputtering cathode systems. Innovations in cathode design, materials (such as planar and rotatable types), and magnetron sputtering technologies are further enhancing system performance and process efficiency.

Sputtering Equipment Cathode Market Analysis

- Sputtering Equipment Cathodes are critical components in thin-film deposition systems used across various industries, including semiconductors, photovoltaics, data storage, optics, and advanced displays. These cathodes facilitate the controlled release of target materials onto substrates through magnetron sputtering processes, enabling the creation of uniform and functional thin films with high precision and performance.

- The rising adoption of sputtering technology in semiconductor fabrication and the increased production of advanced microelectronic components are major factors driving market demand. As the electronics industry pushes toward miniaturization and higher functionality, the need for precise, contamination-free, and efficient material deposition processes is fueling the integration of sputtering cathodes into next-generation manufacturing lines.

- Furthermore, the market is experiencing growth due to expanding investments in renewable energy, particularly in solar photovoltaics, where sputtering is used to deposit anti-reflective and conductive coatings on solar panels. Similarly, the demand for sputtered coatings in flat panel displays, optical lenses, and medical devices is contributing to a wider application base for sputtering cathodes.

- Asia-Pacific dominates the Global Sputtering Equipment Cathode Market with the largest revenue share of 35.18% in 2024, driven by strong growth in semiconductor manufacturing, photovoltaics, and consumer electronics industries.

- North America holds a significant revenue share of 27.37% in 2024 in the sputtering equipment cathode market, largely driven by the U.S. semiconductor sector, demand for advanced coatings in aerospace & defense, and innovation in thin-film solar technologies.

- The circular segment dominates the largest market revenue share of 58.91% in 2024, attributed to its widespread use in magnetron sputtering systems and its suitability for achieving uniform thin-film coatings in electronics and semiconductor industries.

Report Scope and Sputtering Equipment Cathode Market Segmentation

|

Attributes |

Sputtering Equipment Cathode Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sputtering Equipment Cathode Market Trends

“Growing Demand for High-Precision Coating in Semiconductors and Electronics”

- The global shift toward miniaturization and performance optimization in electronic devices is significantly driving the need for high-quality thin-film coatings, which is where sputtering equipment cathodes play a vital role.

- These cathodes are essential in physical vapor deposition (PVD) processes used for coating semiconductor wafers, integrated circuits, hard disks, and display panels.

- For instance, in March 2024, Applied Materials, Inc. unveiled an upgraded sputtering platform optimized for 3D NAND and advanced DRAM nodes, highlighting the growing reliance on sputtering systems in next-gen semiconductor production.

- With rapid growth in consumer electronics, wearables, and data storage solutions, the demand for highly uniform and defect-free sputtered films is expected to remain strong.

- Moreover, the increasing complexity of chip architectures in AI and high-performance computing is further boosting investments in sputtering equipment, reinforcing the market's upward trajectory.

Sputtering Equipment Cathode Market Dynamics

Driver

“Surge in Renewable Energy Applications Requiring Thin-Film Coatings”

- The transition toward sustainable energy is fueling demand for thin-film solar cells and coatings used in solar panels, where sputtering cathodes are a core component in the manufacturing process.

- These cathodes help deposit critical layers such as transparent conductive oxides, metal contacts, and anti-reflective coatings on solar panels.

- In 2023, Veeco Instruments Inc. collaborated with major solar manufacturers to supply advanced sputtering systems tailored to cadmium telluride (CdTe) and CIGS (copper indium gallium selenide) thin-film technologies.

- The growing push for localized, efficient solar energy systems especially in Asia-Pacific and Europe is expected to generate sustained demand for sputtering cathodes over the coming decade.

- As countries work to achieve net-zero carbon targets, the role of thin-film photovoltaic modules is becoming more central, further opening opportunities for cathode suppliers.

Restraint/Challenge

“High Capital Costs and Operational Complexity Limit Adoption in SMEs”

- Hindering market penetration especially in price-sensitive or emerging economies is the high capital investment associated with sputtering equipment cathodes and vacuum deposition systems.

- Advanced sputtering systems, especially those involving magnetron or multi-cathode configurations, require substantial upfront costs in equipment, vacuum infrastructure, and cleanroom environments.

- Additionally, the operation of these systems demands highly trained personnel and stringent process control, which adds to ongoing operational expenses.

- As a result, small and medium-sized enterprises (SMEs) may find it financially unviable to adopt sputtering technologies, limiting market growth to large-scale manufacturers or tech-focused players with ample capital and technical resources.

Sputtering Equipment Cathode Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Sputtering Equipment Cathode Market is segmented into linear and circular. The circular segment dominates the largest market revenue share of 58.91% in 2024, attributed to its widespread use in magnetron sputtering systems and its suitability for achieving uniform thin-film coatings in electronics and semiconductor industries. Circular cathodes are highly efficient in high-vacuum applications and are compatible with a wide range of materials, making them a preferred choice for coating substrates in displays, solar panels, and microelectronics.

The linear segment is anticipated to witness the fastest growth rate of 5.9% CAGR from 2025 to 2032, driven by its growing adoption in large-area deposition applications such as architectural glass, automotive glass, and flat-panel displays. Linear cathodes enable efficient coating of large substrates with uniformity and are increasingly being integrated into high-throughput production lines for industrial and commercial applications.

- By Application

On the basis of application, the Sputtering Equipment Cathode Market is segmented into automotive, electronics, aerospace, and others. The electronics segment accounted for the largest market revenue share of 46.38% in 2024, owing to the booming demand for high-performance thin-film coatings in semiconductors, printed circuit boards, and electronic displays. Sputtering equipment cathodes are essential for depositing conductive, insulating, or functional layers that are critical to modern electronic devices. The continued advancement of consumer electronics, wearable devices, and miniaturized components supports segment dominance.

The automotive segment is expected to witness the fastest CAGR of 7.2% from 2025 to 2032, driven by the increasing need for advanced coatings in electric vehicles (EVs), smart mirrors, decorative trim, and anti-glare coatings. As automotive OEMs focus on lightweight materials, energy efficiency, and aesthetics, sputtering technology provides a scalable and precise solution for next-generation automotive components.

Sputtering Equipment Cathode Market Regional Analysis

- Asia-Pacific dominates the Global Sputtering Equipment Cathode Market with the largest revenue share of 35.18% in 2024, driven by strong growth in semiconductor manufacturing, photovoltaics, and consumer electronics industries.

- Countries in the region especially China, Japan, South Korea, and Taiwan—have made substantial investments in thin-film deposition technologies, bolstering the demand for sputtering equipment cathodes used in high-precision applications such as integrated circuits, OLED displays, and solar panels.

- The region’s robust R&D ecosystem, increasing domestic demand for advanced electronic devices, and government support for renewable energy and semiconductor self-reliance programs have made Asia-Pacific the key hub for cathode technology and innovation.

China Sputtering Equipment Cathode Market Insight

The China Sputtering Equipment Cathode Market accounted for the largest share in Asia-Pacific in 2024, fueled by the nation’s rapid industrialization and dominant position in semiconductor and solar panel production. China's strategic initiatives such as "Made in China 2025" and the focus on self-sufficiency in chipmaking are driving large-scale investments in thin-film deposition technologies, where sputtering equipment cathodes are critical. Moreover, a strong network of domestic manufacturers and expanding research into advanced materials continue to boost the domestic market.

Japan Sputtering Equipment Cathode Market Insight

The Japan Sputtering Equipment Cathode Market is expanding steadily, supported by the country’s well-established electronics and display manufacturing industries. Japan’s technological advancements in high-precision deposition equipment, combined with demand from industries such as automotive electronics, healthcare devices, and energy-efficient displays, are driving growth. Continuous innovation and partnerships between academia and industry help sustain its leadership in vacuum coating technologies, including high-performance cathodes.

North America Sputtering Equipment Cathode Market Insight

North America holds a significant revenue share of 27.37% in 2024 in the sputtering equipment cathode market, largely driven by the U.S. semiconductor sector, demand for advanced coatings in aerospace & defense, and innovation in thin-film solar technologies. The region benefits from high-tech infrastructure, strong government support for domestic chip fabrication, and strategic collaborations between universities and tech companies in materials science and nanotechnology.

U.S. Sputtering Equipment Cathode Market Insight

The U.S. market contributes the largest share in North America, supported by a rising number of fabrication plants (fabs), strong investment in defense electronics, and growth in electric vehicle (EV) battery production that demands high-performance thin-film coatings.

Additionally, the U.S. government's CHIPS Act and incentives for reshoring semiconductor manufacturing have attracted global equipment providers, expanding the demand for cathodes and related components.

Europe Sputtering Equipment Cathode Market Insight

Europe is expected to witness consistent growth over the forecast period, driven by increasing demand for sputtered coatings in sectors such as solar energy, medical technology, automotive, and industrial equipment. Countries such as Germany, France, and the Netherlands are investing in semiconductor ecosystems and clean energy infrastructure, supporting regional demand for sputtering equipment. Emphasis on sustainability, energy efficiency, and precision engineering aligns well with thin-film deposition applications using cathode technologies..

Germany Sputtering Equipment Cathode Market Insight

Germany stands out in Europe due to its advanced manufacturing capabilities, emphasis on high-precision engineering, and investments in smart manufacturing and renewable energy. The use of sputtering cathodes in coatings for medical devices, automotive parts, and optical components is seeing growth, supported by Germany’s push toward Industry 4.0 and innovation in materials science.

Sputtering Equipment Cathode Market Share

The Sputtering Equipment Cathode industry is primarily led by well-established companies, including:

- Kurt J. Lesker Company (United States)

- Veeco Instruments Inc (United States)

- Semicore Equipment, Inc(United States)

- Soleras Advanced Coatings BVBA(Belgium)

- Sputtering Components (United States)

- KDF Electronic & Vacuum Services Inc(United States)

- PVD Products, Inc(United States)

- Angstrom Sciences, Inc (United States)

- Kenosistec Srl (Italy)

- AJA International(United States)

- Applied Materials, Inc (United States)

- CANON ANELVA CORPORATION (Japan)

- OC Oerlikon Corporation AG(Switzerland)

- ULVAC Technologies, Inc.(United States)

- KOLZER SRL(Italy)

- KOBE STEEL, LTD(Japan)

- Izovac (Belarus)

Latest Developments in Global Sputtering Equipment Cathode Market

- In April 2024, Applied Materials, Inc. announced the launch of its next-generation sputtering cathode platform designed to support advanced semiconductor manufacturing processes, including 3D NAND and AI chip production. This cutting-edge technology enhances precision and throughput, reflecting the company’s commitment to meeting the escalating demands of the semiconductor industry and reinforcing its leadership in the global sputtering equipment cathode market.

- In March 2024, Veeco Instruments Inc. expanded its product portfolio with the introduction of a high-efficiency sputtering cathode system tailored for thin-film solar panel manufacturing. This innovation aims to increase deposition rates while reducing energy consumption, aligning with the growing global emphasis on sustainable energy solutions and positioning Veeco as a key player in the renewable energy sector.

- In February 2024, Kurt J. Lesker Company announced a strategic partnership with a major electronics manufacturer to co-develop customized sputtering cathodes optimized for flexible display applications. This collaboration underscores the rising importance of flexible and wearable electronics, offering enhanced coating uniformity and material utilization, thereby driving market growth in emerging application areas.

- In January 2024, Semicore Equipment, Inc. unveiled an upgraded magnetron sputtering cathode technology with improved target utilization and longer lifespan. The enhancement reduces downtime and operational costs for manufacturers in the aerospace and automotive sectors, highlighting Semicore’s focus on delivering durable, cost-effective solutions to specialized industries.

- In December 2023, AJA International introduced an integrated sputtering cathode system with advanced remote monitoring and diagnostic capabilities, leveraging IoT connectivity. This system allows real-time performance tracking and predictive maintenance, improving operational efficiency for commercial and industrial clients and reflecting the broader trend towards Industry 4.0 in thin-film deposition technologies.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sputtering Equipment Cathode Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sputtering Equipment Cathode Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sputtering Equipment Cathode Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.