Global Stacker Crane Market

Market Size in USD Billion

CAGR :

%

USD

1.35 Billion

USD

2.33 Billion

2025

2033

USD

1.35 Billion

USD

2.33 Billion

2025

2033

| 2026 –2033 | |

| USD 1.35 Billion | |

| USD 2.33 Billion | |

|

|

|

|

Stacker Crane Market Size

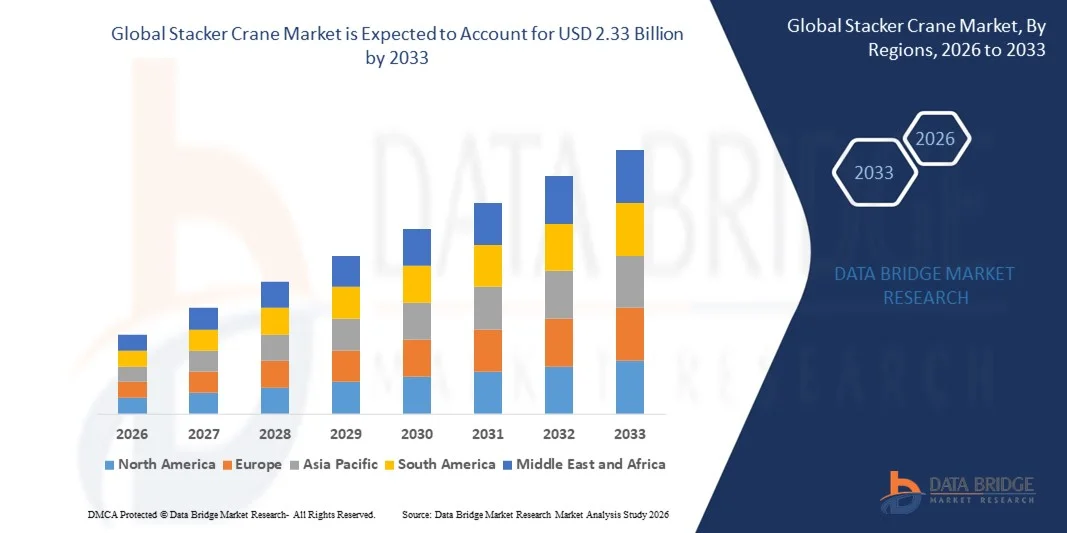

- The global stacker crane market size was valued at USD 1.35 billion in 2025 and is expected to reach USD 2.33 billion by 2033, at a CAGR of 7.01% during the forecast period

- The market growth is largely fuelled by the increasing demand for automated storage and retrieval systems (AS/RS) in warehouses, distribution centers, and manufacturing facilities

- Growing adoption of Industry 4.0 and smart warehouse technologies, coupled with rising e-commerce activities, is driving the need for efficient material handling solutions

Stacker Crane Market Analysis

- Stacker cranes are increasingly preferred due to their ability to automate storage and retrieval operations, reduce labor costs, and enhance safety in warehouses

- The market is witnessing significant investments in advanced stacker cranes with features such as high-speed operation, IoT integration, and remote monitoring capabilities

- North America dominated the stacker crane market with the largest revenue share of 38.45% in 2025, driven by the growing adoption of automated warehouses, e-commerce expansion, and increasing demand for efficient material handling solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global stacker crane market, driven by rapid urbanization, increasing e-commerce and manufacturing activities, and government initiatives supporting smart warehouses. Rising demand for high-density storage systems and cost-effective automated solutions further fuels market expansion across the region

- The Single-mast segment held the largest market revenue share in 2025, driven by its cost-effectiveness, compact design, and suitability for medium-density warehouse storage. Single-mast stacker cranes are widely adopted in distribution centers and manufacturing facilities where moderate throughput and storage optimization are required

Report Scope and Stacker Crane Market Segmentation

|

Attributes |

Stacker Crane Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Stacker Crane Market Trends

Rising Adoption of Automated Material Handling Solutions

- The growing focus on warehouse automation and efficient storage solutions is significantly shaping the global stacker crane market, as companies increasingly seek to reduce labor costs, optimize space, and improve operational efficiency. Stacker cranes are gaining traction due to their ability to handle high-density storage, speed up retrieval operations, and integrate seamlessly with automated storage and retrieval systems (AS/RS). This trend strengthens their adoption across e-commerce, manufacturing, and cold storage industries, encouraging manufacturers to innovate with high-speed, intelligent crane solutions

- Increasing investment in smart warehousing and industrial automation has accelerated the demand for stacker cranes in distribution centers, fulfillment warehouses, and manufacturing plants. Companies are deploying stacker cranes equipped with sensors, IoT connectivity, and software-based control systems to enhance precision, reduce errors, and enable real-time inventory tracking. Rising e-commerce and omni-channel logistics requirements are driving continuous upgrades and modernization of material handling systems

- Integration with warehouse management systems (WMS) and Industry 4.0 technologies is influencing purchasing decisions, with operators emphasizing system compatibility, automation efficiency, and real-time monitoring. These factors are helping businesses reduce operational bottlenecks, improve throughput, and maximize storage utilization, while also driving adoption of advanced stacker crane solutions in new and existing facilities

- For instance, in 2024, Swisslog in Switzerland and Dematic in Germany expanded their product portfolios by introducing high-speed stacker cranes with automated guidance and intelligent software integration. These deployments were targeted at e-commerce and pharmaceutical warehouses to handle high-density storage and rapid retrieval. The solutions also emphasized safety, precision, and energy efficiency, supporting improved warehouse performance

- While demand for stacker cranes is growing, sustained market expansion depends on continuous R&D, cost-effective deployment, and integration with existing warehouse infrastructure. Manufacturers are focusing on improving scalability, load capacity, software integration, and operational reliability for broader adoption across industries

Stacker Crane Market Dynamics

Driver

Growing Demand for Warehouse Automation and Efficient Storage

- Rising need for automated storage and retrieval solutions is a major driver for the stacker crane market. Companies are increasingly deploying stacker cranes to improve storage density, reduce labor dependence, and enhance operational speed. This trend also encourages technological innovations in crane design, control systems, and integration with warehouse management systems

- Expanding applications across e-commerce fulfillment centers, cold storage facilities, and manufacturing warehouses are influencing market growth. Stacker cranes help optimize space, reduce retrieval times, and improve inventory management accuracy. The growing adoption of smart warehouses globally further reinforces this trend

- Logistics and material handling providers are actively promoting stacker crane-based solutions through automation upgrades, software integration, and customized system designs. These efforts are supported by rising demand for faster order fulfillment, reduced errors, and improved workplace safety, encouraging partnerships between equipment manufacturers and warehouse operators

- For instance, in 2023, Dematic in Germany and Swisslog in Switzerland reported increased deployments of automated stacker cranes in e-commerce and cold storage facilities. The adoption followed higher demand for efficient material handling, real-time inventory tracking, and operational cost reduction. Both companies highlighted smart integration and energy efficiency in marketing campaigns to strengthen client trust and long-term partnerships

- Although rising automation trends support growth, wider adoption depends on high capital investment, technical expertise, and system compatibility. Investment in software integration, operator training, and advanced crane designs will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

High Capital Costs and Technical Complexity

- The relatively high cost of stacker crane systems compared to conventional storage solutions remains a key challenge, limiting adoption among small and mid-sized warehouses. Elevated procurement, installation, and maintenance costs contribute to slower uptake in price-sensitive markets

- Operational complexity and need for skilled personnel also pose challenges, particularly in regions where warehouse automation is emerging. Limited understanding of system capabilities and lack of trained operators restrict adoption across certain industries

- Integration with existing warehouse management systems and material handling infrastructure can also impact market growth. Stacker cranes require precision installation, software compatibility, and ongoing maintenance, increasing operational planning and expenditure

- For instance, in 2024, warehouse operators in Southeast Asia and Latin America reported slower adoption of high-density stacker cranes due to high upfront costs, technical expertise requirements, and system integration challenges. These factors also prompted some companies to delay upgrades and limit automation investments

- Overcoming these challenges will require cost-efficient solutions, scalable designs, and operator training programs. Collaboration with logistics service providers, software developers, and equipment manufacturers can help unlock the long-term growth potential of the global stacker crane market. Developing modular, energy-efficient, and user-friendly systems will be essential for widespread adoption

Stacker Crane Market Scope

The market is segmented on the basis of stacking type, operation mode, load capacity, lifting height, and application.

- By Stacking Type

On the basis of stacking type, the global stacker crane market is segmented into Single-mast stacker cranes, Double-mast stacker cranes, and Tri-mast stacker cranes. The Single-mast segment held the largest market revenue share in 2025, driven by its cost-effectiveness, compact design, and suitability for medium-density warehouse storage. Single-mast stacker cranes are widely adopted in distribution centers and manufacturing facilities where moderate throughput and storage optimization are required.

The Double-mast segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its ability to handle higher loads and taller racking systems. Double-mast stacker cranes are increasingly preferred for high-density warehouses and automated storage facilities, offering enhanced stability, speed, and operational efficiency.

- By Operation Mode

On the basis of operation mode, the market is segmented into Automated Guided Vehicle (AGV) stacker cranes and Manually Operated stacker cranes. The AGV stacker cranes segment held the largest market revenue share in 2025, driven by growing adoption of fully automated warehouse operations and Industry 4.0-enabled material handling systems. AGV stacker cranes reduce labor dependence and improve accuracy in inventory management.

The Manually Operated stacker cranes segment is expected to witness the fastest growth rate from 2026 to 2033, driven by demand in small and medium warehouses where semi-automation is more feasible. These cranes offer flexibility, lower upfront costs, and easy integration into existing storage setups.

- By Load Capacity

On the basis of load capacity, the market is segmented into Light-duty stacker cranes, Medium-duty stacker cranes, and Heavy-duty stacker cranes. The Medium-duty segment held the largest market revenue share in 2025, owing to its balance of lifting capability, operational efficiency, and suitability for a wide range of storage applications. Medium-duty stacker cranes are commonly used in logistics centers, manufacturing facilities, and cold storage warehouses.

The Heavy-duty segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand from industries such as automotive, metalworking, and large-scale distribution centers requiring high-load lifting and robust handling capabilities.

- By Lifting Height

On the basis of lifting height, the market is segmented into Low-lift stacker cranes, Medium-lift stacker cranes, and High-lift stacker cranes. The Medium-lift segment held the largest market revenue share in 2025, driven by its ability to optimize vertical storage in medium-height warehouse racks while maintaining speed and operational safety.

The High-lift segment is expected to witness the fastest growth rate from 2026 to 2033, owing to the rising adoption of high-rise automated storage systems and the need for maximizing storage density in modern logistics and distribution facilities.

- By Application

On the basis of application, the market is segmented into Automotive Industry, Food and Beverage Industry, Pharmaceutical Industry, Logistics and Warehousing, and Metalworking Industry. The Logistics and Warehousing segment held the largest market revenue share in 2025, driven by growing e-commerce, retail distribution, and the expansion of automated fulfillment centers. Stacker cranes help improve inventory management, storage density, and operational efficiency in warehouses.

The Pharmaceutical Industry segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by stringent storage and retrieval requirements, cold chain management, and the growing adoption of automated systems to ensure product safety and compliance.

Stacker Crane Market Regional Analysis

- North America dominated the stacker crane market with the largest revenue share of 38.45% in 2025, driven by the growing adoption of automated warehouses, e-commerce expansion, and increasing demand for efficient material handling solutions

- Companies in the region highly value the ability of stacker cranes to optimize storage density, reduce labor costs, and enhance operational speed and safety

- This widespread adoption is further supported by high investment in industrial automation, technologically advanced logistics infrastructure, and the growing preference for high-throughput fulfillment centers, establishing stacker cranes as a preferred solution for warehouses, manufacturing, and distribution centers

U.S. Stacker Crane Market Insight

The U.S. stacker crane market captured the largest revenue share in 2025 within North America, fueled by the rapid expansion of e-commerce, automation in logistics, and the need for space-efficient storage solutions. Companies are increasingly investing in automated guided vehicle (AGV) stacker cranes and high-speed cranes to improve warehouse throughput and inventory accuracy. Moreover, the integration of stacker cranes with warehouse management systems (WMS) and IoT-based monitoring is significantly contributing to market growth.

Europe Stacker Crane Market Insight

The Europe stacker crane market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by the modernization of warehouses, rising labor costs, and growing adoption of Industry 4.0 technologies. Increasing demand for automated storage and retrieval systems in logistics, automotive, and manufacturing sectors is fostering the adoption of stacker cranes. European companies are also focusing on energy-efficient and high-precision cranes, contributing to rapid market growth across multiple applications.

Germany Stacker Crane Market Insight

The Germany stacker crane market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing warehouse automation, technological innovation, and demand for high-density storage solutions. Germany’s robust industrial infrastructure, focus on efficiency, and emphasis on sustainable operations promote stacker crane adoption in logistics, automotive, and manufacturing facilities. Integration with smart warehouse systems and IoT-enabled monitoring is further accelerating adoption.

Asia-Pacific Stacker Crane Market Insight

The Asia-Pacific stacker crane market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, expansion of e-commerce, and rising demand for automated warehousing solutions in countries such as China, Japan, and India. Government initiatives supporting digitalization and smart logistics are encouraging the deployment of stacker cranes. Moreover, APAC is emerging as a manufacturing hub for material handling equipment, enhancing affordability and accessibility for warehouses and industrial facilities.

China Stacker Crane Market Insight

The China stacker crane market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid industrial growth, large-scale warehouse construction, and rising e-commerce fulfillment centers. Stacker cranes are increasingly deployed in manufacturing, logistics, and cold storage facilities to optimize space and improve operational efficiency. Strong domestic manufacturers and government support for smart warehousing initiatives are key factors driving market expansion in China.

Japan Stacker Crane Market Insight

The Japan stacker crane market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high adoption of industrial automation, technological advancements, and demand for efficient storage systems. Japanese companies are focusing on high-speed, automated stacker cranes integrated with IoT and WMS solutions. In addition, the need for space optimization in densely populated regions and the growing trend of automated manufacturing facilities is fueling market growth.

Stacker Crane Market Share

The Stacker Crane industry is primarily led by well-established companies, including:

- Kion Group AG (Germany)

- Daifuku Co., Ltd. (Japan)

- Dematic Corporation (U.S.)

- Jungheinrich AG (Germany)

- SSI Schafer Group (Germany)

- Toyota Industries (Japan)

- Mecalux S.A (Spain)

- KUKA AG (Germany)

- Konecranes (Finland)

Latest Developments in Global Stacker Crane Market

- In September 2025, Dematic partnered with a leading e-commerce company to develop an advanced automated fulfillment center, enhancing operational capabilities, enabling data-driven insights, and strengthening its competitive positioning in the market

- In August 2025, Konecranes introduced an AI-enabled automated stacker crane system to optimize warehouse operations, enhance productivity, and set new efficiency benchmarks, driving technological adoption across the industry

- In July 2025, Mitsubishi Logisnext expanded its manufacturing footprint with a new facility in Southeast Asia, aimed at catering to rising demand in the Asia-Pacific market, optimizing supply chains, and reducing costs

- In January 2021, Toyota Industries completed the acquisition of Vanderlande, a Dutch provider of automated material handling solutions including stacker cranes, to strengthen its global portfolio, enhance automation capabilities, and expand its market presence in logistics and warehouse operations

- In March 2021, Konecranes launched a new range of stacker cranes for automated container handling, designed to improve operational efficiency, safety, and automation in port and terminal operations, reinforcing its industry leadership

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.