Global Stamped Component Market

Market Size in USD Billion

CAGR :

%

USD

7.28 Billion

USD

9.89 Billion

2024

2032

USD

7.28 Billion

USD

9.89 Billion

2024

2032

| 2025 –2032 | |

| USD 7.28 Billion | |

| USD 9.89 Billion | |

|

|

|

|

Stamped Component Market Size

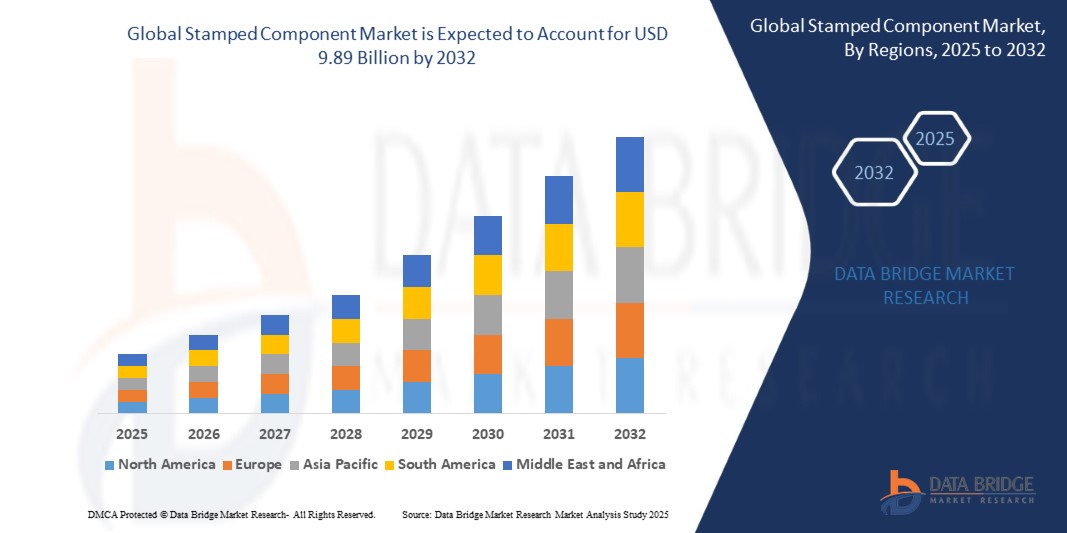

- The global stamped component market size was valued at USD 7.28 billion in 2024 and is expected to reach USD 9.89 billion by 2032, at a CAGR of 3.9% during the forecast period

- The market growth is largely fueled by the rising demand for lightweight, high-strength automotive components and the growing focus on vehicle efficiency, safety, and emission reduction, driving extensive adoption of stamped components across passenger and commercial vehicles

- Furthermore, advancements in stamping technologies, including hot stamping and progressive die processes, are enabling manufacturers to produce complex, precision-formed parts at scale, which is significantly accelerating market expansion across global automotive production

Stamped Component Market Analysis

- Stamped components are precision-formed metal parts produced through processes such as bending, flanging, embossing, coining, and blanking. These components are widely used in the automotive industry for manufacturing structural, body, and engine parts due to their durability, lightweight properties, and cost-effectiveness

- The escalating demand for stamped components is primarily fueled by the growing focus on vehicle light weighting, rising automotive production, and advancements in stamping technologies that enable the efficient manufacturing of complex, high-strength components for both passenger and commercial vehicles

- North America is expected to dominate the stamped component market with a share of 27.3% in 2024, due to the robust automotive manufacturing sector and the growing emphasis on lightweight vehicle components to meet stringent fuel efficiency and emission standards

- Asia-Pacific is expected to be the fastest growing region in the stamped component market during the forecast period due to booming vehicle production, rapid urbanization, and the presence of low-cost manufacturing hubs

- Bending segment is expected to dominate the market with a market share of 39% in 2024, due to its widespread use across automotive body structures and chassis parts that require precise angles and structural integrity. The growing demand for lightweight yet durable vehicle components, particularly in electric and fuel-efficient vehicles, has reinforced the prominence of bending processes, as they allow manufacturers to form complex geometries without compromising material strength. The compatibility of bending technology with various metals and alloys further enhances its appeal across diverse stamped component applications

Report Scope and Stamped Component Market Segmentation

|

Attributes |

Stamped Component Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Stamped Component Market Trends

“Rising Demand for Lightweight, Durable, Cost-Effective Metal Parts”

- A significant and accelerating trend in the global stamped component market is the rising demand for lightweight, durable, and cost-effective metal parts such as those used in automotive, electronics, and industrial applications

- For instance, companies such as Gestamp and Magna International are developing advanced stamped components using high-strength steel and aluminum alloys to meet the requirements of next-generation vehicles and machinery

- The adoption of precision stamping technologies enables features such as complex geometries, tight tolerances, and reduced material waste. For instance, Schuler Group utilizes automated stamping lines and digital process controls to enhance production efficiency and part quality

- The seamless integration of stamped components into automated assembly lines and modular product designs facilitates centralized manufacturing, lower labor costs, and faster time-to-market for finished goods

- This trend toward lightweighting and enhanced durability is fundamentally reshaping design strategies in sectors such as automotive and aerospace. Companies such as Martinrea International and Benteler are investing in research and development to create stamped parts that improve fuel efficiency and structural integrity

- The demand for stamped components that deliver a balance of strength, weight reduction, and affordability is growing rapidly across both established and emerging markets, as manufacturers increasingly prioritize efficiency, performance, and cost control

Stamped Component Market Dynamics

Driver

“Increasing Demand for Stamped Components in Aerospace Applications”

- The growing use of stamped components in aerospace applications, driven by the need for lightweight and high-strength parts, is a significant driver for market expansion

- For instance, companies such as Arconic and LISI Aerospace are supplying precision-stamped components for aircraft structures, engine assemblies, and interior systems

- As aerospace manufacturers seek to reduce overall aircraft weight and improve fuel efficiency, stamped metal parts offer advantages such as design flexibility, consistent quality, and compatibility with advanced alloys

- The trend toward modular aircraft construction and the adoption of new manufacturing technologies is making stamped components an integral part of aerospace supply chains

- The convenience of rapid prototyping, scalable production, and streamlined assembly processes is propelling adoption of stamped components in both commercial and defense aviation. The growth of the global aerospace industry and ongoing investments in next-generation aircraft further contribute to market growth

Restraint/Challenge

“Fluctuating Raw Material Prices”

- Concerns surrounding the volatility of raw material prices, including steel, aluminum, and specialty alloys, pose a significant challenge to profitability and pricing strategies in the stamped component market

- For instance, periods of rapid price increases for steel have led companies such as Gestamp and Magna International to implement hedging strategies and renegotiate supplier contracts

- Addressing these challenges through long-term supply agreements, diversified sourcing, and advanced inventory management is crucial for maintaining cost stability. Companies such as Schuler Group and Martinrea International are investing in digital supply chain solutions to monitor market trends and optimize procurement

- The unpredictability of raw material costs can be a barrier for smaller manufacturers and may impact the ability to secure long-term contracts with major OEMs

- Overcoming these challenges through industry collaboration, transparent pricing models, and the adoption of alternative materials will be vital for sustained market growth and competitiveness

Stamped Component Market Scope

The market is segmented on the basis of technology, station type, stamping process, forming temperature, and application.

• By Technology

On the basis of technology, the stamped component market is segmented into bending, flanging, embossing, coining, and blanking. The bending segment dominated the largest market revenue share 0f 39% in 2024, attributed to its widespread use across automotive body structures and chassis parts that require precise angles and structural integrity. The growing demand for lightweight yet durable vehicle components, particularly in electric and fuel-efficient vehicles, has reinforced the prominence of bending processes, as they allow manufacturers to form complex geometries without compromising material strength. The compatibility of bending technology with various metals and alloys further enhances its appeal across diverse stamped component applications.

The embossing segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing emphasis on aesthetics, branding, and structural reinforcement in automotive body panels. Embossing technology offers manufacturers the ability to enhance both the visual appeal and functional strength of components, particularly in passenger vehicles where design differentiation is crucial. The adoption of embossing also aligns with automakers' focus on optimizing part weight without sacrificing rigidity.

• By Station Type

On the basis of station type, the stamped component market is segmented into single and progressive. The progressive segment held the largest market revenue share in 2024, driven by its ability to produce high-volume, complex parts with minimal downtime and material wastage. Automotive manufacturers favor progressive die stamping for its efficiency in producing intricate components in a continuous operation, significantly reducing production cycles and costs. The demand for consistent quality, especially in high-performance vehicle components, further fuels the segment's dominance.

The single station segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its cost-effectiveness and flexibility for low-to-medium volume production runs. Small and mid-sized automotive suppliers increasingly adopt single-station setups for prototyping, custom parts, and short production batches, particularly in emerging markets where capital investment for large-scale operations may be limited.

• By Stamping Process

On the basis of stamping process, the market is segmented into mechanical, hydraulic, and pneumatic. The mechanical segment dominated the largest market revenue share in 2024, supported by its high-speed operation and suitability for mass production of automotive parts with consistent precision. Mechanical presses are widely favored in automotive manufacturing for their ability to maintain production efficiency while handling high-strength materials required in vehicle body frames and structural components.

The hydraulic segment is projected to register the fastest growth from 2025 to 2032, propelled by its superior flexibility in handling complex part geometries and varying material thicknesses. Hydraulic stamping enables the formation of intricate components with greater control over force and speed, making it increasingly popular for producing advanced safety-critical parts and complex assemblies in both passenger and commercial vehicles.

• By Forming Temperature

On the basis of forming temperature, the stamped component market is segmented into hot and cold. The cold stamping segment accounted for the largest revenue share in 2024, driven by its lower energy requirements and suitability for high-volume production of lightweight automotive parts. Cold stamping processes are extensively used for exterior panels, brackets, and reinforcements where dimensional accuracy and surface finish are critical. The automotive sector's focus on material efficiency and manufacturing cost optimization further boosts demand for cold stamping.

The hot stamping segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for ultra-high-strength steel components in modern vehicles. Hot stamping enhances the strength-to-weight ratio of parts, meeting stringent safety standards while contributing to vehicle lightweighting initiatives aimed at improving fuel efficiency and reducing emissions.

• By Application

On the basis of application, the market is segmented into passenger cars and commercial vehicles. The passenger car segment dominated the largest market revenue share in 2024, supported by the growing global production of passenger vehicles and the increasing integration of lightweight stamped components to enhance fuel efficiency and meet emission regulations. The need for cost-effective, high-precision stamped parts in body structures, interiors, and engine components has cemented the segment's dominance.

The commercial vehicle segment is anticipated to register the fastest growth rate from 2025 to 2032, driven by rising demand for heavy-duty, durable components capable of withstanding rigorous operational conditions. As global logistics, e-commerce, and infrastructure development activities expand, the production of stamped components for trucks, buses, and utility vehicles is witnessing substantial growth, with manufacturers focusing on enhancing strength and longevity without compromising weight efficiency.

Stamped Component Market Regional Analysis

- North America dominated the stamped component market with the largest revenue share of 27.3% in 2024, driven by the robust automotive manufacturing sector and the growing emphasis on lightweight vehicle components to meet stringent fuel efficiency and emission standards

- The region's strong presence of established automakers, coupled with increasing demand for high-strength, precision-formed stamped parts in passenger cars and commercial vehicles, is accelerating market growth

- In addition, technological advancements in metal forming processes and the adoption of progressive die stamping are further supporting market expansion, making North America a key region for stamped component production

U.S. Stamped Component Market Insight

The U.S. stamped component market captured the largest revenue share in 2024 within North America, fueled by high automotive production volumes, advanced manufacturing capabilities, and a growing focus on electric vehicles (EVs). Automakers in the U.S. are increasingly utilizing lightweight, high-performance stamped components to enhance vehicle safety, reduce weight, and comply with regulatory standards. Moreover, investments in smart manufacturing and the integration of advanced stamping technologies, such as hot stamping and progressive die systems, continue to drive growth across the automotive and commercial vehicle sectors

Europe Stamped Component Market Insight

The Europe stamped component market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict emission regulations, increasing EV adoption, and advancements in lightweight materials. European automakers are integrating high-strength stamped components into vehicle designs to meet sustainability targets and safety requirements. The demand for complex, precision-formed parts is rising, particularly in Germany, the U.K., and France, supported by well-established automotive production hubs and innovation in stamping technologies

U.K. Stamped Component Market Insight

The U.K. stamped component market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a focus on sustainable vehicle production and the transition towards electric mobility. Growing demand for lightweight, durable components, alongside an increase in automotive exports and R&D investments in metal forming processes, is expected to stimulate market growth. The integration of advanced stamping methods to produce structurally optimized parts for passenger cars and commercial vehicles is contributing to the market's upward trajectory

Germany Stamped Component Market Insight

The Germany stamped component market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s position as a global automotive manufacturing leader and its focus on engineering excellence. German automakers are heavily investing in innovative metal forming techniques, including hot stamping and high-strength steel applications, to meet rising safety and performance demands. The emphasis on vehicle lightweighting, coupled with the development of complex structural components, continues to propel the demand for stamped components across both passenger and commercial vehicle segments

Asia-Pacific Stamped Component Market Insight

The Asia-Pacific stamped component market is poised to grow at the fastest CAGR from 2025 to 2032, driven by booming vehicle production, rapid urbanization, and the presence of low-cost manufacturing hubs in countries such as China, India, and Japan. The region's rising demand for passenger cars, coupled with government initiatives promoting electric mobility and vehicle safety, is driving the integration of high-performance stamped components. In addition, technological advancements, coupled with strong domestic supply chains, are making Asia-Pacific a key contributor to global stamped component production

Japan Stamped Component Market Insight

The Japan stamped component market is gaining momentum due to the country's reputation for high-quality automotive production and precision engineering. The growing demand for lightweight, high-strength stamped components is aligned with Japan's focus on fuel efficiency, vehicle safety, and innovation. Japan's well-established automotive ecosystem and increasing adoption of advanced forming technologies are further driving market growth across both domestic and export vehicle production

China Stamped Component Market Insight

The China stamped component market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country's massive automotive production capacity and rising demand for lightweight, efficient vehicle components. China's rapid urbanization, growing middle class, and strong presence of domestic automakers are accelerating the use of advanced stamped components in both passenger and commercial vehicles. In addition, the government's push for new energy vehicles (NEVs) and the availability of cost-effective manufacturing solutions are key factors propelling market growth in China

Stamped Component Market Share

The stamped component industry is primarily led by well-established companies, including:

- Gestamp (Spain)

- TRANS-MATIC MANUFACTURING INC. (U.S.)

- Nelson Miller (U.S.)

- Batesville Tool & Die Inc. (U.S.)

- All-New Stamping Company (U.S.)

- thyssenkrupp AG (Germany)

- Hobson & Motzer (U.S.)

- Martinrea International Inc. (Canada)

- Magna International Inc. (Canada)

- Alcoa Corporation (U.S.)

- D&H Industries, Inc. (U.S.)

- Manor Tool & Manufacturing (U.S.)

- Clow Stamping Company (U.S.)

- Shiloh Industries (U.S.)

- Lyons Tool and Die Company (U.S.)

- Klesk Metal Stamping Co. (U.S.)

- Kenmode, Inc. (U.S.)

- American Axle & Manufacturing, Inc. (U.S.)

Latest Developments in Global Stamped Component Market

- In February 2025, ESI Group introduced BM-Stamp, an advanced stamping simulation tool designed to simplify and accelerate the metal stamping process. By enabling engineers at all expertise levels to conduct accurate, predictive simulations for both standard and high-strength materials such as steel and aluminum—without requiring specialized knowledge of FEM or meshing—the tool enhances production efficiency and reduces errors. This innovation is expected to significantly support automotive manufacturers in cutting costs and shortening development cycles, positively influencing the demand for precision-stamped components across the market

- In January 2024, GSC Steel Stamping LLC announced the successful acquisition of Dixien, LLC's assets, marking a significant milestone that strengthens its leadership in the sector. With 43 years of experience in stamping automobile components, this strategic acquisition represents a pivotal moment in the company's history

- In November 2023, Generational Growth Capital, a Milwaukee-based equity firm, acquired Federal Tool & Engineering, BP Metals, and Rockford Specialties, three U.S.-based metal stamping and structural steel manufacturers. This strategic consolidation expands the new entity's manufacturing capacity and strengthens its logistics network, ensuring consistent delivery to customers. The acquisition is set to boost production efficiency and meet growing demand for high-quality stamped components, particularly across automotive, construction, and industrial sectors in North America

- In October 2023, Ryerson acquired Norlen Inc., a Wisconsin-based metal stamping fabricator serving the agricultural and defense industries. This acquisition enhances Ryerson's product portfolio and strengthens its capabilities in delivering precision-stamped components for critical sectors. The expansion is expected to drive growth opportunities within niche market segments and reinforce supply chains for complex, high-performance stamped parts

- In June 2023, General Motors announced a USD 500 million investment in its Arlington, Texas assembly plant to support production of its next-generation SUVs. The investment includes the purchase of advanced metal stamping equipment and upgrades to the body shop, highlighting GM's focus on increasing production efficiency and vehicle quality. This move is expected to drive demand for high-precision stamped components, reinforcing the role of advanced stamping technologies in meeting evolving automotive design and performance requirements.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.