Global Stannic Chloride Market

Market Size in USD Million

CAGR :

%

USD

790.50 Million

USD

1,318.13 Million

2024

2032

USD

790.50 Million

USD

1,318.13 Million

2024

2032

| 2025 –2032 | |

| USD 790.50 Million | |

| USD 1,318.13 Million | |

|

|

|

|

Stannic Chloride Market Size

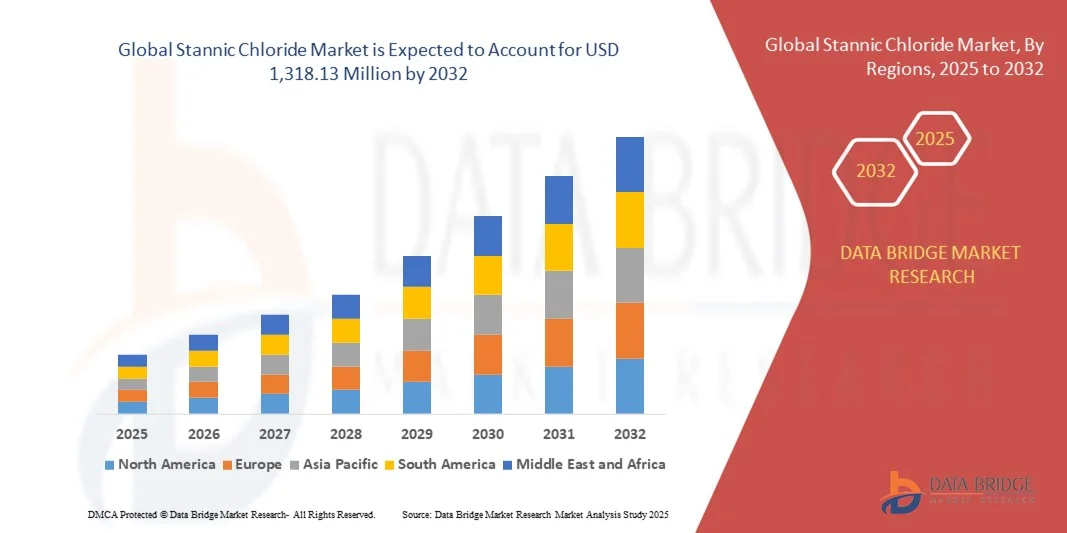

- The global stannic chloride market size was valued at USD 790.50 million in 2024 and is expected to reach USD 1,318.13 million by 2032, at a CAGR of 6.60% during the forecast period

- The market growth is largely fuelled by the rising demand for stannic chloride in catalysts, glass manufacturing, and tin-based coatings

- Increasing industrial applications in polymers, electronics, and pharmaceuticals are further supporting market expansion

Stannic Chloride Market Analysis

- The stannic chloride market is witnessing steady growth due to its extensive use as a catalyst and intermediate in various chemical synthesis processes. The growing electronics industry is driving demand for high-purity tin compounds used in semiconductors and conductive coatings

- In addition, the increasing adoption of stannic chloride in glass etching and tin-plating applications enhances product durability and transparency, boosting its usage across automotive and construction industries

- North America dominated the stannic chloride market with the largest revenue share of 41.25% in 2024, driven by high demand from the polymer, coatings, and electronics industries across the region

- Asia-Pacific region is expected to witness the highest growth rate in the global stannic chloride market, driven by strong industrial expansion in China, Japan, and India, along with growing investments in electronics, agriculture, and chemical production

- The liquid segment held the largest market revenue share in 2024, driven by its wide usage in catalytic and coating applications where high solubility and easy dispersion are essential. Liquid stannic chloride offers excellent handling convenience and compatibility with diverse chemical systems, making it the preferred form for industrial and laboratory applications

Report Scope and Stannic Chloride Market Segmentation

|

Attributes |

Stannic Chloride Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Stannic Chloride Market Trends

Increasing Use Of Stannic Chloride In Electronics And Semiconductor Manufacturing

- The growing demand for stannic chloride in semiconductor production and electronic components is significantly shaping market growth. Its role as a precursor in producing transparent conducting oxides (TCOs) and tin-based thin films makes it essential for advanced display and solar cell technologies. Rising global investments in semiconductor fabrication are further accelerating consumption rates. The material’s compatibility with high-precision coating processes also enhances its appeal in optoelectronic applications such as LEDs and integrated circuits

- With the expansion of electric vehicles and renewable energy infrastructure, the need for efficient photovoltaic cells and sensors is increasing. Stannic chloride’s ability to enhance film uniformity and electrical conductivity supports the production of high-performance devices, particularly in Asia-Pacific, which dominates global semiconductor manufacturing. The compound’s use in improving light transmittance and stability of conductive layers makes it critical for next-generation transparent electronics. Governments promoting domestic chip manufacturing are also strengthening its demand

- In addition, research institutions and chemical manufacturers are developing high-purity grades of stannic chloride to meet the stringent quality standards of the electronics sector. This is driving technological advancements and improving product consistency across large-scale fabrication units. The growing emphasis on precision engineering and defect-free production in semiconductors is pushing suppliers to enhance purification and packaging processes. As a result, manufacturers are focusing on scalable, contamination-free synthesis methods to ensure long-term competitiveness

- For instance, in 2024, multiple Asian semiconductor producers upgraded their thin-film coating lines using refined stannic chloride solutions to enhance product yield and optical quality. This shift is expected to improve energy efficiency in display panels and boost demand for the compound in next-generation manufacturing processes. The initiative also reflects a broader movement toward sustainable materials that deliver both performance and environmental compliance. As investments in advanced electronics manufacturing continue to rise, the integration of stannic chloride is projected to expand further

- As semiconductor and electronics sectors evolve, the integration of stannic chloride in new applications such as sensors, smart displays, and microelectronics is likely to sustain long-term market expansion. However, consistent quality assurance and contamination control will remain key challenges for large-scale adoption. Continuous R&D focused on refining purity levels and adapting the compound to emerging fabrication technologies will be vital. Furthermore, strategic collaborations between chemica

Stannic Chloride Market Dynamics

Driver

Rising Demand From The Polymer And Coatings Industry

- The increasing utilization of stannic chloride as a catalyst and stabilizer in polymerization processes is one of the major drivers of the market. It plays a critical role in producing plastics, resins, and coatings that require high stability and clarity. The product’s ability to act as a cross-linking agent in epoxy coatings enhances film durability and adhesion. Moreover, its catalytic properties reduce the time and temperature required for polymer curing, improving production efficiency. This contributes to reduced operational costs and energy consumption in large-scale polymer manufacturing

- The construction and automotive sectors are boosting demand for high-performance coatings where stannic chloride is used to improve gloss, resistance, and curing speed. The compound’s versatility allows manufacturers to tailor it for applications ranging from corrosion-resistant metal coatings to specialty finishes for industrial equipment. As infrastructure and automotive production rise globally, the demand for advanced protective coatings continues to surge. The product’s adaptability in various resin systems also makes it suitable for powder coatings and UV-curable materials

- The chemical’s catalytic efficiency also supports large-scale polymer synthesis, reducing energy consumption and reaction time, which aligns with sustainability goals across chemical manufacturing. This makes it a valuable additive for companies aiming to improve production efficiency and lower environmental impact. Its use in producing high-clarity polyurethanes and epoxy systems is expanding rapidly, especially in regions with strong industrial output such as China and India. Manufacturers are also exploring hybrid formulations using stannic chloride to enhance performance and recyclability

- For instance, in 2023, major coatings manufacturers in Europe adopted stannic chloride catalysts in high-performance epoxy formulations to meet increasing standards for weather resistance and durability in architectural coatings. This transition enabled the development of coatings with longer life spans and lower maintenance requirements. European sustainability directives promoting eco-friendly additives have further boosted its acceptance in advanced coating technologies. The success of such initiatives is encouraging global players to replicate similar strategies in emerging markets

- While the demand continues to rise, maintaining purity standards and safe handling protocols remain critical challenges. Manufacturers are focusing on sustainable production methods and efficient waste management to align with global environmental regulations. Investment in closed-loop systems and cleaner production technologies is becoming a key focus to minimize environmental footprint. Furthermore, collaboration with end-use industries to develop customized formulations is expected to enhance market adaptability and customer satisfaction

Restraint/Challenge

Environmental And Health Concerns Associated With Stannic Chloride Handling

- The toxic and corrosive nature of stannic chloride poses significant environmental and occupational safety challenges during production, transport, and application. Direct exposure can cause respiratory and skin irritation, prompting stricter handling requirements in industrial environments. Companies are investing heavily in protective infrastructure such as sealed processing lines and advanced filtration systems to mitigate these risks. However, the cost of compliance remains high, especially for small-scale producers in developing economies

- Compliance with regulatory frameworks such as REACH and OSHA has increased operational costs for manufacturers, particularly in regions emphasizing chemical safety. The need for specialized containment systems and waste disposal processes adds complexity to manufacturing operations. Companies must allocate significant resources to monitoring emissions and maintaining safety certifications, impacting overall profitability. This has led to a consolidation trend where only larger, well-capitalized players can sustain full compliance while maintaining competitive margins

- Moreover, improper disposal or accidental leaks during large-scale industrial use can result in environmental contamination, leading to fines and operational halts. These risks discourage smaller producers from entering the market and limit production scalability in emerging economies. Growing public scrutiny and environmental activism are compelling companies to implement transparent reporting systems and regular audits. Such measures, while necessary, add further administrative burden and delay production processes

- For instance, in 2023, several Asian producers were required to upgrade safety systems and introduce closed-loop processes after environmental audits identified elevated levels of chloride emissions in wastewater discharge. The move led to temporary shutdowns and increased costs for facility modernization but helped improve long-term compliance and environmental performance. Governments in the region are now encouraging partnerships between local industries and environmental technology providers to ensure sustainable operations

- While ongoing innovations in green chemistry and alternative formulations aim to reduce toxicity levels, balancing regulatory compliance with cost-effectiveness will be a crucial factor influencing the future growth trajectory of the stannic chloride market. The development of eco-friendly substitutes or safer derivative compounds is gaining traction as part of industry sustainability initiatives. However, widespread adoption will depend on cost parity, scalability, and performance reliability compared to conventional formulations

Stannic Chloride Market Scope

The global stannic chloride market is segmented on the basis of product form, purity of product, applications, end-user industry, and product.

- By Product Form

On the basis of product form, the stannic chloride market is segmented into liquid and solid. The liquid segment held the largest market revenue share in 2024, driven by its wide usage in catalytic and coating applications where high solubility and easy dispersion are essential. Liquid stannic chloride offers excellent handling convenience and compatibility with diverse chemical systems, making it the preferred form for industrial and laboratory applications.

The solid segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its higher storage stability, lower transportation risk, and longer shelf life. Its increasing use in specialized chemical synthesis and electronic component manufacturing is further supporting its demand among precision-driven industries.

- By Purity of Product

On the basis of purity of product, the stannic chloride market is segmented into 99% and others. The 99% purity segment accounted for the largest revenue share in 2024, due to its extensive use in semiconductor processing, high-end coatings, and fine chemical manufacturing where consistency and quality are crucial. Manufacturers in electronics and optics sectors increasingly prefer this grade to ensure optimal performance and low impurity levels.

The others segment is expected to witness significant growth from 2025 to 2032, fuelled by demand in bulk applications such as tin plating, pigment preparation, and polymer catalysts. This segment is favored by cost-sensitive industries that prioritize large-scale consumption over high purity specifications.

- By Applications

On the basis of applications, the stannic chloride market is segmented into electronics, tinplate, float glass, brass & bronze, and others. The electronics segment dominated the market in 2024, supported by the growing adoption of stannic chloride in producing conductive coatings, transparent electrodes, and thin films for semiconductor devices. Its role in manufacturing display panels, sensors, and solar cells continues to expand with rising electronic component production.

The tinplate and float glass segments are expected to experience strong growth from 2025 to 2032, driven by the use of stannic chloride as a key material for coating processes and as a refining agent to improve glass clarity. In addition, the compound’s role in alloy preparation for brass and bronze applications supports market demand in metal finishing and foundry sectors.

- By End-User Industry

On the basis of end-user industry, the stannic chloride market is segmented into polymers, agriculture, pharmaceuticals, electrical & electronics, chemical, and other industrial sectors. The electrical & electronics segment captured the largest revenue share in 2024, owing to the compound’s expanding use in integrated circuits, optical coatings, and conductive films. Increasing semiconductor investments across Asia-Pacific and North America have amplified its consumption in precision manufacturing.

The polymers and chemical industries is expected to witness significant growth from 2025 to 2032, driven by stannic chloride’s catalytic role in polymerization and resin stabilization. In addition, rising utilization in pharmaceuticals and agriculture as an intermediate or analytical reagent highlights its expanding industrial versatility.

- By Product

On the basis of product, the stannic chloride market is segmented into stannic chloride anhydrate and stannic chloride pentahydrate. The stannic chloride pentahydrate segment held the dominant market share in 2024 due to its broad application range in coatings, catalysts, and glass manufacturing, along with easier handling properties and safer storage conditions.

The stannic chloride anhydrate segment is expected to witness significant growth from 2025 to 2032, primarily attributed to its high reactivity and suitability for electronic and fine chemical synthesis. Its superior performance in processes demanding minimal moisture content positions it as a critical material in advanced industrial applications.

Stannic Chloride Market Regional Analysis

- North America dominated the stannic chloride market with the largest revenue share of 41.25% in 2024, driven by high demand from the polymer, coatings, and electronics industries across the region

- The market growth is supported by the region’s strong industrial infrastructure, advancements in semiconductor and chemical manufacturing, and increasing applications of stannic chloride in catalysts, stabilizers, and conductive coatings

- Furthermore, growing investments in R&D, along with stricter environmental regulations promoting safer and more efficient chemical processing, are contributing to the region’s leading position in the global market

U.S. Stannic Chloride Market Insight

The U.S. stannic chloride market accounted for the largest revenue share in 2024 within North America, driven by expanding use in polymers, coatings, and specialty chemical production. The country’s advanced manufacturing sector and robust demand for high-performance materials have significantly contributed to consumption levels. Rising applications in electronics, pharmaceuticals, and glass coating further enhance market potential. Moreover, increasing focus on sustainable production methods and compliance with stringent safety regulations are shaping the future landscape of the U.S. stannic chloride market.

Europe Stannic Chloride Market Insight

The Europe stannic chloride market is expected to witness significant growth from 2025 to 2032, supported by its growing demand across glass manufacturing, pharmaceuticals, and specialty coatings industries. The region’s emphasis on high-quality production standards and adoption of green chemistry principles is promoting sustainable product innovation. Furthermore, strong presence of leading chemical producers and advanced R&D infrastructure continues to enhance market competitiveness. Increasing investment in precision coatings and specialty materials is also expected to drive consistent growth during the forecast period.

Germany Stannic Chloride Market Insight

The Germany stannic chloride market is expected to register substantial growth from 2025 to 2032, fuelled by its advanced industrial base and emphasis on sustainable material production. The country’s strong automotive, electronics, and coatings sectors are major end-users of stannic chloride, leveraging its catalytic and stabilizing properties. Furthermore, ongoing innovation in corrosion-resistant and energy-efficient coatings is driving demand. Germany’s commitment to environmental compliance and technological excellence positions it as one of the key contributors to Europe’s overall market expansion.

U.K. Stannic Chloride Market Insight

The U.K. stannic chloride market is expected to witness notable growth from 2025 to 2032, driven by the expanding demand for advanced coatings, specialty polymers, and electronic materials. The increasing adoption of high-purity stannic chloride in research and industrial applications is propelling market expansion. Moreover, the U.K.’s strong focus on sustainability and green manufacturing is encouraging the use of eco-friendly chemical formulations. Continued investments in R&D and partnerships between academic institutions and chemical manufacturers are expected to further strengthen the market outlook.

Asia-Pacific Stannic Chloride Market Insight

The Asia-Pacific stannic chloride market is projected to witness the fastest growth rate from 2025 to 2032, driven by expanding electronics, semiconductor, and chemical industries in countries such as China, Japan, and South Korea. The region benefits from abundant raw materials, low production costs, and a robust manufacturing ecosystem. Rapid industrialization and infrastructure development are also enhancing demand from polymer and coatings applications. Moreover, the growing emphasis on export-oriented production and technological innovation continues to position Asia-Pacific as a critical growth hub.

China Stannic Chloride Market Insight

The China stannic chloride market held the largest revenue share in 2024 within Asia-Pacific, driven by extensive industrial usage across electronics, glass, and chemical processing sectors. The country’s strong manufacturing capabilities, coupled with continuous technological advancements, are enhancing production efficiency and export capacity. Growing investments in semiconductor fabrication and high-performance materials further boost market demand. In addition, the presence of key domestic producers and supportive government policies contribute to China’s leadership in the regional stannic chloride market.

Japan Stannic Chloride Market Insight

The Japan stannic chloride market is projected to grow at a significant rate from 2025 to 2032, supported by the country’s advanced electronics and semiconductor manufacturing sectors. The compound’s critical role in producing thin films, transparent conductive coatings, and precision glass coatings positions Japan as a key consumer in Asia. Furthermore, local producers are focusing on refining product purity and consistency to meet stringent quality standards for high-tech applications. Japan’s continuous innovation in materials science, along with government support for electronic component manufacturing, will continue to fuel demand for stannic chloride throughout the forecast period.

Stannic Chloride Market Share

The Stannic Chloride industry is primarily led by well-established companies, including:

• Gulbrandsen (U.S.)

• Mason Corporation (U.S.)

• Merck Sharp & Dohme Corp. (U.S.)

• American Elements, a subsidiary of Merck & Co., Inc. (U.S.)

• Hefei TNJ Chemical Industry Co., Ltd. (China)

• BOC Sciences (U.S.)

• Westman Chemicals Pvt. Ltd. (India)

• Acadechem Company Limited (China)

• Tinchem Enterprises (U.S.)

• Meghachem Industries (India)

• S. V. Enterprises (India)

• Maharashtra Organo Metallic Catalysts Pvt. Ltd. (India)

• Rektol GmbH & Co. KG (Germany)

• AN PharmaTech Co. Ltd. (China)

• Oakwood Products, Inc. (U.S.)

• Glentham Life Sciences Limited (U.K.)

• Debyesci (China)

• LTS Research Laboratories, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Stannic Chloride Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Stannic Chloride Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Stannic Chloride Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.