Global Starter Cultures Market

Market Size in USD Billion

CAGR :

%

USD

1.78 Billion

USD

21.31 Billion

2024

2032

USD

1.78 Billion

USD

21.31 Billion

2024

2032

| 2025 –2032 | |

| USD 1.78 Billion | |

| USD 21.31 Billion | |

|

|

|

|

Starter Cultures Market Size

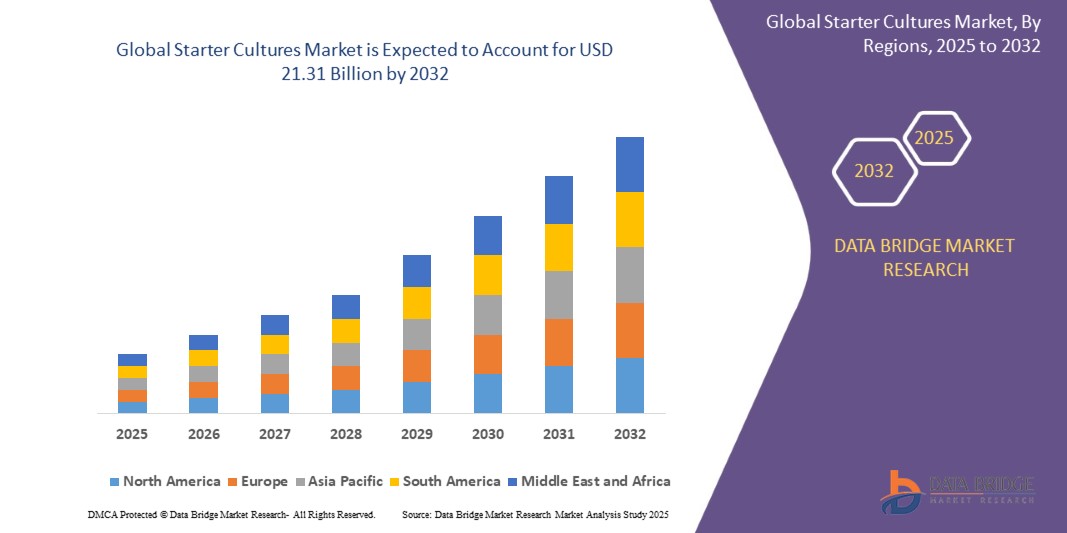

- The global starter cultures market size was valued at USD 1.78 billion in 2024 and is expected to reach USD 21.31 billion by 2032, at a CAGR of 9.1% during the forecast period

- Market growth is fuelled by the rising demand for fermented and probiotic foods and beverages, increased consumer awareness about gut health and clean label benefits, and rapid innovation in functional, bioprotective, and plant-based starter culture solutions.

- Expansion in dairy, meat, bakery, beverage, and plant-based food sectors—especially in Europe and Asia-Pacific—has significantly accelerated adoption rates for both traditional and specialized microbial starter cultures worldwide.

Starter Cultures Market Analysis

- Starter cultures are essential microbial blends—predominantly bacteria, yeast, and molds—used to initiate and control fermentation in a variety of foods and beverages.

- Bacterial cultures dominate the largest share, especially in yogurt, cheese, and fermented meat production, thanks to their efficiency, health benefits, and safe flavor development

- Yeast cultures are fast growing, driven by bakery, alcoholic beverage, and specialty fermentation applications.

- Freeze-dried formulations are prevalent for their stability, shelf life, easy transportation, and consistent performance across commercial processing lines.

- Multi-strain mixes are increasingly adopted for their ability to yield unique flavors, improved texture, and greater microbial robustness.

- Innovations in customized, bioprotective strains, and advances in synthetic biology are enhancing product quality and expanding options for manufacturers across food, beverage, and nutraceutical sectors.

Report Scope and Starter Cultures Market Segmentation

|

Attributes |

Starter Cultures Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Starter Cultures Market Trends

Advancement and Integration of Functional, Natural, and Bioprotective Cultures

- A key emerging trend in the global starter cultures market is the accelerating use of natural, functional, and bioprotective microbial blends in food and beverage production. This shift is driven by rising consumer demand for clean label, additive-free, and probiotic-rich products—reflecting greater awareness of gut health, immunity, and overall well-being.

- Food manufacturers are exploring specialty cultures tailored for dairy, meat, plant-based, and bakery applications, focusing on blends that impart unique flavors, improved texture, and enhanced safety without synthetic preservatives.

- For example, leaders like Chr. Hansen and DSM have launched multi-strain starter cultures for plant-based yogurts and cheeses, while Sacco SRL’s bioprotective cultures are widely used to extend shelf life and prevent spoilage in natural cheeses and cured meats.

- There is growing innovation in bioprotective and health-promoting cultures—including strains with proven antimicrobial activity to inhibit pathogens, and functional blends that deliver digestive and immune support. These trends are shaping product development for baby food, sports nutrition, and functional beverages, where quality, safety, and natural origin are critical.

- Producers are increasingly emphasizing environmentally sustainable, high-yield, and robust strains to support resource efficiency and supply chain resilience, with advances in freeze-drying and synthetic biology further expanding applications and shelf stability.

- As consumers and the food industry prioritize safety, health, and sustainability—especially since the pandemic—demand for specialty and natural starter cultures is projected to rise rapidly, offering a decisive advantage to companies innovating in this space.

Starter Cultures Market Dynamics

Driver

Rising Demand for Fermented, Functional, and Clean Label Foods

- Increasing global demand for fermented foods and beverages—such as yogurt, cheese, plant-based alternatives, and probiotic-rich products—is a primary driver of starter cultures market growth.

- Heightened awareness of digestive health, immunity, and the benefits of natural fermentation has substantially boosted consumer interest in products made with specialized bacterial, yeast, and bioprotective cultures.

- Innovation in functional foods, including the fortification of starter cultures with probiotics, is propelling adoption across dairy, bakery, beverage, and wellness categories.

- In emerging economies, rapid urbanization and rising disposable incomes are expanding consumer access to and interest in quality, safe, and health-promoting fermented food options.

- As sustainability gains priority, manufacturers are investing in cultures that reduce the need for artificial additives, extend shelf life naturally, and support clean label product development—addressing both health and environmentally conscious consumer segments.

Restraint/Challenge

Regulatory Stringency, Raw Material Quality, and Market Competition

- Strict regulatory requirements governing the approval and use of microbial strains for food applications present a significant hurdle. Differing regional standards, safety testing, and labeling mandates can delay new product launches and increase compliance and R&D costs.

- Variability in the quality of raw materials (such as milk, grains, and fermentable substrates) can adversely affect starter culture performance, consistency, and safety, posing operational and supply chain challenges.

- Intensifying competition—especially from global players and lower-cost alternatives—pressures margins and differentiates the need for innovation, performance, and documentation of health claims.

- Price sensitivity, particularly in developing markets, may limit adoption of premium or advanced starter culture products, requiring companies to balance efficacy, cost, and accessibility.

- Ongoing education of manufacturers, retailers, and consumers regarding best practices in culture use, benefits, and safety profiles is essential for market growth, trust, and successful adoption across diverse food segments.

Starter Cultures Market Scope

The market is segmented on the basis of culture type, form, microorganism, composition, and application.

- By Type

On the basis of type, the global starter cultures market is segmented into bacterial cultures, yeast cultures, and mould cultures. Bacterial cultures hold the largest revenue share in 2024, predominantly due to their essential role in the fermentation of dairy products like yogurt, cheese, and certain meat products, offering consistent quality, safety, and desired flavors. Yeast cultures are expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand in bakery, beverages (such as wine, beer), and plant-based dairy alternatives. Their ability to impart unique flavors and health attributes makes them a favored choice in innovative and functional food applications.

- By Form

On the basis of form, the market is segmented into freeze-dried, frozen, and liquid forms. Freeze-dried cultures dominate the market due to their superior shelf life, convenience in storage and transportation, and consistent performance in large-scale industrial processing. Liquid and frozen cultures are gaining popularity in artisanal, craft, and customized food production, where flexibility and strain diversity are prioritized.

- By Microorganism

On the basis of microorganism, the Starter Culturess market is segmented into Starter cultures are classified into single strain, multi-strain, and multi-strain mixes based on composition. Multi-strain mixes are increasingly favored for generating complex flavors, stronger fermentation profiles, and improved resilience against environmental variations.

- By Application

On the application basis, the market is segmented into dairy & dairy-based products, meat & seafood products, bakery & confectionery, alcoholic and non-alcoholic beverages, animal feed, and others. Dairy and dairy-based products represent the largest application, with starter cultures crucial for consistent fermentation and product innovation. Meat and seafood, bakery, and beverages are expanding quickly, supported by interest in functional, probiotic, and clean label foods. Growth in plant-based, specialty, and health-focused categories further stimulates segment diversification.

Starter Cultures Market Regional Analysis

- Asia-Pacific is the dominant region in the global starter cultures market, accounting for the 48.56% revenue share in 2024. This leadership is driven by rapid growth in dairy, meat, bakery, and fermented beverage industries across key countries such as China, India, Japan, and Southeast Asian nations.

- Rising disposable incomes, urbanization, and increasing consumer awareness about health benefits associated with fermented and probiotic foods are fueling demand for starter cultures in the region.

- The expansion of food processing industries, strengthening supply chains, and government support for food safety and nutrition programs further accelerate adoption.

- Asia-Pacific’s vast agricultural base, availability of raw materials for fermentation, and cost-effective manufacturing infrastructure enhance market growth and export competitiveness.

U.S. Starter Cultures Market Insight

The U.S. holds a leading position in North America’s starter cultures market in 2024, supported by advanced food processing infrastructure, robust dairy and meat industries, and strong consumer demand for probiotic and clean label fermented foods. High regulatory standards and ongoing innovation propel adoption of specialty starter cultures in yogurt, cheese, processed meats, sourdough bakery, and functional beverages. Major producers focus on multi-strain and bioprotective blends to address health trends and food safety requirements.

Europe Starter Cultures Market Insight

Europe’s starter cultures market is projected for robust, sustained growth, driven by strict food safety regulations, heritage of artisanal and specialty cheeses, and strong consumer preference for natural and healthy fermented products. Widespread applications span dairy, meat, bakery, beverages, and plant-based alternatives. Regional leaders such as France, Germany, Italy, and the Netherlands play key roles in manufacturing and innovation, supporting high-quality starter blends for both domestic and export markets.

U.K. Starter Cultures Market Insight

The U.K. starter cultures market is experiencing notable expansion, spurred by rising demand for probiotic dairy, specialty yogurts, traditional cheeses, and sourdough as well as interest in health-focused fermented products. Foodservice, major retailers, and specialty producers are increasingly adopting tailored bacterial and yeast cultures to meet clean label, convenience, and flavor innovation trends in both consumer and institutional channels.

Germany Starter Cultures Market Insight

Germany’s starter cultures market grows steadily on the back of engineering excellence, strict quality standards, and a diversified food manufacturing sector. High use in cheese, fermented meats, bakery, and beverages underscores the country’s commitment to tradition, safety, and continuous innovation. German producers are noted for pioneering bioprotective and multi-functional culture solutions for shelf life extension and product differentiation.

Asia-Pacific Starter Cultures Market Insight

Asia-Pacific accounts for the largest revenue share globally in 2024, fueled by expanding dairy, meat, bakery, and beverage industries in China, India, and Japan. Rising awareness of gut health, wellness, and functional nutrition accelerates starter culture adoption in both mass-market and specialty products. Government nutrition initiatives, affordable production, and dynamic exports make the region a leader in both consumption and supply of starter cultures.

India Starter Cultures Market Insight

India’s starter cultures market is projected to grow at the highest CAGR, propelled by increased focus on health and nutrition, growth in dairy processing and plant-based foods, and consumer interest in traditional fermented items such as curd, lassi, idli, and dosa. Government support and domestic investments in food safety and manufacturing capacity further boost adoption and innovation.

China Starter Cultures Market Insight

China leads the Asia-Pacific starter cultures market in revenue share, leveraging its massive dairy, bakery, and beverage industries and implementation of advanced fermentation technologies. Domestic and export demand for traditional fermented foods, probiotics, and clean label innovations fosters strong growth. China continues to invest in research, infrastructure, and product development for starter cultures in both food and beverage applications.

Starter Cultures Market Share

The Starter Cultures industry is primarily led by well-established companies, including:

- Chr. Hansen Holding (Denmark)

- DuPont/IFF (US)

- DSM (Netherlands)

- Sacco SRL (Italy)

- Angel Yeast (China)

- Döhler Group SE (Germany)

- Mediterranea Biotecnologie (Italy)

- Benny Impex (India)

- Biochem SRL (Italy)

- CSK Food (Netherlands)

- Bioprox (France)

- Genesis Laboratories (Bulgaria)

Latest Developments in Global Starter Cultures Market

- In January 2025 Chr. Hansen introduced tailored multi-strain blends for plant-based fermented dairy alternatives.

- In May 2024 DSM launched freeze-dried cultures optimized for shelf life and international transport.

- In September 2024 Sacco SRL developed bioprotective starter cultures for extended shelf life in meat and cheese.

- In March 2024 Angel Yeast expanded R&D efforts in probiotic and specialty cultures for functional foods in Asia-Pacific.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.