Global Starter Fertilizers Market

Market Size in USD Billion

CAGR :

%

USD

9.73 Billion

USD

14.71 Billion

2024

2032

USD

9.73 Billion

USD

14.71 Billion

2024

2032

| 2025 –2032 | |

| USD 9.73 Billion | |

| USD 14.71 Billion | |

|

|

|

|

Starter Fertilizers Market Size

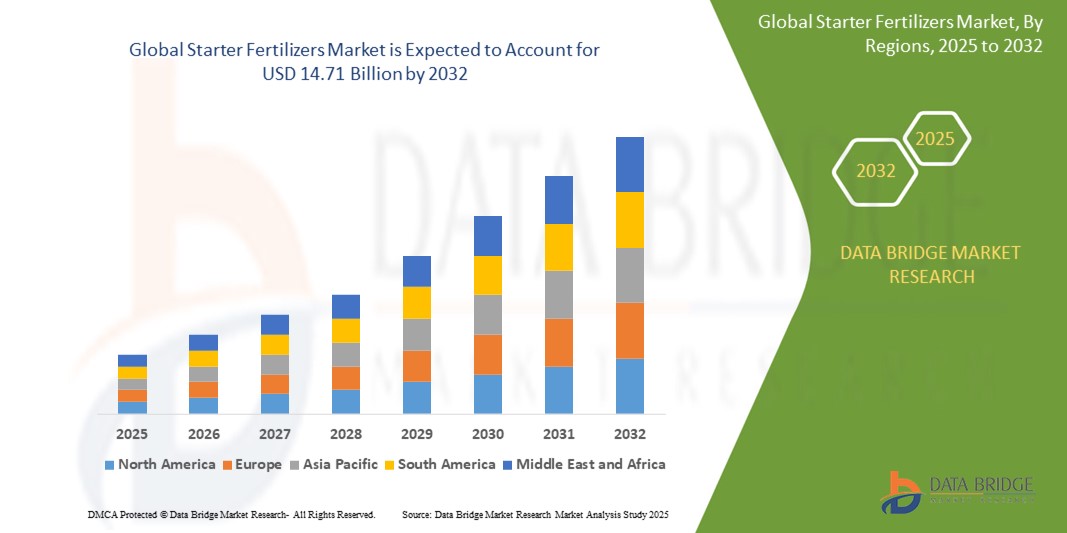

- The global starter fertilizers market size was valued at USD 9.73 billion in 2024 and is expected to reach USD 14.71 billion by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is primarily driven by the increasing adoption of precision agriculture techniques and the rising need for enhanced crop yields to meet global food demand

- Growing awareness among farmers about the benefits of starter fertilizers in improving early plant growth and nutrient uptake, coupled with advancements in fertilizer formulations, is accelerating market expansion

Starter Fertilizers Market Analysis

- Starter fertilizers, applied near seeds or plant roots during planting, provide essential nutrients to support early crop growth, improve root development, and enhance overall yield potential

- The demand for starter fertilizers is fueled by the global push for sustainable agriculture, increasing food security concerns, and the adoption of modern farming practices that emphasize efficient nutrient management

- Europe dominated the starter fertilizers market with the largest revenue share of 38.5% in 2024, driven by advanced agricultural practices, high adoption of precision farming, and supportive government policies promoting sustainable agriculture

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, rising agricultural investments, and increasing awareness of advanced farming techniques in countries such as China, India, and Australia

- The phosphorous starter fertilizer segment dominated the largest market revenue share of 38.2% in 2024, driven by its critical role in stimulating early root development and energy transfer in crops, particularly during germination and early growth stages

Report Scope and Starter Fertilizers Market Segmentation

|

Attributes |

Starter Fertilizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Starter Fertilizers Market Trends

“Increasing Integration of Precision Agriculture and Biostimulants”

- The global starter fertilizers market is experiencing a significant trend toward the integration of precision agriculture technologies and biostimulants

- These technologies enable precise nutrient delivery tailored to specific crop and soil conditions, optimizing early plant growth and improving yield efficiency

- Biostimulant-based starter fertilizers, derived from natural sources such as plant extracts and microbial fermentation, enhance nutrient uptake and promote sustainable farming practice

- For instance, companies are developing advanced formulations such as controlled-release fertilizers and microbial-based solutions that improve nutrient availability during critical early growth stages

- This trend enhances the value of starter fertilizers, making them increasingly attractive to farmers aiming to maximize productivity while minimizing environmental impact

- Precision agriculture tools, such as soil sensors and data analytics, allow for real-time monitoring and application of starter fertilizers, ensuring optimal nutrient delivery for crops such as cereals, fruits, and vegetables

Starter Fertilizers Market Dynamics

Driver

“Rising Demand for High-Yield Crops and Sustainable Agriculture”

- Increasing global food demand, driven by population growth and changing dietary patterns, is a major driver for the starter fertilizers market

- Starter fertilizers enhance early plant growth by providing essential nutrients such as nitrogen, phosphorus, potassium, and micronutrients, leading to improved crop yields and quality for cereals, fruits, vegetables, forage, and turf grasses

- Government initiatives promoting sustainable agriculture, particularly in Europe, which dominates the market, are encouraging the adoption of starter fertilizers to improve nutrient use efficiency

- The proliferation of IoT and advancements in fertigation and foliar application methods are enabling more efficient nutrient delivery, further driving market growth

- Farmers are increasingly adopting starter fertilizers to meet the rising demand for high-value crops and to address soil nutrient deficiencies, particularly in regions such as Asia-Pacific, the fastest-growing market

Restraint/Challenge

“High Costs and Environmental Concerns”

- The high initial costs of starter fertilizers, including production, application equipment, and integration with precision agriculture systems, can be a barrier, particularly in emerging markets with cost-sensitive farmers

- Application methods such as in-furrow, fertigation, and foliar require specialized equipment, adding to the overall expense

- Environmental concerns related to the overuse of synthetic starter fertilizers, which dominate the market, pose a challenge due to potential soil and water contamination

- The fragmented regulatory landscape across countries, especially regarding nutrient runoff and environmental impact, complicates compliance for manufacturers and limits market expansion

- These factors may deter adoption in regions with high environmental awareness or limited financial resources, despite the growing demand for organic starter fertilizers as a sustainable alternative

Starter Fertilizers market Scope

The market is segmented on the basis of nutrient, form, crop type, method of application, and type.

- By Nutrient

On the basis of nutrient, the global starter fertilizers market is segmented into nitrogen starter fertilizer, phosphorous starter fertilizer, potassium, and micronutrients. The phosphorous starter fertilizer segment dominated the largest market revenue share of 38.2% in 2024, driven by its critical role in stimulating early root development and energy transfer in crops, particularly during germination and early growth stages. Phosphorus is essential for crops such as corn and soybeans, which are widely cultivated globally.

The nitrogen starter fertilizer segment is expected to witness the fastest growth rate of 6.1% from 2025 to 2032. This growth is fueled by increasing demand for nitrogen-based fertilizers to promote rapid plant growth and biomass, addressing the rising global food demand and enhancing crop yields. Advancements in precision agriculture further boost nitrogen fertilizer adoption.

- By Form

On the basis of form, the global starter fertilizers market is segmented into dry and liquid. The liquid segment is expected to hold the largest market revenue share of 52.3% in 2024, driven by its ease of application, uniform nutrient distribution, and compatibility with precision farming technologies. Liquid formulations, such as 10-34-0 and 7-21-7, are widely used for their efficiency in nutrient delivery.

The dry segment is anticipated to experience robust growth from 2025 to 2032, with a projected CAGR of 5.8%. This growth is attributed to the cost-effectiveness and longer shelf life of dry fertilizers, such as 18-46-0 and 8-32-16, making them a preferred choice for large-scale farming operations in diverse soil conditions.

- By Crop Type

On the basis of crop type, the global starter fertilizers market is segmented into cereals, fruits and vegetables, forage and turf grasses, and others. The cereals segment dominated the market with a revenue share of 45.7% in 2024, driven by the high global demand for staple crops such as corn, wheat, and barley. Starter fertilizers, particularly those high in phosphorus, are extensively used to enhance early growth in cereal crops, especially in North America.

The fruits and vegetables segment is expected to witness the fastest growth rate of 6.5% from 2025 to 2032. Increasing consumer demand for high-quality produce, coupled with the need for nutrient-efficient farming to support health-conscious trends, drives the adoption of starter fertilizers in this segment.

- By Method of Application

On the basis of method of application, the global starter fertilizers market is segmented into in-furrow, fertigation, foliar, and other methods. The in-furrow segment held the largest market revenue share of 40.1% in 2024, driven by its effectiveness in placing nutrients directly near the seed, ensuring optimal uptake during early growth stages. This method is widely used in cereal and row crop production.

The foliar segment is anticipated to experience the fastest growth rate of 6.8% from 2025 to 2032. Foliar application is gaining popularity due to its ability to deliver nutrients rapidly, especially in crops with underdeveloped root systems, such as corn and soybeans, enhancing nutrient use efficiency and crop yields.

- By Type

On the basis of type, the global starter fertilizers market is segmented into synthetic and organic. The synthetic segment dominated the market with a revenue share of 68.4% in 2024, driven by its widespread availability, cost-effectiveness, and ability to provide precise nutrient ratios tailored to specific crop needs. Common synthetic formulations include granular, liquid, and controlled-release fertilizers.

The organic segment is expected to witness the fastest growth rate of 7.2% from 2025 to 2032. The rising trend of organic and sustainable farming practices, driven by consumer demand for eco-friendly products and government initiatives promoting reduced chemical use, is fueling the adoption of organic starter fertilizers, such as those derived from animal manure, compost, and plant-based sources.

Starter Fertilizers Market Regional Analysis

- Europe dominated the starter fertilizers market with the largest revenue share of 38.5% in 2024, driven by advanced agricultural practices, high adoption of precision farming, and supportive government policies promoting sustainable agriculture

U.S. Starter Fertilizers Market Insight

The U.S. starter fertilizers market is expected to witness significant growth, fueled by strong demand for high-efficiency fertilizers and growing awareness of nutrient management benefits. The trend toward precision agriculture and sustainable farming practices further boosts market expansion. The use of starter fertilizers in both conventional and organic farming complements the growing focus on crop productivity and soil health.

Europe Starter Fertilizers Market Insight

The Europe dominated the global starter fertilizers market share of 77.9% in 2024, supported by stringent regulations on sustainable agriculture and a strong emphasis on crop productivity. Farmers seek fertilizers that optimize early plant growth while ensuring environmental compliance. The growth is prominent in both large-scale farming and specialized crop production, with countries such as Germany and France showing significant adoption due to advanced agricultural technologies and environmental concerns.

U.K. Starter Fertilizers Market Insight

The U.K. market for starter fertilizers is expected to witness rapid growth, driven by demand for improved crop yields and nutrient efficiency in diverse farming systems. Increased interest in sustainable agriculture and awareness of soil health benefits encourage adoption. Evolving regulations promoting eco-friendly farming practices influence farmer choices, balancing nutrient application with environmental compliance.

Germany Starter Fertilizers Market Insight

Germany is expected to experience robust growth in the starter fertilizers market, attributed to its advanced agricultural sector and high farmer focus on crop efficiency and sustainability. German farmers prefer technologically advanced fertilizers that enhance early plant growth and contribute to resource-efficient farming. The integration of these fertilizers in both conventional and organic farming supports sustained market growth.

Asia-Pacific Starter Fertilizers Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding agricultural production and rising adoption of modern farming techniques in countries such as China, India, and Japan. Increasing awareness of nutrient management, crop yield optimization, and sustainable agriculture is boosting demand. Government initiatives promoting precision farming and food security further encourage the use of advanced starter fertilizers.

Japan Starter Fertilizers Market Insight

Japan’s starter fertilizers market is expected to witness rapid growth due to strong farmer preference for high-quality, nutrient-efficient fertilizers that enhance crop establishment and yield. The presence of advanced agricultural practices and integration of starter fertilizers in large-scale farming accelerate market penetration. Rising interest in precision agriculture also contributes to growth.

China Starter Fertilizers Market Insight

China holds the largest share of the Asia-Pacific starter fertilizers market, propelled by rapid agricultural expansion, rising food demand, and increasing adoption of nutrient-efficient solutions. The country’s growing agricultural sector and focus on sustainable farming support the adoption of advanced starter fertilizers. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Starter Fertilizers Market Share

The starter fertilizers industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- BASF SE (Germany)

- Yara (Norway)

- Compass Minerals (US)

- Syngenta Crop Protection AG (Switzerland)

- ADAMA (Israel)

- Sumitomo Chemical Co., Ltd. (Japan)

- Nufarm Canada (Australia)

- UPL (India)

- KS Aktiengesellschaft (Germany)

- ICL (Israel)

- Agrium Inc. (Canada)

- Helena Agri-Enterprises, LLC (U.S.)

- Wilbur-Ellis Company (U.S.)

- Haifa Group (Israel)

What are the Recent Developments in Global Starter Fertilizers Market?

- In July 2024, Brazilian manufacturer Terraplant introduced MinerOxi+, the country’s first 3-in-1 organomineral fertilizer. This innovative product blends essential minerals, organic fractions, and oxides into a single, ready-to-use formulation. Designed to tackle environmental and climate challenges, MinerOxi+ enhances nutrient availability, corrects soil acidity, and supports sustainable farming practices. Unlike traditional fertilizers that require separate mixing and certification, MinerOxi+ is pre-certified by Brazil’s Ministry of Agriculture, offering farmers a standardized, efficient solution. It delivers both the immediate benefits of mineral fertilizers and the long-term advantages of organic matter, making it suitable for a wide range of crops

- In December 2023, Yara International announced the acquisition of the organic-based fertilizer business of Agribios Italiana, marking its second strategic move to expand its organic portfolio in Europe. This acquisition enhances Yara’s ability to offer sustainable crop nutrition solutions, combining Agribios’ expertise in high-quality organic fertilizers with Yara’s scale and reach. It supports Yara’s broader goals of regenerative agriculture, soil health improvement, and climate change mitigation, while also aligning with the EU’s ambition to increase organic farmland. The move strengthens Yara’s presence in Italy—Europe’s second-largest organic fertilizer market—and beyond

- In September 2023, SABIC Agri-Nutrients Company partnered with BiOWiSH Technologies and ADM to introduce a biologically enhanced urea fertilizer, recognized as a ‘green fertilizer’. This innovative product is designed to reduce greenhouse gas emissions and improve carbon sequestration in soil, offering a more sustainable alternative to conventional urea. The collaboration launched a 50,000-acre pilot project in the U.S. Midwest, where participating farmers also joined ADM’s re:generations program to adopt regenerative agriculture practices. The initiative supports SABIC’s commitment to carbon neutrality by 2050 and reflects a broader industry shift toward climate-smart farming

- In July 2022, Nutrien Inc. announced an agreement to acquire Casa do Adubo S.A., a Brazilian agricultural retailer with 39 retail outlets and 10 distribution centers operating under the Agrodistribuidor Casal brand. This strategic acquisition significantly expanded Nutrien’s footprint in Brazil—from five to 13 states—and bolstered its distribution capabilities for starter fertilizers and crop inputs. The deal, valued at approximately $290 million, was finalized in October 2022, and is expected to contribute an additional $400 million in annual sales, reinforcing Nutrien’s position in Latin America’s growing agricultural market

- In August 2020, Yara East Africa launched Yara Microp, a specialized micronutrient fertilizer formulated to improve maize yields in Western Kenya. Tailored to address local soil deficiencies, Yara Microp contains a balanced blend of phosphorus, nitrogen, sulfur, and zinc, which are essential for early plant development and nutrient uptake. The fertilizer was developed based on extensive soil analysis and farmer feedback, ensuring it meets the specific agronomic needs of the region. By enhancing nutrient efficiency and supporting strong root and shoot growth, Yara Microp contributes to higher productivity and more resilient crops

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Starter Fertilizers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Starter Fertilizers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Starter Fertilizers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.