Global Steam Turbine Market

Market Size in USD Million

CAGR :

%

USD

25,200.00 Million

USD

33,183.59 Million

2021

2029

USD

25,200.00 Million

USD

33,183.59 Million

2021

2029

| 2022 –2029 | |

| USD 25,200.00 Million | |

| USD 33,183.59 Million | |

|

|

|

|

Market Analysis and Size

Steam turbines are fundamentally used in conjunction with gas turbines to improve plant efficiency by harnessing exhaust gas heat to generate additional power. Steam turbine market revenue share will be thrusted by strict emission regulations to decrease GHG emissions and lowering natural gas prices. Additionally, over the forecast period, the industry's potential will be fueled by the government's continuous efforts to boost domestic manufacturing, which are aligned with a favorable prognosis for long-term political stability. These determinants will significantly aid the market traction over the forecast timeframe.

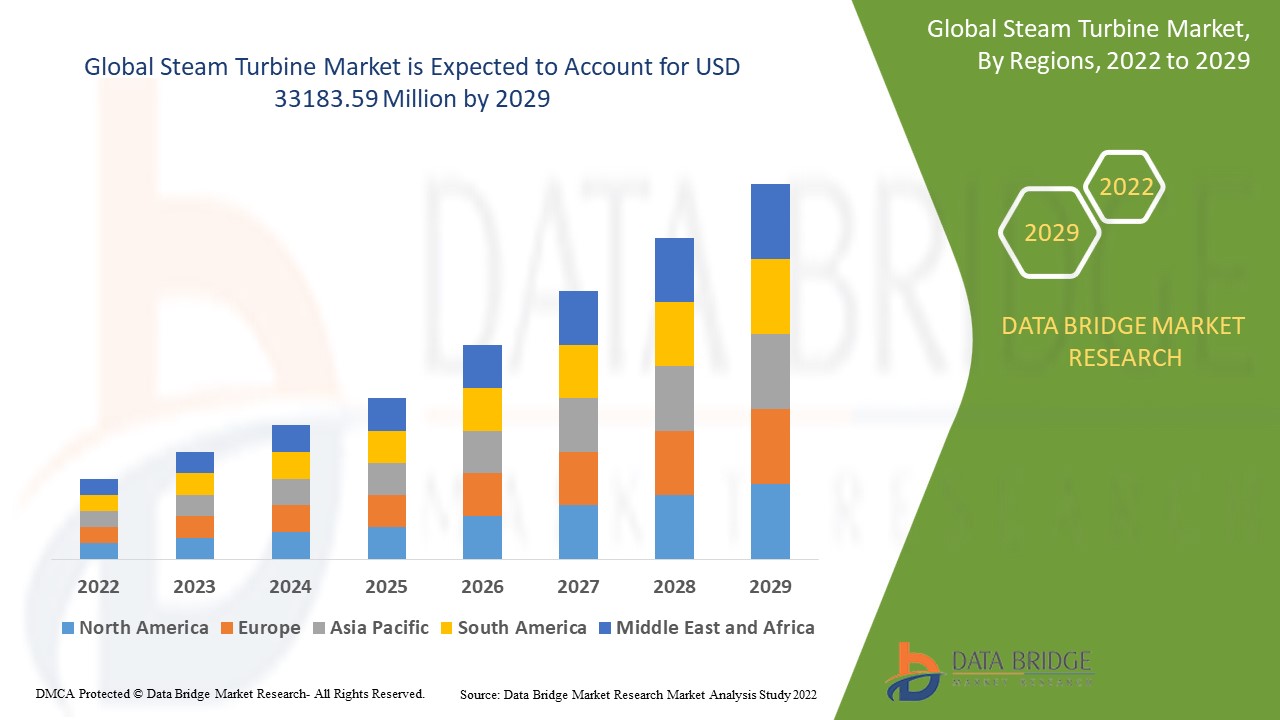

Global Steam Turbine Market was valued at USD 25,200.00 million in 2021 and is expected to reach USD 33183.59 million by 2029, registering a CAGR of 3.50% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes technological advancements, regulatory framework, PESTEL, porter's five forces analysis, industry standards-at a glance, raw material costs/ operational expenditure-overview, supply chain analysis, vendor selection criteria, pricing analysis, production analysis, and climate chain scenario.

Market Definition

A steam turbine is a mechanical device that uses thermal energy to perform mechanical work from a rotating output shaft. A steam turbine is made up of a boiler, turbine, condenser, feed pump, and numerous other components. Steam turbines are powered by a heated, gaseous stream that flows from the turbine's revolving blades. The steam spins the blades continually, transforming the bulk of the steam's energy into kinetic energy. It is used to generate electricity by powering a generator. Thermal energy, which is the most frequently used source of energy for electricity generation worldwide and has the biggest installed capacity of any other source, is used to power steam turbines.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Design (Reaction, Impulse), Exhaust (Condensing, Non-condensing), Fuel (Fossil Fuel, Biomass, Geothermal), Capacity (≤3 MW, >3 MW - 100 MW, >100 MW), By Technology (Steam Cycle, Combined Cycle, Cogeneration), End Use Industry (Power Generation, Petrochemical, Oil and Gas, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Poland, Norway, Finland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Nigeria, Algeria, Angola, Ghana, Rest of Middle East and Africa |

|

Market Players Covered |

General Electric (U.S.), Siemens (Spain), Shanghai Electric (China), ABB (Switzerland), Doosan Corporation (South Korea), Alstom (France), Hitachi Ltd. (Japan), Ming Yang Smart Energy Group Co (China), Rockwell Automation Inc., (U.S.), Toshiba Corporation (Japan), Hyundai Motor Company (South Korea), Schneider Electric (France), Elliott Group (U.S.), Taiyuan Heavy Industry Co., (China), Fuji Electric Co., Ltd. (Japan) and Man Diesel & Turbo SE (Germany) |

|

Market Opportunities |

|

Steam Turbine Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Surge in Demand for Power

The need for steam turbines is projected to expand in tandem with the rise in power demand. Around the world, steam-electric power plants generate the majority of electric electricity. As the world's population expands, the demand for power is expected to skyrocket. This factor is expected to drive up demand for steam turbines even further. On the other hand, the worldwide steam turbine market has yet to realize its full potential.

Furthermore the factors such as the rapid industrialization and rising electricity demand, particularly in developing economies will drive industry growth. Moreover, increasing electricity consumption and surging thermal power capacities also accelerates the market growth. With ever-growing electricity consumption, annual thermal capacity additions are increasing. Another factor increasing demand for steam turbines is the growth of the renewable energy market, notably in biomass. The rising need for steam turbines for power generation has been fueled by frequent power outages, blackouts, and load shedding. The expansion of the steam turbine for power generation market is predicted to be fueled by an increase in combined cycle and co-generation activities all over the world.

Opportunities

- Surging Developments and Research

Furthermore, various developments and technological advancements of steam turbines by the market players further extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Additionally, the consistent research to produce clean coal technology offers lucrative growth opportunities for the market.

- Increasing Government Policies

Several government policies are in place to support the greener energy initiative. Many multinational corporations are taking steps to reduce their carbon footprint in order to contribute to a greener world and long-term sustainability. For instance, Equinor (Norway), aims to cut carbon emissions in half by 2050. One component of the strategy is to expand its renewable energy businesses, particularly steam turbine, which could reach 6,000 megawatts in six years and 16,000 megawatts in fifteen years. As a result, the boost in various government policies as well as the regulations associated with greener energy initiative and reduction in carbon footprint generates various opportunities for the market.

Restraints/Challenges

- High Capital Costs

The high capital cost is preventing the implementation of steam turbine which can further become a major disadvantage for the steam turbine market. This factors is anticipated hamper the overall growth of the market.

- Surging Restrictions due to Climate Concerns

There has been growing concerns about carbon emissions' negative impact on the climate, as well as policies at the regional and national levels such as capping the amount of emissions acceptable from these plants, have led to the retirement of existing plants and the postponement of future construction in favor of other, more expensive options. The regulatory and legislative restrictions on fossil-fuel-fired power plants will further pose as a serious challenge to the growth of the steam turbine market.

This steam turbine market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the steam turbine market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Steam turbine Market

The recent outbreak of coronavirus had a negative impact on the steam turbine market, because of the enforcement of lockdowns and a large decrease in capital spending in terms of improvements and growth of power production activities, the COVID-19 pandemic has only a minor impact on the steam turbine industry. Government initiatives to restart operations in significant enterprises, manufacturing facilities, and infrastructure projects, on the other hand, will boost market growth. The government's increasing investment in various power production facilities as a result of the increased importance of self-sufficiency during the pandemic breakout led to the expansion of the steam turbine market. During the epidemic, there was a drop in infrastructure and construction development operations, which had a detrimental impact on market development.

Global Steam Turbine Market Scope

The steam turbine market is segmented on the basis of design, exhaust, fuel, capacity, technology and end use industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Design

- Reaction

- Impulse

Exhaust

- Condensing

- Non-condensing

Fuel

- Fossil Fuel

- Biomass

- Geothermal

Capacity

- ≤3 MW

- >3 MW - 100 MW

- >100 MW

Technology

- Steam Cycle

- CombinedCycle

- Cogeneration

End Use Industry

- Power Generation

- Petrochemical

- Oil and Gas

- Others

Steam Turbine Market Regional Analysis/Insights

The steam turbine market is analyzed and market size insights and trends are provided by country, design, exhaust, fuel, capacity, technology and end use industry as referenced above.

The countries covered in the steam turbine market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Poland, Norway, Finland, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Nigeria, Algeria, Angola, Ghana, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the steam turbine market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2022-2029. The market growth over this region is attributed to the rising integration of combined cycle technologies for captive power generation within the region.

Asia-Pacific on the other hand, is estimated to show lucrative growth over the forecast period of 2022-2029. This is due to the strict government regulations imposed in countries such as China to decrease greenhouse gas emissions from key industries.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Steam turbine Market Share Analysis

The steam turbine market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to steam turbine market.

Some of the major players operating in the steam turbine market are

- General Electric (U.S.)

- Siemens (Spain)

- Shanghai Electric (China)

- ABB (Switzerland)

- Doosan Corporation (South Korea)

- Alstom (France)

- Hitachi Ltd. (Japan)

- Ming Yang Smart Energy Group Co (China)

- Rockwell Automation Inc., (U.S.)

- Toshiba Corporation (Japan)

- Hyundai Motor Company (South Korea)

- Schneider Electric (France)

- Elliott Group (U.S.)

- Taiyuan Heavy Industry Co., (China)

- Fuji Electric Co., Ltd. (Japan)

- Man Diesel & Turbo SE (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL STEAM TURBINE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL STEAM TURBINE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMAPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL STEAM TURBINE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

6. GLOBAL STEAM TURBINE MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 NOZZLE

6.3 ROTOR

6.3.1 ROTOR, BY TYPE

6.3.1.1. DRUM TYPE

6.3.1.2. DISK TYPE

6.4 BLADES

6.4.1 BLADES, BY TYPE

6.4.1.1. FIXED TYPE

6.4.1.2. MOVING TYPE

6.5 CASING

6.5.1 CASING, BY TYPE

6.5.1.1. INNER CASING

6.5.1.2. EXTERIOR CASING

6.6 DIAPHRAGM

7. GLOBAL STEAM TURBINE MARKET, BY TYPE

7.1 OVERVIEW

7.2 STEAM CYCLE (CONVENTIONAL)

7.3 COGENERATION

7.4 COMBINED CYCLE

8. GLOBAL STEAM TURBINE MARKET, BY NUMBER OF CASING

8.1 OVERVIEW

8.2 TWO CASINGS

8.3 THREE CASINGSS

8.4 FOUR CASING

8.5 FIVE CASINGS

8.6 OTHERS

9. GLOBAL STEAM TURBINE MARKET, BY EXHAUST TYPE

9.1 OVERVIEW

9.2 CONDENSING

9.3 NON-CONDENSING

10. GLOBAL STEAM TURBINE MARKET, BY BLADE DESIGN

10.1 OVERVIEW

10.2 REACTION

10.3 IMPULSE

11. GLOBAL STEAM TURBINE MARKET, BY STAGES

11.1 OVERVIEW

11.2 SINGLE STAGE TURBINE

11.3 MULTI STAGE TURBINE

12. GLOBAL STEAM TURBINE MARKET, BY PRESSURE

12.1 OVERVIEW

12.2 LOW PRESSURE

12.3 MEDIUM PRESSURE

12.4 HIGH PRESSURE

12.5 SUPERCRITICAL PRESSURE

13. GLOBAL STEAM TURBINE MARKET, BY FLOW DIRECTION TYPE

13.1 OVERVIEW

13.2 AXIAL FLOW TURBINE

13.3 RADIAL FLOW TURBINE

14. GLOBAL STEAM TURBINE MARKET, BY CAPACITY

14.1 OVERVIEW

14.2 LESS THAN 100 MW

14.3 101 MW -350 MW

14.4 351 MW -750 MW

14.5 ABOVE 750 MW

15. GLOBAL STEAM TURBINE MARKET, BY SPEED

15.1 OVERVIEW

15.2 UPTO 3,600 RPM

15.3 3,600 RPM -8,000 RPM

15.4 8,000 RPM -12,000 RPM

15.5 12,001 RPM – 15,000 RPM

15.6 MORE THAN 15,000 RPM

16. GLOBAL STEAM TURBINE MARKET, BY APPLICATION

16.1 OVERVIEW

16.2 COAL

16.3 NUCLEAR

16.4 BIOMASS

16.5 NATURAL GAS

16.6 OTHERS

17. GLOBAL STEAM TURBINE MARKET, BY GOVERNING TYPE

17.1 OVERVIEW

17.2 THROTTLE GOVERNING

17.3 NOZZLE GOVERNING

17.4 BY-PASS GOVERNING

18. GLOBAL STEAM TURBINE MARKET, BY END USER

18.1 OVERVIEW

18.2 POWER AND UTILITY

18.2.1 BY TYPE

18.2.1.1. STEAM CYCLE (CONVENTIONAL)

18.2.1.2. COGENERATION

18.2.1.3. COMBINED CYCLE

18.3 INDUSTRIAL

18.3.1 INDUSTRIAL, BY TYPE

18.3.1.1. REFINERY

18.3.1.2. PETROCHEMICAL

18.3.1.3. CHEMICAL PLANT

18.3.1.4. SUGAR PLANT

18.3.1.5. PULP AND PAPER

18.3.1.6. STEEL AND METALLURGICAL

18.3.1.7. CEMENT

18.3.1.8. MINES

18.3.1.9. SEAWATER DESALINATION PLANTS

18.3.1.10. OTHERS

18.3.2 BY TYPE

18.3.2.1. STEAM CYCLE (CONVENTIONAL)

18.3.2.2. COGENERATION

18.3.2.3. COMBINED CYCLE

19. GLOBAL STEAM TURBINE MARKET, BY GEOGRAPHY

GLOBAL STEAM TURBINE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

19.1.1 NORTH AMERICA

19.1.1.1. U.S.

19.1.1.2. CANADA

19.1.1.3. MEXICO

19.1.2 EUROPE

19.1.2.1. GERMANY

19.1.2.2. FRANCE

19.1.2.3. U.K.

19.1.2.4. ITALY

19.1.2.5. SPAIN

19.1.2.6. RUSSIA

19.1.2.7. TURKEY

19.1.2.8. BELGIUM

19.1.2.9. NETHERLANDS

19.1.2.10. NORWAY

19.1.2.11. FINLAND

19.1.2.12. SWITZERLAND

19.1.2.13. DENMARK

19.1.2.14. SWEDEN

19.1.2.15. POLAND

19.1.2.16. REST OF EUROPE

19.1.3 ASIA PACIFIC

19.1.3.1. JAPAN

19.1.3.2. CHINA

19.1.3.3. SOUTH KOREA

19.1.3.4. INDIA

19.1.3.5. AUSTRALIA

19.1.3.6. NEW ZEALAND

19.1.3.7. SINGAPORE

19.1.3.8. THAILAND

19.1.3.9. MALAYSIA

19.1.3.10. INDONESIA

19.1.3.11. PHILIPPINES

19.1.3.12. TAIWAN

19.1.3.13. VIETNAM

19.1.3.14. REST OF ASIA PACIFIC

19.1.4 SOUTH AMERICA

19.1.4.1. BRAZIL

19.1.4.2. ARGENTINA

19.1.4.3. REST OF SOUTH AMERICA

19.1.5 MIDDLE EAST AND AFRICA

19.1.5.1. SOUTH AFRICA

19.1.5.2. EGYPT

19.1.5.3. SAUDI ARABIA

19.1.5.4. U.A.E

19.1.5.5. OMAN

19.1.5.6. BAHRAIN

19.1.5.7. ISRAEL

19.1.5.8. KUWAIT

19.1.5.9. QATAR

19.1.5.10. REST OF MIDDLE EAST AND AFRICA

19.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

20. GLOBAL STEAM TURBINE MARKET,COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

20.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

20.3 COMPANY SHARE ANALYSIS: EUROPE

20.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

20.5 MERGERS & ACQUISITIONS

20.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

20.7 EXPANSIONS

20.8 REGULATORY CHANGES

20.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

21. GLOBAL STEAM TURBINE MARKET, SWOT & DBMR ANALYSIS

22. GLOBAL STEAM TURBINE MARKET, COMPANY PROFILE

22.1 ARANER

22.1.1 COMPANY SNAPSHOT

22.1.2 REVENUE ANALYSIS

22.1.3 PRODUCT PORTFOLIO

22.1.4 RECENT DEVELOPMENT

22.2 GENERAL ELECTRIC

22.2.1 COMPANY SNAPSHOT

22.2.2 REVENUE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENT

22.3 SIEMENS

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 PRODUCT PORTFOLIO

22.3.4 RECENT DEVELOPMENT

22.4 MITSUBISHI HEAVY INDUSTRIES, LTD

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 PRODUCT PORTFOLIO

22.4.4 RECENT DEVELOPMENT

22.5 SUMITOMO HEAVY INDUSTRIES, LTD

22.5.1 COMPANY SNAPSHOT

22.5.2 REVENUE ANALYSIS

22.5.3 PRODUCT PORTFOLIO

22.5.4 RECENT DEVELOPMENT

22.6 TRIVENI TURBINE LTD

22.6.1 COMPANY SNAPSHOT

22.6.2 REVENUE ANALYSIS

22.6.3 PRODUCT PORTFOLIO

22.6.4 RECENT DEVELOPMENT

22.7 ELLIOTT GROUP(A PART OF EBARA CORPORATION)

22.7.1 COMPANY SNAPSHOT

22.7.2 REVENUE ANALYSIS

22.7.3 PRODUCT PORTFOLIO

22.7.4 RECENT DEVELOPMENT

22.8 TOSHIBA

22.8.1 COMPANY SNAPSHOT

22.8.2 REVENUE ANALYSIS

22.8.3 PRODUCT PORTFOLIO

22.8.4 RECENT DEVELOPMENT

22.9 ANSALDO ENERGIA(A PART OF CDP EQUITY)

22.9.1 COMPANY SNAPSHOT

22.9.2 REVENUE ANALYSIS

22.9.3 PRODUCT PORTFOLIO

22.9.4 RECENT DEVELOPMENT

22.10 TGM KANIS TURBINEN GMBH

22.10.1 COMPANY SNAPSHOT

22.10.2 REVENUE ANALYSIS

22.10.3 PRODUCT PORTFOLIO

22.10.4 RECENT DEVELOPMENT

22.11 ALSTOM SA

22.11.1 COMPANY SNAPSHOT

22.11.2 REVENUE ANALYSIS

22.11.3 PRODUCT PORTFOLIO

22.11.4 RECENT DEVELOPMENT

22.12 FRANCO TOSI MECCANICA S.P.A.

22.12.1 COMPANY SNAPSHOT

22.12.2 REVENUE ANALYSIS

22.12.3 PRODUCT PORTFOLIO

22.12.4 RECENT DEVELOPMENT

22.13 FINCANTIERI S.P.A

22.13.1 COMPANY SNAPSHOT

22.13.2 REVENUE ANALYSIS

22.13.3 PRODUCT PORTFOLIO

22.13.4 RECENT DEVELOPMENT

22.14 HOWDEN( A PART OF CHART INDUSTRIES)

22.14.1 COMPANY SNAPSHOT

22.14.2 REVENUE ANALYSIS

22.14.3 PRODUCT PORTFOLIO

22.14.4 RECENT DEVELOPMENT

22.15 M+M TURBINEN-TECHNIK

22.15.1 COMPANY SNAPSHOT

22.15.2 REVENUE ANALYSIS

22.15.3 PRODUCT PORTFOLIO

22.15.4 RECENT DEVELOPMENT

22.16 MAN ENERGY SOLUTION(A PART OF VOLKSWAGEN GROUP)

22.16.1 COMPANY SNAPSHOT

22.16.2 REVENUE ANALYSIS

22.16.3 PRODUCT PORTFOLIO

22.16.4 RECENT DEVELOPMENT

22.17 DONGFANG ELECTRIC CORPORATION

22.17.1 COMPANY SNAPSHOT

22.17.2 REVENUE ANALYSIS

22.17.3 PRODUCT PORTFOLIO

22.17.4 RECENT DEVELOPMENT

22.18 TURBIMAQ EUROPE D.O.O

22.18.1 COMPANY SNAPSHOT

22.18.2 REVENUE ANALYSIS

22.18.3 PRODUCT PORTFOLIO

22.18.4 RECENT DEVELOPMENT

22.19 HARBIN ELECTRIC CORPORATION CO.,LTD

22.19.1 COMPANY SNAPSHOT

22.19.2 REVENUE ANALYSIS

22.19.3 PRODUCT PORTFOLIO

22.19.4 RECENT DEVELOPMENT

22.20 DOOSAN ŠKODA POWER

22.20.1 COMPANY SNAPSHOT

22.20.2 REVENUE ANALYSIS

22.20.3 PRODUCT PORTFOLIO

22.20.4 RECENT DEVELOPMENT

22.21 KAWASAKI HEAVY INDUSTRIES, LTD.

22.21.1 COMPANY SNAPSHOT

22.21.2 REVENUE ANALYSIS

22.21.3 PRODUCT PORTFOLIO

22.21.4 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

23. CONCLUSION

24. QUESTIONNAIRE

25. RELATED REPORTS

26. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.