Global Stearoyl Lactylate Market

Market Size in USD Million

CAGR :

%

USD

611.58 Million

USD

2,392.93 Million

2024

2032

USD

611.58 Million

USD

2,392.93 Million

2024

2032

| 2025 –2032 | |

| USD 611.58 Million | |

| USD 2,392.93 Million | |

|

|

|

|

Stearoyl Lactylate Market Size

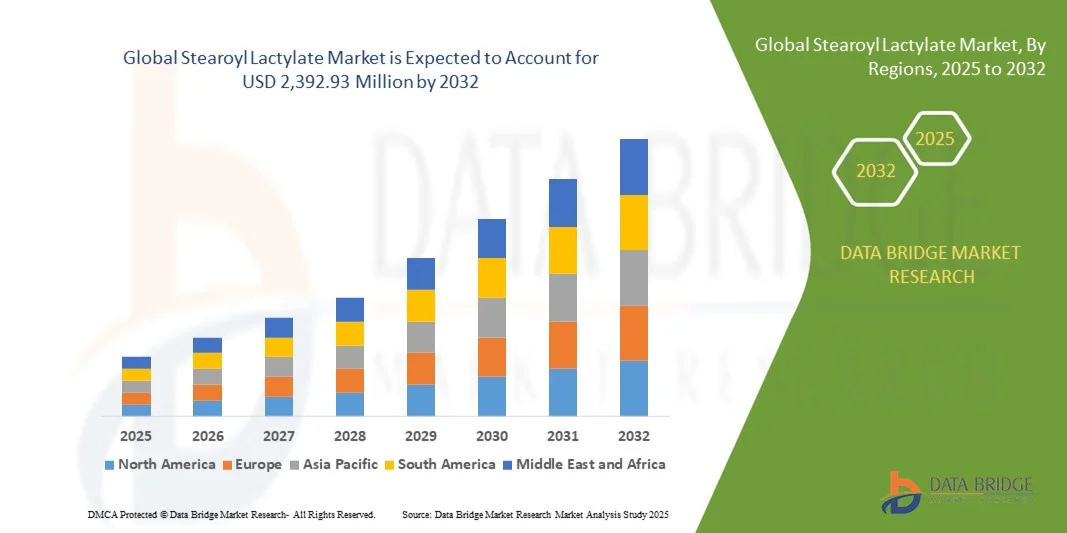

- The global stearoyl lactylate market size was valued at USD 611.58 million in 2024 and is expected to reach USD 2,392.93 million by 2032, at a CAGR of 7.00% during the forecast period

- The market growth is largely fuelled by the increasing demand for clean-label and functional food ingredients, the rising consumption of baked goods and processed foods, and the expanding use of stearoyl lactylate as an emulsifier and dough conditioner

Stearoyl Lactylate Market Analysis

- Growing adoption of stearoyl lactylate in bakery products, confectionery, and dairy applications due to its ability to improve texture, volume, and shelf life

- Rising consumer preference for clean-label and non-GMO ingredients is encouraging manufacturers to use stearoyl lactylate as a functional additive

- North America dominated the stearoyl lactylate market with the largest revenue share in 2024, driven by strong demand from the bakery and processed food industries, as well as increasing adoption of clean-label and functional ingredients

- Asia-Pacific region is expected to witness the highest growth rate in the global stearoyl lactylate market, driven by rising disposable incomes, increasing urban population, expansion of the bakery and processed food sectors, and growing focus on affordable, high-quality food ingredients

- The sodium stearoyl lactylates segment held the largest market revenue share in 2024, driven by its wide application in bakery and processed foods to improve dough stability, texture, and shelf life. Its compatibility with clean-label and non-GMO formulations makes it a preferred choice among food manufacturers

Report Scope and Stearoyl Lactylate Market Segmentation

|

Attributes |

Stearoyl Lactylate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

Here’s the list with the top 5 companies hyperlinked, keeping the format and without linking the countries:

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Stearoyl Lactylate Market Trends

Increasing Adoption of Stearoyl Lactylate in Bakery and Processed Foods

- The growing use of stearoyl lactylate as an emulsifier and dough conditioner is transforming the food industry by improving texture, volume, and shelf life in baked goods. Its functionality enables manufacturers to produce consistent, high-quality products, reducing waste and enhancing consumer satisfaction. In addition, it supports large-scale production processes while maintaining product uniformity across batches

- The rising demand for clean-label and functional ingredients is accelerating the adoption of stearoyl lactylate in bakery, dairy, and confectionery applications. Its compatibility with non-GMO and natural formulations makes it an attractive choice for health-conscious consumers and manufacturers aiming for transparent labeling. The ingredient also allows manufacturers to meet regulatory and consumer-driven quality standards efficiently

- The affordability and ease of incorporation of stearoyl lactylate into various formulations are encouraging manufacturers to adopt it for routine product enhancement. This allows food producers to improve product quality without significant increases in production costs, leading to greater market penetration. Moreover, it reduces dependency on multiple additives, simplifying formulations and operational workflows

- For instance, in 2023, several bakery and confectionery companies in Europe reported improved dough stability and extended shelf life after incorporating stearoyl lactylate into their formulations. This led to reduced product waste, improved consumer satisfaction, and enhanced operational efficiency. Companies also observed better product handling and reduced equipment wear during mixing and baking processes

- While stearoyl lactylate is driving quality improvements and clean-label adoption, its market impact depends on continued innovation, regulatory compliance, and raw material availability. Manufacturers must focus on optimized formulations and scalable production to fully capitalize on growing demand. In addition, adapting to evolving consumer trends and product diversification will further expand its market presence

Stearoyl Lactylate Market Dynamics

Driver

Rising Demand for Functional Food Ingredients and Clean-Label Products

- Increasing consumer preference for clean-label, functional, and non-GMO food ingredients is driving the adoption of stearoyl lactylate across bakery, dairy, and processed foods. Manufacturers are prioritizing ingredients that enhance product quality while aligning with consumer expectations. This shift is also promoting transparency in labeling and brand trust among health-conscious buyers

- Food producers are becoming more aware of the operational and financial benefits of using stearoyl lactylate, such as improved dough stability, extended shelf life, and reduced product waste. This awareness is encouraging widespread integration of the ingredient across various product lines. Companies also gain operational efficiency by minimizing batch inconsistencies and optimizing ingredient usage

- Industry initiatives and support from ingredient suppliers are strengthening the adoption of stearoyl lactylate, providing formulation guidance, technical support, and optimized product solutions. These efforts are helping manufacturers implement the ingredient efficiently and enhance product performance. Collaborative R&D and training programs further support smooth integration into existing production lines

- For instance, in 2022, a leading European bakery supplier launched ready-to-use stearoyl lactylate blends that improved product consistency and volume across multiple bakery lines, driving higher adoption among mid- and large-scale producers. The initiative also reduced production downtime and simplified supply chain management for clients

- While rising demand and institutional support are driving growth, there is still a need to ensure affordability, maintain consistent raw material supply, and comply with food safety regulations to sustain market adoption. Manufacturers must also innovate formulations to meet regional taste preferences and functional requirements for diverse product categories

Restraint/Challenge

High Cost of Raw Materials and Regulatory Compliance Requirements

- The high cost of stearoyl lactylate and its raw materials can limit adoption among small and mid-sized food manufacturers. Price sensitivity remains a key barrier, especially in cost-competitive product categories. Fluctuations in raw material availability and import dependencies can further impact production planning and overall profitability

- In many regions, manufacturers face challenges in complying with stringent food safety and labeling regulations, which may delay product launches or require reformulations. Lack of standardized guidelines across regions can complicate adoption. Companies must invest in testing, certification, and quality assurance to meet regulatory requirements while maintaining production efficiency

- Market penetration is also hindered by limited technical expertise in optimizing formulations for specific applications, which may result in suboptimal product performance. Manufacturers may rely on external consultants or suppliers for guidance, adding to operational costs. Training and process standardization are necessary to ensure consistent product quality and functional benefits

- For instance, in 2023, several small-scale bakery units in Southeast Asia reported difficulty in sourcing quality-grade stearoyl lactylate at affordable prices, restricting their ability to enhance product quality. This limited access affected their competitiveness against larger producers and delayed product innovation

- While stearoyl lactylate formulations continue to evolve, addressing cost, regulatory, and technical challenges is crucial. Market stakeholders must focus on scalable production, formulation support, and cost-effective supply chains to unlock long-term growth potential. In addition, collaboration with local suppliers and investment in R&D will help overcome adoption barriers and drive global market expansion

Stearoyl Lactylate Market Scope

The market is segmented on the basis of product type, end use, and sales channel

- By Product Type

On the basis of product type, the stearoyl lactylate market is segmented into sodium stearoyl lactylates and calcium stearoyl lactylates. The sodium stearoyl lactylates segment held the largest market revenue share in 2024, driven by its wide application in bakery and processed foods to improve dough stability, texture, and shelf life. Its compatibility with clean-label and non-GMO formulations makes it a preferred choice among food manufacturers.

The calcium stearoyl lactylates segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its functional benefits in dough conditioning, emulsification, and product consistency. Its effectiveness in improving volume, texture, and processing efficiency is encouraging adoption across bakery, confectionery, and dairy applications, making it increasingly popular among manufacturers.

- By End Use

On the basis of end use, the stearoyl lactylate market is segmented into the food and beverage industry, bakery & confectionery, meat and poultry, dairy products, alcoholic beverages, convenience products, plastic industry, pet food, and cosmetic and personal care products. The bakery & confectionery segment held the largest market revenue share in 2024, driven by its widespread use to enhance dough performance, improve product quality, and extend shelf life in commercial baking applications.

Dairy products is expected to witness the fastest growth rate from 2025 to 2032 during the forecast period, fueled by increasing consumer demand for functional, clean-label, and ready-to-eat foods. The rising focus on product quality, consistency, and shelf-life extension is driving manufacturers to adopt stearoyl lactylate across diverse applications.

- By Sales Channel

On the basis of sales channel, the stearoyl lactylate market is segmented into direct sales/B2B, indirect sales/B2C, intermediate/bulk distributors, online retailers, and specialty stores. The direct sales/B2B segment held the largest market revenue share in 2024, driven by long-term contracts with food manufacturers and ingredient suppliers, ensuring consistent supply and technical support for large-scale production.

The online retailers and specialty stores segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing awareness of clean-label ingredients among small-scale manufacturers and specialty food producers. Easy access to product information, bulk ordering options, and reliable delivery services are encouraging adoption through these channels.

Stearoyl Lactylate Market Regional Analysis

- North America dominated the stearoyl lactylate market with the largest revenue share in 2024, driven by strong demand from the bakery and processed food industries, as well as increasing adoption of clean-label and functional ingredients

- Food manufacturers in the region highly value the ingredient for its ability to improve dough stability, texture, and shelf life, while maintaining product consistency across large-scale production

- This widespread adoption is further supported by well-established food processing infrastructure, technological advancements, and growing consumer preference for high-quality, functional food products

U.S. Stearoyl Lactylate Market Insight

The U.S. stearoyl lactylate market captured the largest revenue share in North America in 2024, fueled by high consumption of bakery, dairy, and convenience foods. Manufacturers are increasingly focusing on improving product quality, shelf life, and clean-label compliance. The rising trend of functional foods, combined with technological advancements in emulsifier formulations, is further propelling market growth. In addition, supportive regulatory frameworks and strong ingredient supply chains contribute to steady adoption.

Europe Stearoyl Lactylate Market Insight

The Europe stearoyl lactylate market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by rising demand for bakery and confectionery products and strict food safety regulations. Increasing urbanization and growing consumer preference for functional and clean-label foods are encouraging adoption. Manufacturers are incorporating stearoyl lactylate into both traditional and innovative food products, supporting market expansion across multiple European countries.

U.K. Stearoyl Lactylate Market Insight

The U.K. stearoyl lactylate market is expected to witness significant growth from 2025 to 2032, driven by rising demand for high-quality bakery and processed foods, as well as increasing awareness of clean-label ingredients. The growing focus on functional and convenient food products, along with government and industry support for ingredient innovation, is expected to stimulate market adoption among food manufacturers.

Germany Stearoyl Lactylate Market Insight

The Germany stearoyl lactylate market is expected to witness substantial growth from 2025 to 2032, fueled by increasing demand for bakery, confectionery, and processed foods. German manufacturers are prioritizing product quality, texture, and shelf-life extension while adhering to clean-label and sustainability standards. Integration of functional ingredients such as stearoyl lactylate into innovative food formulations is becoming prevalent, supporting long-term market expansion.

Asia-Pacific Stearoyl Lactylate Market Insight

The Asia-Pacific stearoyl lactylate market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising urbanization, increasing disposable incomes, and growing demand for processed and convenience foods in countries such as China, India, and Japan. The region’s emergence as a manufacturing hub for bakery ingredients and functional food additives is increasing accessibility and affordability, supporting broader adoption among food producers.

Japan Stearoyl Lactylate Market Insight

The Japan stearoyl lactylate market is expected to witness strong growth from 2025 to 2032 due to high consumer demand for bakery, dairy, and processed foods. Japanese manufacturers are increasingly focusing on product consistency, clean-label compliance, and functional benefits, while rapid urbanization and an aging population drive demand for convenient, high-quality food products. Integration of stearoyl lactylate with innovative formulations is fueling market expansion.

China Stearoyl Lactylate Market Insight

The China stearoyl lactylate market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rising consumption of bakery, dairy, and convenience foods, rapid urbanization, and expanding middle-class population. The push towards functional and clean-label foods, along with strong domestic ingredient manufacturing capabilities, is driving widespread adoption of stearoyl lactylate across both large-scale and small-scale food producers.

Stearoyl Lactylate Market Share

The Stearoyl Lactylate industry is primarily led by well-established companies, including:

- Stepan Company (U.S.)

- Tate & Lyle (U.K.)

- Niacet (U.S.)

- Parchem Fine & Specialty Chemicals (U.S.)

- Musashino Chemical Laboratory, Ltd. (Japan)

- BASF SE (Germany)

- Cargill, Incorporated (U.S.)

- Croda International Plc (U.K.)

- Dow (U.S.)

- DSM (Netherlands)

- DuPont (U.S.)

- IVANHOE INDUSTRIES INC. (U.S.)

- Kerry Inc (U.S.)

- The Lubrizol Corporation (U.S.)

- Nikko Chemicals Co., Ltd. (Japan)

- Palsgaard (Denmark)

- RIKEN VITAMIN Co., Ltd. (Japan)

- Zhejiang Synose Tech Co., Ltd. (China)

- Savannah Surfactants Ltd (U.K.)

- Merck KGaA (Germany)

- Kowa Europe GmbH (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Stearoyl Lactylate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Stearoyl Lactylate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Stearoyl Lactylate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.