Global Steel Processing Market

Market Size in USD Million

CAGR :

%

USD

749.45 Million

USD

984.60 Million

2024

2032

USD

749.45 Million

USD

984.60 Million

2024

2032

| 2025 –2032 | |

| USD 749.45 Million | |

| USD 984.60 Million | |

|

|

|

|

Steel Processing Market Size

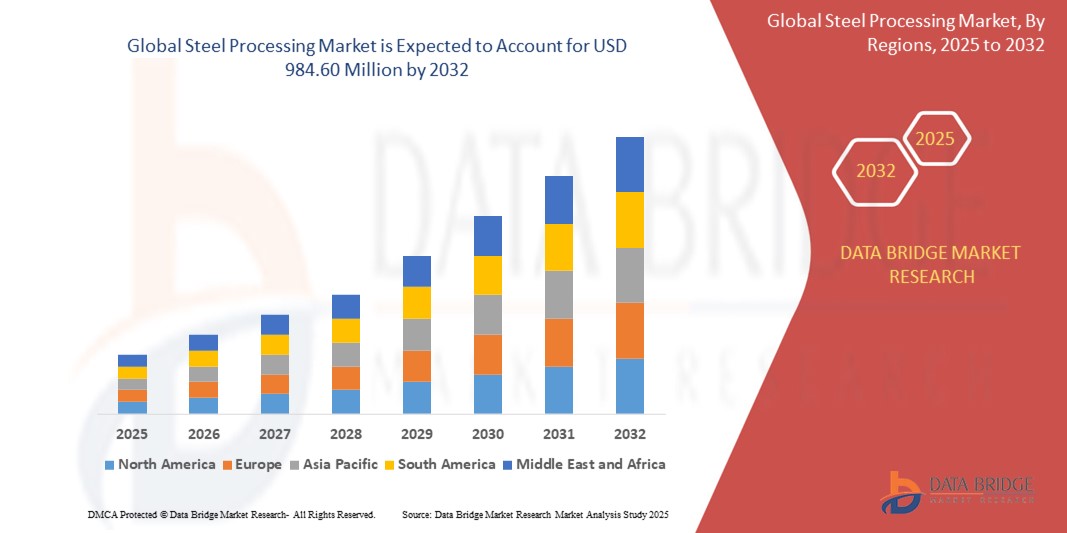

- The global steel processing market size was valued at USD 749.45 million in 2024 and is expected to reach USD 984.60 million by 2032, at a CAGR of 3.47% during the forecast period

- The market growth is largely fueled by increasing demand for high-quality finished steel products across various end-use industries, including automotive, construction, and machinery manufacturing

- Rapid urbanization and government investments in infrastructure projects worldwide are driving the demand for processed steel products such as beams, sheets, and coils, which are essential for construction and industrial applications

- The automotive sector's shift towards lightweight, high-strength steel components to improve fuel efficiency and vehicle safety is propelling the demand for advanced steel processing techniques

Steel Processing Market Analysis

- The global steel processing market is increasingly focusing on sustainability by shifting from traditional coal-based production methods to electric arc furnace technology. This shift helps reduce energy consumption and carbon emissions, aligning with growing environmental concerns across industries

- Electric arc furnace technology not only supports environmental goals but also offers flexibility in raw material usage by recycling scrap steel. This enables manufacturers to optimize costs and reduce waste, making steel processing more efficient and sustainable

- North America dominates the steel processing market with the largest revenue share of 89.55% in 2024, driven by strong presence of advanced manufacturing facilities and large-scale infrastructure investments across sectors such as automotive, construction, and energy

- Asia-Pacific is expected to be the fastest growing region in the steel processing market during the forecast period due to 62.12% share, driven by rapid industrialization, urbanization, and escalating infrastructure investments in countries

- The carbon steel segment dominates the largest market revenue share with 33.05% due to its widespread use in construction, automotive, and manufacturing due to its versatility, strength, and cost-effectiveness

Report Scope and Steel Processing Market Segmentation

|

Attributes |

Steel Processing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Steel Processing Market Trends

“Sustainable Shift in Global Steel Processing Methods”

- Electric arc furnaces enable the use of recycled steel, reducing reliance on raw materials and lowering production costs

- The flexibility of electric arc furnaces allows for easier integration with renewable energy sources, enhancing sustainability efforts

- Investments in electric arc furnace technology are increasing, with companies aiming to modernize facilities and meet environmental standards

- The adoption of electric arc furnaces contributes to a circular economy by promoting the recycling of steel scrap

- For instance, Tata Steel has announced plans to replace traditional blast furnaces with electric arc furnaces at its Port Talbot plant, aiming to reduce carbon emissions and modernize production

- In conclusion, the steel processing market is increasingly embracing electric arc furnace technology, reflecting a broader commitment to sustainable and efficient steel production methods

Steel Processing Market Dynamics

Driver

“Rising Demand for Customized and High-Quality Steel Products”

- One of the key drivers of the global steel processing market is the rising demand for customized and high-quality steel products in sectors such as automotive and heavy machinery which require tailored specifications to meet evolving design and strength standards

- Industries such as construction and appliances are increasingly seeking processed steel that matches specific surface finishes and dimensions for enhanced aesthetic and structural performance

- For instance, companies such as ArcelorMittal and Tata Steel are offering specialized high-strength steel for automotive use to support fuel-efficient vehicle production and structural integrity

- Advancements in technologies such as CNC-based cutting and automated heat treatment are enabling steel processors to deliver consistent quality and reduce material waste while increasing efficiency

- Such as JFE Steel Corporation has implemented intelligent processing systems that enhance traceability and accuracy in steel output for industrial clients

- In conclusion, growing customization needs are reshaping steel processing by driving innovation, improving output precision, and aligning products more closely with end-user expectations

Restraint/Challenge

“High Energy Consumption and Operational Costs”

- High energy consumption in steel processing operations, especially during heating, cutting, and rolling, significantly increases operational costs and exposes companies to unstable electricity and fuel pricing

- Both traditional blast furnaces and electric arc furnaces require constant high-temperature environments, which puts a financial strain on manufacturers trying to manage profit margins

- For instance, according to a 2024 report by the World Steel Association, energy costs account for nearly 20 to 40 percent of total steel production expenses, prompting several European steelmakers to temporarily shut down facilities during energy price spikes

- Steel plants also face the burden of maintaining complex equipment and hiring skilled labor for operations and compliance, with smaller players often struggling to keep up with technology upgrades due to limited capital

- In conclusion, high operational costs and energy dependencies continue to challenge the scalability and profitability of the steel processing market, especially for mid-tier and emerging players

Steel Processing Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

By Type of Steel

On the basis of type of steel, the steel processing market is segmented into carbon steel and alloy steel. The carbon steel segment dominates the largest market revenue share with 33.05%, driven by its widespread use in construction, automotive, and manufacturing due to its versatility, strength, and cost-effectiveness. Carbon steel's properties make it suitable for a vast array of applications, from structural components to consumer goods.

The alloy steel segment is anticipated to witness the fastest growth rate. This growth is fueled by increasing demand from specialized applications in industries such as aerospace, defense, and high-performance automotive, where enhanced properties such as higher strength, corrosion resistance, and heat resistance are crucial. Alloy steels are specifically engineered to meet demanding performance requirements.

By Shape of Steel

On the basis of shape of steel, the steel processing market is segmented into long steel, flat steel, and tube steel. The flat steel segment held the largest market revenue share, driven by its extensive use in industries such as automotive, construction, for roofing and cladding, and manufacturing of appliances. Flat steel, including sheets and plates, is fundamental for producing a wide range of products requiring flat surfaces.

The long steel segment is expected to witness the fastest CAGR. This growth is driven by continuous infrastructure development projects globally, including bridges, buildings, and railway tracks, which heavily rely on long steel products such as rebar, wire rods, and structural sections for their foundational and support structures.

By Process

On the basis of process, the steel processing market is segmented into bessemer process, basic oxygen steelmaking (BOS), electric arc furnaces (EAF), argon oxygen decarburization, and others. The basic oxygen steelmaking (BOS) segment held the largest market revenue share, primarily due to its high efficiency in converting hot metal from blast furnaces into steel on a large scale, making it a cornerstone for primary steel production globally.

The electric arc furnaces (EAF) segment is expected to witness the fastest CAGR. This growth is driven by the increasing emphasis on sustainability and the use of recycled scrap steel, which is the primary feedstock for EAFS. EAFS offer greater flexibility in production and a lower carbon footprint compared to traditional methods, aligning with environmental regulations and green initiatives.

By Method

On the basis of method, the steel processing market is segmented into primary steelmaking, secondary steelmaking, and others. The primary steelmaking segment accounted for the largest market revenue share, driven by the fundamental need for initial production of crude steel from raw materials such as iron ore. This process forms the foundation of the steel industry.

The secondary steelmaking segment is expected to witness the fastest CAGR. This growth is driven by the increasing demand for customized and high-quality steel with specific properties, which are achieved through secondary refining processes. These processes allow for precise control over steel composition and impurity removal, catering to specialized industrial requirements.

By Application

On the basis of application, the steel processing market is segmented into beams, steel plate, steel strip, billets, wires, and others. The steel plate segment held the largest market revenue share, driven by its extensive use in heavy industries such as shipbuilding, construction (for structural foundations and bridges), and manufacturing of heavy machinery where robustness and structural integrity are paramount.

The beams segment is expected to witness the fastest CAGR. This growth is fueled by the continuous expansion of infrastructure projects, commercial buildings, and industrial facilities globally. Steel beams are critical structural components, providing essential support and stability in large-scale construction.

By End-Use Industry

On the basis of end-use industry, the steel processing market is segmented into building and construction, aerospace and defense, marine, automotive, consumer goods, and others. The building and construction segment accounted for the largest market revenue share, driven by the widespread use of steel in residential, commercial, and industrial infrastructure due to its strength, durability, and cost-effectiveness. Urbanization and infrastructure development continue to fuel this demand.

The automotive segment is expected to witness the fastest CAGR. This growth is driven by the increasing global production of vehicles and the growing demand for lightweight, high-strength steel solutions to improve fuel efficiency and enhance vehicle safety. Innovations in advanced high-strength steels (ahss) are particularly contributing to this segment's expansion.

Steel Processing Market Regional Analysis

- North America dominates the steel processing market with the largest revenue share of 89.55% in 2024, driven by strong presence of advanced manufacturing facilities and large-scale infrastructure investments across sectors such as automotive, construction, and energy

- The increasing demand for high-strength and lightweight steel materials in transportation and aerospace industries supports the growth of innovative steel processing technologies that meet stringent performance and safety standards

- Integration of automation and smart technologies in steel production lines is enhancing operational efficiency, reducing production costs, and enabling consistent output, making North America a global leader in processed steel supply

U.S. Steel Processing Market Insight

The U.S. Steel processing market captured the largest revenue share within north America in 2025, driven by the rapid adoption of advanced manufacturing technologies and the growing demand for high-quality steel components in automotive and construction sectors. Increasing investments in infrastructure development and modernization projects have further accelerated market growth. The push for lightweight yet durable materials in transportation and industrial applications is also promoting the use of steel processing technologies that enhance material strength and reduce waste. Moreover, the trend of automation and digitalization in steel manufacturing plants is boosting production efficiency and product consistency, contributing significantly to the market expansion.

Europe Steel Processing Market Insight

The European steel processing market is anticipated to grow steadily during the forecast period, supported by strong industrialization and regulatory frameworks focusing on environmental compliance and sustainability. The emphasis on reducing carbon footprints in steel production encourages the adoption of energy-efficient and eco-friendly steel processing technologies. Additionally, Europe’s thriving automotive and construction industries continue to demand processed steel products with enhanced mechanical properties. The region’s advanced technological infrastructure facilitates the integration of industry 4.0 and smart manufacturing solutions in steel processing, improving operational efficiency and product quality across various applications.

U.K. Steel Processing Market Insight

The U.K. steel processing market is projected to experience considerable growth, fueled by government-led infrastructure projects and a growing need for resilient construction materials. Increasing investments in renewable energy sectors, such as offshore wind farms, are also driving demand for specialized steel processing techniques. The U.K.’s focus on innovation in manufacturing, including automation and robotics, is enhancing production capabilities and output quality. Furthermore, the demand for customized steel components for both commercial and residential applications is rising, contributing positively to the market’s trajectory.

Germany Steel Processing Market Insight

Germany’s steel processing market is expected to expand significantly owing to its strong industrial base and emphasis on technological advancement. The country’s automotive sector, one of the largest globally, heavily relies on processed steel with superior performance characteristics. Germany’s commitment to sustainable manufacturing and energy-efficient production processes is encouraging the adoption of advanced steel processing methods. Integration of digital solutions such as real-time monitoring and predictive maintenance in steel plants is improving productivity and reducing operational costs, thereby fueling market growth.

Asia-Pacific Steel Processing Market Insight

The Asia-pacific steel processing market is poised for the fastest growth rate of 62.12% share, due to rapid industrialization, urbanization, and escalating infrastructure investments in countries such as China, India, and Japan. The expansion of automotive, construction, and heavy machinery industries is increasing the demand for steel products with enhanced durability and precision processing. Rising disposable incomes and government initiatives to upgrade manufacturing capabilities are further catalyzing market expansion. Moreover, the region’s emergence as a manufacturing hub supports the development and availability of cost-effective steel processing technologies accessible to a broader customer base.

Japan Steel Processing Market Insight

Japan’s steel processing market is gaining momentum due to the country’s advanced manufacturing culture and focus on precision engineering. The automotive and electronics sectors significantly contribute to the demand for high-quality steel processing solutions. Japan’s aging population and urban redevelopment projects are pushing the need for durable, easy-to-install steel products. Integration of smart manufacturing practices and robotic automation in steel processing plants is enhancing production efficiency and maintaining Japan’s competitive edge in global steel markets.

China Steel Processing Market Insight

China leads the Asia-pacific region in steel processing market revenue, attributed to its massive industrial base and ongoing urban development. The country’s expansive automotive, construction, and machinery manufacturing sectors are primary consumers of processed steel products. China’s investments in smart factories and industry 4.0 technologies are streamlining steel processing operations and improving product quality. Government initiatives promoting infrastructure modernization and sustainable production methods also play a key role in market growth. The availability of competitive domestic manufacturers enhances China’s position as a leader in the steel processing industry globally.

Steel Processing Market Share

The Steel Processing industry is primarily led by well-established companies, including:

- NACHI-FUJIKOSHI CORP. (Japan)

- Daido Steel (Japan)

- voestalpine High Performance Metals GmbH (Austria)

- Sandvik AB (Sweden)

- Kennametal Inc. (U.S.)

- Hudson Tool Steel Corporation (U.S.)

- ERASTEEL (France)

- ArcelorMittal (Luxembourg)

- Baosteel Group Corporation (China)

- POSCO (South Korea)

- Nippon Steel & Sumitomo Metal Corporation (Japan)

- JFE Holdings, Inc. (Japan)

- TATA Steel Ltd.(India)

- United States Steel (U.S.)

- Angang Steel Company Limited (China)

- Gerdau SA (Brazil)

- Maanshan Iron and Steel Company Limited (China)

Latest Developments in Global Steel Processing Market

- In December 2023, China Baowu signed investment agreements with the Shandong provincial government to take over state-owned Shandong Iron and Steel Group Co Ltd. Under the agreement, China Baowu will hold a 49% stake in Shandong Iron and Steel, while Bashan Iron and Steel Co Ltd, a core enterprise of China Baowu, will hold a 48.61% stake in SD Steel RI Zhao Co Ltd

- In June 2022, Tata Steel completed the acquisition of 93.71% of Neelachal Ispat Nigam Limited (NINL) through its listed step-down subsidiary, Tata Steel Long Products (TSLP), for a consideration of USD1.5 billion. This acquisition marked Tata Steel's entry into the Odisha-based Neelachal Ispat Nigam Ltd, which is owned by central and state public sector undertakings

- In May 2022, NSK Ltd, a leading manufacturer of linear technology, bearings, and steering systems, and ThyssenKrupp AG announced an agreement to create the way for a joint venture between NSK Steering and ThyssenKrupp Automation

- In April 2021, Tata Steel made several other strategic moves, including the acquisition of NatSteel for USD486.4 million, and the amalgamation of Bamnipal Steel Ltd. and Tata Steel BSL

- In May 2022, NSK Ltd, a leading manufacturer of linear technology, bearings, and steering systems, and Thyssenkrupp AG announced an agreement to pave the way for a joint venture between NSK Steering and Thyssenkrupp Automation

- In January 2022, Solace Nutrition, a U.S.-based medical nutrition company, acquired the assets of R-Kane Nutritionals for an undisclosed amount. This acquisition allows Solace Nutrition to create synergy between the two brands, drive growth, and strengthen its position in an adjacent nutrition sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Steel Processing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Steel Processing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Steel Processing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.