Global Sterile And Antiviral Packaging Market

Market Size in USD Billion

CAGR :

%

USD

29.23 Billion

USD

49.11 Billion

2024

2032

USD

29.23 Billion

USD

49.11 Billion

2024

2032

| 2025 –2032 | |

| USD 29.23 Billion | |

| USD 49.11 Billion | |

|

|

|

|

Sterile and Antiviral Packaging Market Size

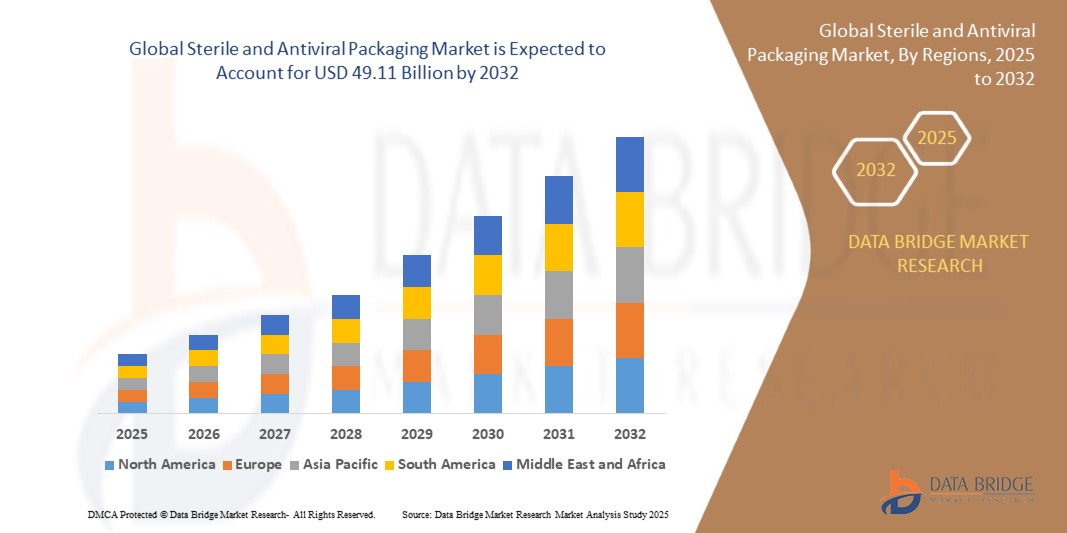

- The global sterile and antiviral packaging market size was valued at USD 29.23 billion in 2024 and is expected to reach USD 49.11 billion by 2032, at a CAGR of 6.70% during the forecast period

- The market growth is largely fuelled by the rising demand for infection-free, tamper-proof packaging in the pharmaceutical, healthcare, and food industries, particularly after the COVID-19 pandemic increased focus on safety and hygiene

- Continuous investments in research and development to enhance the durability, effectiveness, and sustainability of antiviral packaging materials are further propelling market expansion

Sterile and Antiviral Packaging Market Analysis

- Increasing regulatory emphasis on sterilization and infection control standards is boosting the adoption of antiviral packaging solutions

- Advancements in materials science, such as incorporation of copper oxide, silver ions, and zinc-based additives, are enhancing antimicrobial efficacy

- North America dominated the sterile and antiviral packaging market with the largest revenue share of 39.86% in 2024, driven by the expanding pharmaceutical sector, high healthcare expenditure, and increasing demand for sterile packaging in medical device distribution

- Asia-Pacific region is expected to witness the highest growth rate in the global sterile and antiviral packaging market, driven by increasing demand from pharmaceutical and food packaging sectors, growing population, government health initiatives, and rapid industrialization in countries such as China, Japan, and India

- The plastic material segment dominated the market with the largest market revenue share in 2024, attributed to its versatility, cost-effectiveness, and ability to be engineered with antiviral additives. Plastics are widely used in pharmaceutical and medical device packaging due to their barrier properties and adaptability to various sterilization processes. Demand for plastic-based sterile solutions is also rising in food and beverage applications, where single-use packaging ensures hygiene and safety

Report Scope and Sterile and Antiviral Packaging Market Segmentation

|

Attributes |

Sterile and Antiviral Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sterile and Antiviral Packaging Market Trends

“Integration of Biodegradable Materials in Sterile and Antiviral Packaging”

- Antiviral coatings such as silver ions, zinc oxide, and copper-based compounds are increasingly integrated into packaging materials to actively neutralize pathogens on surfaces

- Smart packaging technologies, including tamper-evident seals, QR codes, and freshness indicators, are gaining traction in sterile packaging for enhanced product integrity

- The combination of sterility and real-time tracking is becoming essential for pharmaceutical packaging, especially in the post-pandemic era

- Growing regulatory emphasis on hygiene and traceability in healthcare packaging is accelerating the adoption of smart and antiviral packaging formats

- For instance, AptarGroup developed packaging with antiviral additives specifically designed to neutralize SARS-CoV-2 particles on contact, enhancing sterility for high-risk healthcare environments

Sterile and Antiviral Packaging Market Dynamics

Driver

“Growing Demand for Infection Prevention in Healthcare and Pharmaceutical Sectors”

- The increasing incidence of infectious diseases has intensified the need for sterile packaging in hospitals, labs, and pharmaceutical facilities

- Demand for contamination-free packaging for injectables, surgical tools, and diagnostic kits is rising sharply in the wake of global pandemics

- Regulatory authorities are enforcing stricter norms for sterility in packaging to prevent hospital-acquired infections (HAIs)

- The surge in vaccine development and chronic disease treatments has led to growing adoption of sterile pouches and containers

- For instance, during the COVID-19 pandemic, pharmaceutical firms widely deployed antiviral packaging solutions for vaccine transport to maintain sterility and drug efficacy

Restraint/Challenge

“High Cost of Advanced Antiviral Packaging Materials”

- Incorporating antiviral agents such as nanosilver or copper ions significantly increases material and production costs

- Complex manufacturing and sterilization technologies lead to higher pricing compared to conventional packaging methods

- Smaller pharmaceutical and medical device companies face budgetary constraints in adopting premium packaging alternatives

- Cost sensitivity in emerging economies hinders large-scale adoption despite rising healthcare needs

- For instance, a Southeast Asian drug distributor experienced a 30% rise in costs after shifting to antiviral blister packs, limiting its use to critical care medications only

Sterile and Antiviral Packaging Market Scope

The sterile and antiviral packaging market is segmented on the basis of type and application.

• By Type

On the basis of type, the sterile and antiviral packaging market is segmented into plastic material, glass material, metallic material, and others. The plastic material segment dominated the market with the largest market revenue share in 2024, attributed to its versatility, cost-effectiveness, and ability to be engineered with antiviral additives. Plastics are widely used in pharmaceutical and medical device packaging due to their barrier properties and adaptability to various sterilization processes. Demand for plastic-based sterile solutions is also rising in food and beverage applications, where single-use packaging ensures hygiene and safety.

The metallic material segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its excellent durability, chemical resistance, and ability to maintain sterility under extreme conditions. Metal packaging, especially aluminum, is increasingly used in pharmaceutical vials, surgical kits, and protective pouches. Its ability to offer both tamper resistance and long shelf life further boosts adoption across high-risk environments.

• By Application

On the basis of application, the market is segmented into pharmaceutical and biological, surgical and medical instruments, food and beverage packaging, and others. The pharmaceutical and biological segment held the largest market share in 2024, driven by stringent regulatory standards and the rising demand for contamination-free drug delivery and vaccine distribution. The segment benefits from increased investments in pharmaceutical manufacturing and the need for sterile conditions in every step of the supply chain.

The food and beverage packaging segment is expected to witness the fastest growth rate from 2025 to 2032 due to heightened consumer demand for hygienic, tamper-evident packaging. The increased awareness around viral transmissions and shelf-life stability is pushing manufacturers to incorporate antimicrobial coatings and sealed designs in food-grade packaging solutions.

Sterile and Antiviral Packaging Market Regional Analysis

- North America dominated the sterile and antiviral packaging market with the largest revenue share of 39.86% in 2024, driven by the expanding pharmaceutical sector, high healthcare expenditure, and increasing demand for sterile packaging in medical device distribution

- The market in this region benefits from stringent regulatory standards, a well-established healthcare infrastructure, and the rising need for contamination-free medical and food packaging

- The rising prevalence of chronic diseases, combined with a heightened focus on patient safety and product integrity, supports the continued adoption of sterile and antiviral packaging across North America

U.S. Sterile and Antiviral Packaging Market Insight

The U.S. sterile and antiviral packaging market accounted for the largest revenue share of over 80% within North America in 2024, largely due to strong investments in research and development, the presence of global pharmaceutical leaders, and the need for advanced infection-control packaging solutions. The country’s growing elderly population and increased surgical procedures have escalated the demand for sterile medical device packaging. In addition, the Food and Drug Administration (FDA) regulations and evolving healthcare norms contribute to consistent innovation in packaging materials and formats.

Europe Sterile and Antiviral Packaging Market Insight

The Europe sterile and antiviral packaging market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the region's robust pharmaceutical manufacturing capacity, strict packaging guidelines, and heightened awareness about infection prevention. With a strong emphasis on sustainability, European packaging companies are increasingly shifting toward recyclable and biodegradable sterile materials. Moreover, cross-border healthcare logistics and the development of temperature-sensitive drug formulations are enhancing the need for reliable and contamination-resistant packaging solutions across the region.

U.K. Sterile and Antiviral Packaging Market Insight

The U.K. sterile and antiviral packaging market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for sterile solutions in diagnostics, surgical equipment, and drug delivery systems. The growing trend of outpatient treatments and at-home medical care is propelling the market for single-use, pre-sterilized packaging formats. The National Health Service’s (NHS) commitment to reducing healthcare-associated infections, coupled with rising imports of biologics and vaccines, is further bolstering packaging advancements in the country.

Germany Sterile and Antiviral Packaging Market Insight

The Germany sterile and antiviral packaging market is expected to witness the fastest growth rate from 2025 to 2032, backed by the country's leadership in medical device exports and advanced production technologies. Germany's strong industrial base supports high-quality packaging solutions with superior antimicrobial and tamper-evident properties. The nation’s rising healthcare demands, supported by a growing elderly population and digitization in the healthcare supply chain, are fostering the widespread use of sterile and antiviral materials across hospitals and laboratories.

Asia-Pacific Sterile and Antiviral Packaging Market Insight

The Asia-Pacific sterile and antiviral packaging market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rapid expansion of the pharmaceutical and food sectors in countries such as China, India, and South Korea. Government-led healthcare reforms, coupled with increasing exports of medical and food products, are generating strong demand for contamination-free packaging. The rise in infectious diseases and the growing trend of e-pharmacy and online food delivery platforms are also accelerating the adoption of sterile and antiviral packaging across the region.

China Sterile and Antiviral Packaging Market Insight

The China sterile and antiviral packaging market captured the largest revenue share in Asia Pacific in 2024, attributed to the country’s vast pharmaceutical base, mass-scale vaccine production, and continuous efforts in controlling cross-contamination in healthcare environments. Domestic packaging manufacturers are innovating to meet international quality standards, driven by export growth and a shift toward self-sufficiency. The expanding elderly population, rising surgical procedures, and government-backed infection control measures are creating favorable conditions for the market's sustained growth.

Japan Sterile and Antiviral Packaging Market Insight

The Japan sterile and antiviral packaging market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s aging population, advanced healthcare system, and strong pharmaceutical manufacturing capabilities. The growing need for infection prevention in clinical and home-care settings has increased the demand for high-barrier, contamination-resistant packaging solutions. In addition, Japan’s rigorous quality standards and preference for precision in medical packaging contribute to the widespread adoption of sterile pouches, trays, and blister packs. The rise in biologics and personalized medicine further supports the growth of advanced antiviral packaging technologies across the nation.

Sterile and Antiviral Packaging Market Share

The Sterile and Antiviral Packaging industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Anchor Packaging LLC (U.S.)

- Berry Global Inc. (U.S.)

- CeDo Ltd. (U.K.)

- Dow (U.S.)

- Harwal Group of Companies (UAE)

- Intertape Polymer Group (Canada)

- Jindal Poly (India)

- Klöckner Pentaplast (Germany)

- Mitsubishi Chemical Corporation (Japan)

- Multi Wrap (Pty) Ltd. (South Africa)

- Schott (Germany)

- Amcor plc (Switzerland)

- AptarGroup, Inc. (U.S.)

- Klöckner Pentaplast (Germany)

- West Pharmaceutical Services, Inc. (U.S.)

- Berry Global Inc. (U.S.)

- Honeywell International, Inc. (U.S.)

- ACG (India)

- Nipro (Japan)

- Gerresheimer AG (Germany)

- Catalent Inc. (U.S.)

- WestRock Company (U.S.)

- Nan Ya Plastics Corporation (China)

Latest Developments in Global Sterile and Antiviral Packaging Market

- In April 2024, Amcor Plc, in collaboration with Kimberly Clark, launched a new packaging bag for Eco Protect diapers. This development introduced a more sustainable solution by incorporating 30% post-consumer recycled materials. Designed for hypoallergenic diapers made from certified plant-based fibers, the initiative enhances eco-friendly packaging efforts and aligns with growing consumer demand for sustainable hygiene products, positively impacting the sterile and antiviral packaging market

- In January 2024, ProAmpac introduced the ProActive Intelligence Moisture Protect (MP-1000), a packaging innovation aimed at regulating internal moisture levels. This smart packaging solution is expected to extend product shelf life and enhance product safety, offering a significant advantage for pharmaceutical and food sectors, thereby supporting market growth in intelligent and protective packaging technologies

- In May 2023, DuPont completed the acquisition of Spectrum Plastics Group, a specialist in producing advanced medical device components. This strategic move strengthens DuPont’s capabilities in the healthcare packaging segment, allowing the company to expand its sterile and antiviral packaging portfolio and cater more effectively to rising demand for high-performance medical packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sterile And Antiviral Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sterile And Antiviral Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sterile And Antiviral Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.