Global Sterile Injectable Drugs Market

Market Size in USD Million

CAGR :

%

USD

661.29 Million

USD

1,539.41 Million

2024

2032

USD

661.29 Million

USD

1,539.41 Million

2024

2032

| 2025 –2032 | |

| USD 661.29 Million | |

| USD 1,539.41 Million | |

|

|

|

|

Sterile Injectable Drugs Market Size

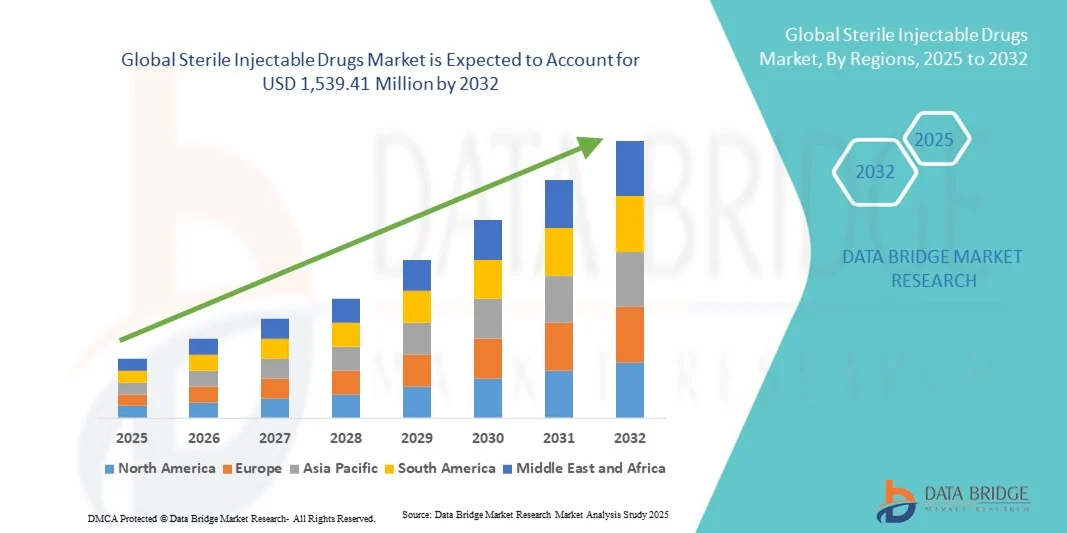

- The global sterile injectable drugs market size was valued at USD 661.29 million in 2024 and is expected to reach USD 1,539.41 million by 2032, at a CAGR of 11.14% during the forecast period

- The market growth is largely fueled by increasing demand for injectable drugs in hospitals, clinics, and outpatient care, along with advancements in sterile manufacturing technologies that ensure safety and efficacy

- Furthermore, rising prevalence of chronic and acute diseases, coupled with growing adoption of biologics and specialty injectable therapies, is accelerating the uptake of sterile injectable drugs, thereby significantly boosting the industry's growth.

Sterile Injectable Drugs Market Analysis

- Sterile injectable drugs, including vials, ampoules, and prefilled syringes, are increasingly essential in modern healthcare due to precise dosing, rapid therapeutic effects, and suitability for patients who cannot take oral medications

- The rising demand for sterile injectable drugs is driven by the increasing prevalence of chronic and infectious diseases, expanding hospital infrastructure, and growing adoption of parenteral therapies in critical care and outpatient settings

- North America dominated the sterile injectable drugs market with the largest revenue share of 39.5% in 2024, owing to advanced healthcare infrastructure, high patient awareness, and strong presence of leading pharmaceutical manufacturers. The U.S. leads the region due to widespread adoption of injectable therapies, robust clinical research, and ongoing development of innovative biologics, vaccines, and specialty drugs

- Asia-Pacific is expected to be the fastest-growing region in the sterile injectable drugs market, with a CAGR from 2025 to 2032, fueled by rising healthcare investments, increasing access to hospitals and clinics, and expanding pharmaceutical manufacturing in countries such as China, India, and Japan. Government initiatives promoting healthcare accessibility and awareness about injectable therapies further support growth

- The Vaccines segment dominated the sterile injectable drugs market with the largest market revenue share of 46.1% in 2024, supported by global immunization programs, government initiatives, and increasing awareness of preventable diseases

Report Scope and Sterile Injectable Drugs Market Segmentation

|

Attributes |

Sterile Injectable Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sterile Injectable Drugs Market Trends

Increasing Adoption of Advanced Injectable Therapies

- A significant and accelerating trend in the global sterile injectable drugs market is the growing adoption of advanced injectable therapies, including biologics, vaccines, and high-potency drugs. These therapies are increasingly preferred due to their precision, rapid onset of action, and suitability for targeted treatment

- For instance, the rising use of monoclonal antibodies and recombinant protein-based therapies in hospitals and specialty clinics is driving market growth. Injectable biologics are being increasingly integrated into treatment regimens for oncology, autoimmune disorders, and infectious diseases

- Advancements in formulation technologies, such as lyophilization, prefilled syringes, and dual-chamber systems, are enhancing stability, safety, and patient compliance

- The expansion of hospital and clinic infrastructures globally is facilitating the adoption of sterile injectable drugs, ensuring wider patient access

- The shift from traditional oral therapies to injectables in critical care and chronic disease management is a key factor supporting this trend

- Growing awareness among healthcare professionals and patients regarding the efficacy and safety of injectable therapies is further propelling market adoption

- Overall, the trend toward advanced injectable therapies is driving innovation and expansion in manufacturing and distribution channels

Sterile Injectable Drugs Market Dynamics

Driver

Rising Prevalence of Chronic and Infectious Diseases

- The increasing prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders, along with infectious diseases, is a significant driver for the sterile injectable drugs market

- For instance, in 2024, the U.S. and European markets witnessed heightened demand for injectable biologics to manage complex conditions, supporting industry growth

- Hospitals and specialty clinics are increasingly investing in injectable drug inventories to meet the rising demand for critical care therapies

- The growing elderly population globally, which requires more frequent and specialized treatment, is further accelerating the uptake of sterile injectables

- Government initiatives and funding to support vaccination programs, biologic therapies, and high-potency injectables are key contributors to market expansion

- The increasing adoption of prefilled syringes and ready-to-use injectable formulations is improving patient safety and compliance, thereby encouraging wider acceptance

- Overall, rising disease burden and expanding healthcare infrastructure are core drivers supporting sustained market growth

Restraint/Challenge

Stringent Regulatory Compliance and High Production Costs

- Stringent regulatory requirements for manufacturing, sterility, and quality control pose significant challenges for the sterile injectable drugs market. Compliance with FDA, EMA, and WHO guidelines requires substantial investment in facility infrastructure and validation processes

- High production costs associated with advanced biologics, vaccines, and sterile injectable formulations can limit adoption, especially in developing regions or smaller healthcare centers

- Logistical challenges such as cold chain storage, temperature-controlled distribution, and safe handling further add to operational complexity

- Market entry barriers for new players are high due to the need for specialized facilities, trained personnel, and regulatory approvals

- Despite gradual improvements in production efficiency, the cost of sterile injectable drugs remains a concern for price-sensitive markets

- Overcoming these challenges through investment in innovative manufacturing technologies, robust quality assurance, and partnerships with distributors is critical for sustained growth

- Healthcare providers are increasingly focusing on cost-effective procurement and supply chain optimization to mitigate these challenges

Sterile Injectable Drugs Market Scope

The market is segmented on the basis of type, drug class, indication, and distribution channel.

- By Type

On the basis of type, the sterile injectable drugs market is segmented into small molecules and large molecules. The small molecules segment dominated the largest market revenue share of 44.3% in 2024, driven by their well-established manufacturing processes, wide therapeutic applicability, and cost-effectiveness. Small molecules include widely used injectable antibiotics, analgesics, and cardiovascular drugs, which are essential in hospital formularies and outpatient treatment. Hospitals and clinics prefer small molecule injectables for acute treatments due to their proven efficacy, stability, and shorter development timelines. The segment’s dominance is also supported by extensive regulatory approvals and familiarity among healthcare professionals. Their compatibility with standard vial and ampoule formats allows seamless administration across diverse patient populations. Small molecules are integral to emergency care and high-volume treatment centers, sustaining strong demand. Additionally, the segment benefits from frequent updates to treatment protocols and inclusion in essential drug lists by healthcare authorities. Large-scale adoption in both developed and emerging regions further reinforces its dominant market position.

The Large Molecules segment is expected to witness the fastest CAGR of 22.8% from 2025 to 2032, fueled by the growing demand for biologics, monoclonal antibodies, and therapeutic proteins. Large molecules are increasingly used in oncology, autoimmune, and rare disease therapies due to their targeted action and lower systemic side effects. Adoption is also driven by improvements in biopharmaceutical manufacturing, advanced formulation technologies, and rising awareness of specialty therapies. Hospitals, specialty clinics, and homecare providers increasingly favor large molecule injectables for personalized medicine applications. Growth is particularly strong in emerging markets where biologics penetration is expanding. Patient preference for prefilled and ready-to-use formulations further accelerates adoption. Regulatory approvals for innovative biologics and biosimilars are creating a pipeline of new injectable therapies. Furthermore, ongoing clinical research and rising prevalence of chronic diseases contribute to the fast expansion of this segment.

- By Drug Class

On the basis of drug class, the sterile injectable drugs market is segmented into monoclonal antibodies, cytokines, insulin, peptide hormones, vaccines, immunoglobulin, and blood factors. The Vaccines segment dominated the largest market revenue share of 46.1% in 2024, supported by global immunization programs, government initiatives, and increasing awareness of preventable diseases. Vaccines are widely used in both pediatric and adult populations, and their demand surged during recent public health campaigns. Hospitals, clinics, and public health centers rely heavily on injectable vaccines for effective disease prevention. Technological advances such as prefilled syringes, lyophilized formulations, and combination vaccines improve patient compliance and streamline administration. The growing focus on pandemic preparedness and routine immunization drives high adoption rates globally. Mass immunization programs in emerging markets and strong government funding in developed countries further sustain the dominance of this segment. Vaccine cold-chain infrastructure, supply reliability, and integration into hospital protocols also reinforce its position. Regular updates in immunization schedules create continuous demand, while international collaborations and NGO programs expand reach in low-income regions.

The Monoclonal Antibodies segment is expected to witness the fastest CAGR of 24.3% from 2025 to 2032, driven by increasing applications in oncology, autoimmune diseases, and infectious disease therapeutics. Monoclonal antibodies offer targeted therapy with high efficacy and fewer side effects, fueling adoption in hospitals and specialty clinics. Advanced manufacturing technologies, biosimilar approvals, and rising healthcare investments support rapid market growth. The segment is further propelled by growing patient awareness of biologic treatments and the expanding prevalence of chronic and rare diseases. Prefilled syringes and ready-to-use formats enhance convenience for healthcare providers and patients alike. Clinical trials and regulatory incentives for innovative biologics continue to expand the therapeutic pipeline. Growth is particularly strong in developed markets due to high healthcare expenditure and in emerging economies due to improving infrastructure and accessibility. Collaboration between pharmaceutical companies and healthcare providers accelerates distribution and adoption. Overall, monoclonal antibodies are shaping the next generation of injectable therapies.

- By Indication

On the basis of indication, the sterile injectable drugs market is segmented into cardiology and metabolic disorders, musculoskeletal disorders, neurology disorders, autoimmune, oncology, and infectious diseases. The oncology segment dominated the largest market revenue share of 42.7% in 2024, owing to rising cancer incidence, increasing demand for chemotherapy, immunotherapy, and targeted therapies, and expanding hospital oncology units. Injectable oncology drugs, including biologics and cytotoxic agents, are critical in treatment regimens. Hospitals, specialty clinics, and cancer centers prioritize injectable formulations due to controlled dosing and rapid therapeutic effects. Continuous advancements in personalized medicine, adoption of prefilled syringes, and the inclusion of biologics enhance treatment outcomes. Government funding, awareness campaigns, and insurance coverage further strengthen adoption. Oncology injectable therapies also benefit from research initiatives and global collaborations in clinical trials. Their integration into treatment protocols and high efficacy ensure sustained demand. Additionally, the increasing prevalence of chronic hematologic cancers supports long-term market stability. Advanced distribution systems for cold-chain and sterile handling reinforce accessibility and safety.

The infectious diseases segment is expected to witness the fastest CAGR of 25.1% from 2025 to 2032, fueled by global vaccination drives, rising prevalence of bacterial and viral infections, and enhanced hospital and clinic infrastructure. Injectable antibiotics and vaccines are the primary treatment choice for infectious diseases in both acute and chronic cases. Increased awareness of antimicrobial resistance, public health campaigns, and pandemic preparedness programs drive demand. Prefilled syringes and user-friendly delivery systems enhance administration efficiency. The segment benefits from government funding, NGO programs, and global disease control initiatives. Emerging markets with rising healthcare access and expanding immunization programs contribute to strong growth. Ongoing research and new drug approvals further accelerate adoption. Hospitals, specialty clinics, and community health centers are increasingly incorporating injectable therapies for rapid response. The segment also benefits from technological advancements in formulation and cold-chain storage, ensuring drug stability and effectiveness.

- By Distribution Channel

On the basis of distribution channel, the sterile injectable drugs market is segmented into hospital pharmacy, retail pharmacy, and E-Commerce. The Hospital Pharmacy segment dominated the largest market revenue share of 48.3% in 2024, driven by the critical role of hospitals in administering injectable therapies for acute, chronic, and specialty conditions. Hospital pharmacies manage large volumes of sterile injectable drugs, ensure cold-chain compliance, and facilitate direct patient administration under healthcare supervision. Specialized staff, quality control, and integration with clinical protocols reinforce adoption. Hospitals remain the primary distribution channel for oncology, biologics, and high-cost injectable therapies. Public and private hospitals in developed and emerging markets contribute significantly to the revenue share. Increasing hospital bed capacity, expansion of specialty units, and rising patient volume further strengthen market dominance. Government funding and insurance coverage also support high utilization. Collaboration with pharmaceutical companies ensures timely supply and availability of sterile injectables.

The E-Commerce segment is expected to witness the fastest CAGR of 23.9% from 2025 to 2032, supported by the rising trend of online pharmacy platforms, home healthcare delivery, and patient preference for convenient, timely access. E-commerce platforms facilitate access to prefilled syringes, biologics, and vaccines, especially for homecare and chronic disease management. Integration with telemedicine, subscription-based delivery models, and real-time tracking enhances adoption. Growth is particularly strong in developed regions with digital literacy and in emerging economies with expanding internet penetration. E-commerce also reduces logistical bottlenecks and improves patient adherence. Technological innovations in packaging, temperature control, and secure delivery systems drive rapid uptake. Partnerships between pharmaceutical companies and online platforms accelerate distribution efficiency. Consumer awareness, digital payment adoption, and regulatory approvals further support expansion of this segment.

Sterile Injectable Drugs Market Regional Analysis

- North America dominated the sterile injectable drugs market with the largest revenue share of 39.5% in 2024, owing to advanced healthcare infrastructure, high patient awareness, and the strong presence of leading pharmaceutical manufacturers

- The region benefits from increasing adoption of injectable therapies for chronic and acute conditions, rising prevalence of lifestyle-related diseases, and growing demand for biologics and biosimilars

- Continuous innovation in drug formulation and delivery, coupled with robust clinical research capabilities, further strengthens North America’s leadership in this market. The presence of well-established pharmaceutical companies and favorable reimbursement structures continues to accelerate market expansion across the region

U.S. Sterile Injectable Drugs Market Insight

The U.S. sterile injectable drugs market captured the largest revenue share in 2024 within North America, driven by the widespread use of biologics, vaccines, and specialty injectable drugs. The country’s advanced R&D ecosystem, along with the growing number of FDA approvals for sterile injectable products, continues to stimulate industry growth. Moreover, increasing investments in sterile manufacturing facilities and continuous innovations in prefilled syringes and lyophilized formulations are further fueling the market’s momentum.

Europe Sterile Injectable Drugs Market Insight

The Europe sterile injectable drugs market is projected to expand at a substantial CAGR throughout the forecast period, primarily supported by stringent quality standards, strong biopharmaceutical production capabilities, and rising demand for targeted therapies. The growing prevalence of chronic diseases, such as cancer and diabetes, is driving the need for effective injectable formulations. Additionally, investments in advanced aseptic manufacturing technologies and supportive regulatory frameworks are fostering market growth across key European economies.

U.K. Sterile Injectable Drugs Market Insight

The U.K. sterile injectable drugs market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by an expanding biotechnology sector and an increasing focus on innovative injectable treatments. The country's strong clinical trial infrastructure, rising healthcare expenditure, and growing adoption of biologics for chronic disease management are key factors contributing to market expansion. Furthermore, the government’s initiatives to strengthen domestic pharmaceutical manufacturing capacity are likely to support long-term growth.

Germany Sterile Injectable Drugs Market Insight

The Germany sterile injectable drugs market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing investments in sterile manufacturing technologies and the growing demand for injectable biologics and biosimilars. Germany’s emphasis on innovation, coupled with a well-established healthcare infrastructure and strong pharmaceutical exports, supports the adoption of sterile injectable therapies across hospitals and clinics. The trend towards automation and sustainable production practices is also enhancing the country’s market outlook.

Asia-Pacific Sterile Injectable Drugs Market Insight

The Asia-Pacific sterile injectable drugs market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising healthcare investments, expanding hospital networks, and increasing pharmaceutical manufacturing capacity in countries such as China, India, and Japan. The growing prevalence of infectious and chronic diseases, along with government initiatives promoting access to advanced treatments, is accelerating market growth. Furthermore, the rising number of contract manufacturing organizations (CMOs) and favorable regulatory reforms are making APAC a global hub for sterile injectable production.

Japan Sterile Injectable Drugs Market Insight

The Japan sterile injectable drugs market is gaining momentum due to the country’s aging population, growing burden of chronic diseases, and strong demand for high-quality injectable formulations. Japan’s focus on precision medicine and innovation in biologics is driving the development of advanced sterile injectable therapies. The country’s well-established pharmaceutical industry, supported by high R&D expenditure and strong regulatory oversight, continues to promote steady market growth.

China Sterile Injectable Drugs Market Insight

The China sterile injectable drugs market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to expanding healthcare infrastructure, a rapidly growing pharmaceutical manufacturing base, and increasing government support for domestic drug production. China’s ongoing investments in modern aseptic facilities and the rising adoption of injectable therapies for chronic and infectious diseases are propelling the market. The country’s emphasis on self-sufficiency in drug manufacturing and the growing demand for affordable biologics further reinforce its leading position in the region.

Sterile Injectable Drugs Market Share

The Sterile Injectable Drugs industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- AstraZeneca (U.K.)

- Johnson & Johnson and its affiliates (U.S.)

- F. Hoffmann-La Roche AG (Switzerland)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- GSK. Plc. (U.K.)

- Sanofi (France)

- Amgen Inc. (U.S.)

- Lilly USA, LLC. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Gilead Sciences, Inc. (U.S.)

- Biocon Limited (India)

- Cipla Limited (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Fresenius Kabi AG (Germany)

- Teva Pharmaceutical Industries Ltd. (Israel)

Latest Developments in Global Sterile Injectable Drugs Market

- In April 2024, INCOG BioPharma Services announced that its sterile injectable manufacturing facility received approval from the U.S. FDA to produce a commercially approved drug product. This milestone marked a major achievement for the company, reflecting its compliance with stringent regulatory standards and strengthening its position as a trusted contract manufacturer for sterile injectables in the U.S. market

- In June 2024, Hikma Pharmaceuticals entered into an agreement to acquire injectable assets from Xellia Pharmaceuticals for up to USD 185 million. The acquisition included eight approved injectable products and eleven more in development, significantly expanding Hikma’s portfolio and reinforcing its leadership in the global sterile injectables segment

- In October 2024, Piramal Pharma announced an investment of USD 85 million to upgrade and expand its sterile injectable manufacturing facilities. The expansion aimed to enhance production capacity, integrate advanced fill-finish technologies, and meet the growing global demand for high-quality sterile formulations across therapeutic areas such as oncology and critical care

- In January 2025, Upperton Pharma completed the construction of its new sterile manufacturing facility in Nottingham, United Kingdom. The state-of-the-art plant was designed to provide comprehensive sterile fill-finish services for small-molecule and biologic injectables, further strengthening Upperton’s capabilities in the rapidly expanding contract manufacturing market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.