Global Sterile Injectable Market

Market Size in USD Billion

CAGR :

%

USD

36.44 Billion

USD

68.30 Billion

2025

2033

USD

36.44 Billion

USD

68.30 Billion

2025

2033

| 2026 –2033 | |

| USD 36.44 Billion | |

| USD 68.30 Billion | |

|

|

|

|

Sterile Injectable Market Size

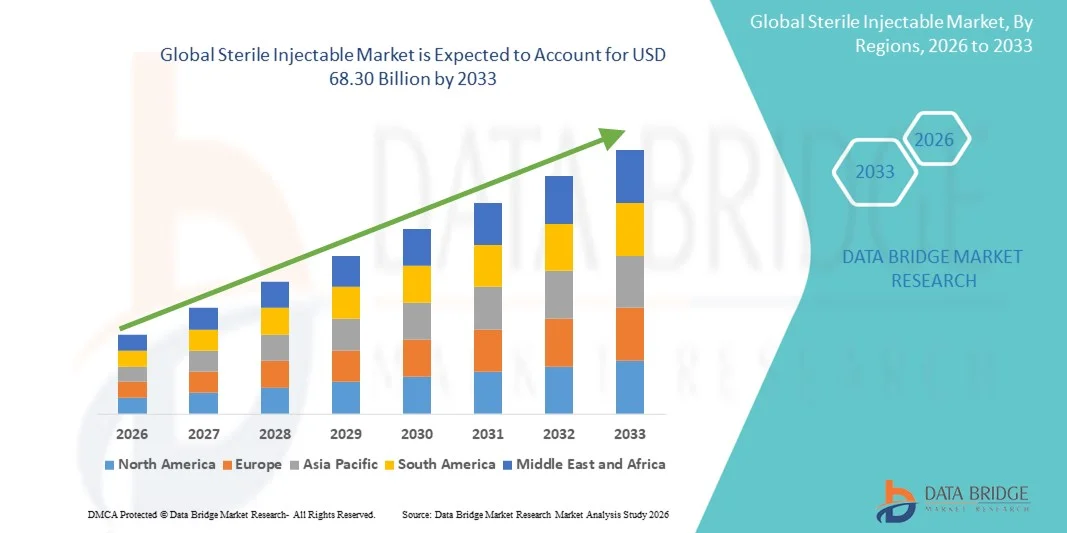

- The global sterile injectable market size was valued at USD 36.44 billion in 2025 and is expected to reach USD 68.30 billion by 2033, at a CAGR of 8.17% during the forecast period

- The market growth is largely fueled by increasing demand for sterile injectable formulations in hospitals, clinics, and home healthcare settings, alongside advances in drug development and biopharmaceutical manufacturing

- Furthermore, rising healthcare expenditure, the prevalence of chronic and acute diseases, and the growing preference for injectable medications over oral formulations are accelerating the adoption of sterile injectables, thereby significantly boosting the industry's growth

Sterile Injectable Market Analysis

- Sterile injectables, including parenteral drugs and biologics, are critical components in modern healthcare due to their precise dosing, rapid therapeutic effects, and suitability for high-potency medication

- The escalating demand for sterile injectables is primarily fueled by the increasing prevalence of chronic and acute diseases, growing preference for parenteral drug delivery over oral administration, and rapid advancements in biopharmaceutical manufacturing

- North America dominated the sterile injectable market with the largest revenue share of approximately 42.5% in 2025, driven by the U.S.'s strong pharmaceutical and biotechnology industry, high R&D investments, and well-established healthcare infrastructure

- Asia-Pacific is expected to be the fastest-growing region in the sterile injectable market during the forecast period, registering an estimated CAGR of around 9.1%, due to rising healthcare expenditure, expanding hospital infrastructure, and increasing adoption of advanced injectable formulations

- The Intravenous (IV) segment dominated with a market share of approximately 48.1% in 2025, owing to its preference in hospitals for oncology, biologics, and emergency care

Report Scope and Sterile Injectable Market Segmentation

|

Attributes |

Sterile Injectable Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Pfizer Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Sterile Injectable Market Trends

Rising Adoption of Advanced Sterile Injectable Formulations

- A significant and accelerating trend in the global sterile injectable market is the increasing adoption of advanced sterile injectable formulations, driven by the demand for high-purity, preservative-free, and ready-to-use products across the pharmaceutical and biotech sectors

- For instance, in 2024, a leading U.S.-based pharmaceutical company launched a prefilled, preservative-free monoclonal antibody injectable designed to improve patient safety and compliance, reflecting the broader industry movement toward user-friendly and clinically optimized formulations

- Biopharmaceutical companies are increasingly focusing on high-concentration formulations, lyophilized products, and combination injectable therapies to meet the growing needs of complex treatments, particularly in oncology, autoimmune diseases, and rare disorders

- In addition, the trend toward personalized medicine and targeted therapies is driving demand for smaller batch production, flexible manufacturing solutions, and advanced formulation technologies, enabling precise dosing and improved therapeutic efficacy

- Overall, the global Sterile Injectable market is evolving toward higher efficiency, safety, and patient-centricity, with manufacturers investing in state-of-the-art sterile production facilities and innovative delivery systems

Sterile Injectable Market Dynamics

Driver

Expanding Biopharmaceutical Production and Rising Therapeutic Demand

- The growth of the Sterile Injectable market is primarily driven by the rapid expansion of biopharmaceutical and injectable drug production worldwide. Increasing prevalence of chronic diseases, cancer, and autoimmune disorders is creating a strong demand for injectable therapeutics

- For instance, in 2025, a major Indian contract manufacturing organization expanded its sterile injectable production lines to support both domestic and international oncology drug supply, enhancing capacity for high-quality biologics and small-molecule injectables

- Stringent regulatory requirements for sterility, patient safety, and quality control in both developed and emerging markets necessitate reliable, validated sterile injectable processes, further propelling industry growth

- Investments in advanced manufacturing technologies such as automated filling, lyophilization, and aseptic processing also support scalability, efficiency, and reduced contamination risks, making sterile injectables increasingly favored by healthcare providers

- Global initiatives to improve access to injectable vaccines, biosimilars, and specialty drugs, particularly in Asia-Pacific and Latin America, are expanding the market’s reach, enhancing both patient outcomes and revenue potential

Restraint/Challenge

High Production Costs and Regulatory Complexities

- The Sterile Injectable market faces challenges related to high production costs, stringent regulatory compliance, and technical complexities associated with aseptic manufacturing. Establishing and maintaining GMP-compliant facilities requires significant capital investment and operational expertise

- For instance, in 2023, several mid-sized European contract manufacturers delayed the launch of new sterile injectable vaccines due to extended validation processes and regulatory approval timelines, illustrating how compliance hurdles can impact market expansion

- Limited availability of skilled personnel trained in aseptic processing, quality control, and advanced formulation techniques adds to operational constraints, particularly in emerging regions

- Addressing these barriers through process optimization, automation, workforce development, and harmonization of regulatory standards is critical to sustaining growth and ensuring reliable supply in the global Sterile Injectable market

Sterile Injectable Market Scope

The market is segmented on the basis of molecule type, drug type, therapeutic application, route of administration, and distribution channel.

- By Molecule Type

On the basis of molecule type, the Sterile Injectable market is segmented into Large Molecule and Small Molecule. The Large Molecule segment dominated the market with the largest revenue share of approximately 57.6% in 2025, driven by the growing demand for monoclonal antibodies, vaccines, and protein-based therapies. Large molecules are preferred due to their targeted efficacy, reduced side effects, and stability in injectable formulations. Hospitals and specialty clinics increasingly rely on large molecule injectables for chronic and autoimmune disease treatment, where oral administration is not effective. Prefilled syringes, autoinjectors, and ready-to-use formats enhance adoption by improving patient safety and compliance. Continuous innovation in biologics, expansion of R&D pipelines, and regulatory approvals further strengthen market dominance. Additionally, government initiatives supporting biologics production and personalized medicine approaches contribute to steady growth. Market leaders focus on process optimization, cold-chain logistics, and patient-friendly devices, reinforcing the segment’s stronghold. The rising prevalence of cancer, diabetes, and infectious diseases further fuels demand.

The Small Molecule segment is expected to witness the fastest CAGR of 8.2% from 2026 to 2033, driven by increasing adoption of insulin, peptide hormones, cytokines, and other small molecule therapies. Small molecules are favored due to lower production costs, longer shelf life, and easier distribution. Rising chronic disease prevalence and increasing pharmaceutical manufacturing investments in emerging markets support growth. Technological advancements in injectable delivery devices, such as prefilled pens and smart autoinjectors, improve patient adherence and convenience. Governments and healthcare providers are expanding access to small molecule injectables for metabolic and cardiovascular diseases. Partnerships between pharmaceutical companies and contract manufacturing organizations (CMOs) further accelerate market expansion. Moreover, increasing awareness of biosimilars and generic injectables contributes to rapid growth.

- By Drug Type

On the basis of drug type, the market is segmented into Monoclonal Antibodies (mAbs), Cytokines, Insulin, Peptide Hormones, Vaccines, Immunoglobulins, Blood Factors, Peptide Antibiotics, and Others. The Monoclonal Antibodies (mAbs) segment dominated the market with a revenue share of approximately 32.4% in 2025, driven by high demand for oncology and autoimmune therapies. Hospitals and clinics prefer mAbs for targeted therapy due to high specificity, reduced adverse reactions, and integration with advanced delivery technologies. Continuous innovation in antibody engineering, increasing approvals, and expanded patient access support the segment’s growth. The segment benefits from large R&D investments in biologics, oncology pipelines, and combination therapies. Prefilled syringes and autoinjector systems improve patient compliance and ease of administration. Geographical expansion in emerging markets, especially Asia-Pacific, further strengthens dominance. Regulatory approvals and clinical adoption accelerate market uptake, while the focus on personalized medicine enhances long-term growth. Growing awareness among healthcare professionals about novel mAbs treatments adds momentum. Strategic partnerships and licensing agreements between biotech and pharmaceutical companies further consolidate market leadership.

The Vaccines segment is expected to witness the fastest CAGR of 9.1% from 2026 to 2033, driven by global immunization campaigns and rising infectious disease prevalence. COVID-19 accelerated vaccine development infrastructure, while governments are investing heavily in vaccination programs. Technological advancements in mRNA and recombinant vaccines, along with prefilled syringes and cold-chain innovations, support the segment’s growth. Emerging markets are expanding domestic vaccine production, enhancing access. Awareness programs, preventive healthcare initiatives, and funding for public health strengthen adoption. Hospitals, clinics, and mass vaccination centers increasingly rely on sterile injectables for vaccines. Growth in pediatric and adult immunization programs contributes to sustained demand. Partnerships between pharma companies and local governments expand distribution networks. The focus on new indications, booster campaigns, and combination vaccines further drives expansion.

- By Therapeutic Application

On the basis of therapeutic application, the market is segmented into Cancer, Metabolic Diseases, Cardiovascular Diseases, Central Nervous Systems Disorders, Infectious Disorders, Musculoskeletal Disorders, and Others. The Cancer segment dominated with a revenue share of approximately 29.5% in 2025, driven by high prevalence of cancer worldwide and increasing adoption of injectable oncology therapies, including mAbs and chemotherapy. Hospitals and specialty clinics prefer sterile injectables for precise dosing and rapid efficacy. Rising investment in targeted therapies, immunotherapies, and combination treatments supports segment growth. Prefilled delivery systems, autoinjectors, and infusion pumps enhance clinical adoption. Regulatory approvals for new oncology injectables contribute to market dominance. Expansion of hospital networks and cancer care centers globally increases access. Continuous pipeline development, clinical trials, and high R&D expenditure further drive adoption. Improved patient outcomes with injectable therapies strengthen clinical preference. Partnerships between biotech companies and hospitals for access programs also add momentum. Growth in personalized medicine and patient-centric treatment models supports long-term expansion.

The Metabolic Diseases segment is expected to witness the fastest CAGR of 8.8% from 2026 to 2033, driven by the increasing prevalence of diabetes, obesity, and hormonal disorders. Insulin, peptide hormones, and cytokine injectables are central to treatment. Prefilled pens, autoinjectors, and self-administration devices improve adherence and convenience. Government programs and healthcare expenditure in chronic disease management strengthen adoption. Emerging markets are investing in domestic production and distribution infrastructure. Pharmaceutical companies are innovating in long-acting and combination therapies. Digital health and remote monitoring integration further drive adoption. Rising awareness and preventive healthcare initiatives contribute to growth. The convenience of at-home administration reduces hospital visits. Growth in the pediatric and geriatric populations supports sustained expansion. Strategic collaborations with distributors accelerate market penetration.

- By Route of Administration

On the basis of route of administration, the market is segmented into Subcutaneous (SC), Intravenous (IV), Intramuscular (IM), and Others. The Intravenous (IV) segment dominated with a market share of approximately 48.1% in 2025, owing to its preference in hospitals for oncology, biologics, and emergency care. IV administration provides rapid systemic delivery, precise dosing, and integration with hospital infusion systems. Sterile injectables in IV format are essential for critical care therapies. Prefilled IV bags and ready-to-use formulations enhance operational efficiency. High adoption in developed countries and hospital-centric healthcare infrastructure strengthens dominance. Regulatory approvals, hospital investments, and R&D pipelines support growth. Combination therapies and immunotherapy adoption boost segment demand. Training of healthcare personnel for IV administration ensures safety and compliance. Partnerships with hospital distributors expand supply. Continuous innovation in infusion devices supports market leadership.

The Subcutaneous (SC) segment is expected to witness the fastest CAGR of 8.6% from 2026 to 2033, driven by patient preference for self-administration, convenience, and reduced hospital visits. SC injectables, including insulin, mAbs, and vaccines, allow at-home treatment, enhancing patient adherence. Autoinjectors, prefilled pens, and safety-engineered devices improve usability. Growth in chronic disease treatment and preventive healthcare programs strengthens adoption. Digital health integration and remote monitoring boost patient compliance. Emerging markets show increased SC adoption due to ease of administration. Healthcare providers encourage SC therapies for cost-effective treatment. Regulatory incentives support SC formulations. Expansion of biologics pipelines and homecare delivery drives segment growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospitals Pharmacies, Retail Pharmacies, and Online Pharmacies. Hospitals Pharmacies dominated with a revenue share of approximately 61.2% in 2025, as hospitals remain the primary point for oncology, biologics, and critical care injectables. Hospitals ensure proper storage, trained personnel, and regulatory compliance. Prefilled syringes, autoinjectors, and IV bags are widely utilized in hospital settings. Expansion of hospital networks and oncology centers enhances access. Partnerships with pharmaceutical companies for direct supply strengthen dominance. Regulatory compliance and clinical guidelines further support adoption. Specialized storage and cold-chain infrastructure ensure product quality. Adoption of injectable therapies in surgical and critical care units adds momentum. Rising patient preference for hospital-administered therapies supports sustained growth. Investment in hospital infrastructure for biologics and vaccines contributes to market stability.

Online Pharmacies are expected to witness the fastest CAGR of 10.2% from 2026 to 2033, driven by the expansion of e-commerce healthcare platforms and home delivery services. Online distribution increases access to specialty injectables, particularly in remote regions. Digital prescriptions, telemedicine, and patient awareness programs contribute to adoption. Convenience, privacy, and reduced hospital visits encourage usage. Partnerships between pharmaceutical companies and e-commerce platforms enhance market reach. Cold-chain logistics and secure delivery technologies ensure product stability. Growth in chronic disease management supports online pharmacy expansion. Regulatory frameworks for safe online distribution are strengthening. Technological innovations, including automated inventory management, support rapid growth. Emerging markets show higher adoption due to convenience and accessibility. Strategic alliances with hospitals and clinics drive online pharmacy penetration.

Sterile Injectable Market Regional Analysis

- North America dominated the sterile injectable market with the largest revenue share of approximately 42.5% in 2025, driven by the U.S.'s strong pharmaceutical and biotechnology industry, high R&D investments, and well-established healthcare infrastructure

- The region benefits from the presence of leading pharmaceutical and biotechnology companies, extensive manufacturing facilities, and supportive regulatory frameworks, enabling rapid adoption of innovative sterile injectable products

- Increasing demand for biologics, vaccines, and specialty injectables further fuels market growth

U.S. Sterile Injectable Market Insight

The U.S. sterile injectable market captured the majority of North American revenue, supported by high adoption of advanced injectable formulations, robust pharmaceutical R&D, and strong government initiatives promoting healthcare innovation. The rising prevalence of chronic and infectious diseases, along with the growing demand for safe and efficient injectable therapies, continues to drive the market. Additionally, expanding contract manufacturing organizations (CMOs) and investment in sterile manufacturing facilities contribute to U.S. market dominance.

Europe Sterile Injectable Market Insight

The Europe sterile injectable market is expected to grow steadily during the forecast period, supported by advanced pharmaceutical manufacturing infrastructure, strict regulatory compliance, and growing adoption of biologics and vaccines. Countries such as Germany, France, and Italy are investing in state-of-the-art sterile production facilities and advanced formulation technologies, which are driving market expansion. Increasing healthcare expenditure and awareness regarding injectable therapies are key growth factors.

U.K. Sterile Injectable Market Insight

The U.K. sterile injectable market is projected to witness significant growth, driven by government support for pharmaceutical innovation, expanding biologics production, and robust healthcare infrastructure. Rising demand for vaccines, oncology injectables, and specialty therapies further boosts market growth. The presence of leading pharmaceutical companies and CMOs enhances the adoption of advanced sterile injectable solutions.

Germany Sterile Injectable Market Insight

The Germany sterile injectable market is expected to expand at a healthy CAGR, fueled by advanced pharmaceutical manufacturing capabilities, strong regulatory frameworks, and increased production of biologics and vaccines. The country’s emphasis on high-quality manufacturing standards and ongoing investment in sterile production technologies supports market growth. Germany continues to serve as a key hub for Europe’s sterile injectable production and innovation.

Asia-Pacific Sterile Injectable Market Insight

The Asia-Pacific sterile injectable market is poised to grow at the fastest CAGR of approximately 9.1% during the forecast period, driven by rising healthcare expenditure, expanding hospital infrastructure, and increasing adoption of advanced injectable formulations. Countries such as China, India, and Japan are witnessing robust growth due to government initiatives promoting healthcare access, growing prevalence of chronic diseases, and rising demand for biologics and vaccines. Expanding pharmaceutical manufacturing capabilities in the region further support market expansion.

Japan Sterile Injectable Market Insight

The Japan sterile injectable market is experiencing steady growth, supported by a technologically advanced healthcare system, increasing demand for vaccines and specialty injectables, and government support for pharmaceutical innovation. High awareness regarding safe and effective injectable therapies drives adoption in hospitals and research centers.

China Sterile Injectable Market Insight

The China sterile injectable market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, strong pharmaceutical and biotechnology growth, and high adoption of biologics and vaccines. The country’s expanding hospital infrastructure, government healthcare initiatives, and growing demand for safe and advanced injectable therapies are key factors driving market growth. Domestic manufacturing capabilities and investment in sterile production facilities also contribute significantly to China’s market expansion.

Sterile Injectable Market Share

The Sterile Injectable industry is primarily led by well-established companies, including:

• Pfizer Inc. (U.S.)

• Roche Holding AG (Switzerland)

• Novartis AG (Switzerland)

• Johnson & Johnson (U.S.)

• Sanofi S.A. (France)

• Merck & Co., Inc. (U.S.)

• GlaxoSmithKline plc (U.K.)

• Eli Lilly and Company (U.S.)

• AbbVie Inc. (U.S.)

• Amgen Inc. (U.S.)

• Bayer AG (Germany)

• Bristol-Myers Squibb Company (U.S.)

• Astellas Pharma Inc. (Japan)

• Teva Pharmaceutical Industries Ltd. (Israel)

• Hikma Pharmaceuticals PLC (U.K.)

• Dr. Reddy’s Laboratories Ltd. (India)

• Sun Pharmaceutical Industries Ltd. (India)

• Cipla Limited (India)

• Boehringer Ingelheim GmbH (Germany)

• Biocon Limited (India)

Latest Developments in Global Sterile Injectable Market

- In April 2023, Bridgewest Group, a global private investment firm, finalized the acquisition of the Perth sterile injectable manufacturing facility from Pfizer (Perth) Pty Ltd, marking a significant consolidation in sterile injectable manufacturing capacity to support increased demand and strengthen production pipelines. This acquisition aims to leverage Bridgewest’s expertise in life sciences to modernize and scale production infrastructure for prefilled syringes and vials, enhancing regional supply resilience and responding to growing needs for sterile injectable therapies in multiple therapeutic areas

- In August 2024, Fresenius Kabi launched a new generic version of Cetrorelix Acetate for Injection, a sterile injectable used in reproductive health treatments, broadening its women’s health product portfolio by offering a cost‑effective alternative that includes pre‑filled syringe formats designed for ease of use and improved clinical compliance. This launch reflects ongoing expansion of sterile injectable offerings beyond high‑cost branded biologics into essential therapeutic categories with strong clinical demand

- In July 2024, Amneal Pharmaceuticals, Inc. and Steriscience jointly launched FOCINVEZ, a ready‑to‑use (RTU) sterile injectable formulation of fosaprepitant designed to prevent nausea and vomiting associated with chemotherapy. The product’s single‑dose vial eliminates the need for reconstitution, reducing preparation errors and improving safety in oncology care settings

- In November 2024, Adragos Pharma, a contract development and manufacturing organization (CDMO), significantly enhanced its sterile injectable production capabilities with a new ampoule filling line in France, boosting flexibility in fill volumes from 1 ml to 20 ml and accommodating diverse formulation needs. This facility upgrade strengthens Europe’s capacity to support customized sterile injectable manufacturing for pharmaceutical clients

- In February 2025, Eli Lilly and Merck & Co. partnered with Purdue University to establish the Young Institute Pharmaceutical Manufacturing Consortium, a collaborative initiative focused on research and development of next‑generation sterile injectable production technologies designed to improve manufacturing efficiency and address capacity bottlenecks for complex biologics and specialty injectables

- In January 2025, Akums Drugs and Pharmaceuticals launched a new sterile facility dedicated to producing lyophilized products, vials, ampoules, and fill‑finish injectables, significantly expanding capacity for sterile dosage forms including eye and ear drops and various injectable formats, to support rising regional and global demand

- In March 2025, The Noramco Group announced a major investment in Halo Pharma to build sterile injectable manufacturing capabilities for ready‑to‑use syringes, cartridges, and vials, including the installation of high‑speed Groninger UFVN FlexFill lines to help alleviate U.S. supply chain constraints and increase domestic readiness for critical care sterile injectable

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.