Global Sterile Packaging Market

Market Size in USD Billion

CAGR :

%

USD

38.19 Billion

USD

59.50 Billion

2024

2032

USD

38.19 Billion

USD

59.50 Billion

2024

2032

| 2025 –2032 | |

| USD 38.19 Billion | |

| USD 59.50 Billion | |

|

|

|

|

Sterile Packaging Market Size

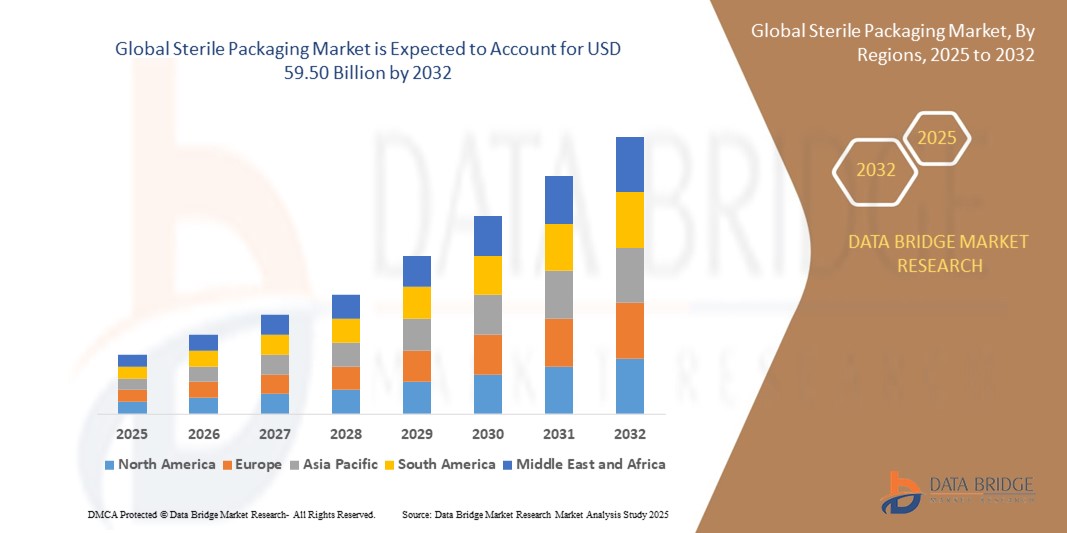

- The global sterile packaging market size was valued at USD 38.19 billion in 2024 and is expected to reach USD 59.50 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is primarily driven by the increasing demand for safe and contamination-free packaging solutions in the pharmaceutical and food industries, coupled with advancements in packaging technologies

- Rising consumer awareness of hygiene, stringent regulatory requirements for sterile packaging, and the growing adoption of advanced medical devices are key factors propelling the market's expansion

Sterile Packaging Market Analysis

- Sterile packaging, designed to maintain product sterility and prevent contamination, is a critical component in industries such as pharmaceuticals, food and beverages, and chemicals, ensuring product safety and extended shelf life

- The surge in demand for sterile packaging is fueled by the growing prevalence of chronic diseases, increasing pharmaceutical production, and a rising focus on food safety standards globally

- North America dominated the sterile packaging market with the largest revenue share of 38.5% in 2024, driven by advanced healthcare infrastructure, high adoption of innovative packaging solutions, and the presence of major industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rapid urbanization, increasing healthcare expenditure, and growing demand for packaged food products

- The vials and ampoules segment held the largest market revenue share of 38.2% in 2024, driven by their widespread use in the pharmaceutical industry for storing and delivering sensitive drugs, vaccines, and biologics, ensuring product integrity and safety

Report Scope and Sterile Packaging Market Segmentation

|

Attributes |

Sterile Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sterile Packaging Market Trends

“Increasing Adoption of Sustainable and Eco-Friendly Packaging Solutions”

- The global sterile packaging market is experiencing a significant trend toward the adoption of sustainable and eco-friendly materials, driven by environmental concerns and regulatory pressures

- Advanced materials such as biodegradable plastics, recyclable metals, and paper-based packaging are being integrated to reduce environmental impact while maintaining sterility

- For instance, companies are developing bio-based plastics and recyclable packaging solutions, such as vials and pouches, to meet the growing demand for sustainable healthcare packaging

- These solutions are designed to comply with stringent regulations while offering cost-effective and environmentally responsible alternatives

- The use of smart packaging technologies, such as tamper-evident seals and digital tracking, is also enhancing the appeal of sterile packaging by ensuring product integrity and traceability

- This trend is particularly attractive to pharmaceutical and medical device manufacturers aiming to align with global sustainability goals and consumer preferences for greener products

Sterile Packaging Market Dynamics

Driver

“Rising Demand for Safe and Sterile Healthcare Products”

- The increasing global demand for safe, contamination-free healthcare products, such as pharmaceuticals, biologics, and medical devices, is a key driver for the sterile packaging market

- Sterile packaging ensures the safety and efficacy of products by preventing microbial contamination during manufacturing, storage, and transportation

- Government regulations, particularly in North America with standards set by the FDA, are mandating the use of sterile packaging to ensure patient safety and product integrity

- The expansion of 5G and IoT technologies is enabling advanced tracking and monitoring of sterile packaging, ensuring compliance with regulatory standards and improving supply chain efficiency

- Manufacturers are increasingly incorporating sterile packaging as a standard feature to meet consumer expectations for high-quality, safe healthcare products

Restraint/Challenge

“High Costs and Regulatory Compliance Issues”

- The significant initial investment required for developing and implementing sterile packaging solutions, including advanced materials and sterilization technologies, poses a barrier to adoption, particularly in cost-sensitive emerging markets

- Integrating sterile packaging into existing manufacturing processes can be complex and costly, requiring specialized equipment and expertise

- Data security and regulatory compliance concerns are also significant challenges, as sterile packaging often incorporates smart technologies that collect and transmit sensitive product data, raising risks of breaches or non-compliance with data protection regulations

- The fragmented regulatory landscape across regions, with varying standards for packaging safety and environmental impact, complicates operations for global manufacturers

- These factors can limit market growth, particularly in regions with high cost sensitivity or stringent regulatory environments

Sterile Packaging market Scope

The market is segmented on the basis of type, material type, and end user.

- By Type

On the basis of type, the global sterile packaging market is segmented into thermoform trays, sterile bottles and containers, vials and ampoules, pre-fillable inhalers, sterile closures, pre-filled syringes, blister and clamshells, bags and pouches, wraps, and others. The vials and ampoules segment held the largest market revenue share of 38.2% in 2024, driven by their widespread use in the pharmaceutical industry for storing and delivering sensitive drugs, vaccines, and biologics, ensuring product integrity and safety.

The pre-filled syringes segment is anticipated to experience the fastest growth rate of 18.4% from 2025 to 2032. This growth is propelled by rising demand for biologics, self-administration of drugs, and advancements in syringe design, which enhance patient convenience and reduce contamination risks.

- By Material Type

On the basis of material type, the global sterile packaging market is segmented into plastics, metals, glass, paper and paperboard, and others. The plastics segment dominated with a market revenue share of 62.7% in 2024, attributed to its versatility, cost-effectiveness, and ability to meet stringent sterility requirements. Plastics such as polyethylene and polypropylene are widely used for their durability and compatibility with various sterilization methods.

The glass segment is expected to witness significant growth from 2025 to 2032, driven by its inert properties, making it ideal for high-value pharmaceuticals and biologics that require long-term stability and protection from environmental factors.

- By End User

On the basis of end user, the global sterile packaging market is segmented into the packaging industry, pharmaceutical, food and beverages, chemical industry, and others. The pharmaceutical segment held the largest market revenue share of 70.3% in 2024, driven by the critical need for sterile packaging to ensure drug safety, efficacy, and compliance with global regulatory standards.

The food and beverages segment is projected to grow at the fastest rate from 2025 to 2032, fueled by increasing demand for sterile packaging to extend shelf life, ensure food safety, and meet consumer preferences for ready-to-eat and minimally processed products. The rise of e-commerce and global food trade further accelerates adoption.

Sterile Packaging Market Regional Analysis

- North America dominated the sterile packaging market with the largest revenue share of 38.5% in 2024, driven by advanced healthcare infrastructure, high adoption of innovative packaging solutions, and the presence of major industry players

- Consumers and industries prioritize sterile packaging for ensuring product integrity, extending shelf life, and meeting regulatory standards, particularly in the pharmaceutical and food and beverage sectors

- Growth is supported by advancements in packaging technology, such as high-barrier materials and sustainable solutions, alongside rising adoption across both OEM and aftermarket segments

U.S. Sterile Packaging Market Insight

The U.S. sterile packaging market captured the largest revenue share of 77.9% in 2024 within North America, fueled by strong demand from the pharmaceutical and healthcare sectors, coupled with growing awareness of contamination prevention. The trend towards sustainable and recyclable packaging solutions, combined with strict FDA regulations, further drives market expansion. The integration of sterile packaging in medical devices and drug delivery systems complements aftermarket growth, fostering a diverse product ecosystem.

Europe Sterile Packaging Market Insight

The Europe sterile packaging market is expected to witness significant growth, supported by stringent regulatory frameworks emphasizing product safety and environmental sustainability. Industries seek packaging solutions that ensure sterility while offering eco-friendly options. Growth is notable in pharmaceutical and food packaging applications, with countries such as Germany and France leading due to advanced manufacturing capabilities and rising environmental consciousness.

U.K. Sterile Packaging Market Insight

The U.K. market for sterile packaging is expected to witness rapid growth, driven by demand for safe and sustainable packaging in pharmaceuticals and food and beverage industries. Increased focus on product safety and consumer awareness of contamination risks boost adoption. Evolving regulations promoting recyclable materials and compliance with sterility standards influence market trends, balancing functionality with sustainability.

Germany Sterile Packaging Market Insight

Germany is expected to witness the fastest growth rate in the European sterile packaging market, attributed to its advanced pharmaceutical and manufacturing sectors and high focus on product safety and sustainability. German industries prefer innovative packaging solutions, such as high-barrier trays and vials, that ensure sterility and reduce environmental impact. The integration of these solutions in premium medical and food products supports sustained market growth.

Asia-Pacific Sterile Packaging Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding pharmaceutical production, rising healthcare demands, and increasing disposable incomes in countries such as China, India, and Japan. Growing awareness of product safety, contamination prevention, and sustainability is boosting demand. Government initiatives promoting healthcare advancements and stringent packaging standards further encourage the adoption of advanced sterile packaging solutions.

Japan Sterile Packaging Market Insight

Japan’s sterile packaging market is expected to witness rapid growth due to strong consumer and industry preference for high-quality, technologically advanced packaging solutions that ensure product safety and compliance. The presence of major pharmaceutical and medical device manufacturers, along with the integration of sterile packaging in OEM applications, accelerates market penetration. Rising interest in sustainable packaging solutions also contributes to growth.

China Sterile Packaging Market Insight

China holds the largest share of the Asia-Pacific sterile packaging market, propelled by rapid urbanization, rising healthcare expenditure, and increasing demand for safe and sterile packaging solutions. The country’s growing middle class and focus on healthcare innovation support the adoption of advanced packaging formats. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility and growth.

Sterile Packaging Market Share

The sterile packaging industry is primarily led by well-established companies, including:

- Amcor plc (Australia)

- 3M (U.S.)

- DuPont (U.S.)

- Placon (U.S.)

- Sonoco Products Company (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- STERIPACK GROUP LIMITED (U.S.)

- Wihuri Oy (Finland)

- MULTIVAC (Germany)

- Riverside Medical Packaging Company Ltd (U.K.)

- Tekni-Plex, Inc. (U.S.)

- Klockner Pentaplast Group (Germany)

- ProAmpac (U.S.)

- Oliver Healthcare Packaging (U.S.)

- Huhtamaki Oyj (Finland)

What are the Recent Developments in Global Sterile Packaging Market?

- In June 2024, Keystone Folding Box Co. launched Push-Pak, a new line of paper-based blister packs designed for the pharmaceutical industry. These blister wallets feature a push-through opening system and are made from tear-resistant paperboard, offering F=1 child resistance while remaining easy to open for seniors. Push-Pak uses up to 75% less plastic than traditional blister packaging, making it a more eco-friendly alternative. The compact design improves transport efficiency, supports medication adherence, and aligns with the industry’s growing focus on sustainable packaging solutions

- In March 2024, Amcor partnered with PFM Packaging Machinery to launch AmPrima®, a lightweight, flexible mono-PE material with robust barrier properties designed to preserve product freshness and extend shelf life. Developed for applications including sterile products, AmPrima offers puncture resistance, seal strength, and heat resistance, making it ideal for high-speed packaging lines. This collaboration reflects a growing industry shift toward sustainable, high-performance packaging solutions. AmPrima is recycle-ready, aligning with upcoming regulatory standards and Amcor’s commitment to making all packaging recyclable or reusable by 2025

- In March 2024, Berry Global partnered with Mitsubishi Gas Chemical Company, Inc. (MGC) to develop a recyclable barrier solution for thermoformed items, plastic tubes, jars, and bottles using MXD6, a high-performance barrier resin created by MGC. This EVOH-free material offers up to 12% loading, strong oxygen barrier properties, and compatibility with polypropylene recycling streams, earning Critical Guidance recognition from the Association of Plastics Recyclers (APR). The collaboration aims to advance sustainable packaging technologies for applications including sterile products, reducing both plastic waste and food spoilage

- In February 2024, Sanofi Consumer Healthcare joined the Blister Pack Collective, a sustainability initiative formed by PA Consulting and PulPac to develop recyclable fiber-based blister packs. These packs utilize Dry Molded Fiber technology, offering a paper-recyclable alternative to traditional PVC-based pharmaceutical packaging. The collaboration aims to reduce the over 100,000 tonnes of plastic used annually in medicine packaging, significantly lowering CO₂ emissions and water usage. Sanofi’s involvement underscores the industry’s growing commitment to plastic-free, eco-friendly packaging solutions, especially for sterile pharmaceutical applications

- In January 2023, Nelipak added Eastman Renew's materials for sterile medical device packaging. The company utilized Eastman's Easter Renew 6763 to produce rigid thermoformed sterile barrier packaging, becoming the first healthcare packaging manufacturer to use this material for Class 2 and Class 3 medical packaging applications. This development emphasizes the adoption of sustainable materials in sterile packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sterile Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sterile Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sterile Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.