Global Sterilization Equipment Market

Market Size in USD Billion

CAGR :

%

USD

17.48 Billion

USD

32.84 Billion

2024

2032

USD

17.48 Billion

USD

32.84 Billion

2024

2032

| 2025 –2032 | |

| USD 17.48 Billion | |

| USD 32.84 Billion | |

|

|

|

|

Sterilization Equipment Market Size

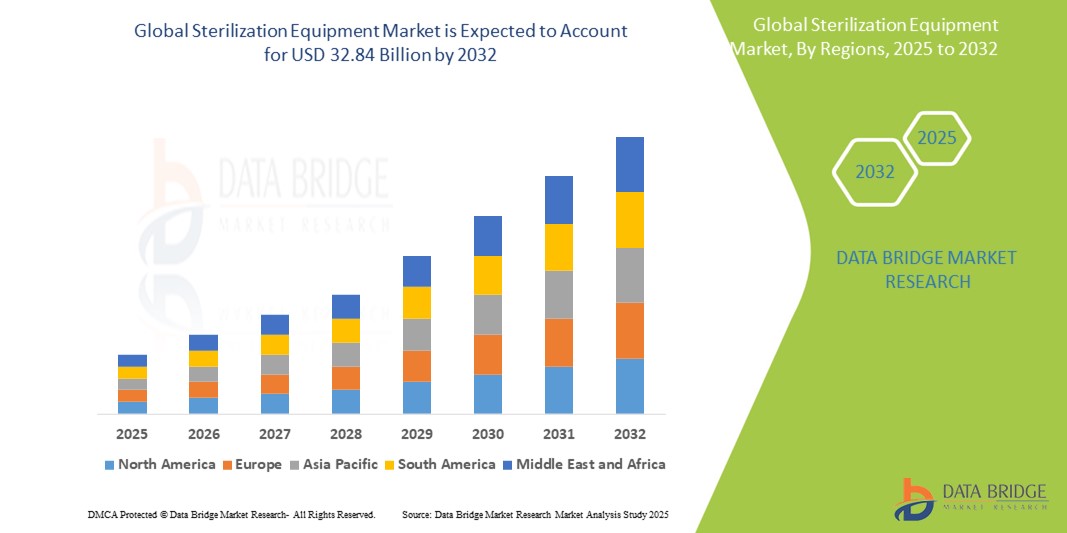

- The global sterilization equipment market size was valued at USD 17.48 billion in 2024 and is expected to reach USD 32.84 billion by 2032, at a CAGR of 8.20% during the forecast period

- This growth is driven by factors such as the rising demand for infection control in healthcare settings, increasing surgical procedures, and growing awareness about sterilization in pharmaceutical and food industries

Sterilization Equipment Market Analysis

- Sterilization equipment is essential in maintaining aseptic conditions in healthcare facilities, pharmaceutical manufacturing, and food processing by eliminating all forms of microbial life from instruments and surfaces

- The demand for sterilization equipment is significantly driven by the rise in hospital-acquired infections (HAIs), the growing number of surgical procedures, and increased awareness regarding infection control

- North America is expected to dominate the sterilization equipment market with a market share of 36.5%, due to advanced healthcare infrastructure, stringent infection control regulations, and widespread adoption of technologically advanced sterilization solutions

- Asia-Pacific is expected to be the fastest growing region in the sterilization equipment market with a market share of 20.3%, during the forecast period due to rapid healthcare infrastructure development, increased government spending on infection prevention, and expanding medical device manufacturing

- Sterilization consumables and accessories segment is expected to dominate the market with a market share of 37.7% due to its recurring demand and critical role in ensuring effective sterilization cycles

Report Scope and Sterilization Equipment Market Segmentation

|

Attributes |

Sterilization Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sterilization Equipment Market Trends

“Automation and Integration of Smart Technologies in Sterilization Processes”

- One prominent trend in the sterilization equipment market is the increasing automation and integration of smart technologies such as IoT connectivity, real-time monitoring, and digital tracking systems

- These innovations enhance process efficiency and compliance by enabling automated sterilization cycles, remote monitoring, and accurate documentation of sterilization parameters

- For instance, advanced sterilizers equipped with RFID and barcode scanning capabilities streamline instrument tracking and ensure traceability, reducing the risk of human error and improving patient safety

- These technological advancements are reshaping sterilization workflows in hospitals and laboratories, driving demand for intelligent, high-performance equipment that meets stringent regulatory standards

Sterilization Equipment Market Dynamics

Driver

“Rising Incidence of Hospital-Acquired Infections (HAIs)”

- The increasing prevalence of hospital-acquired infections (HAIs) is a major driver for the global sterilization equipment market, as healthcare facilities are under growing pressure to maintain sterile environments

- HAIs result in prolonged hospital stays, increased medical costs, and higher mortality rates, prompting hospitals to adopt advanced sterilization technologies to minimize infection risks

- The need for effective infection control protocols is fueling demand for sterilization equipment across hospitals, clinics, and diagnostic laboratories, particularly in the wake of the COVID-19 pandemic

For instance,

- According to the Centers for Disease Control and Prevention (CDC), about 1 in 31 hospital patients has at least one healthcare-associated infection on any given day in the U.S., highlighting the urgent need for stringent sterilization practices

- As the burden of HAIs continues to grow globally, the adoption of sterilization equipment becomes increasingly critical in ensuring patient safety and regulatory compliance

Opportunity

“Integration of IoT and AI for Smart Sterilization Solutions”

- The integration of Internet of Things (IoT) and Artificial Intelligence (AI) into sterilization equipment presents a significant opportunity for enhancing operational efficiency, traceability, and regulatory compliance in healthcare and laboratory environments

- AI-driven systems can analyze sterilization data in real time, identify anomalies, and optimize sterilization cycles for different types of instruments and materials, reducing energy consumption and improving effectiveness

- In addition, IoT-enabled sterilization units can provide remote monitoring, predictive maintenance alerts, and cloud-based documentation, which supports centralized sterilization management across multiple facilities

For instance,

- In February 2025, an article published in Journal of Infection Control highlighted how AI-powered sterilization systems have been implemented in hospitals to predict equipment failure before it occurs. AI algorithms analyze past performance data to schedule maintenance and optimize sterilization cycles, thus preventing costly repairs and ensuring patient safety

- The adoption of smart sterilization solutions enables healthcare providers to increase productivity, ensure patient safety, and reduce operational costs, paving the way for next-generation infection control systems in both developed and emerging markets

Restraint/Challenge

“High Capital Investment and Maintenance Costs”

- The high initial investment and ongoing maintenance costs of advanced sterilization equipment represent a significant restraint for the market, particularly for smaller healthcare facilities and clinics in low- and middle-income countries

- Modern sterilization technologies such as low-temperature hydrogen peroxide plasma or ethylene oxide systems can require substantial financial outlays for installation, operation, and compliance with safety regulations

- These costs, combined with the need for specialized training and infrastructure, can deter institutions from upgrading to more efficient sterilization systems, leading to continued reliance on outdated methods

For instance,

- In October 2023, according to an article by Infection Control Today, smaller healthcare facilities often face challenges in affording and maintaining state-of-the-art sterilization systems, citing high equipment costs and regulatory requirements as major barriers to adoption

- Consequently, the financial burden limits widespread adoption of advanced sterilization equipment, potentially compromising infection control standards and slowing market expansion, especially in resource-constrained settings

Sterilization Equipment Market Scope

The market is segmented on the basis of product and services, end user

|

Segmentation |

Sub-Segmentation |

|

By Product and Services |

|

|

By End User |

|

In 2025, the sterilization consumables and accessories is projected to dominate the market with a largest share in product and services segment

The sterilization consumables and accessories segment is expected to dominate the sterilization equipment market with the largest share of 37.7% in 2025 due to its recurring demand and critical role in ensuring effective sterilization cycles. Items such as sterilization wraps, indicators, and disinfectants are essential for maintaining compliance with safety standards. Their frequent replacement and widespread use across hospitals and laboratories contribute to consistent market growth.

The hospitals and clinics is expected to account for the largest share during the forecast period in end user market

In 2025, the hospitals and clinics segment is expected to dominate the market with the largest market share of 36.4% due to its high volume of surgical procedures, strict infection control protocols, and increasing patient admissions. These facilities require constant sterilization of instruments and environments to prevent hospital-acquired infections (HAIs). In addition, ongoing investments in healthcare infrastructure further boost the demand for sterilization equipment in this segment.

Sterilization Equipment Market Regional Analysis

“North America Holds the Largest Share in the Sterilization Equipment Market”

- North America dominates the sterilization equipment market with a market share of estimated 36.5%, driven, by advanced healthcare infrastructure, stringent infection control regulations, and widespread adoption of technologically advanced sterilization solutions

- U.S. holds a market share of 28.1%, due to the high volume of surgical procedures, strong focus on preventing hospital-acquired infections (HAIs), and consistent investment in healthcare quality and safety

- The presence of major sterilization equipment manufacturers, coupled with well-established reimbursement frameworks and regulatory compliance mandates, supports continued market dominance

- In addition, the rising demand for outpatient surgical centers and the increasing use of reusable medical instruments are further propelling the market growth across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Sterilization Equipment Market”

- Asia-Pacific is expected to witness the highest growth rate in the sterilization equipment market with a market share of 20.3%, driven by rapid healthcare infrastructure development, increased government spending on infection prevention, and expanding medical device manufacturing

- Countries such as China, India, and Japan are emerging as key markets due to growing awareness of infection control, rising surgical volumes, and increased adoption of sterilization protocols in hospitals and clinics

- Japan continues to lead in the adoption of high-end sterilization technologies, supported by its well-regulated medical sector and focus on patient safety

- India is projected to register the highest CAGR of 11.9% within the region, owing to growing healthcare access in rural areas, rising hospital construction, and initiatives promoting sterilization practices to combat healthcare-associated infections

Sterilization Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- STERIS (U.S.)

- Getinge (Sweden)

- 3M (U.S.)

- Sotera Health (U.S.)

- Fortive (U.S.)

- Cardinal Health (U.S.)

- Metall Zug AG (Switzerland)

- Stryker (U.S.)

- Merck KGaA (Germany)

- MMM Group (Germany)

- MATACHANA (Spain)

- Tuttnauer (Netherlands)

- Andersen Sterilizers (U.S.)

- Steelco S.p.A. (Italy)

- Noxilizer Inc. (U.S.)

- DE LAMA S.P.A. (Italy)

- Cosmed Group (U.S.)

- E-BEAM Services, Inc. (U.S.)

- Life Science Outsourcing, Inc. (U.S.)

- Systec GmbH & Co. KG (Germany)

- Continental Construction (U.S.)

- Midwest Sterilization Corporation (U.S.)

- ACMAS Technologies (P) Ltd. (India)

Latest Developments in Global Sterilization Equipment Market

- In April 2025, STERIS Corporation introduced the V-PRO s2 Low Temperature Sterilization System, a compact vaporized hydrogen peroxide (VH₂O₂) sterilizer designed for terminal sterilization of medical devices. This system operates at low temperatures, processing medical devices without leaving toxic residues, and offers pre-programmed cycles for efficient sterilization

- In March 2025, Getinge announced the global launch of its GSS P Steam Sterilizer series, tailored for pharmaceutical production. The GSS P ensures a reproducible process, product quality, and a safe environment, making it easier to achieve high performance, productivity, and a streamlined process in biopharmaceutical settings

- In February 2025, RAD Technology Medical Systems and Belimed completed the first installation of the FlexSPD, a fully equipped, self-contained sterile processing facility. This portable unit can be rapidly deployed on existing hospital campuses or during renovations, ensuring continuous sterilization services

- In January 2025, SGS received approval to extend the scope of its EU Medical Device Regulation (MDR) sterilization services. This extension allows SGS to assess additional sterilization processes, enhancing its service offerings to medical device manufacturers seeking compliance with MDR requirements

- In October 2024, ClorDiSys announced the expansion of its chlorine dioxide gas sterilization technology into the European market. This move introduces a sustainable and innovative sterilization approach, offering an alternative to traditional methods and aligning with new MDR regulations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.