Global Storage Area Network San Solutions Market

Market Size in USD Billion

CAGR :

%

USD

27.32 Billion

USD

87.75 Billion

2024

2032

USD

27.32 Billion

USD

87.75 Billion

2024

2032

| 2025 –2032 | |

| USD 27.32 Billion | |

| USD 87.75 Billion | |

|

|

|

|

Storage Area Network (SAN) Solutions Market Size

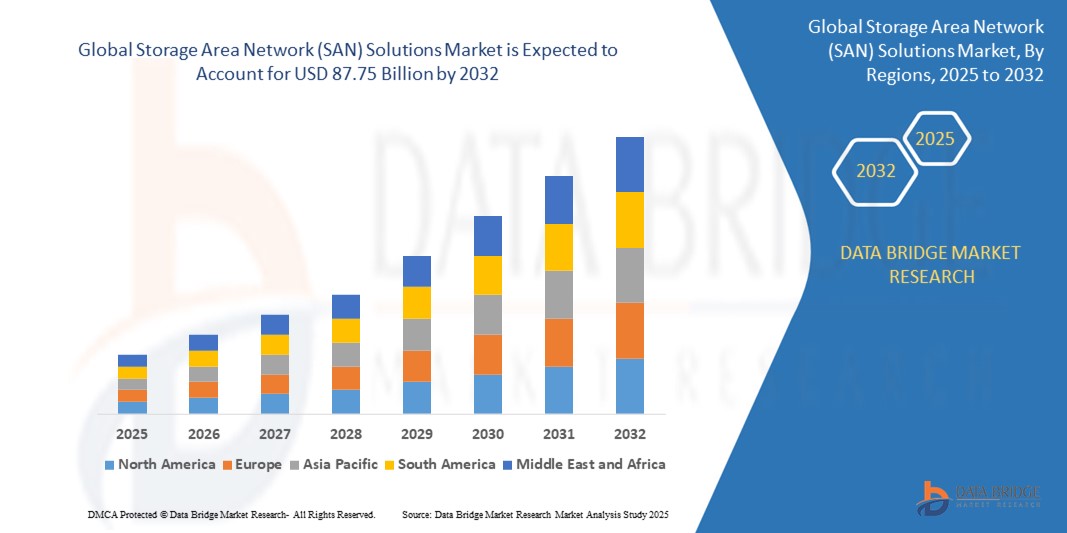

- The global storage area network (SAN) solutions market size was valued at USD 27.32 billion in 2024 and is expected to reach USD 87.75 billion by 2032, at a CAGR of 15.70% during the forecast period

- Market growth is being driven by increasing data generation across industries, which is prompting organizations to seek efficient, scalable, and high-performance data storage solutions. SANs are gaining traction as they offer centralized storage, high availability, and disaster recovery capabilities essential for mission-critical applications

- Furthermore, technological advancements in SAN hardware and software, including the integration of NVMe over Fabrics (NVMe-oF) and AI-driven storage management, are transforming the SAN landscape, offering improved efficiency, reduced latency, and lower total cost of ownership (TCO)

Storage Area Network (SAN) Solutions Market Analysis

- Storage Area Network (SAN) solutions, which provide dedicated, high-speed connectivity between servers and storage devices, are increasingly essential in modern enterprise IT environments. Their ability to deliver high performance, centralized storage management, and data redundancy makes them critical for supporting virtualization, cloud platforms, and big data workloads

- The rising demand for SAN solutions is fueled by the surge in enterprise data volumes, growing cloud adoption, and the increasing need for secure and scalable storage infrastructure. Industries such as BFSI, healthcare, and telecom are investing heavily in SAN technologies to ensure data availability, compliance, and disaster recovery

- North America dominates the global SAN solutions market with the largest revenue share of 38.6% in 2025, driven by early technology adoption, robust IT infrastructure, and the presence of leading vendors such as Dell Technologies, Hewlett Packard Enterprise, IBM, and NetApp. The U.S. market in particular is experiencing high SAN deployment across hyperscale data centers and cloud service providers

- Asia-Pacific is projected to be the fastest-growing region, expected to expand at a CAGR of over 17% during the forecast period, due to rapid digital transformation, increased investment in data center infrastructure, and rising enterprise IT spending in countries such as China, India, and Southeast Asia

- Fibre Channel SAN segment is expected to hold the largest market share at 45.2% in 2025, valued for its low-latency performance and reliability in mission-critical environments. Meanwhile, the IP SAN segment is gaining momentum, particularly among small to mid-sized enterprises, due to its cost-efficiency and easier network integration

Report Scope and Storage Area Network (SAN) Solutions Market Segmentation

|

Attributes |

Storage Area Network (SAN) Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Storage Area Network (SAN) Solutions Market Trends

“Enhanced Performance through AI and Cloud Integration”

- A significant and accelerating trend in the global Storage Area Network (SAN) solutions market is the increasing integration with (AI) and cloud-based management platforms. This fusion is significantly enhancing storage performance, automation, and data management efficiency across enterprise IT infrastructures

- For instance, Dell EMC’s PowerStore leverages machine learning to automate storage operations and dynamically allocate resources, improving system responsiveness and reducing administrative overhead. Similarly, IBM’s FlashSystem integrates AI-powered analytics for real-time monitoring and predictive maintenance, helping businesses proactively manage data loads and avoid downtime

- AI integration in SAN environments enables capabilities such as predictive analytics for performance optimization, intelligent tiering of data storage, and automated workload balancing. For example, HPE Primera uses AI to analyze usage patterns and automatically place data in the most optimal storage tier, ensuring both cost efficiency and performance.

- The seamless integration of SAN solutions with artificial intelligence cloud environments facilitates centralized and scalable storage management, enabling hybrid and multi-cloud strategies. Through unified dashboards, IT teams can monitor and control on-premises and cloud-based SAN resources, implement policy-driven automation, and ensure compliance with data governance requirements

- This trend towards smarter, self-optimizing, and cloud-connected SAN architectures is fundamentally transforming how enterprises approach data storage. Consequently, vendors such as NetApp are developing SAN solutions with embedded AI engines and native cloud connectivity to address evolving data storage demands in AI, analytics, and virtualization workloads

- The demand for SAN solutions that offer integrated AI capabilities and seamless cloud compatibility is growing rapidly across sectors such as finance, healthcare, and telecommunications, as organizations increasingly require high-performance, scalable, and intelligent data storage systems to support digital transformation and real-time analytics

Storage Area Network (SAN) Solutions Market Dynamics

Driver

“Growing Need Due to Data Explosion and Enterprise Digital Transformation”

- The exponential growth of data generation across enterprises, fueled by digital transformation, cloud computing, and IoT adoption, is a significant driver for the increasing demand for Storage Area Network (SAN) solutions

- For instance, IDC projects that the volume of data created worldwide will reach over 180 zettabytes by 2025, necessitating scalable, high-performance storage infrastructures such as SAN to manage, access, and protect this data effectively

- Organizations in sectors such as healthcare, finance, manufacturing, and media are adopting SAN solutions to support mission-critical workloads that demand low-latency, high-throughput, and reliable data access

- Furthermore, the shift toward virtualization and the growing adoption of enterprise applications (e.g., ERP, CRM, and AI/ML workloads) are reinforcing the need for centralized, robust, and efficient storage environments that SANs provide

- SAN solutions also offer critical features such as storage scalability, centralized backup, and disaster recovery capabilities, which are essential for ensuring business continuity and regulatory compliance

- The rise in remote work, hybrid cloud architectures, and data decentralization is prompting IT departments to adopt SANs with enhanced automation, flexibility, and centralized management, driving sustained market growth

Restraint/Challenge

“Concerns Regarding High Costs and Infrastructure Complexity”

- The high initial investment and ongoing maintenance costs associated with SAN infrastructure remain a significant barrier to adoption, particularly for small and medium-sized enterprises (SMEs). SAN deployments typically require specialized hardware, fiber channel switches, trained personnel, and robust networking infrastructure, all of which can contribute to high capital and operational expenditures

- For instances, enterprises deploying all-flash SAN arrays or high-performance NVMe-over-Fabric (NVMe-oF) architectures often face steep costs, making it challenging for organizations with limited IT budgets to justify the expenditure

- In addition, the complexity of configuring and managing SAN environments can deter organizations lacking in-house IT expertise. Improper configurations can lead to suboptimal performance, system downtime, and increased vulnerability to data loss or breaches

- Addressing these challenges requires continued innovation in SAN automation, simplified deployment tools, and the development of cost-effective hybrid storage solutions. Vendors such as NetApp and HPE are working to lower the entry barrier by offering SAN-as-a-Service (SANaaS) models, where customers can access scalable SAN capabilities on a subscription basis without large upfront investments

- Nevertheless, overcoming the twin challenges of cost and complexity will be crucial for expanding SAN adoption across a broader range of industries and organization sizes, especially in emerging markets and sectors with limited IT resources

Storage Area Network (SAN) Solutions Market Scope

The market is segmented on the basis component, technology, SAN type, and end-use industry.

By Component

On the basis of component, the SAN solutions market is segmented into hardware, software, and services. The hardware segment dominates the largest market revenue share of 48.5% in 2025, driven by the continuous demand for high-performance storage arrays, switches, and host bus adapters that enable reliable data transfer and storage management. Enterprises prioritize hardware upgrades to support growing data volumes, ensure business continuity, and meet latency requirements in mission-critical environments

The services segment is anticipated to witness the fastest growth rate of 20.3% from 2025 to 2032, fueled by increasing demand for deployment, consulting, and managed services across various industries. As businesses aim to reduce infrastructure complexity and improve storage optimization, third-party SAN service providers are playing a crucial role in providing tailored, end-to-end solutions

• By Technology

On the basis of technology, the SAN solutions market is segmented into Fiber Channel (FC), Fiber Channel Over Ethernet (FCoE), InfiniBand, and iSCSI Protocol. The Fiber Channel segment held the largest market revenue share in 2025, driven by its widespread adoption in enterprise data centers for delivering low-latency and high-throughput connectivity. Its proven reliability and efficiency make it the backbone technology for mission-critical applications in sectors such as BFSI and healthcare

The iSCSI Protocol segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its cost-effectiveness and flexibility over standard Ethernet networks. iSCSI enables organizations to leverage existing IP infrastructure while still benefiting from centralized SAN storage capabilities, making it particularly attractive for small to medium-sized businesses

• By SAN Type

On the basis of SAN type, the market is segmented into Hyperscale Server SAN and Enterprise Server SAN. The Enterprise Server SAN segment held the largest market revenue share in 2025, driven by the high adoption of traditional SAN architectures across large enterprises for structured workloads, centralized storage, and high availability systems. These solutions remain essential for organizations with complex IT environments and strict data governance needs

The Hyperscale Server SAN segment is anticipated to experience the fastest growth rate from 2025 to 2032, fueled by rising demand from cloud service providers, data-intensive AI workloads, and edge computing. Hyperscale SANs offer the scalability and agility needed to support massive datasets, distributed computing models, and rapid provisioning of storage resources

• By End-Use Industry

On the basis of end-use industry, the SAN solutions market is segmented into BFSI, E-Commerce, IT and Telecommunication, Energy and Utility, Government Offices and Education, Aerospace and Defense, and Others. The IT and Telecommunication segment accounted for the largest market revenue share in 2025, driven by the sector’s vast data storage needs, fast-paced digital transformation, and the implementation of virtualization and cloud services. The ability of SAN solutions to ensure secure, high-speed data access is critical to supporting this industry’s infrastructure demands

The E-Commerce segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the explosion of online shopping, real-time data analytics, and customer data management. Retailers and logistics companies increasingly rely on SAN systems to process high volumes of transactional data securely, manage digital content, and ensure seamless digital experiences

Storage Area Network (SAN) Solutions Market Regional Analysis

- North America dominates the SAN solutions market with the largest revenue share of 38.6% in 2025, driven by the widespread adoption of advanced IT infrastructure, strong presence of major technology firms, and increasing enterprise demand for scalable and secure data storage solutions

- Enterprises in the region prioritize high-performance storage technologies such as Fibre Channel and NVMe-over-Fabric to support mission-critical applications, data analytics, and virtualization

- This growth is further supported by high investments in cloud computing, AI-driven workloads, and digital transformation initiatives across industries such as BFSI, telecom, and government. The maturity of data center infrastructure and the region’s focus on cybersecurity and regulatory compliance also contribute to the rapid adoption of SAN technologies

U.S. Storage Area Network (SAN) Solutions Market Insight

The U.S. SAN solutions market captured the largest revenue share of 79.4% within North America in 2025, fueled by the rapid digital transformation of enterprises, proliferation of data-intensive applications, and the increasing shift toward cloud-based infrastructure. Organizations are prioritizing investments in high-performance SAN systems to manage growing volumes of structured and unstructured data securely and efficiently. The rising adoption of virtualization, AI, and machine learning workloads further accelerates the demand for low-latency, high-bandwidth storage solutions. Additionally, the presence of major SAN vendors and data center infrastructure in the U.S. contributes significantly to market expansion

Europe Storage Area Network (SAN) Solutions Market Insight

The European SAN solutions market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent data protection regulations such as GDPR and the increasing focus on cybersecurity, business continuity, and compliance. The region is witnessing strong demand for scalable and resilient storage infrastructure across industries including finance, government, and healthcare. Rising adoption of hybrid cloud environments and the modernization of legacy IT systems are also key contributors to the market’s growth. Both public and private sectors in Europe are investing in advanced SAN technologies to support digital innovation and ensure secure data access

U.K. Storage Area Network (SAN) Solutions Market Insight

The U.K. SAN solutions market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a surge in enterprise cloud adoption, digital banking, and data-driven operations. Businesses are increasingly turning to SAN technologies to ensure high availability, efficient backup, and rapid data retrieval for mission-critical applications. Furthermore, the expansion of data centers and the growing e-commerce ecosystem are creating sustained demand for robust, scalable SAN systems. The country’s focus on IT modernization across government, education, and healthcare sectors is expected to further fuel market growth

Germany Storage Area Network (SAN) Solutions Market Insight

The German SAN solutions market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong industrial base, increasing demand for data sovereignty, and emphasis on smart manufacturing. Germany’s commitment to digital innovation and automation across sectors such as automotive, engineering, and energy is driving the need for secure, efficient storage systems. The widespread adoption of Industry 4.0 and smart factory initiatives promotes the integration of SAN solutions for seamless data flow, real-time analytics, and long-term data storage. German enterprises are particularly inclined toward secure, enterprise-grade SAN systems that align with stringent data privacy norms

Asia-Pacific Storage Area Network (SAN) Solutions Market Insight

The Asia-Pacific SAN solutions market is poised to grow at the fastest CAGR of over 22.8% in 2025, driven by rapid digitalization, increasing IT investments, and the expansion of cloud services across countries such as China, India, and Japan. The region’s thriving start-up ecosystem, combined with growth in telecommunications, e-commerce, and fintech sectors, is fueling demand for reliable and scalable storage networks. Government initiatives promoting smart cities and digital infrastructure are further supporting SAN deployment. Additionally, the increasing presence of hyperscale data centers and SAN component manufacturers in the region enhances affordability and accessibility

Japan Storage Area Network (SAN) Solutions Market Insight

The Japan SAN solutions market is gaining momentum due to the country’s focus on technological excellence, data integrity, and operational efficiency. As enterprises modernize their IT infrastructure and integrate AI and robotics into core operations, SAN systems are becoming vital for real-time processing and secure data management. Japan’s aging population and labor shortages also encourage businesses to adopt automation and digital storage solutions to improve productivity. The integration of SANs into smart factories, cloud platforms, and financial services is contributing to market growth, with high emphasis placed on reliability and compliance

China Storage Area Network (SAN) Solutions Market Insight

The China SAN solutions market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s booming digital economy, strong enterprise IT spending, and government-backed initiatives in data security and cloud computing. China is a leading hub for hyperscale data centers, and its expansive e-commerce, fintech, and manufacturing sectors are increasingly relying on SAN technologies for large-scale data management. Domestic SAN providers are investing heavily in R&D and offering competitive, high-performance solutions tailored to local business needs. The integration of SAN systems into smart city projects and industrial automation initiatives continues to drive growth

Storage Area Network (SAN) Solutions Market Share

The storage area network (SAN) solutions industry is primarily led by well-established companies, including:

- 4DS Memory Limited (Australia)

- Avalanche Technology (U.S.)

- Everspin Technologies Inc. (U.S.)

- FUJITSU (Japan)

- IBM (U.S.)

- Microchip Technology Inc. (U.S.)

- Nantero. (U.S.)

- SAMSUNG (South Korea)

- Rambus (U.S.)

- SK HYNIX INC. (South Korea)

- NXP Semiconductors. (Netherlands)

- Toshiba CORPORATION (Japan)

- Texas Instruments Incorporated. (U.S.)

- Western Digital Corporation (U.S.)

- Viking Technology (U.S.)

Latest Developments in Global Storage Area Network (SAN) Solutions Market

- In February 2024, Software-Defined Storage (SDS) saw increased adoption, revolutionizing Storage Area Networks (SANs) by decoupling storage management from physical hardware. This shift enhances agility, manageability, and cost-effectiveness, allowing organizations to optimize storage resources dynamically. SDS abstracts storage infrastructure, enabling policy-driven provisioning and seamless scalability. Unlike traditional SANs reliant on proprietary hardware, SDS leverages commodity systems, reducing vendor lock-in and improving flexibility. By virtualizing storage, businesses gain greater control over data management, ensuring efficient allocation and utilization

- In January 2024, new Multi-Protocol SAN solutions emerged, enabling enterprises to leverage Fiber Channel, FCoE, and iSCSI within a single platform. This advancement enhances protocol compatibility and deployment flexibility, allowing businesses to optimize storage infrastructure without being locked into a single protocol. By integrating multiple storage networking technologies, organizations can streamline operations, improve scalability, and reduce costs. These solutions cater to diverse workloads, ensuring seamless data access across different environments

- In November 2023, leading SAN providers introduced energy-efficient storage arrays designed to minimize power consumption and cooling costs in large data centers. These innovations support sustainability by optimizing energy use while maintaining high-performance storage capabilities. By leveraging advanced hardware and intelligent power management, enterprises can reduce their carbon footprint and operational expenses. These solutions align with global efforts to enhance eco-friendly IT infrastructure

- In June 2023, vendors expanded Cloud-Integrated SAN solutions, enabling seamless integration with public and private cloud platforms. This advancement supports hybrid storage architectures, enhancing flexibility and scalability for enterprises. By bridging traditional SAN environments with cloud-based storage, businesses can optimize data management, improve disaster recovery, and reduce operational costs. These solutions ensure high-performance storage while maintaining security and compliance across diverse workloads

- In March 2023, hyperscale data centers have been rapidly adopting scalable, high-performance SAN solutions to manage massive data volumes with low latency. This trend is driven by the increasing demand for AI workloads, cloud computing, and big data analytics. Leading providers are expanding their data center footprints, integrating advanced storage architectures to enhance efficiency and scalability. These deployments ensure seamless data access, optimized resource utilization, and reduced operational costs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.