Global Street Roadway Lighting Market

Market Size in USD Billion

CAGR :

%

USD

10.27 Billion

USD

16.31 Billion

2024

2032

USD

10.27 Billion

USD

16.31 Billion

2024

2032

| 2025 –2032 | |

| USD 10.27 Billion | |

| USD 16.31 Billion | |

|

|

|

|

Street and Roadway Lighting Market Size

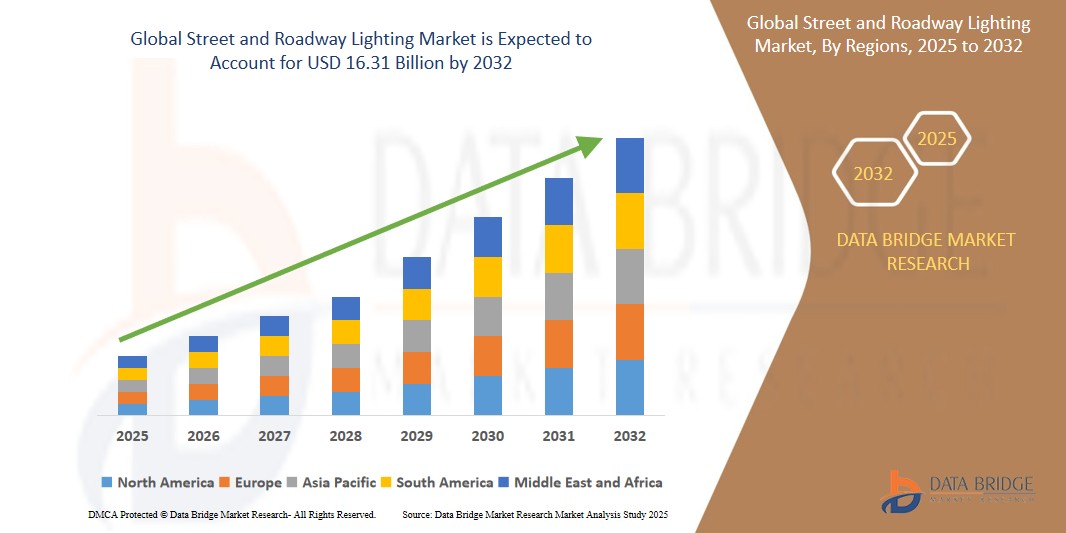

- The global street and roadway lighting market size was valued at USD 10.27 billion in 2024 and is expected to reach USD 16.31 billion by 2032, at a CAGR of 5.96% during the forecast period

- This growth is driven by factors such as growing smart city initiatives, rising demand for energy-efficient solutions, supportive government regulations, advancements in IoT and sensor technologies, and rapid urbanization driving infrastructure development

Street and Roadway Lighting Market Analysis

- Street and roadway lighting refers to the systems and technologies used to illuminate public roads, highways, and urban areas, aimed at enhancing visibility, ensuring traffic safety, and supporting urban infrastructure. These systems include a range of solutions such as LED lights, smart lighting networks, and traditional light sources

- The street and roadway lighting market is witnessing strong growth driven by increasing global investments in smart city infrastructure, rising demand for energy-efficient lighting solutions, rapid urbanization, government mandates for sustainable public lighting, and advancements in IoT-enabled smart lighting technologies

- Asia-Pacific is expected to dominate the street and roadway lighting market due to robust government initiatives promoting smart city development and energy-efficient infrastructure upgrades across major economies

- Europe is expected to be the fastest growing region in the street and roadway lighting market during the forecast period due to strict regulatory mandates aimed at enhancing energy efficiency, sustainability, and public safety

- LEDs segment is expected to dominate the market with a largest market share of 80.2% due to their superior energy efficiency, longer lifespan, lower maintenance costs, and growing global initiatives focused on sustainable and smart city infrastructure development

Report Scope and Street and Roadway Lighting Market Segmentation

|

Attributes |

Street and Roadway Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Street and Roadway Lighting Market Trends

“Increasing Adoption of Smart Lighting Systems”

- One prominent trend in the global street and roadway lighting market is the increasing adoption of smart lighting systems

- This trend is driven by the growing need for energy efficiency, reduced operational costs, and real-time control capabilities enabled by IoT, AI, and sensor-based technologies

- For instance, many cities are implementing adaptive street lighting that adjusts brightness based on traffic flow and ambient conditions, helping lower energy consumption and improve public safety

- The adoption of smart lighting is expanding across both developed regions such as Europe and North America, and rapidly urbanizing areas in Asia-Pacific, where smart city initiatives are being prioritized

- As urban areas strive for sustainability, automation, and enhanced infrastructure performance, the shift toward intelligent lighting systems is expected to accelerate, shaping the future of the street and roadway lighting market

Street and Roadway Lighting Market Dynamics

Driver

“Increasing Government Regulations”

- Increasing government regulations on energy efficiency and environmental standards are driving the growth of the street and roadway lighting market, as stricter guidelines push for more sustainable and energy-efficient lighting solutions

- These regulations are gaining momentum in regions worldwide, especially in urban areas where governments are aiming to reduce carbon footprints and lower energy consumption through better street lighting infrastructure

- The demand for smart, energy-efficient, and long-lasting lighting systems is increasing, prompting a shift toward LED technology and other advanced solutions that meet regulatory standards while reducing operational costs

- Governments are incentivizing the adoption of these technologies by offering rebates, grants, or tax credits for municipalities to replace outdated lighting systems with energy-efficient alternatives

- As regulations become more stringent, there is a growing emphasis on smart grid integration and automation in lighting systems to improve control, reduce energy waste, and meet sustainability targets

For instance,

- Companies such as Signify (formerly Philips Lighting) are innovating in connected LED street lights, integrating smart technology to offer enhanced energy savings and longer lifespans while complying with government standards

- Research and development efforts are focused on creating energy-efficient street lighting systems that meet or exceed governmental energy codes while providing better public safety and visibility

- As sustainability and energy efficiency continue to be prioritized by governments, the street and roadway lighting market is expected to see rapid growth in the adoption of compliant, smart, and environmentally friendly solutions

Opportunity

“Rise in Energy Efficiency Initiatives”

- The rising emphasis on energy efficiency presents a significant opportunity for the street and roadway lighting market, as municipalities and private entities increasingly focus on reducing energy consumption and operational costs

- Governments, urban planners, and infrastructure companies are leveraging energy-efficient lighting technologies, such as LED streetlights, to reduce electricity usage, lower maintenance costs, and meet sustainability goals

- This opportunity aligns with growing global initiatives to reduce carbon emissions, enhance environmental sustainability, and support smarter, more efficient urban infrastructure

For instance,

- Companies such as Cree Lighting and Acuity Brands are leading the way in developing energy-efficient, smart lighting solutions that provide long-term cost savings while meeting energy efficiency regulations

- Integration of smart lighting systems with sensors and automation is enabling cities to further reduce energy consumption while improving public safety and convenience

- As energy efficiency initiatives gain momentum globally, the street and roadway lighting market is well-positioned to capitalize on this opportunity by offering advanced lighting solutions that deliver both cost savings and environmental benefits

Restraint/Challenge

“Growing Infrastructure Limitations”

- Growing infrastructure limitations pose a significant challenge for the street and roadway lighting market, as aging infrastructure, insufficient funding, and a lack of modernization hinder the adoption of energy-efficient lighting systems in many regions

- The slow pace of infrastructure upgrades in older cities and rural areas means that efforts to replace outdated streetlights with energy-efficient LED systems are often delayed, which in turn limits the market’s potential for growth and sustainability

- This challenge is particularly pronounced in developing regions and cities with constrained budgets, where financial limitations can prevent the implementation of advanced lighting solutions, slowing the transition to smarter and more energy-efficient systems

For instance,

- In some parts of the U.S., urban areas struggle to secure funding for large-scale lighting upgrades, leading to delays in adopting new technologies that could lower energy consumption and maintenance costs

- Without strategic investments in infrastructure modernization, increased funding for smart city initiatives, and greater government support, these limitations could significantly impede the growth and advancement of the street and roadway lighting market

Street and Roadway Lighting Market Scope

The market is segmented on the basis of lighting type, light source, wattage type, end user, and offering.

|

Segmentation |

Sub-Segmentation |

|

By Lighting Type |

|

|

By Light Source |

|

|

By Wattage Type |

|

|

By End User

|

|

|

By Offering |

|

In 2025, the LEDs is projected to dominate the market with a largest share in light source segment

The LEDs segment is expected to dominate the street and roadway lighting market with the largest share of 80.2% in 2025 due to their superior energy efficiency, longer lifespan, lower maintenance costs, and growing global initiatives focused on sustainable and smart city infrastructure development.

The smart lighting is expected to account for the largest share during the forecast period in lighting type segment

In 2025, the smart lighting segment is expected to dominate the market due to increasing adoption of IoT and sensor-based technologies, which enable remote monitoring, adaptive lighting, energy savings, and improved public safety through real-time data analytics and automated control systems.

Street and Roadway Lighting Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Street and roadway lighting Market”

- Asia-Pacific dominates the street and roadway lighting market, driven by the robust government initiatives promoting smart city development and energy-efficient infrastructure upgrades across major economies

- China holds a significant share due to extensive urbanization, large-scale LED deployment in public infrastructure, and heavy investments in smart lighting systems by both central and local governments

- Regional dominance is further supported by favorable regulatory policies, public-private partnerships, and rapid advancements in connected lighting technologies and city digitization

- With sustained focus on reducing carbon emissions and improving public safety through intelligent lighting networks, Asia-Pacific is expected to retain its leading position in the street and roadway lighting market through 2032

“Europe is Projected to Register the Highest CAGR in the Street and roadway lighting Market”

- Europe is expected to witness the highest growth rate in the street and roadway lighting market, driven by strict regulatory mandates aimed at enhancing energy efficiency, sustainability, and public safety

- Germany holds a significant share due to aggressive adoption of smart lighting solutions, strong commitment to green infrastructure, and government-funded urban modernization programs

- Growth is further accelerated by rising demand for intelligent lighting systems, integration of IoT-based controls, and increasing replacement of conventional lights with LEDs across municipalities

- With continued investment in smart city frameworks and sustainable public infrastructure, Europe is poised to be the fastest-growing region in the street and roadway lighting market through 2032

Street and Roadway Lighting Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Koninklijke Philips N.V. (Netherlands)

- Cree, Inc. (U.S.)

- General Electric Company (U.S.)

- ACUITY BRANDS LIGHTING, INC. (U.S.)

- Hubbell (U.S.)

- Dongguan Kingsun Optoelectronic Co., Ltd. (China)

- Thorn (U.K.)

- LED ROADWAY LIGHTING LTD (Canada)

- Syska (India)

- Virtual Extension (Israel)

- Eaton (Ireland)

- OSRAM Opto Semiconductors GmbH (Germany)

- CIMCON Lighting, Inc. (U.S.)

- AGC Inc. (Japan)

- Electrolite Fitting & Equipments (India)

- Cree Lighting (U.S.)

- SpecGrade LED (U.S.)

- LEDVANCE GmbH (Germany)

- SKYLER TEK, Inc. dba SKYLER LED Lighting (U.S.)

- Itron Inc. (U.S.)

Latest Developments in Global Street and Roadway Lighting Market

- In June 2023, the Government of India approved the installation of 90,000 smart street lights on all Public Works Department (PWD) roads in Delhi. This initiative aims to eliminate dark spots and enhance women's security, with a focus on a robust central monitoring system to ensure the lights' uninterrupted functioning

- In February 2023, the Monroe City Council announced the approval of a motion to submit a grant request to the Southeast Michigan Council of Governments (SEMCOG). The grant, if approved, would cover up to 80 percent of the costs for converting the city's street lights to LED lamps, significantly reducing the financial burden on the city

- In April 2022, Ams OSRAM revealed plans to establish a EUR 800 million LED production facility in Malaysia. The company also announced substantial investments in advanced 8-inch LED front-end capacity in Malaysia, aiming to enhance the production of cutting-edge LED technologies and micro LEDs

- In March 2021, Smart Global Holdings Inc. acquired Cree Inc.'s LED Products business unit. This acquisition is part of Smart Global Holdings' strategy to diversify its portfolio and expand its presence in the LED market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Street Roadway Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Street Roadway Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Street Roadway Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.