Global Structural Steel Market

Market Size in USD Billion

CAGR :

%

USD

117.47 Billion

USD

188.36 Billion

2024

2032

USD

117.47 Billion

USD

188.36 Billion

2024

2032

| 2025 –2032 | |

| USD 117.47 Billion | |

| USD 188.36 Billion | |

|

|

|

|

Structural Steel Market Size

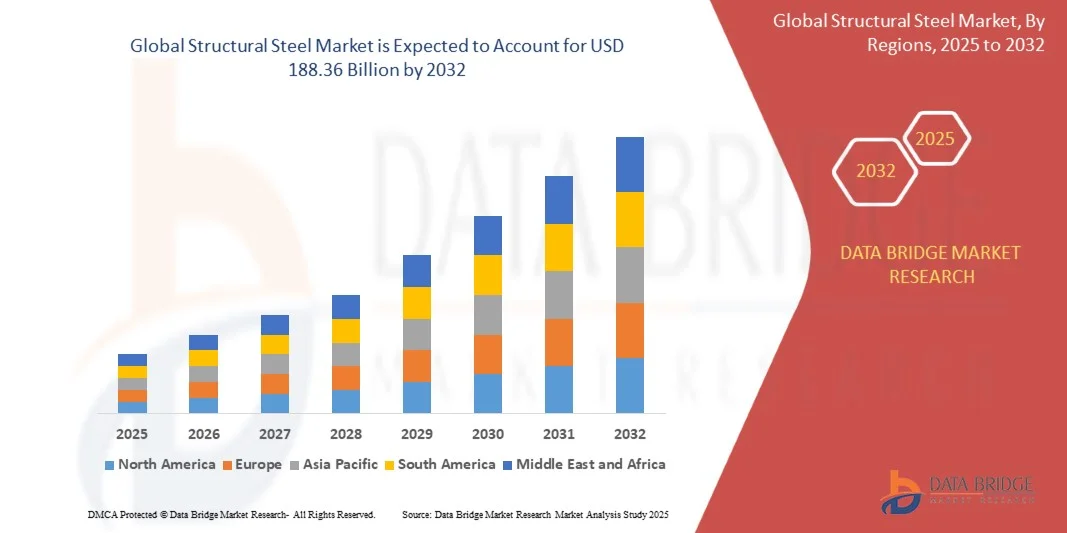

- The global structural steel market size was valued at USD 117.47 billion in 2024 and is expected to reach USD 188.36 billion by 2032, at a CAGR of 6.08% during the forecast period

- The market growth is largely fueled by the increasing infrastructure development, rapid urbanization, and industrial expansion across emerging and developed economies, leading to higher demand for structural steel in construction, transportation, and industrial applications

- Furthermore, rising adoption of high-strength, sustainable, and fire-resistant steel products for commercial, residential, and infrastructure projects is establishing structural steel as the preferred material for modern construction and industrial frameworks. These converging factors are accelerating the uptake of advanced steel solutions, thereby significantly boosting the industry's growth

Structural Steel Market Analysis

- Structural steel, offering superior strength, durability, and design flexibility, is increasingly vital in construction, transportation, and industrial applications due to its load-bearing capacity, cost-efficiency, and adaptability for complex architectural and engineering designs

- The escalating demand for structural steel is primarily fueled by large-scale infrastructure projects, government investments in smart cities and industrial corridors, and a growing focus on sustainable construction practices, which are driving the adoption of advanced steel grades worldwide

- Asia-Pacific dominated the structural steel market with a share of 69.5% in 2024, due to rapid urbanization, large-scale infrastructure projects, and the region’s status as a hub for construction and industrial activities

- North America is expected to be the fastest growing region in the structural steel market during the forecast period due to large-scale infrastructure projects, expanding industrial facilities, and rising adoption of advanced steel in construction and transportation

- Carbon-manganese steel segment dominated the market with a market share of 44% in 2024, due to its widespread availability, cost-effectiveness, and balanced mechanical properties suitable for a variety of structural applications. Its robustness, ductility, and ease of fabrication make it a preferred choice for large-scale construction projects and infrastructure development. In addition, carbon-manganese steel supports welding and forming processes efficiently, making it compatible with modern structural design requirements and reducing overall project timelines. The segment’s strong adoption is also supported by its long-term reliability in load-bearing structures and commercial construction

Report Scope and Structural Steel Market Segmentation

|

Attributes |

Structural Steel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Structural Steel Market Trends

“Rising Use of High-Strength and Sustainable Steel in Construction”

- The global structural steel market is experiencing accelerated growth driven by the increasing utilization of high-strength and sustainable steel grades in modern construction. The material’s durability, recyclability, and adaptability make it an ideal choice for infrastructure and commercial projects requiring both structural integrity and environmental performance

- For instance, ArcelorMittal and Nippon Steel Corporation have introduced advanced high-strength and low-alloy steel variants designed for green building applications. These innovations help reduce overall steel consumption in structural frameworks while lowering carbon emissions during production and lifecycle use, aligning with global sustainability mandates

- Continuous advancements in metallurgical processes and alloy compositions are enabling the development of stronger yet lighter steel structures capable of supporting higher loads. These technical improvements are particularly significant for high-rise and long-span buildings, bridges, and industrial complexes where superior strength-to-weight ratios are critical

- The adoption of sustainable steelmaking technologies such as hydrogen-based direct reduction and electric arc furnaces is enhancing environmental performance. The integration of recycled scrap and carbon capture systems further supports the transition toward low-carbon structural steel production

- The increasing emphasis on green certifications and energy-efficient construction practices is propelling the market for eco-friendly steel components. Builders and contractors are prioritizing sustainable materials to meet global climate commitments and improve the environmental footprint of large-scale projects

- As smart infrastructure initiatives expand globally, high-performance structural steel is becoming essential in achieving safety, efficiency, and sustainability targets. This trend highlights the material’s pivotal role in shaping resilient and future-ready construction across both developed and emerging economies

Structural Steel Market Dynamics

Driver

“Rapid Urbanization and Infrastructure Development”

- The accelerating pace of urbanization and large-scale infrastructure expansion across developing nations is one of the primary drivers fueling the demand for structural steel. Governments and private developers are investing heavily in transportation, commercial, and residential projects, increasing the need for durable and cost-efficient construction materials

- For instance, Tata Steel Limited and POSCO Holdings Inc. have secured major supply contracts for metro rail, bridge, and industrial park projects across Asia and the Middle East. These partnerships demonstrate how leading steel manufacturers are supporting global infrastructure growth through customized, high-strength steel solutions

- The versatility of structural steel, combined with its ability to meet diverse architectural requirements, makes it an indispensable material in urban development. Its ease of fabrication, assembly, and adaptability to prefabricated construction models enhances project speed and cost efficiency

- Infrastructure modernization efforts in transportation, logistics hubs, and renewable energy projects such as wind towers and solar structures are further reinforcing demand. Structural steel provides resilience, design flexibility, and recyclability, supporting both long-term durability and sustainability goals

- The increasing population concentration in urban centers ensures sustained demand for steel-intensive infrastructure, driving continuous market momentum. This global construction boom positions structural steel as a critical enabler of industrial growth and modern city development

Restraint/Challenge

“Fluctuating Raw Material Prices”

- The volatility in raw material prices, particularly for iron ore, coking coal, and scrap metal, poses a significant challenge to the structural steel industry. Frequent price fluctuations directly impact production costs and profit margins for manufacturers and distributors worldwide

- For instance, companies such as JSW Steel and Severstal have reported profit pressure due to sharp variations in input prices and supply chain disruptions. These cost instabilities affect long-term contract planning and create pricing uncertainty across end-use construction sectors

- Global macroeconomic factors, trade restrictions, and logistics bottlenecks add further unpredictability to raw material availability. Such volatility often leads to delayed procurement decisions by construction firms relying on consistent steel pricing for large-scale projects

- Price-sensitive markets are particularly vulnerable as cost escalation can prompt substitution with alternative materials such as concrete or composites. This reaction limits structural steel consumption in budget-constrained projects, especially in developing economies

- The mitigation of price volatility through vertical integration, raw material hedging, and sustainable sourcing strategies will be essential for long-term stability. Achieving balanced supply chains and controlled production costs will determine the resilience and competitiveness of structural steel manufacturers amid ongoing market fluctuations

Structural Steel Market Scope

The market is segmented on the basis of type, application, and end use.

• By Type

On the basis of type, the structural steel market is segmented into carbon-manganese steel, HSLA (High Strength, Low Alloy) steel, heat-treated carbon steel, and heat-treated alloy steel. The carbon-manganese steel segment dominated the market with the largest revenue share of 44% in 2024, driven by its widespread availability, cost-effectiveness, and balanced mechanical properties suitable for a variety of structural applications. Its robustness, ductility, and ease of fabrication make it a preferred choice for large-scale construction projects and infrastructure development. In addition, carbon-manganese steel supports welding and forming processes efficiently, making it compatible with modern structural design requirements and reducing overall project timelines. The segment’s strong adoption is also supported by its long-term reliability in load-bearing structures and commercial construction.

The HSLA steel segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for lighter, high-strength materials in construction and transportation sectors. HSLA steels provide superior strength-to-weight ratios, corrosion resistance, and improved weldability, making them ideal for modern high-rise buildings, bridges, and specialized engineering projects. For instance, companies such as ArcelorMittal have been incorporating HSLA steel in sustainable and high-performance construction projects to reduce material usage without compromising safety. The growing focus on eco-friendly construction and energy efficiency also supports the adoption of HSLA steel.

• By Application

On the basis of application, the structural steel market is segmented into large facades, walls, curvilinear roofs, and others. The large facades segment dominated the market in 2024 due to the rising popularity of steel frameworks in modern architectural designs that emphasize open, visually striking exterior structures. Large facades benefit from the strength and versatility of structural steel, enabling expansive spans with minimal support columns while ensuring structural integrity. Steel facades are increasingly used in commercial complexes, airports, and institutional buildings where aesthetics and safety are equally prioritized. The segment also gains traction because of easy integration with curtain wall systems and glass panels, providing architects with design flexibility.

The curvilinear roofs segment is expected to witness the fastest growth from 2025 to 2032, driven by rising adoption of complex roof designs in stadiums, airports, and exhibition centers. Curvilinear roofs require high-strength, flexible steel grades capable of withstanding dynamic loads while maintaining aesthetic appeal. For instance, Tata Steel has supplied advanced steel solutions for landmark stadiums with sweeping roof designs, highlighting the capability of steel in enabling innovative architecture. The demand is further propelled by increasing investments in commercial and cultural infrastructure projects worldwide.

• By End Use

On the basis of end use, the structural steel market is segmented into construction, transportation, machinery, and others. The construction segment dominated the market with the largest revenue share in 2024, owing to the widespread use of structural steel in residential, commercial, and industrial buildings. Structural steel’s superior load-bearing capacity, durability, and adaptability make it a preferred material for high-rise structures, bridges, and urban infrastructure. The segment also benefits from the growing trend of prefabricated steel components and modular construction, which reduce project timelines and costs while ensuring quality and safety standards. Steel construction is further supported by its recyclability and compliance with sustainable building practices, increasing its adoption globally.

The transportation segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising demand for steel in the automotive, railway, and aerospace sectors. Steel provides the strength, lightweight properties, and fatigue resistance required for vehicle frames, chassis, and railway tracks, enhancing fuel efficiency and safety. For instance, Jindal Steel & Power has supplied advanced steel grades for electric vehicles and high-speed rail projects, reflecting the increasing application of structural steel in modern transportation solutions. The growth is further accelerated by urbanization and the expansion of public transportation infrastructure.

Structural Steel Market Regional Analysis

- Asia-Pacific dominated the structural steel market with the largest revenue share of 69.5% in 2024, driven by rapid urbanization, large-scale infrastructure projects, and the region’s status as a hub for construction and industrial activities

- The region’s cost-effective manufacturing base, abundant raw material availability, and growing investments in smart and sustainable infrastructure are accelerating market growth

- The availability of skilled labor, supportive government policies, and increasing adoption of high-strength steel in construction and transportation sectors are contributing to heightened structural steel consumption

China Structural Steel Market Insight

China held the largest share in the Asia-Pacific structural steel market in 2024, owing to its extensive construction activity, leadership in steel production, and investments in high-rise buildings and large infrastructure projects. The country’s strong industrial base, government support for infrastructure expansion, and large-scale urban development programs are major growth drivers. Rising adoption of high-performance steel grades in bridges, industrial facilities, and transportation infrastructure is further boosting market demand.

India Structural Steel Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid industrialization, expanding transportation networks, and rising demand for residential and commercial construction. Initiatives such as “Make in India” and increased foreign investments in infrastructure are strengthening the demand for structural steel. Growing focus on urban redevelopment, metro rail projects, and smart city development is accelerating adoption of high-strength and versatile steel grades.

Europe Structural Steel Market Insight

The Europe structural steel market is expanding steadily, supported by high infrastructure quality standards, stringent construction regulations, and demand for sustainable and high-performance steel. The region emphasizes durability, environmental compliance, and energy-efficient building materials, which is driving the use of advanced steel grades in commercial and public infrastructure. Investment in green construction, renovations of aging structures, and modernization of industrial facilities are further enhancing market growth.

Germany Structural Steel Market Insight

Germany’s structural steel market is driven by its strong industrial base, advanced construction technologies, and emphasis on quality and precision engineering. The country’s focus on infrastructure modernization, energy-efficient buildings, and high-rise constructions supports continuous demand. Structural steel is extensively used in industrial plants, bridges, and commercial projects, with innovation in steel fabrication and modular construction strengthening market adoption.

U.K. Structural Steel Market Insight

The U.K. market is supported by ongoing infrastructure upgrades, urban redevelopment projects, and high demand for steel in commercial and residential construction. Investment in transportation, bridges, and energy-efficient buildings is driving structural steel consumption. Strong collaboration between construction companies and steel manufacturers, along with government-backed initiatives for modern urban development, is further promoting market growth.

North America Structural Steel Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by large-scale infrastructure projects, expanding industrial facilities, and rising adoption of advanced steel in construction and transportation. A focus on resilient, high-strength steel for commercial buildings, bridges, and industrial applications is boosting demand. Increasing investment in renewable energy infrastructure, smart cities, and urban redevelopment projects is further accelerating market growth.

U.S. Structural Steel Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by strong construction activity, robust industrial growth, and investment in high-performance structural materials. Demand is particularly high for steel in commercial, transportation, and infrastructure projects. Presence of key manufacturers, advanced fabrication capabilities, and stringent quality standards further solidify the U.S.’s leading position in the region.

Structural Steel Market Share

The structural steel industry is primarily led by well-established companies, including:

- Gerdau S/A (Brazil)

- ArcelorMittal (Luxembourg)

- Tata Structura (India)

- Nippon Steel Corporation (Japan)

- POSCO (South Korea)

- JSW (India)

- thyssenkrupp AG (Germany)

- Essar Steel (India)

- Sahaviriya Steel Industries PLC (Thailand)

- G Steel Public Company Limited (Thailand)

- Capitol Steel Structures (U.S.)

- Hyundai Steel (South Korea)

- Nucor Corporation (U.S.)

- Baosteel Co., Ltd. (China)

- China Ansteel Group Corporation Limited (China)

- Shagang Group Inc. (China)

- Masteel UK Limited (U.K.)

- Shandong Iron and Steel Group Co., Ltd. (China)

- Baosteel Group Hu (China)

- Pag-asa Steel Works, Inc. (Philippines)

- HBIS Group (China)

- SAIL (India)

- NLMK (Russia)

- ChinaSteel (Taiwan)

Latest Developments in Global Structural Steel Market

- In 2024, Tata Steel launched a new high-strength structural steel product line aimed at supporting large-scale infrastructure and green building projects. This strategic move is expected to strengthen Tata Steel’s position in both domestic and export markets by catering to growing demand for durable, high-performance steel in construction and sustainable building initiatives. The introduction of advanced steel grades also enhances the company’s competitiveness in the premium structural steel segment, driving adoption across modern infrastructure projects

- In 2024, ArcelorMittal and Nippon Steel completed the acquisition of Essar Steel’s structural division in India, significantly expanding their footprint in the South Asian construction and infrastructure market. This acquisition is anticipated to consolidate their market position, enhance production capabilities, and meet the rising demand for structural steel in industrial, commercial, and infrastructure development projects across the region. The deal also enables these companies to leverage Essar Steel’s established supply chains and customer base

- In 2024, Nucor Corporation announced plans to build a $3 billion steel plate mill in West Virginia, aiming to expand structural steel production capacity to meet growing infrastructure demand in the eastern United States. This investment is expected to boost Nucor’s ability to supply high-quality steel for construction, transportation, and industrial projects, while supporting regional economic development and creating employment opportunities. The new mill also positions Nucor to better serve infrastructure-driven markets with high-demand steel products

- In August 2023, Hybar LLC commenced construction of its steel rebar mill in Arkansas, U.S., utilizing steel scrap as feedstock with machinery supplied by SMS group GmbH. This project is expected to enhance the company’s production capabilities, promote sustainable steel recycling, and meet increasing demand for construction-grade rebar in the U.S. market. The focus on recycled steel also aligns with growing environmental regulations and sustainability trends in the structural steel sector

- In March 2023, JSPL announced plans to produce India’s first-ever fire-resistant steel structures at its Raigarh facility in Chhattisgarh. This initiative is expected to introduce high-value structural steel solutions into the Indian market, addressing safety concerns in commercial and infrastructure projects. By pioneering fire-resistant steel, JSPL positions itself as an innovator in advanced construction materials, likely driving adoption in premium and safety-critical construction segments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Structural Steel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Structural Steel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Structural Steel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.