Global Structured Cabling Market

Market Size in USD Billion

CAGR :

%

USD

12.70 Billion

USD

17.80 Billion

2024

2032

USD

12.70 Billion

USD

17.80 Billion

2024

2032

| 2025 –2032 | |

| USD 12.70 Billion | |

| USD 17.80 Billion | |

|

|

|

|

Structured Cabling Market Size

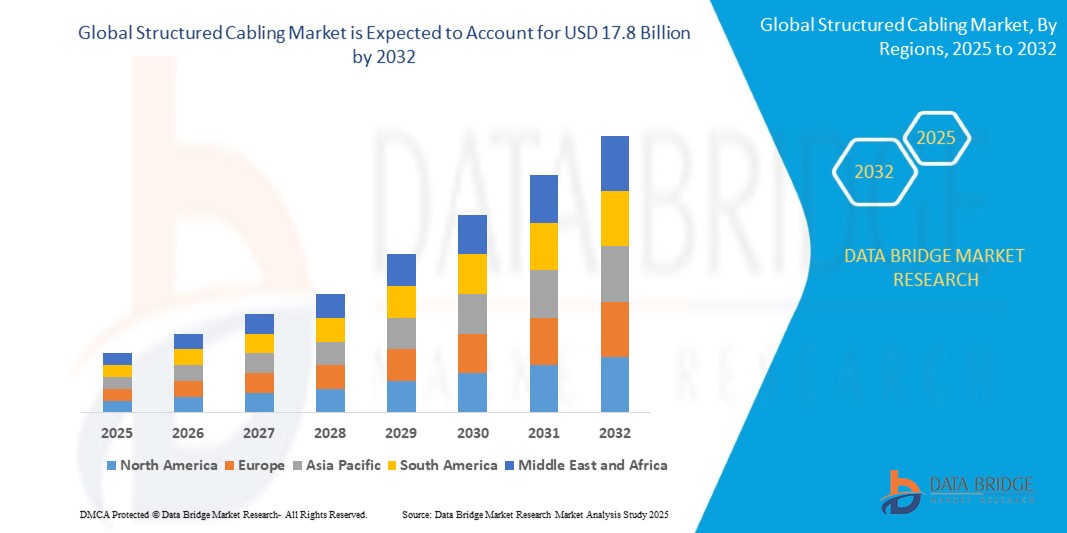

- The Structured Cabling Market was valued at USD 12.7 billion in 2025 and is projected to reach USD 17.8 billion by 2032, growing at a CAGR of 4.9% during the forecast period.

- Market growth is primarily fueled by the increasing demand for high-speed and reliable data transmission, rising investments in data centers, and the expansion of smart buildings and 5G infrastructure worldwide.

Structured Cabling Market Analysis

- Structured cabling systems provide a standardized, high-performance infrastructure for voice, data, and video transmission—critical for modern enterprise networks, smart buildings, and industrial automation environments.

- Data centers are key adopters due to the need for scalable, high-bandwidth connectivity and ease of management in dense, mission-critical IT environments. Fiber optic cabling is increasingly preferred for faster data transmission and long-distance communication.

- Commercial and office buildings are integrating structured cabling to support unified communication systems, surveillance, and building automation. The shift to hybrid work models is also boosting demand for network flexibility and reliability.

- Industrial sectors are adopting structured cabling in smart factories and process automation, enabling real-time control, machine-to-machine communication, and predictive maintenance.

- The rise of 5G networks, IoT, and cloud-based applications is further driving structured cabling deployments, ensuring low latency, futureproofing, and compliance with evolving IT and telecom standards.

Report Scope and Structured Cabling Market Segmentation

|

Attributes |

Structured Cabling Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Structured Cabling Market Trends

High‑Speed Data, Pre-Termination, and Green Cabling

- A prominent trend in the Structured Cabling Market is the growing demand for high-speed data transmission, especially with the adoption of 10G, 40G, and 100G Ethernet in enterprise networks and data centers.

- Pre-terminated cabling systems are gaining traction for faster, plug-and-play installations, reducing labor time, and improving scalability in complex network environments.

- The emergence of Power over Ethernet (PoE) for powering devices like VoIP phones, cameras, and access points is transforming cable infrastructure requirements and increasing demand for higher-grade copper cabling.

- Green cabling solutions, including low-smoke zero-halogen (LSZH) materials and energy-efficient designs, are increasingly being adopted to meet environmental and safety regulations.

- Integration with smart building systems and IoT-enabled infrastructure is further boosting demand for structured cabling that supports automation, occupancy tracking, and intelligent lighting.

Structured Cabling Market Dynamics

Driver

5G Rollouts and Enterprise Digitalization

- The rapid expansion of 5G networks and edge data centers is significantly driving the need for robust and scalable structured cabling infrastructure that supports low latency and high bandwidth.

- Enterprises undergoing digital transformation are investing in high-performance cabling to support cloud computing, AI, and IoT applications that demand real-time data access and transmission.

- Increasing smart building adoption is fueling demand for structured cabling that can interconnect lighting, HVAC, security systems, and wireless access points on a unified backbone.

- Growth in video surveillance, IP telephony, and collaborative digital platforms is reinforcing the importance of reliable and centralized cabling networks.

Restraint/Challenge

Installation Complexity and Cost Pressures

- High initial investment and installation complexity of structured cabling systems—especially in older buildings or large campuses—can pose challenges for SMEs.

- Frequent technology upgrades, such as shifts from Cat5e to Cat6A or fiber optics, can render existing systems obsolete, leading to additional costs for replacements and retrofitting

- Downtime during cabling installation or reconfiguration can disrupt operations, particularly in 24/7 facilities like data centers and hospitals.

- A shortage of skilled technicians trained in the latest cabling standards and best practices can also impact deployment quality and timelines.

Structured Cabling Market Scope

The market is segmented on the basis of solution type, cabling type, component and end user.

- By Solution Type

Solution types include Product, Services, and Software.Product solutions dominate the market in 2025, driven by increasing demand for physical cabling infrastructure in data centers, smart buildings, and enterprise networks. Services, including installation, maintenance, and consulting, are growing steadily due to the rising complexity of cabling deployments and retrofits. Software solutions, which include network monitoring and cable management platforms, are gaining momentum as organizations prioritize operational visibility and automation.

- By Cabling Type

Cabling types include Cat 5e, Cat 6, Cat 6A, Cat 8, OM3, OM4, OM5, and Single‑Mode Fiber. Cat 6 and Cat 6A cables hold the largest share in 2025, offering improved bandwidth and performance over legacy cabling for enterprise and commercial use. Cat 8 is emerging for high-speed data center applications requiring up to 40Gbps. On the fiber optic front, OM4 and OM5 multimode fibers are preferred in data center environments for their high-speed capabilities and extended reach. Single-mode fiber remains dominant in long-haul and campus-wide backbone cabling.

- By Component

Components include Cables, Connectors & Jacks, Panels & Enclosures, and Others (such as Cable Trays and Cable Management tools).Cables constitute the largest component segment due to the foundational need for high-performance copper and fiber optic cabling. Connectors and jacks are crucial for ensuring reliable, interference-free connectivity in modular networks. Panels and enclosures are increasingly adopted to support structured layout and ease of maintenance, especially in dense data center and telecom environments. Other components like trays and organizers support cable routing and thermal management

- By End User

End users include BFSI, IT & Telecom, Healthcare, Manufacturing, Commercial Buildings, and Others (Education, Government).IT & Telecom holds the dominant share in 2025 due to high data throughput needs, constant network upgrades, and large-scale deployments in telecom towers and data centers. BFSI leverages structured cabling for secure, high-speed communication in branches and data recovery sites. Healthcare requires reliable cabling for electronic health records (EHR), medical imaging, and IoT devices. Manufacturing and Commercial Buildings are seeing growing adoption for automation, HVAC integration, and smart building controls. The Others segment covers institutional users like government agencies and universities adopting digital infrastructure at scale.

Structured Cabling Market Regional Analysis

- North America dominates the Structured Cabling Market with the largest revenue share in 2025, driven by rapid digital transformation, widespread data center expansion, and increasing adoption of high-speed networking in enterprises and government agencies. The presence of major IT and cloud service providers, along with early adoption of Cat 6A and fiber optic infrastructure, fuels demand across the U.S. and Canada.

- Additionally, substantial investments in domestic manufacturing, automation, and advanced machining centers—including multi-axis and AI-integrated CNC machines—are accelerating growth across the region. Federal incentives promoting reshoring of production and skilled workforce development further enhance the adoption of CNC technologies.

- The Europe Structured Cabling Market is projected to grow steadily during the forecast period, supported by rapid expansion of smart offices, digitization in manufacturing, and regulatory emphasis on green ICT infrastructure. The rollout of 5G and EU funding for broadband upgrades are encouraging widespread deployment of structured cabling in telecom, public sector, and commercial spaces.

- Asia-Pacific is poised to grow at the fastest CAGR through 2032 due to rapid urbanization, booming e-commerce, and strong government-led digitization programs. Countries like China, India, Japan, and South Korea are investing heavily in smart city infrastructure, next-gen telecom networks, and hyperscale data centers—boosting demand for high-speed structured cabling across fiber and copper solutions.

- The MEA structured cabling market is set to grow steadily through 2032, driven by smart city megaprojects like NEOM in Saudi Arabia, rising data center investments in the UAE and South Africa, and increased adoption of enterprise digital transformation. Demand for high-bandwidth fiber cabling is growing with expanding telecom infrastructure and cloud services.

- South America’s structured cabling market is experiencing gradual growth due to expanding urban connectivity, growing demand for reliable enterprise networks, and investments in broadband infrastructure—particularly in Brazil, Colombia, and Chile. Government initiatives promoting digital inclusion and cloud adoption are also boosting structured cabling demand across commercial and industrial sectors.

United States

The U.S. Structured Cabling Market captured the largest share in North America in 2025. Growth is driven by extensive investment in IT infrastructure, rising demand for secure, high-speed enterprise connectivity, and strict compliance with ANSI/TIA and ISO standards. Strong demand from finance, healthcare, and government sectors is further supported by frequent network upgrades and cloud migration trends.

France

France’s market is growing steadily with increasing demand for structured cabling in healthcare, education, and commercial sectors. Digital transformation of SMEs, rising cloud data consumption, and support for sustainable infrastructure upgrades are propelling the deployment of high-bandwidth, energy-efficient structured cabling systems like OM3/OM4 and single-mode fibers.

China

China dominates the Asia-Pacific structured cabling market in 2025, backed by strong investments in 5G infrastructure, data centers, and digital government services. The country's vast public cloud and enterprise IT sectors are driving large-scale deployments of structured cabling in commercial, industrial, and educational environments. Local manufacturing strength and regulatory mandates further reinforce market expansion.

UAE

The UAE structured cabling market is expanding rapidly due to its leadership in smart city initiatives, such as Dubai Smart City, and increased investment in hyperscale data centers. The government's focus on digital economy transformation and 5G rollout is driving strong demand for high-performance copper and fiber cabling infrastructure.

Brazil

Brazil leads the South American structured cabling market, driven by rapid growth in e-commerce, enterprise IT modernization, and 5G network expansion. Government-backed broadband initiatives and the development of smart buildings and business parks are accelerating the deployment of structured cabling solutions across commercial and residential sectors.

Structured Cabling Market Share

The Structured Cabling Market is primarily led by a combination of global cabling manufacturers, infrastructure solution providers, and networking technology companies. These players are investing in high-speed cabling systems, fiber optics, and modular connectivity to support the growing demand for scalable, future-proof network infrastructure across data centers, commercial buildings, and industrial sectors:

- ABB Ltd (Switzerland)

- Belden Inc. (US)

- CommScope Holding Company, Inc. (US)

- Corning Incorporated (US)

- Furukawa Electric Co., Ltd. (Japan)

- Legrand SA (France)

- Nexans (France)

- Schneider Electric (France)

- Siemens AG (Germany)

Latest Developments in Structured Cabling Market

- In February 2025, CommScope launched its SYSTIMAX 2.0 platform, featuring enhanced Category 6A and fiber solutions with built-in intelligence for power efficiency, network monitoring, and IoT-ready infrastructure in smart buildings and campuses.

- In January 2025, Corning Incorporated expanded its EDGE™ Rapid Connect solutions to support faster data center deployment with pre-terminated, plug-and-play fiber cabling systems—reducing installation time and complexity.

- In November 2024, Schneider Electric introduced its EcoStruxure Modular Data Centers with integrated structured cabling architecture, aimed at edge computing and hybrid IT environments across enterprise and telecom sectors.

- In September 2024, Belden Inc. unveiled its REVConnect Shielded System, offering improved EMI protection and PoE performance for mission-critical applications in industrial automation, healthcare, and smart grid installations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Structured Cabling Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Structured Cabling Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Structured Cabling Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.