Global Structured Data Management Software Market

Market Size in USD Billion

CAGR :

%

USD

79.37 Billion

USD

137.39 Billion

2024

2032

USD

79.37 Billion

USD

137.39 Billion

2024

2032

| 2025 –2032 | |

| USD 79.37 Billion | |

| USD 137.39 Billion | |

|

|

|

|

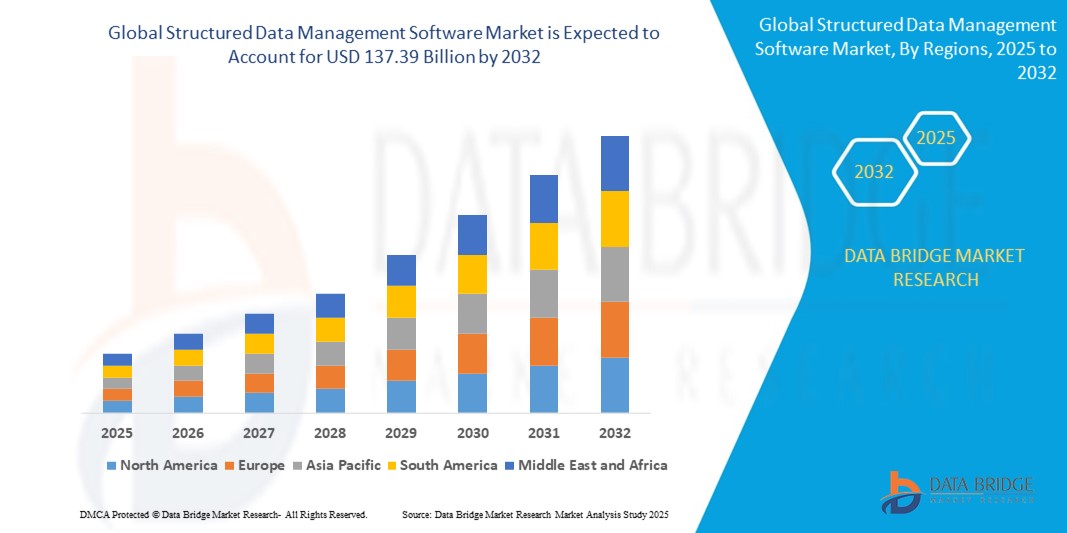

What is the Global Structured Data Management Software Market Size and Growth Rate?

- The global structured data management software market size was valued at USD 79.37 billion in 2024 and is expected to reach USD 137.39 billion by 2032, at a CAGR of 7.10% during the forecast period

- Structured data management software market is experiencing growth through advancements such as AI-powered data processing and real-time analytics. These technologies enhance data accessibility and decision-making, driving adoption in sectors such as finance and healthcare

- Cloud integration is also crucial, offering scalable and secure data management solutions. This progress supports market expansion by enabling organizations to efficiently handle increasing volumes of structured data

What are the Major Takeaways of Structured Data Management Software Market?

- AI and machine learning integration drives the structured data management software market by enhancing data processing capabilities, enabling automated data classification, and predictive analytics

- For instance, IBM's Db2 database software leverages AI to optimize query performance and streamline data management tasks, reducing manual effort and improving accuracy. This integration allows businesses to extract more value from their structured data, fueling the demand for advanced data management solutions that incorporate AI and machine learning

- North America dominated the structured data management software market with the largest revenue share of 41.01% in 2024, driven by the increasing adoption of cloud platforms, enterprise digitalization, and rising data governance mandates

- Asia-Pacific market is poised to grow at the fastest CAGR of 12.87% during 2025 to 2032, fueled by large-scale digitization, government-driven IT investments, and rising demand across banking, telecom, and retail sectors

- The Cloud-Based segment dominated the market with the largest revenue share of 61.3% in 2024, driven by its flexibility, scalability, and lower upfront infrastructure costs

Report Scope and Structured Data Management Software Market Segmentation

|

Attributes |

Structured Data Management Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Structured Data Management Software Market?

“Enhanced Intelligence through AI and Seamless Cloud Integration”

- A prominent trend in the structured data management software market is the growing integration of artificial intelligence (AI) and cloud-based data platforms to streamline data discovery, classification, governance, and accessibility across enterprises

- Modern structured data management tools are increasingly embedding AI-powered automation to identify data anomalies, classify information, and enhance data quality. This is particularly critical for large enterprises managing complex databases across hybrid and multi-cloud environments

- For instance, Informatica’s CLAIRE AI engine helps automate data cataloging, cleansing, and lineage tracking, enabling real-time governance and intelligent metadata management. Similarly, Microsoft Purview offers an AI-driven unified data governance solution integrated with Azure, enhancing data discovery and compliance

- Cloud-native platforms such as Google Cloud Data Catalog and Amazon DataZone are also contributing to the trend, providing centralized access to structured data assets and empowering users with contextual insights, semantic tagging, and collaboration features

- This convergence of AI and cloud-native capabilities enables organizations to simplify data management, improve regulatory compliance (such as GDPR, CCPA), and support scalable analytics with minimal human intervention

- As data volume and complexity continue to grow, the demand for intelligent, scalable, and cloud-integrated Structured Data Management Software is expected to surge across sectors such as BFSI, healthcare, and retail

What are the Key Drivers of Structured Data Management Software Market?

- The rapid digitalization of industries and the explosion of structured data from ERP systems, CRM tools, and transactional databases are key drivers accelerating market demand

- For instance, in April 2024, Salesforce announced enhancements to its data cloud platform with native structured data management capabilities, enabling unified customer views and faster data processing across ecosystems

- The increasing emphasis on regulatory compliance and data governance mandates such as GDPR, HIPAA, and PCI-DSS is pushing organizations to adopt structured data management tools that offer transparency, audit trails, and role-based access controls

- In addition, the rising adoption of business intelligence (BI) and advanced analytics in decision-making is prompting enterprises to implement robust structured data foundations to ensure data quality, consistency, and trustworthiness

- The emergence of Data-as-a-Service (DaaS) models and growing usage of multi-cloud environments have also created the need for centralized data management platforms that can harmonize structured data across disparate systems and geographies

- Together, these drivers are fueling investments in structured data management software that enhances data reliability, operational efficiency, and compliance

Which Factor is challenging the Growth of the Structured Data Management Software Market?

- A significant challenge facing the structured data management software market is the integration complexity and data silos prevalent in legacy systems, especially within large enterprises with diverse IT landscapes

- For instance, organizations relying on outdated on-premise databases often face difficulties in synchronizing structured data across cloud-native tools, slowing down digital transformation efforts

- Moreover, data security and privacy concerns persist as structured data frequently contains sensitive information such as PII and financial records, making it a prime target for breaches. The risk increases with distributed cloud deployments and third-party data processors

- Companies such as Oracle and SAP are addressing these concerns through embedded encryption, access controls, and integration with external key management systems (e.g., BYOK and HSMs), but adoption remains uneven across sector

- Another constraint is the high implementation cost and resource-intensive migration processes, particularly for small and medium-sized enterprises (SMEs) with limited IT budgets. Despite the availability of open-source tools, achieving enterprise-grade scalability and security remains a hurdle

- To overcome these barriers, vendors are focusing on offering modular, interoperable, and low-code platforms, along with enhanced support services and subscription pricing models to lower the entry barrier for structured data management adoption

How is the Structured Data Management Software Market Segmented?

The market is segmented on the basis of deployment mode, enterprise size, and end user.

- By Deployment Mode

On the basis of deployment mode, the structured data management software market is segmented into Cloud-Based and On-Premises. The Cloud-Based segment dominated the market with the largest revenue share of 61.3% in 2024, driven by its flexibility, scalability, and lower upfront infrastructure costs. Organizations increasingly prefer cloud-based solutions due to easy integration with other SaaS platforms, remote accessibility, and automatic updates. The demand for remote data access, especially in post-pandemic hybrid work models, has further accelerated the adoption of cloud deployments.

The On-Premises segment is expected to witness steady growth from 2025 to 2032, especially among large enterprises and government organizations that prioritize data security, regulatory compliance, and control over internal infrastructure. This model remains relevant for sectors requiring full data sovereignty or those operating in regions with limited internet connectivity.

- By Enterprise Size

On the basis of enterprise size, the structured data management software market is segmented into Small and Medium Enterprises (SMEs) and Large Enterprises. The Large Enterprises segment accounted for the largest market revenue share of 58.9% in 2024, attributed to their complex data infrastructure, high-volume transactions, and the need for robust structured data governance solutions. These organizations often invest in advanced analytics and AI-enabled platforms to leverage structured data for strategic decision-making, customer personalization, and operational optimization.

The SMEs segment is projected to record the fastest CAGR from 2025 to 2032, driven by the increasing affordability of cloud-based solutions, growing digital transformation efforts, and the need to manage structured data effectively to compete with larger firms. Government incentives and startup ecosystems are also encouraging SMEs to adopt structured data management tools.

- By End User

On the basis of end user, the structured data management software market is segmented into BFSI, Automobile, Healthcare, Government, Manufacturing, IT and Telecom, Retail and E-commerce, and Others. The BFSI (Banking, Financial Services, and Insurance) segment led the market with the largest revenue share of 22.4% in 2024, owing to the critical importance of structured data in risk management, fraud detection, regulatory reporting, and customer data handling. The sector relies heavily on real-time analytics and high data accuracy, making advanced data management tools indispensable.

The Healthcare segment is expected to witness the fastest growth from 2025 to 2032 due to the rising adoption of Electronic Health Records (EHRs), compliance with data protection regulations such as HIPAA, and the increasing use of AI and analytics in diagnostics and treatment planning. Structured data systems support efficient patient record management, billing, and healthcare analytics.

Which Region Holds the Largest Share of the Structured Data Management Software Market?

- North America dominated the structured data management software market with the largest revenue share of 41.01% in 2024, driven by the increasing adoption of cloud platforms, enterprise digitalization, and rising data governance mandates

- The region benefits from strong IT infrastructure, widespread use of big data analytics, and the presence of key market players offering enterprise-scale structured data solutions

- Industries across banking, healthcare, and retail are leveraging structured data tools to enhance operational efficiency, regulatory compliance, and personalized customer experiences, solidifying North America’s leadership in the market

U.S. Structured Data Management Software Market Insight

The U.S. captured the largest revenue share in North America in 2024, fueled by robust demand across large enterprises and government bodies. The market is driven by the growing need for data integration, regulatory compliance (HIPAA, CCPA), and cloud-native architectures. Technological advancements in AI, machine learning, and data lakes have also strengthened the demand for structured data platforms, as enterprises seek to derive actionable insights from massive datasets.

Europe Structured Data Management Software Market Insight

The Europe market is projected to expand at a substantial CAGR through the forecast period, driven by stringent GDPR regulations and increased enterprise focus on data transparency and compliance. The rapid digitalization of industries such as manufacturing, logistics, and financial services supports adoption. Furthermore, the growing importance of interoperability and data standardization within the EU promotes demand for structured data platforms integrated with AI and analytics tools.

U.K. Structured Data Management Software Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, supported by rising digital transformation across the public and private sectors. Organizations are increasingly relying on structured data tools for secure data processing, governance, and real-time analytics. In addition, the country’s thriving fintech ecosystem, combined with innovation in retail and healthcare data systems, is driving sustained market interest and investment.

Germany Structured Data Management Software Market Insight

The Germany market is expected to grow considerably, backed by its strong manufacturing base and Industry 4.0 initiatives. Enterprises are leveraging structured data management to optimize production, monitor supply chains, and enhance compliance reporting. The emphasis on secure, scalable, and efficient data solutions—particularly within automotive and industrial sectors—is shaping the country’s demand trajectory.

Which Region is the Fastest Growing in the Structured Data Management Software Market?

Asia-Pacific market is poised to grow at the fastest CAGR of 12.87% during 2025 to 2032, fueled by large-scale digitization, government-driven IT investments, and rising demand across banking, telecom, and retail sectors. Countries such as China, Japan, and India are accelerating adoption due to booming e-commerce ecosystems and enterprise needs for structured data governance and cloud migration. Affordable solutions and cloud-native offerings from regional vendors are further catalyzing growth.

Japan Structured Data Management Software Market Insight

The Japan market is gaining momentum due to its advanced ICT landscape, growing corporate digitalization, and increasing integration of structured data with AI-driven analytics. Demand is particularly strong in financial services, healthcare, and retail, where real-time data processing and accuracy are critical. The country’s mature data privacy framework also supports adoption of secure and compliant solutions.

China Structured Data Management Software Market Insight

The China market led the Asia-Pacific region in revenue share in 2024, driven by large-scale enterprise IT upgrades, rising demand from e-commerce giants, and the government’s Smart City initiatives. The proliferation of domestic vendors, combined with strong demand from BFSI and telecom sectors, is accelerating the use of structured data tools to enhance decision-making and service delivery.

Which are the Top Companies in Structured Data Management Software Market?

The structured data management software industry is primarily led by well-established companies, including:

- Hewlett Packard Enterprise Development LP (U.S.)

- Salesforce, Inc. (U.S.)

- Teradata (U.S.)

- SAS Institute Inc. (U.S.)

- Oracle (U.S.)

- RACKSPACE TECHNOLOGY (U.S.)

- Google (U.S.)

- SAP SE (Germany)

- Talend, Inc. (U.S.)

- Broadcom (U.S.)

- Ataccama (Canada)

- Fujitsu (Japan)

- Open Text (Canada)

- Adobe (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Microsoft (U.S.)

- Informatica Inc. (U.S.)

What are the Recent Developments in Global Structured Data Management Software Market?

- In May 2021, IBM Corp. acquired Catalogic Software, renowned for its expertise in data protection and copy data management. This acquisition aims to enhance IBM's capabilities in safeguarding data and managing copies efficiently across various industries, bolstering its position in the data management sector

- In April 2021, IBM Corporation introduced a new storage system designed for efficient data management across hybrid clouds. This innovative solution aims to enhance data availability and flexibility in hybrid cloud environments, addressing the growing need for effective data handling in complex IT infrastructures

- In November 2020, Tally Solutions Pvt. Ltd. launched Tally Prime, an advanced enterprise software tailored for small- and medium-sized businesses. This software facilitates comprehensive management of finance-related tasks, including payroll, banking, taxation, and accounting, providing an integrated solution for business financial operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Structured Data Management Software Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Structured Data Management Software Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Structured Data Management Software Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.