Global Student Information System Market

Market Size in USD Billion

CAGR :

%

USD

12.45 Billion

USD

38.75 Billion

2024

2032

USD

12.45 Billion

USD

38.75 Billion

2024

2032

| 2025 –2032 | |

| USD 12.45 Billion | |

| USD 38.75 Billion | |

|

|

|

|

Student Information System Market Size

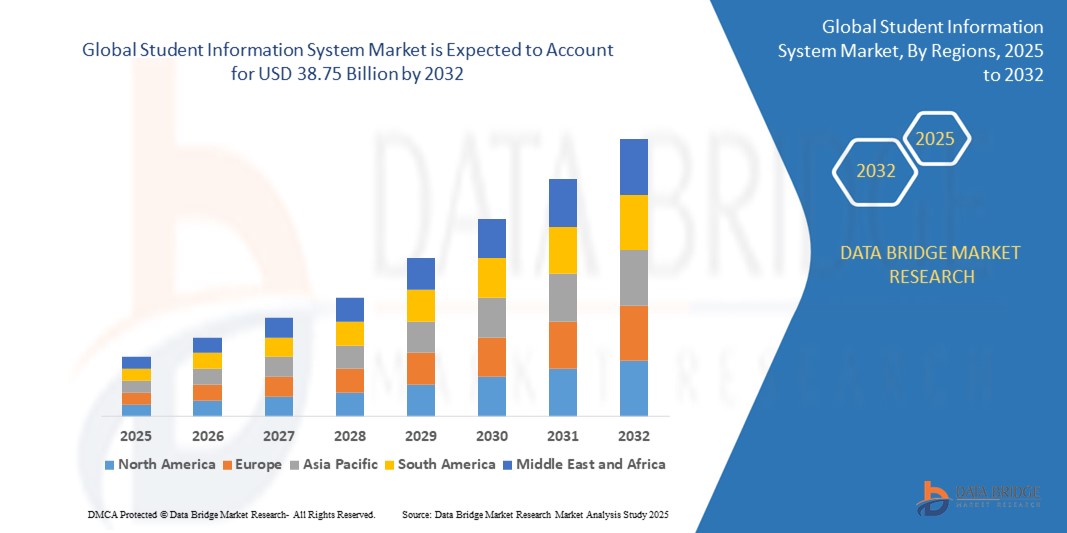

- The global student information system market size was valued at USD 12.45 billion in 2024 and is expected to reach USD 38.75 billion by 2032, at a CAGR of 15.25% during the forecast period

- The market growth is largely fuelled by the rising demand for automation in educational institutions, increased adoption of cloud-based solutions, and the growing focus on improving student engagement and administrative efficiency

- The shift toward hybrid and remote learning models post-pandemic has significantly accelerated the adoption of student information systems, enabling institutions to maintain operational continuity and personalized academic support

Student Information System Market Analysis

- The student information system (SIS) market is witnessing robust expansion as academic institutions increasingly adopt digital platforms for seamless management of student data, performance tracking, and communication

- Integration with learning management systems (LMS), mobile access, and real-time analytics is driving the value proposition of SIS solutions, particularly in higher education

- North America dominated the student information system market with the largest revenue share in 2024, driven by the widespread digitalization of education, increasing adoption of cloud-based solutions, and a high emphasis on centralized academic data management

- Asia-Pacific region is expected to witness the highest growth rate in the global student information system market, driven by rapid urbanization, the expansion of the education sector in emerging economies such as China and India, and rising awareness about the benefits of digital campus management systems among institutions and administrators

- The software segment held the largest revenue share in 2024 due to the rising demand for centralized platforms that manage student records, academic performance, and institutional operations. Educational institutions are adopting robust software solutions that offer flexibility, automation, and scalability to support growing student populations and digital transformation initiatives

Report Scope and Student Information System Market Segmentation

|

Attributes |

Student Information System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Oracle (U.S.) • Illuminate Education (U.S.) |

|

Market Opportunities |

• Integration of Artificial Intelligence in Student Information Systems • Rising Demand for Cloud-Based Education Management Platforms |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Student Information System Market Trends

“Increased Adoption of Mobile-Accessible Platforms for Real-Time Academic Management”

- Educational institutions are increasingly adopting mobile-accessible SIS platforms to support real-time access to student data, schedules, grades, and performance

- The rising use of smartphones among students, teachers, and parents has made mobile functionality a core requirement for modern SIS solutions

- Mobile applications enable faster communication between stakeholders through push notifications and instant updates on attendance, assignments, and announcements

- Many SIS providers are prioritizing responsive design and cross-platform compatibility to ensure smooth experiences across Android and iOS devices

- For instance, PowerSchool has expanded its mobile suite to allow parents and students to view progress reports and attendance directly from their phones, enhancing engagement and accessibility

Student Information System Market Dynamics

Driver

“Growing Demand for Centralized Student Data Management Across Institutions”

- Institutions are replacing fragmented systems with centralized SIS platforms to streamline academic records, admissions, grading, and fee management

- Centralized solutions improve data consistency, reduce duplication, and minimize human error in student information handling

- These systems support compliance with government regulations and accreditation requirements through secure, auditable records

- Data centralization allows real-time analytics and insights to guide academic strategies and enhance learning outcomes

- For instance, several U.S. universities have adopted Ellucian’s Banner SIS to manage student lifecycle processes efficiently and ensure compliance with federal education standards

Restraint/Challenge

“High Implementation and Maintenance Costs in Developing Regions”

- The high upfront costs for software licenses, infrastructure upgrades, and IT personnel limit SIS adoption in budget-constrained educational institutions

- Ongoing costs for cloud subscriptions, technical support, and system updates create long-term financial pressure, particularly for smaller institutions

- Poor internet connectivity in rural and underdeveloped regions restricts access to cloud-based SIS functionalities

- Lack of skilled professionals and digital literacy challenges hinder the deployment and effective use of SIS platforms

- For instance, schools in Sub-Saharan Africa have reported delays in implementing SIS systems due to insufficient funding and inadequate technological infrastructure, limiting modernization efforts

Student Information System Market Scope

The market is segmented on the basis of component, deployment, application, and end-use.

• By Component

On the basis of component, the student information system market is segmented into software and service. The software segment held the largest revenue share in 2024 due to the rising demand for centralized platforms that manage student records, academic performance, and institutional operations. Educational institutions are adopting robust software solutions that offer flexibility, automation, and scalability to support growing student populations and digital transformation initiatives.

The service segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing need for integration, customization, training, and technical support services. As schools and universities transition from legacy systems, service providers play a crucial role in ensuring smooth implementation and post-deployment maintenance. The surge in cloud-based deployment further supports demand for managed services across both public and private institutions.

• By Deployment

On the basis of deployment, the market is segmented into on-premise and cloud. The cloud segment dominated the market in 2024, supported by scalability, remote accessibility, and cost-effectiveness. Cloud-based solutions are increasingly preferred for enabling real-time updates, seamless integration with learning management systems, and reduced IT overheads.

The on-premise segment is expected to witness the fastest growth from 2025 to 2032, particularly in institutions with strict data privacy regulations or limited internet connectivity. Some universities prefer on-premise systems for greater control over infrastructure, customization, and data management.

• By Application

On the basis of application, the market is segmented into financial management, student management, admission & recruitment, student engagement & support, and others. The student management segment held the largest revenue share in 2024, driven by rising adoption of systems that automate student tracking, scheduling, grading, and progress monitoring.

The student engagement & support segment is expected to witness the fastest growth from 2025 to 2032. Institutions are increasingly focusing on improving communication and interaction between faculty and students through portals, chat features, and mobile apps, enhancing the overall academic experience.

• By End-use

On the basis of end-use, the student information system market is segmented into K-12 and higher education. The higher education segment led the market in 2024, owing to the broader use of SIS platforms for managing enrollment, compliance, academic programs, and financial aid. Colleges and universities are investing heavily in digital infrastructure to meet administrative and learning demands.

The K-12 segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing digitization of school operations and the rising emphasis on parent-teacher-student connectivity. SIS adoption at the K-12 level is also supported by government funding and educational reforms focused on data-driven decision-making.

Student Information System Market Regional Analysis

- North America dominated the student information system market with the largest revenue share in 2024, driven by the widespread digitalization of education, increasing adoption of cloud-based solutions, and a high emphasis on centralized academic data management

- Educational institutions across the region are investing heavily in advanced information systems to enhance administrative efficiency, student engagement, and performance tracking

- The presence of prominent edtech companies, strong IT infrastructure, and government initiatives supporting digital learning further strengthen the market position of North America in this sector

U.S. Student Information System Market Insight

The U.S. student information system market captured the largest revenue share in North America in 2024, primarily due to the country’s focus on education modernization and digital transformation. A surge in cloud-based system deployments and integrated learning platforms in both K-12 and higher education institutions is supporting growth. Universities and school districts are increasingly using SIS solutions to manage complex academic operations, enrollment processes, and performance analytics. Moreover, the presence of key players and high levels of IT investment are further contributing to market expansion.

Europe Student Information System Market Insight

The Europe student information system market is expected to witness the fastest growth from 2025 to 2032, propelled by government-backed digitization programs and an increasing need for efficient education management systems. Educational institutions are progressively adopting SIS to streamline administrative tasks and improve communication between students, faculty, and parents. Countries such as Germany, France, and the U.K. are seeing rising demand due to growing enrollments and efforts to ensure seamless student lifecycle management.

U.K. Student Information System Market Insight

The U.K. student information system market is expected to witness the fastest growth from 2025 to 2032, driven by the national push towards digital learning environments and the integration of cloud technologies across schools and universities. Rising concerns around academic performance tracking and administrative efficiency are encouraging educational bodies to adopt robust SIS platforms. In addition, the country’s strong education infrastructure and investment in digital tools for teaching and learning continue to boost market prospects.

Germany Student Information System Market Insight

The Germany student information system market is expected to witness the fastest growth from 2025 to 2032, supported by increasing digital adoption in the education sector and demand for streamlined academic operations. German educational institutions are adopting SIS to automate and centralize student data management, optimize curriculum planning, and enhance user experience. The focus on data privacy and compliance with standards such as the General Data Protection Regulation (GDPR) is further shaping system implementation trends across the country.

Asia-Pacific Student Information System Market Insight

The Asia-Pacific student information system market is expected to witness the fastest growth from 2025 to 2032, led by growing investments in educational infrastructure, rising student populations, and increasing demand for digital learning solutions in countries such as India, China, and Japan. Governments across the region are supporting e-learning initiatives and encouraging institutions to implement centralized information systems for better administration. The expansion of online education and the adoption of cloud-based technologies are also key growth drivers in the region.

China Student Information System Market Insight

The China student information system market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to its strong push for education digitalization and widespread integration of smart classroom technologies. The rapid increase in student enrollments and expansion of higher education institutions have necessitated the use of centralized platforms for managing academic and administrative functions. Furthermore, government policies promoting the adoption of edtech solutions are accelerating SIS deployments across the country.

Japan Student Information System Market Insight

The Japan student information system market is expected to witness the fastest growth from 2025 to 2032, driven by the country’s strong technological foundation and emphasis on educational efficiency. Japanese institutions are increasingly integrating SIS platforms to streamline operations such as admissions, attendance, grading, and student communication. The government's push for digital transformation in education, along with rising demand for real-time data access and student performance analytics, is supporting SIS adoption. Moreover, Japan’s aging population and shrinking student base are prompting schools and universities to adopt centralized, automated systems that optimize resource allocation and improve administrative productivity.

Student Information System Market Share

The Student Information System industry is primarily led by well-established companies, including:

• Oracle (U.S.)

• Workday, Inc. (U.S.)

• SAP SE (Germany)

• Jenzabar, Inc. (U.S.)

• Skyward, Inc. (U.S.)

• Illuminate Education (U.S.)

• Ellucian Company L.P. (U.S.)

• Anthology Inc. (U.S.)

• Foradian Technologies (India)

• Beehively (U.S.)

Latest Developments in Global Student Information System Market

- In July 2023, Practically acquired Fedena (Foradian Technologies.), aiming to provide a full-suite solution that integrates experiential learning content with school ERP tools. This move enhances Practically’s ability to serve both academic and administrative needs, boosting its appeal in the K-12 edtech space

- In July 2023, Si6 Associates Pvt Limited launched its student admission portal and curriculum catalogue on the SAP Store. Integrated with SAP S/4HANA and SAP Industry Solution for Higher Education & Research, the no-code portal simplifies program creation and provides applicants real-time access to manage their admissions, streamlining institutional operations

- In May 2023, Monash University collaborated with Oracle to roll out a hands-on digital skills program for undergraduate business students. The initiative aims to bridge the gap between academic knowledge and real-world business applications, preparing students for the digital economy

- In May 2023, Jenzabar introduced Campus Marketplace, a new platform offering schools an e-commerce-style storefront with registration tools and ready-to-deploy skills-based courses. The solution supports institutions in delivering flexible, non-traditional learning paths aligned with market demands

- In February 2023, Skyward partnered with Otus to enable seamless rostering integration for K-12 educators. This collaboration enhances data accessibility and visualization, helping teachers make informed decisions to improve student outcomes

- In September 2022, Renaissance acquired Illuminate Education to expand its MTSS (Multi-Tiered System of Support) offerings. The integration provides schools with a more robust platform to support the holistic development and academic progress of K-12 students

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.