Global Styrene Butadiene Styrene Sbs Market

Market Size in USD Billion

CAGR :

%

USD

6.04 Billion

USD

8.92 Billion

2024

2032

USD

6.04 Billion

USD

8.92 Billion

2024

2032

| 2025 –2032 | |

| USD 6.04 Billion | |

| USD 8.92 Billion | |

|

|

|

|

Styrene Butadiene Styrene (SBS) Market Size

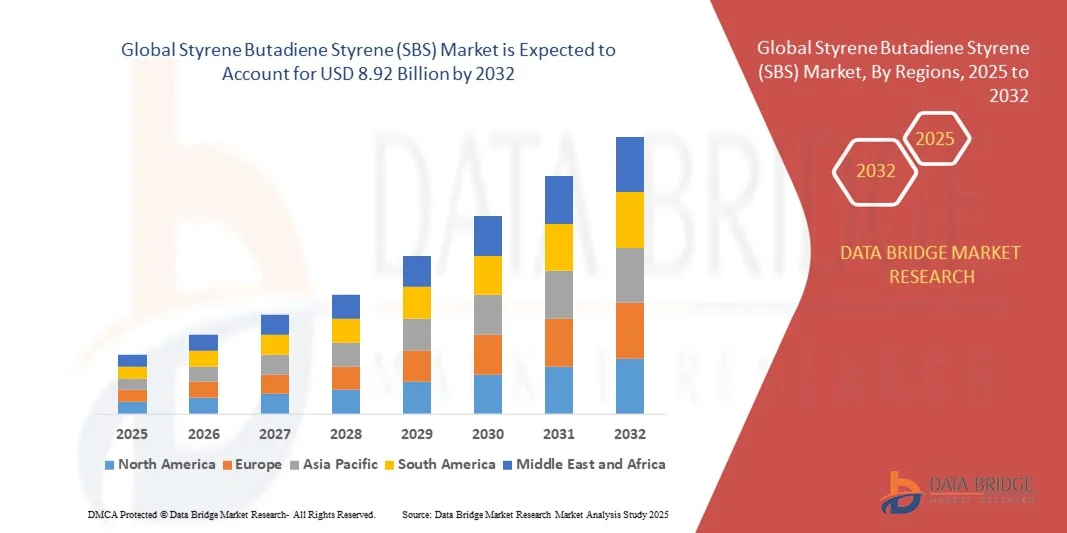

- The global styrene butadiene styrene (SBS) market size was valued at USD 6.04 billion in 2024 and is expected to reach USD 8.92 billion by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is largely fuelled by increasing demand from construction, automotive, and footwear industries for high-performance, durable, and flexible polymer materials

- Rising adoption of SBS in asphalt modification, adhesives, sealants, and coatings applications is driving consistent growth, as these materials improve durability, elasticity, and weather resistance in end-use products

Styrene Butadiene Styrene (SBS) Market Analysis

- Expanding infrastructure projects, urbanization, and the need for high-quality road construction materials are positively impacting the SBS market globally

- The shift towards sustainable, recyclable, and energy-efficient polymers in industrial applications is boosting demand, particularly in emerging economies with growing industrial and construction sectors

- North America dominated the SBS market with the largest revenue share of 38.5% in 2024, driven by growing infrastructure development, increasing automotive production, and rising demand for SBS-modified asphalt and industrial applications

- Asia-Pacific region is expected to witness the highest growth rate in the global styrene butadiene styrene (SBS) market, driven by increasing industrialization, growth in automotive and footwear sectors, and government initiatives promoting sustainable and high-performance materials

- The non-oil-extended SBS segment held the largest market revenue share in 2024, driven by its widespread use in asphalt modification, adhesives, and industrial coatings. Non-oil-extended SBS offers superior mechanical strength, elasticity, and thermal stability, making it ideal for high-performance applications across construction and industrial sectors

Report Scope and Styrene Butadiene Styrene (SBS) Market Segmentation

|

Attributes |

Styrene Butadiene Styrene (SBS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Styrene Butadiene Styrene (SBS) Market Trends

Increasing Use of SBS in Asphalt Modification and Industrial Applications

- The rising adoption of styrene butadiene styrene (SBS) in asphalt modification is transforming road construction by enhancing durability, flexibility, and resistance to cracking. SBS-modified asphalt improves pavement life, reduces maintenance costs, and ensures better performance under varying climatic conditions. In addition, SBS contributes to noise reduction, skid resistance, and better adhesion with aggregates, making highways safer and more sustainable over the long term

- Growing industrial applications, including adhesives, sealants, and coatings, are accelerating SBS demand due to its superior elasticity, chemical resistance, and thermal stability. These properties make SBS a preferred material in manufacturing and construction sectors. Moreover, SBS enhances bonding performance in multilayer composites, improves weathering resistance, and allows for innovative designs in industrial applications

- The versatility and processability of modern SBS grades make them attractive for automotive parts, footwear, and packaging applications, supporting performance improvements and operational efficiency. Regular use in these sectors optimizes product quality while reducing lifecycle costs. SBS is also increasingly used in flexible hoses, gaskets, and molded components, offering improved mechanical performance and contributing to lightweight product designs

- For instance, in 2023, several European road infrastructure projects implemented SBS-modified asphalt in highways, resulting in enhanced pavement longevity, reduced cracking, and lower overall maintenance expenditures. Additional benefits observed included reduced road rutting, improved temperature resistance, and lower long-term rehabilitation costs. These outcomes have encouraged governments and contractors to adopt SBS on a wider scale

- While SBS is driving innovation across construction and industrial applications, its market adoption depends on raw material availability, production scalability, and ongoing R&D to develop cost-effective, high-performance formulations. Manufacturers must focus on optimizing supply chains to meet rising global demand. Continuous investment in technology, automation, and process efficiency will be crucial for meeting the growing demand from both emerging and mature markets

Styrene Butadiene Styrene (SBS) Market Dynamics

Driver

Rising Infrastructure Development and Growing Automotive Industry

- Increasing global investments in road construction, urban development, and highway modernization are driving SBS demand in asphalt modification. Its ability to improve mechanical strength, flexibility, and durability makes it indispensable for modern infrastructure projects. In addition, expanding government-funded infrastructure programs and urban mobility projects are increasing the need for high-performance pavement materials globally

- Expanding automotive and footwear industries are contributing to SBS adoption due to the polymer’s excellent elasticity, thermal stability, and resistance to wear and tear. These properties enhance product performance, longevity, and consumer satisfaction. SBS is also being integrated into electric vehicles, lightweight automotive interiors, and performance footwear, meeting rising consumer expectations for comfort, safety, and sustainability

- The focus on sustainable and recyclable materials is encouraging manufacturers to incorporate SBS, which supports eco-friendly production while maintaining superior material properties. This further fuels market growth across industrial applications. Growing awareness of circular economy principles and the push for low-carbon construction materials is reinforcing SBS adoption, particularly in Europe and Asia-Pacific regions

- For instance, in 2022, several North American and Asian manufacturers increased SBS usage in pavements and industrial coatings, improving product lifespan, reducing maintenance costs, and optimizing production efficiency. Additional benefits included enhanced weathering performance, reduced material waste, and lower lifecycle costs for infrastructure projects, which further accelerated adoption rates

- While industrial demand and infrastructure growth drive SBS adoption, widespread use depends on balancing cost, raw material supply, and production efficiency to ensure consistent availability for global markets. Strategic partnerships, local sourcing, and investment in advanced polymerization technologies will play a key role in sustaining market expansion

Restraint/Challenge

High Raw Material Costs and Production Complexity

- The high cost of styrene and butadiene, essential raw materials for SBS, increases production expenses, limiting adoption among smaller manufacturers and price-sensitive markets. Cost remains a primary barrier for widespread use in certain regions. Fluctuations in crude oil prices and geopolitical tensions affecting petrochemical feedstock availability further amplify market volatility and production costs

- Complex polymerization and processing techniques required for high-quality SBS production can lead to operational challenges, especially in regions lacking advanced manufacturing infrastructure. This affects timely supply and scalability. Additional challenges include energy-intensive processes, stringent safety requirements, and high technical expertise needed for consistent polymer quality

- Limited availability of specialty grades in some regions can disrupt the supply chain, affecting construction and industrial projects that rely on consistent SBS quality and performance. This may delay adoption or force use of alternative materials. Moreover, transportation and storage limitations for SBS pellets or modified asphalt mixtures add logistical challenges in remote or underdeveloped regions

- For instance, in 2023, several South American and African industrial projects faced delays in SBS-based asphalt and adhesive production due to raw material shortages and high processing costs, slowing market growth in these regions. These disruptions also led to increased lead times, project cost overruns, and reliance on less efficient substitute materials

- While technological advancements are improving production efficiency and quality, addressing cost, supply chain, and regional accessibility challenges is critical for expanding global SBS market penetration and achieving long-term growth. Investment in local production facilities, strategic inventory management, and collaboration with feedstock suppliers will be essential to mitigate risks and stabilize supply chains

Styrene Butadiene Styrene (SBS) Market Scope

The market is segmented on the basis of product type, type, and application.

- By Product Type

On the basis of product type, the SBS market is segmented into non-oil-extended SBS and oil-extended SBS. The non-oil-extended SBS segment held the largest market revenue share in 2024, driven by its widespread use in asphalt modification, adhesives, and industrial coatings. Non-oil-extended SBS offers superior mechanical strength, elasticity, and thermal stability, making it ideal for high-performance applications across construction and industrial sectors.

The oil-extended SBS segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its enhanced flexibility, processability, and compatibility with bitumen and polymer blends. Oil-extended SBS is particularly popular in paving, roofing, and polymer modification applications, where improved durability and resistance to thermal and mechanical stress are critical.

- By Type

On the basis of type, the SBS market is segmented into thermoplastic elastomers, polybutadiene rubber, styrene-butadiene rubber, styrene-butadiene-styrene rubber, and others. The styrene-butadiene-styrene (SBS) rubber segment held the largest revenue share in 2024 due to its excellent mechanical performance, chemical resistance, and broad industrial adoption. SBS rubber is widely used in adhesives, sealants, footwear, and asphalt modification, supporting both product durability and operational efficiency.

The thermoplastic elastomers segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand in automotive components, flexible hoses, and molded consumer goods. Its lightweight, recyclable, and high-performance characteristics make it an attractive alternative to conventional elastomers in diverse applications.

- By Application

On the basis of application, the SBS market is segmented into TPE compounding, electric and electronic devices, medical devices, adhesives and sealants, polymer modification, asphalt modification, footwear industry, and others. The asphalt modification segment accounted for the largest market share in 2024, driven by increasing investments in road infrastructure and the superior performance of SBS-modified bitumen. SBS enhances flexibility, cracking resistance, and long-term durability of pavements, making it essential for modern highway and urban road construction projects.

The adhesives and sealants segment is expected to register the fastest growth from 2025 to 2032, owing to rising demand in industrial, construction, and automotive applications. SBS-based adhesives and sealants offer strong bonding, chemical resistance, and thermal stability, making them preferred solutions for durable and high-performance assembly operations.

Styrene Butadiene Styrene (SBS) Market Regional Analysis

- North America dominated the SBS market with the largest revenue share of 38.5% in 2024, driven by growing infrastructure development, increasing automotive production, and rising demand for SBS-modified asphalt and industrial applications

- Manufacturers and end-users in the region highly value SBS for its superior elasticity, durability, and thermal stability, which enhance pavement performance, industrial coatings, and adhesive applications

- This widespread adoption is further supported by advanced manufacturing capabilities, strong R&D infrastructure, and growing focus on sustainable and recyclable materials, establishing SBS as a preferred polymer solution across multiple industries

U.S. SBS Market Insight

The U.S. SBS market captured the largest revenue share in 2024 within North America, fueled by major investments in highway modernization, urban development, and the footwear and automotive sectors. The increasing adoption of SBS in asphalt modification, polymer modification, and industrial applications is boosting demand. Moreover, growing awareness of sustainable and recyclable polymers, coupled with robust R&D and technological adoption, is further driving market expansion.

Europe SBS Market Insight

The Europe SBS market is expected to register the fastest growth from 2025 to 2032, primarily driven by large-scale infrastructure projects, expanding automotive and footwear industries, and rising demand for high-performance polymers. The region’s emphasis on sustainability and eco-friendly production is fostering the adoption of SBS. European manufacturers are increasingly integrating SBS in asphalt modification, industrial coatings, adhesives, and sealants, enhancing product performance and operational efficiency.

U.K. SBS Market Insight

The U.K. SBS market is expected to register the fastest growth from 2025 to 2032, fueled by ongoing road modernization projects, rising industrial production, and increased adoption in the automotive and footwear sectors. The demand for durable, flexible, and high-performance polymers in construction, infrastructure, and industrial applications is driving market expansion. The country’s advanced polymer manufacturing capabilities and focus on sustainable materials further support SBS adoption.

Germany SBS Market Insight

The Germany SBS market is expected to register the fastest growth from 2025 to 2032, driven by robust automotive production, industrial growth, and extensive infrastructure projects. German manufacturers are increasingly using SBS in asphalt modification, adhesives, and polymer modification to enhance product performance and reduce lifecycle costs. The region’s emphasis on innovation, sustainability, and high-quality manufacturing infrastructure encourages wider SBS adoption across residential, commercial, and industrial applications.

Asia-Pacific SBS Market Insight

The Asia-Pacific SBS market is expected to register the fastest growth from 2025 to 2032, driven by rapid urbanization, large-scale infrastructure development, and increasing automotive and industrial production in countries such as China, Japan, and India. The region’s growing investment in smart cities, highway modernization, and industrial expansion is fueling SBS demand. Furthermore, APAC is emerging as a manufacturing hub for SBS, increasing affordability and accessibility for global markets.

Japan SBS Market Insight

The Japan SBS market is expected to register the fastest growth from 2025 to 2032 due to high industrial activity, advanced automotive and footwear industries, and increasing infrastructure investments. Japanese manufacturers are adopting SBS for asphalt modification, industrial coatings, adhesives, and polymer modification to improve product resilience and performance. Moreover, Japan’s emphasis on sustainable and recyclable materials is driving SBS integration across multiple sectors.

China SBS Market Insight

The China SBS market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, high rates of automotive and industrial production, and extensive infrastructure development. China is one of the largest consumers of SBS-modified asphalt and industrial polymers, with demand driven by government-led infrastructure projects, industrial growth, and increasing adoption in adhesives, sealants, and polymer modification. Strong domestic manufacturing capabilities and competitive pricing further contribute to market expansion.

Styrene Butadiene Styrene (SBS) Market Share

The Styrene Butadiene Styrene (SBS) industry is primarily led by well-established companies, including:

- Kraton Corporation (U.S.)

- China National Petroleum Corporation (China)

- Kumho Petrochemical Co., Ltd (South Korea)

- Lee Chang Yung Chemical Industry Corporation (Taiwan)

- LG Chem Ltd. (South Korea)

- En Chuan Chemical Industries Co., Ltd. (Taiwan)

- Dycon Chemicals (U.K.)

- Dynasol Group (Spain)

- Avient (U.S.)

- Biesterfeld AG (Germany)

- Trinseo (U.S.)

- Elevate (U.S.)

Latest Developments in Global Styrene Butadiene Styrene (SBS) Market

- In February 2024, Sibur launched a new SBS production line at its Tobolsk facility. The expansion increased annual capacity by 50,000 tons to meet rising demand in road construction and adhesives. It strengthens Sibur’s market position, supports infrastructure development, and ensures consistent supply for industrial applications. The move also addresses growing regional and global demand for high-performance SBS elastomers

- In January 2024, Kraton Corporation expanded SBS capacity at its Belpre, Ohio plant. The increase supports North American infrastructure, footwear, and industrial markets. This expansion improves production efficiency, ensures reliable supply, and allows Kraton to meet growing customer demand. The move enhances the company’s competitive position in the SBS market

- In February 2024, LCY Chemical Corp. introduced a new medical-grade SBS copolymer. The product is designed for medical tubing and device components, targeting the expanding healthcare materials sector. It supports innovation in specialized applications, enhances product performance, and strengthens LCY’s presence in high-value SBS segments

- In March 2024, Versalis and Eni formed a strategic partnership to develop bio-based SBS elastomers. The initiative aims to reduce the carbon footprint of specialty polymers while promoting sustainable materials. It opens opportunities in eco-friendly applications, increases market appeal for bio-based SBS, and drives innovation in high-performance elastomers

- In February 2024, LG Chem secured a multi-year SBS supply contract with a European tire manufacturer. The agreement ensures a stable supply of SBS for high-performance tire production. It strengthens LG Chem’s footprint in the automotive sector, enhances customer relationships, and supports growth in industrial applications across Europe

- In January 2025, Sibur appointed Elena Ivanova as head of its SBS business unit. The leadership change reflects a strategic focus on expanding its specialty elastomers portfolio. It supports operational efficiency, drives innovation, and enhances Sibur’s position in global SBS markets

- In February 2025, Zeon Corporation inaugurated a new SBS R&D center in Kanagawa, Japan. The center focuses on accelerating development of high-performance SBS for industrial and consumer applications. It enhances Zeon’s innovation capabilities, supports faster product commercialization, and strengthens market competitiveness

- In March 2024, Dynasol Group invested €40 million to expand its SBS plant in Santander, Spain. The expansion increases capacity to serve European adhesives and asphalt modification markets. It strengthens regional supply chains, supports growth in construction and industrial sectors, and enhances Dynasol’s market share in Europe

- In Q4 2024, Kumho Petrochemical launched an eco-friendly SBS line for the footwear industry. The new products utilize recycled raw materials and low-emission processes. It supports sustainable manufacturing, reduces environmental impact, and caters to the growing demand for green and high-performance SBS elastomers

- In January 2025, TSRC Corporation signed a North American distribution agreement for SBS. The partnership expands product availability for construction and automotive sectors. It improves supply chain efficiency, increases market reach, and supports regional demand for high-quality SBS materials

- In February 2025, Eni’s Versalis received regulatory approval for a new SBS plant in Brindisi, Italy. The new facility will produce SBS for adhesives and road paving applications. It strengthens European supply, supports regional infrastructure projects, and ensures consistent availability of specialty SBS products

- In March 2025, LCY Chemical Corp. committed USD 60 million to expand SBS capacity at Kaohsiung, Taiwan. The expansion addresses rising Asia-Pacific demand for specialty elastomers. It enhances regional production, improves supply reliability, and strengthens LCY’s position in the high-growth SBS market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL STYRENE BUTADIENE STYRENE (SBS) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL STYRENE BUTADIENE STYRENE (SBS) MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 COMPANY POSITIONING GRID

2.7 COMPANY MARKET SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TOP TO BOTTOM ANALYSIS

2.1 STANDARDS OF MEASUREMENT

2.11 VENDOR SHARE ANALYSIS

2.12 IMPORT DATA

2.13 EXPORT DATA

2.14 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.15 DATA POINTS FROM KEY SECONDARY DATABASES

2.16 GLOBAL STYRENE BUTADIENE STYRENE (SBS) MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 PRODUCTION CAPACITY OVERVIEW

7.1 PRODUCTION STATISTICS, BY REGION, 2024, (KILO TONS)

7.1.1 NORTH AMERICA

7.1.2 EUROPE

7.1.3 ASIA PACIFIC

7.1.4 SOUTH AMERICA

7.1.5 MIDDLE EAST AND AFRICA

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 GLOBAL STYRENE BUTADIENE STYRENE (SBS) MARKET, BY PRODUCT, 2018-2032 (USD MILLION) (KILO TONS)

10.1 OVERVIEW

10.2 NON OIL EXTENDED

10.2.1 BY GRADE

10.2.1.1. 3411P

10.2.1.2. 3520

10.2.1.3. 3522

10.2.1.4. 3527

10.2.1.5. 3536

10.2.1.6. 3537

10.2.1.7. 3542

10.2.1.8. 3545

10.2.1.9. 3546

10.2.1.10. 3566

10.2.1.11. 3710

10.2.1.12. 3741

10.2.1.13. 3411

10.2.1.14. 3412

10.2.1.15. 3501

10.2.1.16. 3780

10.2.2 BY BD/SM

10.2.2.1. 70/30

10.2.2.2. 69/31

10.2.2.3. 77/23

10.2.2.4. 75/25

10.2.2.5. 70/30

10.2.2.6. 65/35

10.2.2.7. 60/40

10.2.2.8. 55/45

10.2.2.9. 60/40

10.2.2.10. 70/30

10.2.2.11. 70/30

10.2.2.12. 70/30

10.2.2.13. 69/31

10.2.2.14. 67/33

10.2.2.15. 69/31

10.2.2.16. 70/30

10.3 OIL EXTENDED

10.3.1 BY GRADE

10.3.1.1. 1475

10.3.1.2. 1485

10.3.1.3. 1487

10.3.1.4. 1546

10.3.1.5. 1502

10.3.2 BY BD/SM

10.3.2.1. 60/40

10.3.2.2. 68/32

10.3.2.3. 45/55

10.3.2.4. 60/40

10.3.2.5. 70/30

11 GLOBAL STYRENE BUTADIENE STYRENE (SBS) MARKET, BY TYPE , 2018-2032 (USD MILLION)

11.1 OVERVIEW

11.2 EMULSION POLYMERIZATION

11.3 SOLUTION POLYMERIZATION

11.4 THERMOPLASTIC STYRENE-BUTADIENE BLOCK POLYMER (SBS)

12 GLOBAL STYRENE BUTADIENE STYRENE (SBS) MARKET, BY SOLUBILITY, 2018-2032 (USD MILLION)

12.1 OVERVIEW

12.2 HIGH SOLUBILITY

12.3 LOW SOLUBILITY

12.4 INSOLUBLE

13 GLOBAL STYRENE BUTADIENE STYRENE (SBS) MARKET, BY PROCESS, 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 INJECTION MOLDING

13.3 T-DIE EXTRUSION MOLDING

13.4 VACUUM FORMING

13.5 OTHERS

14 GLOBAL STYRENE BUTADIENE STYRENE (SBS) MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 PELLET

14.3 POWDER

14.4 CRUMB

14.5 ASPHALT MODIFICATION

14.6 MODIFICATION OF BITUMEN

14.7 POLYMER MODIFICATION AND COMPOUNDING

14.8 ADHESIVES

14.9 GRAFTABLE RUBBER MODIFICATION

14.1 OTHERS

15 GLOBAL STYRENE BUTADIENE STYRENE (SBS) MARKET, BY END-USE, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 AUTOMOTIVE

15.2.1 PASSENGER VEHICLES

15.2.2 COMMERCIAL VEHICLES

15.2.3 HEAVY-DUTY VEHICLES

15.2.4 OTHERS

15.3 BUILDING AND CONSTRUCTION

15.3.1 RESIDENTIAL

15.3.2 COMMERCIAL

15.3.3 INDUSTRIAL

15.3.4 INFRASTRUCTURAL

15.4 HEALTHCARE

15.4.1 MEDICAL DEVICES

15.4.2 PHARMACEUTICALS

15.5 PACKAGING

15.5.1 TRAYS

15.5.2 CUSHIONING NET

15.5.3 OTHERS

15.6 CONSUMER GOODS

15.6.1 SHOES

15.6.1.1. CASUAL SHOES

15.6.1.2. FORMAL SHOES

15.6.1.3. BOOTS

15.6.1.4. SLIPPERS

15.6.1.5. MEDICAL FOOT

15.6.2 TEXTILE

15.6.3 OTHERS

15.7 ELECTRONICS AND ELECTRICALS

15.8 AGRICULTURE

15.9 OTHERS

16 GLOBAL STYRENE BUTADIENE STYRENE (SBS) MARKET, BY GEOGRAPHY, 2018-2032 (USD MILLION) (KILO TONS)

GLOBAL STYRENE BUTADIENE STYRENE (SBS) MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

16.2 EUROPE

16.2.1 GERMANY

16.2.2 U.K.

16.2.3 ITALY

16.2.4 FRANCE

16.2.5 SPAIN

16.2.6 SWITZERLAND

16.2.7 RUSSIA

16.2.8 TURKEY

16.2.9 BELGIUM

16.2.10 NETHERLANDS

16.2.11 SWITZERLAND

16.2.12 DENMARK

16.2.13 NORWAY

16.2.14 FINLAND

16.2.15 SWEDEN

16.2.16 REST OF EUROPE

16.3 ASIA-PACIFIC

16.3.1 JAPAN

16.3.2 CHINA

16.3.3 SOUTH KOREA

16.3.4 INDIA

16.3.5 SINGAPORE

16.3.6 THAILAND

16.3.7 INDONESIA

16.3.8 MALAYSIA

16.3.9 PHILIPPINES

16.3.10 AUSTRALIA

16.3.11 NEW ZEALAND

16.3.12 HONG KONG

16.3.13 TAIWAN

16.3.14 REST OF ASIA-PACIFIC

16.4 SOUTH AMERICA

16.4.1 BRAZIL

16.4.2 ARGENTINA

16.4.3 REST OF SOUTH AMERICA

16.5 MIDDLE EAST AND AFRICA

16.5.1 SOUTH AFRICA

16.5.2 EGYPT

16.5.3 SAUDI ARABIA

16.5.4 UNITED ARAB EMIRATES

16.5.5 ISRAEL

16.5.6 BAHRAIN

16.5.7 KUWAIT

16.5.8 OMAN

16.5.9 QATAR

16.5.10 REST OF MIDDLE EAST AND AFRICA

17 GLOBAL STYRENE BUTADIENE STYRENE (SBS) MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 COMPANY SHARE ANALYSIS: SOUTH AMERICA

17.6 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

17.7 MERGERS & ACQUISITIONS

17.8 NEW PRODUCT DEVELOPMENT & APPROVALS

17.9 EXPANSIONS

17.1 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTSS

18 GLOBAL STYRENE BUTADIENE STYRENE (SBS) MARKET, SWOT ANALYSIS

19 GLOBAL STYRENE BUTADIENE STYRENE (SBS) MARKET, COMPANY PROFILES

(NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST)

19.1 PETROCHINA COMPANY LIMITED

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT UPDATES

19.2 KUMHO PETROCHEMICAL

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT UPDATES

19.3 TSRC

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT UPDATES

19.4 ASAHI KASEI CORPORATION

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT UPDATES

19.5 INEOS STYROLUTION GROUP GMBH

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT UPDATES

19.6 KRATON CORPORATION

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT UPDATES

19.7 LCY GROUP

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT UPDATES

19.8 LG CHEM

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT UPDATES

19.9 TRINSEO

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT UPDATES

19.1 VERSALIS S.P.A.

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT UPDATES

19.11 GRUPO DYNASOL

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT UPDATES

19.12 CHI MEI CORPORATION

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT UPDATES

19.13 HO HSIANG CHING

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT UPDATES

19.14 NINGBO CHANGHONG POLYMER SCIENTIFIC AND TECHNICAL INC.

19.14.1 COMPANY SNAPSHOT

19.14.2 REVENUE ANALYSIS

19.14.3 PRODUCT PORTFOLIO

19.14.4 RECENT UPDATES

19.15 FUYOUMAOYI

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT UPDATES

20 RELATED REPORTS

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Global Styrene Butadiene Styrene Sbs Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Styrene Butadiene Styrene Sbs Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Styrene Butadiene Styrene Sbs Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.