Global Styrenics Market

Market Size in USD Billion

CAGR :

%

USD

98.17 Billion

USD

161.26 Billion

2024

2032

USD

98.17 Billion

USD

161.26 Billion

2024

2032

| 2025 –2032 | |

| USD 98.17 Billion | |

| USD 161.26 Billion | |

|

|

|

|

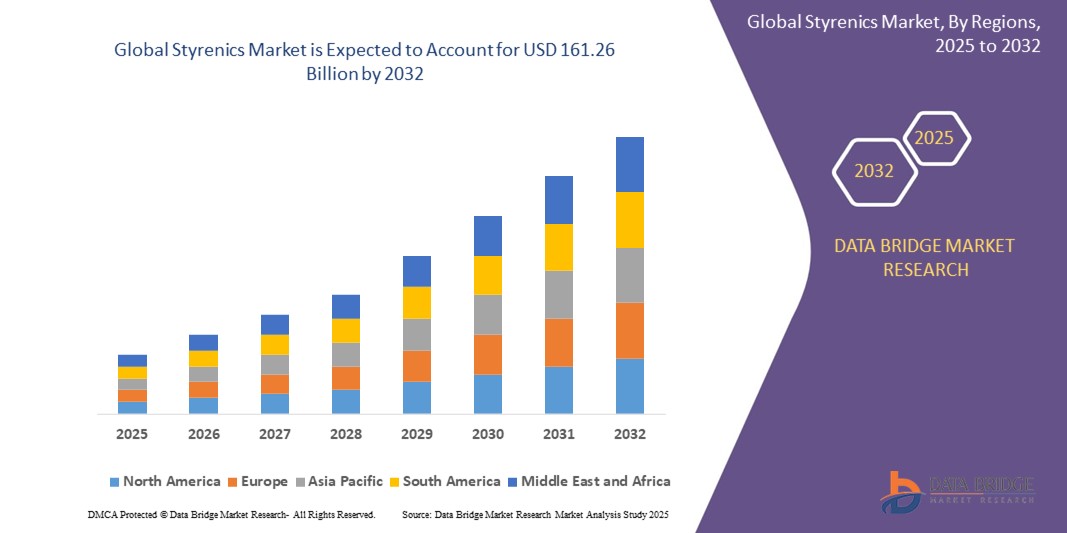

What is the Global Styrenics Market Size and Growth Rate?

- The global styrenics market size was valued at USD 98.17 billion in 2024 and is expected to reach USD 161.26 billion by 2032, at a CAGR of 6.40% during the forecast period

- The styrenics market is fuelled by advancements in technology and methods. The latest innovations are optimizing production processes and enhancing product performance, driving increased utilization across various industries

- With a focus on sustainability and efficiency, the market is poised for substantial expansion, offering promising opportunities for stakeholders to capitalize on evolving consumer demands and market dynamics

What are the Major Takeaways of Styrenics Market?

- The rising environmental consciousness and regulatory pressures have spurred a surge in demand for recycled styrenics, particularly in packaging. Companies prioritize sustainability, using recycled styrenics to align with eco-friendly consumer preferences

- For instance, major beverage corporations have committed to increasing the use of recycled polystyrene in their packaging to reduce environmental impact, catalyzing market growth for recycled styrenics

- Asia-Pacific dominated the styrenics market with the largest revenue share of 42.3% in 2024, driven by strong demand from packaging, construction, and automotive industries across key economies such as China, India, Japan, and South Korea

- North America is poised to grow at the fastest CAGR of 21.3% during 2025–2032, fueled by increased focus on lightweight materials in automotive manufacturing and expanded use of styrenics in construction and packaging

- The Polystyrene (PS) segment dominated the Styrenics market with the largest revenue share of 29.4% in 2024, owing to its cost-effectiveness, rigidity, and wide-ranging applications in packaging, disposable consumer goods

Report Scope and Styrenics Market Segmentation

|

Attributes |

Styrenics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Styrenics Market?

“Rising Demand for Lightweight and Sustainable Polymers”

- A major trend in the global styrenics market is the growing demand for lightweight and sustainable materials across automotive, construction, and packaging sectors. Manufacturers are increasingly substituting conventional materials with styrenic polymers such as ABS, SAN, and polystyrene for their excellent mechanical strength, durability, and lower carbon footprint

- For instance, INEOS Styrolution introduced a new line of recycled-content styrenics in 2024 to meet demand for sustainable alternatives, supporting circular economy initiatives and reduced landfill waste

- The automotive industry is one of the largest consumers of styrenics, especially in interior and exterior applications, due to the polymers’ favorable strength-to-weight ratio, design flexibility, and ability to reduce vehicle emissions through lightweighting

- Similarly, sustainable packaging made from styrenics is gaining traction, especially in food and personal care sectors, where recyclable and high-barrier materials are critical

- Key players such as Trinseo and LG Chem are investing in R&D to produce bio-based and recyclable styrenics, targeting regulatory compliance and evolving customer preferences

- As sustainability becomes a core purchasing criterion across industries, the demand for innovative, eco-friendly styrenic materials is expected to drive product development and reshape market dynamics

What are the Key Drivers of Styrenics Market?

- Rising demand from automotive and construction industries is a major growth driver for the styrenics market. These materials are widely used for their lightweight, thermal insulation, and impact resistance properties

- For instance, in January 2024, BASF SE launched a new generation of expandable polystyrene (EPS) optimized for building insulation, aligning with green building regulations in Europe and Asia-Pacific

- Booming packaging demand, especially in the e-commerce and food sectors, is boosting the consumption of styrenic polymers due to their rigidity, clarity, and hygiene compliance

- Growing applications in consumer electronics and medical devices—where durability, aesthetics, and compliance with safety standards are critical—further propel market adoption

- In addition, urbanization and rising disposable incomes in emerging economies are driving demand for high-quality construction and consumer products, fueling styrenics consumption in these regions

Which Factor is challenging the Growth of the Styrenics Market?

- Environmental and regulatory concerns related to the use of styrene-based products are a key challenge for the market. Styrene is classified as a possible human carcinogen, prompting stricter regulations on emissions, usage, and recycling

- For instance, in 2023, the European Chemicals Agency (ECHA) proposed stricter workplace exposure limits for styrene, impacting its production and handling in the region

- These regulations push manufacturers to invest heavily in compliance and mitigation technologies, increasing operational costs and slowing product rollout

- Furthermore, competition from alternative materials such as polyethylene, polypropylene, and bioplastics often perceived as more eco-friendly poses a market threat, particularly in environmentally conscious segments

- Public perception of plastics as environmentally harmful adds to this challenge, potentially impacting consumer demand for polystyrene-based packaging and products

- To counteract this, leading companies such as INEOS Styrolution are focusing on advanced recycling technologies and low-emission production processes to retain market relevance and regulatory approval

How is the Styrenics Market Segmented?

The market is segmented on the basis of polymer type and application.

• By Polymer Type

On the basis of polymer type, the styrenics market is segmented into Polystyrene (PS), Expanded Polystyrene (EPS), Acrylonitrile Butadiene Styrene (ABS), Styrene Butadiene Rubber (SBR), Unsaturated Polyester Resin (UPR), and Other Polymers. The Polystyrene (PS) segment dominated the Styrenics market with the largest revenue share of 29.4% in 2024, owing to its cost-effectiveness, rigidity, and wide-ranging applications in packaging, disposable consumer goods, and insulation materials. PS is extensively used in both food packaging and electronics due to its excellent formability and lightweight nature.

The Acrylonitrile Butadiene Styrene (ABS) segment is expected to witness the fastest growth rate of 20.6% from 2025 to 2032, driven by its rising use in automotive, consumer electronics, and 3D printing applications. ABS offers superior impact resistance, dimensional stability, and aesthetic appeal, making it ideal for modern design requirements across multiple sectors. Increasing demand for lightweight and durable components in vehicles and electronics is expected to further boost the ABS segment.

• By Application

On the basis of application, the styrenics market is segmented into Building and Construction, Packaging, Automotive, Appliances, Marine Accessories, Electrical and Electronics, and Wind Energy. The Packaging segment accounted for the largest revenue share of 31.7% in 2024, driven by the high consumption of polystyrene and EPS for food containers, protective packaging, and industrial transport solutions. Styrenics offer the necessary balance of durability, lightweight, and recyclability, making them ideal for packaging applications worldwide.

The Automotive segment is projected to register the fastest CAGR from 2025 to 2032, propelled by the growing demand for lightweight materials to improve fuel efficiency and reduce emissions. Styrenic polymers such as ABS and SBR are widely adopted in automotive interiors, body panels, and sealing systems due to their high strength, thermal resistance, and moldability. As electric vehicle production accelerates globally, the demand for innovative and sustainable styrenic materials is set to rise significantly.

Which Region Holds the Largest Share of the Styrenics Market?

- Asia-Pacific dominated the styrenics market with the largest revenue share of 42.3% in 2024, driven by strong demand from packaging, construction, and automotive industries across key economies such as China, India, Japan, and South Korea

- Rapid industrialization, growing urban populations, and rising infrastructure investments have significantly boosted consumption of styrenic polymers such as PS, EPS, ABS, and SBR in the region

- In addition, the expansion of the manufacturing base and the presence of cost-effective raw materials and labor support the large-scale production and utilization of styrenic materials across various applications, including consumer goods and electronics

China Styrenics Market Insight

The China styrenics market captured the largest revenue share within Asia-Pacific in 2024, fueled by its massive manufacturing ecosystem, infrastructure development, and government-backed industrial projects. The country is a leading consumer and producer of styrenic materials used in packaging, construction panels, and automotive components. In addition, strong domestic demand and the presence of major styrenic producers make China a central hub for regional and global supply chains.

India Styrenics Market Insight

The India styrenics market is expected to expand at a robust CAGR over the forecast period, supported by rising urbanization, housing demand, and infrastructure initiatives such as Smart Cities. Demand for EPS in construction and packaging, and ABS in consumer electronics and automotive applications, is growing steadily. Favorable government policies promoting domestic manufacturing are also encouraging investment in styrenics production facilities.

Japan Styrenics Market Insight

The Japan styrenics market continues to grow, driven by advancements in sustainable materials and recycling technologies. Japan’s automotive and electronics sectors, known for precision and quality, have consistently demanded high-performance styrenic polymers. The country’s emphasis on eco-friendly alternatives is encouraging the development of bio-based and recyclable styrenic materials, particularly in high-end applications.

Which Region is the Fastest Growing in the Styrenics Market?

North America is poised to grow at the fastest CAGR of 21.3% during 2025–2032, fueled by increased focus on lightweight materials in automotive manufacturing and expanded use of styrenics in construction and packaging. Rising demand for ABS in 3D printing, consumer electronics, and electric vehicles is a major growth driver. Moreover, sustainable packaging trends and innovations in EPS recycling are reshaping the regional landscape. With strong R&D infrastructure, leading polymer producers, and a push for circular economy practices, North America is set to play a pivotal role in the future evolution of the styrenics market.

U.S. Styrenics Market Insight

The U.S. styrenics market held the largest share within North America in 2024, driven by increasing demand in the construction and automotive sectors. With growing interest in eco-friendly materials and insulation solutions, EPS and PS are seeing high usage in energy-efficient buildings. Moreover, ABS’s expanding role in consumer electronics and 3D printing continues to support market momentum.

Canada Styrenics Market Insight

The Canada styrenics market is growing steadily, backed by increased infrastructure development and demand for sustainable packaging solutions. The country’s focus on reducing plastic waste has prompted innovations in recyclable and bio-based styrenics. Growth is also fueled by demand from its automotive parts manufacturing and home renovation industries.

Mexico Styrenics Market Insight

The Mexico styrenics market is gaining traction due to the presence of a strong automotive assembly base and rising demand for consumer goods. Its strategic location for exports to both the U.S. and Latin America supports production and distribution of styrenic materials. Mexico’s increasing investments in housing and industrial infrastructure further propel market adoption.

Which are the Top Companies in Styrenics Market?

The styrenics industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- Solvay (Belgium)

- Dow (U.S.)

- Huntsman International LLC (U.S.)

- Bostik (France)

- H.B. Fuller Company (U.S.)

- Cardolite Corporation (U.S.)

- KUKDO CHEMICAL CO., LTD. (South Korea)

- BASF SE (Germany)

- Covestro AG (Germany)

- LANXESS (Germany)

- Mitsui Chemicals India Pvt. Ltd. (Japan)

- Wanhua (China)

- Arkema (France)

- Hexion (U.S.)

What are the Recent Developments in Global Styrenics Market?

- In June 2023, Styrenics Circular Solutions (SCS) proposed a pioneering technology for recycled polystyrene, designed for safe use in food contact applications. The innovation involves employing recycled polystyrene (rPS) within an ABA structure, featuring a functional barrier to ensure safety and compliance with regulations governing food packaging materials

- In October 2022, Arkema introduced new recyclable high-performance polyamides as part of its Virtucycle program. These polymers, including Rilsan Polyamide 11, Rilsamid Polyamide 12, and Pebax, are produced at specialized facilities in Italy. The initiative underscores Arkema's commitment to sustainability by offering recyclable alternatives for various industrial applications

- In November 2021, Asahi Kasei embarked on a collaboration with Shell Eastern Petroleum to supply butadiene derived from plastic waste and biomass. This partnership aims to produce sustainable solution-polymerized styrene-butadiene rubber (S-SBR) using butadiene from renewable sources at Asahi Kasei's Singapore plant, making significant strides in environmental responsibility and circular economy practices

- In November 2021, Trinseo, a U.S.-based engineered materials manufacturer, initiated discussions regarding the potential divestiture of its styrenics assets. This strategic move involves exploring the sale of Trinseo's Feedstocks and Polystyrene businesses, along with its stake in the Americas Styrenics joint venture, aligning with the company's refocused business objectives and market dynamics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.