Global Subcutaneous Oncology Biologic Drug Market

Market Size in USD Billion

CAGR :

%

USD

15.78 Billion

USD

34.82 Billion

2025

2033

USD

15.78 Billion

USD

34.82 Billion

2025

2033

| 2026 –2033 | |

| USD 15.78 Billion | |

| USD 34.82 Billion | |

|

|

|

|

Subcutaneous Oncology Biologic Drug Market Size

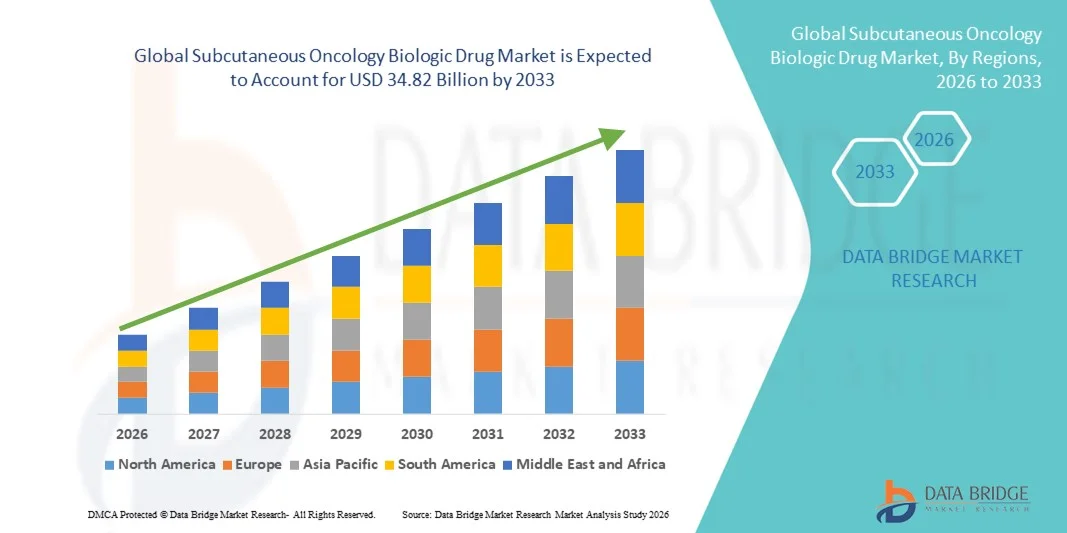

- The global Subcutaneous Oncology Biologic Drug market size was valued at USD 15.78 billion in 2025 and is expected to reach USD 34.82 billion by 2033, at a CAGR of 10.40% during the forecast period

- The market growth is largely fueled by the rising prevalence of cancer worldwide, increasing adoption of targeted therapies, and growing preference for subcutaneous administration over intravenous delivery due to convenience, reduced treatment time, and improved patient compliance

- Furthermore, advancements in biologic drug formulations, development of patient-friendly delivery devices (such as prefilled syringes and autoinjectors), and expanding access to oncology care in hospitals, specialty clinics, and homecare settings are establishing subcutaneous oncology biologic drugs as a preferred treatment option. These converging factors are accelerating the uptake of Subcutaneous Oncology Biologic Drug solutions, thereby significantly boosting overall market growth

Subcutaneous Oncology Biologic Drug Market Analysis

- Subcutaneous oncology biologic drugs, including monoclonal antibodies, cytokines, and fusion proteins, are increasingly vital in modern cancer treatment due to their ability to provide targeted therapy, reduce hospital visits, and improve patient convenience through subcutaneous administration in hospitals, specialty clinics, and homecare settings

- The escalating demand for subcutaneous oncology biologic drugs is primarily fueled by the rising global cancer prevalence, increasing adoption of targeted therapies, technological advancements in patient-friendly delivery devices (prefilled syringes, autoinjectors, pen injectors), and growing awareness among patients and healthcare providers regarding the benefits of subcutaneous administration over intravenous therapy

- The North America. dominated the subcutaneous oncology biologic drug market with the largest revenue share of 31.7% in 2025, driven by advanced healthcare infrastructure, high adoption of biologic therapies, strong oncology treatment programs, and the presence of leading pharmaceutical companies and specialty oncology centers

- Asia Pacific is expected to be the fastest growing country in the subcutaneous oncology biologic Drug market during the forecast period, fueled by rising incidence of cancer, increasing investments in oncology biologics, growing preference for patient-centric therapies, and adoption of homecare and outpatient subcutaneous treatments

- The Monoclonal Antibodies (mAbs) segment dominated the largest market revenue share of 46.5% in 2025, driven by their extensive use in targeted cancer therapies and strong clinical efficacy

Report Scope and Subcutaneous Oncology Biologic Drug Market Segmentation

|

Attributes |

Subcutaneous Oncology Biologic Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Subcutaneous Oncology Biologic Drug Market Trends

Rising Adoption of Patient-Friendly Subcutaneous Delivery

- A key and accelerating trend in the global subcutaneous oncology biologic drug market is the shift from traditional intravenous (IV) administration to subcutaneous formulations

- This transition is driven by the need to reduce administration time, minimize hospital visits, and provide more patient-centric therapy options. Patients benefit from less invasive procedures, reduced treatment-related stress, and the possibility of home-based administration, which collectively enhance quality of life

- For instance, Roche’s subcutaneous rituximab (Rituxan Hycela) and trastuzumab (Herceptin SC) have demonstrated significantly shorter administration times compared to IV infusions, allowing hospitals and oncology centers to optimize workflow and reduce patient waiting times

- These formulations have been particularly beneficial during high-demand periods, such as in large oncology centers managing multiple patients simultaneously

- Biopharmaceutical companies are increasingly investing in innovative delivery devices, such as pre-filled syringes, on-body injectors, and wearable systems, which facilitate self-administration, improve adherence, and reduce healthcare provider dependency. In addition, ongoing R&D focuses on improving formulation stability and tolerability, aiming to expand the range of therapies available in subcutaneous form

- The trend is also supported by regulatory encouragement for patient-friendly therapies, with agencies prioritizing drugs that reduce hospital burden and improve patient comfort without compromising efficacy

Subcutaneous Oncology Biologic Drug Market Dynamics

Driver

Growing Prevalence of Cancer and Need for Efficient Biologic Therapies

- The rising incidence of cancers globally, including breast cancer, lymphoma, and multiple myeloma, is fueling the demand for biologic therapies that can be administered subcutaneously. These therapies offer comparable efficacy to IV treatments while reducing infusion-related complications such as hypersensitivity reactions, venous access issues, and prolonged chair time

- For instance, in 2024, Amgen launched its subcutaneous formulations for multiple myeloma, providing patients with faster administration and fewer hospital visits. This not only enhances patient adherence but also improves hospital efficiency and reduces healthcare costs associated with prolonged IV infusions

- The growing adoption of combination therapies, where biologics are combined with targeted small molecules or chemotherapeutics, further encourages the development of convenient subcutaneous delivery formats. Healthcare providers are increasingly prioritizing therapies that balance efficacy with operational feasibility in high-volume oncology centers

- Furthermore, strong reimbursement frameworks in developed markets, along with government initiatives promoting early cancer detection and outpatient care, support the uptake of subcutaneous biologics

- The expansion of homecare services, telemedicine platforms, and nurse-assisted administration programs also contributes to market growth, enabling broader access to these therapies

- Patient preference is a major factor driving adoption, as many prefer shorter treatment sessions and the ability to self-administer medications at home, which reduces disruption to daily life and mitigates anxiety associated with hospital visits

Restraint/Challenge

High Cost of Biologic Therapies and Administration Limitations

- Despite their advantages, subcutaneous oncology biologic drugs are often more expensive than traditional IV therapies, creating affordability challenges in emerging markets and for uninsured or underinsured patients. The high production costs, patent-protected formulations, and specialized delivery devices contribute to the premium pricing

- For instance, while trastuzumab SC reduces administration time, its cost remains a barrier for widespread adoption in certain regions with limited healthcare budgets. Similarly, subcutaneous rituximab has seen slower uptake in developing markets despite its operational and patient benefits

- Technical limitations also present challenges, such as volume restrictions that limit the maximum dose that can be delivered subcutaneously. Large-volume biologics may still require IV administration, reducing the scope of subcutaneous delivery. In addition, injection-site reactions, such as pain, redness, or swelling, can affect patient compliance, requiring careful formulation optimization

- Patient training and support programs are essential to ensure proper administration and avoid dosing errors. Lack of adequate caregiver support or patient education can hinder adoption, especially for home-based administration programs

- Overcoming these challenges involves the development of concentrated formulations, user-friendly injection devices, and robust patient education initiatives. Governments and healthcare providers also play a key role in expanding insurance coverage, reducing out-of-pocket costs, and incentivizing adoption through value-based healthcare frameworks

Subcutaneous Oncology Biologic Drug Market Scope

The market is segmented on the basis of type, cancer indication, and application.

- By Type

On the basis of type, the Subcutaneous Oncology Biologic Drug market is segmented into Monoclonal Antibodies (mAbs), Cytokines, Fusion Proteins, and Other Biologic Therapeutics. The Monoclonal Antibodies (mAbs) segment dominated the largest market revenue share of 46.5% in 2025, driven by their extensive use in targeted cancer therapies and strong clinical efficacy. mAbs are widely adopted for breast cancer, hematological cancers, and other solid tumors due to their ability to precisely target tumor cells while minimizing systemic toxicity. Hospitals, oncology clinics, and specialty cancer centers prefer mAbs for both early-stage and advanced cancers. Regulatory approvals, robust clinical trial pipelines, and high physician awareness reinforce their dominance. Large-scale manufacturing capabilities and established reimbursement frameworks enhance adoption. mAbs also benefit from strong physician preference for combination therapy regimens. Integration with subcutaneous delivery technologies improves patient compliance. Continued innovation in antibody engineering further strengthens market leadership. Market expansion in emerging regions supports consistent revenue growth.

The Fusion Proteins segment is expected to witness the fastest CAGR of 14.2% from 2026 to 2033, fueled by increasing research in immune-oncology and targeted therapies. Fusion proteins combine therapeutic domains to improve efficacy and reduce side effects, attracting adoption in both hematological malignancies and solid tumors. Development of novel fusion protein drugs with improved pharmacokinetics and subcutaneous delivery formats drives growth. Rising demand for patient-friendly injectable biologics encourages adoption. Biopharmaceutical companies are focusing on innovative fusion protein platforms. Clinical trials in lung and colorectal cancers are expanding usage. Cost-effectiveness and ease of administration support wider clinical acceptance. Regulatory approvals for new fusion protein therapies are rising. Hospital and specialty clinic adoption grows due to shorter administration times and lower infusion requirements. Expanding pipeline of oncology fusion proteins contributes to sustained growth. Market penetration in North America and Europe supports rapid expansion. Overall, fusion proteins represent a high-growth segment driven by innovation and patient-centric therapy.

- By Cancer Indication

On the basis of cancer indication, the market is segmented into Breast Cancer, Lung Cancer, Colorectal Cancer, Hematological Cancers (Leukemia, Lymphoma, and Multiple Myeloma), and Other Solid Tumors. The Breast Cancer segment dominated the largest market revenue share of 34.8% in 2025, attributed to high prevalence, early diagnosis programs, and strong uptake of subcutaneous biologics such as trastuzumab and pertuzumab. Breast cancer treatment increasingly relies on biologic therapies, improving survival outcomes. Hospitals, oncology centers, and specialized breast clinics prioritize biologics for adjuvant and neoadjuvant therapies. Reimbursement frameworks and patient assistance programs support access. Integration with subcutaneous delivery devices improves patient convenience and adherence. Adoption in combination therapy regimens further strengthens revenue contribution. Research and clinical trials continue to expand treatment options. Awareness campaigns and screening programs increase the patient pool. Biologics for HER2-positive and triple-negative subtypes drive robust adoption. European and North American markets dominate revenue due to established healthcare infrastructure. The availability of generic or biosimilar versions enhances affordability.

The Hematological Cancers segment is expected to witness the fastest CAGR of 13.9% from 2026 to 2033, driven by increasing prevalence of leukemia, lymphoma, and multiple myeloma globally. Subcutaneous biologics such as monoclonal antibodies and fusion proteins improve therapy delivery and reduce hospital visits. Advanced therapies including CAR-T and immunomodulatory fusion proteins complement standard treatments, supporting adoption. Hematological cancer centers and specialty clinics prioritize subcutaneous administration to enhance patient comfort. Pipeline expansion and FDA/EMA approvals boost market confidence. Clinical demand for targeted therapies continues to rise. Home-based administration programs also support growth. Pharmaceutical companies are investing in novel subcutaneous biologic formulations. Population aging and rising incidence rates further accelerate growth. Hospital and clinic adoption ensures consistent revenue expansion. Access programs in emerging markets improve penetration.

Subcutaneous Oncology Biologic Drug Market Regional Analysis

- North America dominated the subcutaneous oncology biologic drug market with the largest revenue share of 31.7% in 2025, driven by advanced healthcare infrastructure, high adoption of biologic therapies, strong oncology treatment programs, and the presence of leading pharmaceutical companies and specialty oncology centers

- Consumers in the region highly value the convenience, efficacy, and safety offered by subcutaneous biologic therapies, along with the ability to administer treatments in outpatient settings or at home under healthcare guidance. For instance, Roche’s subcutaneous trastuzumab and rituximab formulations have significantly reduced hospital infusion times, allowing both patients and medical facilities to optimize schedules and reduce costs

- This widespread adoption is further supported by high disposable incomes, technological awareness, and increasing patient preference for minimally invasive treatments. The integration of digital monitoring, homecare services, and telemedicine platforms is also encouraging self-administration and adherence, establishing subcutaneous biologics as a preferred treatment approach for both residential and clinical settings

U.S. Subcutaneous Oncology Biologic Drug Market Insight

The U.S. subcutaneous oncology biologic drug market captured the largest revenue share in 2025 within North America, fueled by the swift uptake of connected healthcare devices and expanding outpatient and homecare treatment programs. Patients are increasingly prioritizing the convenience of home administration, reduced hospital visits, and the ability to combine therapy with daily routines. For instance, Amgen’s subcutaneous multiple myeloma biologics and Bristol-Myers Squibb’s SC formulations allow faster administration with comparable efficacy to IV treatments, enhancing patient adherence and comfort. The growing preference for home-based oncology care, supported by insurance reimbursement and patient support programs, alongside robust adoption of remote monitoring technologies, is expected to drive further market expansion.

Europe Subcutaneous Oncology Biologic Drug Market Insight

The Europe subcutaneous oncology biologic drug market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of patient-centric treatment approaches and the rising need for efficient biologic administration in hospitals and outpatient clinics. The shift towards subcutaneous therapies reduces hospital burden, improves patient compliance, and allows for faster infusion processes. For instance, Roche’s Herceptin SC adoption in Europe has streamlined treatment schedules across oncology centers in France, Germany, and the U.K., providing operational efficiency and patient convenience. The region’s strong regulatory frameworks, increasing urbanization, and adoption of connected health devices are further promoting subcutaneous biologic therapy uptake, especially in homecare and outpatient oncology settings.

U.K. Subcutaneous Oncology Biologic Drug Market Insight

The U.K. subcutaneous oncology biologic drug market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by advanced healthcare infrastructure, high adoption of biologic therapies, and strong reimbursement policies. In addition, the increasing emphasis on patient convenience and reduced hospital stays is encouraging hospitals and clinics to adopt subcutaneous formulations. For instance, Roche and Pfizer have rolled out training programs for nurses and patients to administer biologics at home, ensuring safety and adherence. The country’s robust healthcare network, specialized oncology centers, and patient support initiatives continue to drive the adoption of SC biologics in breast cancer, lymphoma, and hematologic malignancies.

Germany Subcutaneous Oncology Biologic Drug Market Insight

The Germany subcutaneous oncology biologic drug market is expected to expand at a considerable CAGR during the forecast period, fueled by rising cancer incidence, increasing investment in oncology biologics, and the adoption of innovative patient-friendly delivery methods. The integration of subcutaneous biologics into both hospital and homecare treatment models allows patients to receive therapy more conveniently while maintaining high standards of care. For instance, German hospitals have incorporated SC rituximab and trastuzumab into day clinics, reducing infusion times and freeing up hospital resources. Emphasis on sustainability and minimally invasive therapies, combined with strong insurance coverage for biologics, further strengthens market growth.

Asia-Pacific Subcutaneous Oncology Biologic Drug Market Insight

The Asia-Pacific subcutaneous oncology biologic drug market is expected to be the fastest growing region during the forecast period, fueled by rising incidence of cancer, increasing investments in oncology biologics, growing preference for patient-centric therapies, and adoption of homecare and outpatient subcutaneous treatments. Rapid urbanization, expanding healthcare infrastructure, and rising disposable incomes are making SC biologics more accessible in countries such as China, Japan, and India. For instance, China has seen widespread adoption of subcutaneous trastuzumab and rituximab in both hospital and homecare settings, supported by government initiatives promoting cancer care accessibility. Increasing awareness among patients and healthcare providers about the advantages of SC administration, including reduced infusion time and enhanced convenience, is driving demand. Coupled with the emergence of local manufacturing and distribution channels, the affordability and accessibility of SC therapies are expanding across the region.

Japan Subcutaneous Oncology Biologic Drug Market Insight

The Japan subcutaneous oncology biologic drug market is gaining momentum due to high healthcare standards, rapid urbanization, and patient preference for convenient therapies. The adoption of SC biologics is supported by hospitals implementing outpatient infusion programs and homecare initiatives. For example, Japanese oncology clinics are actively introducing pre-filled syringe options for trastuzumab and rituximab to facilitate easier patient self-administration. The aging population and increased cancer prevalence further drive demand for therapies that minimize hospital visits while maintaining high efficacy and safety standards.

China Subcutaneous Oncology Biologic Drug Market Insight

The China subcutaneous oncology biologic drug market accounted for the largest market revenue share in Asia Pacific in 2025, driven by rapid urbanization, an expanding middle class, and high adoption rates of modern oncology therapies. Smart hospital infrastructure, government-led cancer care initiatives, and growing awareness of patient-friendly biologic therapies have promoted the uptake of SC administration. For instance, hospitals in Beijing and Shanghai are increasingly adopting SC trastuzumab and rituximab to improve patient throughput and reduce operational costs. The country’s domestic manufacturers and support programs are also expanding access to subcutaneous biologics in smaller cities and outpatient care, helping to further boost market penetration.

Subcutaneous Oncology Biologic Drug Market Share

The Subcutaneous Oncology Biologic Drug industry is primarily led by well-established companies, including:

- Roche Holding AG (Switzerland)

- Amgen Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Sanofi S.A. (France)

- Johnson & Johnson (U.S.)

- AbbVie Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- AstraZeneca plc (U.K.)

- Eli Lilly and Company (U.S.)

- Boehringer Ingelheim GmbH (Germany)

- Celltrion, Inc. (South Korea)

- Sandoz International GmbH (Switzerland)

Latest Developments in Global Subcutaneous Oncology Biologic Drug Market

- In August 2023, Roche announced global approvals for Tecentriq Hybreza, the first and only subcutaneous anti‑PD‑(L)1 cancer immunotherapy, enabling patients to receive the therapy in approximately seven minutes compared with traditional 30‑ to 60‑minute intravenous infusions. This subcutaneous formulation expanded administration options for patients with advanced cancers worldwide, underscoring the growing trend toward more convenient oncology biologic delivery formats

- In June 2025, Nanoform Finland Plc announced the development of nanotrastuzumab, a high‑concentration nanoformulation of trastuzumab suitable for subcutaneous injection, aimed at enabling high‑dose delivery under the skin rather than intravenously. This innovation highlights ongoing efforts to enhance subcutaneous formulations of established oncology biologics by improving drug concentration and patient experience

- In September 2025, the U.S. FDA approved Merck’s subcutaneous formulation of Keytruda, branded as Keytruda Qlex, enabling intravenous‑length cancer immunotherapy to be administered subcutaneously in as little as one to two minutes. This injectable version of one of the world’s top‑selling cancer immunotherapies is designed to improve patient convenience and clinical efficiency across multiple cancer indications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.