Global Submarine Cable Market

Market Size in USD Billion

CAGR :

%

USD

33.05 Billion

USD

59.39 Billion

2025

2033

USD

33.05 Billion

USD

59.39 Billion

2025

2033

| 2026 –2033 | |

| USD 33.05 Billion | |

| USD 59.39 Billion | |

|

|

|

|

Submarine Cable Market Size

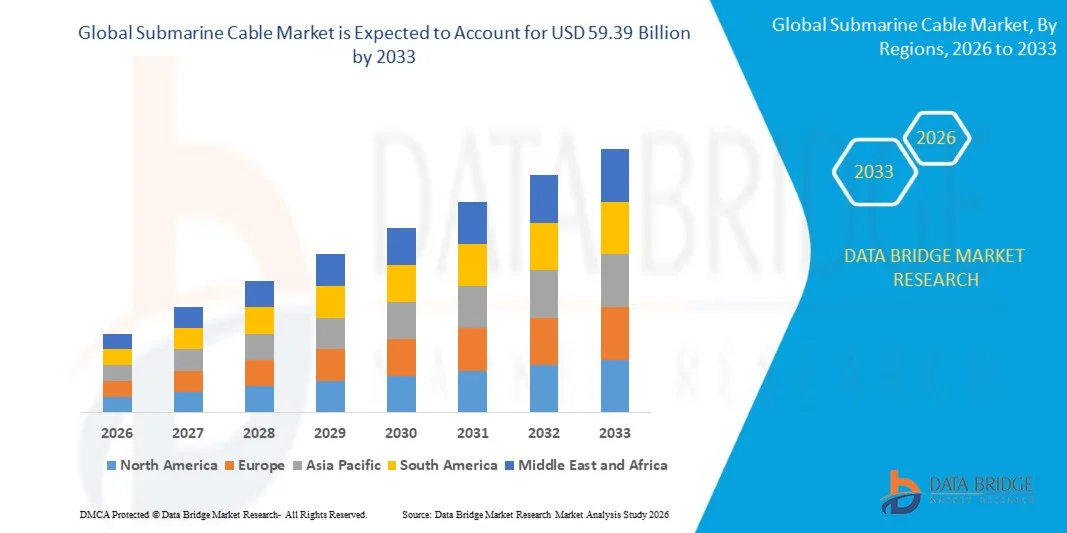

- The global submarine cable market size was valued at USD 33.05 billion in 2025 and is expected to reach USD 59.39 billion by 2033, at a CAGR of 7.60% during the forecast period

- The market growth is largely fueled by the rising demand for high-speed data transmission, increasing internet penetration, and the expansion of global communication networks, driving the deployment of advanced submarine cable infrastructure across continents

- Furthermore, the growth of offshore renewable energy projects, inter-country power transmission initiatives, and investments in regional connectivity solutions are establishing submarine cables as the backbone of international data and power networks. These converging factors are accelerating network expansion, thereby significantly boosting the submarine cable market

Submarine Cable Market Analysis

- Submarine cables, comprising fiber-optic communication lines and high-voltage power cables laid under the sea, are increasingly vital for enabling reliable, high-capacity data and electricity transmission across continents and regions due to their low-latency performance and high bandwidth capacity

- The escalating demand for submarine cables is primarily fueled by growing global internet traffic, expansion of cloud services and data centers, rising offshore wind power projects, and the need for resilient inter-country and inter-island connectivity to support economic and digital infrastructure growth

- Asia-Pacific dominated the submarine cable market with a share of 39.2% in 2025, due to increasing demand for high-capacity data transmission, rapid expansion of offshore wind power, and strong investments in inter-country and island connectivity projects

- North America is expected to be the fastest growing region in the submarine cable market during the forecast period due to demand for communication networks, offshore wind projects, and inter-country power transmission

- High voltage segment dominated the market with a market share of 67.1% in 2025, due to its extensive use in power transmission for offshore wind farms and inter-country electricity interconnections. High voltage cables provide the required capacity and stability for large-scale power transmission, ensuring minimal energy loss over long distances. Key players such as Prysmian Group and Nexans focus on developing high voltage solutions with improved insulation and thermal performance to withstand underwater conditions

Report Scope and Submarine Cable Market Segmentation

|

Attributes |

Submarine Cable Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Submarine Cable Market Trends

“Growing Demand for High-Capacity Global Connectivity”

- A significant trend in the submarine cable market is the rising demand for high-capacity, low-latency global connectivity, driven by the exponential growth of internet traffic, cloud computing, and digital services worldwide. This trend is elevating submarine cables as critical infrastructure for international data transfer and energy transmission across continents and regions

- For instance, SubCom and Prysmian Group are deploying advanced fiber-optic and power cables for transoceanic routes, supporting high-bandwidth data transfer for hyperscalers and telecom operators. These deployments enhance network reliability, reduce latency, and enable efficient cross-border connectivity

- The demand for resilient network infrastructure is increasing as enterprises and governments seek uninterrupted data flow for cloud services, financial transactions, and communication platforms. This is positioning submarine cables as essential enablers of global digital economies

- Offshore renewable energy expansion is complementing this trend, as subsea power cables are deployed to transmit electricity from wind farms and solar installations to mainland grids. Companies such as Nexans and ZTT provide high-voltage submarine cables that facilitate large-scale energy transmission over long distances

- Increasing reliance on remote working, e-commerce, and streaming services is further intensifying the need for international connectivity, requiring additional submarine cable capacity to meet latency and bandwidth expectations

- The market is witnessing growing collaboration among telecom operators, technology firms, and cable manufacturers to design next-generation subsea systems that integrate fiber-optic communication with power transmission capabilities, reinforcing the importance of submarine cables in supporting digital and energy infrastructures

Submarine Cable Market Dynamics

Driver

“Expansion of Offshore Energy and Cross-Border Power Projects”

- The growth of the submarine cable market is primarily driven by large-scale offshore renewable energy projects, inter-country power transmission initiatives, and regional connectivity programs that require durable, high-capacity subsea cables. These projects are creating substantial demand for advanced fiber-optic and high-voltage power cables

- For instance, the Dhivaru subsea cable system by Google connects the Maldives, Christmas Island, and Oman to support regional connectivity and cloud services, while Prysmian Group supplies high-voltage cables for European offshore wind projects. Such projects are accelerating network deployment and expanding capacity for critical digital and energy infrastructures

- Increasing investments in inter-country and inter-island connectivity, particularly across Asia-Pacific and Africa, are stimulating demand for submarine cable systems that enable seamless data exchange and stable electricity supply. These initiatives address bandwidth constraints and improve regional digital inclusion

- The rising adoption of cloud computing, hyperscale data centers, and 5G networks is also boosting the need for high-capacity subsea cables capable of handling enormous data volumes. This ensures that cross-border networks can support growing traffic loads efficiently

- The expanding demand for renewable energy transmission and reliable communication networks continues to reinforce this driver, positioning submarine cables as indispensable components for global infrastructure modernization

Restraint/Challenge

“High Cost and Complex Installation”

- The submarine cable market faces challenges due to the high capital expenditure and technical complexity involved in manufacturing, laying, and maintaining subsea cables. These factors increase project costs and can limit rapid market expansion

- For instance, SubCom and NEC Corporation undertake extensive marine surveys, specialized vessel deployment, and precise cable-laying operations to install long-distance subsea systems. These procedures require advanced engineering, skilled personnel, and substantial investment

- Installation in deep-sea environments and challenging seabed conditions further complicates deployment, increasing project timelines and risk exposure. Cable systems must be designed to withstand high pressure, currents, and potential mechanical hazards

- The reliance on rare materials, precision components, and specialized equipment adds to the cost and complexity of production, affecting pricing and supply chain stability. Manufacturers face ongoing pressure to balance durability, capacity, and economic feasibility

- Scaling subsea cable projects while maintaining quality, reliability, and regulatory compliance remains a significant challenge. These constraints collectively influence market growth, emphasizing the need for technological innovation and strategic project planning

Submarine Cable Market Scope

The market is segmented on the basis of component, type, configuration, voltage, offering, application, and end-users.

• By Component

On the basis of component, the submarine cable market is segmented into dry plant products and wet plant products. The wet plant products segment dominated the market with the largest revenue share in 2025, driven by the critical role of submerged cables, repeaters, and joints in ensuring long-distance signal transmission under harsh underwater conditions. Wet plant products are essential for maintaining signal integrity and minimizing data loss over transoceanic distances, which is crucial for global communication networks. Key market players such as SubCom and Prysmian Group emphasize durable wet plant components with advanced insulation and protective measures to withstand deep-sea pressure and corrosion. The growing demand for high-capacity, low-latency data transmission supports continued investments in wet plant product development. In addition, technological advancements in fiber optic wet plant components are improving performance and reliability across extensive submarine cable networks.

The dry plant products segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising need for terminal equipment, power feeding, and monitoring systems that support the efficient operation of submarine networks. For instance, NEC Corporation has been expanding its dry plant product offerings to enhance network monitoring, ensuring seamless integration with wet plant infrastructure. The adoption of sophisticated dry plant solutions helps operators optimize maintenance, manage power supply efficiently, and reduce downtime across network lifecycles.

• By Type

On the basis of type, the submarine cable market is segmented into unarmored cable and armored cable. The armored cable segment held the largest market revenue share in 2025, driven by its robust protection against mechanical damage, fishing activities, and underwater currents. Armored cables are particularly preferred for deep-sea deployments and areas with high external threats, ensuring uninterrupted data and power transmission. Key companies such as Nexans and Prysmian Group focus on designing armored cables with high tensile strength and enhanced shielding for extended durability. The market demand for armored cables is also supported by offshore energy projects and intercontinental communication networks, where reliability is critical. In addition, armored cables are increasingly integrated with fiber optic technology to meet the growing bandwidth requirements of international communication networks.

The unarmored cable segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by shallow-water deployments and cost-effective installation requirements for short-distance connections. For instance, SubCom has deployed unarmored cables in regional and island networks where reduced protection requirements allow for faster installation and lower overall project costs. The lighter structure and flexibility of unarmored cables make them ideal for rapid deployment in less hazardous marine environments.

• By Configuration

On the basis of configuration, the submarine cable market is segmented into submerged plant, beach manhole, shore section, land sections, terminal station, and terminal station equipment. The submerged plant segment dominated the market in 2025, owing to its pivotal role in laying and maintaining cables across ocean floors and ensuring stable communication links between continents. Submerged plant configurations include fiber optic and power cables, repeaters, and branching units that collectively enhance long-distance transmission efficiency. Companies such as NEC Corporation and TE Connectivity invest heavily in submerged plant technologies to improve durability and signal quality across challenging seabed conditions. The increasing deployment of high-capacity submarine cables to support global data traffic contributes to the sustained dominance of submerged plant configurations. Advanced monitoring and maintenance solutions further strengthen the reliability of submerged plants, minimizing disruptions in transoceanic communication.

The terminal station segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the growing deployment of sophisticated landing stations that facilitate high-speed data transfer and network management. For instance, Alcatel Submarine Networks has developed advanced terminal station equipment with integrated monitoring and power management systems, enabling seamless connectivity for inter-country and island connections. The rising digitalization of communication networks and offshore energy projects fuels demand for modern terminal station configurations.

• By Voltage

On the basis of voltage, the submarine cable market is segmented into medium voltage, high voltage, and extra high voltage. The high voltage segment held the largest market revenue share of 67.1% in 2025, driven by its extensive use in power transmission for offshore wind farms and inter-country electricity interconnections. High voltage cables provide the required capacity and stability for large-scale power transmission, ensuring minimal energy loss over long distances. Key players such as Prysmian Group and Nexans focus on developing high voltage solutions with improved insulation and thermal performance to withstand underwater conditions. The growing global emphasis on renewable energy integration and intercontinental grid connectivity reinforces the demand for high voltage submarine cables. Advanced technologies in high voltage cable manufacturing enhance safety, reduce maintenance requirements, and increase operational efficiency across submarine power networks.

The extra high voltage segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by the rising investments in offshore wind power generation and large-scale inter-country power projects. For instance, Nexans has been developing extra high voltage submarine cables for projects connecting European offshore wind farms to national grids, supporting large-scale renewable energy integration. The demand for extra high voltage cables continues to increase due to their ability to transmit higher loads with lower losses across long distances.

• By Offering

On the basis of offering, the submarine cable market is segmented into installation and commissioning, maintenance, and upgrades. The installation and commissioning segment dominated the market in 2025, fueled by the growing number of submarine cable projects for communication and power transmission. Installation involves precise cable laying, jointing, and testing, which are critical to ensuring the long-term reliability of submarine networks. Companies such as SubCom and TE Connectivity provide comprehensive installation services, employing advanced vessels and technologies to optimize cable placement and reduce deployment risks. The increasing demand for global connectivity and energy transmission underscores the significance of installation services in supporting uninterrupted operations. Modern installation practices enhance operational efficiency while minimizing environmental impact and system failures during initial deployment.

The maintenance segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the necessity for regular inspection, repair, and performance optimization of submarine cable networks. For instance, Prysmian Group offers predictive maintenance solutions that help monitor cable health, preventing unexpected downtimes and improving overall network reliability. The growing complexity of submarine networks and expansion into deep-sea and offshore locations increases the need for robust maintenance services.

• By Application

On the basis of application, the submarine cable market is segmented into communication cables and power cables. The communication cables segment dominated the market in 2025, owing to the escalating global data traffic and dependence on transoceanic fiber optic networks for internet, cloud, and financial services. Communication cables form the backbone of global connectivity, supporting high-speed, low-latency data transfer across continents. Companies such as SubCom, Alcatel Submarine Networks, and TE Connectivity focus on enhancing the bandwidth and durability of communication cables to meet rising demand. The expansion of data centers and digital services worldwide further strengthens the dominance of communication cable applications. Advanced fiber optic technologies improve transmission quality, reliability, and the ability to accommodate future data traffic growth.

The power cables segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by the increasing adoption of offshore wind power, inter-country electricity interconnections, and offshore oil and gas power supply requirements. For instance, Nexans has deployed high-capacity submarine power cables for offshore wind projects connecting North Sea wind farms to national grids. The demand for power cables continues to rise with the global focus on renewable energy and sustainable power transmission solutions.

• By End Users

On the basis of end users, the submarine cable market is segmented into offshore wind power generation, inter-country and island connection, and offshore oil and gas. The inter-country and island connection segment dominated the market in 2025, driven by the need for stable communication and electricity supply between geographically separated regions. These projects require long-distance submarine cable networks to facilitate data transfer and power distribution, ensuring regional connectivity. Companies such as SubCom and NEC Corporation specialize in designing and implementing reliable inter-country and island connection solutions to handle high-capacity traffic and power demands. The increasing reliance on digital infrastructure, cloud services, and renewable energy integration contributes to the segment’s market leadership. In addition, technological advancements in cable durability and signal integrity strengthen the operational efficiency of these interconnections.

The offshore wind power generation segment is expected to witness the fastest growth rate from 2026 to 2033, driven by large-scale deployment of offshore wind farms in Europe, Asia-Pacific, and North America. For instance, Prysmian Group has supplied submarine cables for several North Sea offshore wind projects, facilitating efficient power transmission from turbines to onshore grids. The rising global focus on renewable energy generation and carbon reduction targets supports sustained growth in the offshore wind end-user segment.

Submarine Cable Market Regional Analysis

- Asia-Pacific dominated the submarine cable market with the largest revenue share of 39.2% in 2025, driven by increasing demand for high-capacity data transmission, rapid expansion of offshore wind power, and strong investments in inter-country and island connectivity projects

- The region’s cost-effective manufacturing landscape, growing infrastructure investments, and supportive government policies are accelerating submarine cable deployment

- The availability of skilled labor, technological advancements in cable laying and maintenance, and rapid industrialization across developing economies are contributing to increased adoption of submarine cables for both communication and power transmission

China Submarine Cable Market Insight

China held the largest share in the Asia-Pacific submarine cable market in 2025, owing to its extensive manufacturing capabilities, active participation in global data network projects, and strong offshore renewable energy development. The country’s industrial base, investment in fiber optic technology, and government support for infrastructure expansion are key growth drivers, and rising exports of submarine cables and components, along with inter-country connectivity initiatives, are further strengthening market growth.

India Submarine Cable Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing digitalization, expansion of broadband networks, and rising offshore energy projects. Government initiatives such as “Digital India” and renewable energy programs are supporting market expansion, while rising investments in telecom, IT, and inter-island connectivity projects, coupled with strategic partnerships with global cable manufacturers, are contributing to robust growth in the submarine cable sector.

Europe Submarine Cable Market Insight

The Europe submarine cable market is expanding steadily, supported by growing demand for transcontinental communication networks and offshore wind power transmission. Emphasis on sustainable, high-reliability cable solutions, along with increasing investments in renewable energy, inter-country grid connectivity, and advanced fiber optic networks, is enhancing market growth across the region.

Germany Submarine Cable Market Insight

Germany’s submarine cable market is driven by leadership in offshore wind projects, strong engineering expertise, and a mature renewable energy sector. Extensive R&D networks and partnerships between academic institutions and cable manufacturers foster innovation, and high demand for high-voltage power cables and advanced fiber optic communication cables connecting domestic and international grids supports continued growth.

U.K. Submarine Cable Market Insight

The U.K. market is supported by expansion of offshore energy projects, investments in inter-island connectivity, and increasing reliance on digital infrastructure. Growing R&D initiatives, collaboration between telecom operators and cable manufacturers, and regulatory support for sustainable energy transmission and modernized communication networks are contributing to market expansion.

North America Submarine Cable Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by demand for communication networks, offshore wind projects, and inter-country power transmission. Investments in advanced fiber optic technology, grid modernization, and high-voltage power cables, along with collaborations between telecom companies, renewable energy developers, and cable manufacturers, are supporting rapid market growth.

U.S. Submarine Cable Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by robust broadband infrastructure, strong offshore wind development, and advanced R&D in submarine cable technology. Focus on reliable communication networks, sustainable energy transmission, and regulatory compliance, combined with presence of major players and well-established installation and maintenance services, solidifies the U.S.’s leading position in the region.

Submarine Cable Market Share

The submarine cable industry is primarily led by well-established companies, including:

- TE Connectivity (U.S.)

- NEC Corporation (Japan)

- Huawei Marine Networks Co. Ltd. (China)

- Saudi Ericsson (Saudi Arabia)

- Prysmian Group (Italy)

- Nexans (France)

- ZTT Group (China)

- SubCom (U.S.)

- HENGTONG GROUP CO. LTD. (China)

- NKT A/S (Denmark)

- Sumitomo Electric Industries Ltd. (Japan)

- Corning Incorporated (U.S.)

- TFKable (Germany)

- FUJITSU (Japan)

- Hellenic Cables S.A. (Greece)

- The Okonite Company (U.S.)

- Apar Industries Ltd. (India)

- AFL (U.S.)

- Hexatronic (Sweden)

Latest Developments in Global Submarine Cable Market

- In January 2026, SUBCO unveiled plans for APX East, a next‑generation submarine cable project that will create the longest continuous subsea optical path connecting Australia and the U.S., aiming to meet growing demand for high‑capacity connectivity driven by AI and cloud services. The proposed APX East cable will feature a 16‑fiber pair system providing direct connectivity without intermediate landings, significantly reducing latency and enhancing network resilience for hyperscalers, neoclouds, and carriers. This development highlights the increasing importance of bespoke submarine infrastructure for digital economies and reinforces Australia’s strategy to strengthen sovereign connectivity links with major global markets, while addressing escalating data traffic demands and futureproofing international bandwidth capacity

- In December 2025, Vietnam commissioned the Asia Direct Cable (ADC), the largest‑capacity submarine fiber‑optic cable system in the country, boosting its international connectivity with a 50 Tbps capacity that exceeds previous national links. The ADC project connects multiple Asian telecom operators and significantly enhances Vietnam’s digital backbone by supporting high‑speed data transmission for cloud services, broadband, and enterprise applications. This milestone strengthens regional network resilience, reduces latency for international traffic, and positions Vietnam as a key node in the expanding Asia‑Pacific subsea cable ecosystem, accelerating economic digitization and global data exchange

- In November 2025, Australia announced funding for a second international submarine telecommunications cable for the Solomon Islands, known as the Adamasia Cable System 1, as part of a partnership with the Solomon Islands Government and the Australian Infrastructure Financing Facility for the Pacific. The 1,015‑kilometre cable will connect to Google’s Bulikula system, offering more resilient and diverse international connectivity that enhances digital access, economic opportunities, and social development for the Pacific island nation. This initiative underscores the role of targeted infrastructure investment in expanding inclusive digital networks across underserved regions and supports broader regional stability and growth by strengthening critical network redundancy and capacity

- In November 2025, China Mobile advanced major submarine cable investments, reinforcing its role in global digital connectivity through expansion and upgrades to the 2Africa and SEA‑H2X subsea cable systems. These developments aim to boost capacity and network reach across multiple continents, allowing smoother, higher‑bandwidth data flows and supporting the backbone of international internet traffic. China Mobile’s progress signals intensifying competition among regional operators to capture rising demand for bandwidth and connectivity infrastructure, particularly as emerging digital economies expand their reliance on robust international cable systems

- In October 2025, the Medusa subsea cable system secured a new landing agreement in Syria, extending its route across the Mediterranean to strengthen connectivity between Europe, the Middle East, and Asia. This expansion is set to enhance route diversity, reduce latency, and support growing digital services demand across adjacent regions by linking multiple national networks through a resilient east‑west submarine corridor. The Medusa project’s progress illustrates continued investment in regional subsea infrastructure to meet mounting bandwidth requirements and to foster economic integration through improved digital interconnectivity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Submarine Cable Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Submarine Cable Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Submarine Cable Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.