Global Subscription Free Internet Protocol Television Market

Market Size in USD Billion

CAGR :

%

USD

50.13 Billion

USD

97.79 Billion

2024

2032

USD

50.13 Billion

USD

97.79 Billion

2024

2032

| 2025 –2032 | |

| USD 50.13 Billion | |

| USD 97.79 Billion | |

|

|

|

|

Subscription Free Internet Protocol Television Market Size

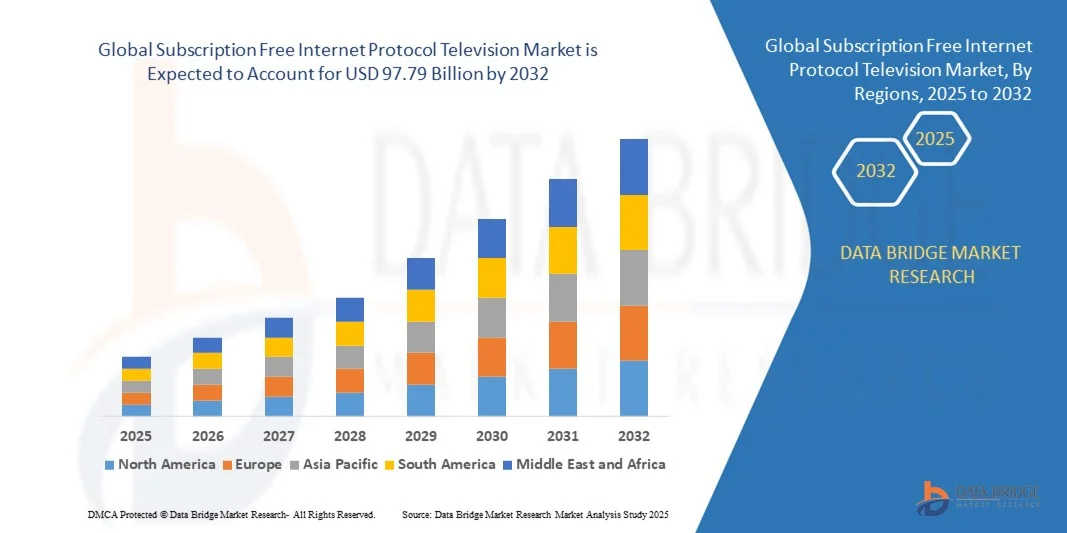

- The global subscription free internet protocol television market size was valued at USD 50.13 billion in 2024 and is expected to reach USD 97.79 billion by 2032, at a CAGR of 8.71% during the forecast period

- The market growth is largely fuelled by the rising demand for cost-effective and flexible television services, increasing internet penetration, and the proliferation of smart devices that support IPTV streaming

- The expansion of broadband infrastructure, coupled with consumer preference for on-demand content and cord-cutting trends, is further driving market adoption

Subscription Free Internet Protocol Television Market Analysis

- The subscription free IPTV market is witnessing a shift toward OTT-based streaming platforms, allowing users to access content without traditional cable or satellite subscriptions

- Technological advancements, such as adaptive streaming, cloud-based delivery, and interactive features, are enhancing the viewing experience and encouraging wider adoption

- North America dominated the subscription free internet protocol television market with the largest revenue share in 2024, driven by increasing demand for free and on-demand digital content, rising broadband penetration, and growing adoption of smart TVs and connected devices

- Asia-Pacific region is expected to witness the highest growth rate in the global subscription free internet protocol television market, driven by rapid urbanization, increasing disposable incomes, expanding smart device penetration, and government initiatives promoting digitalization

- The live segment held the largest market revenue share in 2024, driven by real-time content streaming demand for news, sports, and events. Live IPTV services offer instant access and engagement, making them highly preferred for residential and commercial users

Report Scope and Subscription Free Internet Protocol Television Market Segmentation

|

Attributes |

Subscription Free Internet Protocol Television Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Subscription Free Internet Protocol Television Market Trends

Increasing Adoption of Free and OTT-Based Streaming Services

- The growing shift toward subscription-free IPTV and OTT-based streaming is transforming the television and media landscape by enabling real-time, on-demand content access. The convenience and flexibility of these platforms allow users to bypass traditional cable or satellite subscriptions, improving viewing options and reducing costs. Integration with smart TVs, mobile devices, and interactive interfaces further enhances user engagement and viewing satisfaction

- Rising demand for ad-supported and free-to-access content in emerging and under-served regions is accelerating the deployment of subscription-free IPTV platforms. These solutions are particularly valuable for mobile users, smart TV owners, and households seeking flexible entertainment options without monthly fees. In addition, regional content customization and multi-language support are driving adoption among diverse audiences

- The affordability and wide device compatibility of modern IPTV platforms are making them increasingly attractive for both consumers and service providers. Providers can deploy content across smartphones, smart TVs, and set-top boxes, improving accessibility, user engagement, and audience reach. Cloud-based infrastructure and adaptive streaming technologies also enhance platform reliability and scalability

- For instance, in 2023, several media providers in Europe and Asia reported significant increases in viewership and user retention after offering subscription-free IPTV services with localized content and interactive features. These initiatives also resulted in higher advertising revenue and strengthened brand loyalty among end-users. The success of such implementations encourages further expansion into untapped markets

- While subscription-free IPTV services are driving widespread content access, their success depends on continued innovation in streaming technology, ad monetization, and user interface design. Providers must focus on scalable, secure, and high-quality streaming solutions to fully capitalize on growing demand. Partnerships with content creators and technology vendors are also critical to maintaining competitive advantage

Subscription Free Internet Protocol Television Market Dynamics

Driver

Rising Internet Penetration And Growing Demand For Free Digital Content

- The rapid expansion of broadband and mobile internet connectivity is driving the adoption of subscription-free IPTV services across residential, commercial, and public sectors. Reliable internet access enables seamless streaming and improved viewing experiences. In addition, 5G deployment and fiber-optic networks are supporting higher resolution content and low-latency delivery

- Increasing consumer preference for free-to-access and ad-supported content is encouraging service providers to offer subscription-free platforms. This trend supports cord-cutting, allowing users to consume content on-demand without long-term commitments. Consumers are also seeking multi-device flexibility, which further enhances the market potential

- OTT platform providers and technology partners are offering integrated IPTV solutions, including cloud-based delivery and multi-device support, which simplify deployment and enhance user experience. This trend is fostering wider adoption in both urban and rural markets. Advanced analytics and AI-driven recommendations are also improving content personalization and retention

- For instance, in 2022, several telecom operators in North America and Europe integrated subscription-free IPTV services with existing broadband packages, boosting customer engagement and expanding market penetration. These initiatives helped providers capture new demographics while strengthening existing subscriber bases. Strategic collaborations with content networks further improved offerings

- While internet penetration and demand for free content are driving market growth, ensuring platform stability, high-quality streaming, and effective content monetization remains critical for sustained adoption. Addressing cybersecurity and data privacy concerns is also essential to maintain consumer trust and regulatory compliance

Restraint/Challenge

Content Licensing Issues And Technical Infrastructure Limitations

- The complexity of acquiring content rights and licensing agreements for free IPTV platforms limits the availability of premium content. Providers often face legal and contractual challenges that can hinder service offerings. In addition, regional copyright laws and restrictions increase the complexity of content distribution globally

- In many regions, inadequate network infrastructure and low internet speeds restrict access to high-quality streaming services. Poor connectivity can result in buffering, latency, and reduced user satisfaction, impacting adoption rates. Network congestion and peak-hour traffic further exacerbate streaming performance issues

- Integration with diverse devices, including smart TVs, mobile devices, and set-top boxes, requires significant technical expertise. Ensuring compatibility, security, and seamless user interfaces adds operational complexity for service providers. Continuous firmware updates and device certifications are necessary to maintain quality standards

- For instance, in 2023, several IPTV providers in Asia-Pacific experienced delays in platform rollouts due to licensing disputes and insufficient broadband infrastructure in remote areas. These challenges also impacted revenue projections and delayed market expansion strategies. Provider investments in regional infrastructure upgrades are ongoing to mitigate such issues

- While technological solutions continue to advance, addressing content licensing and infrastructure challenges is essential. Stakeholders must focus on scalable platforms, adaptive streaming technologies, and localized content strategies to unlock the full potential of the subscription-free IPTV market. Collaboration with telecom operators, regulators, and content creators is vital to overcome these barriers effectively

Subscription Free Internet Protocol Television Market Scope

The subscription free internet protocol television market is segmented on the basis of model type, service type, transmission method, component, application, and end user.

- By Model Type

On the basis of model type, the market is segmented into live and on-demand. The live segment held the largest market revenue share in 2024, driven by real-time content streaming demand for news, sports, and events. Live IPTV services offer instant access and engagement, making them highly preferred for residential and commercial users.

The on-demand segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing consumption of personalized content at the user’s convenience. On-demand services are particularly popular for their flexibility, ability to cater to diverse content preferences, and integration with mobile and smart TV platforms.

- By Service Type

On the basis of service type, the market is segmented into managed services and in-house service. The managed services segment held the largest market revenue share in 2024, driven by seamless deployment, maintenance, and technical support provided by service providers. Managed IPTV solutions offer enhanced reliability and convenience, making them highly preferred for both residential and enterprise users.

The in-house service segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of proprietary IPTV solutions by enterprises and content providers. In-house services are particularly popular for their customization capabilities, better control over content delivery, and integration with internal IT infrastructure.

- By Transmission Method

On the basis of transmission method, the market is segmented into wired transmission and wireless transmission. The wired transmission segment held the largest market revenue share in 2024, driven by stable bandwidth, reliable data delivery, and low latency for large-scale deployments. Wired IPTV services are widely adopted in residential complexes and commercial setups for uninterrupted content streaming.

The wireless transmission segment is expected to witness the fastest growth rate from 2025 to 2032, driven by mobility, flexible installation, and rising use of smartphones, tablets, and smart TVs. Wireless IPTV services are particularly preferred for remote access, convenience, and ease of integration across multiple devices.

- By Component

On the basis of component, the market is segmented into video on demand (VoD) software, set-top box, access system, video head-end encoder system, and digital rights management system. The set-top box segment held the largest market revenue share in 2024, driven by its role in connecting traditional TVs with IPTV platforms and simplifying content access. Set-top boxes are widely used in households and commercial establishments for seamless media delivery.

The VoD software segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for personalized and interactive content. VoD solutions are particularly attractive due to their flexibility, scalability, and ability to enhance user engagement across multiple devices.

- By Application

On the basis of application, the market is segmented into gaming, online store, media and entertainment, healthcare and medicines, and others. The media and entertainment segment held the largest market revenue share in 2024, driven by increasing consumption of movies, TV shows, live sports, and digital broadcasts. This segment is highly preferred by households and commercial establishments for entertainment and content streaming.

The gaming segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising popularity of cloud gaming, e-sports, and interactive entertainment requiring low-latency streaming. Gaming IPTV solutions are particularly favored for their real-time content delivery and immersive user experience.

- By End User

On the basis of end user, the market is segmented into residential use, small and medium-sized enterprise, and large enterprise. The residential use segment held the largest market revenue share in 2024, driven by growing adoption of smart TVs, mobile devices, and home entertainment systems. Residential IPTV services are highly preferred for on-demand content, convenience, and multi-device support.

The small and medium-sized enterprise segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing deployment of IPTV solutions for corporate communications, training, and customer engagement. SME users particularly value cost-effective, scalable, and customizable IPTV platforms for business operations.

Subscription Free Internet Protocol Television Market Regional Analysis

- North America dominated the subscription free internet protocol television market with the largest revenue share in 2024, driven by increasing demand for free and on-demand digital content, rising broadband penetration, and growing adoption of smart TVs and connected devices

- Consumers in the region highly value the convenience, flexibility, and cost savings offered by subscription-free IPTV services, enabling access to news, entertainment, and live events without monthly fees

- This widespread adoption is further supported by high disposable incomes, technologically savvy populations, and the growing preference for OTT-based streaming solutions, establishing subscription-free IPTV as a preferred entertainment option for both residential and commercial users

U.S. Subscription Free IPTV Market Insight

The U.S. subscription free IPTV market captured the largest revenue share in 2024 within North America, fueled by the rapid uptake of smart TVs, mobile devices, and high-speed internet services. Consumers are increasingly prioritizing flexible, ad-supported streaming platforms that offer live and on-demand content. The growing preference for personalized viewing, combined with integration with OTT platforms and multi-device support, further propels market growth. Moreover, rising investments by telecom operators in IPTV infrastructure and cloud-based streaming solutions are significantly contributing to the market’s expansion.

Europe Subscription Free IPTV Market Insight

The Europe subscription free IPTV market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by increasing urbanization, expanding broadband networks, and rising adoption of OTT and ad-supported streaming services. The region’s consumers are drawn to cost-effective content delivery models that enable access to live sports, news, and entertainment. Europe is experiencing significant growth across residential, commercial, and hospitality sectors, with subscription-free IPTV being integrated into new installations and retrofit projects.

U.K. Subscription Free IPTV Market Insight

The U.K. subscription free IPTV market is expected to witness rapid growth from 2025 to 2032, fueled by rising demand for flexible entertainment options, increased awareness of OTT services, and preference for cost-effective streaming solutions. Consumers are choosing subscription-free platforms to avoid high cable fees and access live and on-demand content conveniently. The strong e-commerce and telecom infrastructure in the U.K., alongside growing adoption of smart devices, supports expanding market penetration.

Germany Subscription Free IPTV Market Insight

The Germany subscription free IPTV market is expected to witness significant growth from 2025 to 2032, driven by high broadband penetration, digital literacy, and demand for on-demand streaming services. Consumers prefer subscription-free IPTV platforms for their ease of access, personalized content options, and compatibility with smart TVs and mobile devices. Germany’s emphasis on innovation and smart home integration encourages wider adoption across residential and commercial applications, including hotels and corporate offices.

Asia-Pacific Subscription Free IPTV Market Insight

The Asia-Pacific subscription free IPTV market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and expanding high-speed internet connectivity in countries such as China, Japan, and India. The region’s growing smart device penetration and government initiatives supporting digital media consumption are boosting adoption. In addition, APAC’s role as a manufacturing hub for IPTV devices and components enhances affordability and accessibility, expanding the consumer base.

Japan Subscription Free IPTV Market Insight

The Japan subscription free IPTV market is expected to witness rapid growth from 2025 to 2032, fueled by the country’s tech-savvy population, high broadband penetration, and preference for on-demand and live streaming services. Japanese consumers are prioritizing convenience, personalization, and seamless integration with smart TVs and mobile devices. Furthermore, the aging population and increasing number of connected homes are driving demand for easy-to-use, ad-supported IPTV platforms across residential and commercial sectors.

China Subscription Free IPTV Market Insight

The China subscription free IPTV market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, expanding middle class, and high digital adoption rates. China stands as one of the largest markets for OTT and IPTV services, with consumers preferring subscription-free platforms for live news, sports, and entertainment. The push towards smart cities, government support for digital media, and availability of affordable IPTV solutions from domestic providers are key factors driving market expansion across residential, commercial, and hospitality segment.

Subscription Free Internet Protocol Television Market Share

The Subscription Free Internet Protocol Television industry is primarily led by well-established companies, including:

• Akamai Technologies (U.S.)

• AT&T Intellectual Property (U.S.)

• Roku, Inc. (U.S.)

• stl.tech (U.K.)

• Triple Play Interactive Network Pvt. Ltd. (U.S.)

• Nevron d.o.o. (U.K.)

• UTStarcom Incorporated (U.S.)

• ALE International (U.K.)

• Cisco Systems Inc. (U.S.)

• Limelight Networks (U.S.)

• Multivirt India Pvt Ltd. (U.K.)

• Etisalat (U.A.E.)

• Infomir Group (U.K.)

• Verizon (U.S.)

• CenturyLink (U.S.)

• Deutsche Telekom AG (Germany)

• ZTE Corporation (China)

• Verimatrix (U.K.)

• Foxtel (Australia)

• MatrixStream Technologies, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.