Global Subsea Control Systems Market

Market Size in USD Billion

CAGR :

%

USD

3.47 Billion

USD

6.97 Billion

2025

2033

USD

3.47 Billion

USD

6.97 Billion

2025

2033

| 2026 –2033 | |

| USD 3.47 Billion | |

| USD 6.97 Billion | |

|

|

|

|

Subsea Control Systems Market Size

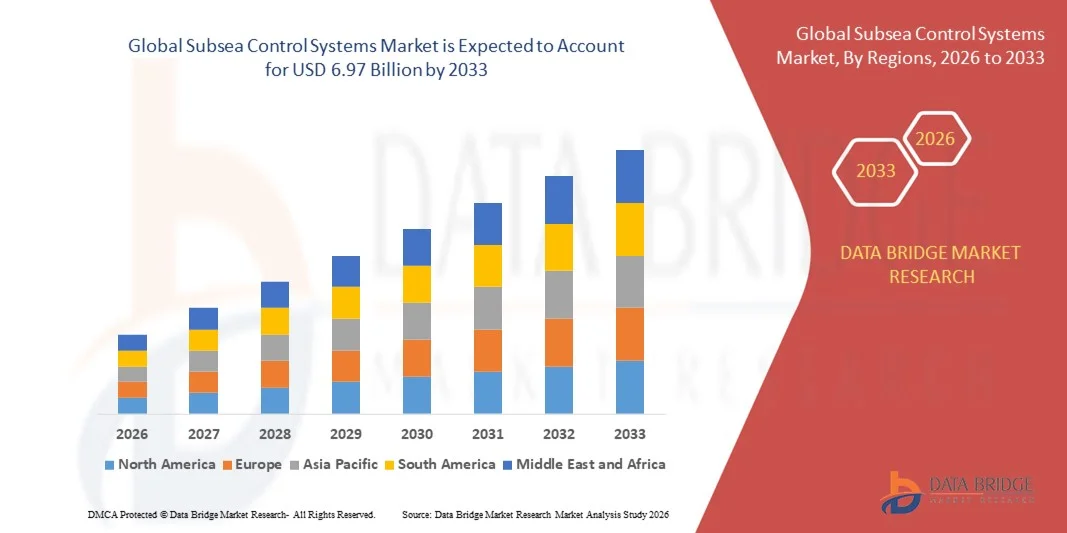

- The global subsea control systems market size was valued at USD 3.47 billion in 2025 and is expected to reach USD 6.97 billion by 2033, at a CAGR of 9.09% during the forecast period

- The market growth is largely fuelled by the rising demand for offshore oil and gas production, driven by increasing global energy consumption and depletion of onshore reserves

- Technological advancements in deepwater and ultra-deepwater exploration are further propelling the adoption of advanced subsea control systems that enhance operational safety and production efficiency

Subsea Control Systems Market Analysis

- The market is witnessing significant growth due to increased investment in offshore exploration and production activities by major oil companies

- Growing focus on digitalization, remote monitoring, and real-time data analytics in subsea operations is also accelerating the deployment of intelligent control systems across subsea infrastructure

- North America dominated the subsea control systems market with the largest revenue share of 37.85% in 2025, driven by extensive offshore oil and gas exploration projects and the growing adoption of advanced subsea technologies across deepwater fields. The region’s established energy infrastructure and focus on operational efficiency have positioned it as a leading hub for subsea innovations

- Asia-Pacific region is expected to witness the highest growth rate in the global subsea control systems market, driven by expanding offshore infrastructure, rising oil & gas exploration activities, and growing investments from regional energy companies

- The Underwater segment held the largest market revenue share in 2025, driven by the increasing demand for deepwater and ultra-deepwater exploration activities that require robust underwater control and monitoring solutions. The growing complexity of offshore operations and the need for real-time communication between subsea equipment and topside facilities have further accelerated the adoption of advanced underwater control units

Report Scope and Subsea Control Systems Market Segmentation

|

Attributes |

Subsea Control Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Subsea Control Systems Market Trends

Rise Of Digitalization And Remote Monitoring In Subsea Operations

- The increasing integration of digital technologies such as IoT, AI, and data analytics is revolutionizing subsea control systems by enabling real-time performance monitoring and predictive maintenance. These technologies enhance the efficiency, reliability, and safety of subsea equipment, reducing downtime and operational costs. The trend is particularly strong in offshore oil and gas projects focusing on optimizing production in challenging environments where human intervention is limited and costly

- The growing use of digital twins and cloud-based control systems allows operators to simulate subsea infrastructure performance under varying conditions. This aids in early fault detection and remote troubleshooting, minimizing the need for costly underwater interventions. Digital twins also facilitate performance benchmarking and maintenance planning, helping operators reduce energy consumption and extend equipment lifespan

- The adoption of remote monitoring solutions is improving data transparency and decision-making for operators managing multiple offshore fields. By leveraging real-time analytics, companies can identify potential system failures before they occur, ensuring continuous operations and maximizing asset lifespan. This approach enables faster response times, lowers operational risk, and supports more sustainable offshore production practices

- For instance, in 2024, several offshore operators in the North Sea implemented AI-based remote control platforms that helped reduce maintenance-related downtime by over 20%. These systems provided live performance insights, allowing for proactive equipment management and increased production efficiency. The deployment of such digital tools has also improved collaboration between offshore and onshore teams, streamlining operational workflows

- While digitalization offers major operational benefits, its full potential depends on robust cybersecurity frameworks, skilled workforce training, and continued investment in communication infrastructure to support remote offshore connectivity. Addressing these gaps will be crucial for achieving safe, efficient, and scalable subsea automation systems in the long term

Subsea Control Systems Market Dynamics

Driver

Increasing Deepwater And Ultra-Deepwater Exploration Activities

- The rising focus on deepwater and ultra-deepwater oil and gas exploration is significantly driving demand for advanced subsea control systems. These systems play a vital role in managing subsea production and ensuring efficient operation under high-pressure, extreme-depth environments. The expanding number of deepwater projects, particularly in regions such as the Gulf of Mexico, Brazil, and West Africa, continues to boost market growth and encourage technological innovation

- Oil and gas companies are investing in advanced control and monitoring technologies to enhance safety, improve flow assurance, and optimize production efficiency. With depleting shallow-water reserves, exploration activities are shifting toward more complex subsea environments that require reliable and durable control systems. This shift is also driving collaborations among operators, suppliers, and research institutions to develop high-performance subsea architectures

- Governments and energy companies are increasing investments in offshore infrastructure, supported by favorable regulatory frameworks and incentives. This has resulted in rising adoption of next-generation subsea control units capable of supporting longer tie-backs and higher data transmission speeds. The increased focus on sustainable offshore production is further accelerating innovation in digital and hybrid control systems

- For instance, in 2023, a major offshore development in Brazil adopted a digital subsea control architecture to improve system response time and ensure better communication between subsea equipment and surface facilities. This move enhanced overall field productivity and reduced operational risks, setting a precedent for future deepwater projects

- As deepwater projects expand globally, subsea control systems are becoming essential for ensuring efficiency, safety, and sustainability, positioning them as a critical component of future offshore energy production. Continuous advancements in digitalization, automation, and material engineering are expected to further support the market’s evolution over the next decade

Restraint/Challenge

High Installation And Maintenance Costs Of Subsea Control Systems

- The high cost of installation, maintenance, and repair of subsea control systems remains a major restraint for the market. Deploying complex control units in deepwater environments requires advanced technology, specialized vessels, and skilled personnel, all of which contribute to elevated project expenses. These costs often limit adoption in smaller or marginal fields where return on investment is uncertain

- Maintenance of subsea infrastructure presents significant challenges due to the harsh underwater environment, corrosion risks, and limited accessibility. Regular inspections and replacements are costly and time-consuming, requiring remotely operated vehicles (ROVs) or autonomous underwater systems to perform the tasks. The logistical difficulties involved in mobilizing such operations further increase downtime and operational expenditure

- The high capital investment required for developing and integrating digital control systems further adds to the financial burden, especially for smaller operators. Cost overruns and fluctuating oil prices can delay project timelines, impacting market growth. Furthermore, the complexity of integrating new systems with existing infrastructure often leads to technical delays and higher implementation costs

- For instance, in 2024, several offshore projects in West Africa faced budget constraints due to higher-than-expected subsea control system costs, prompting operators to delay installation schedules and explore leasing options for equipment. This highlighted the financial challenges associated with deepwater operations and the need for more flexible business models

- To overcome these barriers, industry participants are focusing on modular system designs, enhanced material durability, and collaborative cost-sharing initiatives to reduce overall expenditure and improve the economic feasibility of subsea developments. Such efforts are likely to make advanced control systems more accessible and accelerate adoption across emerging offshore regions

Subsea Control Systems Market Scope

The market is segmented on the basis of type, component, application, and processing technology.

- By Type

On the basis of type, the subsea control systems market is segmented into Topside and Underwater. The Underwater segment held the largest market revenue share in 2025, driven by the increasing demand for deepwater and ultra-deepwater exploration activities that require robust underwater control and monitoring solutions. The growing complexity of offshore operations and the need for real-time communication between subsea equipment and topside facilities have further accelerated the adoption of advanced underwater control units.

The Topside segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by the growing emphasis on integrating surface-based control systems with digital monitoring platforms. Topside systems enable operators to manage subsea assets remotely through enhanced connectivity and automation, reducing intervention frequency and improving operational reliability in offshore environments.

- By Component

On the basis of component, the subsea control systems market is segmented into Subsea Control Module, Umbilical Assembly, Master Control Systems, and Sensors. The Subsea Control Module segment held the largest market share in 2025 due to its critical role in controlling valves, chokes, and subsea instrumentation. The module’s reliability and adaptability make it indispensable for managing production and safety functions in challenging subsea conditions.

The Sensors segment is expected to witness the fastest growth rate from 2026 to 2033, supported by the rising demand for real-time monitoring and predictive maintenance. The integration of smart sensors enhances data acquisition accuracy and helps detect potential faults early, improving efficiency and reducing downtime across offshore operations.

- By Application

On the basis of application, the subsea control systems market is segmented into Production and Processing. The Production segment accounted for the largest share in 2025, owing to the rising number of offshore production fields and increasing investment in deepwater exploration. Subsea control systems in this segment are essential for ensuring operational continuity and optimizing production rates under extreme conditions.

The Processing segment is expected to witness the fastest growth rate from 2026 to 2033, driven by advancements in subsea separation and boosting technologies. These systems help reduce backpressure on wells, improve recovery rates, and lower operating costs by minimizing the need for surface processing infrastructure.

- By Processing Technology

On the basis of processing technology, the subsea control systems market is segmented into Subsea Compression System, Subsea Boosting System, Subsea Injection Systems, and Subsea Separation Systems. The Subsea Boosting System segment held the dominant share in 2025, as it enhances oil recovery and increases production efficiency from mature fields. These systems are increasingly deployed to overcome declining reservoir pressure and improve flow assurance in long tie-back developments.

The Subsea Compression System segment is expected to witness the fastest growth from 2026 to 2033, driven by its ability to optimize gas recovery and extend the life of offshore fields. Growing demand for energy efficiency, coupled with ongoing technological advancements, is promoting the adoption of these systems in both greenfield and brownfield offshore projects.

Subsea Control Systems Market Regional Analysis

- North America dominated the subsea control systems market with the largest revenue share of 37.85% in 2025, driven by extensive offshore oil and gas exploration projects and the growing adoption of advanced subsea technologies across deepwater fields. The region’s established energy infrastructure and focus on operational efficiency have positioned it as a leading hub for subsea innovations

- The high concentration of offshore production sites in the Gulf of Mexico, combined with continuous investments in automation and digital control systems, is fuelling market growth. Moreover, strong collaboration between oilfield service companies and equipment manufacturers is enabling the deployment of reliable, high-performance subsea solutions across critical projects

- This dominance is further supported by favorable government policies, a skilled technical workforce, and robust research and development activities aimed at enhancing subsea production efficiency and safety

U.S. Subsea Control Systems Market Insight

The U.S. subsea control systems market captured the largest revenue share in 2025 within North America, primarily driven by the expansion of deepwater projects in the Gulf of Mexico and increasing focus on maximizing offshore oil recovery. Major oil companies are investing in digital subsea control technologies to improve operational reliability and reduce maintenance costs. Furthermore, the integration of IoT and AI-based monitoring systems is enhancing data-driven decision-making and predictive maintenance capabilities. These advancements are solidifying the U.S. as a global leader in offshore technology deployment.

Europe Subsea Control Systems Market Insight

The Europe subsea control systems market is expected to witness substantial growth from 2026 to 2033, supported by rising investments in offshore energy projects across the North Sea and Norwegian continental shelf. The region’s push toward sustainable offshore production and renewable energy integration, such as subsea technologies for offshore wind, is driving market expansion. European operators are also focusing on extending the operational lifespan of existing subsea fields through advanced control and monitoring systems. Moreover, collaboration between technology providers and regulatory bodies is fostering innovation and efficiency in subsea operations.

Germany Subsea Control Systems Market Insight

The Germany subsea control systems market is expected to witness steady growth from 2026 to 2033, driven by the nation’s strong engineering expertise and emphasis on industrial innovation. German companies are increasingly contributing to subsea technology advancements through precision manufacturing, automation, and sensor development. The country's commitment to energy transition is also encouraging the integration of subsea systems in offshore renewable projects such as wind farms. Furthermore, collaboration between German research institutes and energy firms is fostering the development of sustainable and digitally integrated subsea control solutions that enhance system reliability and environmental compliance.

U.K. Subsea Control Systems Market Insight

The U.K. subsea control systems market is expected to witness the fastest growth rate from 2026 to 2033, driven by the modernization of offshore infrastructure and increasing focus on maximizing oil recovery from mature fields. Investments in automation, subsea digitalization, and advanced umbilical technologies are transforming the region’s offshore industry. In addition, supportive government policies aimed at enhancing offshore energy security and promoting innovation are encouraging the adoption of cost-efficient subsea systems. The U.K.’s strong network of engineering firms and research institutions continues to accelerate technological advancements in this field.

Asia-Pacific Subsea Control Systems Market Insight

The Asia-Pacific subsea control systems market is expected to witness the fastest growth rate from 2026 to 2033, propelled by the expansion of offshore drilling projects and growing energy demand in countries such as China, India, and Australia. Governments across the region are supporting offshore exploration through favorable policies and investment incentives, fostering the adoption of modern subsea technologies. The rising number of domestic oilfield equipment manufacturers and technological collaborations is also improving cost efficiency and supply chain capabilities, driving overall market expansion in APAC.

China Subsea Control Systems Market Insight

The China subsea control systems market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by extensive offshore development activities in the South China Sea and the country’s focus on achieving energy independence. The government’s continued investment in subsea infrastructure and technology localization is fostering innovation and cost competitiveness. Domestic manufacturers are increasingly producing advanced subsea modules and sensors to meet local demand, further accelerating market growth. Moreover, collaborations with international oilfield service companies are enhancing operational performance and technology transfer.

Japan Subsea Control Systems Market Insight

The Japan subsea control systems market is expected to grow significantly between 2026 and 2033, supported by increasing offshore exploration activities and technological modernization in the country’s energy infrastructure. Japan’s advanced robotics, automation, and IoT capabilities are driving innovation in subsea control and monitoring systems, ensuring greater efficiency and precision in offshore operations. The government’s focus on energy diversification and ocean resource development is further accelerating investment in subsea technology. Moreover, collaborations between Japanese manufacturers and global oilfield service companies are promoting the deployment of compact, high-performance subsea systems suited for the region’s unique marine environments.

Subsea Control Systems Market Share

The Subsea Control Systems industry is primarily led by well-established companies, including:

• TechnipFMC plc (U.K.)

• Halliburton (U.S.)

• GE Oil & Gas Spa (Italy)

• Aker Solutions (Norway)

• Schlumberger Limited (U.S.)

• Baker Hughes Company (U.S.)

• KONGSBERG (Norway)

• Proserv UK Ltd (U.K.)

• Weatherford (U.S.)

• Siemens (Germany)

• Oceaneering International, Inc. (U.S.)

• Hitec Products AS (Norway)

• KW Ltd (U.K.)

• General Electric Company (U.S.)

• Cameron International (U.S.)

• HCS Control Systems Ltd (U.K.)

Latest Developments in Global Subsea Control Systems Market

- In February 2023, Equinor announced a new commercial oil and gas discovery in the North Sea off Norway, utilizing a Transocean-owned rig. The discovery followed the completion of both a wildcat well (31/1-3 S) and an appraisal well (31/1-3 A) under production license 923. This development is expected to strengthen Norway’s offshore production capabilities and contribute to resource expansion in the North Sea basin. It also reinforces Equinor’s commitment to enhancing energy security through strategic exploration efforts

- In February 2022, Norwegian company Innova partnered with U.S.-based Teledyne Energy System to test the use of hydrogen power in subsea control systems. The validation took place at the Norwegian Center for Offshore Education, where the Subsea Supercharger powered a subsea hydraulic pumping unit (sHPU) developed by Innova. This initiative showcased the feasibility of hydrogen-based energy for subsea operations, promoting cleaner, more sustainable offshore technologies and reducing dependence on fossil fuel-based power sources

- In March 2022, BP PLC secured two offshore exploration blocks, Agung I and Agung II, in Indonesia as part of the 2021 Oil & Gas Working Area (WK) Bid Round. The project aims to expand BP’s exploration portfolio in Southeast Asia and strengthen Indonesia’s position as a key player in regional energy production. This development highlights the company’s strategic focus on unlocking new offshore reserves while supporting the country’s energy diversification goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Subsea Control Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Subsea Control Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Subsea Control Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.