Global Sugar Alcohols Market

Market Size in USD Billion

CAGR :

%

USD

18.23 Billion

USD

30.41 Billion

2025

2033

USD

18.23 Billion

USD

30.41 Billion

2025

2033

| 2026 –2033 | |

| USD 18.23 Billion | |

| USD 30.41 Billion | |

|

|

|

|

Sugar Alcohols Market Size

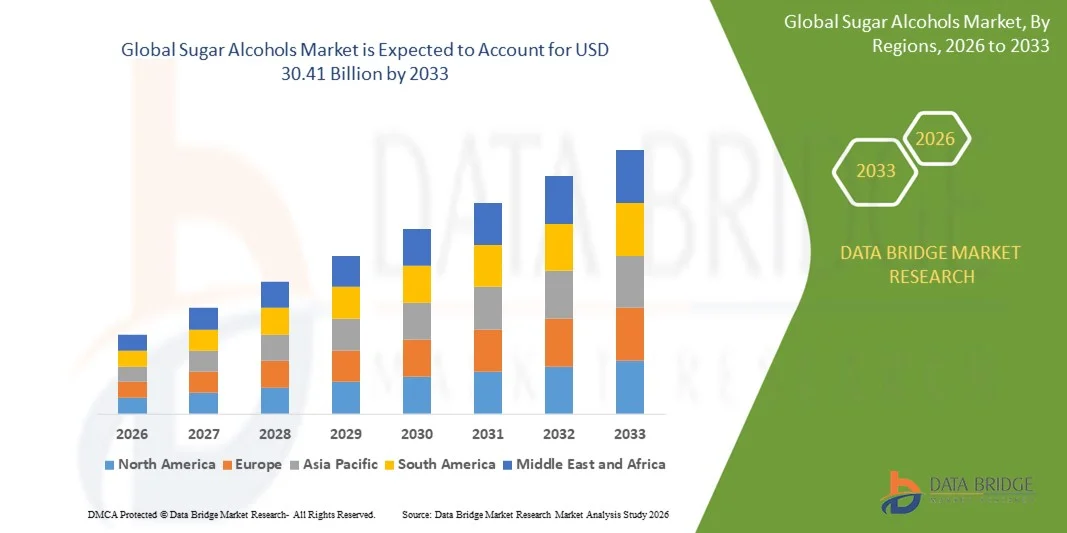

- The global sugar alcohols market size was valued at USD 18.23 billion in 2025 and is expected to reach USD 30.41 billion by 2033, at a CAGR of 6.60% during the forecast period

- The market growth is largely fueled by the increasing consumer demand for low-calorie, sugar-free, and diabetic-friendly products across food, beverage, and pharmaceutical sectors. Rising health consciousness and lifestyle changes are prompting manufacturers to adopt sugar alcohols as healthier alternatives to traditional sugar, thereby accelerating market expansion

- Furthermore, growing awareness of functional and clean-label ingredients is establishing sugar alcohols such as sorbitol, erythritol, and xylitol as preferred sweeteners in confectionery, bakery, beverages, and dairy products. These converging factors are driving product innovation and adoption, significantly boosting the growth of the sugar alcohol industry

Sugar Alcohols Market Analysis

- Sugar alcohols, offering sweetness with reduced calories and glycemic impact, are increasingly utilized in modern food and beverage formulations due to their functional properties such as humectancy, texture enhancement, and mouthfeel improvement. Their versatility across diverse applications is reinforcing their importance in product development

- The escalating demand for sugar alcohols is primarily fueled by rising prevalence of diabetes and obesity, government initiatives promoting reduced sugar intake, and consumer preference for healthier dietary options. Food and beverage manufacturers are increasingly incorporating sugar alcohols to meet regulatory standards and consumer expectations

- North America dominated the sugar alcohols market in 2025, due to growing consumer preference for low-calorie, sugar-free, and diabetic-friendly products

- Asia-Pacific is expected to be the fastest growing region in the sugar alcohols market during the forecast period due to rising urbanization, increasing disposable incomes, and growing health awareness in countries such as China, Japan, and India

- Powder and crystal segment dominated the market with a market share of 65.5% in 2025, due to their widespread use in confectionery, bakery, and beverage applications due to ease of handling, precise dosing, and consistent quality. These forms offer superior solubility, uniform particle size, and enhanced sweetness perception, making them ideal for industrial-scale production and automated processing. Manufacturers also prefer powder and crystal sugar alcohols for their stability, long shelf life, and compatibility with diverse formulations, supporting strong adoption across food and beverage products. Consumer preference for familiar crystalline forms in sugar-free and reduced-calorie products has further reinforced the segment’s market leadership

Report Scope and Sugar Alcohols Market Segmentation

|

Attributes |

Sugar Alcohols Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sugar Alcohols Market Trends

Growing Demand for Low-Calorie and Sugar-Free Products

- The global shift toward health-conscious consumption is driving significant demand for low-calorie and sugar-free food products, leading to widespread use of sugar alcohols such as xylitol, sorbitol, and erythritol. These polyols provide sweetness with fewer calories and a lower glycemic index, appealing to consumers seeking balanced and cleaner diets without compromising on taste

- For instance, Cargill and Ingredion Incorporated have expanded their low-calorie sweetener portfolios with erythritol and sorbitol-based formulations aimed at reducing total sugar content in confections and beverages. These solutions enable food manufacturers to maintain sweetness while lowering caloric values, addressing the preferences of diabetic and weight-conscious consumers

- The rising incidence of obesity, diabetes, and cardiovascular disorders has prompted regulatory bodies and consumers to limit traditional sugar intake. Sugar alcohols serve as functional alternatives that help maintain product taste and texture while supporting global dietary recommendations for sugar reduction in processed foods

- Expanding product innovation across bakery, confectionery, and beverage applications is strengthening market growth. Sugar alcohols act as sweeteners and also improve moisture retention, shelf life, and mouthfeel, making them versatile ingredients for clean-label and reformulated products

- In addition, the growing popularity of keto and low-carb diets has increased the adoption of erythritol and xylitol in food and beverage formulations. Their compatibility with such dietary preferences positions sugar alcohols as key enablers in the fast-growing functional nutrition and weight management product segments

- The continuous rise in consumer preference for healthier, sugar-free, and low-calorie products is shaping the future of the sweetener industry. As manufacturers align with global sugar-reduction strategies and clean-label trends, sugar alcohols are expected to remain vital ingredients supporting the demand for guilt-free, nutritionally responsible foods

Sugar Alcohols Market Dynamics

Driver

Rising Health Awareness and Diabetic-Friendly Product Adoption

- The global increase in health awareness and adoption of diabetic-friendly food products is a major driver for the sugar alcohols market. With rising prevalence of diabetes and obesity, consumers are actively seeking alternatives that provide sweetness without adverse metabolic effects, which has amplified the commercial relevance of sugar alcohols

- For instance, Roquette Frères and Tate & Lyle plc have invested in expanding production capacities for maltitol and erythritol to cater to growing demand from sugar-free confectionery and functional beverages. These ingredients help maintain desirable sweetness levels while offering reduced caloric content and minimal blood glucose impact

- Consumer awareness of the health implications of excess sugar consumption is influencing shifts toward reduced-sugar diets. Sugar alcohols meet this demand by providing up to 50–70 percent of the sweetness of sucrose, with significantly lower energy value and improved dental benefits, making them popular among health-focused consumers

- In addition, government-led nutrition initiatives and labeling regulations encouraging lower sugar content in processed foods are motivating manufacturers to substitute traditional sweeteners with sugar alcohols. These regulatory changes are further strengthening market penetration across bakery, dairy, and beverage segments

- The expanding global focus on health, wellness, and disease prevention continues to stimulate demand for diabetic-friendly and functional food products. As food producers and consumers increasingly prioritize ingredient transparency and health-positive formulations, sugar alcohols are projected to experience continued growth as a key sweetening solution

Restraint/Challenge

High Production Costs and Supply Chain Constraints

- High production costs and raw material supply constraints represent significant challenges for sugar alcohol manufacturers. The extraction and hydrogenation processes used to produce polyols from starch or plant-based feedstocks are energy-intensive and costly, impacting overall product affordability and pricing competitiveness

- For instance, fluctuations in corn and wheat-derived starch availability have affected sorbitol and xylitol production costs for major producers including Jungbunzlauer Suisse AG and Mitsubishi Chemical Corporation. Supply shortages or price increases in raw materials can disrupt stable output and create pricing uncertainties across global markets

- Complex refining procedures and technological requirements for maintaining product purity further contribute to higher operational expenses. Producers need continuous investments in process innovation and energy-efficient production to reduce cost burdens and enhance manufacturing scalability

- In addition, global logistics disruptions and uneven regional supply infrastructure have resulted in inconsistent availability of sugar alcohols. Transportation restrictions and limited storage capacity have, at times, constrained production planning and end-user supply reliability

- Overcoming these cost and supply challenges will be critical for maintaining competitive pricing and ensuring consistent supply to rapidly growing end-use industries. Strategic sourcing, investment in energy-efficient technologies, and regional production diversification are expected to help stabilize supply chains and support long-term market sustainability for sugar alcohols

Sugar Alcohols Market Scope

The market is segmented on the basis of source, product type, form, application, and end-user.

- By Source

On the basis of source, the sugar alcohols market is segmented into corn, wheat, rice, potato, and others. The corn segment dominated the market with the largest revenue share in 2025, driven by the high availability of corn starch and its cost-effective conversion into sugar alcohols such as sorbitol and maltitol. Corn-based sugar alcohols are widely preferred in food and beverage formulations due to their consistent quality, scalability, and ease of integration in various production processes. Manufacturers also favor corn-derived sugar alcohols for their high yield, efficient processing, and minimal environmental impact. The market growth in this segment is further supported by well-established supply chains in major producing countries, enabling stable production and distribution.

The potato segment is anticipated to witness the fastest CAGR from 2026 to 2033, fueled by increasing research on alternative starch sources and the rising demand for non-corn sugar alcohols. Potato-based sugar alcohols provide unique functional properties such as better crystallization and reduced glycemic response, making them attractive for specialty applications in confectionery and dietary products. Innovations in processing technology have also enhanced yield and cost-effectiveness, contributing to the accelerated adoption of potato-derived sugar alcohols across regional and niche markets.

- By Product Type

On the basis of product type, the market is segmented into sorbitol, mannitol, xylitol, maltitol, lactitol, erythritol, isomalt, and other product types. The sorbitol segment dominated the market with the largest revenue share in 2025, driven by its extensive applications in sweeteners, pharmaceuticals, and personal care products. Sorbitol’s humectant and texturizing properties enhance product stability and shelf life, making it a preferred choice for manufacturers. Its compatibility with various formulations, low hygroscopicity, and proven safety profile have further reinforced its market leadership. Large-scale production capabilities and cost efficiency of corn-derived sorbitol have also supported its strong adoption across food, beverage, and pharmaceutical sectors.

The erythritol segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising health awareness and increasing demand for low-calorie, non-glycemic sweeteners. For instance, Cargill has expanded its erythritol production to meet growing consumer preference for sugar-free and diabetic-friendly products. Erythritol’s natural origin, pleasant taste profile, and minimal digestive side effects compared to other polyols make it increasingly popular in beverages, confectionery, and bakery applications. Growing investments in R&D to improve production efficiency and scalability are also accelerating market adoption.

- By Form

On the basis of form, the sugar alcohols market is segmented into powder and crystal and liquid and syrup. The powder and crystal segment dominated the market with the largest revenue share of 65.5% in 2025, driven by their widespread use in confectionery, bakery, and beverage applications due to ease of handling, precise dosing, and consistent quality. These forms offer superior solubility, uniform particle size, and enhanced sweetness perception, making them ideal for industrial-scale production and automated processing. Manufacturers also prefer powder and crystal sugar alcohols for their stability, long shelf life, and compatibility with diverse formulations, supporting strong adoption across food and beverage products. Consumer preference for familiar crystalline forms in sugar-free and reduced-calorie products has further reinforced the segment’s market leadership.

The syrup segment is anticipated to witness the fastest CAGR from 2026 to 2033, fueled by increasing applications in beverages and liquid-based sweet spreads. Syrup sugar alcohols provide functional benefits such as moisture retention, smooth texture, and improved mouthfeel in liquid products. For instance, Ingredion has expanded its portfolio of liquid maltitol syrups to cater to the rising demand from beverage and dairy manufacturers. Innovations in concentration and shelf-stable formulations have also enhanced commercial viability, driving rapid market growth in this segment.

- By Application

On the basis of application, the market is segmented into bakery goods, sweet spreads, confectionery and chewing gum, beverages, dairy products, and others. The bakery goods segment dominated the market with the largest revenue share in 2025, driven by the widespread use of sugar alcohols as sugar substitutes in cakes, pastries, and bread. Sugar alcohols improve texture, moisture retention, and shelf life, making them highly suitable for baked goods. Manufacturers prefer sugar alcohols over traditional sugar for low-calorie, diabetic-friendly, and reduced-sugar products. Consumer demand for healthier bakery options and increasing regulatory emphasis on sugar reduction have further accelerated adoption in this segment.

The beverages segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the rising demand for low-calorie and functional drinks. For instance, Tate & Lyle has launched sugar alcohol-based beverage sweeteners to meet growing consumer preference for sugar-free alternatives. Sugar alcohols in beverages provide sweetness without adding calories, prevent crystallization, and maintain flavor stability, enhancing overall product quality. Expanding energy drinks, flavored waters, and low-calorie soft drinks markets are driving accelerated growth in this segment.

- By End User

On the basis of end user, the market is segmented into food and beverages, pharmaceuticals, cosmetics and personal care, and others. The food and beverages segment dominated the market with the largest revenue share in 2025, driven by the high demand for sugar-free and reduced-calorie products across global markets. Sugar alcohols are extensively used in confectionery, bakery, beverages, and dairy products due to their sweetness, low-calorie content, and functional benefits such as moisture retention and mouthfeel enhancement. Well-established manufacturing processes and strong supply chains have further strengthened the adoption of sugar alcohols in food and beverage applications.

The pharmaceuticals segment is anticipated to witness the fastest CAGR from 2026 to 2033, fueled by increasing use of sugar alcohols in oral care, syrups, and medicinal formulations. For instance, Pfizer utilizes sorbitol and xylitol in medicinal syrups and chewable tablets to enhance taste and patient compliance. Sugar alcohols offer stability, non-cariogenic properties, and improved product palatability, driving their accelerated adoption in pharmaceutical applications. Growing R&D investments in sugar-free and pediatric-friendly medicines are also supporting rapid market growth in this segment.

Sugar Alcohols Market Regional Analysis

- North America dominated the sugar alcohols market with the largest revenue share in 2025, driven by growing consumer preference for low-calorie, sugar-free, and diabetic-friendly products

- Consumers in the region increasingly seek healthier alternatives in confectionery, bakery, beverages, and dairy products, boosting demand for sugar alcohols such as sorbitol and erythritol

- The widespread adoption is further supported by advanced food processing infrastructure, stringent quality standards, and a strong presence of leading sugar alcohol manufacturers. High disposable incomes and awareness of health and wellness trends are encouraging both consumers and manufacturers to incorporate sugar alcohols into mainstream and functional food products

U.S. Sugar Alcohols Market Insight

The U.S. sugar alcohols market captured the largest revenue share in North America in 2025, fueled by the rising consumption of sugar-free and reduced-calorie products across retail and foodservice sectors. Consumers are increasingly prioritizing products with lower glycemic index, enhanced functional benefits, and improved taste profiles, driving demand for sugar alcohols such as maltitol and erythritol. The growing trend of clean-label and health-focused formulations, coupled with strong R&D investments from companies such as Cargill and Tate & Lyle, further accelerates market growth. Moreover, large-scale production and well-established distribution networks ensure easy accessibility and affordability, supporting sustained market expansion.

Europe Sugar Alcohols Market Insight

The Europe sugar alcohols market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing health awareness, sugar reduction initiatives, and regulatory support for low-calorie sweeteners. The rise in lifestyle diseases, including diabetes and obesity, is prompting food and beverage manufacturers to adopt sugar alcohols in confectionery, bakery, beverages, and dairy applications. European consumers favor functional and natural sweeteners, enhancing the adoption of erythritol and xylitol. The region is experiencing strong growth across packaged foods, beverages, and pharmaceutical products, with sugar alcohols being incorporated in both mainstream and specialty formulations.

U.K. Sugar Alcohols Market Insight

The U.K. sugar alcohols market is anticipated to grow at a noteworthy CAGR, driven by consumer demand for sugar-free, reduced-calorie, and functional food products. Concerns regarding obesity, diabetes, and overall health are motivating manufacturers to replace traditional sugar with sugar alcohols in bakery, confectionery, and beverage products. The U.K.’s well-established retail and foodservice sectors, along with rising awareness of low-glycemic alternatives, continue to support market expansion. Companies are also focusing on innovative formulations that combine sugar alcohols with natural sweeteners to meet consumer taste preferences.

Germany Sugar Alcohols Market Insight

The Germany sugar alcohols market is expected to expand at a considerable CAGR, fueled by strong health consciousness, regulatory initiatives on sugar reduction, and demand for functional foods. Germany’s advanced food manufacturing infrastructure, coupled with focus on sustainable and high-quality ingredients, promotes the adoption of sugar alcohols in bakery, dairy, and confectionery applications. Leading manufacturers are investing in R&D to produce innovative sugar alcohol blends and formulations tailored to local consumer preferences. Growing interest in clean-label, low-calorie, and diabetic-friendly products is also contributing to the market’s growth.

Asia-Pacific Sugar Alcohols Market Insight

The Asia-Pacific sugar alcohols market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising urbanization, increasing disposable incomes, and growing health awareness in countries such as China, Japan, and India. The region’s expanding food and beverage industry, along with increasing demand for sugar-free and functional products, is boosting adoption of sugar alcohols. Government initiatives promoting healthy diets and low-sugar consumption are further supporting market growth. In addition, Asia-Pacific is emerging as a significant manufacturing hub for sugar alcohols, providing cost-effective and accessible solutions to a broad consumer base.

Japan Sugar Alcohols Market Insight

The Japan sugar alcohols market is gaining momentum due to high consumer awareness of health and wellness, increasing demand for low-calorie and diabetic-friendly products, and a strong preference for functional foods. Sugar alcohols are widely used in beverages, confectionery, bakery, and dairy products to enhance taste while reducing sugar content. For instance, Japanese manufacturers are integrating erythritol and maltitol into sugar-free sweets and beverages to meet consumer expectations. The aging population is also driving demand for sugar alcohols in health-focused and easy-to-consume products, supporting consistent market growth.

China Sugar Alcohols Market Insight

The China sugar alcohols market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, a growing middle class, and rising health-conscious consumer behavior. Sugar alcohols are increasingly used in confectionery, bakery, beverages, and dairy products as low-calorie, sugar-reducing alternatives. Government initiatives encouraging healthier diets, alongside strong domestic manufacturing capabilities, are expanding market accessibility. Companies are leveraging local production and distribution networks to meet growing demand from both retail and foodservice sectors, propelling market expansion across the country.

Sugar Alcohols Market Share

The sugar alcohols industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- A & Z Food Additives Co., Ltd. (China)

- ACT (Germany)

- Beckmann-Kenko GmbH (Germany)

- Roquette Frères (France)

- SANXINYUAN FOOD INDUSTRY (China)

- Archer Daniels Midland (ADM) (U.S.)

- Ingredion Incorporated (U.S.)

- Mitsubishi Corporation Life Sciences Limited (Japan)

- Associated British Foods plc (U.K.)

- Dow (U.S.)

- Tate & Lyle (U.K.)

- BENEO (Germany)

- SPI Pharma (U.S.)

- Lonza (Switzerland)

- Ajinomoto Co., Inc. (Japan)

- Symrise (Germany)

- MacAndrews & Forbes Incorporated (U.S.)

- Merck KGaA (Germany)

- Pfizer Inc (U.S.)

Latest Developments in Global Sugar Alcohols Market

- In April 2025, Cargill completed the rebranding of SJC Bioenergia as Cargill Bioenergia, consolidating its full ownership of the company. This strategic initiative enables Cargill to better synchronize production strategies for sugar and bio-products that act as key precursors for sugar alcohols. The move strengthens operational efficiency and supply chain control, ensuring consistent quality and availability of raw materials. By leveraging synergies between its global production units, Cargill is positioned to expand its downstream sugar alcohol manufacturing, support large-scale industrial applications, and reinforce its leadership in the competitive global sugar alcohol market

- In March 2025, researchers developed an engineered Pichia pastoris strain capable of producing xylitol from sustainable carbon sources through a novel NADPH-dependent pathway. This breakthrough in microbial metabolic engineering addresses key challenges in cost and environmental impact associated with traditional sugar alcohol production. By enabling scalable, eco-friendly xylitol production, this innovation supports the growing global demand for low-calorie, sugar-free, and functional food products. Food and beverage manufacturers can adopt this technology to develop sustainable product lines, while pharmaceutical and personal care industries benefit from cleaner, cost-efficient sugar alcohol sources

- In February 2025, Cargill acquired the remaining 50% stake in SJC Bioenergia, gaining full operational control over the Brazilian sugar and renewable energy company. This acquisition strengthens Cargill’s access to sugarcane and corn feedstocks, which are critical for sugar alcohol production, allowing more reliable and cost-effective supply. The integration of SJC Bioenergia’s operations enhances production scalability, reduces dependency on external suppliers, and enables Cargill to respond swiftly to rising global demand. The move reinforces Cargill’s market positioning and competitiveness in the rapidly expanding sugar alcohol segment across food, beverage, and pharmaceutical applications

- In 2025, advances in microbial fermentation processes for erythritol production were reported, focusing on optimizing carbon-to-nitrogen ratios, osmotic pressure, and other fermentation parameters to maximize yields. These improvements significantly reduce production costs and energy requirements, making erythritol more competitive compared to conventional sugars and other sugar alcohols. The enhanced efficiency and scalability are expected to encourage wider adoption in sugar-free confectionery, beverages, and functional food products. Manufacturers benefit from higher output, improved consistency, and sustainable production methods, supporting long-term growth in the sugar alcohol market

- In February 2024, Gujarat Ambuja Exports commissioned a new 100 tonnes-per-day sorbitol production unit at its Hubli facility in India. This capacity expansion strengthens the company’s ability to meet rising domestic and export demand for sugar alcohols in food, pharmaceutical, and personal care applications. The additional production capability ensures a reliable supply of high-quality sorbitol, enabling manufacturers to scale product offerings while maintaining cost-effectiveness. By increasing output and securing a stronger position in the global sugar alcohol supply chain, Gujarat Ambuja is poised to capitalize on the growing preference for sugar-free and low-calorie products in international and regional markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sugar Alcohols Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sugar Alcohols Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sugar Alcohols Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.