Global Sugar Free Hard Candies Market

Market Size in USD Billion

CAGR :

%

USD

1.37 Billion

USD

1.81 Billion

2024

2032

USD

1.37 Billion

USD

1.81 Billion

2024

2032

| 2025 –2032 | |

| USD 1.37 Billion | |

| USD 1.81 Billion | |

|

|

|

|

Sugar-free Hard Candies Market Size

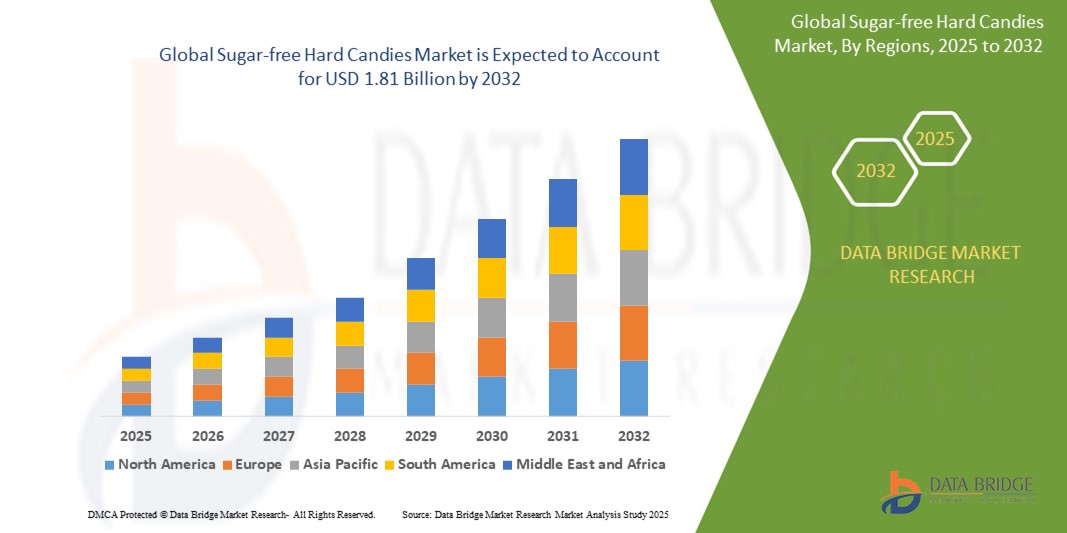

- The global sugar-free hard candies market size was valued at USD 1.37 billion in 2024 and is expected to reach USD 1.81 billion by 2032, at a CAGR of 3.50% during the forecast period

- The market growth is largely fueled by increasing health consciousness and rising incidences of diabetes and obesity, which are driving consumers to seek alternatives to traditional sugary confections. This shift in dietary preferences is propelling the demand for sugar-free hard candies that offer guilt-free indulgence without compromising on taste or satisfaction

- Furthermore, advancements in sugar substitute formulations, such as stevia, xylitol, and isomalt, are enabling manufacturers to develop flavorful, tooth-friendly products that appeal to a wide range of consumers, including children, diabetics, and fitness-conscious individuals. These converging factors are accelerating innovation and product adoption, thereby significantly boosting the industry's growth

Sugar-free Hard Candies Market Analysis

- Sugar-free hard candies are confectionery products formulated without traditional sugars, using alternative sweeteners to provide sweetness with reduced caloric and glycemic impact. These products cater to health-aware consumers, offering benefits such as improved oral health, controlled blood sugar levels, and low calorie intake

- The growing demand for sugar-free confections is driven by lifestyle changes, regulatory support for healthier food labeling, and increasing availability through both B2B and B2C distribution channels. As consumers increasingly scrutinize ingredient labels, brands are focusing on clean-label, functional, and flavored offerings to stay competitive and meet evolving taste and health preferences

- North America dominated the sugar-free hard candies market with a share of 38.6% in 2024, due to growing health awareness, rising diabetic population, and increased demand for sugar alternatives

- Asia-Pacific is expected to be the fastest growing region in the sugar-free hard candies market during the forecast period due to rising disposable incomes, rapid urbanization, and a growing focus on health and wellness

- Texture segment dominated the market with a market share of 42.2% in 2024, due to consumer preference leans heavily toward candies that replicate the mouthfeel and crunch of conventional sugar-based varieties. Manufacturers focus extensively on maintaining appealing textures despite the absence of sugar, making this functionality critical in product development

Report Scope and Sugar-free Hard Candies Market Segmentation

|

Attributes |

Sugar-free Hard Candies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sugar-free Hard Candies Market Trends

“Increasing Availability in Retail Channels”

- The sugar-free hard candies market is expanding rapidly due to growing health awareness, with extensive product launches focused on low-calorie and diabetic-friendly confectionery options available across supermarkets, pharmacies, and online retail platforms

- For instance, Ferrara Candy Company has increased shelf presence of its sugar-free lemon and mint hard candies in major retail chains such as Walmart and CVS, improving consumer accessibility and driving sales growth

- Innovations in sugar substitutes, such as use of natural sweeteners such as stevia and erythritol, are enhancing taste profiles and consumer acceptance of sugar-free candies without compromising flavor or texture

- Packaging and portion control advancements are enabling convenient, on-the-go options that appeal to busy consumers seeking healthier snacking alternatives

- The rising popularity of functional hard candies incorporating added ingredients such as vitamins, minerals, or breath freshening agents is diversifying product offerings and attracting broader demographics

- Increasing marketing initiatives by manufacturers targeting health-conscious and diabetic consumers are raising awareness and fostering higher demand for sugar-free hard candy variants

Sugar-free Hard Candies Market Dynamics

Driver

“Increase in Diabetes Incidence”

- The global rise in diabetes prevalence is strongly influencing consumer dietary choices, increasing demand for sugar-free alternatives such as hard candies that allow indulgence without spiking blood sugar levels

- For instance, The Hershey Company has launched a sugar-free hard candy line specifically formulated to address diabetic consumers’ needs, supported by educational campaigns in regions with rising diabetes rates

- Growing public health initiatives and nutritional guidelines promoting reduced sugar intake are pushing manufacturers to innovate and expand their sugar-free confectionery portfolios

- Increasing consumer preference for healthier lifestyles, including weight management and sugar reduction, fuels demand for sugar-free candies as guilt-free indulgence options

- The availability of sugar-free candies as substitutes in professional healthcare and wellness settings further drives adoption among diabetic and diet-conscious individuals

Restraint/Challenge

“High Cost of Ingredients”

- The use of premium sugar substitutes and specialty ingredients such as polyols and natural sweeteners increases production costs for sugar-free hard candies compared to traditional sugar-based confectionery

- For instance, the premium pricing of ingredients employed by companies such as Perfetti Van Melle in their sugar-free product lines impacts final retail prices, potentially limiting consumer affordability and market penetration

- Complex formulation processes are required to maintain desirable taste and texture in absence of sugar, which can increase R&D and manufacturing expenses

- Price-sensitive consumers, especially in emerging markets, may prefer conventional candies due to lower costs and familiar taste profiles, limiting widespread adoption of sugar-free variants

- Supply chain constraints and regulatory challenges related to approval and labeling of alternative sweeteners further complicate ingredient sourcing and cost management

Sugar-free Hard Candies Market Scope

The market is segmented on the basis of type, sweetening agent, functionality, flavors, and distribution channel.

- By Type

On the basis of type, the sugar-free hard candies market is segmented into hard candy, chewy candy, gummies, lollipops, and chewing gums. The hard candy segment dominated the largest market revenue share in 2024, owing to its traditional appeal, extended shelf life, and widespread consumer familiarity. These candies are preferred by diabetic and calorie-conscious consumers seeking long-lasting flavors without sugar intake. Their easy availability across retail and online channels, combined with diverse flavor offerings, has further solidified their dominant position.

The gummies segment is projected to witness the fastest growth rate from 2025 to 2032, driven by rising demand among children and young adults for fun, flavorful, and soft-textured alternatives. The surge in functional gummy innovations—such as vitamin-enriched or fiber-added variants—has also made sugar-free gummies appealing for health-conscious consumers, fueling market expansion across both the B2C and nutraceutical sectors.

- By Sweetening Agent

On the basis of sweetening agent, the market is segmented into stevia, isomalt, sorbitol, maltitol, xylitol, polydextrose, and others. The stevia segment captured the largest revenue share in 2024 due to its plant-based origin and high consumer trust as a natural, zero-calorie alternative to sugar. Its suitability for diabetic and keto-friendly products makes it a preferred sweetener in clean-label candy formulations.

Xylitol is expected to witness the fastest CAGR from 2025 to 2032, attributed to its dental benefits, close resemblance to sugar in taste, and lower glycemic index. Increasing awareness about oral health and the inclusion of xylitol in products positioned as tooth-friendly are major factors accelerating its adoption in sugar-free confectionery products.

- By Functionality

On the basis of functionality, the market is segmented into texture, stability, and moisture retention. The texture segment led the market with a share of 42.2% in 2024, as consumer preference leans heavily toward candies that replicate the mouthfeel and crunch of conventional sugar-based varieties. Manufacturers focus extensively on maintaining appealing textures despite the absence of sugar, making this functionality critical in product development.

Moisture retention is expected to grow at the fastest pace during the forecast period due to its role in extending shelf life and maintaining the integrity of sugar-free products in varying climates. Formulators are increasingly using such as polydextrose to preserve softness in chewy formats and prevent crystallization in hard candies, thereby improving product stability and consumer satisfaction.

- By Flavors

On the basis of flavors, the sugar-free hard candies market is segmented into butterscotch, caramel, blueberry, strawberry, banana, coffee, and others. The strawberry segment held the largest revenue share in 2024, bolstered by its universal appeal across age groups and consistent use in both standalone and mixed-flavor offerings. Its familiarity and perceived freshness have positioned it as a top choice among consumers globally.

The coffee flavor segment is anticipated to grow at the fastest rate from 2025 to 2032, spurred by increasing demand from adult consumers and the rising popularity of gourmet-inspired confections. Coffee-flavored sugar-free candies are gaining traction as a healthier indulgence, often consumed as breath fresheners or low-calorie alternatives to caffeinated beverages.

- By Distribution Channel

On the basis of distribution channel, the market is bifurcated into B2B and B2C. The B2C segment dominated the market in 2024, driven by strong retail presence, rising e-commerce penetration, and increasing health awareness among individual consumers. The convenience of online platforms offering sugar-free candies in diverse flavors and packs has further amplified direct-to-consumer sales.

The B2B segment is expected to register the highest growth rate over the forecast period, supported by growing partnerships with hospitality businesses, health institutions, and travel operators. Custom formulations and bulk procurement by foodservice and corporate sectors are expanding the commercial use of sugar-free hard candies beyond the conventional consumer base.

Sugar-free Hard Candies Market Regional Analysis

- North America dominated the sugar-free hard candies market with the largest revenue share of 38.6% in 2024, driven by growing health awareness, rising diabetic population, and increased demand for sugar alternatives

- Consumers in the region are increasingly shifting toward guilt-free indulgence and actively seeking functional, low-calorie confectionery options made without artificial sweeteners

- This trend is further supported by strong retail networks, rising preference for clean-label products, and a robust presence of leading health-focused candy manufacturers catering to both adult and pediatric demographics

U.S. Sugar-free Hard Candies Market Insight

The U.S. captured largest share of North America’s sugar-free hard candies revenue in 2024. Growth is fueled by heightened consumer awareness of obesity, diabetes, and lifestyle-related health conditions, leading to a shift toward healthier snacking. Products sweetened with stevia, xylitol, and other natural alternatives are in high demand, especially those aligned with keto, vegan, and diabetic-friendly trends. The surge in online health retailers, combined with increased product visibility in pharmacies and supermarkets, supports continued expansion. In addition, innovation in flavors, texture, and functional benefits such as added vitamins or dental protection is shaping consumer preferences.

Europe Sugar-free Hard Candies Market Insight

Europe held a substantial share of the sugar-free hard candies market in 2024 and is projected to maintain steady growth throughout the forecast period. The market is largely influenced by government initiatives aimed at reducing sugar consumption and encouraging healthier eating habits. European consumers exhibit high awareness of ingredient quality, nutritional value, and product sustainability, driving demand for organic, clean-label, and naturally sweetened sugar-free candies. The rise of specialty health stores, premium candy offerings, and functional confectionery with added benefits is further propelling growth across the region.

U.K. Sugar-free Hard Candies Market Insight

The U.K. market is expected to grow at a notable CAGR, supported by public health campaigns focused on reducing sugar intake among children and adults. Consumers increasingly prefer portion-controlled, vegan, and sugar-free candies that fit into active, health-conscious lifestyles. Products tailored for on-the-go consumption, combined with rising demand in schools and workplace environments, are creating new growth opportunities for brands focused on low-calorie innovation.

Germany Sugar-free Hard Candies Market Insight

Germany's sugar-free hard candies market is expanding steadily, driven by a well-established health food culture and strong demand for high-quality, functional confections. German consumers show strong preference for products with transparent labeling, natural ingredients, and health-enhancing attributes such as digestive support or oral care. The country’s advanced confectionery manufacturing and robust retail infrastructure support the availability of diverse sugar-free options across pharmacies, grocery chains, and specialty wellness outlets.

Asia-Pacific Sugar-free Hard Candies Market Insight

Asia-Pacific is projected to register the fastest CAGR between 2025 and 2032, driven by rising disposable incomes, rapid urbanization, and a growing focus on health and wellness. Consumers in countries such as China, India, and Japan are becoming more health-conscious, leading to increased demand for sugar-free alternatives, particularly among urban youth and aging populations. Government initiatives promoting healthier lifestyles and the influence of global dietary trends are contributing to rapid adoption of sugar-free confections. Local manufacturing advancements and affordable pricing are enabling broad access to sugar-free hard candies through both traditional and digital retail channels.

China Sugar-free Hard Candies Market Insight

China accounted for the largest market share in Asia-Pacific in 2024, supported by a growing middle class, rising health awareness, and high rates of e-commerce penetration. The country's domestic brands are expanding their portfolios with innovative sugar-free candies formulated using stevia, isomalt, and xylitol. The increasing popularity of functional confections—such as those promoting dental health or fortified with vitamins—is aligning with national health trends. In addition, the affordability and variety of sugar-free options are driving strong demand among children and working professionals.

Japan Sugar-free Hard Candies Market Insight

Japan’s market is witnessing strong growth due to its aging population, advanced food technology landscape, and demand for functional, easy-to-consume health products. Consumers are drawn to sugar-free hard candies that incorporate added nutrients, herbal extracts, or anti-aging benefits. Japan’s emphasis on innovation, combined with a cultural preference for convenience and wellness, is accelerating the development and acceptance of premium, multifunctional sugar-free confections tailored to specific age groups and dietary needs.

Sugar-free Hard Candies Market Share

The sugar-free hard candies industry is primarily led by well-established companies, including:

- THE HERSHEY COMPANY (U.S.)

- Asher’s Chocolate Co. (U.S.)

- Hyet Sweet B.V. (Netherlands)

- Dr. John's Healthy Sweets LLC (U.S.)

- LILY'S SWEETS (U.S.)

- ROY Chocolatier (France)

- Russell Stover Chocolates, LLC (U.S.)

- Koochikoo Lollipops (U.S.)

- Sugarless Confectionery (U.S.)

- Barnett (U.S.)

Latest Developments in Global Sugar-free Hard Candies Market

- In April 2024, Candy Pros introduced the Naked Gold Sugar-Free Hard Candy Mix, a groundbreaking innovation building on the success of their widely used Melt and Pour gummy base. This new formulation is specially crafted to enable the production of both THC-infused hard candies and CBD-based edibles, giving confectioners a highly versatile and health-conscious base to work with. As demand for cannabis edibles continues to rise—particularly those that are sugar-free, customizable, and align with wellness trends—this product addresses a critical market gap. The Naked Gold mix allows producers to easily infuse precise cannabinoid dosages while maintaining flavor clarity, texture stability, and clean-label appeal, making it an ideal choice for artisanal and commercial edible makers targeting both recreational and medicinal cannabis consumers

- In May 2024, Xlear, a prominent producer of xylitol-based products, expanded the retail availability of its sugar-free hard candies through new partnerships with major North American pharmacy chains. Known for promoting dental health, Xlear’s candy line is formulated with non-GMO xylitol and offers benefits such as cavity prevention and oral hygiene support. The expansion enhances consumer access to tooth-friendly treats and strengthens the brand’s footprint in the health and wellness confectionery segment

- In March 2024, Lakanto, a brand recognized for its monk fruit sweeteners, launched a new line of sugar-free hard candies in flavors such as lemon, ginger, and cinnamon. These plant-based candies are formulated without artificial additives and are designed to appeal to diabetic and health-conscious consumers. With monk fruit as the primary sweetener, the launch reinforces Lakanto’s commitment to offering clean-label, low-glycemic treats that align with modern wellness trends and dietary restrictions

- In October 2023, Mars Wrigley acquired a controlling stake in a U.S.-based better-for-you confectionery startup specializing in sugar-free mints and hard candies. The acquisition represents a strategic step toward portfolio diversification and supports Mars’ goal of tapping into the rapidly expanding segment of health-forward, low-sugar confections. By integrating the startup’s innovative product lines and health-driven consumer base, Mars aims to strengthen its presence in the functional candy space

- In January 2024, Zolli Candy launched its innovative Zero-Sugar Gum Pop, branded as Zolli Gum PopZ, marking a first in the confectionery market. This dual-texture treat features a zero-sugar chewing gum core enveloped in a zero-sugar hard candy shell, offering consumers a completely sugar-free, long-lasting candy experience. Designed with oral health and wellness in mind, the product aligns with Zolli’s mission of creating dentist-approved, diabetic-friendly sweets. Zolli Gum PopZ caters to growing consumer demand for guilt-free confections, particularly among parents seeking healthier candy options for children and individuals managing sugar intake due to dietary or medical reasons. The launch reinforces Zolli’s position as a pioneer in functional and sugar-free confectionery innovations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sugar Free Hard Candies Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sugar Free Hard Candies Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sugar Free Hard Candies Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.