Global Sugar Reduction Technology Market

Market Size in USD Billion

CAGR :

%

USD

25.95 Billion

USD

56.45 Billion

2024

2032

USD

25.95 Billion

USD

56.45 Billion

2024

2032

| 2025 –2032 | |

| USD 25.95 Billion | |

| USD 56.45 Billion | |

|

|

|

|

Sugar Reduction Technology Market Size

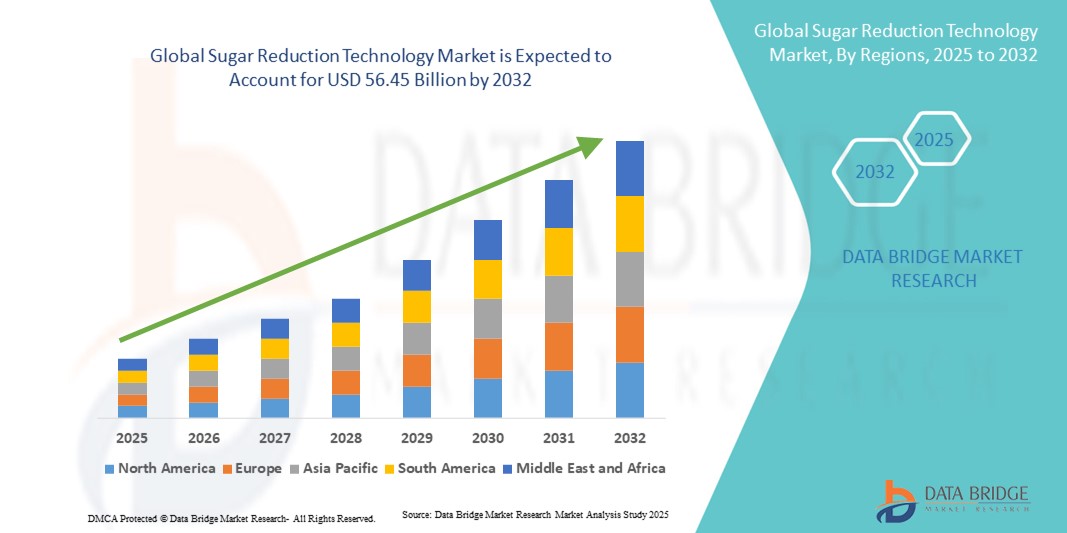

- The global sugar reduction technology market size was valued at USD 25.95 billion in 2024 and is expected to reach USD 56.45 billion by 2032, at a CAGR of 10.2% during the forecast period

- The market expansion is driven by increasing health concerns related to obesity, diabetes, and cardiovascular diseases, pushing both consumers and food manufacturers toward reduced sugar formulations and alternatives

- In addition, strong regulatory support, advancements in sweetener innovation, and the rising preference for natural, low-calorie substitutes are positioning sugar reduction technologies as a critical enabler for the future of food and beverages. These converging trends are fueling widespread adoption, thereby significantly accelerating the industry’s growth

Sugar Reduction Technology Market Analysis

- Sugar reduction technologies, enabling manufacturers to cut sugar content through artificial sweeteners, naturally derived sweeteners, sugar alcohols, and flavor modulators, are becoming increasingly critical in the global food and beverage sector due to rising health consciousness, regulatory pressures, and demand for low-calorie, better-for-you products

- The growing adoption of sugar reduction is primarily fueled by consumer concerns over obesity, diabetes, and cardiovascular diseases, along with the surging popularity of clean-label and natural alternatives that deliver sweetness without compromising taste

- North America dominated the sugar reduction technology market with the largest revenue share of 39.3% in 2024, driven by strict government initiatives on sugar reduction, strong consumer awareness, and major investments by leading food and beverage manufacturers in reformulating products, with the U.S. leading due to large-scale integration of natural and low-calorie sweeteners

- Asia-Pacific is expected to be the fastest growing region in the sugar reduction technology market during the forecast period, supported by rapid urbanization, rising middle-class incomes, and growing demand for healthier packaged foods and beverages

- Artificial Sweeteners segment dominated the sugar reduction technology market with a market share of 38.1% in 2024, owing to their cost-effectiveness, high sweetness intensity, and extensive usage across beverages, confectionery, and processed foods

Report Scope and Sugar Reduction Technology Market Segmentation

|

Attributes |

Sugar Reduction Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sugar Reduction Technology Market Trends

Shift Toward Natural and Clean-Label Sweeteners

- A significant and accelerating trend in the global sugar reduction technology market is the strong shift toward natural, plant-based, and clean-label alternatives such as stevia, monk fruit, and allulose. This consumer-driven movement is reshaping product development strategies across the food and beverage industry

- For instance, in 2024, Cargill expanded its EverSweet® stevia sweetener production in partnership with DSM-Firmenich, scaling up availability to meet growing demand for sugar-free and reduced-sugar products. Similarly, Tate & Lyle is advancing its monk fruit and soluble fiber solutions to support calorie reduction while maintaining taste

- Natural sugar substitutes are increasingly paired with flavor modulation technologies to overcome aftertaste challenges, enabling manufacturers to deliver closer-to-sugar taste experiences. For instance, Firmenich’s flavor modulation systems are being widely adopted in beverages to balance sweetness perception

- The trend toward clean-label sweeteners is further driven by regulatory pressures in the U.S. and Europe, as well as sugar taxes in markets such as Mexico and the U.K., encouraging reformulation with healthier sugar alternatives

- This growing preference for natural, low-calorie, and label-friendly solutions is positioning sugar reduction technologies as a key enabler of next-generation health-focused foods and beverages. Companies such as Ingredion and Sweegen are investing heavily in expanding portfolios of natural sweeteners to address evolving consumer needs

- Demand for sugar reduction technologies that align with natural, sustainable, and clean-label trends is expected to accelerate across both developed and emerging markets, creating long-term growth opportunities

Sugar Reduction Technology Market Dynamics

Driver

Increasing Health Awareness and Regulatory Push for Sugar Reduction

- The rising global incidence of obesity, diabetes, and cardiovascular diseases has placed sugar reduction at the forefront of health and nutrition strategies, making it a key growth driver for the industry

- For instance, in January 2024, the U.K. government reinforced its sugar reduction program for packaged foods and beverages, urging manufacturers to cut sugar content by 20%. Similar initiatives are being implemented in the U.S., India, and Southeast Asia

- Food and beverage companies are responding with reformulation strategies that incorporate alternative sweeteners, enzymatic sugar reduction, and flavor modulation technologies to meet consumer health expectations while maintaining taste

- The push for healthier lifestyles, coupled with consumer demand for low-calorie, low-glycemic products, is significantly driving adoption of sugar reduction technologies across bakery, dairy, beverages, and processed food categories

- Furthermore, advances in biotechnology and fermentation-based production of novel sweeteners are enabling cost-effective scaling, supporting broader adoption by both global brands and regional players

Restraint/Challenge

Taste, Cost Barriers, and Regulatory Complexity

- Despite rapid growth, challenges persist around taste modification, high production costs of natural sweeteners, and the regulatory variability across different regions. These factors pose hurdles to mass adoption

- For instance, while stevia and monk fruit are popular, they often require taste modulation technologies to mask bitterness or aftertaste, increasing formulation costs for manufacturers

- Regulatory approval timelines for newer sweeteners such as allulose remain inconsistent across regions, slowing global rollout. The EU, for instance, still has stricter frameworks compared to the U.S. and Asia-Pacific markets

- In addition, premium pricing of natural sweeteners compared to traditional sugar or artificial sweeteners limits accessibility in cost-sensitive markets, restraining adoption by smaller manufacturers and price-conscious consumers

- Overcoming these challenges requires innovation in taste enhancement, scaling biotechnological production to reduce costs, and harmonizing international regulatory frameworks. Companies focusing on these solutions will be well-positioned for long-term growth in the sugar reduction technology space

Sugar Reduction Technology Market Scope

The market is segmented on the basis of alternative type, technology, application, sales channel, and form.

- By Alternative Type

On the basis of alternative type, the sugar reduction technology market is segmented into artificial sweeteners, naturally-derived sweeteners, sugar alcohols, and sweetness modulators. Artificial Sweeteners dominated the market with the largest revenue share of 38.1% in 2024. These sweeteners, including aspartame, sucralose, and saccharin, are widely used in beverages, confectionery, and processed foods due to their high sweetness intensity and cost-effectiveness. Manufacturers favor them because they maintain taste while significantly reducing calorie content. Regulatory approvals across multiple regions further support their adoption. The segment also benefits from established manufacturing processes and strong industry familiarity. Their long-standing usage and versatility across applications make artificial sweeteners the preferred choice for global food and beverage companies.

Naturally-Derived Sweeteners are expected to witness the fastest growth from 2025 to 2032. Rising consumer demand for clean-label, plant-based alternatives such as stevia, monk fruit, and allulose is driving this growth. These sweeteners align with health-conscious trends and sustainability preferences. Technological innovations improve taste profiles and reduce aftertaste, expanding their adoption across beverages, dairy, and confectionery products. Consumers increasingly prefer natural options over synthetic sweeteners, enhancing market potential.

- By Technology

On the basis of technology, the sugar reduction technology market is segmented into enzymatic conversion, extraction technology, flavor delivery technology, cambya sugar reduction technology, and others. Enzymatic Conversion dominated with 34.2% share in 2024 due to its effectiveness in reducing sugar while preserving taste and texture. It is widely applied in dairy, beverages, and processed foods. This technology allows manufacturers to reformulate products without compromising sweetness perception. Compliance with sugar reduction regulations has further boosted adoption. Enzymatic conversion is cost-efficient compared to some natural alternatives, making it attractive for large-scale production. Its versatility in multiple applications makes it a leading choice for global food producers.

Flavor Delivery Technology is expected to witness the fastest growth from 2025 to 2032. It helps mask off-flavors from natural or alternative sweeteners while enhancing perceived sweetness. The technology supports low-calorie, clean-label product development, particularly in beverages and bakery items. It also improves consumer acceptance of sugar-reduced products. Rising demand for indulgent yet healthier products is driving rapid adoption. Flavor delivery solutions allow manufacturers to balance health and taste effectively.

- By Application

On the basis of application, the sugar reduction technology market is segmented into food & beverages, bakery and confectionery, processed foods, dairy products, and others. Food & Beverages dominated the market with 46.8% share in 2024. The segment benefits from high consumption of low-sugar beverages, juices, and functional drinks. Manufacturers reformulate products to meet regulatory sugar reduction guidelines. Consumer health awareness and lifestyle changes are major growth drivers. High product turnover and brand innovation sustain market leadership. Widespread consumer knowledge about sugar intake contributes to strong demand.

Bakery and Confectionery is expected to witness the fastest growth from 2025 to 2032. Technological advancements in sugar substitutes and flavor modulators enable low-calorie snacks without compromising taste. Rising demand for indulgence products with reduced sugar content fuels this growth. Clean-label and health-conscious trends are particularly influential in developed and emerging markets. Reformulated bakery and confectionery products are increasingly preferred by millennials and urban consumers.

- By Sales Channel

On the basis of sales channel, the sugar reduction technology market is segmented into direct channel, indirect channel, and specialty stores. Direct Channel dominated the market with 41.5% share in 2024. Major manufacturers source sugar reduction technologies directly from suppliers for large-scale production. Direct procurement ensures supply reliability, cost efficiency, and technical support for formulation. It also allows close collaboration between ingredient suppliers and product developers. This channel is particularly preferred by global food and beverage companies. Strong relationships with suppliers and bulk purchase benefits further strengthen dominance.

Indirect Channel is expected to witness the fastest growth from 2025 to 2032. Small- and medium-sized enterprises are increasingly relying on distributors, online platforms, and regional suppliers to access sugar reduction solutions. This approach reduces their capital investment requirements and simplifies procurement. The indirect channel enhances accessibility, especially in emerging markets. It enables faster adoption of new sweeteners without the need for complex logistics. Growing demand from regional and local manufacturers is further driving the segment’s expansion.

- By Form

On the basis of form, the sugar reduction technology market is segmented into crystallized, powder, liquid, and others. Powder form dominated the market with 39.9% share in 2024. Powders are versatile, stable, and easy to incorporate into beverages, bakery, and processed foods. They offer advantages in packaging, storage, and shelf-life management. Powdered sweeteners are cost-effective and widely accepted by manufacturers. Their compatibility with multiple product matrices enhances adoption. High demand in food and beverage processing sustains dominance.

Liquid form is expected to witness the fastest growth from 2025 to 2032. Liquids are increasingly used in ready-to-drink beverages, liquid dairy, and industrial applications. They allow precise sweetness control and uniform distribution. Liquid sweeteners simplify blending in manufacturing processes. Rising popularity of functional drinks and low-calorie beverages fuels adoption. They are particularly suitable for modern, automated food production systems. In addition, their compatibility with modern, automated production systems makes them highly suitable for contemporary food and beverage manufacturing.

Sugar Reduction Technology Market Regional Analysis

- North America dominated the sugar reduction technology market with the largest revenue share of 39.3% in 2024, driven by strict government initiatives on sugar reduction, strong consumer awareness, and major investments by leading food and beverage manufacturers in reformulating products, with the U.S. leading due to large-scale integration of natural and low-calorie sweeteners

- Consumers and manufacturers in the region are increasingly focused on reducing sugar content in beverages, bakery, dairy, and processed foods, while maintaining taste and product quality

- This widespread adoption is further supported by high disposable incomes, well-established food and beverage industries, and advanced R&D capabilities, enabling rapid formulation of innovative sugar reduction solutions. North America remains a key market for both established and emerging players due to its large-scale production and early adoption of sugar alternatives

U.S. Sugar Reduction Technology Market Insight

The U.S. sugar reduction technology market captured the largest revenue share of 82% in North America in 2024, fueled by increasing consumer awareness of obesity, diabetes, and lifestyle diseases. Food and beverage manufacturers are rapidly reformulating products using artificial and natural sweeteners to meet growing demand for low-calorie and clean-label solutions. The adoption of advanced enzymatic conversion and flavor modulation technologies further supports market expansion. Strong R&D capabilities, coupled with high disposable incomes, are enabling manufacturers to innovate and launch healthier products. In addition, regulatory initiatives such as sugar taxes and labeling guidelines are accelerating the integration of sugar reduction solutions across beverages, bakery, and dairy segments. The U.S. market continues to lead due to its combination of consumer health consciousness and industry readiness for innovation.

Europe Sugar Reduction Technology Market Insight

The Europe sugar reduction technology market is projected to expand at a significant CAGR during the forecast period, driven by stringent sugar reduction regulations and increasing consumer health awareness. Urbanization and the rising prevalence of lifestyle-related diseases are promoting demand for low-sugar and sugar-free alternatives. European manufacturers are actively adopting natural sweeteners, enzymatic solutions, and flavor enhancement technologies to comply with regulations and meet clean-label demands. Growth is observed across bakery, beverages, dairy, and processed food sectors. Increasing demand for functional foods and beverages, along with technological adoption in product reformulation, is further boosting market growth.

U.K. Sugar Reduction Technology Market Insight

The U.K. sugar reduction technology market is expected to grow at a robust CAGR during the forecast period, driven by government initiatives to reduce sugar intake, such as voluntary sugar reduction targets in food and beverages. Rising consumer preference for low-calorie, natural, and clean-label products is encouraging manufacturers to adopt sugar reduction solutions. Retailers and e-commerce platforms are supporting wider availability of sugar-reduced products. Health-conscious consumers are influencing reformulation strategies, particularly in beverages, bakery, and dairy categories. The country’s strong regulatory framework and technological adoption in food manufacturing continue to propel growth.

Germany Sugar Reduction Technology Market Insight

The Germany sugar reduction technology market is anticipated to expand at a notable CAGR during the forecast period, fueled by high awareness of health and wellness, and stringent EU sugar regulations. German consumers prefer natural and clean-label alternatives, driving manufacturers to innovate with sweeteners, enzymatic solutions, and flavor modulators. The well-developed food and beverage industry, combined with focus on sustainability and quality, supports market adoption. Sugar reduction technologies are being widely applied in bakery, dairy, beverages, and processed food segments. The integration of novel solutions in functional foods and beverages is becoming increasingly prevalent. The market is strongly influenced by consumer demand for healthier, eco-conscious, and safe food products.

Asia-Pacific Sugar Reduction Technology Market Insight

The Asia-Pacific sugar reduction technology market is poised to grow at the fastest CAGR of 23% during 2025–2032, driven by increasing urbanization, rising disposable incomes, and health-conscious lifestyles in countries such as China, Japan, and India. Governments are promoting healthier diets and implementing sugar reduction initiatives, boosting adoption of sugar reduction solutions. Rising demand for low-calorie beverages, bakery, dairy, and processed foods is encouraging manufacturers to integrate artificial and natural sweeteners, as well as enzymatic and flavor technologies. Technological advancements and expanding manufacturing capabilities make sugar reduction products more affordable and accessible. The market is further supported by a growing middle-class population and strong consumer preference for clean-label and functional products.

Japan Sugar Reduction Technology Market Insight

The Japan sugar reduction technology market is gaining momentum due to a high-tech food industry, increasing health awareness, and aging population. Consumers are actively seeking low-sugar and naturally sweetened products in beverages, dairy, and confectionery categories. Adoption of enzymatic conversion, flavor modulation, and clean-label sweeteners is accelerating. Manufacturers are integrating sugar reduction technologies to meet demand for functional foods and healthier alternatives. Japan’s focus on quality, safety, and innovation is driving market expansion. In addition, growth in ready-to-drink beverages and convenience foods supports the adoption of sugar reduction solutions.

India Sugar Reduction Technology Market Insight

The India sugar reduction technology market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, rising middle-class incomes, and growing health awareness. Increasing incidence of diabetes and lifestyle diseases is fueling demand for low-calorie and naturally sweetened food and beverage products. The government’s promotion of healthier diets and functional foods is encouraging adoption of sugar reduction solutions. Domestic manufacturers and global companies are expanding portfolios to include enzymatic, natural, and artificial sweetener-based technologies. Affordable sugar reduction solutions and growing consumer acceptance in bakery, beverages, dairy, and processed foods segments are key factors driving market growth. India’s position as a manufacturing hub for food ingredients further supports accessibility and scalability.

Sugar Reduction Technology Market Share

The sugar reduction technology industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- SweeGen, Inc. (U.S.)

- Ingredion (U.S.)

- Bonumose, Inc. (U.S.)

- Tate & Lyle (U.K.)

- Roquette Frères (France)

- ADM (U.S.)

- Unilever (U.K.)

- Nestlé (Switzerland)

- PepsiCo (U.S.)

- GODAVARI BIOREFINERIES LTD (India)

- EID Parry (India) Limited (India)

- MarkUpgrade. (Israel)

- Batory Foods (U.S.)

- The Scoular Company (U.S.)

- Heartland Food Products Group (U.S.)

- Incredo Ltd. (Israel)

- Alchemy Foodtech (Singapore)

- Sweetener Products Co (U.S.)

What are the Recent Developments in Global Sugar Reduction Technology Market?

- In August 2025, NNB Nutrition unveiled SweetVantage + Allulose at IFT FIRST 2025. This combination offers 2.5× the potency of stevia but without bitterness, delivering a genuine “sugar-such as taste and texture.” It represents a breakthrough in natural sweetening technology touted under the bold “Sugar is Dead” campaign

- In July 2025, Layn Natural Ingredients launched SteviUp M2, a next-generation stevia sweetener. SteviUp M2, introduced for its clean taste, superior solubility, and low bitterness, achieved FDA GRAS status (GRN 1203). It is formulation-friendly (95% steviol glycosides), non-GMO, and suitable for clear, ready-to-mix beverages, including functional and powdered drinks

- In June 2025, BlueTree Technology entered the European market with its additive-free sugar reduction process. The technology can reduce natural sugar in fruit juices by up to 30% without altering taste or mouthfeel, qualifying products for “reduced-sugar fruit juice” labeling under upcoming EU regulations. BlueTree is exploring applications in dairy and beer

- In May 2025, BlueTree Technologies announced the rollout of its sugar-reduction technology in Latin America and Southeast Asia. BlueTree, following a successful launch with Israeli juice-maker Priniv—producing orange juice with 33% reduced sugar—signed a deal with a manufacturer in Thailand and is in talks to expand to major juice producers in Latin America. The firm is also developing solutions for low- to zero-sugar dairy products, eyeing launch by 2026

- In April 2025, the Institute of Food Technologists (IFT) released new educational resources on sugar alternatives. They launched the free-to-download Sugar Alternatives At A Glance and the more detailed IFS Members-Only Sugar Alternatives Overview, covering artificial, natural sweeteners, and sugar alcohols—with info on regulatory status, uses, and sweetness levels

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.