Global Sugar Toppings Market

Market Size in USD Billion

CAGR :

%

USD

8.61 Billion

USD

14.24 Billion

2024

2032

USD

8.61 Billion

USD

14.24 Billion

2024

2032

| 2025 –2032 | |

| USD 8.61 Billion | |

| USD 14.24 Billion | |

|

|

|

|

Global Sugar Toppings Market Size

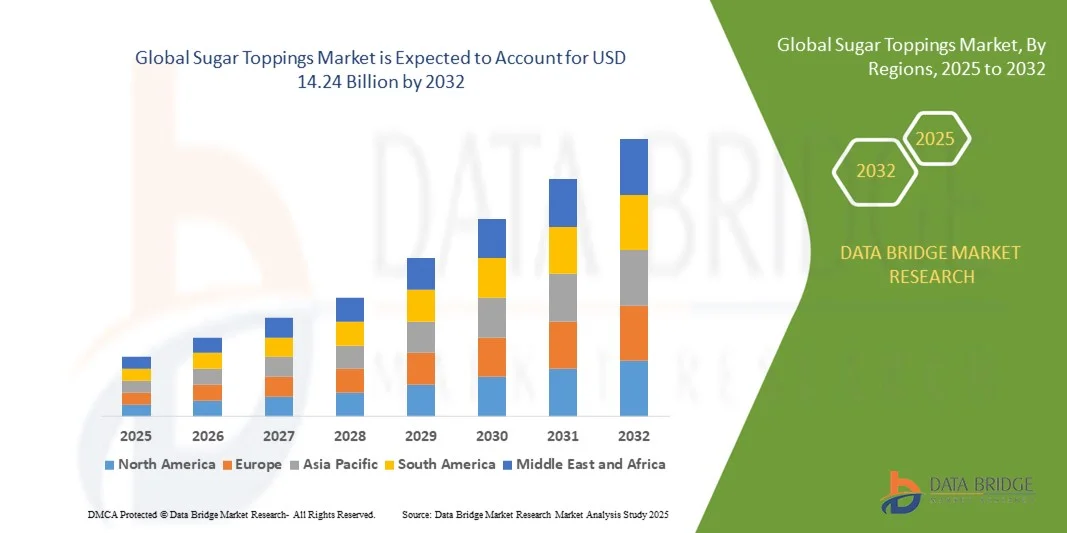

- The global Sugar Toppings Market size was valued at USD 8.61 billion in 2024 and is projected to reach USD 14.24 billion by 2032, growing at a CAGR of 6.50% during the forecast period.

- The market expansion is primarily driven by rising consumer preferences for premium, artisanal, and visually appealing dessert offerings, as well as the surge in home baking and dessert customization trends globally.

- Additionally, the increasing use of sugar toppings in quick-service restaurants (QSRs), bakeries, and packaged foods, coupled with innovation in flavors and formats, is propelling demand—firmly establishing sugar toppings as a staple in modern culinary and confectionery applications.

Global Sugar Toppings Market Analysis

- Sugar toppings, including sprinkles, syrups, icing, and flavored sugars, are becoming essential ingredients in modern baking and dessert preparation across residential, commercial, and industrial applications due to their ability to enhance visual appeal, texture, and flavor profiles.

- The increasing demand for sugar toppings is primarily fueled by the growing popularity of home baking, expanding café and bakery culture, and rising consumer interest in premium and customizable dessert experiences.

- North America dominated the Global Sugar Toppings Market with the largest revenue share of 34.2% in 2024, driven by a well-established bakery industry, high consumption of convenience desserts, and strong presence of global and regional players offering innovative topping solutions.

- Asia-Pacific is expected to be the fastest growing region in the Global Sugar Toppings Market during the forecast period due to rapid urbanization, westernization of diets, and increased spending on premium food products.

- The Dry Sugar Toppings segment dominated the market with the largest revenue share of approximately 58% in 2024, owing to their versatility, ease of application, and longer shelf life.

Report Scope and Global Sugar Toppings Market Segmentation

|

Attributes |

Sugar Toppings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Sugar Toppings Market Trends

Product Innovation and Visual Appeal Driving Consumer Engagement

- A significant and accelerating trend in the global Sugar Toppings Market is the growing emphasis on product innovation, particularly in terms of flavor diversity, texture enhancements, and aesthetic appeal. Consumers are increasingly seeking toppings that not only taste good but also enhance the visual presentation of desserts, baked goods, and beverages. This trend is reshaping product development strategies across the industry.

- For instance, companies are launching color-changing sprinkles, glitter-infused syrups, and toppings infused with trending flavors such as matcha, salted caramel, and tropical fruits to cater to evolving consumer preferences. These innovations are especially popular among younger demographics who value visually striking and Instagram-worthy food creations.

- In addition, premium and artisanal sugar toppings—such as organic cane sugar crystals, handcrafted caramel drizzles, and vegan icing glazes—are gaining momentum as health-conscious consumers and gourmet food lovers look for higher-quality, natural alternatives. These products often feature clean-label ingredients and cater to niche markets, including plant-based and allergen-free diets.

- The expansion of social media-driven food culture is further amplifying this trend. Bakers, food influencers, and home chefs frequently showcase creative dessert designs using a wide variety of sugar toppings, thereby increasing product visibility and encouraging trial. This has led brands to launch limited-edition, seasonal, and co-branded toppings in collaboration with influencers and popular franchises.

- The demand for toppings that provide both sensory appeal and personalization options is driving companies to invest in R&D, 3D food printing technologies, and customization platforms that allow consumers to choose colors, flavors, and textures. Brands like MONIN and The Hershey Company are focusing on expanding their sugar toppings portfolios with tailored offerings for both the retail and foodservice sectors.

- This trend toward aesthetic enhancement, flavor exploration, and customizable dessert experiences is fundamentally transforming the sugar toppings category, positioning it as a key component in both everyday and premium food applications. As a result, manufacturers are continuously innovating to stay relevant and capture consumer attention in a highly visual and taste-driven market.

Global Sugar Toppings Market Dynamics

Driver

Growing Demand Driven by Dessert Customization and Foodservice Expansion

- The increasing consumer interest in personalized and visually appealing desserts, combined with the rapid expansion of the foodservice industry, is a major driver fueling demand in the global Sugar Toppings Market.

- For instance, quick-service restaurants (QSRs), cafés, and bakery chains are significantly boosting their offerings with diverse sugar toppings such as flavored syrups, drizzles, sprinkles, and icing to cater to evolving customer preferences for indulgent and Instagram-worthy treats. Seasonal and limited-edition toppings have become popular tools for customer engagement and repeat visits.

- As at-home baking continues to rise, especially post-pandemic, consumers are increasingly looking for bakery-style finishing touches that are easy to apply yet elevate homemade desserts. This trend has led to increased retail demand for decorative toppings such as glitter sugar, color-coated sprinkles, and ready-to-use icing tubes.

- Furthermore, the global rise in disposable income, urbanization, and exposure to Western dessert trends in emerging markets are accelerating the adoption of premium sugar toppings. The growing presence of global food chains and local dessert startups in countries across Asia-Pacific, the Middle East, and Latin America is further propelling the market forward.

- Convenience and variety remain central to the appeal of sugar toppings in both commercial and domestic kitchens. From gourmet dessert bars to do-it-yourself ice cream parlors and frozen yogurt chains, the ability to offer consumers multiple topping options has become a key differentiator. This demand is also influencing product packaging innovations, such as dual-chamber bottles and single-serve sachets tailored for both bulk and retail users.

Restraint/Challenge

Health Concerns and Growing Regulatory Scrutiny

- Rising global awareness regarding health and nutrition is emerging as a significant restraint in the sugar toppings market. As consumers become more health-conscious, there is growing concern over excessive sugar consumption and its link to conditions such as obesity, diabetes, and heart disease.

- For instance, several governments, including those in the U.K., Mexico, and parts of the U.S., have introduced sugar taxes or labeling mandates that require manufacturers to disclose sugar content more transparently. These regulations are pushing companies to rethink formulations and reduce added sugars.

- In response, manufacturers are investing in reduced-sugar, sugar-free, and alternative sweetener-based toppings. However, maintaining the taste, texture, and appearance of traditional sugar toppings while meeting health expectations remains a technical challenge, which can impact product development timelines and cost efficiency.

- Moreover, consumer skepticism toward artificial sweeteners and synthetic additives can limit the acceptance of some "healthier" reformulated products. Balancing indulgence with wellness is a key strategic challenge for brands in this space.

- To overcome these obstacles, companies must focus on clean-label innovations, transparent ingredient sourcing, and consumer education around moderation and healthy indulgence. Strategic collaborations with health experts and food scientists will also play a vital role in ensuring future growth while meeting evolving regulatory and consumer standards.

Global Sugar Toppings Market Scope

The sugar toppings market is segmented on the basis of type, channel, nature, end user and distribution channel.

- By Type

On the basis of type, the Global Sugar Toppings Market is segmented into Dry Sugar Toppings and Wet Sugar Toppings. The Dry Sugar Toppings segment dominated the market with the largest revenue share of approximately 58% in 2024, owing to their versatility, ease of application, and longer shelf life. These toppings, including colored sugars, sprinkles, and sanding sugars, are widely used in bakery, confectionery, and packaged foods to add texture and visual appeal.

The Wet Sugar Toppings segment is expected to witness the fastest growth rate during the forecast period due to rising demand for syrups, glazes, and drizzles that enhance flavor profiles and provide a premium finish, particularly in foodservice and gourmet dessert applications. This segment’s growth is also driven by innovations in flavors and natural ingredient formulations catering to health-conscious consumers.

- By Channel

On the basis of channel, the market is segmented into Industrial, Grocery, and Food Service channels. The Grocery segment accounted for the largest market revenue share of around 50% in 2024, propelled by the growing trend of at-home baking and easy access to sugar toppings through supermarkets and specialty stores. Consumer preference for convenience and ready-to-use products supports this segment’s dominance.

The Food Service segment is projected to experience the fastest CAGR during the forecast period due to the rapid expansion of quick-service restaurants, bakeries, and cafés emphasizing dessert customization and visual appeal. The Industrial channel maintains steady demand driven by bulk purchasing from large-scale manufacturers incorporating sugar toppings into processed foods.

- By Nature

The market is segmented by nature into Organic and Conventional sugar toppings. The Conventional segment held the dominant market share of approximately 70% in 2024, supported by wide availability, cost-effectiveness, and established manufacturing processes. Conventional toppings continue to meet the demand of a broad consumer base across all food categories.

the Organic segment is expected to witness the fastest growth rate during the forecast period, fueled by increasing consumer awareness of health and environmental benefits associated with organic products. Rising demand in North America and Europe, alongside growing clean-label trends, drives organic sugar toppings’ rapid adoption, with manufacturers focusing on certifications and natural ingredient sourcing.

- By End User

The market is segmented by end user into Bakery, Confectionery, Dairy, Ready-to-Eat Snacks, Convenience Foods, and Packaged Foods. The Bakery segment dominated the market in 2024 with a revenue share of approximately 45%, driven by the extensive use of sugar toppings for decoration, flavor, and texture enhancement in cakes, pastries, and breads. Bakeries continuously innovate with toppings to attract customers and meet demand for visually appealing products.

The Confectionery segment is anticipated to witness the fastest growth rate during the forecast period due to the rising consumption of chocolates, candies, and premium desserts enhanced with decorative sugar toppings. Ready-to-eat and convenience food sectors also contribute to increasing usage driven by snacking trends.

- By Distribution Channel

On the basis of distribution channel, the Global Sugar Toppings Market is segmented into Business to Business (B2B) and Business to Consumer (B2C). The B2B segment held the largest market share of approximately 65% in 2024, mainly due to bulk purchases by bakeries, food manufacturers, and hospitality businesses. This segment benefits from steady demand and long-term supply contracts.

The B2C segment is expected to witness the fastest CAGR during the forecast period, supported by growing consumer interest in home baking and increased availability of sugar toppings through online retail and supermarkets. The expansion of e-commerce and direct-to-consumer marketing strategies has made sugar toppings more accessible, enhancing product variety and convenience for end consumers.

Global Sugar Toppings Market Regional Analysis

- North America dominated the Global Sugar Toppings Market with the largest revenue share of 34.2% in 2024, driven by strong demand in the bakery and confectionery sectors as well as widespread consumer preference for premium and decorative toppings

- Consumers in the region increasingly seek high-quality sugar toppings that enhance product aesthetics and flavor, supported by rising disposable incomes and sophisticated taste preferences

- This dominance is further reinforced by well-established distribution networks, advanced retail infrastructure, and growing awareness of health-conscious and organic product options, positioning North America as a key market for innovation and adoption of diverse sugar topping varieties across both commercial and home baking segments

U.S. Sugar Toppings Market Insight

The U.S. sugar toppings market captured the largest revenue share of 81% in North America in 2024, driven by strong consumer demand for premium bakery and confectionery products. The growing popularity of home baking, coupled with increasing consumer interest in visually appealing and flavored toppings, is fueling market growth. Additionally, the expansion of foodservice outlets and quick-service restaurants offering customized desserts and snacks supports this trend. The availability of diverse sugar topping varieties and innovations such as organic and natural options are further propelling market adoption across residential and commercial segments.

Europe Sugar Toppings Market Insight

The Europe sugar toppings market is projected to grow at a substantial CAGR throughout the forecast period, driven by rising consumer demand for premium and organic bakery products. Increasing health consciousness and regulatory emphasis on food safety are influencing the adoption of clean-label sugar toppings. Urbanization and the expanding foodservice industry are fostering the use of sugar toppings in commercial applications. The market also benefits from growing interest in artisanal and gourmet food products that leverage decorative and flavorful sugar toppings for enhanced appeal.

U.K. Sugar Toppings Market Insight

The U.K. sugar toppings market is expected to experience noteworthy growth during the forecast period, fueled by the rising trend of home baking and increased demand for premium confectionery products. Concerns around food quality and sustainability are prompting consumers to seek organic and natural sugar toppings. The U.K.’s robust retail and e-commerce infrastructure facilitates wider product availability, while the thriving café and bakery culture continues to drive commercial demand for innovative sugar toppings.

Germany Sugar Toppings Market Insight

The Germany sugar toppings market is anticipated to expand steadily, supported by a strong bakery tradition and growing consumer preference for high-quality, natural ingredients. Emphasis on sustainable and organic food production aligns with the demand for organic sugar toppings. The increasing number of bakery chains and the popularity of ready-to-eat snacks are creating growth opportunities. Integration of innovative flavors and textures in sugar toppings enhances product differentiation, appealing to Germany’s quality-conscious consumers.

Asia-Pacific Sugar Toppings Market Insight

The Asia-Pacific sugar toppings market is expected to grow at the fastest CAGR of 24% from 2025 to 2032, driven by rising urbanization, increasing disposable incomes, and the expanding bakery and confectionery sectors in countries such as China, India, and Japan. Growing consumer interest in Western-style baked goods and desserts, along with government initiatives supporting food industry modernization, is boosting demand. The region’s role as a manufacturing hub for food ingredients also helps improve affordability and accessibility, expanding market reach to both commercial and home users.

Japan Sugar Toppings Market Insight

The Japan sugar toppings market is gaining momentum due to the country’s sophisticated consumer base, emphasis on aesthetics in food presentation, and high demand for convenience foods. Increasing integration of sugar toppings in ready-to-eat snacks and confectionery products is fueling growth. Moreover, Japan’s aging population drives demand for easy-to-use packaged toppings that enhance taste and texture without additional preparation effort, benefiting both retail and foodservice segments.

China Sugar Toppings Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, rising middle-class incomes, and the growing popularity of baked goods and confectioneries. The expanding foodservice industry and surge in quick-service restaurant chains offering desserts and snacks with sugar toppings are key growth drivers. Additionally, strong domestic manufacturing capabilities and the government’s push towards food innovation are enabling greater product variety and affordability, making sugar toppings increasingly accessible across the country.

Global Sugar Toppings Market Share

The Sugar Toppings industry is primarily led by well-established companies, including:

• The J.M. Smucker Company (U.S.)

• The Hershey Company (U.S.)

• The Kraft Heinz Company (U.S.)

• Baldwin Richardson Foods Co. (U.S.)

• MONIN. (France)

• W.T. Lynch Foods Limited (Canada)

• Regal Food Products Group PLC. (U.K.)

• The Quaker Oats Company (U.S.)

• Ck Products LLC (U.S.)

• Ghirardelli Chocolate Company (U.S.)

• Paulaur Corporation (U.S.)

• Nimbus Foods Ltd (U.K.)

• Wafer Limited (U.K.)

• Sanders Candy (U.S.)

• I. Rice & Company Inc. (U.S.)

• Hermès (France)

• NZ Sugar Company Ltd (New Zealand)

• Chobani, LLC (U.S.)

• CSM Ingredients (Italy)

What are the Recent Developments in Global Sugar Toppings Market?

- In April 2023, Sweet Solutions Inc., a global leader in confectionery ingredients, launched a strategic initiative in South Africa focused on expanding the availability of premium sugar toppings for both residential baking and commercial foodservice sectors. This initiative highlights the company’s commitment to delivering innovative, high-quality topping products tailored to local taste preferences and market demands. By leveraging its global manufacturing expertise and extensive product portfolio, Sweet Solutions aims to strengthen its foothold in the rapidly growing global sugar toppings market.

- In March 2023, SugarCraft Ltd., a veteran-led company based in Tennessee, introduced its new line of organic dry sugar toppings specifically designed for bakeries and confectionery businesses. This innovative product line offers enhanced flavor profiles and natural ingredients, meeting increasing consumer demand for healthier, clean-label options. SugarCraft’s launch underscores its dedication to advancing sugar topping technologies that cater to evolving trends in the bakery and foodservice industries.

- In March 2023, Global Sugar Co. successfully partnered with key foodservice providers in Bengaluru to supply a variety of wet sugar toppings aimed at enhancing dessert menus across the region. This collaboration supports the city’s growing culinary scene by offering premium toppings that improve taste and visual appeal. The project demonstrates Global Sugar Co.’s commitment to leveraging innovative ingredient solutions to meet rising demand for premium dessert customization in emerging markets.

- In February 2023, SweetTech LLC, a leading provider of sugar topping solutions for the packaged foods sector, announced a strategic partnership with the National Bakery Association to develop new market channels and educational programs for bakery professionals. This collaboration is designed to enhance product awareness and usage, facilitating wider adoption of sugar toppings in commercial baking. The initiative highlights SweetTech’s commitment to innovation and industry collaboration to drive growth within the global sugar toppings market.

- In January 2023, Crystal Sweeteners, a prominent player in the sugar toppings segment under the Crystal Foods Group, unveiled its new line of flavored sugar sprinkles at the International Food Ingredients Expo 2023. This product range, featuring vibrant colors and unique flavors, enables food manufacturers and bakers to offer consumers more diverse and attractive dessert options. Crystal Sweeteners’ launch reflects the company’s focus on integrating advanced flavor technologies into sugar toppings, enhancing consumer experience while supporting product differentiation.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sugar Toppings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sugar Toppings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sugar Toppings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.