Global Sulfite Based Paperboard Packaging Market

Market Size in USD Billion

CAGR :

%

USD

12.17 Billion

USD

18.67 Billion

2024

2032

USD

12.17 Billion

USD

18.67 Billion

2024

2032

| 2025 –2032 | |

| USD 12.17 Billion | |

| USD 18.67 Billion | |

|

|

|

|

Sulfite-Based Paperboard Packaging Market Size

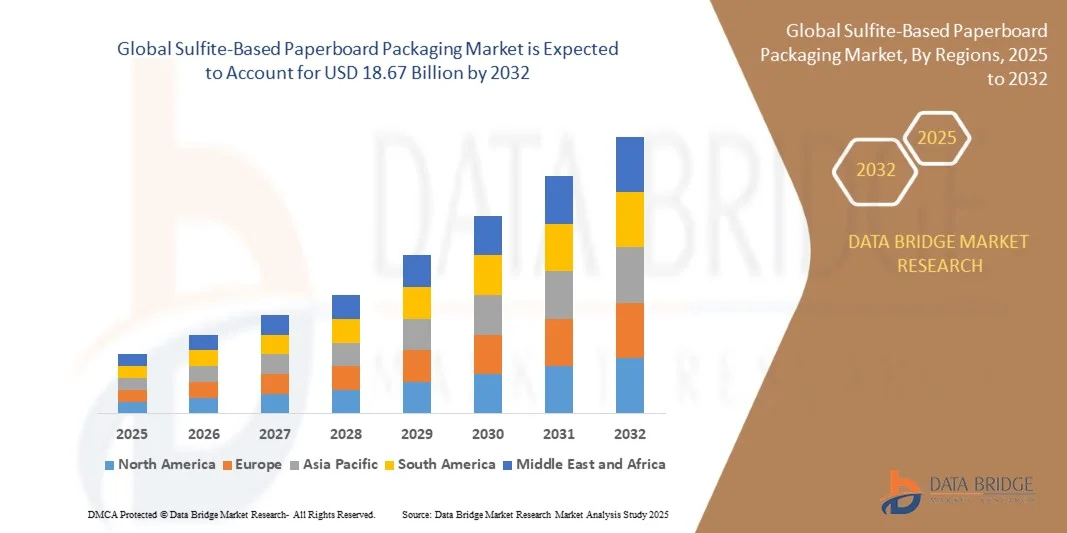

- The global sulfite-based paperboard packaging market size was valued at USD 12.17 billion in 2024 and is expected to reach USD 18.67 billion by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is largely fuelled by the increasing demand for sustainable and eco-friendly packaging solutions across food, beverage, and consumer goods industries. The biodegradability, recyclability, and cost-effectiveness of sulfite-based paperboards are driving adoption globally

- Rising e-commerce penetration and the need for protective yet lightweight packaging are further contributing to market expansion. Manufacturers are increasingly opting for paperboard packaging to reduce shipping costs and improve supply chain efficiency

Sulfite-Based Paperboard Packaging Market Analysis

- The market is characterized by a high level of competition among global and regional players, focusing on innovation, quality improvement, and sustainable production techniques. Companies are investing in research to enhance strength, barrier properties, and printability of paperboard packaging

- Increasing adoption in food and beverage, pharmaceuticals, and personal care products is driving diversified application growth. The market is witnessing a shift toward premium packaging formats that improve product appeal and consumer experience

- Asia-Pacific dominated the sulfite-based paperboard packaging market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, growing e-commerce activities, and increased demand for sustainable packaging solutions

- North America region is expected to witness the highest growth rate in the global sulfite-based paperboard packaging market, driven by increasing consumer awareness of recyclable packaging, widespread use in food & beverage and personal care products, and innovations in lightweight and high-performance paperboards

- The Coated SBS segment held the largest market revenue share in 2024, driven by its superior printability, surface smoothness, and suitability for premium packaging applications. Coated SBS is widely adopted for retail packaging, folding cartons, and high-end consumer goods due to its aesthetic appeal and structural performance

Report Scope and Sulfite-Based Paperboard Packaging Market Segmentation

|

Attributes |

Sulfite-Based Paperboard Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sulfite-Based Paperboard Packaging Market Trends

Increasing Demand for Sustainable and Lightweight Packaging Solutions

- The growing shift toward sustainable and lightweight packaging is transforming the sulfite-based paperboard packaging landscape by enabling eco-friendly, cost-effective, and durable packaging. These boards allow for reduced material usage, lower transportation costs, and improved operational efficiency for manufacturers. The trend is further fueled by increasing consumer preference for environmentally responsible packaging, encouraging brands to adopt sustainable solutions across multiple product categories

- The high demand for protective packaging in e-commerce, food & beverage, and consumer goods sectors is accelerating the adoption of sulfite-based paperboard. This packaging provides superior printability, structural integrity, and customization options, meeting modern branding and functional requirements. Companies are leveraging innovative designs and enhanced barrier properties to maintain product quality during transit and storage, reducing product losses

- The versatility and recyclability of sulfite-based paperboard make it attractive for both commercial and retail packaging. Businesses benefit from enhanced shelf appeal, reduced environmental impact, and compliance with emerging regulations promoting circular economy practices. In addition, the use of coated and laminated boards supports specialized applications such as premium gift packaging and fragile product protection

- For instance, in 2023, several North American and European FMCG companies reported improved packaging efficiency and reduced shipping damages after transitioning to advanced sulfite-based paperboard solutions, leading to cost savings and sustainability recognition. This transition also enhanced brand reputation among environmentally conscious consumers and strengthened market positioning

- While adoption is increasing, market growth depends on continued innovation in board formulations, lightweight design, and environmentally friendly coatings to ensure long-term relevance and operational advantages. Companies investing in R&D to improve moisture resistance, print quality, and structural performance are likely to gain a competitive edge in the market

Sulfite-Based Paperboard Packaging Market Dynamics

Driver

Rising E-Commerce Demand and Focus on Sustainable Packaging

- The rapid expansion of e-commerce and online retail is driving manufacturers to adopt sulfite-based paperboard as a preferred packaging solution. Its lightweight, durable, and printable properties enhance product protection and presentation. The demand is particularly strong in fast-moving consumer goods, electronics, and food delivery sectors, where packaging plays a critical role in maintaining product integrity

- Businesses are increasingly aware of the environmental and cost benefits of sulfite-based paperboard, including reduced carbon footprint, recyclability, and lower shipping expenses, which encourages adoption across various sectors. Companies are also leveraging these benefits for marketing advantages, promoting eco-friendly packaging as a brand differentiator to attract environmentally conscious consumers

- Regulatory support and sustainability initiatives promoting biodegradable and recyclable packaging further stimulate market adoption in commercial operations. Governments and industry bodies are implementing policies favoring sustainable materials, incentivizing manufacturers to replace conventional packaging with sulfite-based alternatives that comply with evolving environmental standards

- For instance, in 2022, several European and North American e-commerce packaging companies implemented sulfite-based paperboard solutions for consumer goods and electronics, boosting packaging efficiency and reducing material waste. This led to operational cost savings, enhanced supply chain sustainability, and improved customer satisfaction due to safer and more attractive packaging

- While the growing e-commerce sector drives demand, manufacturers must focus on product innovation, regulatory compliance, and optimized board designs to maintain long-term adoption and market confidence. Continuous improvements in material strength, print quality, and environmental certifications will be key to supporting wider adoption globally

Restraint/Challenge

High Production Costs and Limited Availability in Certain Regions

- The high cost of producing premium sulfite-based paperboard, due to raw material sourcing, energy-intensive manufacturing, and specialized processing, limits adoption among smaller manufacturers and cost-sensitive markets. This creates barriers for new entrants and restricts widespread use in developing regions where cost constraints are significant

- In some regions, inconsistent availability of raw materials, coupled with logistical and distribution challenges, restricts timely supply and reduces market penetration. Manufacturers face challenges in maintaining consistent quality and meeting large-scale demand, which may hinder growth in emerging economies and remote areas

- Limited awareness of sustainable packaging alternatives in emerging markets may slow adoption, especially in cost-driven sectors where conventional packaging remains dominant. Without targeted education, incentives, and local supply chain development, these regions may continue relying on traditional, less sustainable packaging options

- For instance, in 2023, several SMEs in Southeast Asia reported difficulty in procuring high-quality sulfite-based paperboard locally, leading to reliance on imported material and higher costs. The added logistical complexity and currency fluctuations further increased operational costs for businesses seeking sustainable packaging solutions

- While packaging technologies continue to evolve, addressing cost, availability, and regional supply challenges is crucial for sustained global market growth and wider adoption. Investments in localized production facilities, raw material sourcing partnerships, and efficient distribution networks are essential to overcome these limitations and drive long-term market expansion

Sulfite-Based Paperboard Packaging Market Scope

The market is segmented on the basis of product type, packaging format, and end-use industry.

• By Product Type

On the basis of product type, the sulfite-based paperboard packaging market is segmented into Coated SBS, Uncoated SBS, and Laminated Sulfite Board. The Coated SBS segment held the largest market revenue share in 2024, driven by its superior printability, surface smoothness, and suitability for premium packaging applications. Coated SBS is widely adopted for retail packaging, folding cartons, and high-end consumer goods due to its aesthetic appeal and structural performance.

The Uncoated SBS segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its cost-effectiveness, recyclability, and adaptability for bulk packaging applications. Uncoated SBS boards are particularly popular for industrial and e-commerce packaging where functionality and sustainability are prioritized over premium finishes.

• By Packaging Format

On the basis of packaging format, the market is segmented into Folding Cartons, Liquid Packaging Cartons, Labels and Tags, Tubes and Cores, and Others. The Folding Cartons segment held the largest market revenue share in 2024, fueled by high demand from food & beverage, personal care, and retail sectors. Folding cartons offer versatility, brand visibility, and protection, making them a preferred choice for both manufacturers and retailers.

The Liquid Packaging Cartons segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing consumption of packaged beverages and growing adoption in the dairy and juice industries. These cartons provide leak-proof, lightweight, and sustainable packaging solutions that align with modern consumer preferences.

• By End-Use Industry

On the basis of end-use industry, the market is segmented into Food and Beverage, Personal Care and Cosmetics, Pharmaceutical, Tobacco, and More. The Food and Beverage segment held the largest market revenue share in 2024, driven by rising demand for packaged foods, beverages, and confectioneries requiring protective and visually appealing packaging.

The Personal Care and Cosmetics segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the expanding beauty and personal care industry and increasing consumer focus on premium and sustainable packaging solutions. The demand is particularly strong for packaging that enhances shelf appeal while maintaining product safety and quality.

Sulfite-Based Paperboard Packaging Market Regional Analysis

- Asia-Pacific dominated the sulfite-based paperboard packaging market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, growing e-commerce activities, and increased demand for sustainable packaging solutions

- Businesses and manufacturers in the region highly value the lightweight, durable, and eco-friendly properties of sulfite-based paperboard, which enhance operational efficiency and reduce transportation costs

- This widespread adoption is further supported by the presence of large packaging manufacturers, expanding FMCG sectors, and government initiatives promoting environmentally responsible packaging practices, establishing sulfite-based paperboard as a preferred solution across multiple industries

China Sulfite-Based Paperboard Packaging Market Insight

The China sulfite-based paperboard packaging market captured the largest revenue share in 2024 within Asia-Pacific, fueled by rapid urbanization, rising disposable incomes, and the growth of e-commerce and retail sectors. Manufacturers are increasingly prioritizing sustainable, lightweight, and customizable packaging solutions to meet consumer demand. Moreover, government policies supporting eco-friendly packaging and the presence of domestic board manufacturers are significantly contributing to market expansion.

Japan Sulfite-Based Paperboard Packaging Market Insight

The Japan sulfite-based paperboard packaging market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s strong focus on sustainable packaging, advanced manufacturing infrastructure, and high consumer awareness regarding eco-friendly products. The growing demand from food & beverage, personal care, and pharmaceutical sectors is driving adoption. Manufacturers are increasingly investing in lightweight, durable, and recyclable sulfite-based paperboard solutions, supported by government initiatives promoting circular economy practices and reducing packaging waste.

Europe Sulfite-Based Paperboard Packaging Market Insight

The Europe sulfite-based paperboard packaging market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent environmental regulations, sustainability initiatives, and the rising adoption of recyclable and biodegradable packaging solutions. The demand from food & beverage, personal care, and pharmaceutical sectors is fostering market growth. European companies are increasingly focusing on eco-conscious packaging innovations, enhancing both brand reputation and compliance with circular economy policies.

U.K. Sulfite-Based Paperboard Packaging Market Insight

The U.K. sulfite-based paperboard packaging market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand from e-commerce, retail, and FMCG sectors. Consumers’ and businesses’ focus on sustainable, recyclable packaging solutions is encouraging manufacturers to adopt sulfite-based paperboard. In addition, the U.K.’s robust logistics and retail infrastructure supports wider market penetration and accelerated adoption of lightweight, environmentally responsible packaging solutions.

Germany Sulfite-Based Paperboard Packaging Market Insight

The Germany sulfite-based paperboard packaging market is expected to witness the fastest growth rate from 2025 to 2032, fueled by stringent regulatory standards for sustainable packaging and a strong focus on recycling and environmental conservation. Germany’s well-developed manufacturing infrastructure and innovation-oriented packaging sector support the adoption of high-quality sulfite-based paperboard. The integration of eco-friendly materials into food, beverage, and personal care packaging is increasingly prevalent, driving demand for premium and compliant board solutions.

North America Sulfite-Based Paperboard Packaging Market Insight

The North America sulfite-based paperboard packaging market is expected to witness the fastest growth rate from 2025 to 2032, driven by the expansion of e-commerce, food & beverage, and personal care industries. The region’s preference for sustainable, lightweight, and customizable packaging solutions is accelerating adoption. Moreover, the presence of leading packaging manufacturers, strong supply chains, and supportive environmental regulations contribute to the widespread use of sulfite-based paperboard in commercial and retail sectors.

U.S. Sulfite-Based Paperboard Packaging Market Insight

The U.S. sulfite-based paperboard packaging market is expected to witness the fastest growth rate from 2025 to 2032, attributed to the growth of e-commerce, FMCG, and food & beverage industries. Manufacturers are increasingly investing in lightweight, recyclable, and high-performance paperboard solutions to enhance product protection and reduce shipping costs. Government initiatives promoting eco-friendly packaging and strong domestic production capabilities further propel market growth and adoption across commercial and retail applications.

Sulfite-Based Paperboard Packaging Market Share

The Sulfite-Based Paperboard Packaging industry is primarily led by well-established companies, including:

- International Paper (U.S.)

- WestRock Company (U.S.)

- Stora Enso Oyj (Finland)

- Smurfit Kappa Group (Ireland)

- DS Smith Plc (U.K.)

- Oji Holdings Corporation (Japan)

- Mondi Group (South Africa)

- Nine Dragons Paper Holdings Limited (China)

- Packaging Corporation of America (U.S.)

- Mayr-Melnhof Karton AG (Austria)

Latest Developments in Sulfite-Based Paperboard Packaging Market

- In May 2025, Stora Enso completed the acquisition of Finnish sawmill company Junnikkala Oy for up to EUR 137 million (USD 148 million), enhancing its raw-material integration for the Oulu board line, improving supply chain efficiency and strengthening its competitive position in the packaging board market

- In April 2025, International Paper reported Q1 2025 net sales of USD 5.9 billion following the acquisition of DS Smith, expanding its North American packaging footprint and increasing production capacity, which is expected to drive greater market share and revenue growth

- In March 2025, Stora Enso initiated the production ramp-up of its new consumer packaging board line at Oulu, with full capacity expected by 2027, aimed at meeting growing demand for sustainable packaging solutions and enhancing operational efficiency

- In February 2024, Graphic Packaging agreed to sell its Augusta bleached board plant to Clearwater Paper for USD 700 million, allowing the company to sharpen its strategic focus, optimize resource allocation, and improve overall market positioning in key regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sulfite Based Paperboard Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sulfite Based Paperboard Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sulfite Based Paperboard Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.