Global Sulphonated Polymers Market

Market Size in USD Billion

CAGR :

%

USD

2.13 Billion

USD

3.25 Billion

2024

2032

USD

2.13 Billion

USD

3.25 Billion

2024

2032

| 2025 –2032 | |

| USD 2.13 Billion | |

| USD 3.25 Billion | |

|

|

|

|

Sulphonated Polymers Market Size

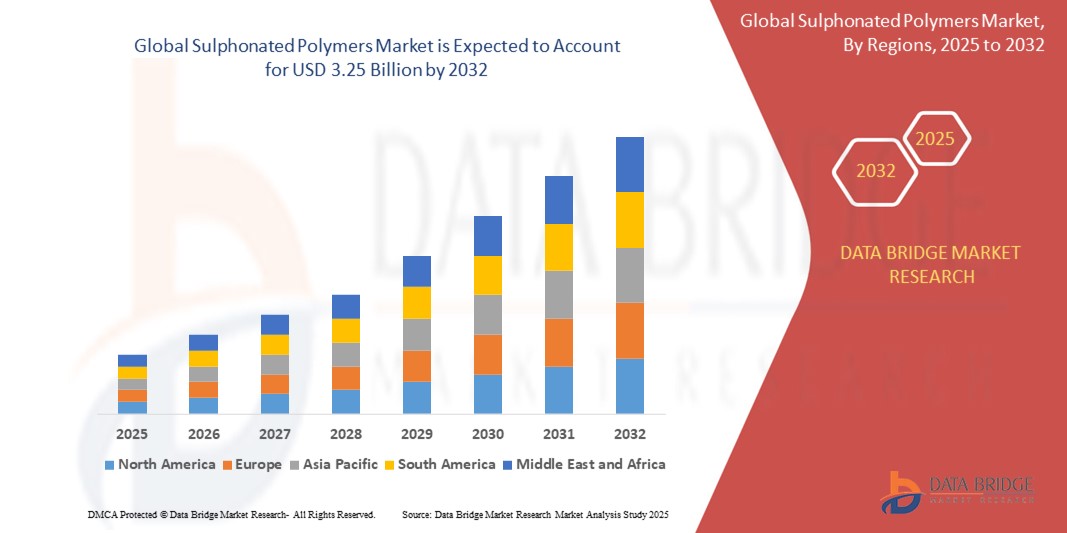

- The global sulphonated polymers market size was valued at USD 2.13 billion in 2024 and is expected to reach USD 3.25 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-performance polymers in industrial filtration, water treatment, energy, and medical applications due to their chemical resistance, thermal stability, and ion-exchange properties

- In addition, expanding use in proton exchange membranes for fuel cells, growing emphasis on environmental sustainability, and rising R&D investments in advanced polymer technologies are also contributing to the market’s expansion

Sulphonated Polymers Market Analysis

- The market is experiencing strong growth due to increasing adoption across sectors such as automotive, electronics, and pharmaceuticals, where durability and high chemical resistance are critical

- Sulphonated polymers, including sulphonated polyether ether ketone (SPEEK) and sulphonated polyphenylene oxide (SPPO), are gaining traction for their performance in harsh environments

- North America dominated the sulphonated polymers market with the largest revenue share of 38.6% in 2024, driven by strong demand from the oil and gas sector, advanced water treatment infrastructure, and high adoption of high-performance polymers across industrial applications

- Asia-Pacific region is expected to witness the highest growth rate in the global sulphonated polymers market, driven by rapid industrialization, expansion in oil & gas and packaging sectors, and increasing investments in water treatment infrastructure across emerging economies such as China, India, and Indonesia

- The PAC segment dominated the market with the largest market revenue share of 56.4% in 2024, driven by its extensive use in oilfield drilling operations due to its superior water retention, thermal stability, and rheological properties. PAC is widely adopted as a viscosifier and filtration control agent in water-based drilling fluids, particularly in offshore and high-pressure drilling environments. The increasing exploration of unconventional oil reserves and deep-water drilling projects continues to bolster demand for PAC in the global market

Report Scope and Sulphonated Polymers Market Segmentation

|

Attributes |

Sulphonated Polymers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Use of Sulphonated Polymers in Sustainable Packaging Solutions • Expansion of Applications in Water Treatment and Filtration Technologies |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sulphonated Polymers Market Trends

“Rising Adoption of Sulphonated Polymers in Fuel Cell Technologies”

- Sulphonated polymers such as SPEEK are increasingly used in proton exchange membranes for hydrogen fuel cells

- These polymers offer high ionic conductivity, thermal stability, and chemical resistance, making them suitable for clean energy applications

- Governments worldwide are supporting hydrogen fuel initiatives, accelerating demand for high-performance sulphonated membranes

- Major automotive and energy players are investing in research to reduce the cost and improve the durability of PEM fuel cells

- SPEEK is emerging as a potential alternative to Nafion in next-gen electric vehicles and stationary fuel cell systems

- For instance, Toyota’s Mirai fuel cell vehicle project includes research on replacing traditional membranes with SPEEK-based alternatives for better performance and lower costs

Sulphonated Polymers Market Dynamics

Driver

“Growing Demand for High-Performance Polymers in Water Treatment and Industrial Applications”

- Sulphonated polymers are widely used in filtration membranes and ion-exchange systems due to their strength and durability

- The rise in global water scarcity is prompting industries to invest in advanced water purification and treatment technologies

- sPPSU and SPEEK are preferred in harsh chemical environments due to their stability at high temperatures and extreme pH levels

- The demand for ultrapure water in electronics, pharmaceuticals, and power sectors is driving polymer adoption

- Sulphonated polymers support sustainability by offering long service life and reduced system maintenance

- For instance, Dow Water & Process Solutions uses sulphonated polymers in ultrafiltration membranes for industrial and municipal water reuse systems

Restraint/Challenge

“High Production Costs and Processing Complexities”

- The sulphonation process involves complex chemical reactions and requires specialized infrastructure

- These polymers are more expensive to produce than conventional alternatives, limiting adoption in cost-sensitive markets

- Limited solubility in common solvents complicates processing, especially in membrane fabrication

- Tight quality control requirements in applications such as fuel cells and medical devices increase production costs

- Smaller manufacturers often lack the resources to scale up or enter the market competitively

- For instance, Several small-scale filtration system providers in Southeast Asia have opted for less expensive polymer alternatives due to the high cost of sulphonated polymer membranes

Sulphonated Polymers Market Scope

The market is segmented on the basis of type, application, and end user.

• By Type

On the basis of type, the sulphonated polymers market is segmented into Polyanionic Cellulose (PAC) and Carboxy Methylcellulose (CMC). The PAC segment dominated the market with the largest market revenue share of 56.4% in 2024, driven by its extensive use in oilfield drilling operations due to its superior water retention, thermal stability, and rheological properties. PAC is widely adopted as a viscosifier and filtration control agent in water-based drilling fluids, particularly in offshore and high-pressure drilling environments. The increasing exploration of unconventional oil reserves and deep-water drilling projects continues to bolster demand for PAC in the global market.

The CMC segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by its growing application in both oilfield and non-oilfield industries such as pharmaceuticals, food, and paper manufacturing. CMC offers excellent film-forming and stabilizing properties, making it a cost-effective solution in packaging and chemical processing applications. The segment's growth is also supported by increasing demand for biodegradable and water-soluble polymers across end-use sectors.

• By Application

On the basis of application, the sulphonated polymers market is segmented into drilling fluid and cement slurry. The drilling fluid segment held the largest revenue share in 2024, owing to the critical role of sulphonated polymers such as PAC in improving drilling efficiency, controlling fluid loss, and stabilizing shale formations. Their compatibility with both freshwater and saltwater-based systems enhances their adaptability in diverse geologic conditions.

The cement slurry segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing infrastructure development and oil well cementing operations. Sulphonated polymers improve cement slurry workability, reduce fluid loss, and enhance bonding between the casing and formation. The growth in well completion activities and demand for high-performance additives is expected to contribute to segment expansion.

• By End User

On the basis of end user, the market is segmented into oil and gas industry, packaging industry, and others. The oil and gas industry accounted for the largest market revenue share in 2024 due to the essential role sulphonated polymers play in drilling mud formulation and cementing applications. Growing global energy demand and continuous exploration and production (E&P) investments, especially in shale and deepwater reserves, are reinforcing the segment’s dominance.

The packaging industry is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing need for sustainable, biodegradable, and water-soluble materials. Sulphonated polymers such as CMC are gaining traction as environmentally friendly additives in film coatings, adhesives, and barrier layers. Rising consumer preference for eco-conscious packaging and tightening environmental regulations are key factors supporting market growth in this segment.

Sulphonated Polymers Market Regional Analysis

• North America dominated the sulphonated polymers market with the largest revenue share of 38.6% in 2024, driven by strong demand from the oil and gas sector, advanced water treatment infrastructure, and high adoption of high-performance polymers across industrial applications

• The region benefits from established drilling operations, especially in the U.S., where sulphonated polymers are extensively used in drilling fluid systems and cement slurry formulations

• Increased investments in energy exploration and stricter water discharge regulations are reinforcing the use of sulphonated materials as essential components for environmental compliance and process efficiency

U.S. Sulphonated Polymers Market Insight

The U.S. sulphonated polymers market accounted for the largest revenue share of 82% in 2024 within North America, owing to extensive use in upstream oil and gas operations, along with rising demand in packaging and water purification applications. The country’s advanced shale drilling infrastructure and ongoing E&P investments are key growth drivers. In addition, U.S.-based manufacturers are investing in R&D to enhance polymer performance and broaden their application scope beyond oilfield uses, particularly in the development of biodegradable and water-soluble packaging materials

Europe Sulphonated Polymers Market Insight

The Europe sulphonated polymers market is expected to witness the fastest growth rate from 2025 to 2032, driven by a strong push for sustainability, well-developed industrial manufacturing base, and increasing focus on clean water initiatives. Demand is growing across packaging, food processing, and pharmaceutical industries where sulphonated polymers are used for stabilization, binding, and filtration. The region’s ongoing transition toward greener materials and compliance with environmental directives continues to stimulate the adoption of sulphonated alternatives to traditional polymers

U.K. Sulphonated Polymers Market Insight

The U.K. sulphonated polymers market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s focus on sustainable industrial practices and increasing investment in advanced water treatment solutions. The rising need for efficient drilling fluid additives in offshore oil operations and a growing preference for biodegradable packaging solutions are contributing to demand. Moreover, domestic companies are prioritizing material innovation to meet evolving regulatory standards and circular economy goals

Germany Sulphonated Polymers Market Insight

The Germany sulphonated polymers market is expected to witness the fastest growth rate from 2025 to 2032, supported by its leading role in chemical processing, high-end manufacturing, and environmental technology sectors. German industries value performance polymers for their precision, consistency, and sustainability, making sulphonated variants ideal for critical applications in filtration and energy systems. In addition, the country’s initiatives to reduce carbon emissions and water waste are encouraging the replacement of conventional materials with high-performance, eco-conscious alternatives

Asia-Pacific Sulphonated Polymers Market Insight

The Asia-Pacific sulphonated polymers market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, expanding oil and gas activities, and strong growth in packaging and water treatment sectors across China, India, and Southeast Asia. The region benefits from large-scale manufacturing capacities, availability of raw materials, and increasing awareness of water conservation and industrial efficiency. Supportive government policies and infrastructure development are further enhancing adoption of sulphonated polymers in both traditional and emerging applications

Japan Sulphonated Polymers Market Insight

The Japan sulphonated polymers market is expected to witness the fastest growth rate from 2025 to 2032, due to the country's emphasis on precision chemical processing, innovation in water filtration, and clean energy development. Japanese manufacturers are incorporating sulphonated polymers in membrane technologies for desalination, electronics, and medical devices. As Japan continues to lead in advanced materials R&D and promote sustainable practices, the demand for sulphonated polymers in high-performance applications is expected to rise

China Sulphonated Polymers Market Insight

The China sulphonated polymers market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by strong domestic demand in the oil and gas, packaging, and chemical industries. China’s rapidly growing energy sector and its leadership in polymer production make it a key contributor to global supply. In addition, ongoing industrial reforms and environmental policies aimed at reducing pollution are accelerating the transition to performance-based, eco-friendly materials such as sulphonated polymers across various end-use markets

Sulphonated Polymers Market Share

The Sulphonated Polymers industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Clariant AG (Switzerland)

- Ashland (U.S.)

- Evonik Industries (Germany)

- Eastman Chemical Company (U.S.)

- Cabot Corporation (U.S.)

- The Lubrizol Corporation (U.S.)

- BASF SE (Germany)

- Arkema (France)

- Asahi Kasei Corporation (Japan)

- DIC CORPORATION (Japan)

- Solvay (Belgium)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sulphonated Polymers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sulphonated Polymers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sulphonated Polymers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.