Global Superalloys Market

Market Size in USD Billion

CAGR :

%

USD

8.00 Billion

USD

13.75 Billion

2024

2032

USD

8.00 Billion

USD

13.75 Billion

2024

2032

| 2025 –2032 | |

| USD 8.00 Billion | |

| USD 13.75 Billion | |

|

|

|

|

Superalloys Market Size

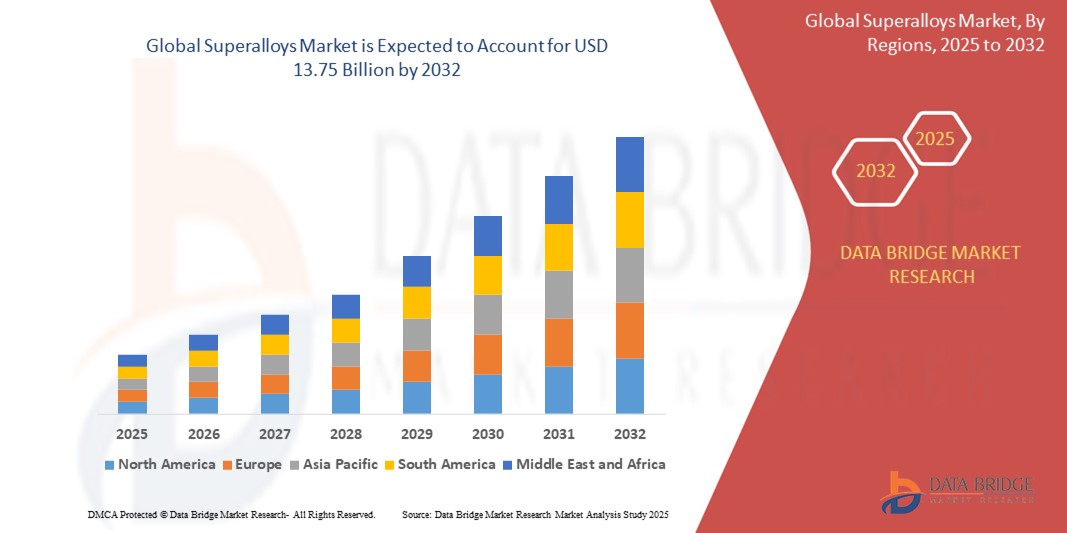

- The global superalloys market size was valued at USD 8.00 billion in 2024 and is expected to reach USD 13.75 billion by 2032, at a CAGR of 7.00% during the forecast period

- The market growth is primarily driven by increasing demand for high-performance materials in high-temperature and corrosive environments, particularly in aerospace, defense, and energy sectors, fueled by advancements in manufacturing technologies and growing industrial applications

- Rising investments in aerospace and energy infrastructure, coupled with the need for lightweight, durable, and heat-resistant materials, are key factors accelerating the adoption of superalloys, significantly boosting industry growth

Superalloys Market Analysis

- Superalloys, high-performance alloys designed to withstand extreme temperatures, corrosion, and mechanical stress, are critical components in industries such as aerospace, energy, and automotive due to their superior strength, oxidation resistance, and durability

- The growing demand for superalloys is driven by the expansion of the aerospace and defense sector, increasing energy demands, and the need for efficient, high-performance materials in industrial gas turbines and automotive applications

- North America dominated the superalloys market with the largest revenue share of 42.5% in 2024, driven by a strong aerospace and defense industry, advanced manufacturing capabilities, and significant R&D investments

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rapid industrialization, increasing energy demands, and growing aerospace manufacturing in countries such as China and India

- The nickel-based superalloys segment dominated the market with a revenue share of 66.88% in 2024, driven by their superior high-temperature strength, corrosion resistance, and mechanical properties, making them ideal for demanding applications such as aerospace engines and industrial gas turbines.

Report Scope and Superalloys Market Segmentation

|

Attributes |

Superalloys Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Superalloys Market Trends

“Increasing Integration of Additive Manufacturing and Advanced Processing Techniques”

- The global superalloys market is experiencing a significant trend toward the integration of additive manufacturing (3D printing) and advanced processing techniques to enhance production efficiency and material performance

- These technologies enable the creation of complex superalloy components with reduced material waste, lower production costs, and shorter lead times compared to traditional manufacturing methods

- For instance, innovations such as the development of nickel-based superalloy ABD-900AM for crack-free 3D printing are enabling the direct production of intricate parts for aerospace and industrial gas turbines

- Additive manufacturing allows for precise control over alloy microstructure, improving mechanical properties such as high-temperature strength and corrosion resistance

- This trend is increasing the appeal of superalloys for manufacturers in aerospace, automotive, and power generation, as it supports the production of lightweight, high-performance components

- Advanced processing techniques, such as vacuum induction melting and powder metallurgy, are further optimizing the durability and performance of superalloys, expanding their applications across various industries

Superalloys Market Dynamics

Driver

“Rising Demand for High-Performance Materials in Aerospace and Energy Sectors”

- The increasing demand for high-performance materials capable of withstanding extreme temperatures, mechanical stress, and corrosive environments is a major driver for the global superalloys market

- Superalloys, particularly nickel-based, are critical in aerospace applications for components such as turbine blades, jet engines, and combustors, driven by the need for fuel-efficient and durable aircraft

- Government investments in defense modernization and the expansion of commercial aviation, particularly in North America, are boosting the adoption of superalloys

- The proliferation of renewable energy and natural gas-based power generation is driving demand for superalloys in industrial gas turbines and nuclear reactors, where high-temperature resistance and structural integrity are essential

- Automakers are increasingly utilizing superalloys in high-performance and electric vehicles to enhance engine efficiency and durability, further fueling market growth

- The development of 5G technology and IoT is enabling real-time monitoring and optimization of superalloy-based components, enhancing their value in smart industrial applications

Restraint/Challenge

“High Production Costs and Supply Chain Volatility”

- The high cost of raw materials, such as nickel, cobalt, and titanium, combined with complex manufacturing processes such as vacuum arc re-melting and investment casting, poses a significant barrier to the widespread adoption of superalloys, particularly in cost-sensitive markets

- Integrating superalloys into existing designs or retrofitting them into older systems can be technically challenging and expensive, limiting their use in certain applications

- Supply chain disruptions, driven by geopolitical tensions and fluctuations in raw material availability, create uncertainty in the superalloys market, impacting production timelines and costs

- Environmental concerns and regulatory pressures related to mining and processing of raw materials, such as cobalt, are pushing manufacturers to adopt sustainable practices, which can further increase production costs

- These factors may deter adoption in emerging markets or industries with lower budgets, potentially slowing market expansion in regions outside North America and Asia-Pacific

Superalloys market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the global superalloys market is segmented into nickel-based superalloys, cobalt-based superalloys, and iron-based superalloys. The nickel-based superalloys segment dominated the market with a revenue share of 66.88% in 2024, driven by their superior high-temperature strength, corrosion resistance, and mechanical properties, making them ideal for demanding applications such as aerospace engines and industrial gas turbines. Their extensive use in turbine blades, combustors, and other critical components further solidifies their market dominance.

The cobalt-based superalloys segment is expected to witness the fastest growth rate of 8.9% from 2025 to 2032. This growth is fueled by their excellent sulfidation resistance and high strength, particularly in niche applications within aerospace, gas turbines, and power plants, where reliability and material longevity are critical.

- By Application

On the basis of application, the global superalloys market is segmented into aerospace and defense, industrial gas turbines, automotive, oil and gas, power, marine industry, chemical processing industry, nuclear reactors, electrical and electronics, and others. The aerospace and defense segment held the largest market revenue share of 38.99% in 2024, driven by the increasing demand for high-performance, durable materials in aircraft engines, turbine blades, and structural components. The push for fuel-efficient and lightweight aircraft, coupled with rising defense budgets globally, supports this segment's dominance.

The industrial gas turbines segment is anticipated to experience the fastest growth rate of 9.2% from 2025 to 2032. This growth is propelled by the rising demand for energy-efficient power generation systems and the expansion of renewable energy infrastructure, such as wind and concentrated solar power plants, which rely on superalloys for components such as turbine blades and heat exchangers that endure extreme thermal stress.

Superalloys Market Regional Analysis

- North America dominated the superalloys market with the largest revenue share of 42.5% in 2024, driven by a strong aerospace and defense industry, advanced manufacturing capabilities, and significant R&D investments

- Consumers and industries prioritize superalloys for their exceptional heat resistance, mechanical strength, and corrosion resistance, particularly in applications requiring durability under high temperatures

- Growth is supported by advancements in alloy technology, including additive manufacturing and lightweight compositions, alongside rising adoption in both OEM and aftermarket segments across aerospace, energy, and automotive industries

U.S. Superalloys Market Insight

The U.S. superalloys market captured the largest revenue share of 81.7% in 2024 within North America, fueled by strong demand from the aerospace and defense sectors and growing awareness of superalloys’ benefits in high-temperature applications. The trend towards lightweight, fuel-efficient aircraft and increasing regulations promoting advanced material standards further boost market expansion. Automakers’ and aerospace manufacturers’ growing incorporation of superalloys in critical components complements aftermarket sales, creating a diverse product ecosystem.

Europe Superalloys Market Insight

The Europe superalloys market is expected to witness significant growth, supported by regulatory emphasis on energy efficiency and safety in aerospace and automotive applications. Consumers and industries seek superalloys that enhance performance under extreme conditions while offering durability. The growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing significant uptake due to rising environmental concerns and industrial advancements.

U.K. Superalloys Market Insight

The U.K. market for superalloys is expected to witness rapid growth, driven by demand for high-performance materials in aerospace and industrial gas turbines in urban and industrial settings. Increased interest in lightweight and durable components and rising awareness of corrosion resistance benefits encourage adoption. Evolving regulations on emissions and material standards influence industry choices, balancing performance with compliance.

Germany Superalloys Market Insight

Germany is expected to witness rapid growth in the superalloys market, attributed to its advanced aerospace and automotive manufacturing sector and high industry focus on energy efficiency and durability. German industries prefer technologically advanced superalloys that withstand high temperatures and contribute to lower fuel consumption. The integration of these alloys in premium vehicles, aircraft, and aftermarket options supports sustained market growth.

Asia-Pacific Superalloys Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding aerospace and automotive production and rising investments in energy infrastructure in countries such as China, India, and Japan. Increasing awareness of superalloys’ heat resistance, corrosion protection, and mechanical strength boosts demand. Government initiatives promoting energy efficiency and industrial safety further encourage the use of advanced superalloys.

Japan Superalloys Market Insight

Japan’s superalloys market is expected to witness rapid growth due to strong industry preference for high-quality, technologically advanced superalloys that enhance performance and safety in aerospace and power generation. The presence of major aerospace and automotive manufacturers and integration of superalloys in OEM components accelerate market penetration. Rising interest in aftermarket applications also contributes to growth.

China Superalloys Market Insight

China holds the largest share of the Asia-Pacific superalloys market, propelled by rapid industrialization, rising aerospace and automotive production, and increasing demand for high-performance materials. The country’s growing industrial base and focus on advanced manufacturing support the adoption of superalloys. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Superalloys Market Share

The superalloys industry is primarily led by well-established companies, including:

- Special Melted Products Ltd. (U.K.)

- Proterial, Ltd. (Japan)

- Precision Castparts Corp. (U.S.)

- BAOTI Group Co.,Ltd (China)

- Sandvik Coromant US (U.S.)

- Rolled Alloys Inc. (U.S.)

- VDM Metals (Germany)

- Doncasters Group (U.K.)

- Fushun Special Steel Co., Ltd. (China)

- Alcoa Corporation (U.S.)

- Outokumpu (Finland)

- ATI (U.S.)

- CRS Holdings, LLC. (U.S.)

- HAYNES INTERNATIONAL (U.S)

- AMG ALUMINUM (U.S.)

- IBC Advanced Alloys (U.S.)

- Eramet (France)

- Mishra Dhatu Nigam Limited (India)

- Aperam (Luxembourg)

What are the Recent Developments in Global Superalloys Market?

- In November 2024, Acerinox finalized its acquisition of Haynes International, a U.S.-based leader in high-performance alloys. This strategic move strengthens Acerinox’s footprint in the U.S. market and significantly boosts its capabilities in the aerospace sector. The integration of Haynes—alongside VDM Metals—forms Acerinox’s new High-Performance Alloys (HPA) Division, aligning with the company’s goal to expand its product portfolio and global reach. Acerinox plans over four years, primarily in Haynes’s Kokomo operations, to build a unified stainless steel and alloy platform. This acquisition reflects a broader industry trend toward consolidation and specialization in advanced materials

- In November 2024, EOS expanded its additive manufacturing material portfolio with nickel-based EOS IN738 and EOS K500 powders. These two nickel-based superalloy powders were added for its Laser Beam Powder Bed Fusion (PBF-LB) additive manufacturing machines, with commercial availability for EOS M 290 machines starting in December 2024 and for EOS M 400-4 in the first half of 2025. This product launch highlights the growing integration of superalloys with additive manufacturing technologies

- In June 2024, Aubert & Duval and Alloyed Ltd. introduced the high-temperature nickel superalloy ABD-1000AM. This new nickel-based superalloy is specifically designed for metal additive manufacturing (AM) and boasts exceptional environmental resistance and high-temperature strength, making it ideal for the extreme conditions prevalent in this advanced manufacturing technique. This product launch signifies a pivotal advancement in high-temperature nickel superalloys tailored for AM

- In September 2023, ATI (Allegheny Technologies Incorporated) was awarded a contract by Bechtel Plant Machinery Inc. (BPMI) to support the development of highly engineered part solutions for the U.S. Naval Nuclear Propulsion Program. As part of this initiative, ATI announced plans to build a dedicated additive manufacturing facility near Fort Lauderdale, Florida, equipped with large-format metal 3D printing, heat treating, machining, and inspection capabilities. This facility is designed to accelerate ship construction, improve operational readiness, and enhance performance for critical defense applications—highlighting a major investment in advanced manufacturing technologies for national security and aerospace sectors

- In July 2023, Doncasters and Safran Aircraft Engines renewed and expanded their long-standing partnership to support the LEAP-1A and LEAP-1B engine platforms. The agreement centers on the supply of large superalloy structural castings and hot section airflow castings, essential for high-performance aerospace applications. This collaboration reflects a deepening relationship between the two companies and leverages Doncasters’ ongoing capital investments to boost production capacity. It also highlights a broader industry trend of strategic alliances aimed at securing reliable component supply for major aerospace programs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Superalloys Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Superalloys Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Superalloys Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.