Global Supply Chain Analytics Market

Market Size in USD Billion

CAGR :

%

USD

5.98 Billion

USD

22.48 Billion

2024

2032

USD

5.98 Billion

USD

22.48 Billion

2024

2032

| 2025 –2032 | |

| USD 5.98 Billion | |

| USD 22.48 Billion | |

|

|

|

|

Supply Chain Analytics Market Size

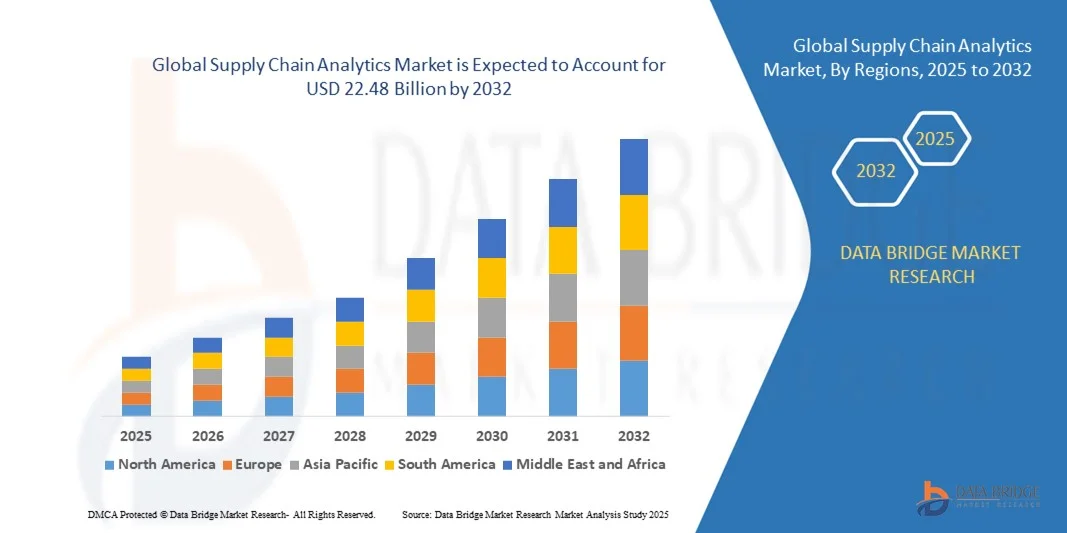

- The global supply chain analytics market size was valued at USD 5.98 billion in 2024 and is expected to reach USD 22.48 billion by 2032, at a CAGR of 18.00% during the forecast period

- The market growth is largely fuelled by increasing adoption of AI and machine learning technologies, rising demand for real-time supply chain visibility, and the need to optimize logistics and inventory management across industries

- In addition, growing complexities in global supply chains, emphasis on risk mitigation, and the expansion of e-commerce and digital supply chain initiatives are further driving market demand

Supply Chain Analytics Market Analysis

- The global supply chain analytics market is witnessing rapid growth due to increasing demand for real-time data-driven decision-making, optimization of logistics operations, and reduction of operational costs across industries

- The rising adoption of advanced analytics, artificial intelligence (AI), and machine learning (ML) in supply chain management is enabling organizations to predict demand fluctuations, improve inventory management, and enhance overall efficiency

- North America dominated the supply chain analytics market with the largest revenue share of 38.50% in 2024, driven by the growing adoption of digital supply chain solutions, increasing demand for operational efficiency, and rising investments in AI and predictive analytics

- Asia-Pacific region is expected to witness the highest growth rate in the global supply chain analytics market, driven by expanding e-commerce, rising demand for efficient logistics, growing manufacturing hubs, and increasing investments in AI, IoT, and cloud-based analytics solutions

- The logistics analytics segment held the largest market revenue share in 2024, driven by the growing need for real-time monitoring of shipments, route optimization, and inventory tracking. Organizations are increasingly leveraging advanced analytics to gain end-to-end visibility, minimize delays, and improve overall supply chain efficiency

Report Scope and Supply Chain Analytics Market Segmentation

|

Attributes |

Supply Chain Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Supply Chain Analytics Market Trends

Adoption of Advanced Analytics and Real-Time Data Monitoring in Supply Chains

- The growing adoption of advanced analytics and real-time monitoring is transforming supply chain management by enabling organizations to make data-driven decisions, optimize operations, and reduce costs. The integration of AI, machine learning, and predictive analytics allows for proactive identification of supply chain disruptions, leading to enhanced efficiency and resilience. Companies are also leveraging scenario modeling to anticipate demand fluctuations, improving overall operational agility and responsiveness

- The increasing demand for visibility across global supply chains is accelerating the deployment of cloud-based platforms, IoT sensors, and analytics tools. These solutions help businesses track inventory, monitor logistics performance, and mitigate risks in real time, ensuring smoother operations. Enhanced transparency also supports regulatory compliance, supplier management, and sustainability initiatives, further reinforcing strategic decision-making across multiple tiers of the supply chain

- The accessibility and scalability of modern supply chain analytics solutions are making them attractive for companies of all sizes, from SMEs to multinational corporations. Organizations benefit from predictive insights without incurring high IT overheads, driving wider adoption. Flexible subscription-based and cloud-hosted models allow rapid deployment, while integration with mobile and edge devices ensures real-time actionable insights for field operations and logistics management

- For instance, in 2023, several manufacturing and retail companies implemented AI-powered analytics platforms to optimize inventory management, reduce lead times, and improve customer satisfaction, resulting in measurable cost savings and operational improvements. The solutions also enabled better demand forecasting, warehouse optimization, and enhanced supplier collaboration, ultimately strengthening resilience against market disruptions

- While analytics adoption is boosting supply chain efficiency, its impact depends on continuous technological innovation, skilled workforce availability, and integration with existing ERP and logistics systems. Companies must focus on training, data quality, and scalable deployment strategies to fully leverage this trend. In addition, leveraging hybrid analytics architectures and automated reporting further improves decision-making speed and strategic agility across global operations

Supply Chain Analytics Market Dynamics

Driver

Increasing Need for Operational Efficiency and Risk Mitigation in Global Supply Chains

- The rising complexity of global supply chains is driving the adoption of analytics tools to improve operational efficiency, optimize inventory, and reduce transportation costs. Organizations are investing in predictive and prescriptive analytics to anticipate demand fluctuations and supply disruptions. Advanced optimization algorithms are helping companies allocate resources more effectively, reduce waste, and improve overall supply chain responsiveness

- Businesses are increasingly aware of the financial and reputational risks associated with supply chain inefficiencies. Analytics enables proactive management of potential bottlenecks, delays, and disruptions, minimizing losses and improving service levels. Real-time alerts and automated decision-support systems further allow faster response to emergencies, enhancing overall supply chain resilience and customer trust

- Governments and industry bodies are promoting digitalization and smart supply chain practices, providing incentives for adopting advanced analytics. This support is accelerating the deployment of data-driven supply chain solutions. Initiatives such as smart ports, IoT-enabled logistics corridors, and policy-backed digital infrastructure enhance cross-border trade visibility and encourage private sector investment in analytics capabilities

- For instance, in 2022, several multinational logistics companies implemented predictive analytics platforms to optimize routes and reduce fuel consumption, improving both cost efficiency and sustainability metrics. These platforms also supported carbon footprint tracking, warehouse energy management, and predictive maintenance of transport fleets, creating measurable environmental and financial benefits

- While the push for operational efficiency is driving market growth, challenges remain in data standardization, system integration, and workforce expertise, requiring continuous investment and innovation. Companies must also address cybersecurity risks, data privacy concerns, and multi-system interoperability to ensure that analytics adoption translates into long-term value across global operations

Restraint/Challenge

High Implementation Costs And Data Integration Complexities

- The high cost of implementing advanced supply chain analytics solutions, including AI platforms, cloud infrastructure, and IoT-enabled monitoring, limits adoption among small and mid-sized organizations. Investment in hardware, software, and skilled personnel can be substantial. In addition, ongoing subscription fees, system upgrades, and maintenance add to the total cost of ownership, creating a barrier for smaller enterprises seeking analytics-driven transformation

- Many companies face challenges in integrating analytics tools with legacy systems, ERP platforms, and multi-tiered supply chains, which can delay implementation and reduce effectiveness. Incompatibilities between old and new technologies often result in fragmented data, requiring additional investment in middleware and custom integration solutions to ensure seamless operations

- Limited availability of skilled data analysts and supply chain experts further hampers adoption, particularly in developing regions. Companies may struggle to extract actionable insights from complex datasets without proper expertise. The talent gap also impacts model development, predictive accuracy, and the ability to leverage AI effectively, slowing digital transformation initiatives

- For instance, in 2023, several regional manufacturing firms in Southeast Asia reported difficulties deploying real-time analytics due to integration challenges and lack of trained personnel, slowing digital transformation initiatives. These issues led to underutilized platforms, delayed ROI, and incomplete operational insights, highlighting the critical importance of workforce development alongside technology adoption

- While supply chain analytics technologies continue to evolve, addressing cost, integration, and skill gaps is critical. Stakeholders must focus on scalable, modular solutions, workforce training, and cross-system compatibility to unlock full market potential. Investment in cloud-based, low-code platforms and AI-assisted analytics can further lower adoption barriers and accelerate value creation across organizations

Supply Chain Analytics Market Scope

The supply chain analytics market is segmented on the basis of solutions, service, deployment, enterprise size, and end-use.

- By Solutions

On the basis of solutions, the supply chain analytics market is segmented into logistics analytics, manufacturing analytics, planning and procurement, sales and operations analytics, and visualization & reporting. The logistics analytics segment held the largest market revenue share in 2024, driven by the growing need for real-time monitoring of shipments, route optimization, and inventory tracking. Organizations are increasingly leveraging advanced analytics to gain end-to-end visibility, minimize delays, and improve overall supply chain efficiency.

The manufacturing analytics segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the adoption of predictive and prescriptive analytics for production planning, quality control, and resource optimization. Manufacturing analytics enables companies to reduce operational costs, improve product quality, and respond rapidly to market demand fluctuations, making it a key area of investment for businesses seeking data-driven manufacturing insights.

- By Service

On the basis of service, the supply chain analytics market is segmented into professional services and support & maintenance. The professional services segment held the largest market revenue share in 2024, driven by the growing need for consulting, system integration, and solution deployment. Organizations are increasingly relying on expert services to implement analytics platforms efficiently, optimize operations, and maximize return on investment.

The support & maintenance segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for continuous system monitoring, troubleshooting, and software updates. Support & maintenance services help companies maintain analytics solution performance, minimize downtime, and ensure uninterrupted operational efficiency, making it a vital investment for sustainable supply chain management.

- By Deployment

On the basis of deployment, the market is segmented into cloud and on-premise. The cloud segment held the largest market revenue share in 2024, driven by the increasing preference for scalable, cost-effective, and remotely accessible solutions. Organizations are adopting cloud deployment to enable real-time data access, improve collaboration, and enhance agility across complex supply chains.

The on-premise segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the demand for data security, control, and customization. On-premise solutions allow organizations to maintain sensitive data in-house, tailor analytics platforms to their specific workflows, and improve overall operational reliability, driving adoption across enterprises.

- By Enterprise Size

On the basis of enterprise size, the market is segmented into large enterprises and small & medium enterprises (SMEs). The large enterprise segment held the largest market revenue share in 2024, driven by the complexity of global supply chains and high investment capacity in advanced analytics solutions. These organizations leverage analytics to optimize decision-making, reduce costs, and enhance overall supply chain performance.

The SME segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption of affordable and scalable analytics solutions. SMEs benefit from predictive insights, streamlined operations, and improved competitiveness, making analytics a critical tool for growth and operational efficiency.

- By End-Use

On the basis of end-use, the market is segmented into retail and consumer goods, healthcare, manufacturing, transportation, aerospace & defense, high technology products, and others. The manufacturing segment held the largest market revenue share in 2024, driven by the need to optimize production efficiency, reduce operational costs, and maintain timely delivery across global supply chains

The transportation segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the rising demand for logistics optimization, real-time tracking, and predictive analytics. Companies are increasingly leveraging transportation analytics to reduce transit delays, enhance route efficiency, and improve customer satisfaction, driving significant market adoption.

Supply Chain Analytics Market Regional Analysis

- North America dominated the supply chain analytics market with the largest revenue share of 38.50% in 2024, driven by the growing adoption of digital supply chain solutions, increasing demand for operational efficiency, and rising investments in AI and predictive analytics

- Businesses in the region highly value real-time visibility, advanced analytics capabilities, and seamless integration with ERP and logistics systems, enabling improved decision-making, reduced operational costs, and enhanced supply chain resilience

- This widespread adoption is further supported by high technological readiness, strong IT infrastructure, and favorable regulatory frameworks, establishing supply chain analytics as a critical tool for large and mid-sized enterprises.

U.S. Supply Chain Analytics Market Insight

The U.S. supply chain analytics market captured the largest revenue share in 2024 within North America, fueled by the rapid adoption of AI, IoT-enabled monitoring, and cloud-based analytics platforms. Companies are increasingly prioritizing predictive and prescriptive analytics to optimize inventory, reduce transportation costs, and mitigate supply chain disruptions. The growing focus on digital transformation initiatives, coupled with strong demand from manufacturing, retail, and logistics sectors, is significantly contributing to market growth.

Europe Supply Chain Analytics Market Insight

The Europe supply chain analytics market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by the need for operational efficiency, regulatory compliance, and sustainability in logistics and manufacturing operations. Businesses are increasingly investing in real-time analytics, predictive modeling, and cloud-based solutions to enhance supply chain performance. The region is witnessing significant growth across manufacturing, retail, and transportation sectors, with analytics being incorporated into both new and existing supply chain operations.

U.K. Supply Chain Analytics Market Insight

The U.K. supply chain analytics market is expected to witness the fastest growth rate from 2025 to 2032, driven by the digitalization of supply chain operations and a focus on efficiency, risk management, and cost reduction. Companies are adopting advanced analytics platforms to enhance visibility, streamline procurement, and improve logistics performance. The country’s strong IT infrastructure, coupled with robust e-commerce and manufacturing sectors, continues to support market expansion.

Germany Supply Chain Analytics Market Insight

The Germany supply chain analytics market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing investments in AI-driven analytics, smart manufacturing, and predictive supply chain solutions. Germany’s well-established industrial base and emphasis on innovation, efficiency, and sustainability are promoting analytics adoption, particularly in manufacturing, automotive, and logistics sectors. Integration with enterprise systems and real-time monitoring is becoming increasingly prevalent, aligning with local industry standards and consumer expectations.

Asia-Pacific Supply Chain Analytics Market Insight

The Asia-Pacific supply chain analytics market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, urbanization, and increasing adoption of digital supply chain solutions in countries such as China, India, and Japan. The region's expanding manufacturing and e-commerce sectors, coupled with government initiatives promoting smart logistics and digital transformation, are fostering analytics adoption. Furthermore, the growing availability of cloud-based solutions and affordable analytics platforms is enabling wider accessibility across small, medium, and large enterprises.

Japan Supply Chain Analytics Market Insight

The Japan supply chain analytics market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high technological readiness, advanced manufacturing base, and focus on operational efficiency. Companies are leveraging predictive analytics and real-time monitoring tools to optimize inventory management, enhance logistics performance, and reduce operational costs. The increasing integration of AI, IoT, and cloud platforms is driving adoption, particularly in manufacturing and transportation sectors, while addressing challenges related to supply chain visibility and risk management.

China Supply Chain Analytics Market Insight

The China supply chain analytics market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s rapid industrial growth, expanding e-commerce sector, and strong government support for digital supply chain transformation. Chinese companies are increasingly deploying cloud-based analytics platforms, AI tools, and IoT-enabled solutions to optimize operations, enhance visibility, and reduce costs across logistics, manufacturing, and retail supply chains. The growth is further supported by the rise of domestic technology providers and affordable analytics solutions catering to enterprises of all sizes.

Supply Chain Analytics Market Share

The Supply Chain Analytics industry is primarily led by well-established companies, including:

- Oracle (U.S.)

- IBM (U.S.)

- SAS Institute Inc. (U.S.)

- Software AG (Germany)

- Micro Strategy Incorporated (U.S.)

- TABLEU SOFTWARE,LLC (U.S.)

- Qlik (U.S.)

- TIBCO Software Inc. (U.S.)

- Cloudera,Inc.(U.S.)

- American Software,Inc.(U.S.)

- Accenture (Ireland)

- Aera Technology (U.S.)

- Birst, Inc. (U.S.)

- Capgemini (France)

- Genpact (U.S.)

- JDA Software Inc. (U.S.)

- Kinaxis (Canada)

- Lockheed Martin Corporation (U.S.)

- A.P. Moller – Maersk (Denmark)

Latest Developments in Global Supply Chain Analytics Market

- In 2020, SAP SE, in response to the COVID-19 pandemic, announced new technology offerings and expanded access to existing solutions. These initiatives aimed to help organizations adapt to operational disruptions, maintain business continuity, and manage remote work more efficiently. By providing enhanced digital tools and support, SAP facilitated faster decision-making, improved workflow management, and strengthened organizational resilience, positively impacting enterprise operations across multiple sectors

- In 2020, Infosys Limited launched a personalized medicine solution tailored for the pharmaceutical industry. The platform leverages cloud-based technologies to support regulatory authorities in monitoring and managing drug development and compliance processes. This solution enabled faster, data-driven decision-making, improved regulatory adherence, and enhanced efficiency in pharmaceutical operations, contributing to more streamlined healthcare innovation

- In 2020, the Chinese government introduced policies to support small and medium-sized enterprises (SMEs) in their production and operational processes. The measures focused on financial assistance, social security relief, subsidies, and taxation benefits. These policies aimed to reduce operational burdens, improve liquidity, and stimulate business continuity, thereby accelerating SME growth and strengthening the overall supply chain ecosystem in the country

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.