Global Surface Mount Technology Smt Equipment Market

Market Size in USD Billion

CAGR :

%

USD

6.38 Billion

USD

15.26 Billion

2024

2032

USD

6.38 Billion

USD

15.26 Billion

2024

2032

| 2025 –2032 | |

| USD 6.38 Billion | |

| USD 15.26 Billion | |

|

|

|

|

What is the Global Surface Mount Technology (SMT) Equipment Market Size and Growth Rate?

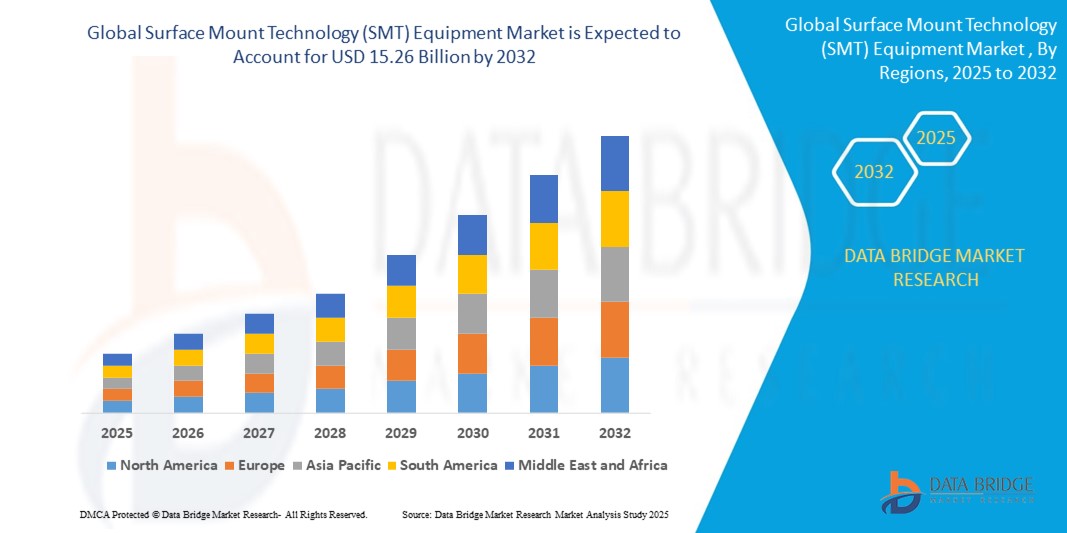

- The global surface mount technology (SMT) Equipment market size was valued at USD 6.38 billion in 2024 and is expected to reach USD 15.26 billion by 2032, at a CAGR of 11.50% during the forecast period

- This strong growth is primarily driven by the increasing demand for miniaturized electronics, rapid advancements in consumer electronics, and the expansion of the automotive and telecommunication industries.

- The surge in demand for high-performance, compact, and energy-efficient electronic devices is accelerating the adoption of SMT equipment, making it a critical enabler for modern PCB assembly and high-volume electronics manufacturing

What are the Major Takeaways of Surface Mount Technology (SMT) Equipment Market?

- Surface mount technology equipment plays a pivotal role in automating the assembly of printed circuit boards (PCBs), allowing for high-speed, precision placement of components, which is essential for producing next-generation electronic devices

- The growing focus on automation, production efficiency, and quality assurance in electronics manufacturing is fueling the demand for advanced surface mount technology solutions across industries such as consumer electronics, automotive electronics, industrial control systems, and healthcare devices

- As electronics continue to shrink in size and increase in functionality, investments in surface mount technology innovation, including 3D inspection systems, pick-and-place machines, and reflow ovens, are expected to shape the future trajectory of the global surface mount technology equipment market

- North America dominated the surface mount technology (SMT) Equipment market with the largest revenue share of 42.01% in 2024, supported by the rising demand for high-precision electronic assembly in sectors such as aerospace, defense, automotive, and consumer electronics

- Asia-Pacific surface mount technology Equipment market is expected to grow at the fastest CAGR of 7.24% from 2025 to 2032, led by rapid industrialization, rising electronics consumption, and manufacturing capacity expansions in China, Japan, India, and South Korea

- The placement equipment segment dominated the market with the largest revenue share of 38.5% in 2024, due to its critical role in accurately placing surface mount components at high speed and precision during PCB assembly

Report Scope and Surface Mount Technology (SMT) Equipment Market Segmentation

|

Attributes |

Surface Mount Technology (SMT) Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Surface Mount Technology (SMT) Equipment Market?

“Automation and AI Integration Driving Manufacturing Precision”

- A dominant trend reshaping the global surface mount technology (SMT) Equipment market is the increasing integration of automation and artificial intelligence (AI) in PCB assembly lines. These technologies are enhancing real-time process control, quality assurance, and production efficiency

- For instance, ASMPT has introduced AI-driven process optimization in its surface mount technology solutions, enabling predictive maintenance and adaptive production to minimize downtime and defects. This significantly improves productivity and reduces operational costs

- AI integration allows surface mount technology equipment to automatically adjust placement parameters, detect alignment issues, and ensure optimal solder joint formation without manual intervention. Vision systems powered by machine learning are also increasingly used for advanced optical inspection (AOI), improving yield rates

- The shift toward “smart factories” and Industry 4.0 adoption is further boosting the demand for intelligent surface mount technology systems capable of real-time analytics and seamless integration with other manufacturing technologies such as MES (Manufacturing Execution Systems)

- This transformation is not limited to large-scale manufacturers. Mid-sized and smaller EMS (Electronics Manufacturing Services) providers are also adopting modular AI-powered surface mount technology solutions to stay competitive and meet high-mix, low-volume production demands

- As electronic components become smaller and more complex, the need for AI-enhanced precision, traceability, and flexibility is accelerating, making automation a strategic priority for manufacturers across the globe

What are the Key Drivers of Surface Mount Technology (SMT) Equipment Maret?

- The rapid growth of the consumer electronics, automotive electronics, and telecommunication sectors is a key driver of the surface mount technology Equipment market, as these industries demand compact, efficient, and high-speed PCB assembly processes

- For instance, in March 2024, Fuji Corporation announced new surface mount technology placement systems that support ultra-fine pitch component mounting and are designed for electric vehicle (EV) powertrain electronics and 5G infrastructure modules

- Increasing demand for miniaturization of electronic devices from smartphones to wearable tech requires highly accurate and fast surface mount technology solutions for component placement, spurring new equipment investments

- The trend toward electric vehicles (EVs) and autonomous driving has also intensified the demand for advanced surface mount technology machinery, as automotive electronics become more complex and safety-critical

- In addition, the rise of industrial IoT (IIoT) and smart infrastructure projects are fueling demand for flexible surface mount technology systems capable of handling diversified component profiles and production volumes

Which Factor is challenging the Growth of the Surface Mount Technology (SMT) Equipment Market?

- One major challenge for the surface mount technology equipment market is the high initial investment and maintenance costs associated with advanced machines, which can deter small and mid-sized manufacturers from upgrading or adopting new systems

- For instance, full-line surface mount technology solutions with AI capabilities from brands such as Yamaha Motor IM or Juki can require substantial capital expenditure, which limits accessibility for low-volume producers

- Moreover, the shortage of skilled technical labor to operate, program, and maintain sophisticated surface mount technology machinery is creating operational bottlenecks, especially in emerging economies

- Frequent design changes in consumer electronics and rapid technological obsolescence also require flexible and adaptable surface mount technology systems, which not all manufacturers can afford or implement swiftly

- Addressing these challenges involves greater emphasis on training programs, leasing models, and scalable automation solutions. Vendors that offer modular systems and robust after-sales support are more likely to capture opportunities in price-sensitive markets

How is the Surface Mount Technology (SMT) Equipment Market Segmented?

The market is segmented on the basis of equipment, component, service and application.

• By Equipment

On the basis of equipment, the surface mount technology (SMT) equipment market is segmented into placement equipment, inspection equipment, soldering equipment, screen printing equipment, cleaning equipment, repair equipment, and rework equipment. The placement equipment segment dominated the market with the largest revenue share of 38.5% in 2024, owing to its critical role in accurately placing surface mount components at high speed and precision during PCB assembly. Growing miniaturization of electronics and increasing demand for high-density circuit boards are key drivers for placement systems in mass production environments.

The inspection equipment segment is anticipated to witness the fastest CAGR of 12.4% from 2025 to 2032, driven by the rising need for automated optical inspection (AOI), X-ray inspection, and solder paste inspection (SPI) to ensure assembly quality and detect minute defects early. Enhanced quality control requirements in automotive and medical electronics manufacturing are accelerating this demand.

• By Component

On the basis of component, the market is segmented into passive components and active components. The active components segment held the largest market revenue share of 57.1% in 2024, due to their indispensable use in power regulation, signal amplification, and digital processing in virtually all electronics. Rapid advancements in processors, sensors, and communication ICs drive the demand for precise surface mount technology assembly solutions.

The passive components segment is projected to witness significant growth from 2025 to 2032, supported by the rising integration of capacitors, resistors, and inductors in miniaturized form factors, especially for compact consumer devices and automotive control units.

• By Service

On the basis of service, the surface mount technology Equipment market is segmented into designing, test and prototyping, supply chain services, manufacturing, and aftermarket services. The manufacturing segment dominated with the largest market share of 42.6% in 2024, driven by the expanding electronics manufacturing services (EMS) industry and the growing trend of outsourcing assembly operations to improve cost efficiency and scalability.

The test and prototyping segment is projected to grow at the fastest CAGR through 2032, fueled by the increasing need for quick design validation and small-batch testing before full-scale production. This is particularly crucial in high-mix, low-volume production scenarios such as automotive and aerospace industries.

• By Application

On the basis of application, the surface mount technology Equipment market is segmented into consumer electronics, telecommunication, automotive, aerospace and defence, medical, industrial, and energy and power systems. The consumer electronics segment accounted for the largest market revenue share of 31.8% in 2024, propelled by the ongoing innovation in smartphones, tablets, smart wearables, and household gadgets that demand compact, densely populated PCBs.

The automotive segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising use of advanced driver-assistance systems (ADAS), infotainment systems, and battery management systems in electric vehicles (EVs). The need for reliable, high-precision SMT processes in mission-critical automotive electronics is further accelerating demand.

Which Region Holds the Largest Share of the Surface Mount Technology (SMT) Equipment Market?

- North America dominated the surface mount technology (SMT) Equipment market with the largest revenue share of 42.01% in 2024, supported by the rising demand for high-precision electronic assembly in sectors such as aerospace, defense, automotive, and consumer electronics

- The region benefits from advanced manufacturing capabilities, strong R&D investments, and robust infrastructure for semiconductor and PCB production

- The increasing trend of reshoring electronics manufacturing, combined with government support for domestic semiconductor fabrication, is further fueling surface mount technology equipment adoption across the U.S. and Canada

U.S. Surface Mount Technology (SMT) Equipment Market Insight

The U.S. surface mount technology Equipment market dominates the North American revenue share in 2024, driven by growing demand for automation, smart manufacturing, and miniaturized electronics. The implementation of the CHIPS and Science Act is accelerating domestic semiconductor and PCB assembly, spurring investments in high-speed placement machines, reflow ovens, and inspection systems. In addition, SMT usage in EVs, 5G devices, and defense electronics is steadily increasing, reinforcing the U.S. position as a key SMT equipment market.

Europe Surface Mount Technology (SMT) Equipment Market Insight

The Europe surface mount technology Equipment market is expected to grow at a moderate CAGR, fueled by the region’s strong industrial base and demand for high-quality, automated assembly systems. Automotive, healthcare, and industrial automation sectors in Germany, France, and the U.K. are key drivers of SMT equipment demand. Adoption is supported by stringent regulatory standards, the push for energy-efficient electronics, and increasing investments in EV and IoT technologies. Both new production lines and retrofit projects are contributing to the uptake of modern SMT systems in the region.

Germany Surface Mount Technology (SMT) Equipment Market Insight

The Germany surface mount technology Equipment market is expanding due to the country’s strong engineering focus and its leadership in automotive electronics. With increasing emphasis on Industry 4.0, manufacturers are adopting smart, connected SMT solutions to improve throughput and traceability. The market is also seeing demand from medical device and renewable energy sectors, where precision and miniaturization are critical.

U.K. Surface Mount Technology (SMT) Equipment Market Insight

The U.K. surface mount technology Equipment market is projected to grow steadily, driven by the need for high-performance electronics in healthcare, aerospace, and defense sectors. Growing R&D investments, demand for energy-efficient systems, and the country's emphasis on smart manufacturing practices are promoting the adoption of advanced SMT systems.

Which Region is the Fastest Growing Region in the Surface Mount Technology (SMT) Equipment Market?

Asia-Pacific surface mount technology Equipment market is expected to grow at the fastest CAGR of 7.24% from 2025 to 2032, led by rapid industrialization, rising electronics consumption, and manufacturing capacity expansions in China, Japan, India, and South Korea. Government initiatives such as “Make in India” and “Made in China 2025” are enhancing local production capabilities. Strong demand for smartphones, consumer electronics, EVs, and telecom infrastructure is accelerating SMT equipment installations. APAC's cost-effective manufacturing environment and its role as a global electronics export hub are further strengthening market growth.

China Surface Mount Technology (SMT) Equipment Market Insight

China surface mount technology Equipment market accounted for the largest revenue share within Asia-Pacific in 2024, supported by its dominant position in global electronics production. Strong domestic demand, affordable SMT system availability, and local OEM and EMS growth are fueling adoption across mobile devices, home appliances, and automotive electronics. Government incentives for smart factories and IC production are also accelerating SMT deployment.

Japan Surface Mount Technology (SMT) Equipment Market Insight

The Japan surface mount technology Equipment market is seeing strong growth, backed by advanced automation technologies and a high demand for compact, high-reliability electronic components. With a focus on smart homes, robotics, and electric vehicles, Japanese manufacturers are investing in high-speed, precision SMT systems. In addition, aging workforce trends are encouraging the adoption of automated SMT solutions.

Which are the Top Companies in Surface Mount Technology (SMT) Equipment Market?

The surface mount technology (SMT) Equipment industry is primarily led by well-established companies, including:

- CyberOptics Corporation (U.S.)

- KLA Corporation (Israel)

- Hitachi High-Tech India Private Limited (Japan)

- Nordson Corporation (U.S.)

- FUJI CORPORATION (Japan)

- Electronic Manufacturing Services Group, Inc. (Germany)

- MKS Instruments (U.S.)

- SMTnet (U.S.)

- Heller Industries, Inc. (U.S.)

- JUKI CORPORATION (Japan)

- Koh Young Technology, Inc. (South Korea)

- Kulicke and Soffa Industries, Inc. (Singapore)

- Naprotek, LLC. (U.S.)

- Nikon Metrology NV (U.K.)

- Omron Corporation (Japan)

- Panasonic Corporation of North America (Japan)

- SAKI CORPORATION (Japan)

- Teradyne Inc. (U.S.)

- Universal Instruments Corporation (U.S.)

- Comet Group (Germany)

What are the Recent Developments in Global Surface Mount Technology (SMT) Equipment Market?

- In December 2022, Linx Technologies, now under TE Connectivity, introduced a new surface-mount embedded GNSS antenna supporting GPS, Galileo, GLONASS, Beidou, and QZSS systems in the L1/E1/B1 bands. This addition expands Linx's embedded PCB antenna portfolio, enhancing its offerings such as the uSP410, SP610, and nSP250, providing a comprehensive GNSS solution

- In October 2022, Omron Corporation launched the Omron VT-X Alpha on October 13, 2023, a cutting-edge SMT pick-and-place machine tailored for the electronics manufacturing sector. With high-speed and precision capabilities, the VT-X Alpha addresses industry demands, contributing to enhanced efficiency and productivity in SMT processes

- In March 2022, CyberOptics Corporation launched the CyberOptics SQ3000 3D AOI System, a top-tier SMT equipment boasting high-speed, high-precision capabilities tailored for electronics manufacturing. Equipped with Multi-Reflection Suppression (MRS) technology, it ensures accurate inspection of PCB components on both sides, streamlining quality assurance processes in manufacturing

- In May 2022, Summit Interconnects acquired Royal Circuit Solutions and Affiliates bolsters its position as one of North America's largest privately held PCB producers. With eight new manufacturing facilities, Summit's expanded footprint drives demand for SMT in the region, broadening its product line and strengthening relationships with key clients and markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Surface Mount Technology Smt Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Surface Mount Technology Smt Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Surface Mount Technology Smt Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.