Global Surface Protection Service Market

Market Size in USD Billion

CAGR :

%

USD

19.62 Billion

USD

39.09 Billion

2024

2032

USD

19.62 Billion

USD

39.09 Billion

2024

2032

| 2025 –2032 | |

| USD 19.62 Billion | |

| USD 39.09 Billion | |

|

|

|

|

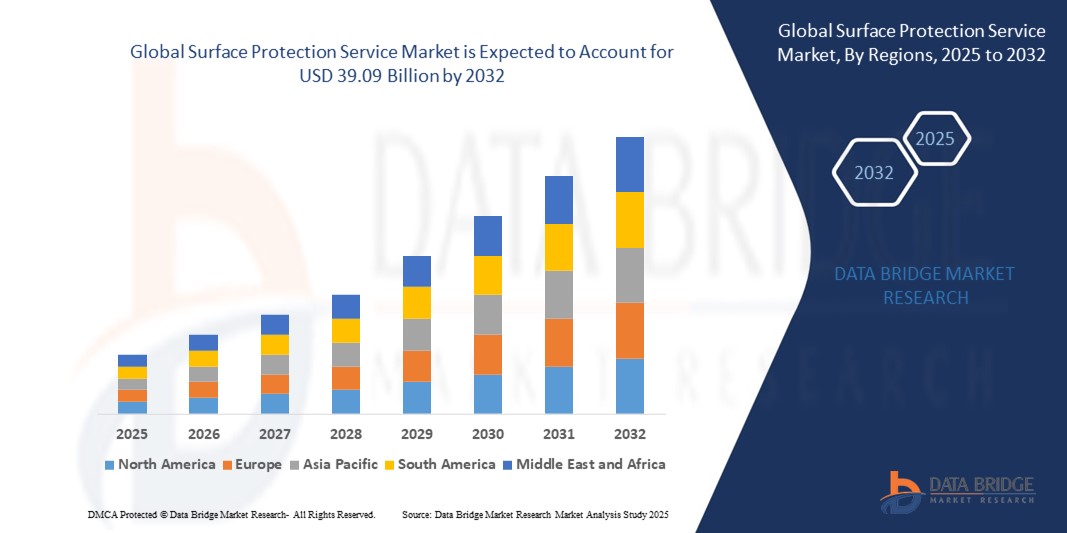

What is the Global Surface Protection Service Market Size and Growth Rate?

- The global surface protection service market size was valued at USD 19.62 billion in 2024 and is expected to reach USD 39.09 billion by 2032, at a CAGR of 9.00% during the forecast period

- The market is poised for substantial growth, fueled by escalating demand for corrosion and abrasion resistance solutions across diverse industries. Technological advancements in coatings and materials, along with the adoption of preventive maintenance strategies, are driving market expansion. Integrated solutions encompassing inspection to maintenance are gaining traction, particularly in rapidly industrializing regions

What are the Major Takeaways of Surface Protection Service Market?

- The increase in demand for the energy sector drives growth in the surface protection market. With rising investments in oil and gas exploration, renewable energy projects, and power generation facilities, there is a growing need to protect assets from corrosion, erosion, and chemical damage. Surface protection solutions play a vital role in extending the lifespan of energy infrastructure, enhancing operational efficiency, and minimizing maintenance costs

- North America dominated the surface protection service market with the largest revenue share of 39.5% in 2024, driven by growing demand for advanced security solutions and smart home integration

- Asia-Pacific market is poised to grow at the fastest CAGR of 7.6% from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India

- The Corrosion Protection Coating segment dominated the market with a revenue share of 37.8% in 2024, driven by its ability to prevent metal degradation, extend asset lifespan, and reduce maintenance costs across industrial and commercial applications

Report Scope and Surface Protection Service Market Segmentation

|

Attributes |

Surface Protection Service Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Surface Protection Service Market?

Integration of AI and Voice-Enabled Control

- A major trend in the global surface protection service market is the growing integration of artificial intelligence (AI) with voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit. This combination is enhancing convenience and enabling users to manage security systems more intuitively

- For instance, August Wi-Fi surface protection services integrate with all three leading voice assistants, allowing hands-free locking and unlocking, while Level Lock+ offers seamless control via Siri and Apple HomeKit, providing discreet and efficient solutions

- AI-enabled surface protection services are increasingly capable of learning user access patterns, optimizing security settings, and generating intelligent alerts when unusual activity is detected. Ultraloq devices, for instance, improve fingerprint recognition accuracy over time and send actionable notifications

- Integration with broader smart home platforms allows centralized management of doors, lighting, climate, and other connected devices, creating a unified, automated living environment

- Companies such as WELOCK are responding to this trend by developing AI-driven Surface Protection Services with automated locking/unlocking features and compatibility with major voice assistants

- The demand for solutions offering AI and voice integration is growing rapidly across residential and commercial sectors, driven by consumer expectations for convenience, connectivity, and intelligent security

What are the Key Drivers of Surface Protection Service Market?

- Rising security concerns among homeowners and businesses, combined with increasing adoption of smart home ecosystems, are major factors driving demand for surface protection services

- In April 2024, Onity, Inc. (Honeywell International, Inc.) announced upgrades to its IoT-enabled Passport locking solution for self-storage, illustrating how innovation by leading companies fuels market growth

- Consumers are increasingly seeking enhanced property protection, with features such as remote monitoring, activity logs, and tamper alerts offering a significant improvement over conventional mechanical lock

- The popularity of interconnected smart home devices is positioning Surface Protection Services as essential components, enabling seamless integration with other systems and platforms

- Keyless entry, smartphone-based access management, and remote control for family or service personnel are driving adoption in both residential and commercial settings. DIY installation trends and the growing availability of user-friendly options further support market expansion

Which Factor is Challenging the Growth of the Surface Protection Service Market?

- Cybersecurity vulnerabilities of connected surface protection services pose a key challenge to adoption, as these devices rely on network connectivity and software, making them targets for hacking or data breaches

- Reports of IoT device security weaknesses have caused some consumers to hesitate in adopting smart home security solutions

- Companies such as August and Level Home emphasize robust encryption, secure authentication, and regular software updates to reassure users, yet high costs of advanced systems remain a barrier in price-sensitive regions. Basic offerings such as Wyze provide affordability, but premium features such as biometric scanning and integrated cameras often carry higher prices

- The perceived premium of smart technology can limit adoption among users who do not immediately value advanced functionalities

- Addressing cybersecurity concerns, educating consumers about best practices, and offering more cost-effective solutions will be crucial for sustained growth in the Surface Protection Service market

How is the Surface Protection Service Market Segmented?

The market is segmented on the basis of service type, application, and end use industry.

- By Service Type

On the basis of service type, the surface protection service market is segmented into Corrosion Protection Coating, Mechanical Protection Coating, Electroplating, Thermal Spray, and Others. The Corrosion Protection Coating segment dominated the market with a revenue share of 37.8% in 2024, driven by its ability to prevent metal degradation, extend asset lifespan, and reduce maintenance costs across industrial and commercial applications. These coatings are widely applied in pipelines, machinery, and structural components to resist harsh environmental conditions, chemicals, and wear.

The Thermal Spray segment is expected to witness the fastest CAGR of 10.5% from 2025 to 2032, propelled by rising demand for high-performance surface protection in aerospace, automotive, and energy sectors. Thermal spray techniques provide advanced wear, corrosion, and heat resistance, making them suitable for high-temperature and high-friction environments. The segment’s versatility and efficiency in protecting critical infrastructure are driving its accelerated adoption globally.

- By Application

On the basis of application, the surface protection service market is segmented into Pipelines, Hydraulic Shafts & Cylinders, Process & Vessel Equipment, Tanks, Pumps & Compressors, and Others. The Pipelines segment dominated the market with a revenue share of 40.2% in 2024, due to the critical need to prevent corrosion and material degradation in oil, gas, and water transportation systems. Pipelines face continuous exposure to harsh chemicals, moisture, and extreme temperatures, which has led to strong adoption of protective surface solutions.

The Hydraulic Shafts & Cylinders segment is expected to witness the fastest CAGR of 11.2% from 2025 to 2032, driven by expanding hydraulic machinery use in construction, manufacturing, and heavy industries. Surface protection for hydraulic components ensures smooth operation, reduces downtime, and increases equipment longevity, making this segment a key growth driver in industrial applications.

- By End Use Industry

On the basis of end use industry, the surface protection service market is segmented into Manufacturing, Oil & Gas, Mining, Power & Energy, Aerospace & Defense, and Others. The Oil & Gas segment dominated the market with a revenue share of 42.5% in 2024, driven by the critical need for corrosion-resistant coatings in pipelines, offshore platforms, refineries, and processing units. Stringent safety standards and long-term operational reliability requirements make surface protection services essential in this sector.

The Aerospace & Defense segment is expected to witness the fastest CAGR of 12.1% from 2025 to 2032, supported by rising demand for lightweight, high-strength, and wear-resistant components in aircraft, defense equipment, and satellites. Advanced coatings and thermal spray solutions protect components from extreme temperatures, friction, and corrosion, making this segment a key area of technological innovation and market expansion.

Which Region Holds the Largest Share of the Surface Protection Service Market?

- North America dominated the surface protection service market with the largest revenue share of 39.5% in 2024, driven by growing demand for advanced security solutions and smart home integration

- Consumers highly value seamless integration with devices such as thermostats, lighting systems, and other connected solutions, enhancing convenience and control

- Widespread adoption is further supported by high disposable incomes, tech-savvy populations, and the increasing preference for remote monitoring, positioning Surface Protection Services as a preferred solution for residential and commercial applications

U.S. Surface Protection Service Market Insight

The U.S. captured the largest revenue share in North America in 2024, led by rapid adoption of connected devices and home automation trends. Keyless entry solutions, DIY smart home setups, and integration with voice assistants such as Alexa, Google Assistant, and Apple HomeKit are major growth drivers. Consumers increasingly prioritize convenience, security, and mobile-controlled access, further fueling market expansion.

Europe Surface Protection Service Market Insight

The Europe market is projected to grow at a substantial CAGR, supported by stringent security regulations and increasing urbanization. Rising demand for connected devices and smart home solutions drives adoption across residential, commercial, and multi-family housing projects. Energy efficiency, convenience, and retrofit capabilities make Surface Protection Services highly appealing in the region.

U.K. Surface Protection Service Market Insight

The U.K. market is expected to expand at a notable CAGR during the forecast period, driven by growing home automation adoption and heightened security awareness. Concerns regarding burglary and safety are encouraging homeowners and businesses to adopt keyless entry systems. Strong e-commerce infrastructure and widespread use of connected devices continue to propel growth.

Germany Surface Protection Service Market Insight

Germany’s market is set to grow at a significant CAGR, supported by awareness of digital security and demand for advanced, eco-conscious solutions. Well-developed infrastructure, innovation-friendly policies, and preference for privacy-focused smart home solutions are driving Surface Protection Service adoption in residential and commercial properties. Integration with broader smart home ecosystems is becoming increasingly common.

Which Region is the Fastest Growing Region in the Surface Protection Service Market?

Asia-Pacific market is poised to grow at the fastest CAGR of 7.6% from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. Government digitalization initiatives and growing smart home adoption are key drivers. Local manufacturing of Surface Protection Service components also enhances affordability and accessibility.

Japan Surface Protection Service Market Insight

Japan’s market is growing due to its high-tech culture, urbanization, and demand for convenience. Adoption is fueled by smart homes and integration with IoT devices such as security cameras and lighting. The aging population further drives demand for easy-to-use, secure access solutions in residential and commercial sectors.

China Surface Protection Service Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, driven by a growing middle class, rapid urbanization, and high technology adoption. Smart home and commercial building projects are increasingly incorporating Surface Protection Services. Push for smart cities and availability of cost-effective solutions by domestic manufacturers further accelerate market growth.

Which are the Top Companies in Surface Protection Service Market?

The surface protection service industry is primarily led by well-established companies, including:

- Tenaris (Luxembourg)

- 3M Company (U.S.)

- Integrated Global Services Inc. (U.S.)

- AkzoNobel (Netherlands)

- Delta T & Protective Products (Canada)

- Corrosion and Abrasion Solutions Ltd. (Canada)

- PPG Industries (U.S.)

- Abtrex Industries Inc. (U.S.)

- Spence Corrosion Services Ltd. (U.S.)

- T.F. Warren Group Inc. (Canada)

What are the Recent Developments in Global Surface Protection Service Market?

- In June 2024, Henkel emphasized its commitment to promoting the role of advanced materials in sustainability across the value chain, including R&D, manufacturing, and field applications for heavy vehicle and equipment designers, manufacturers, and tier suppliers, reinforcing the company’s focus on eco-friendly innovations

- In January 2024, Nippon Paint Holdings launched a new anti-viral paint capable of deactivating 99.9% of coronaviruses on surfaces, enhancing health safety measures, and demonstrating its commitment to innovative, high-performance surface protection solutions

- In September 2023, Nippon Paint Holdings acquired the remaining 49% stake in Nippon Paint (India) from its joint venture partner, Berger Paints, strengthening its presence in the Indian market and consolidating its operational control in the region

- In November 2023, at the Taipei Building Show in Taiwan, Coryor Surface Treatment Company and Nippon Paint Taiwan unveiled new products, including printed Tedlar PVF solutions and PVF coating, which have shown exceptional performance under demanding conditions, highlighting their technological advancements in surface protection

- In October 2023, AkzoNobel completed the sale of its specialty chemicals business to The Carlyle Group and GIC for USD 12.5 billion and unveiled a new powder coating technology that reduces energy consumption and carbon emissions by up to 25%, reinforcing its strategy toward sustainability and portfolio optimization

- In January 2022, Integrated Global Services Inc., a provider of thermal spray surface protection services, acquired AmStar, GE Steam Power’s on-site thermal spray coatings technology, expanding its portfolio of corrosion- and erosion-resistant coatings and strengthening its market position

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.