Global Surface Protection Tapes Market

Market Size in USD Billion

CAGR :

%

USD

19.94 Billion

USD

43.22 Billion

2024

2032

USD

19.94 Billion

USD

43.22 Billion

2024

2032

| 2025 –2032 | |

| USD 19.94 Billion | |

| USD 43.22 Billion | |

|

|

|

|

Surface Protection Tapes Market Size

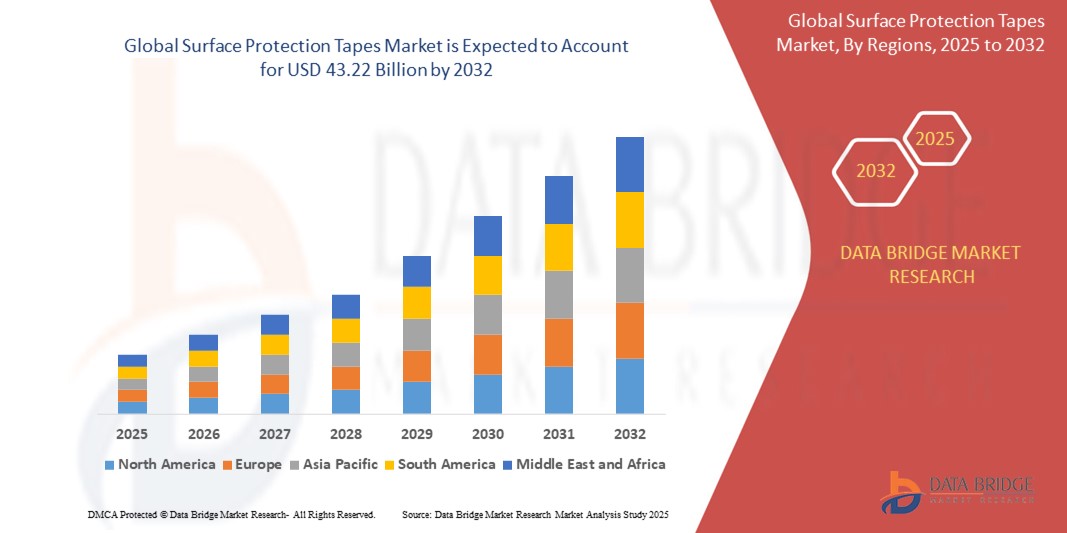

- The global surface protection tapes market size was valued at USD 19.94 billion in 2024 and is expected to reach USD 43.22 billion by 2032, at a CAGR of 10.15% during the forecast period

- The market growth is fuelled by the increasing demand for protective packaging and surface durability across manufacturing and logistics sectors

- In addition, growing applications in electronics and automotive industries are accelerating the adoption of surface protection solutions to preserve product aesthetics and functionality

Surface Protection Tapes Market Analysis

- Surface protection tapes are increasingly adopted in applications requiring temporary shielding from scratches, dust, and damage during processing, storage, and transit

- These tapes offer strong adhesion with easy removability, making them ideal for sensitive surfaces such as polished metals, coated plastics, and glass panels

- Asia-Pacific dominated the surface protection tapes market with the largest revenue share of 42.8% in 2024, owing to expanding electronics production, infrastructure development, and vehicle assembly operations

- North America is expected to witness substantial growth, driven by rising investments in semiconductor manufacturing, home remodeling, and sustainable packaging initiatives

- The polyethylene (PE) segment dominated the market in 2024 due to its cost-effectiveness, flexibility, and superior resistance to abrasion and UV exposure. It is widely used across end-use industries such as automotive, construction, and electronics for temporary surface protection during handling and installation

Report Scope and Surface Protection Tapes Market Segmentation

|

Attributes |

Surface Protection Tapes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Surface Protection Tapes Market Trends

“Increasing Use of Eco-Friendly and Residue-Free Surface Protection Solutions”

- Manufacturers are innovating biodegradable and solvent-free tape materials to reduce environmental footprint

- Electronics and appliance makers prefer residue-free tapes to prevent surface damage during film removal

- Construction projects are increasingly using low-VOC and easy-peel films to protect sensitive surfaces such as aluminum panels and decorative glass

- For instance, a leading smart appliance OEM in South Korea switched to bio-based PE protection films to meet sustainability goals and regulatory compliance

Surface Protection Tapes Market Dynamics

Driver

“Growing Demand for Damage-Free Delivery across Consumer Electronics and Construction Applications”

- Companies in electronics and glass sectors rely on surface protection tapes to preserve appearance and function during transit and installation

- In construction, these tapes are applied to flooring, panels, and frames to reduce replacement costs from accidental scuffs and debris

- Adhesive-coated films allow easy application without leaving residue, ensuring high surface integrity post-removal

- For instance, a U.S.-based prefab construction firm uses multilayer PE tapes to protect modular walls during transportation and on-site assembly

Restraint/Challenge

“Environmental Concerns and Rising Regulatory Pressure against Single-Use Plastics”

- Conventional plastic-based protection films contribute to post-use waste, creating disposal challenges

- Regulations in Europe and parts of Asia are pushing for alternatives that reduce plastic consumption and carbon emissions

- Tape manufacturers must invest in recyclable, bio-based, or reusable variants to remain compliant and competitive

- For instance, an EU-based automotive interiors supplier faced penalties for non-compliant tape usage and transitioned to recyclable films, increasing cost and sourcing complexity

Surface Protection Tapes Market Scope

The surface protection tapes market is segmented based on type, surface material, and end-use industry.

• By Type

On the basis of type, the market is segmented into polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), and others. The polyethylene (PE) segment held the largest market revenue share in 2024, attributed to its superior abrasion resistance, flexibility, and cost-effectiveness. PE tapes are widely adopted across industries such as construction, automotive, and electronics for temporary protection during manufacturing, transportation, and installation. Their compatibility with a wide range of surface types and ease of removal without residue make them the preferred choice for general-purpose applications.

The polypropylene (PP) segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for eco-friendly and residue-free alternatives. PP tapes are lightweight and recyclable, aligning with growing environmental regulations and sustainability goals in packaging and surface protection. Increasing use in electronics and construction is expected to further accelerate the segment’s expansion.

• By Surface Material

On the basis of surface material, the market is segmented into polished metals, glass, plastic, and others. The polished metals segment dominated the market with the largest revenue share in 2024, owing to its widespread application in automotive components, household appliances, and industrial equipment. These surfaces require protection from scratches and contamination during fabrication and assembly, making surface protection tapes a critical component in maintaining quality and finish.

The glass segment is expected to witness the fastest growth rate from 2025 to 2032, due to its increasing application in construction glazing, mobile device screens, solar panels, and high-end consumer products. The need for optical clarity, cleanliness, and scratch resistance during processing and shipping is contributing to the rising adoption of specialized glass protection films across various verticals.

• By End-Use Industry

On the basis of end-use industry, the surface protection tapes market is segmented into electronics & appliances, building & construction, automotive, and others. The electronics & appliances segment accounted for the largest revenue share in 2024 due to the extensive use of protection tapes during the assembly and shipping of devices such as televisions, smartphones, refrigerators, and washing machines. These tapes prevent dust accumulation, scratches, and surface damage, preserving product quality throughout the supply chain.

The automotive segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing integration of high-quality interior and exterior components in electric and premium vehicles. Applications such as painted surfaces, chrome trims, door panels, and dashboards are increasingly protected using surface protection tapes to ensure showroom-quality finishes. Rising consumer expectations for flawless aesthetics and the growth of the electric vehicle (EV) industry are supporting the segment’s robust expansion.

Surface Protection Tapes Market Regional Analysis

- Asia-Pacific dominated the surface protection tapes market with the largest revenue share of 42.8% in 2024, driven by large-scale manufacturing in electronics, automotive, and construction sectors

- The region benefits from lower production costs, rapid industrialization, and a growing domestic consumer base

- In addition, rising urban infrastructure and smart city projects across India, China, and ASEAN nations are fuelling protective film demand in building and construction

China Surface Protection Tapes Market Insight

The China held the largest revenue share in Asia-Pacific in 2024, due to high electronics output, steel processing volume, and rapid real estate development. The country’s emphasis on production efficiency and surface finish quality across manufacturing segments supports sustained demand for surface protection tapes. Government support for expanding semiconductor and photovoltaic manufacturing is also accelerating the need for high-performance protection materials.

Japan Surface Protection Tapes Market Insight

The Japan is expected to witness the fastest growth rate from 2025 to 2032 due to its strong electronics and robotics industries. Precision manufacturing processes and miniaturized consumer devices demand high-performance surface protection tapes with clean removability and superior clarity. The push for energy-efficient building materials and compact EV designs further supports tape utilization in advanced material protection applications.

North America Surface Protection Tapes Market Insight

The North America is expected to witness the fastest growth rate from 2025 to 2032, driven by increased consumer awareness about product protection and durability. High demand from semiconductor cleanroom environments, medical devices, and sustainable packaging sectors are bolstering adoption of specialty protection films. Rising investment in infrastructure upgrades and premium consumer electronics is further contributing to regional growth.

U.S. Surface Protection Tapes Market Insight

The U.S. is expected to witness the fastest growth rate from 2025 to 2032, supported by well-established electronics, automotive, and aerospace industries. Innovation in residue-free tapes and compliance with environmental standards are key drivers for advanced surface protection solutions in the country. In addition, domestic manufacturing resurgence and investments in EV and solar energy segments are boosting the demand for high-adhesion, low-residue films.

Europe Surface Protection Tapes Market Insight

The Europe is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent regulatory frameworks and a shift toward eco-friendly alternatives. Countries such as Germany, the U.K., and France are adopting sustainable packaging and protective solutions in construction and automotive aftermarket segments. The region’s focus on circular economy practices and the presence of advanced manufacturing hubs make it a strong growth arena for recyclable and low-VOC tapes.

U.K. Surface Protection Tapes Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising adoption of protective tapes in residential construction and precision electronics. Increased investment in green infrastructure and expanding smart home appliance manufacturing are key contributors to growth.

Germany Surface Protection Tapes Market Insight

The Germany’s market is expected to witness the fastest growth rate from 2025 to 2032, supported by its leadership in automotive engineering, industrial automation, and solar panel manufacturing. The country's focus on durable and high-finish components is fuelling demand for protective films that ensure flawless surface quality across export-driven sectors.

Surface Protection Tapes Market Share

The Surface Protection Tapes industry is primarily led by well-established companies, including:

- 3M (U.S.)

- TORAY INDUSTRIES, INC. (Japan)

- Chevron Phillips Chemical Company (U.S.)

- Berry Global Inc. (U.S.)

- DuPont (U.S.)

- NITTO DENKO CORPORATION (Japan)

- AVERY DENNISON CORPORATION (U.S.)

- Saint-Gobain (France)

- tesa Tapes (India) Private Limited (India)

- Intertape Polymer Group (Canada)

- Chargeurs (France)

- Mitsui Chemicals, Inc. (Japan)

- Scapa Group Ltd (U.K.)

- American Biltrite (U.S.)

- DELPHON (U.S.)

- Tuftape FZCO (U.A.E.)

- By Integument (U.S.)

- Pregis LLC (U.S.)

- Ajit Industries Pvt. Ltd. (India)

- MEXIM ADHESIVE TAPES PVT. LTD. (India)

Latest Developments in Global Surface Protection Tapes Market

- In October 2021, Toray Industries, Inc. introduced an advanced version of its Lumirror brand, featuring a new line of biaxially oriented polyester films. This latest film innovation precisely manages the height of surface protrusions, significantly reducing the risk of surface defects caused by coarse protrusions. As a result, the film enhances slipperiness and offers improved handling properties, making it suitable for various industrial and consumer applications

- In May 2021, Intertape Polymer Group unveiled its innovative flame retardant polyethylene tape, named PEFR. This versatile tape is designed for a variety of applications, including abatement projects, surface protection, and preservation of marine and heavy equipment. Its flame retardant properties ensure safety and durability, making it an ideal choice for long-term storage solutions where environmental factors and potential hazards must be managed effectively

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Surface Protection Tapes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Surface Protection Tapes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Surface Protection Tapes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.