Global Surface Roughness Measurement Srm Market

Market Size in USD Million

CAGR :

%

USD

955.65 Million

USD

1,351.00 Million

2024

2032

USD

955.65 Million

USD

1,351.00 Million

2024

2032

| 2025 –2032 | |

| USD 955.65 Million | |

| USD 1,351.00 Million | |

|

|

|

|

What is the Global Surface Roughness Measurement (SRM) Market Size and Growth Rate?

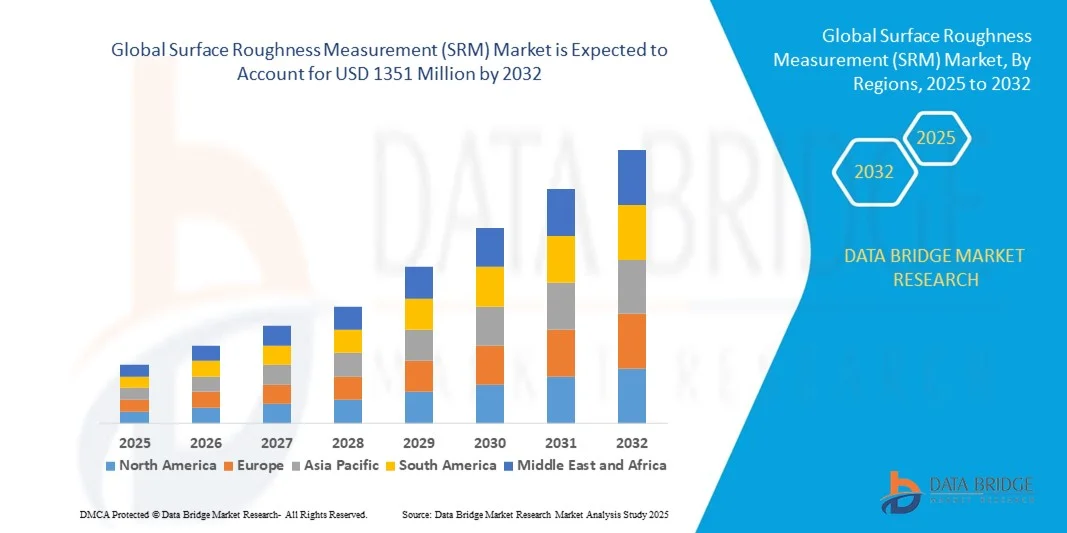

- The global surface roughness measurement (SRM) market size was valued at USD 955.65 million in 2024 and is expected to reach USD 1351 million by 2032, at a CAGR of 4.43% during the forecast period

- Rising industrialization and growth in the number of manufacturing industries will emerge as the major market growth driving factor. Growing demand for better product quality, surging awareness in regards to the industrial automated processes and solutions and rising number of pharmaceutical companies will further aggravate the market value

- Growing expenditure to undertake research and development proficiencies and rising production of automobiles will further carve the way for the growth of the market

What are the Major Takeaways of Surface Roughness Measurement (SRM) Market?

- Dearth of knowledge and technological expertise will act as a growth restraint for the market. Rising inclination towards conventional measuring solutions will further dampen the growth rate of the market. Lack of awareness in the underdeveloped economies will further challenge the market growth rate

- North America dominated the surface roughness measurement (SRM) market with the largest revenue share of 43.15% in 2024, driven by the growing adoption of advanced manufacturing technologies, quality control automation, and precision engineering standards

- The Asia-Pacific SRM market is poised to grow at the fastest CAGR of 12.23% from 2025 to 2032, driven by rapid industrialization, expanding automotive and electronics manufacturing, and rising adoption of automation technologies in China, Japan, and India

- The probes segment dominated the market with the largest revenue share of 36.8% in 2024, driven by their critical role in accurately capturing surface profiles across industries

Report Scope and Surface Roughness Measurement (SRM) Market Segmentation

|

Attributes |

Surface Roughness Measurement (SRM) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Surface Roughness Measurement (SRM) Market?

Integration of Advanced AI and Automated Data Analytics

- A major trend in the global surface roughness measurement (SRM) market is the integration of artificial intelligence (AI) and automated data analytics into measurement devices. This enhances precision, reduces manual intervention, and allows real-time analysis of surface textures, boosting efficiency across manufacturing and quality control processes

- For instance, modern surface roughness measurement instruments such as the Mitutoyo Surftest integrate AI algorithms to automatically classify surface defects and predict wear patterns, minimizing human error and improving reliability

- AI-powered surface roughness measurement solutions enable predictive maintenance by analyzing historical surface data to forecast degradation or failure, while automated analytics provide insights for process optimization

- The seamless integration of surface roughness measurement devices with industrial IoT platforms and manufacturing execution systems facilitates centralized monitoring, allowing engineers to track surface quality across multiple production lines from a single dashboard

- This shift towards intelligent, interconnected surface roughness measurement systems is transforming user expectations for precision measurement. Companies like Keyence and Renishaw are developing AI-enabled surface roughness measurement that deliver automated reporting, defect detection, and integration with manufacturing workflows

- Demand for surface roughness measurement offering AI-driven analytics and automated reporting is growing across automotive, aerospace, and electronics sectors, where precision, repeatability, and operational efficiency are critical

What are the Key Drivers of Surface Roughness Measurement (SRM) Market?

- The increasing demand for high-precision manufacturing in industries such as aerospace, automotive, and electronics is driving adoption of advanced surface roughness measurement tools. Accurate surface measurements improve product performance and ensure compliance with stringent quality standards

- In April 2024, Keyence introduced the AI-enabled Surftest SV-X series, integrating automated defect detection with surface roughness measurement. Innovations like these are expected to drive surface roughness measurement market growth

- The adoption of Industry 4.0 and smart factories is fueling demand for surface roughness measurement devices that offer automated data logging, analytics, and integration with MES/ERP systems

- Growing requirements for predictive maintenance and process optimization are increasing reliance on high-precision surface roughness measurement solutions that reduce downtime and improve production efficiency

- Enhanced surface roughness measurement solutions enable real-time surface monitoring, digital reporting, and seamless integration with CAD/CAM workflows, providing manufacturers with actionable insights and improving decision-making

Which Factor is Challenging the Growth of the Surface Roughness Measurement (SRM) Market?

- The high cost of advanced AI-integrated surface roughness measurement instruments poses a barrier for small and medium manufacturers, limiting market penetration

- SRM devices require skilled operators for optimal performance, and the lack of trained personnel can slow adoption in emerging regions

- Concerns about data security and IoT integration may deter some companies from connecting surface roughness measurement to cloud or networked systems. Companies like Mitutoyo and Renishaw focus on secure data protocols to alleviate these concerns

- While the prices of conventional SRM tools are decreasing, the perceived premium of smart and automated surface roughness measurement systems can hinder adoption, especially among cost-conscious manufacturers

- Overcoming these challenges through affordable solutions, user-friendly interfaces, and employee training programs will be essential for sustained growth and broader adoption of surface roughness measurement solutions globally

How is the Surface Roughness Measurement (SRM) Market Segmented?

The market is segmented on the basis of component, surface, technique, and vertical.

- By Component

On the basis of component, the surface roughness measurement (SRM) market is segmented into probes, frame grabbers, lighting equipment, camera, software, and others. The probes segment dominated the market with the largest revenue share of 36.8% in 2024, driven by their critical role in accurately capturing surface profiles across industries. High precision and compatibility with various SRM instruments make probes indispensable for automotive, aerospace, and semiconductor applications.

The software segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, fueled by the growing adoption of AI-powered analytics, predictive maintenance, and automated reporting features. Advanced SRM software enables real-time analysis, visualization of surface data, and integration with manufacturing execution systems, enhancing operational efficiency and reducing human error. Overall, the combination of hardware and software solutions is driving the modernization of surface roughness measurement practices across global industries.

- By Surface Type

On the basis of surface type, the surface roughness measurement market is segmented into 2D and 3D surfaces. The 3D surface segment dominated the market with a revenue share of 42.5% in 2024, attributed to its ability to provide a comprehensive representation of complex surfaces, including microtextures and defects that 2D measurements might miss. 3D SRM solutions are critical in automotive and aerospace applications where precision is non-negotiable.

The 2D segment is expected to witness the fastest growth rate of 19.5% from 2025 to 2032, as industries increasingly adopt cost-effective 2D solutions for quality control in production lines and smaller-scale manufacturing. Advancements in sensor technology and imaging techniques are further accelerating the adoption of both 2D and 3D SRM tools, enabling manufacturers to improve efficiency, reduce waste, and maintain compliance with stringent surface quality standards.

- By Technique

On the basis of technique, the surface roughness measurement market is segmented into contact and noncontact techniques. The contact technique segment held the largest market revenue share of 48.3% in 2024, driven by its widespread adoption in traditional manufacturing environments and its accuracy in measuring surface profiles through tactile sensors. It remains a preferred choice for automotive, aerospace, and heavy machinery industries due to its reliability and repeatability.

The noncontact technique segment is anticipated to witness the fastest CAGR of 23.4% from 2025 to 2032, fueled by technological advancements in optical and laser-based SRM systems. Noncontact solutions enable faster measurements, minimize the risk of surface damage, and integrate seamlessly with automated inspection lines, making them increasingly popular in semiconductor, electronics, and high-precision industries.

- By Vertical

On the basis of vertical, the surface roughness measurement market is segmented into automotive, aerospace & defense, optics & metal bearing, medical & pharmaceuticals, semiconductor, energy & power, and other verticals. The automotive vertical dominated the market with a revenue share of 31.7% in 2024, due to the high demand for precise surface measurements for engine components, transmission systems, and vehicle body finishes.

The semiconductor vertical is projected to witness the fastest CAGR of 25.2% from 2025 to 2032, driven by the need for ultra-precise surface characterization in microchips, wafers, and electronic devices. Rising adoption of automation, Industry 4.0 practices, and stringent quality control requirements across these sectors are accelerating demand for SRM tools. Overall, the versatility of SRM applications across multiple industrial verticals underscores its critical role in ensuring product quality, reliability, and performance.

Which Region Holds the Largest Share of the Surface Roughness Measurement (SRM) Maret?

- North America dominated the surface roughness measurement (SRM) market with the largest revenue share of 43.15% in 2024, driven by the growing adoption of advanced manufacturing technologies, quality control automation, and precision engineering standards

- Manufacturers and industrial users in the region highly value the accuracy, reliability, and integration capabilities of surface roughness measurement systems with existing production lines and metrology tools

- This widespread adoption is further supported by strong industrial infrastructure, high investments in R&D, and the presence of major surface roughness measurement system providers, establishing North America as a key market for both industrial and research applications

U.S. Surface Roughness Measurement (SRM) Market Insight

The U.S. surface roughness measurement (SRM) market captured the largest revenue share of 81% in 2024 within North America, fueled by increasing industrial automation, stringent quality control regulations, and the adoption of Industry 4.0 practices. Companies prioritize high-precision measurement solutions for automotive, aerospace, and semiconductor manufacturing. Growing investment in research labs, advanced manufacturing facilities, and predictive maintenance systems further propels the surface roughness measurement market. Integration with AI-driven analysis and real-time monitoring solutions enhances efficiency and reduces defects, solidifying the U.S. as a dominant player in the global surface roughness measurement landscape.

Europe Surface Roughness Measurement (SRM) Market Insight

The Europe surface roughness measurement market is projected to grow at a substantial CAGR during the forecast period, driven by strict industrial quality standards, precision manufacturing requirements, and growing adoption of automated inspection technologies. Countries like Germany, France, and Italy are witnessing significant growth in automotive, aerospace, and electronics sectors, which demand high-accuracy surface measurements. Increasing urbanization, smart factory initiatives, and awareness of process optimization are also contributing to the adoption of surface roughness measurement systems. Both new production facilities and modernization of existing plants are fueling market expansion in Europe.

U.K. Surface Roughness Measurement (SRM) Market Insight

The U.K. surface roughness measurement market is anticipated to grow at a noteworthy CAGR, driven by the rising focus on industrial precision, technological advancements in measurement instruments, and increasing investments in R&D facilities. Industrial sectors, particularly automotive and aerospace, are integrating surface roughness measurement solutions to enhance production quality and compliance with international standards. The U.K.’s strong research ecosystem, coupled with smart manufacturing initiatives and government support for digitalization, is further accelerating SRM adoption. Companies are increasingly leveraging SRM systems to improve product reliability and reduce production defects.

Germany Surface Roughness Measurement (SRM) Market Insight

The Germany surface roughness measurement market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s focus on precision engineering, innovation, and sustainable manufacturing practices. Germany’s well-established automotive, aerospace, and industrial machinery sectors are key drivers of SRM adoption. Integration of surface roughness measurement systems with Industry 4.0, automation technologies, and advanced metrology solutions ensures high-quality production outputs. The emphasis on eco-conscious and energy-efficient manufacturing further promotes the use of non-contact and high-precision surface roughness measurement tools, meeting stringent surface quality standards.

Which Region is the Fastest Growing Region in the Surface Roughness Measurement (SRM) Market?

The Asia-Pacific surface roughness measurement market is poised to grow at the fastest CAGR of 12.23% from 2025 to 2032, driven by rapid industrialization, expanding automotive and electronics manufacturing, and rising adoption of automation technologies in China, Japan, and India. Government initiatives supporting smart factories, digitalization, and precision manufacturing are accelerating market penetration. Additionally, APAC’s emergence as a manufacturing hub for surface roughness measurement systems and components is improving affordability and accessibility, making high-precision measurement solutions available to a wider industrial base.

Japan Surface Roughness Measurement (SRM) Market Insight

The Japan surface roughness measurement market is gaining momentum due to the country’s emphasis on advanced manufacturing, high-tech automation, and precision quality control. Industries such as automotive, electronics, and aerospace are driving the demand for surface roughness measurement systems. Integration with IoT devices, robotics, and AI-powered monitoring solutions is fueling market growth. Japan’s aging industrial workforce and focus on efficiency are further boosting the adoption of automated SRM systems for safer, faster, and more accurate surface measurements.

China Surface Roughness Measurement (SRM) Market Insight

The China surface roughness measurement market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country’s massive manufacturing base, urbanization, and rapid adoption of Industry 4.0 practices. SRM systems are increasingly used in automotive, electronics, and semiconductor production to ensure surface quality and process optimization. The push towards smart factories, local manufacturing of measurement instruments, and availability of cost-effective SRM solutions are key factors propelling market growth. China is expected to continue leading the APAC region due to its industrial scale and technology adoption rate.

Which are the Top Companies in Surface Roughness Measurement (SRM) Market?

The surface roughness measurement (SRM) industry is primarily led by well-established companies, including:

- Mahr GmbH (Germany)

- Hexagon AB (Sweden)

- AMETEK, Inc. (U.S.)

- Starrett (U.S.)

- Carl Zeiss AG (Germany)

- JENOPTIK AG (Germany)

- Mitutoyo Corporation (Japan)

- KEYENCE CORPORATION (Japan)

- A.KRÜSS Optronic GmbH (Germany)

- ACCRETECH (Europe) GmbH (Germany)

- FARO (U.S.)

- Optimax Imaging Inspection & Measurement Ltd (U.K.)

- Alicona Imaging GmbH (Austria)

- Kosaka Laboratory Ltd. (Japan)

- Zygo Corporation (U.S.)

- HORIBA, Ltd (Japan)

- The Sempre Group Ltd (U.K.)

- Fowler High Precision, Inc. (U.S.)

- WENZEL (Germany)

What are the Recent Developments in Global Surface Roughness Measurement (SRM) Market?

- In June 2025, Mitutoyo launched the new Hybrid FORMTRACER Avant H-3000 along with Formtracepak v6.2 software, enhancing efficiency for contour and surface roughness measurements. This innovation is set to improve precision and workflow productivity in industrial metrology

- In May 2025, HOMMEL ETAMIC introduced a compact solution from its Visionline product line for inspecting visual surface defects such as pores, cavities, and scratches, featuring optional ‘Shape from Shading’ technology that enables precise detection and classification of defects. This launch strengthens defect analysis capabilities and quality assurance processes

- In June 2023, Hexagon AB partnered with Sony Semiconductor Solutions Corporation, a global leader in image sensors, to advance its reality capture solutions, leveraging Sony’s time-of-flight technologies to improve speed and accuracy. This collaboration enhances the performance of Hexagon’s high-precision measurement tools

- In December 2022, FARO Technologies, a global leader in 4D digital reality solutions, acquired SiteScape, a prominent provider of LiDAR-based scanning software, expanding its digital scanning capabilities and software integration for comprehensive reality capture solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Surface Roughness Measurement Srm Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Surface Roughness Measurement Srm Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Surface Roughness Measurement Srm Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.