Global Surfing Equipment Market

Market Size in USD Million

CAGR :

%

USD

244.12 Million

USD

312.62 Million

2024

2032

USD

244.12 Million

USD

312.62 Million

2024

2032

| 2025 –2032 | |

| USD 244.12 Million | |

| USD 312.62 Million | |

|

|

|

|

Global Surfing Equipment Market Size

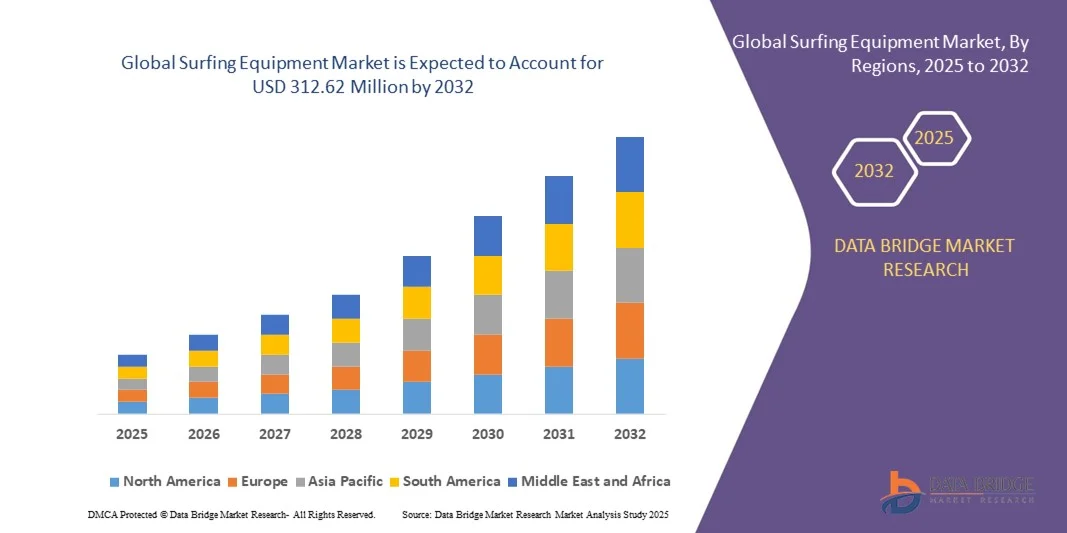

- The global Surfing Equipment Market size was valued at USD 244.12 million in 2024 and is projected to reach USD 312.62 million by 2032, growing at a CAGR of 3.14% during the forecast period

- The market expansion is primarily driven by increasing interest in outdoor recreational activities, rising health consciousness, and growing popularity of surfing as a lifestyle and sport across coastal regions globally

- Additionally, advancements in eco-friendly materials, custom board designs, and surf technology are enhancing user experience and performance, propelling consumer demand and significantly contributing to the industry's rapid growth

Global Surfing Equipment Market Analysis

- Surfing equipment, encompassing surfboards, wetsuits, fins, leashes, and accessories, is becoming an essential part of modern outdoor and water sports culture, supported by growing participation in surfing activities and its inclusion in global sporting events like the Olympics

- The increasing demand for surfing equipment is primarily driven by a surge in adventure tourism, heightened awareness around fitness and wellness, and the global rise of surfing as a recreational and competitive sport

- North America dominated the Global Surfing Equipment Market with the largest revenue share of 35.6% in 2024, attributed to its extensive coastline, strong surfing communities, high consumer spending, and the presence of established brands and surf schools, particularly in California and Hawaii

- Asia-Pacific is expected to be the fastest growing region in the Global Surfing Equipment Market during the forecast period due to expanding coastal tourism, government support for water sports, and a rising youth population engaging in surfing across countries like Indonesia, Japan, and Australia

- The surfing boards segment dominated the market with the largest revenue share of 43.2% in 2024, driven by high consumer demand across both professional and recreational segments.

Report Scope and Global Surfing Equipment Market Segmentation

|

Attributes |

Surfing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Surfing Equipment Market Trends

Enhanced Performance Through Technology and Eco-Innovation

- A significant and accelerating trend in the global Surfing Equipment Market is the growing integration of advanced materials and technologies aimed at enhancing board performance, user experience, and environmental sustainability. These innovations are redefining how surfers interact with equipment and the ocean itself.

- For instance, brands like Firewire and Slater Designs are incorporating eco-friendly materials such as recycled EPS foam, bio-resins, and sustainable wood into high-performance surfboards without compromising durability or responsiveness. Similarly, Surftech’s use of carbon composite construction offers lighter and stronger boards designed for speed and maneuverability.

- Technological advancements in surfboard shaping and design—powered by computer-aided design (CAD) software and hydrodynamic modeling—allow manufacturers to tailor board characteristics for different wave conditions and skill levels. Customization is further enhanced with modular fins and traction pads, enabling surfers to optimize their setup for performance.

- In addition to surfboards, wetsuits are also undergoing transformation, with brands like Patagonia and Vissla using natural rubber alternatives such as Yulex to reduce environmental impact while maintaining thermal efficiency and flexibility. These wetsuits offer both comfort and eco-conscious appeal for environmentally aware consumers.

- The fusion of surf equipment with wearable technology is also emerging, with some boards and accessories incorporating sensors and connectivity features for tracking ride metrics, wave count, and performance analytics. This data-driven approach is helping surfers improve technique and share their experiences in real-time through mobile apps and digital platforms.

- This shift toward high-performance, sustainable, and tech-integrated surfing gear is rapidly reshaping industry standards. Leading brands are investing in R&D to develop equipment that meets the evolving needs of both recreational and competitive surfers, driving demand across global markets, particularly among environmentally conscious and tech-savvy consumers.

Global Surfing Equipment Market Dynamics

Driver

Growing Demand Driven by Outdoor Recreation Trends and Surf Tourism

- The rising popularity of outdoor recreational activities and water sports, particularly surfing, is a major driver of demand in the global Surfing Equipment Market. Increasing participation rates, especially among younger and health-conscious consumers, are fueling the growth of both entry-level and professional-grade surfing gear

- For instance, the inclusion of surfing in the Olympic Games has significantly elevated global awareness and interest in the sport, prompting tourism boards in countries such as Japan, Costa Rica, and Indonesia to invest in surf-friendly infrastructure and promote their coastal regions as surfing destinations

- As more consumers seek active and experience-based lifestyles, surfing is gaining traction not only as a sport but also as a lifestyle symbol, boosting demand for surfboards, wetsuits, and accessories. This is further supported by a surge in surf schools and rental services catering to beginners and travelers

- Furthermore, social media and digital content platforms have played a key role in popularizing surf culture, inspiring a new generation of surfers across regions that were previously underrepresented in the market. This trend is expanding the global customer base, creating demand for both affordable and premium surfing equipment

- The ease of online shopping and availability of direct-to-consumer brands are also simplifying access to gear, encouraging first-time buyers. Equipment innovations such as modular surfboards, environmentally friendly wetsuits, and travel-ready gear are further supporting this growth trajectory, making surfing more accessible to a broader audience

Restraint/Challenge

High Equipment Costs and Limited Access to Surf-Friendly Locations

- Despite its rising popularity, the surfing equipment market faces key challenges, particularly the high initial cost of quality gear and the geographic limitations of surfable coastlines. Surfboards, wetsuits, and accessories can be expensive, especially for beginners or casual surfers who may be deterred by the investment required to participate

- For instance, advanced boards made from sustainable or high-performance materials can cost several hundred dollars, and wetsuits designed for colder water conditions further add to the total expense. This makes the sport less accessible to budget-conscious consumers, particularly in developing regions

- In addition, surfing is geographically constrained to coastal areas with appropriate wave conditions. Landlocked regions often lack access to natural surf environments, limiting the growth potential of the market in those areas. While artificial wave pools and indoor surf parks are emerging solutions, they are still in early development and often come with high infrastructure costs

- To overcome these restraints, brands are beginning to introduce more affordable and durable beginner-friendly gear and expanding surfboard rental networks. The development of soft-top boards, modular designs, and eco-conscious manufacturing is helping reduce price barriers while maintaining product performance

- Broader access to surf facilities, increased surf tourism, and brand-driven initiatives to promote inclusivity and education in the sport will be essential for overcoming these challenges and sustaining long-term market growth

Global Surfing Equipment Market Scope

The surfing equipment market is segmented on the basis of product, application and distribution channel.

- By Product

On the basis of product, the Global Surfing Equipment Market is segmented into Surfing Boards, Apparel & Accessories, and Surf Gear. The surfing boards segment dominated the market with the largest revenue share of 43.2% in 2024, driven by high consumer demand across both professional and recreational segments. Surfboards are essential to the sport, and demand is bolstered by innovations in lightweight materials, customization options, and eco-friendly board construction. Furthermore, the increasing number of surf schools, surf tourism, and participation in international competitions continues to drive demand for various types of boards, including longboards, shortboards, and soft-top boards.

The apparel & accessories segment is projected to witness the fastest CAGR from 2025 to 2032, owing to growing interest in surf culture and fashion, increased awareness about UV protection, and advancements in wetsuit materials. The versatility of surfwear as both functional and lifestyle apparel further supports its growth in both coastal and urban markets.

- By Application

On the basis of application, the Global Surfing Equipment Market is segmented into Entertainment, Sports Competition, and Other. The entertainment segment held the largest market revenue share in 2024, driven by a growing number of recreational surfers and lifestyle-driven participation. Many consumers engage in surfing as a leisure activity, fueled by its association with wellness, adventure, and outdoor experiences. This segment benefits from strong surf tourism and the increasing availability of rental and beginner-friendly equipment.

The sports competition segment is expected to record the fastest CAGR from 2025 to 2032, due to the formal inclusion of surfing in international sports events such as the Olympics and World Surf League (WSL). Increased sponsorship, youth engagement in competitive surfing, and investment in national training programs are helping to professionalize the sport globally, boosting demand for high-performance gear tailored to competitive needs.

- By Distribution Channel

On the basis of distribution channel, the Global Surfing Equipment Market is segmented into Online and Offline. The offline segment dominated the market with the highest revenue share in 2024, supported by established specialty surf shops, sports retailers, and brand-owned stores that provide hands-on product experience, expert guidance, and in-store fittings. Consumers continue to value the ability to physically assess products like surfboards and wetsuits before purchase, especially for high-value or custom-fit items.

The online segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the increasing penetration of e-commerce platforms, digital brand storefronts, and the growing preference for direct-to-consumer channels. Online platforms offer greater accessibility, wider product selection, and competitive pricing, making them especially appealing to younger consumers and those in remote or inland areas. Enhanced product visualization tools, reviews, and flexible return policies are also encouraging online purchases of surfing equipment.

Global Surfing Equipment Market Regional Analysis

- North America dominated the Global Surfing Equipment Market with the largest revenue share of 35.6% in 2024, driven by a strong surfing culture, well-established coastal tourism, and high consumer spending on recreational and lifestyle products

- Consumers in the region actively invest in high-quality surfboards, wetsuits, and accessories, valuing both performance and brand reputation. The presence of renowned surf destinations such as California and Hawaii contributes significantly to consistent demand from both locals and tourists

- This strong market position is further reinforced by widespread participation in surf schools, competitive surfing events, and the adoption of surfing as part of a wellness and active lifestyle. Additionally, the availability of a wide range of products through both physical retail stores and e-commerce platforms ensures easy access, supporting continued growth across the region

U.S. Surfing Equipment Market Insight

The U.S. surfing equipment market captured the largest revenue share of 81% in North America in 2024, driven by a deeply rooted surf culture, strong retail infrastructure, and high levels of consumer spending on lifestyle and recreational products. Iconic surf destinations like California and Hawaii fuel consistent demand for both professional-grade and beginner-level gear. The rising popularity of surf tourism, wellness-focused outdoor recreation, and growing youth participation in surfing are key drivers of market growth. Additionally, the U.S. is home to several leading surf equipment brands and manufacturers, further strengthening its market dominance.

Europe Surfing Equipment Market Insight

The Europe surfing equipment market is projected to expand at a substantial CAGR during the forecast period, fueled by increasing interest in water sports and adventure tourism along the Atlantic and Mediterranean coasts. Countries such as Portugal, France, and Spain are popular surf destinations, attracting both local and international surfers. The market is also seeing a rise in environmentally conscious consumers demanding sustainable and eco-friendly surf products. The trend toward active lifestyles and coastal tourism continues to drive demand across wetsuits, boards, and accessories in both residential and commercial rental segments.

U.K. Surfing Equipment Market Insight

The U.K. surfing equipment market is anticipated to grow at a noteworthy CAGR, driven by increasing awareness of health and wellness, coupled with the popularity of surfing in coastal regions such as Cornwall, Devon, and Wales. The rise in domestic surf tourism and the expansion of surf schools have significantly boosted the adoption of entry-level and rental gear. In addition, the growing appeal of surf-inspired fashion and lifestyle brands in the U.K. is contributing to market growth, particularly within the apparel and accessories segment.

Germany Surfing Equipment Market Insight

The Germany surfing equipment market is expected to expand at a considerable CAGR during the forecast period, supported by rising participation in travel-based water sports and indoor surfing venues. Although Germany lacks extensive coastal regions, inland surf parks and wave pools such as the Eisbach River in Munich are fueling local interest. Sustainability and product innovation are major consumer priorities, with a growing demand for eco-conscious surfboards and wetsuits. Germany’s strong retail and e-commerce presence further supports access to premium global and domestic surf brands.

Asia-Pacific Surfing Equipment Market Insight

The Asia-Pacific surfing equipment market is poised to grow at the fastest CAGR of 24% from 2025 to 2032, driven by increasing coastal tourism, rising disposable incomes, and growing exposure to surfing through media and international events. Countries such as Indonesia, Japan, Australia, and the Philippines are emerging as surfing hotspots, supported by favorable wave conditions and government tourism initiatives. In addition, the rising interest in active and wellness-oriented lifestyles among the youth population is driving demand for accessible and affordable surf gear across the region.

Japan Surfing Equipment Market Insight

The Japan surfing equipment market is gaining momentum due to a combination of growing domestic interest in surfing and increased international exposure following the sport's Olympic debut in Tokyo 2020. Japan's long coastline and well-established transport infrastructure make it an attractive location for surf tourism and local participation. Additionally, a strong preference for quality and technology-driven products is encouraging the adoption of innovative surfboard designs and high-performance wetsuits tailored to Japan’s variable coastal conditions.

China Surfing Equipment Market Insight

The China surfing equipment market accounted for the largest revenue share in Asia Pacific in 2024, fueled by rapid urbanization, a rising middle class, and increasing participation in water sports. As the country invests in surf-friendly infrastructure along its southern coastlines (such as Hainan Island), awareness and interest in surfing are accelerating. China’s growing e-commerce ecosystem and domestic manufacturing capabilities enable wide availability of surf products, while surfing’s rising popularity among younger generations is creating demand across both entry-level and premium gear segments.

Global Surfing Equipment Market Share

The Surfing Equipment industry is primarily led by well-established companies, including:

• Channel Islands Surfboards (U.S.)

• Quiksilver (Australia)

• Rip Curl (Australia)

• Billabong (Australia)

• O'Neill (U.S.)

• Firewire Surfboards (U.S.)

• JS Industries (Australia)

• Lost Surfboards (U.S.)

• Pyzel Surfboards (U.S.)

• Surftech (U.S.)

• Naish International (U.S.)

• Globe International (Australia)

• Hurley (U.S.)

• Decathlon (France)

• Patagonia (U.S.)

• FCS (Surf Hardware International) (Australia)

• Hot Buttered Surfboards (Australia)

• Torq Surfboards (Germany)

• Modern Surfboards (Australia)

• Wave Bandit (U.S.)

What are the Recent Developments in Global Surfing Equipment Market?

- In April 2023, Firewire Surfboards, known for its commitment to sustainability and innovation, announced a partnership with Slater Designs to expand the use of eco-friendly materials, including recycled EPS foam and bio-resins, across its entire product line. This initiative reinforces the brand’s leadership in sustainable surfboard manufacturing and highlights its mission to minimize environmental impact while delivering high-performance products tailored to modern surfers’ expectations. The collaboration reflects the growing market shift toward green innovation in the Global Surfing Equipment Market.

- In March 2023, Rip Curl, one of the world’s leading surfwear and equipment brands, launched its next-generation E7 FlashBomb wetsuit, designed to offer enhanced flexibility, quicker drying times, and improved thermal insulation. Engineered for professional and recreational surfers alike, the E7 wetsuit integrates cutting-edge material technologies to improve comfort and performance in cold-water conditions. This product release demonstrates Rip Curl’s continuous investment in R&D to meet the evolving needs of high-performance surf athletes globally.

- In March 2023, Decathlon announced the expansion of its in-house surf equipment line, Olaian, into new markets across Southeast Asia and Latin America. By offering affordable, beginner-friendly surfboards and gear, Decathlon aims to make surfing more accessible in emerging coastal regions. This move supports the company’s long-term strategy to democratize surfing and tap into growing demand in developing markets where surf culture is gaining momentum, contributing to overall market expansion.

- In February 2023, Patagonia introduced its latest range of Yulex natural rubber wetsuits, further solidifying its position as a pioneer in sustainable surf apparel. This new range features improved stretch, durability, and reduced carbon emissions compared to conventional neoprene wetsuits. The initiative aligns with Patagonia’s broader environmental mission and reflects a significant trend in the market toward responsible manufacturing practices and ethical sourcing within the surfing industry.

- In January 2023, JS Industries, a leading performance surfboard manufacturer, unveiled a collaboration with top pro surfer Julian Wilson to release a limited-edition high-performance shortboard line tailored for competitive surfing. Engineered using advanced CAD modeling and carbon-reinforced stringers, the collection targets elite and aspiring surfers looking for precision and agility in powerful wave conditions. The launch underscores the rising influence of athlete-endorsed gear and performance customization in the Global Surfing Equipment Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SURFING EQUIPMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SURFING EQUIPMENT MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL SURFING EQUIPMENT MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 INDUSTRY INSIGHTS

7 GLOBAL SURFING EQUIPMENT MARKET, BY EQUIPMENT TYPE, (2021-2030), (USD MILLION)

7.1 OVERVIEW

7.2 SURFING BOARDS & ACCESSORIES

7.2.1 SURFING EARPLUGS

7.2.2 SURFING SURFBOARD FINS

7.2.3 HELMETS

7.2.4 LEASH

7.2.5 LONGBOARDS

7.2.6 RASH GUARD

7.2.7 SURFBOARD

7.2.8 TRACTION PADS

7.2.9 FIN REMOVAL TOOL

7.2.10 OTHERS

7.3 APPARELS & ACCESSORIES

7.3.1 SURFBOARD BAG

7.3.2 BOOTS, GLOVES, AND HOODS

7.3.3 SURF PONCHO

7.3.4 BOARDSHORTS

7.3.5 WETSUIT

7.3.6 CAR RACKS

7.3.7 SURF WAX

7.3.8 SUNSCREEN

7.3.9 OTHERS

8 GLOBAL SURFING EQUIPMENT MARKET, BY APPLICATION, (2021-2030), (USD MILLION)

8.1 OVERVIEW

8.2 ENTERTAINMENT

8.2.1 ENTERTAINMENT, BY EQUIPMENT TYPE

8.2.1.1. SURFING BOARDS & ACCESSORIES

8.2.1.2. APPARELS & ACCESSORIES

8.3 SPORTS COMPETITION

8.3.1 SPORTS COPETITION, BY EQUIPMENT TYPE

8.3.1.1. SURFING BOARDS & ACCESSORIES

8.3.1.2. APPARELS & ACCESSORIES

8.4 OTHER

9 GLOBAL SURFING EQUIPMENT MARKET,BY DISTRIBUTION CHANNEL, (2021-2030), (USD MILLION)

9.1 OVERVIEW

9.2 ONLINE

9.2.1 E-COMMERCE

9.2.2 BRAND WEBSITES

9.2.3 OTHERS

9.3 OFFLINE

9.3.1 SUPERMARKETS/HYPERMARKETS

9.3.2 RETAIL STORES

9.3.3 SPECIALITY STORES

9.3.4 OTHERS

10 GLOBAL SURFING EQUIPMENT MARKET, BY GEOGRAPHY, (2021-2030), (USD MILLION)

10.1 GLOBAL SURFING EQUIPMENT MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.2 NORTH AMERICA

10.2.1 U.S.

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 GERMANY

10.3.2 U.K.

10.3.3 ITALY

10.3.4 FRANCE

10.3.5 SPAIN

10.3.6 RUSSIA

10.3.7 SWITZERLAND

10.3.8 TURKEY

10.3.9 BELGIUM

10.3.10 NETHERLANDS

10.3.11 REST OF EUROPE

10.4 ASIA-PACIFIC

10.4.1 JAPAN

10.4.2 CHINA

10.4.3 SOUTH KOREA

10.4.4 INDIA

10.4.5 SINGAPORE

10.4.6 THAILAND

10.4.7 INDONESIA

10.4.8 MALAYSIA

10.4.9 PHILIPPINES

10.4.10 AUSTRALIA & NEW ZEALAND

10.4.11 REST OF ASIA-PACIFIC

10.5 SOUTH AMERICA

10.5.1 BRAZIL

10.5.2 ARGENTINA

10.5.3 REST OF SOUTH AMERICA

10.6 MIDDLE EAST AND AFRICA

10.6.1 SOUTH AFRICA

10.6.2 EGYPT

10.6.3 SAUDI ARABIA

10.6.4 UNITED ARAB EMIRATES

10.6.5 ISRAEL

10.6.6 REST OF MIDDLE EAST AND AFRICA

11 GLOBAL SURFING EQUIPMENT MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11.5 MERGERS AND ACQUISITIONS

11.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

11.7 EXPANSIONS

11.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

12 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

13 GLOBAL SURFING EQUIPMENT MARKET- COMPANY PROFILE

13.1 KEEPER SPORTS PRODUCTS

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT UPDATES

13.2 MT WOODGEE SURFBOARDS

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 QUIKSILVER

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 PRO-LITE.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 BLUE SEA WATERSPORTS

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATES

13.6 TOY FACTORY SURFBOARDS

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT UPDATES

13.7 SHOP RUSTY SURFBOARDS.

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT UPDATES

13.8 XANADU SURF DESIGNS

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATES

13.9 MCTAVISH SURFBOARDS

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 MUSKOKA SURFBOARD COMPANY

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT UPDATES

13.11 RIP CURL

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT UPDATES

13.12 O'NEILL

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT UPDATES

13.13 AGIT GLOBAL, INC

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATES

13.14 KANOA SURFBOARDS

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT UPDATES

13.15 RIOT SURFBOARDS

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

14 RELATED REPORTS

15 QUESTIONNAIRE

16 CONCLUSION

17 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.