Global Surgical Clips Market

Market Size in USD Million

CAGR :

%

USD

530.83 Million

USD

1,120.61 Million

2025

2033

USD

530.83 Million

USD

1,120.61 Million

2025

2033

| 2026 –2033 | |

| USD 530.83 Million | |

| USD 1,120.61 Million | |

|

|

|

|

Surgical Clips Market Size

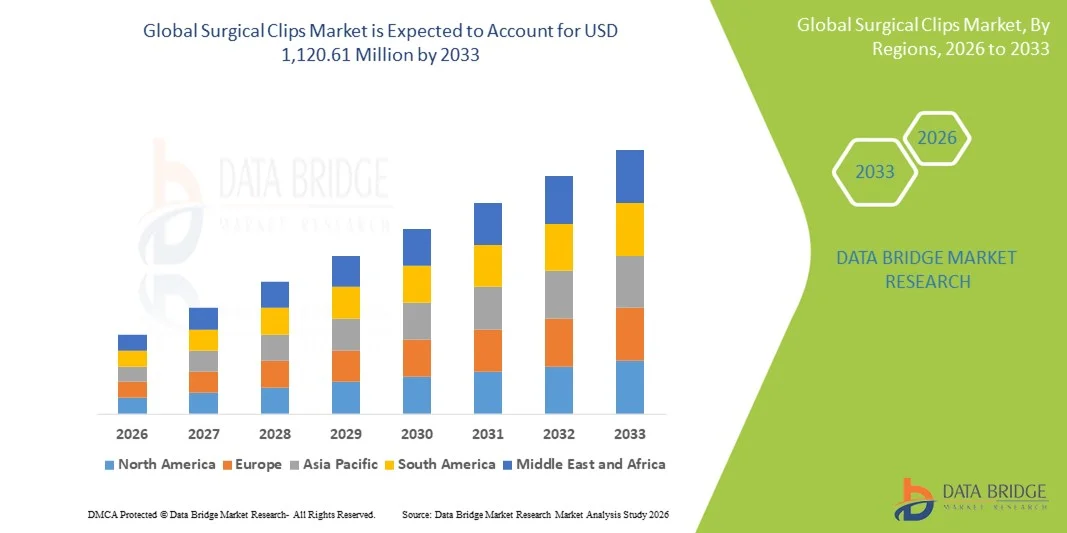

- The global surgical clips market size was valued at USD 530.83 million in 2025 and is expected to reach USD 1,120.61 million by 2033, at a CAGR of 9.79% during the forecast period

- The market growth is primarily driven by the rising volume of surgical procedures worldwide, increasing adoption of minimally invasive surgeries, and continuous advancements in surgical technologies that enhance procedural efficiency and patient safety

- Furthermore, growing demand for reliable, easy-to-use, and biocompatible wound closure and hemostasis solutions across hospitals and ambulatory surgical centers is positioning surgical clips as a preferred choice in modern surgical practices. These combined factors are accelerating the adoption of surgical clip products, thereby significantly supporting the overall growth of the market

Surgical Clips Market Analysis

- Surgical clips, used for ligation and tissue closure during surgical procedures, are becoming essential tools in modern operating rooms due to their efficiency, reliability, and ability to minimize procedure time and blood loss across both open and minimally invasive surgeries

- The rising demand for surgical clips is primarily driven by the increasing number of surgical procedures globally, growing preference for minimally invasive techniques, and the need for safe, quick, and effective hemostatic solutions

- North America dominated the surgical clips market with the largest revenue share of 38.9% in 2025, supported by advanced healthcare infrastructure, high healthcare expenditure, and the presence of leading medical device manufacturers, with the U.S. witnessing significant adoption in hospitals and ambulatory surgical centers due to innovations in absorbable and reusable clip technologies

- Asia-Pacific is expected to be the fastest growing region in the surgical clips market during the forecast period, fueled by expanding healthcare facilities, rising surgical volumes, and increasing awareness about modern surgical technologies

- The titanium segment dominated the surgical clips market with a share of 42.8% in 2025, driven by its biocompatibility, strength, and widespread acceptance in various surgical procedures

Report Scope and Surgical Clips Market Segmentation

|

Attributes |

Surgical Clips Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Surgical Clips Market Trends

Advancements in Bioabsorbable and Polymer Clips

- A notable trend in the global surgical clips market is the increasing adoption of bioabsorbable and polymer clips, which provide safer, post-operative tissue healing and reduce the need for clip removal

- For instance, Medtronic’s Ligating Clips include polymer options designed to minimize tissue reaction and enhance patient safety during both open and minimally invasive procedures

- These clips offer improved flexibility and compatibility with various surgical instruments, allowing surgeons to perform precise ligation with reduced trauma to surrounding tissues

- Bioabsorbable clip technology is particularly gaining traction in laparoscopic surgeries, where patient recovery time and procedural efficiency are critical

- The trend towards innovative, tissue-friendly materials in surgical clips is reshaping clinical expectations and encouraging manufacturers such as Teleflex to develop advanced polymer and absorbable clip solutions

- Growing preference for clips that enhance surgical outcomes and minimize complications is accelerating adoption across hospitals and ambulatory surgical centers globally

- Increasing research and development in smart and preloaded clip applicators is improving procedural speed and reducing human error in surgeries

- Collaborations between surgical device manufacturers and hospitals for clinical trials are helping validate new clip designs and materials, fostering faster adoption of innovative surgical clips

Surgical Clips Market Dynamics

Driver

Increasing Surgical Volumes and Minimally Invasive Procedures

- The rising number of surgical procedures worldwide, coupled with the growing preference for minimally invasive surgeries, is a key driver for surgical clips market growth

- For instance, Johnson & Johnson reported a surge in laparoscopic procedures using Ethicon ligating clips, reflecting increased hospital adoption of efficient tissue closure solutions

- Surgical clips provide reliable hemostasis, reduce operative time, and improve procedural efficiency, making them a preferred choice for surgeons globally

- Expanding healthcare infrastructure in emerging markets and increasing investments in surgical technology are further propelling the demand for advanced surgical clip solutions

- The convenience of quick, precise ligation and compatibility with automated surgical devices strengthens adoption in hospitals and ambulatory surgical centers worldwide

- Growing awareness among surgeons regarding the benefits of polymer and bioabsorbable clips over traditional metal clips is contributing to higher adoption rates

- Increasing integration of surgical clips with robotic-assisted surgical systems is enhancing precision and safety, driving market demand further

- The rising number of outpatient surgical centers and ambulatory procedures is creating steady demand for efficient and reliable clip solutions

- Technological collaborations between clip manufacturers and surgical device developers are enabling innovative product launches that boost adoption rates

Restraint/Challenge

High Costs and Regulatory Compliance Challenges

- The relatively high cost of advanced surgical clips, particularly absorbable and polymer variants, can limit adoption among price-sensitive healthcare providers

- For instance, premium clip systems from Medtronic and Teleflex are often costlier than conventional stainless steel clips, impacting procurement decisions in developing regions

- Regulatory approvals and stringent compliance requirements for surgical devices can delay product launches and restrict market entry for new manufacturers

- Hospitals and clinics require extensive validation and certification of clip materials and designs, adding time and expense to adoption processes

- While advancements in surgical clip technology continue, overcoming cost and compliance barriers through innovation, training, and localized manufacturing will be essential for sustained market expansion

- Limited awareness about advanced clip types in smaller healthcare facilities can slow adoption, particularly in emerging economies

- Supply chain disruptions or raw material shortages, especially for polymer and bioabsorbable clips, may hinder consistent availability and impact market growth

- Variability in reimbursement policies across countries can affect the adoption of premium surgical clips in cost-sensitive healthcare systems

- Competition from alternative wound closure technologies, such as sutures and staplers, may restrain growth for certain clip segments

Surgical Clips Market Scope

The market is segmented on the basis of product material, type, surgery type, and end user.

- By Product Material

On the basis of product material, the surgical clips market is segmented into titanium, tantalum, and polymer. The titanium segment dominated the market with the largest revenue share of 42.8% in 2025, driven by its high biocompatibility, corrosion resistance, and strength, making it suitable for a wide range of surgical procedures. Titanium clips are widely adopted in both open and minimally invasive surgeries due to their proven reliability in maintaining hemostasis. Surgeons prefer titanium for its ease of handling and compatibility with imaging modalities such as MRI. The long-standing clinical acceptance of titanium clips and their minimal tissue reaction contribute to sustained demand in hospitals and surgical centers globally. In addition, titanium clips are often available in various sizes and preloaded applicators, enhancing procedural efficiency. The segment benefits from strong adoption in developed markets such as North America and Europe, where advanced surgical infrastructure exists.

The polymer segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing adoption of bioabsorbable and polymer clips in minimally invasive and laparoscopic procedures. Polymer clips offer advantages such as reduced tissue trauma, lower risk of post-operative complications, and elimination of the need for clip removal. Growing awareness among surgeons regarding the clinical benefits of polymer materials and rising demand in emerging markets contribute to this growth. Advancements in polymer clip design, including enhanced flexibility and compatibility with automated clip appliers, are also accelerating adoption. The expanding preference for patient-friendly and biodegradable solutions in hospitals and ambulatory surgical centers further supports the growth of this segment.

- By Type

On the basis of type, the market is segmented into ligating clips and aneurysm clips. The ligating clips segment dominated the market in 2025, driven by its extensive use in general surgeries and minimally invasive procedures for reliable vessel ligation and hemostasis. These clips are favored due to their ease of application, reduced operative time, and effectiveness in controlling bleeding. Surgeons often rely on ligating clips for laparoscopic and robotic-assisted procedures, where precision and procedural efficiency are critical. The segment benefits from strong adoption across hospitals and ambulatory surgical centers due to consistent clinical outcomes and availability in multiple sizes. Technological improvements in preloaded clip applicators and automated systems further reinforce demand. In addition, ligating clips are widely recognized for their safety profile and minimal tissue reaction, which supports continued growth.

The aneurysm clips segment is expected to witness the fastest growth during the forecast period, driven by rising neurosurgical procedures and increasing prevalence of cerebrovascular diseases. Aneurysm clips are critical in neurovascular surgeries for secure vessel occlusion and preventing rupture. Innovations in clip design, including improved materials and MRI-compatible options, are expanding their adoption in advanced surgical centers. The segment growth is further supported by growing investment in neurosurgical infrastructure in emerging markets. Increasing awareness of minimally invasive neurovascular interventions among surgeons also drives demand.

- By Surgery Type

On the basis of surgery type, the market is segmented into automated surgery clips and manual surgery clips. The manual surgery clips segment dominated the market in 2025, primarily due to widespread adoption in traditional surgical procedures and its cost-effectiveness compared to automated systems. Manual clips are simple to use, require minimal equipment, and are highly reliable for open and laparoscopic surgeries. Surgeons favor manual clips for procedures where precise control over clip placement is needed. The segment’s dominance is further reinforced by extensive clinical familiarity and availability in various sizes and applicators. Manual clips are widely used across hospitals and clinics globally, supporting sustained market revenue.

The automated surgery clips segment is anticipated to witness the fastest growth during the forecast period, driven by the increasing adoption of robotic-assisted and minimally invasive surgeries. Automated clip applicators enhance procedural efficiency, reduce surgeon fatigue, and improve accuracy in high-volume surgical centers. Integration with laparoscopic and robotic platforms allows for precise clip deployment in challenging surgical scenarios. Rising demand for technologically advanced surgical solutions and investments in smart surgical instruments are fueling this segment’s growth. Furthermore, automation reduces procedural errors and improves patient outcomes, encouraging hospitals and ambulatory surgical centers to adopt automated clip systems.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, and ambulatory surgery centers. The hospitals segment dominated the market in 2025, driven by high surgical volumes, advanced infrastructure, and strong purchasing power. Hospitals require reliable and diverse surgical clip solutions to cater to various procedures, including open, laparoscopic, and robotic surgeries. The segment benefits from continuous investments in modern surgical technologies and preloaded applicators, enhancing procedural efficiency. Hospitals also prefer premium clip solutions, such as bioabsorbable or polymer clips, for improved patient outcomes. The extensive use of surgical clips in high-complexity procedures further strengthens revenue dominance.

The ambulatory surgery centers segment is expected to witness the fastest growth during the forecast period, fueled by the rising number of outpatient surgeries and minimally invasive procedures. Ambulatory centers increasingly adopt efficient and safe clip solutions to reduce operation time and improve patient throughput. The growing preference for quick recovery and cost-effective procedures encourages the use of modern clip technologies, including polymer and automated clips. Expanding healthcare access in emerging markets and increasing investments in surgical infrastructure further accelerate growth. In addition, the ease of use and reduced training requirements for advanced clip systems support adoption in outpatient settings.

Surgical Clips Market Regional Analysis

- North America dominated the surgical clips market with the largest revenue share of 38.9% in 2025, supported by advanced healthcare infrastructure, high healthcare expenditure, and the presence of leading medical device manufacturers, with the U.S. witnessing significant adoption in hospitals and ambulatory surgical centers due to innovations in absorbable and reusable clip technologies

- Hospitals and surgical centers in the region prioritize reliable and efficient surgical clip solutions to improve procedural outcomes and reduce operative time, leading to widespread use of both titanium and polymer clips

- This dominance is further supported by high healthcare expenditure, early adoption of advanced surgical technologies, and strong presence of key market players such as Medtronic, Teleflex, and Johnson & Johnson, ensuring availability of innovative clip systems for diverse surgical procedures

U.S. Surgical Clips Market Insight

The U.S. surgical clips market captured the largest revenue share of 36% in 2025 within North America, driven by high surgical volumes and advanced healthcare infrastructure. Hospitals and ambulatory surgical centers increasingly prefer reliable and efficient clip solutions, including titanium and polymer clips, for minimally invasive and robotic-assisted procedures. The demand is further fueled by rising adoption of laparoscopic surgeries and the growing focus on reducing operative time and improving patient outcomes. Technological innovations from key players such as Medtronic, Teleflex, and Johnson & Johnson are also accelerating market growth. Furthermore, strong insurance coverage and high healthcare expenditure support widespread adoption of advanced surgical clip systems.

Europe Surgical Clips Market Insight

The Europe surgical clips market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising number of surgical procedures and stringent healthcare regulations. Increasing awareness about minimally invasive and laparoscopic surgeries is fostering the adoption of advanced clip solutions. European healthcare providers are also prioritizing patient safety and procedural efficiency, leading to higher demand for polymer and bioabsorbable clips. The region sees significant growth across hospitals, clinics, and ambulatory surgical centers, with surgical clips being integrated into both new surgical suites and upgrades of existing facilities. In addition, investments in modern surgical technologies and preloaded clip applicators are boosting market growth.

U.K. Surgical Clips Market Insight

The U.K. surgical clips market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing surgical volumes and the demand for advanced surgical instruments. Hospitals and clinics are adopting ligating and aneurysm clips for improved efficiency, accuracy, and patient safety. The market is supported by the presence of key manufacturers and growing awareness of bioabsorbable and polymer clip benefits among surgeons. Rising outpatient surgical procedures and minimally invasive surgeries further encourage clip adoption. In addition, government initiatives to modernize healthcare infrastructure and promote technological innovation in surgery are expected to stimulate market expansion.

Germany Surgical Clips Market Insight

The Germany surgical clips market is expected to expand at a considerable CAGR during the forecast period, fueled by high adoption of minimally invasive and robotic-assisted surgeries. Hospitals and surgical centers prioritize technologically advanced clip solutions, including titanium and polymer clips, to improve procedural outcomes. Germany’s strong healthcare infrastructure, emphasis on innovation, and focus on patient safety promote adoption across surgical specialties. Integration of clip systems with laparoscopic and robotic platforms is increasing in advanced hospitals. Furthermore, German healthcare providers show strong preference for clips with proven clinical performance, supporting sustained demand.

Asia-Pacific Surgical Clips Market Insight

The Asia-Pacific surgical clips market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rising surgical volumes, increasing investments in healthcare infrastructure, and rapid adoption of minimally invasive procedures. Countries such as China, Japan, and India are witnessing growing demand for polymer and bioabsorbable clips due to their efficiency, safety, and ease of use. Expanding hospital networks, growing awareness of advanced surgical technologies, and government initiatives to improve surgical care are accelerating market adoption. In addition, the region is becoming a manufacturing hub for surgical clips, improving affordability and accessibility for hospitals and clinics.

Japan Surgical Clips Market Insight

The Japan surgical clips market is gaining momentum due to high adoption of minimally invasive and robotic-assisted surgeries. Hospitals and ambulatory centers prioritize precision and procedural efficiency, leading to increased demand for titanium, polymer, and automated clip systems. Integration with advanced surgical instruments and intraoperative imaging further drives adoption. The aging population and growing focus on patient safety are also encouraging the use of efficient and reliable surgical clips. Moreover, ongoing innovations by local and international manufacturers are enhancing product availability and clinical acceptance in the Japanese market.

India Surgical Clips Market Insight

The India surgical clips market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising surgical volumes, increasing number of hospitals and ambulatory centers, and growing awareness of minimally invasive procedures. The expanding middle class and improving healthcare infrastructure are driving demand for advanced surgical clip solutions, including polymer and bioabsorbable clips. Government initiatives promoting healthcare modernization and adoption of modern surgical technologies further support market growth. Affordable pricing, combined with strong domestic manufacturing and international supplier presence, is making surgical clips increasingly accessible across urban and semi-urban healthcare facilities.

Surgical Clips Market Share

The Surgical Clips industry is primarily led by well-established companies, including:

- Teleflex Incorporated (U.S.)

- Medtronic (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Aesculap, Inc. (U.S.)

- B. Braun SE (Germany)

- Karl Storz SE & Co. KG (Germany)

- Stryker (U.S.)

- Boston Scientific Corporation (U.S.)

- CONMED Corporation (U.S.)

- Smith & Nephew (U.K.)

- Scanlan International, Inc. (U.S.)

- Applied Medical Resources Corporation (U.S.)

- Richard Wolf GmbH (Germany)

- KLS Martin Group (Germany)

- Sklar Surgical Instruments (U.S.)

- Genicon, Inc. (U.S.)

- Microline Surgical (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Pilling Surgical (U.S.)

What are the Recent Developments in Global Surgical Clips Market?

- In October 2025, Medtronic received CE Mark approval for its Penditure™ Left Atrial Appendage (LAA) Exclusion System, a surgically implanted clip used to close the heart’s left atrial appendage during cardiac surgery, enabling the company to launch the product commercially in Europe after it surpassed 10,000 units sold worldwide and offering surgeons a recapturable, repositionable clip option for stroke‑risk reduction procedures

- In August 2025, Cook Medical issued a Field Safety Notice for its Instinct Plus Endoscopic Clipping Device, warning clinicians about a potential malfunction where the clip housing may detach and fail to open properly during deployment, prompting risk‑mitigation instructions for providers and highlighting ongoing safety monitoring for surgical clipping tools in endoscopic procedures

- In March 2025, Olympus launched its Retentia™ HemoClip, a new single‑use hemostasis clip designed to provide 360° rotation and intuitive one‑step deployment for gastrointestinal procedures such as endoscopic mucosal resection. This product introduction aims to enhance clip placement control and hemostasis outcomes for GI specialists

- In February 2025, Synovis Micro Companies Alliance (Synovis MCA) announced global distribution rights for the GEM™ SuperFine™ MicroClip, the smallest titanium clip designed for microsurgical hemostasis, enhancing precision and grip in plastic, reconstructive, and hand surgeries

- In August 2023, Medtronic completed acquisition of Penditure™ Left Atrial Appendage Exclusion System, an innovative implantable clip that can be recaptured and redeployed during cardiac surgery, expanding Medtronic’s cardiovascular surgical clip portfolio and control for surgeons

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.