Global Surgical Headlights Market

Market Size in USD Billion

CAGR :

%

USD

73.30 Billion

USD

108.95 Billion

2025

2033

USD

73.30 Billion

USD

108.95 Billion

2025

2033

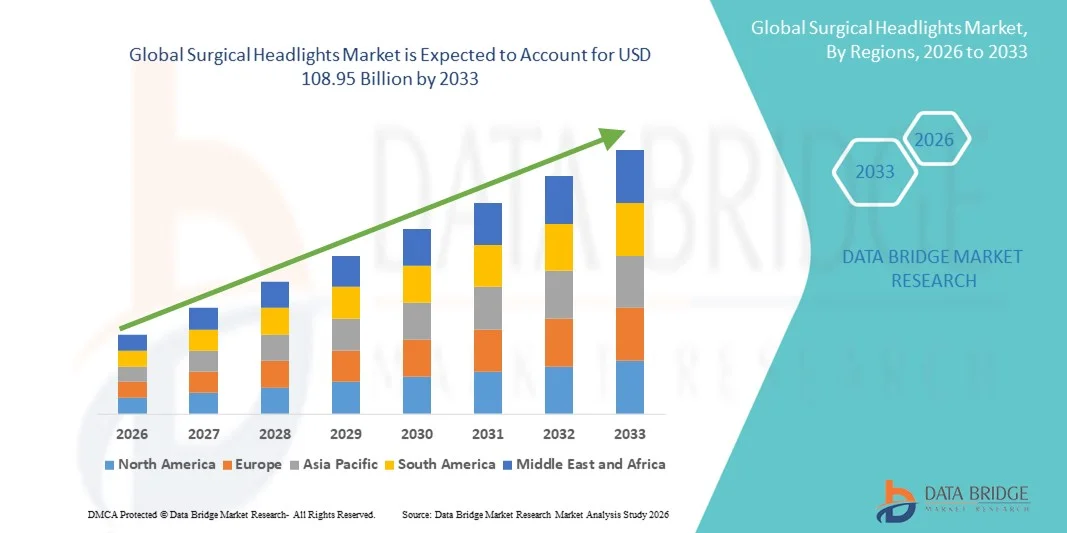

| 2026 –2033 | |

| USD 73.30 Billion | |

| USD 108.95 Billion | |

|

|

|

|

Surgical Headlights Market Size

- The global surgical headlights market size was valued at USD 73.30 billion in 2025 and is expected to reach USD 108.95 billion by 2033, at a CAGR of 5.08% during the forecast period

- The market growth is largely fueled by rising adoption of advanced illumination technologies, increasing volume of surgical procedures globally, and ongoing innovations that enhance precision, visibility, and surgeon efficiency in operating rooms

- Furthermore, growing investments in healthcare infrastructure, expanding surgical specialties and rising demand for reliable, energy‑efficient, and surgeon‑friendly lighting solutions are establishing surgical headlights as essential tools for modern surgery. These converging factors are accelerating the uptake of surgical headlight systems, thereby significantly boosting the industry’s growth

Surgical Headlights Market Analysis

- Surgical headlights, providing focused illumination for operating rooms, are increasingly vital components of modern surgical procedures across hospitals and clinics due to their enhanced visibility, precision, and hands-free operation, enabling surgeons to perform complex procedures with greater safety and efficiency

- The escalating demand for surgical headlights is primarily fueled by the growing volume of surgical procedures globally, rising adoption of advanced LED and ergonomic lighting technologies, and the need for reliable, energy-efficient illumination in minimally invasive and specialty surgeries

- North America dominated the surgical headlights market with the largest revenue share of 38.6% in 2025, characterized by advanced healthcare infrastructure, high adoption of cutting-edge surgical technologies, and a strong presence of key industry players, with the U.S. witnessing substantial investments in modern operating rooms and adoption of portable, lightweight, and wearable surgical headlight systems

- Asia-Pacific is expected to be the fastest growing region in the surgical headlights market during the forecast period due to increasing healthcare infrastructure development, rising number of surgical procedures, and expanding focus on hospital modernization in countries such as China and India

- LED Type segment dominated the surgical headlights market with a market share of 46.9% in 2025, driven by their energy efficiency, long lifespan, superior illumination quality, and ability to reduce shadows and enhance surgical precision

Report Scope and Surgical Headlights Market Segmentation

|

Attributes |

Surgical Headlights Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Surgical Headlights Market Trends

Enhanced Precision Through LED and Smart Integration

- A significant and accelerating trend in the global surgical headlights market is the increasing integration of advanced LED technology with smart operating room systems, enhancing illumination precision and surgeon control during procedures

- For instance, the Skytron UltraLED Surgical Headlight integrates with OR control systems to allow brightness adjustments and beam positioning directly from the surgical console, improving workflow efficiency

- Smart surgical headlights enable features such as automatic brightness adjustment based on ambient light, customizable focus patterns, and real-time monitoring of battery status, enhancing safety and performance. For instance, Heine Omega 5000 LED headlights automatically adapt intensity to ensure optimal tissue visualization during long procedures

- The seamless integration of surgical headlights with digital imaging systems and smart OR platforms facilitates centralized control over lighting, allowing surgeons to coordinate illumination with cameras, endoscopes, and other equipment for better procedural outcomes

- This trend toward more intelligent, adaptive, and ergonomic lighting solutions is fundamentally reshaping expectations for surgical performance. Consequently, companies such as Medical Illumination are developing LED surgical headlights with customizable focus, smart brightness adjustment, and hands-free control options

- The demand for surgical headlights that offer smart integration and advanced LED features is growing rapidly across hospitals and surgical centers, as medical professionals increasingly prioritize precision, safety, and operational efficiency

- Integration of wireless and battery-powered surgical headlights is gaining traction, enabling mobility, portability, and easier positioning without dependency on overhead power sources

Surgical Headlights Market Dynamics

Driver

Rising Demand Due to Increasing Surgical Procedures and Advanced Healthcare Infrastructure

- The increasing number of surgical procedures globally, coupled with expanding healthcare infrastructure in emerging and developed regions, is a significant driver for the heightened demand for surgical headlights

- For instance, in March 2025, Skytron launched an upgraded UltraLED headlight system targeting high-volume surgical centers, emphasizing its integration with modern OR technologies

- As hospitals and surgical centers seek to improve operative outcomes, surgical headlights offer advanced illumination features such as shadow reduction, high-intensity LED output, and uniform beam focus, providing a compelling upgrade over conventional overhead lights

- Furthermore, the growing number of minimally invasive surgeries and specialized procedures is making surgical headlights an essential component of operating room setups, offering precise, focused lighting in critical areas

- The ergonomic design, energy efficiency, and long lifespan of modern surgical headlights are key factors propelling their adoption in both emerging and mature markets, with hospitals increasingly investing in hands-free, wearable, and portable lighting solutions

- Rising government initiatives and funding for hospital modernization in developing countries are encouraging the procurement of advanced surgical headlights to improve surgical outcomes

- Increasing collaborations between surgical headlight manufacturers and medical device companies are enabling bundled solutions for ORs, driving adoption through integrated offerings and support services

Restraint/Challenge

High Cost and Maintenance Complexity

- The relatively high initial investment for advanced surgical headlights, especially those with integrated smart or LED technology, poses a challenge to broader market adoption, particularly in smaller healthcare facilities

- For instance, hospitals in developing regions may delay procurement of premium LED headlight systems such as the Medical Illumination MiScope 3.0 due to budget constraints

- Addressing concerns related to maintenance, battery replacement, and calibration complexity is crucial for broader acceptance. Advanced systems often require specialized servicing and technical expertise to maintain optimal performance, adding to operational costs

- Furthermore, the limited awareness and training among surgical staff on the effective use of smart or adjustable lighting systems can hinder adoption, as suboptimal use may reduce the perceived benefits of the investment

- Overcoming these challenges through cost reduction, simplified maintenance, and training programs will be vital for sustained market growth and wider penetration of surgical headlights in both emerging and developed markets

- The risk of equipment downtime due to battery failure, lamp degradation, or software issues can disrupt surgeries, making hospitals cautious about replacing older lighting systems

- Compliance with stringent medical device regulations and certification standards across different countries increases the time and cost for manufacturers to launch new surgical headlight models, limiting rapid market expansion

Surgical Headlights Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the surgical headlights market is segmented into LED type, Xenon bulb type, Halogen type, and others. The LED type segment dominated the market with the largest market revenue share of 46.9% in 2025, driven by its energy efficiency, long lifespan, superior illumination quality, and reduced shadow formation during surgeries. LED surgical headlights are increasingly preferred for minimally invasive procedures due to their bright, consistent, and adjustable beam intensity. Hospitals also value LED headlights for their lower maintenance requirements and reduced heat generation, improving surgeon comfort during long procedures. Furthermore, the ability to integrate LED headlights with smart OR systems and ergonomic wearable designs enhances workflow efficiency and surgical precision, reinforcing their dominance in the market.

The Xenon bulb type segment is anticipated to witness the fastest growth rate of 8.5% CAGR from 2026 to 2035, fueled by its superior color rendering index and brightness, which makes it suitable for specialty surgeries such as neurosurgery and cardiac procedures. Xenon headlights provide high-intensity illumination for deep cavities and complex operative fields, ensuring optimal visualization. Hospitals and surgical centers are increasingly adopting Xenon systems for advanced surgical suites to enhance diagnostic accuracy and reduce complications. In addition, advancements in cooling and battery-powered Xenon headlights are improving usability, portability, and surgeon comfort. The growing awareness of procedure-specific lighting requirements is also driving Xenon headlights’ adoption, particularly in emerging markets.

- By Application

On the basis of application, the surgical headlights market is segmented into neurosurgery, cardiac surgery, gynecological surgery, ENT surgery, and others. The Neurosurgery segment dominated the market in 2025, driven by the need for high-intensity, shadow-free illumination during intricate and delicate brain procedures. Neurosurgeons require precise lighting to differentiate tissues and perform microsurgical maneuvers, making reliable surgical headlights indispensable. LED and Xenon headlights are increasingly integrated into neurosurgical setups to ensure consistent visibility and reduce eye strain during prolonged surgeries. Hospitals investing in neurosurgery centers prioritize headlights that allow hands-free operation, adjustable focus, and ergonomic wearable designs. Moreover, the segment benefits from a high volume of neurosurgical procedures in North America and Europe, reinforcing its dominant position.

The Cardiac Surgery segment is expected to witness the fastest growth from 2026 to 2035, fueled by the increasing prevalence of cardiovascular diseases and the rising number of complex heart procedures globally. Cardiac surgeons require intense, focused illumination to visualize deep thoracic cavities accurately. Advanced surgical headlights with adjustable beam focus, wireless operation, and integration with imaging systems enhance surgical precision and patient safety. The growth of specialized cardiac centers, especially in Asia-Pacific and Latin America, is contributing to rising demand. In addition, the adoption of minimally invasive cardiac procedures increases the need for portable, battery-powered, and high-intensity headlights, driving segment growth.

- By End User

On the basis of end user, the surgical headlights market is segmented into hospitals, clinics, ambulatory surgery centers, diagnostic laboratories, and others. The Hospitals segment dominated the market with the largest revenue share in 2025, due to the high number of surgical procedures conducted, the availability of advanced surgical infrastructure, and higher budget allocations for modern OR equipment. Hospitals prefer integrated, high-performance surgical headlights that enhance operative visibility, reduce procedure time, and support a range of surgical specialties. Long-term cost efficiency, ergonomic design, and compatibility with smart OR systems further strengthen hospital adoption. The dominance is particularly evident in North America and Europe, where hospitals are rapidly upgrading operating rooms with LED and smart surgical lighting systems.

The Ambulatory Surgery Centers (ASCs) segment is expected to witness the fastest CAGR from 2026 to 2035, driven by the increasing trend of outpatient surgeries, minimally invasive procedures, and cost-conscious healthcare delivery models. ASCs seek compact, portable, and lightweight surgical headlights that offer high-intensity illumination without the need for complex installation or overhead power dependency. The growth of elective and day-care surgeries in emerging markets further fuels adoption. In addition, the rising focus on procedure-specific lighting solutions and ergonomic designs enhances efficiency and patient outcomes, making ASCs a rapidly expanding end-user segment for surgical headlights.

Surgical Headlights Market Regional Analysis

- North America dominated the surgical headlights market with the largest revenue share of 38.6% in 2025, characterized by advanced healthcare infrastructure, high adoption of cutting-edge surgical technologies, and a strong presence of key industry players

- Medical professionals in the region prioritize high-intensity, shadow-free illumination, energy-efficient LED systems, and ergonomic designs that improve comfort during prolonged surgeries, making surgical headlights an essential tool in modern operating rooms

- The widespread adoption is further supported by strong R&D investments, government initiatives to modernize hospital facilities, and collaborations between surgical headlight manufacturers and medical device companies, establishing the region as a leading market for both standard and smart surgical headlight solutions

U.S. Surgical Headlights Market Insight

The U.S. surgical headlights market captured the largest revenue share of 35% in 2025 within North America, fueled by the presence of advanced healthcare infrastructure and the increasing number of complex surgical procedures. Hospitals and surgical centers are prioritizing high-intensity, ergonomic LED and Xenon headlights to improve visibility, precision, and patient safety. The growing adoption of minimally invasive and specialty surgeries is driving demand for portable, battery-powered, and smart-integrated lighting systems. Furthermore, integration with imaging systems and operating room (OR) automation enhances workflow efficiency and reduces surgeon fatigue. The market is also supported by ongoing R&D investments and collaborations between surgical headlight manufacturers and medical device companies, accelerating adoption across hospitals nationwide.

Europe Surgical Headlights Market Insight

The Europe surgical headlights market is projected to expand at a substantial CAGR during the forecast period, driven by the increasing volume of surgical procedures and the region’s focus on modernizing hospital operating rooms. Growing awareness of advanced illumination technologies and the adoption of LED and Xenon headlights for neurosurgery, cardiac, and minimally invasive procedures are fostering market growth. European hospitals value energy-efficient, long-lasting, and ergonomic lighting systems that reduce shadows and improve procedural outcomes. The adoption is particularly strong across Germany, France, and Italy, where healthcare infrastructure upgrades and regulatory emphasis on patient safety and surgical precision are encouraging investments in modern surgical lighting solutions.

U.K. Surgical Headlights Market Insight

The U.K. surgical headlights market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising demand for advanced surgical lighting in hospitals and specialty centers. Concerns regarding surgical precision and patient safety are encouraging hospitals to adopt LED and Xenon surgical headlights, particularly for neurosurgery, cardiac, and ENT procedures. The U.K.’s healthcare system, coupled with strong investments in hospital modernization and digital OR integration, supports widespread adoption. Moreover, the increasing use of minimally invasive surgeries and the trend toward ergonomic, wearable headlights are contributing to the expansion of the market across both public and private healthcare facilities.

Germany Surgical Headlights Market Insight

The Germany surgical headlights market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong emphasis on healthcare innovation, quality, and sustainability. Hospitals are increasingly adopting advanced LED and Xenon headlights for enhanced illumination, energy efficiency, and ergonomic design. Germany’s well-developed hospital infrastructure and high surgical procedure volumes, particularly in neurosurgery and cardiac surgery, promote demand for high-performance surgical lighting. Integration with smart OR systems and imaging devices is also becoming more prevalent, while healthcare providers prioritize lighting solutions that improve precision, reduce procedure time, and enhance surgeon comfort during long operations.

Asia-Pacific Surgical Headlights Market Insight

The Asia-Pacific surgical headlights market is poised to grow at the fastest CAGR during the forecast period, driven by rising healthcare infrastructure investments, increasing number of surgical procedures, and growing awareness of advanced surgical lighting technologies. Countries such as China, India, and Japan are witnessing rapid expansion of modern hospitals and specialty surgical centers where portable, battery-powered, and smart LED or Xenon headlights are in high demand. Government initiatives to upgrade operating rooms and support minimally invasive surgeries are further driving adoption. In addition, the increasing focus on medical tourism in the region and rising healthcare expenditure are accelerating procurement of advanced surgical headlights across both public and private healthcare facilities.

Japan Surgical Headlights Market Insight

The Japan surgical headlights market is gaining momentum due to the country’s highly advanced healthcare system, growing number of specialty surgical procedures, and emphasis on precision and patient safety. Hospitals and clinics increasingly adopt LED and Xenon headlights integrated with smart OR systems and imaging devices to optimize illumination and improve surgical outcomes. Japan’s focus on minimally invasive procedures, coupled with an aging population requiring advanced healthcare, is driving demand for portable, ergonomic, and easy-to-use surgical headlights. In addition, manufacturers are developing lightweight, wearable systems suitable for long-duration surgeries, enhancing comfort and procedural efficiency for surgeons.

India Surgical Headlights Market Insight

The India surgical headlights market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising healthcare infrastructure, and increasing surgical procedure volumes. Hospitals and specialty surgical centers are adopting LED and Xenon headlights for enhanced illumination, energy efficiency, and improved surgical precision. The government’s push for modernizing operating rooms and developing smart hospitals is supporting the market growth. Moreover, rising awareness among surgeons about advanced lighting systems, coupled with increasing medical tourism and the availability of affordable surgical headlights from domestic and international manufacturers, is further propelling the market across India’s residential, commercial, and specialized healthcare facilities.

Surgical Headlights Market Share

The Surgical Headlights industry is primarily led by well-established companies, including:

- Integra LifeSciences Corporation (U.S.)

- Stryker (U.S.)

- KLS Martin Group (Germany)

- Heine Optotechnik GmbH & Co. KG (Germany)

- Optomic (Spain)

- Orascoptic (U.S.)

- BFW Inc. (U.S.)

- Sunoptic Technologies (U.S.)

- Enova Illumination (U.S.)

- Excelitas Technologies Corp. (U.S.)

- Admetec Ltd. (U.K.)

- ATMOS MedizinTechnik GmbH & Co. KG (Germany)

- Bryton Corporation (U.S.)

- Cuda Surgical (U.S.)

- Daray Ltd. (U.K.)

- North Southern Electronics Limited (U.K.)

- VOROTEK (U.S.)

- STILLE AB (Sweden)

- Toffeln (U.K.)

What are the Recent Developments in Global Surgical Headlights Market?

- In October 2024, Orascoptic announced new advancements in its surgical illumination portfolio, showcasing updated headlight technology and broader optical solutions aimed at improving illumination performance and clinician comfort in surgical and dental environments

- In October 2024, BFW Inc. introduced a battery‑operated surgical headlight with extended battery life and advanced LED illumination to improve mobility and operational efficiency in operating rooms across Europe and global markets

- In August 2024, Uniplex (UK) unveiled the HDC300 Surgical Headlight Camera System, a novel surgical illumination solution combining high‑intensity light with integrated camera functionality to support precision and documentation during procedures

- In September 2023, Orascoptic launched the Endeavour™ MD surgical headlight, designed to deliver extended run‑time and enhanced illumination tailored specifically for surgical applications, highlighting ongoing innovation in surgical lighting ergonomics and performance

- In March 2021, Surgical headlight technology advanced with broader ergonomic and LED adoption, reflecting industry recognition of high‑performance LED and xenon headlights as critical tools for precision surgery, spanning improved illumination options and accessory integrations such as magnifying loupes in clinical practice

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.