Global Surgical Imaging Arms Market

Market Size in USD Billion

CAGR :

%

USD

5.56 Billion

USD

7.75 Billion

2025

2033

USD

5.56 Billion

USD

7.75 Billion

2025

2033

| 2026 –2033 | |

| USD 5.56 Billion | |

| USD 7.75 Billion | |

|

|

|

|

Surgical Imaging Arms Market Size

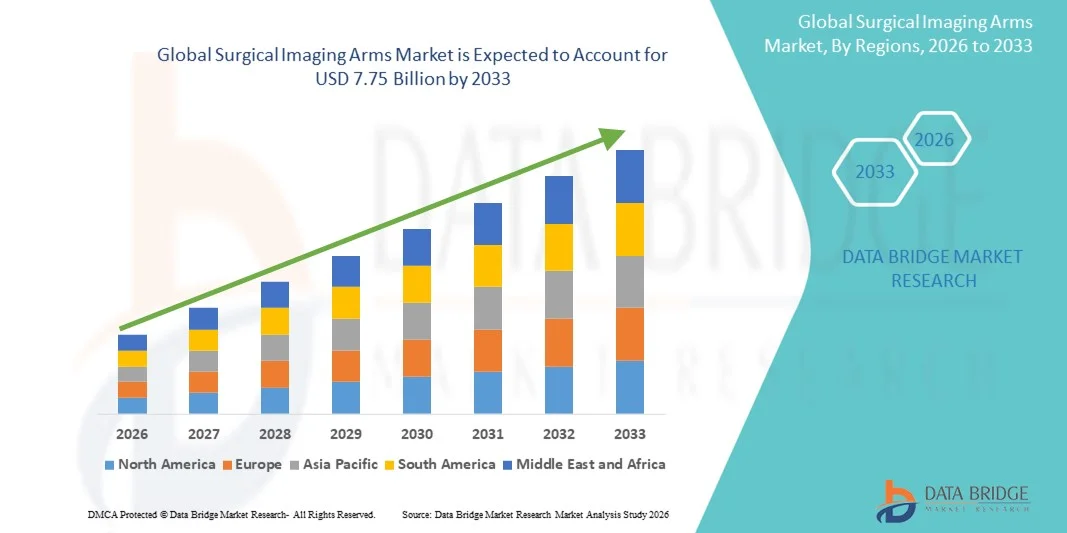

- The global surgical imaging arms market size was valued at USD 5.56 billion in 2025 and is expected to reach USD 7.75 billion by 2033, at a CAGR of 4.25% during the forecast period

- The market growth is largely driven by the increasing adoption of minimally invasive and image-guided surgical procedures, along with advancements in high-precision imaging technologies, which are enhancing surgical accuracy and patient outcomes

- Furthermore, rising demand from hospitals, specialty clinics, and ambulatory surgical centers for efficient, real-time imaging solutions is positioning surgical imaging arms as essential tools in modern operating rooms. These combined factors are accelerating the deployment of surgical imaging arms, thereby significantly propelling the market’s expansion

Surgical Imaging Arms Market Analysis

- Surgical imaging arms, providing precise positioning and maneuverability for imaging devices in operating rooms, are increasingly critical components of modern surgical procedures in both hospitals and specialty clinics due to their enhanced accuracy, real-time imaging capabilities, and seamless integration with advanced surgical technologies

- The rising demand for surgical imaging arms is primarily fueled by the growing adoption of minimally invasive surgeries, increasing preference for image-guided procedures, and the need for improved surgical precision and patient safety

- North America dominated the surgical imaging arms market with the largest revenue share of 40.5% in 2025, driven by the presence of advanced healthcare infrastructure, high healthcare expenditure, and a strong concentration of key industry players, with the U.S. witnessing significant adoption in orthopedic, cardiovascular, and neurosurgical procedures, supported by innovations from leading medical device manufacturers

- Asia-Pacific is expected to be the fastest-growing region in the surgical imaging arms market during the forecast period due to rising investments in healthcare infrastructure, increasing hospital expansions, and growing demand for minimally invasive surgeries

- Image Intensifier C-Arms segment dominated the surgical imaging arms market with a market share of 47.6% in 2025, driven by its widespread use in orthopaedic and trauma surgeries, cost-effectiveness, and compatibility with multiple imaging modalities

Report Scope and Surgical Imaging Arms Market Segmentation

|

Attributes |

Surgical Imaging Arms Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Surgical Imaging Arms Market Trends

Increasing Adoption of AI-Enabled Imaging and Real-Time Surgical Guidance

- A significant and accelerating trend in the global surgical imaging arms market is the integration of artificial intelligence (AI) with imaging systems, enabling enhanced image clarity, automated anatomical recognition, and real-time surgical guidance

- For instance, some Siemens Cios Spin systems utilize AI-driven reconstruction algorithms to provide clearer intraoperative images while minimizing radiation exposure

- AI integration in surgical imaging arms allows features such as predictive surgical path planning, automated positioning of imaging devices, and real-time feedback during procedures. For instance, Medtronic’s O-arm technology leverages AI to optimize imaging angles and provide instant 3D visualizations for orthopedic and spinal surgeries

- The seamless integration of surgical imaging arms with operating room management systems and other digital surgical tools facilitates centralized control over imaging, navigation, and robotic-assisted devices, enhancing surgical efficiency

- This trend towards more intelligent, automated, and interconnected imaging systems is fundamentally reshaping expectations for intraoperative precision. Consequently, companies such as Ziehm Imaging are developing AI-enabled imaging arms with features such as automatic device positioning and compatibility with surgical navigation software

- The demand for surgical imaging arms with advanced AI capabilities is growing rapidly across hospitals and specialty clinics, as medical professionals increasingly prioritize precision, efficiency, and reduced procedural risks

- Integration with telemedicine and remote surgical support systems is emerging, allowing expert guidance and intraoperative consultation from remote locations, expanding the reach of specialized surgical procedures

Surgical Imaging Arms Market Dynamics

Driver

Rising Demand Due to Minimally Invasive and Image-Guided Surgeries

- The growing prevalence of minimally invasive procedures, coupled with the need for high-precision imaging, is a significant driver for the adoption of surgical imaging arms

- For instance, in March 2025, Canon Medical Systems announced an upgrade in its mobile C-arm platform, focusing on image quality enhancement for orthopedic and cardiovascular procedures. Such innovations by key companies are expected to accelerate market growth during the forecast period

- As hospitals and surgical centers aim to improve patient outcomes and reduce operative times, surgical imaging arms provide enhanced imaging accuracy, 3D visualization, and real-time procedural guidance, offering a compelling alternative to conventional imaging setups

- Furthermore, the rising popularity of multi-modality imaging and integration with surgical navigation systems is making surgical imaging arms essential tools in modern operating rooms, enabling precise and efficient workflows

- The ability to perform complex surgeries with lower radiation exposure, improved ergonomics, and streamlined intraoperative imaging is a key factor propelling the adoption of surgical imaging arms across hospitals and ambulatory surgical centers

- Increasing investment in healthcare infrastructure, particularly in emerging markets, is driving the expansion of surgical facilities equipped with advanced imaging arms

- Growing collaboration between device manufacturers and healthcare providers to develop customized imaging solutions for specific surgical specialties is further boosting market adoption

Restraint/Challenge

High Cost and Regulatory Compliance Complexity

- The relatively high initial investment required for surgical imaging arms, combined with ongoing maintenance costs, poses a significant challenge to market penetration, particularly in developing regions or smaller healthcare facilities

- For instance, reports on the high procurement costs of Ziehm and Philips C-arm systems have made some hospitals hesitant to upgrade or expand imaging infrastructure

- Addressing these cost barriers through leasing models, flexible financing options, and bundled service packages is crucial for broader adoption. In addition, surgical imaging arms must comply with stringent regulatory standards for medical devices, including safety, radiation, and operational certifications

- For instance, failure to meet FDA, CE, or ISO requirements can delay product launches and adoption in key markets, adding to operational complexities for manufacturers

- Overcoming these challenges through cost-effective solutions, robust compliance strategies, and targeted hospital education will be vital for sustained growth in the surgical imaging arms market

- Limited skilled personnel to operate advanced imaging arms in some regions restricts optimal utilization and adoption, creating a barrier for hospitals without trained staff

- Rapid technological advancements may render existing systems obsolete quickly, causing hesitancy among healthcare providers to invest in high-cost equipment without clear long-term ROI

Surgical Imaging Arms Market Scope

The market is segmented on the basis of technology, application, end user, and modality.

- By Technology

On the basis of technology, the market is segmented into Image Intensifier C-Arms and Flat Panel Detector C-Arms. The Image Intensifier C-Arms segment dominated the market with the largest revenue share of 47.6% in 2025, owing to its long-standing use in orthopaedic and trauma surgeries, cost-effectiveness, and compatibility with multiple imaging modalities. Hospitals and surgical centers often prioritize Image Intensifier C-Arms for their proven reliability, ability to provide real-time 2D and 3D imaging, and lower maintenance requirements. Their robust design allows for versatile positioning during various procedures, making them suitable for a wide range of surgical applications. In addition, many emerging markets continue to rely on Image Intensifier C-Arms due to lower procurement costs compared to Flat Panel Detector systems. The segment also benefits from a wide availability of service and support networks, ensuring consistent performance across healthcare facilities.

The Flat Panel Detector C-Arms segment is expected to witness the fastest growth from 2026 to 2033, fueled by advancements in high-resolution imaging, digital flat-panel detectors, and integration with AI-assisted imaging technologies. These systems provide superior image quality, reduced radiation exposure, and enhanced intraoperative visualization, which are increasingly preferred in complex neurosurgeries, cardiovascular surgeries, and minimally invasive procedures. Hospitals adopting advanced surgical workflows are driving demand for Flat Panel Detector C-Arms, as these devices allow precise imaging and improved patient safety. The ability to integrate with 3D navigation systems and robotic-assisted surgeries further enhances their appeal. Growing awareness among surgeons about image-guided benefits is also accelerating adoption. In addition, government initiatives to upgrade healthcare infrastructure in emerging regions support the expansion of this segment.

- By Application

On the basis of application, the market is segmented into orthopaedic and trauma surgeries, neurosurgeries, cardiovascular surgeries, gastrointestinal surgeries, and other applications. The Orthopaedic and Trauma Surgeries segment dominated the market with the largest revenue share in 2025, due to the high frequency of trauma-related injuries and the need for precise imaging during fracture repair, joint replacement, and spinal surgeries. Hospitals prioritize surgical imaging arms in orthopaedic procedures to enhance procedural accuracy, minimize operative time, and reduce radiation exposure to both patients and staff. The segment also benefits from a wide range of imaging arm options compatible with different surgical settings, supporting both 2D and 3D imaging requirements. In addition, orthopaedic surgeries are often high-volume procedures, contributing to consistent demand. Advanced positioning and maneuverability features in imaging arms further strengthen adoption.

Neurosurgeries segment is expected to witness the fastest growth during the forecast period, driven by the increasing prevalence of neurological disorders, rising demand for minimally invasive procedures, and the critical need for high-resolution intraoperative imaging. Surgeons increasingly rely on advanced imaging arms for precise navigation in brain and spinal surgeries, improving patient outcomes and reducing complication risks. Integration with AI-based visualization and surgical navigation software enhances surgical precision. Technological advancements, such as real-time 3D imaging, further support complex neurosurgical interventions. Hospitals and specialty centers are expanding neurosurgery capabilities, boosting demand for imaging arms. The rising incidence of neurological disorders worldwide adds to the growth potential of this segment.

- By End User

On the basis of end user, the market is segmented into hospitals and ambulatory surgical centers, and academic research institutes. The Hospitals and Ambulatory Surgical Centers segment dominated the market with the largest revenue share in 2025, attributed to the high volume of surgical procedures performed in these settings and their need for real-time imaging solutions. Hospitals focus on efficiency, patient safety, and multi-specialty applicability, making surgical imaging arms a critical investment. The widespread adoption in orthopedic, cardiovascular, and trauma surgeries further reinforces the dominance of this segment. Moreover, ambulatory surgical centers increasingly prefer portable C-arm systems for flexibility and cost-effectiveness. Hospitals with advanced infrastructure are also integrating imaging arms with surgical navigation and robotic systems.

Academic Research Institutes segment is expected to witness the fastest growth during the forecast period due to rising investments in surgical research, training, and innovation. These institutes increasingly adopt advanced imaging arms to facilitate experimental procedures, simulation-based training, and clinical trials, supporting the development of next-generation surgical techniques and technologies. Research institutes focus on multi-modality imaging integration, providing valuable insights for improving surgical outcomes. Collaborations with device manufacturers help customize imaging solutions for specific research needs. Growing emphasis on precision surgery education and clinical experimentation drives segment growth. In addition, government funding for medical research supports expansion in this subsegment.

- By Modality

On the basis of modality, the market is segmented into MRI, X-ray, computed tomography, optical, nuclear imaging, and ultrasound. The X-ray segment dominated the market with the largest revenue share in 2025, driven by the extensive use of X-ray-based imaging arms in orthopaedic, trauma, and cardiovascular procedures. X-ray C-Arms offer real-time 2D and 3D imaging, affordability, and compatibility with multiple surgical applications, making them a preferred choice in hospitals worldwide. Their rapid image acquisition, ease of integration with operating room workflows, and robust performance in high-volume surgeries strengthen adoption. The availability of a wide range of models suitable for different surgical needs also supports market dominance. Hospitals prioritize X-ray imaging arms for their proven reliability and lower operational costs.

MRI segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing demand for high-resolution soft tissue imaging, minimally invasive neurosurgeries, and advanced diagnostic capabilities. MRI-compatible surgical imaging arms are gaining traction as hospitals and specialized centers focus on precision-guided procedures and integration with intraoperative navigation systems. Growing awareness of MRI benefits for neurosurgery and cardiovascular procedures is driving adoption. Technological improvements reducing scan time and enhancing image quality further boost demand. Increasing investment in advanced imaging infrastructure in emerging regions supports growth. Research institutions are also adopting MRI-based imaging arms for experimental and clinical applications.

Surgical Imaging Arms Market Regional Analysis

- North America dominated the surgical imaging arms market with the largest revenue share of 40.5% in 2025, driven by the presence of advanced healthcare infrastructure, high healthcare expenditure, and a strong concentration of key industry players

- Hospitals and surgical centers in the region prioritize surgical imaging arms for their ability to provide real-time imaging, enhance procedural accuracy, and reduce operative time and patient risk

- This widespread adoption is further supported by a technologically advanced medical workforce, availability of advanced imaging systems, and early adoption of AI-enabled and flat panel detector C-arms, establishing surgical imaging arms as essential tools in operating rooms across the U.S. and Canada

U.S. Surgical Imaging Arms Market Insight

The U.S. surgical imaging arms market captured the largest revenue share of 82% in 2025 within North America, fueled by the rapid adoption of advanced imaging technologies and the growing prevalence of minimally invasive and image-guided surgeries. Hospitals and ambulatory surgical centers are increasingly prioritizing AI-enabled and flat panel detector C-arms for precise intraoperative imaging and improved surgical outcomes. The strong healthcare infrastructure, availability of skilled surgeons, and high healthcare expenditure are further driving demand. Moreover, ongoing innovations by key medical device manufacturers and integration with surgical navigation systems significantly contribute to market expansion. The increasing number of orthopedic, cardiovascular, and neurosurgical procedures is also boosting adoption across the country.

Europe Surgical Imaging Arms Market Insight

The Europe surgical imaging arms market is projected to expand at a significant CAGR throughout the forecast period, primarily driven by rising demand for minimally invasive procedures and stringent regulatory standards promoting advanced imaging solutions. Growing urbanization, hospital expansions, and adoption of high-precision surgical technologies are fostering market growth. European healthcare providers increasingly prefer integrated imaging arms that enhance procedural accuracy, reduce operative times, and support multi-modality imaging. Countries such as Germany, France, and Italy are witnessing substantial adoption in orthopedic, cardiovascular, and neurosurgical applications. Investments in upgrading surgical infrastructure and research collaborations with device manufacturers are further fueling growth.

U.K. Surgical Imaging Arms Market Insight

The U.K. surgical imaging arms market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of image-guided surgeries and increasing investments in healthcare infrastructure. Concerns regarding patient safety, procedural accuracy, and reduced radiation exposure are encouraging hospitals and specialty centers to adopt advanced C-arm systems. The U.K.’s strong technological adoption in healthcare, combined with high-quality medical training and research capabilities, is expected to continue stimulating market growth. In addition, government initiatives to modernize operating rooms and the integration of surgical imaging arms with robotic and navigation systems further support the market.

Germany Surgical Imaging Arms Market Insight

The Germany surgical imaging arms market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of minimally invasive procedures and the adoption of technologically advanced imaging systems. Germany’s well-established healthcare infrastructure, emphasis on innovation, and stringent quality standards promote the adoption of surgical imaging arms in hospitals and specialty clinics. Integration with advanced operating room systems and multi-modality imaging devices is becoming increasingly prevalent. High demand in orthopedic, cardiovascular, and neurosurgical procedures, combined with government support for digital healthcare initiatives, is driving market growth. In addition, collaborations between hospitals and medical device manufacturers enhance localized solutions and adoption.

Asia-Pacific Surgical Imaging Arms Market Insight

The Asia-Pacific surgical imaging arms market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by increasing healthcare investments, rapid hospital expansions, and rising adoption of minimally invasive surgeries in countries such as China, Japan, and India. Government initiatives promoting digital healthcare and modern operating rooms are accelerating adoption. The region’s growing focus on advanced surgical procedures, coupled with rising medical tourism, is further propelling demand. Moreover, manufacturing hubs in APAC are facilitating cost-effective access to high-quality surgical imaging systems. The increasing prevalence of orthopedic, neurosurgical, and cardiovascular procedures is supporting rapid market growth across the region.

Japan Surgical Imaging Arms Market Insight

The Japan surgical imaging arms market is gaining momentum due to the country’s advanced healthcare infrastructure, high adoption of minimally invasive surgeries, and demand for precision imaging. Japanese hospitals prioritize AI-enabled and flat panel detector C-arms to enhance intraoperative visualization and procedural accuracy. The integration of surgical imaging arms with navigation systems, robotic surgery, and other digital tools is fueling market growth. In addition, the aging population is driving demand for procedures requiring enhanced imaging guidance. Government initiatives supporting healthcare technology upgrades and ongoing innovation by local and international manufacturers are further contributing to market expansion.

India Surgical Imaging Arms Market Insight

The India surgical imaging arms market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid hospital expansion, increasing surgical volumes, and high adoption of advanced imaging technologies. India is witnessing growing demand in orthopedic, cardiovascular, and neurosurgical procedures, driving the need for precise intraoperative imaging solutions. Government initiatives to upgrade hospital infrastructure, the rise of private healthcare facilities, and medical tourism are key factors propelling the market. The availability of cost-effective imaging systems and increasing awareness among surgeons further support adoption. In addition, collaborations between hospitals and device manufacturers are accelerating the deployment of surgical imaging arms across the country.

Surgical Imaging Arms Market Share

The Surgical Imaging Arms industry is primarily led by well-established companies, including:

- GE HealthCare (U.S.)

- Siemens Healthineers AG (Germany)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Ziehm Imaging GmbH (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Hologic, Inc. (U.S.)

- Shimadzu Corporation (Japan)

- Medtronic (Ireland)

- Allengers Medical Systems Limited (India)

- OrthoScan, Inc. (U.S.)

- Eurocolumbus S.r.l. (Italy)

- Genoray Co., Ltd. (South Korea)

- MicroPort Scientific Corporation (China)

- B. Braun SE (Germany)

- Zimmer Biomet (U.S.)

- NuVasive, Inc. (U.S.)

- CONMED Corporation (U.S.)

- Assing S.p.A. (Italy)

- AADCO Medical, Inc. (U.S.)

- BMI Biomedical International s.r.l. (Italy)

What are the Recent Developments in Global Surgical Imaging Arms Market?

- In October 2025, Royal Philips announced its 5,000th installation of the Zenition mobile C‑arm surgical imaging system at Kolín Regional Hospital in the Czech Republic, highlighting the platform’s global adoption across 170+ countries and continued demand for efficient intraoperative imaging

- In November 2024, GE HealthCare announced advanced imaging innovations for its OEC 3D mobile C‑arm to broaden clinical applications, including endoscopic bronchoscopy with features such as OEC 3D Lung Suite for enhanced airway visualization and an expanded OEC Open interface for data transfer, improving workflow integration with navigation and robotic systems

- In September 2023, Philips expanded its mobile C‑arm lineup with the Zenition 30, a flexible, workflow‑enhancing surgical imaging system featuring advanced flat‑detector imaging, personalized controls, and superior dose efficiency aimed at increasing surgeon autonomy

- In May 2023, Philips extended its Zenition platform with the Zenition 10 mobile C‑arm, designed to bring high‑quality, flat‑panel imaging to routine surgical care at a lower cost, thus expanding access for more healthcare settings

- In November 2021, FUJIFILM Healthcare Americas launched the Persona CS mobile fluoroscopy system, a compact mobile C‑arm imaging solution designed to provide enhanced live image guidance during a variety of surgical and diagnostic procedures, including orthopaedic, pain management, and emergency care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.