Global Surgical Imaging Market

Market Size in USD Billion

CAGR :

%

USD

2.29 Billion

USD

3.76 Billion

2024

2032

USD

2.29 Billion

USD

3.76 Billion

2024

2032

| 2025 –2032 | |

| USD 2.29 Billion | |

| USD 3.76 Billion | |

|

|

|

|

Surgical Imaging Market Size

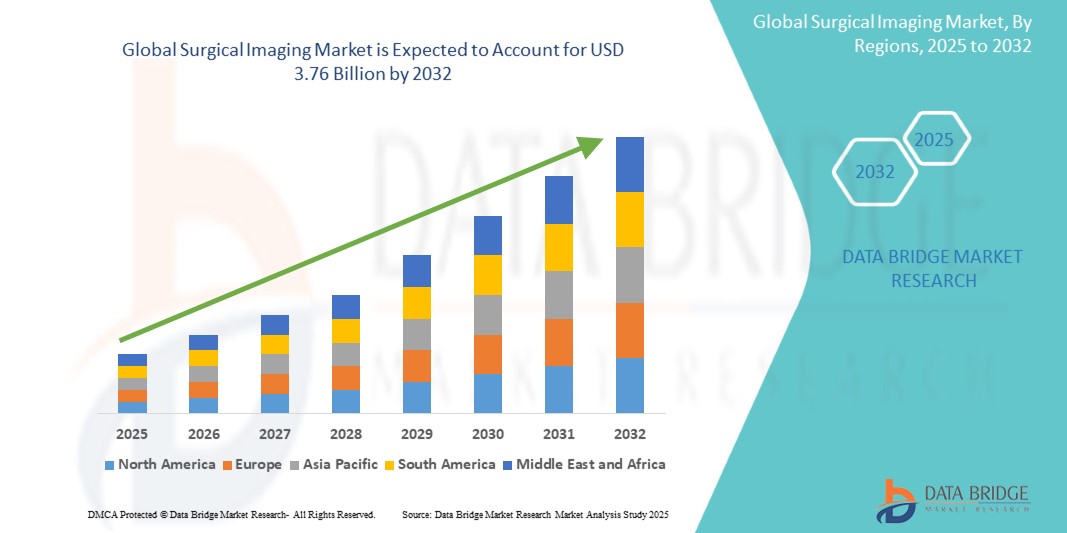

- The global surgical imaging market size was valued at USD 2.29 billion in 2024 and is expected to reach USD 3.76 billion by 2032, at a CAGR of 6.37% during the forecast period

- This growth is driven by factors such as the technological advancements, rising demand for minimally invasive surgeries (MIS), and ageing population

Surgical Imaging Market Analysis

- Surgical imaging systems are vital intraoperative tools used to visualize anatomical structures during surgical procedures. These systems enable real-time imaging, aiding surgeons in making precise decisions and improving patient outcomes. Technologies used include C-arms, endoscopic cameras, and navigation-based imaging systems

- The demand for surgical imaging systems is primarily driven by the rising number of minimally invasive surgeries (MIS), increasing adoption of advanced image-guided surgical procedures, and the growing burden of chronic diseases such as cancer, cardiovascular disorders, and orthopedic conditions. In addition, technological innovations—such as 3D imaging, hybrid operating rooms, and integration with artificial intelligence—are further propelling market growth

- North America is expected to dominate the surgical imaging market, holding share of 42.5%. This dominance is primarily due to the country's advanced healthcare infrastructure, high adoption rates of cutting-edge medical technologies, and significant investments in research and development

- Asia Pacific is expected to be the fastest growing region in surgical imaging market with a market share of 22.4%. This rapid expansion is driven by factors such as increasing demand for minimally invasive surgeries, advancements in imaging technologies, and significant investments in healthcare infrastructure across countries such as China, India, and Japan

- The image intensifier C-arms segment is expected to dominate the surgical imaging market with the largest share of 42.5% in 2024, driven by its real-time imaging capabilities that significantly enhance surgical visualization.

Report Scope and Surgical Imaging Market Segmentation

|

Attributes |

Surgical Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Surgical Imaging Market Trends

“Advancements in Surgical Imaging Technologies for Enhanced Operative Precision”

- One prominent trend shaping the surgical imaging market is the rapid evolution of real-time, high-resolution imaging technologies, including integration with artificial intelligence (AI) and robotics

- These innovations significantly improve intraoperative decision-making by providing surgeons with enhanced anatomical detail, greater tissue differentiation, and improved spatial orientation—crucial in complex procedures such as neurosurgery, orthopedic surgery, and cardiovascular interventions

- For instance, hybrid operating rooms now incorporate advanced imaging modalities such as intraoperative CT, MRI, and 3D fluoroscopy, allowing surgeons to visualize internal structures in real-time and adjust their approach dynamically during surgery, thus reducing the need for revisions or follow-up procedures

- These technological advancements are transforming modern surgery by boosting procedural accuracy, minimizing invasiveness, and enhancing patient safety, thereby fueling the demand for next-generation surgical imaging systems globally

Surgical Imaging Market Dynamics

Driver

“Rising Demand for Minimally Invasive Surgeries”

- The growing preference for minimally invasive surgeries (MIS) is significantly driving the demand for advanced surgical imaging systems, which are essential for enhancing precision during complex procedures

- As healthcare providers aim to reduce patient recovery times, minimize surgical risks, and improve overall outcomes, the adoption of imaging technologies such as intraoperative CT, MRI, fluoroscopy, and 3D imaging systems is increasing

- These imaging solutions enable surgeons to visualize internal structures with high accuracy, making them vital for procedures such as orthopedic surgeries, neurosurgeries, and cardiovascular interventions

For instance

- In September 2024, according to a report published by the European Society of Radiology, the use of intraoperative imaging in minimally invasive spine surgeries has significantly improved surgical precision and reduced postoperative complications, leading to shorter hospital stays and faster recovery times for patient

- As a result, the growing demand for MIS is propelling the need for advanced surgical imaging systems, which play a critical role in improving surgical accuracy and patient outcomes

Opportunity

“Technological Advancements in Real-Time Imaging and AI Integration”

- The integration of artificial intelligence (AI) and real-time imaging technologies is creating substantial growth opportunities in the surgical imaging market. AI-powered systems enhance intraoperative visualization, automate critical tasks, and improve decision-making by providing surgeons with actionable insights during procedures

- Advanced imaging systems equipped with AI algorithms can analyze real-time data, detect anomalies, and assist surgeons in identifying complications such as bleeding, tissue damage, or incomplete resections

- Furthermore, AI integration enables predictive analytics, allowing for improved surgical planning, risk assessment, and postoperative monitoring

For instance,

- In March 2025, according to an article published in the Journal of Medical Imaging and Health Informatics, AI-enabled surgical imaging platforms demonstrated improved tumor detection rates during oncological surgeries, leading to higher surgical precision and better patient outcomes. These systems also reduced operative times by providing instant image analysis, which supported faster clinical decision-making

- The adoption of AI-driven surgical imaging technologies is expected to enhance procedural accuracy, improve patient safety, and optimize healthcare workflows, thereby expanding market growth

Restraint/Challenge

“High Equipment Costs Limiting Market Penetration”

- The substantial costs associated with surgical imaging devices, such as intraoperative MRI, CT scanners, and hybrid operating room setups, pose a significant barrier to market penetration—particularly in developing regions

- These advanced imaging systems often require significant capital investment, installation, and maintenance expenses, which can be financially challenging for smaller hospitals and healthcare facilities with limited budgets

- As a result, many healthcare providers may continue using outdated imaging technologies, which could limit access to advanced surgical procedures and affect overall patient care quality

For instance,

- In November 2024, a report by the European Hospital and Healthcare Federation highlighted that the installation of hybrid operating rooms equipped with intraoperative imaging systems can cost upwards of several million euros, making it difficult for smaller healthcare facilities to invest in such technologies without external funding or government support

- This cost barrier can lead to disparities in the availability of advanced imaging solutions, hindering widespread adoption and slowing market growth—particularly in resource-limited settings

Surgical Imaging Market Scope

The market is segmented on the basis of technology, application, modality and end user.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Application |

|

|

By Modality |

|

|

By End User

|

|

In 2025, the image intensifier C-arms is projected to dominate the market with a largest share in technology segment

The image intensifier C-arms segment is expected to dominate the surgical imaging market with the largest share of 42.5% in 2024, driven by its real-time imaging capabilities that significantly enhance surgical visualization. As a critical tool in procedures across orthopedics, cardiology, and trauma surgery, the integration of advanced features such as flat-panel detectors and 3D imaging has propelled its widespread adoption. Continuous technological advancements and the growing demand for minimally invasive surgical techniques further support the segment’s market leadership.

The orthopedic and trauma surgeries is expected to account for the largest share during the forecast period in application market

In 2025, the orthopedic and trauma surgeries segment is expected to dominate the surgical imaging market with the largest market share of 25.7% due to the high demand for accurate, real-time imaging in complex procedures. As a leading application area, the increasing incidence of fractures, joint injuries, and degenerative bone conditions has significantly driven adoption. Advancements in surgical imaging technologies and the critical need for precision during orthopedic interventions further contribute to this segment’s market dominance.

Surgical Imaging Market Regional Analysis

“North America Holds the Largest Share in the Surgical Imaging Market”

- North America dominates the surgical imaging market, driven by its advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and the strong presence of key market players

- North America holds the largest share 42.5% in the surgical imaging market, with the U.S. accounting for approximately 32.8% of the market in 2024

- U.S. holds a significant share of 35% this is because of the rising demand for high-precision surgical procedures, and the increasing prevalence of diseases

- Well-established reimbursement policies and growing investments in research & development by leading medical device companies further support the market’s growth

“Asia-Pacific is Projected to Register the Highest CAGR in the Surgical Imaging Market”

- Asia Pacific is expected to be the fastest-growing region in surgical imaging market with a market share of 22.4%. This rapid expansion is driven by factors such as increasing demand for minimally invasive surgeries, advancements in imaging technologies, and significant investments in healthcare infrastructure across countries such as China, India, and Japan

- India is projected to be the fastest-growing country with a projected CAGR of 6.2% in the surgical imaging market, fueled by expanding healthcare infrastructure, growing awareness about advanced surgical techniques, and a significant rise in surgical volumes

- Japan, known for its advanced medical technology, continues to be a critical market, with a growing number of surgical procedures and increasing demand for premium surgical imaging equipment to enhance precision in surgeries

- China is also emerging as a key market, with significant investments in healthcare infrastructure and a rising number of surgical procedures, contributing to the robust growth of the surgical imaging market in the region

Surgical Imaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Siemens (Germany)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- General Electric Company (U.S.)

- TOSHIBA CORPORATION (Japan)

- Olympus Corporation (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Hologic, Inc. (U.S.)

- Medtronic (Ireland)

- CONMED Corporation (U.S.)

- NDS Surgical Imaging, a Novanta Company (Florida)

- Carestream Health (U.S.)

- Ziehm Imaging GmbH (Germany)

- Eurocolumbus S.p.A (Italy)

- OrthoScan Inc. (U.S.)

- BPL Medical Technologies (India)

- Basler AG (Germany)

- Surgical Imaging Equipment, Inc. (U.S.)

- Barco (Belgium)

- Shimadzu Corporation (Japan)

- Agilent Technologies, Inc. (U.S.)

- Cook (U.S.)

Latest Developments in Global Surgical Imaging Market

- In March 2025, Siemens Healthineers announced the launch of its new Artis One C-arm system in Europe, offering advanced imaging capabilities for orthopedic and trauma surgeries. The system integrates high-definition imaging with real-time 3D imaging technology, enhancing surgical precision and enabling surgeons to perform complex procedures with greater accuracy. This system also incorporates intuitive touchscreen controls and enhanced workflows for improved surgical efficiency and patient outcomes

- In December 2024, General Electric (GE Healthcare) introduced its latest OEC 9900 Elite C-arm, designed for minimally invasive surgeries. The new system features advanced imaging technologies, including real-time motion tracking and automated image enhancement tools, which allow for higher precision during surgery. GE’s OEC 9900 Elite is optimized for use in various surgical specialties, including orthopedics, neurosurgery, and cardiology

- In November 2024, Canon Medical Systems Corporation launched the Aquilion ONE Prism Edition CT scanner for advanced surgical imaging. The scanner provides high-resolution 3D imaging with reduced radiation exposure, making it particularly useful for guiding minimally invasive surgeries. The new model’s high-speed scanning and enhanced imaging capabilities support complex surgical procedures, including cardiovascular surgeries and trauma cases

- In October 2024, Philips Healthcare announced the expansion of its Azurion 7 interventional imaging platform with advanced 3D imaging and artificial intelligence (AI) integration. The updated system features enhanced clarity and visualization, helping surgeons in real-time decision-making during minimally invasive surgeries, including orthopedic and neuro surgeries. This addition also includes AI-powered automated tracking and image optimization, which further improves surgical outcomes

- In September 2024, Ziehm Imaging GmbH introduced its next-generation Ziehm Vision RFD 3D C-arm, designed to deliver real-time 3D imaging during complex surgeries. The system features an intuitive touchscreen interface and enhanced imaging features, such as bone subtraction and improved soft tissue imaging. It offers orthopedic surgeons a more accurate way to visualize bone fractures and joint injuries, leading to improved surgical planning and outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.