Global Surgical Medical And Hospital Instruments Market

Market Size in USD Billion

CAGR :

%

USD

48.20 Billion

USD

85.32 Billion

2024

2032

USD

48.20 Billion

USD

85.32 Billion

2024

2032

| 2025 –2032 | |

| USD 48.20 Billion | |

| USD 85.32 Billion | |

|

|

|

|

Surgical, Medical, and Hospital Instruments Market Size

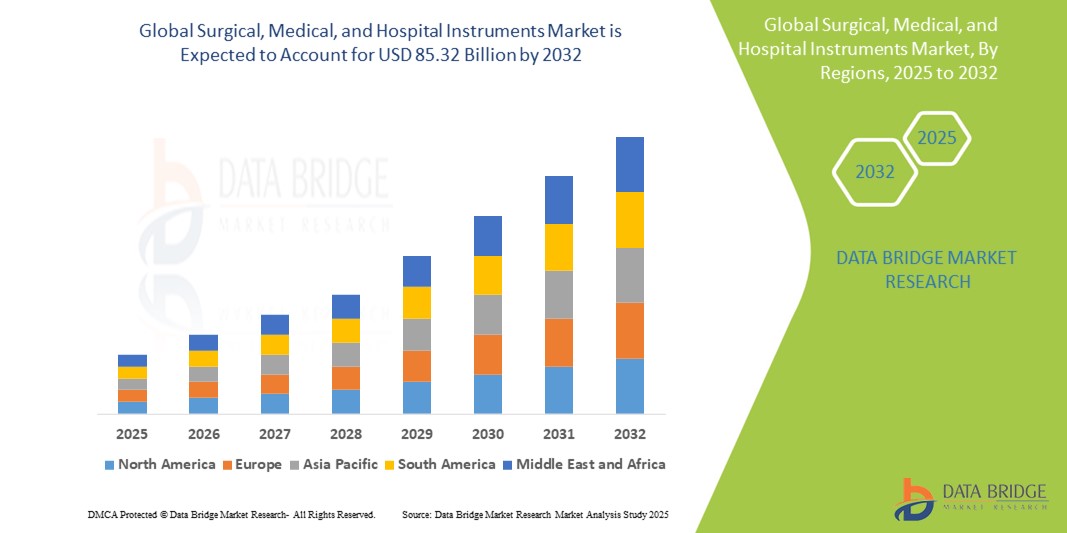

- The global surgical, medical, and hospital instruments market size was valued at USD 48.20 billion in 2024 and is expected to reach USD 85.32 billion by 2032, at a CAGR of 6.80% during the forecast period

- This growth is driven by factors such as increasing prevalence of chronic disease, aging population and technological advancements

Surgical, Medical, and Hospital Instruments Market Analysis

- Surgical, medical, and hospital instruments are essential tools used across a wide range of healthcare settings, from surgeries and diagnostics to patient care. These instruments are critical in ensuring the success of various procedures, including orthopedic surgeries, cardiovascular treatments, neurosurgeries, and routine medical exams. They are integral for a diverse array of treatments, ranging from minor outpatient procedures to complex surgeries that require high precision and specialized tools

- The demand for surgical, medical, and hospital instruments is significantly driven by several factors, including the increasing global prevalence of chronic diseases such as cardiovascular disorders, diabetes, and cancer, which require frequent surgeries. In addition, the growing elderly population, which often requires medical interventions, coupled with advancements in surgical techniques and minimally invasive surgeries, is contributing to market growth. The rise in healthcare infrastructure development across both developed and emerging economies further propels demand for these instruments

- North America is expected to dominate the surgical, medical, and hospital instruments market due to its advanced healthcare infrastructure, high healthcare expenditure, and strong presence of key medical device manufacturers. The increasing adoption of cutting-edge technologies, coupled with the region's well-established healthcare systems and a large number of surgical procedures, drives the demand for high-quality medical instruments

- Asia-Pacific is expected to be the fastest-growing region in the surgical, medical, and hospital instruments market during the forecast period. This growth is attributed to the rising awareness about healthcare and medical technology, along with substantial investments in healthcare infrastructure in countries such as China, India, and Japan. In addition, the growing focus on improving medical standards and access to healthcare across the region is fueling the demand for medical instruments

- Sutures & staplers segment is expected to dominate the market with a market share of 56.22% due to high adoption rate due to their essential role in wound closure procedures. Increasing number of surgical procedures globally, especially in wound closure applications

Report Scope and Surgical, Medical, and Hospital Instruments Market Segmentation

|

Attributes |

Surgical, Medical, and Hospital Instruments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Surgical, Medical, and Hospital Instruments Market Trends

“Advancements in Surgical Instruments & Integration of AI in Medical Devices”

- One prominent trend in the evolution of surgical instruments is the increasing integration of Artificial Intelligence (AI) and robotic technologies. These innovations are enhancing the precision and efficiency of surgeries by enabling real-time data analysis, personalized surgical planning, and improved control during operations

- AI-powered tools are revolutionizing the way surgical procedures are conducted by offering surgeons enhanced capabilities such as predictive analytics for patient outcomes and precision-guided surgery

- For instance, AI can assist in identifying optimal surgical pathways, assisting surgeons during complex surgeries, and minimizing human error. In addition, robotic-assisted surgeries are providing surgeons with enhanced dexterity, precision, and control during operations, particularly in orthopedic and neurosurgeries

- These advancements are transforming the surgical landscape, improving patient outcomes, reducing recovery times, and driving demand for next-generation surgical instruments that integrate AI, robotics, and smart technologies. As a result, the market for these advanced medical tools is expanding rapidly, opening up new opportunities for innovation and development in surgical practices

Surgical, Medical, and Hospital Instruments Market Dynamics

Driver

“Rising Demand Due to Increasing Surgical Procedures and Chronic Diseases”

- The rising global prevalence of chronic diseases such as cardiovascular diseases, cancer, diabetes, and orthopedic disorders is significantly driving the demand for surgical, medical, and hospital instruments

- As the incidence of these conditions increases, the need for surgeries, diagnostics, and continuous medical treatment grows, leading to a heightened demand for advanced medical instruments across healthcare settings

- The growing aging population, who are more susceptible to chronic conditions requiring surgical interventions, further boosts the market demand for specialized tools, from surgical scalpels to robot-assisted surgical systems

For instance,

- According to a 2023 report by the World Health Organization (WHO), chronic diseases are expected to account for nearly 70% of global deaths by 2030. This highlights the increasing necessity for effective surgical interventions, directly impacting the demand for surgical instruments

- As more people seek surgical treatment, the requirement for precise and reliable surgical instruments to ensure better patient outcomes becomes even more critical. This is propelling the demand for a variety of high-quality, advanced surgical tools in hospitals and clinics worldwide

Opportunity

“Integration of AI and Robotics in Surgical Instruments for Precision and Efficiency”

- The integration of AI and robotic systems in surgical instruments presents a significant market opportunity. AI algorithms can enhance real-time decision-making, offer predictive analytics, and improve surgical precision during complex procedures

- Robotic-assisted surgeries, such as those using da Vinci Surgical Systems or MAKO robotic systems, are enhancing the capability of surgeons to perform delicate procedures with higher precision, smaller incisions, and faster recovery times

For instance,

- In January 2025, according to a report published by Mordor Intelligence, AI-powered surgical tools can assist in predictive surgery planning, identify potential complications during surgeries, and improve patient-specific treatment strategies. AI algorithms are already making significant strides in orthopedic surgery, where they help create customized implants and assist in minimally invasive procedures

- The ability to analyze large datasets and guide surgical operations with the help of robotic systems will continue to evolve, improving patient outcomes, reducing the risk of human error, and ensuring quicker recovery. This technological progression offers a significant opportunity for market expansion, particularly in hospitals seeking to modernize their surgical capabilities

Restraint/Challenge

“High Initial Costs and Maintenance Expenses”

- One of the key challenges in the surgical, medical, and hospital instruments market is the high cost of advanced surgical tools and devices, particularly those with AI integration or robotic assistance. These instruments, such as robotic surgical systems and state-of-the-art diagnostic tools, can cost hundreds of thousands of dollars, limiting access for many healthcare providers, especially in developing regions or small-scale healthcare facilities

- The substantial initial investment and ongoing maintenance costs can deter smaller clinics and hospitals from adopting the latest technologies, leading to reliance on outdated equipment

For instance,

- In August 2022, St. Margaret’s Health in Illinois closed permanently due to financial strain, citing unaffordable costs for purchasing and maintaining surgical and medical equipment—highlighting how high initial investments and upkeep expenses can hinder healthcare facilities and restrict market growth

- The financial barrier to accessing advanced surgical tools can result in unequal healthcare access, particularly in emerging economies, limiting the potential for widespread adoption and growth in the market

Surgical, Medical, and Hospital Instruments Market Scope

The market is segmented on the basis of product, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the sutures & staplers is projected to dominate the market with a largest share in product segment

The sutures & staplers segment is expected to dominate the surgical, medical, and hospital instruments market with the largest share of 56.22% in 2025 due to high adoption rate due to their essential role in wound closure procedures. Increasing number of surgical procedures globally, especially in wound closure applications.

The obstetrics & gynecology is expected to account for the largest share during the forecast period in application market

In 2025, the obstetrics & gynecology segment is expected to dominate the market with the largest market share of 23% driven by rising global childbirth rates, increasing gynecological surgeries, greater awareness of women's health, and the growing adoption of advanced surgical tools and minimally invasive technologies.

Surgical, Medical, and Hospital Instruments Market Regional Analysis

“North America Holds the Largest Share in the Surgical, Medical, and Hospital Instruments Market”

- North America dominates the surgical, medical, and hospital instruments market, driven by advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and a strong presence of key market players such as Medtronic, Johnson & Johnson, and Stryker

- U.S. holds a significant portion of the global market, accounting for approximately 33% of the total market share, while North America as a whole contributes to around 41% of the global revenue

- The region’s leadership is fueled by increased demand for high-precision ophthalmic procedures, rising prevalence of eye disorders such as cataracts, glaucoma, and macular degeneration, and continuous advancements in surgical techniques that require sophisticated tools and instruments

- The availability of well-established reimbursement policies and strong government support for medical innovation, along with increased R&D investments by top-tier companies, continues to strengthen the market position of North America

- In addition, the growing number of ophthalmic surgeries, including cataract and refractive procedures, combined with a high rate of adoption of minimally invasive techniques, is contributing significantly to the region's market expansion

“Asia-Pacific is Projected to Register the Highest CAGR in the Surgical, Medical, and Hospital Instruments Market”

- Asia-Pacific is expected to witness the highest growth rate in the surgical, medical, and hospital instruments market over the forecast period, driven by rapid development of healthcare infrastructure, increased government health spending, and a rising volume of surgical procedures

- Countries such as China, India, and Japan are emerging as key growth markets due to their large aging populations, who are increasingly affected by vision-related disorders such as diabetic retinopathy, macular degeneration, and cataracts

- Japan, with its cutting-edge medical technologies and a growing number of specialized ophthalmic surgeons, remains a pivotal market for high-end ophthalmic microscopes and other precision surgical instruments. The country’s emphasis on quality and innovation drives the adoption of premium surgical systems to enhance precision and outcomes

- China and India, with their vast populations and a surge in government and private investments in modern surgical facilities, are experiencing rapid growth in the installation of advanced ophthalmic and surgical equipment. This is further supported by the expanding footprint of global medical device manufacturers and increasing accessibility to modern surgical care, contributing to robust market growth across the region

Surgical, Medical, and Hospital Instruments Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (Ireland)

- Johnson & Johnson Services, Inc. (U.S.)

- Stryker (U.S.)

- B. Braun SE (Germany)

- BD (U.S.)

- Zimmer Biomet (U.S.)

- Smith+Nephew (U.K.)

- Olympus Corporation (Japan)

- Karl Storz SE & Co. KG (Germany)

- CONMED Corporation (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Boston Scientific Corporation (U.S.)

- Cook (U.S.)

- Terumo Corporation (Japan)

- Richard Wolf GmbH (Germany)

- W. L. Gore & Associates, Inc. (U.S.)

Latest Developments in Global Surgical, Medical, and Hospital Instruments Market

- In January 2025, JUNE MEDICAL announced a strategic collaboration with Aspen Surgical Products, Inc. to distribute the Galaxy II retractor system across the U.S. market. This partnership will use Aspen Surgical’s sales network to increase JUNE MEDICAL’S Galaxy II Retractor System, which is a versatile surgical device used in multiple specialties such as orthopedics, gynecology, and others

- In September 2023, PainTEQ, the U.S.-based firm, introduced a new Surgery-Ready Instrument set and provided a cost-effective and safe option for interventional pain physicians

- In June 2023, SURE Retractors Inc., a medical device firm, launched single-use, sterile retractors for trauma, orthopedic, and spinal surgery

- In April 2023, Orthofix Medical (Orthofix), a spine and orthopedics company, introduced the Fathom pedicle-based retractor system and the Lattus lateral access system for spine procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.