Global Suture Passer Market

Market Size in USD Billion

CAGR :

%

USD

1.60 Billion

USD

3.03 Billion

2025

2033

USD

1.60 Billion

USD

3.03 Billion

2025

2033

| 2026 –2033 | |

| USD 1.60 Billion | |

| USD 3.03 Billion | |

|

|

|

|

Suture Passer Market Size

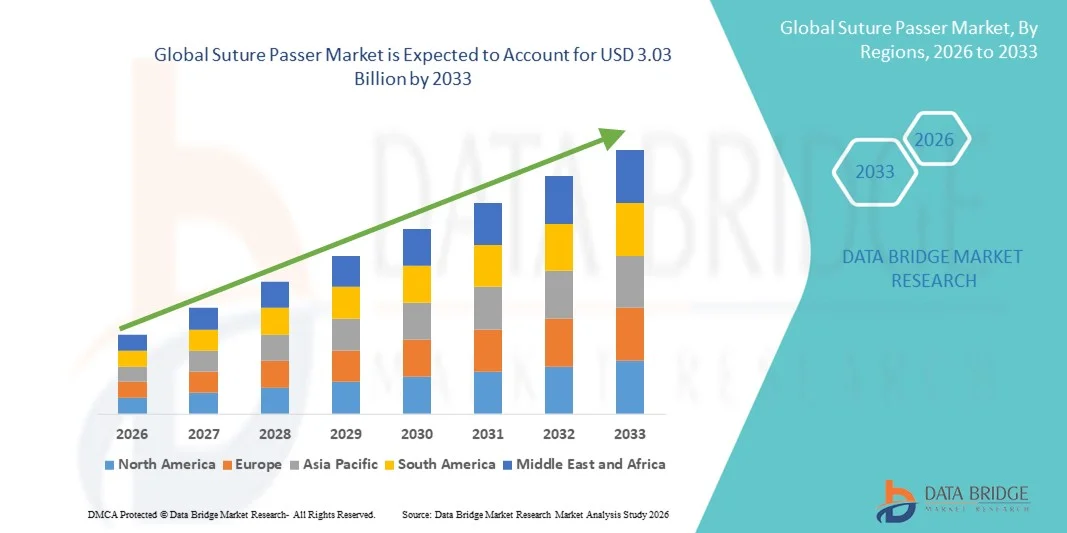

- The global suture passer market size was valued at USD 1.60 billion in 2025 and is expected to reach USD 3.03 billion by 2033, at a CAGR of 8.30% during the forecast period

- The market growth is largely driven by the rising prevalence of orthopedic and minimally invasive surgeries, coupled with advancements in surgical instruments and techniques that enhance precision and reduce operative time

- Furthermore, increasing demand for efficient, safe, and user-friendly suturing devices in hospitals and ambulatory surgical centers is positioning suture passers as essential tools in modern surgical procedures. These factors are collectively propelling the adoption of suture passer solutions, thereby significantly contributing to the market’s expansion

Suture Passer Market Analysis

- Suture passers, designed for minimally invasive tissue suturing and needle-passing in surgical procedures, are becoming essential instruments in modern orthopedic, arthroscopic, and general surgeries due to their precision, ease of use, and efficiency in reducing operative time

- The increasing adoption of minimally invasive surgical techniques, rising prevalence of orthopedic and soft tissue injuries, and growing demand for faster recovery and reduced surgical complications are the primary factors driving the demand for suture passers

- North America dominated the suture passer market with the largest revenue share of 37.9% in 2025, supported by advanced healthcare infrastructure, high surgical procedure volumes, and strong presence of leading medical device manufacturers, with the U.S. witnessing significant uptake of arthroscopic and orthopedic surgeries, fueled by innovations in ergonomic and disposable suture passer designs

- Asia-Pacific is expected to be the fastest-growing region in the suture passer market during the forecast period, driven by increasing surgical procedure volumes, rising healthcare expenditure, and growing adoption of minimally invasive surgeries in emerging economies such as China and India

- Reusable-Disposable Needle-Based Suture Passers dominated the market with a share of 42.8% in 2025, owing to their versatility, cost-effectiveness, and ability to be used across multiple surgical procedures, making them preferred instruments among surgeons

Report Scope and Suture Passer Market Segmentation

|

Attributes |

Suture Passer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Suture Passer Market Trends

Advancements in Minimally Invasive and Robotic-Assisted Surgeries

- A significant and accelerating trend in the global suture passer market is the integration of devices with robotic-assisted and minimally invasive surgical systems, enhancing precision, reducing operative time, and improving patient recovery outcomes

- For instance, the ProxiPass Suture System can be used with robotic-assisted arthroscopy platforms, allowing surgeons to pass sutures in confined anatomical spaces with improved accuracy and control

- Innovations in ergonomics, single-hand operation, and multifunctional suture passer designs are enabling surgeons to perform complex procedures more efficiently, reducing procedural complications and operative fatigue

- The integration of these devices with advanced imaging and visualization systems allows real-time monitoring of tissue placement and needle trajectory, improving procedural outcomes and safety

- Growing demand for disposable suture passers is enabling hospitals to reduce cross-contamination risks and maintain high hygiene standards in surgical environments

- Increasing collaborations between suture passer manufacturers and healthcare institutions for customized solutions are driving market adoption in specialized surgical procedures

- This trend toward more precise, versatile, and technology-integrated suture passers is fundamentally reshaping surgical protocols and expectations in orthopedic, arthroscopic, and soft tissue surgeries

- The demand for suture passers compatible with robotic and minimally invasive systems is growing rapidly across both hospitals and ambulatory surgical centers, as surgeons increasingly prioritize procedural efficiency and patient safety

Suture Passer Market Dynamics

Driver

Increasing Adoption of Minimally Invasive and Arthroscopic Surgeries

- The rising preference for minimally invasive and arthroscopic procedures due to lower recovery time, reduced complications, and better surgical outcomes is a major driver for suture passer adoption

- For instance, in March 2025, ArthroMed introduced its ergonomic needle-based suture passer designed for high-precision arthroscopic procedures, enhancing surgeon efficiency and procedural success rates

- Hospitals and specialty surgical centers are increasingly investing in advanced suturing instruments to meet the growing demand for orthopedic, neurological, and soft tissue surgeries

- Surgeons favor suture passers that improve procedural speed and accuracy, allowing for broader adoption in high-volume surgical environments and improving overall operational efficiency

- Rising awareness of patient safety, infection control, and procedural standardization is further encouraging healthcare facilities to equip operating rooms with modern, reliable suture passer systems

- Expansion of outpatient surgical centers and ambulatory facilities is driving demand for compact, user-friendly suture passers suitable for multiple procedure types

- Increasing emphasis on minimally invasive cosmetic and reconstructive surgeries is boosting demand for specialized suture passers designed for delicate tissue handling

Restraint/Challenge

High Cost and Limited Awareness in Emerging Markets

- The relatively high cost of advanced suture passers, especially robotic-assisted or specialized ergonomic models, limits their adoption in cost-sensitive healthcare settings, particularly in developing regions

- For instance, high-priced systems from companies such as ProxiPass can deter smaller hospitals or clinics from investing, slowing market penetration despite clinical benefits

- Limited awareness among surgeons and healthcare administrators about the benefits of modern suture passer technologies, compared to traditional suturing techniques, poses a challenge for market growth

- Training requirements and procedural learning curves for newer suture passer models can also inhibit adoption, particularly in facilities with less experienced surgical teams

- Challenges related to regulatory approvals and compliance for innovative suture passer devices can delay product launches in multiple regions

- Supply chain constraints and limited availability of specialized surgical instruments in emerging markets can restrict timely adoption and scale-up of advanced suture passer solutions

- Overcoming these challenges through cost optimization, educational initiatives, and awareness campaigns will be crucial for expanding suture passer adoption globally

Suture Passer Market Scope

The market is segmented on the basis of type, procedure, and end user.

- By Type

On the basis of type, the suture passer market is segmented into reusable-disposable needle-based suture passers, reusable-penetrating suture passers, and disposable-retrieving suture passers. The Reusable-Disposable Needle-Based Suture Passers segment dominated the market with the largest market revenue share of 42.8% in 2025, driven by their versatility and ability to be used across multiple surgical procedures. Surgeons often prefer this type for its combination of reusability and single-use features, which helps in balancing cost-effectiveness and infection control. The segment also benefits from compatibility with both minimally invasive and conventional surgical techniques, enhancing procedural efficiency. Hospitals and surgical centers favor these passers for high-volume operations due to their durability and ergonomic designs. In addition, the availability of needle-based passers in various sizes and configurations for different tissue types contributes to their market dominance. Continuous innovations in ergonomic handles, precision tips, and multifunctional designs further strengthen their position.

The Disposable-Retrieving Suture Passers segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption in ambulatory surgical centers and outpatient facilities. Disposable-retrieving passers reduce the risk of cross-contamination and eliminate sterilization requirements, making them ideal for high-turnover surgical environments. Their ease of use and time-saving features are particularly valued in orthopedic, cosmetic, and arthroscopic procedures. Surgeons also appreciate the reliability of single-use instruments in maintaining consistent performance across procedures. Growing awareness of infection control protocols in emerging markets is boosting demand for this segment. Moreover, increasing collaborations between manufacturers and healthcare providers for procedure-specific disposable designs are accelerating market uptake.

- By Procedure

On the basis of procedure, the suture passer market is segmented into ophthalmic surgery, cardiovascular surgery, gynecological surgeries, cosmetic and plastic surgeries, orthopedic surgery, neurological surgery, and others. The Orthopedic Surgery segment dominated the market with the largest revenue share of 39.8% in 2025, attributed to the high prevalence of musculoskeletal injuries and growing arthroscopic and minimally invasive procedures. Suture passers are critical in repairing ligaments, tendons, and joint tissues with precision and minimal tissue trauma. Hospitals and specialty orthopedic centers prioritize advanced suture passer systems to improve procedural outcomes and reduce operation time. The increasing number of sports-related injuries and aging populations further fuel segment growth. Innovations in ergonomic and needle-based passers tailored for orthopedic applications enhance surgical accuracy and efficiency. The integration of passers with arthroscopic tools and visualization systems is strengthening their adoption in operating rooms.

The Cosmetic and Plastic Surgeries segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for minimally invasive aesthetic procedures. Disposable and precise suture passers are preferred for delicate tissue handling in reconstructive and cosmetic surgeries. Surgeons increasingly adopt advanced suture passers to reduce scarring, improve aesthetic outcomes, and shorten recovery periods. The rising number of cosmetic procedures in emerging economies and growing awareness of aesthetic enhancements are major growth factors. In addition, hospitals and specialty clinics are investing in procedure-specific passers to cater to the growing cosmetic surgery segment. Technological advancements in micro-needle and single-use designs support higher adoption in this market.

- By End User

On the basis of end user, the suture passer market is segmented into hospitals, ambulatory centers, specialty clinics, and others. The Hospitals segment dominated the market with the largest revenue share of 47.5% in 2025, owing to high surgical procedure volumes, advanced infrastructure, and strong preference for technologically advanced suturing instruments. Hospitals prefer versatile and durable suture passers that can be used across multiple departments, including orthopedic, cardiovascular, and neurosurgery units. The growing focus on patient safety, procedural efficiency, and infection control further drives adoption. In addition, hospitals often collaborate with manufacturers for custom solutions to suit specific surgical workflows. Leading hospitals in North America and Europe invest heavily in state-of-the-art suture passer systems to maintain operational efficiency and improve outcomes.

The Ambulatory Centers segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing number of outpatient surgical procedures and minimally invasive operations. Ambulatory centers prefer compact, easy-to-use, and cost-effective suture passers that allow high procedure turnover with reduced sterilization needs. Rising demand for outpatient cosmetic, orthopedic, and ophthalmic procedures is further accelerating adoption. Manufacturers are introducing procedure-specific disposable passers to cater to these facilities. The growing trend of outpatient surgeries in emerging markets, along with increasing healthcare investments, supports segment growth.

Suture Passer Market Regional Analysis

- North America dominated the suture passer market with the largest revenue share of 37.9% in 2025, supported by advanced healthcare infrastructure, high surgical procedure volumes, and strong presence of leading medical device manufacturers

- Hospitals and specialty surgical centers in the region prioritize precision, efficiency, and infection control, leading to strong adoption of modern suture passer devices across orthopedic, arthroscopic, and soft tissue procedures

- The widespread adoption is further supported by high healthcare expenditure, technologically advanced surgical equipment, and a strong presence of leading medical device manufacturers, establishing suture passers as essential instruments in operating rooms throughout the region

U.S. Suture Passer Market Insight

The U.S. suture passer market captured the largest revenue share of 82% in 2025 within North America, driven by the high volume of orthopedic, arthroscopic, and minimally invasive surgeries. Hospitals and specialty surgical centers are increasingly investing in advanced suture passers to improve procedural efficiency and patient outcomes. The growing adoption of robotic-assisted and image-guided surgical systems further fuels demand. Surgeons are favoring ergonomic and precision-designed passers to reduce operative time and improve accuracy. In addition, robust healthcare infrastructure, high expenditure on surgical equipment, and strong presence of leading medical device manufacturers support market expansion. The emphasis on infection control and disposable suture passers in high-volume surgical settings further strengthens market growth.

Europe Suture Passer Market Insight

The Europe suture passer market is projected to expand at a substantial CAGR during the forecast period, primarily driven by the increasing adoption of minimally invasive and arthroscopic procedures. Rising awareness of procedural efficiency, patient safety, and infection control in hospitals and specialty centers fosters demand for modern suture passer devices. Growth in orthopedic and cosmetic surgeries, supported by technological advancements in surgical instruments, further fuels the market. European healthcare facilities prefer precision-engineered, reusable, and disposable suture passers for multiple procedure types. The region’s well-developed healthcare infrastructure and focus on surgical innovation are encouraging investments in advanced surgical tools. In addition, collaborations between manufacturers and hospitals for procedure-specific solutions are accelerating adoption.

U.K. Suture Passer Market Insight

The U.K. suture passer market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising number of minimally invasive and cosmetic surgical procedures. Hospitals and specialty clinics increasingly adopt modern suture passers to enhance surgical precision, reduce operative time, and improve patient recovery. Concerns regarding post-surgical complications and infection control are motivating healthcare providers to invest in advanced suturing instruments. The UK’s strong healthcare infrastructure, coupled with high awareness of innovative surgical technologies, supports market growth. Furthermore, growing outpatient procedures and ambulatory surgical centers create additional demand for disposable and procedure-specific suture passers. Technological advancements and ergonomic designs further contribute to market expansion.

Germany Suture Passer Market Insight

The Germany suture passer market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of minimally invasive surgeries and technological innovation in surgical instruments. Hospitals and surgical centers in Germany prioritize patient safety, procedural efficiency, and advanced instrument performance, leading to strong demand for precision-engineered suture passers. The region’s emphasis on innovation, high-quality healthcare infrastructure, and procedural standardization promotes adoption. Reusable-penetrating and needle-based suture passers are increasingly incorporated into orthopedic, arthroscopic, and soft tissue surgeries. Integration with imaging and robotic-assisted systems further strengthens usage. Moreover, Germany’s focus on sustainable, reusable surgical instruments aligns with growing demand for eco-conscious medical devices.

Asia-Pacific Suture Passer Market Insight

The Asia-Pacific suture passer market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by increasing surgical procedure volumes, rising healthcare expenditure, and growing adoption of minimally invasive surgeries. Countries such as China, Japan, and India are witnessing rapid growth in orthopedic, cosmetic, and ophthalmic procedures, boosting demand for modern suture passers. Expansion of hospitals, ambulatory centers, and specialty clinics in urban areas is further supporting market adoption. In addition, local manufacturing of surgical instruments enhances affordability and accessibility. Government initiatives promoting healthcare infrastructure development and surgical innovation are also contributing to market growth. The availability of disposable, procedure-specific suture passers is accelerating adoption across the region.

Japan Suture Passer Market Insight

The Japan suture passer market is gaining momentum due to the country’s high adoption of advanced surgical technologies and growing preference for minimally invasive procedures. Hospitals and specialty clinics are increasingly integrating suture passers with robotic-assisted and imaging systems to enhance procedural precision. The aging population and increasing demand for faster recovery are driving adoption in orthopedic and soft tissue surgeries. Technologically advanced disposable and reusable suture passers are favored to improve infection control and procedural efficiency. Furthermore, Japan’s strong healthcare infrastructure and emphasis on innovative medical devices support sustained growth. Surgeons’ preference for ergonomic designs and high-precision instruments further contributes to market expansion.

India Suture Passer Market Insight

The India suture passer market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s expanding healthcare infrastructure, rising surgical procedure volumes, and growing awareness of minimally invasive techniques. Hospitals, specialty clinics, and ambulatory centers are increasingly adopting advanced suture passers to improve patient outcomes and procedural efficiency. The push towards modernizing surgical facilities and the availability of cost-effective disposable suture passers are driving adoption. Rapid urbanization, increasing medical tourism, and government initiatives to enhance healthcare delivery further propel market growth. In addition, strong presence of domestic and international manufacturers is supporting the availability of advanced suture passer devices across the country.

Suture Passer Market Share

The Suture Passer industry is primarily led by well-established companies, including:

- Arthrex, Inc., (U.S.)

- Smith+Nephew (U.K.)

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- CONMED Corporation (U.S.)

- Richard Wolf GmbH (Germany)

- Karl Storz SE & Co. KG (Germany)

- B. Braun SE (Germany)

- Medtronic plc (Ireland)

- Olympus Corporation (Japan)

- Boston Scientific Corporation (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Teleflex Incorporated (U.S.)

- Cook (U.S.)

- HNM Medical (India)

- Parcus Medical, LLC (U.S.)

- Wright Medical Group N.V. (U.S.)

- Ossio (Switzerland)

- GPC Medical Ltd. (India)

- Tulpar Medical Solutions (Turkey)

What are the Recent Developments in Global Suture Passer Market?

- In May 2025, Applied Medical Technology, Inc. (AMT) launched two new suture‑passing instruments RHAPSO™ and GEMINI® engineered for precision and efficiency in minimally invasive procedures. RHAPSO™ is a 17‑gauge fine‑needle suture passer that offers smooth suture capture even in confined surgical spaces, aided by spring-assisted, atraumatic grasper arms. GEMINI®, meanwhile, uses self‑aligning magnet technology to simplify intracorporeal suture retrieval, minimizing tissue trauma and improving consistency

- In January 2025, Auxein Medical unveiled a range of new orthopedic solutions at Arab Health among them a “Reusable Suture Passer” targeted at arthroscopic. The solution offers multiple curve‑needle options to accommodate different surgical approaches, enhancing flexibility for surgeons

- In November 2024, Auxein showcased a broader set of advanced orthopedic and arthroscopy instruments at MEDICA 2024 (Düsseldorf, Germany), including a Reusable Suture Passer and several complementary instruments (signaling robust market activity and innovation in surgical suturing tools. The strong global interest from distributors, clinicians, and industry experts at the event highlighted the growing recognition of such devices’ importance in modern orthopedic and arthroscopic surgery

- In November 2024, Auxein Medical showcased a new range of orthopedic and arthroscopy‑oriented instruments at MEDICA 2024, including a new reusable suture passer and other complementary tools. This launch signals continued innovation and diversification in suture passer technologies, catering to orthopedic surgeons’ demand for versatile, minimally‑invasive, and procedure‑specific suturing solutions

- In March 2022, Suture Ease introduced two new offering systems at the SAGES 2022 conference the EzStitch Hybrid System and the Securus System. The EzStitch Hybrid pairs a reusable suture passer with a disposable guide to facilitate port‑site closure after laparoscopic surgery, improving safety by protecting the abdominal cavity from needle exposure and simplifying suture retrieval

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.