Global Swellable Packers Market

Market Size in USD Million

CAGR :

%

USD

750.75 Million

USD

1,399.92 Million

2024

2032

USD

750.75 Million

USD

1,399.92 Million

2024

2032

| 2025 –2032 | |

| USD 750.75 Million | |

| USD 1,399.92 Million | |

|

|

|

|

What is the Global Swellable Packers Market Size and Growth Rate?

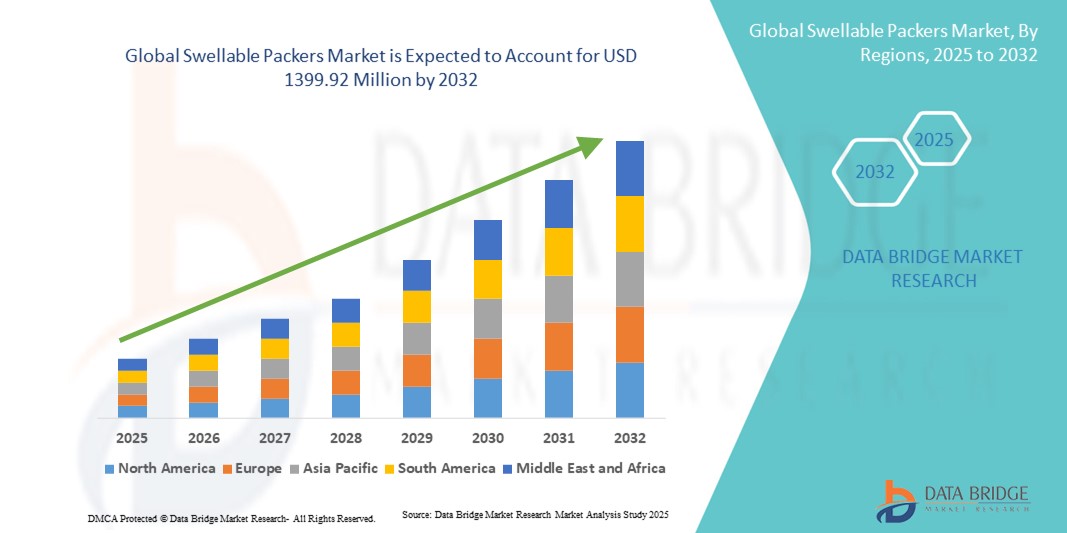

- The global swellable packers market size was valued at USD 750.75 million in 2024 and is expected to reach USD 1399.92 million by 2032, at a CAGR of 8.10% during the forecast period

- The essential factors contributing to the growth of the global swellable Packers market in the forecast period of include the increasing demand for swellable packers with versatalie in applicability and ongoing technological advancements in swellable manufacturing. These factors collectively contribute to the growing adoption of tape unwinder in residential, commercial, and automotive sectors worldwide

What are the Major Takeaways of Swellable Packers Market?

- The global swellable packers market is driven by the expanding exploration and production activities in the oil and gas industry. With rising global demand for oil and gas, cost-effective and efficient extraction methods are essential, making swellable packers crucial for well completions and production operations, both onshore and offshore

- Advancements in swellable technology and materials contribute to their growing adoption. Particularly in offshore operations, swellable packers offer cost-effectiveness and reliability, surpassing traditional mechanical packers and cementing solutions. Consequently, operators increasingly rely on swellable packers to enhance zonal isolation and ensure compliance with safety regulations

- North America dominated the swellable packers market with the largest revenue share of 38.47% in 2024, driven by rising oil & gas exploration and the growing adoption of advanced well-completion technologies

- Asia-Pacific (APAC) market is set to grow at the fastest CAGR of 7.9% during 2025–2032, fueled by rapid urbanization, increasing drilling activities, and the rising need for efficient well isolation solutions

- The Mechanical Swellable Packers segment dominated the market with the largest revenue share of 61.5% in 2024, owing to their proven reliability, easy installation, and wide use in zonal isolation applications in oil and gas wells

Report Scope and Swellable Packers Market Segmentation

|

Attributes |

Swellable Packers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Swellable Packers Market?

Rising Adoption of Advanced Zonal Isolation and Well Integrity Solutions

- A significant trend in the global swellable packers market is the increasing adoption of advanced zonal isolation technologies that ensure well integrity in challenging drilling and completion environments. Operators are turning to swellable packers due to their ability to self-activate without mechanical intervention, reducing operational complexity

- The oil and gas industry is witnessing a shift toward cost-effective completion tools that minimize risks in high-pressure and high-temperature (HPHT) wells, where traditional cementing methods may fail. Swellable packers provide durable sealing performance in such conditions

- Technological innovations are enhancing the swelling elastomer materials, enabling higher resistance to hydrocarbons and brines, which increases operational reliability and broadens application in unconventional reservoir

- For instance, Schlumberger has expanded its swellable packer portfolio to improve isolation efficiency in unconventional shale wells, helping operators lower intervention costs

- This trend is shaping the industry by making swellable packers a preferred choice in complex well operations, driving broader adoption in both onshore and offshore projects

What are the Key Drivers of Swellable Packers Market?

- The rising global demand for oil and gas exploration and production (E&P), especially in unconventional resources such as shale, is a primary driver of swellable packer adoption

- Growing focus on reducing operational costs and ensuring effective zonal isolation in multi-stage completions is boosting the deployment of swellable packers

- Increasing offshore drilling activities and the need for tools that perform reliably in deepwater and HPHT conditions further drive demand

- For instance, in September 2024, Halliburton introduced advanced completion solutions featuring swellable elastomers to improve efficiency in offshore wells, supporting the trend of enhanced well integrity

- In addition, the push toward minimizing cementing challenges and reducing non-productive time (NPT) is making swellable packers a critical element in modern completion strategies

Which Factor is Challenging the Growth of the Swellable Packers Market?

- One of the major challenges is the limited reusability and retrievability of swellable packers. Once deployed and activated, they cannot be easily removed or repositioned, which raises concerns in wells requiring future interventions

- Variability in swelling response due to formation fluids such as crude oil, gas, or brine can impact the performance reliability, especially in unpredictable reservoir conditions

- The relatively high cost of advanced elastomer materials compared to conventional packer solutions can restrict adoption in cost-sensitive markets

- For instance, smaller operators in the Middle East and Asia-Pacific often face budget constraints, leading them to favor mechanical packers over advanced swellable options

- Overcoming these challenges through material innovation, standardized testing for performance predictability, and cost optimization will be essential for sustained growth in the market

How is the Swellable Packers Market Segmented?

The market is segmented on the basis of type, swellable material, application, and end-use.

- By Type

On the basis of type, the swellable packers market is segmented into Mechanical Swellable Packers and Chemical Swellable Packers. The Mechanical Swellable Packers segment dominated the market with the largest revenue share of 61.5% in 2024, owing to their proven reliability, easy installation, and wide use in zonal isolation applications in oil and gas wells. Their ability to expand without external activation fluids and adapt to varying wellbore conditions has made them highly attractive for both onshore and offshore drilling operations.

The Chemical Swellable Packers segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising adoption in complex well environments where chemical-based expansion offers more controlled swelling and enhanced sealing efficiency. Increasing investments in unconventional oil & gas recovery and enhanced reservoir management practices are fueling demand for chemical swellable packers.

- By Swellable Material

On the basis of swellable material, the market is segmented into Thermoplastic Elastomers (TPEs), Thermoset Elastomers, and Others. The Thermoset Elastomers segment accounted for the largest market revenue share of 54.8% in 2024, attributed to their superior swelling capacity, durability under high temperature and pressure conditions, and widespread application in challenging deepwater wells. Thermoset elastomers provide long-term sealing performance and are considered the industry standard for swellable packers.

The Thermoplastic Elastomers (TPEs) segment is projected to record the fastest CAGR from 2025 to 2032. Their adaptability, ease of processing, and cost-effectiveness make them an attractive option for operators focusing on cost optimization without compromising performance. Growing use of TPE-based packers in shallow reservoirs and water management projects further boosts this segment’s growth trajectory.

- By Application

On the basis of application, the Swellable Packers market is segmented into Onshore and Offshore. The Onshore segment dominated the market with the largest share of 68.3% in 2024, mainly due to the high number of onshore exploration and production activities globally, especially across North America, the Middle East, and Asia-Pacific. Onshore wells benefit from swellable packers as a cost-effective alternative to traditional zonal isolation techniques, enhancing reservoir productivity.

The Offshore segment is anticipated to expand at the fastest CAGR during 2025–2032. Increasing investments in offshore oilfield projects, particularly in deepwater and ultra-deepwater reservoirs, coupled with the demand for advanced completion solutions, are driving this growth. Offshore projects require robust sealing technologies that can withstand harsh subsea conditions, making swellable packers a preferred choice for long-term well integrity and production efficiency.

- By End-Use

On the basis of end-use, the market is segmented into the Oil & Gas Industry and Water Management. The Oil & Gas Industry dominated the market with the largest share of 82.7% in 2024, as swellable packers are extensively deployed in well completion, zonal isolation, and production optimization activities. Their cost-effectiveness and reliability compared to conventional mechanical packers have made them a standard choice for E&P companies worldwide.

The Water Management segment is forecast to witness the fastest CAGR from 2025 to 2032, driven by growing emphasis on sustainable water handling, groundwater management, and leak prevention in municipal and industrial water infrastructure. The ability of swellable packers to provide efficient sealing in water wells and prevent contamination makes them increasingly valuable in the context of rising demand for clean water resources.

Which Region Holds the Largest Share of the Swellable Packers Market?

- North America dominated the swellable packers market with the largest revenue share of 38.47% in 2024, driven by rising oil & gas exploration and the growing adoption of advanced well-completion technologies

- The region benefits from strong E&P (exploration and production) investments, shale gas development, and the increasing use of unconventional drilling techniques that require efficient zonal isolation

- High technological readiness, the presence of leading oilfield service providers, and ongoing innovations in downhole sealing solutions further strengthen North America’s position as the key revenue generator

U.S. Swellable Packers Market Insight

The U.S. accounted for 63.4% of North America’s share in 2024, driven by its extensive shale reserves and high drilling activity. Demand for swellable packers is supported by their cost efficiency, reliability in harsh environments, and minimal maintenance requirements. The strong presence of service providers such as Halliburton and Schlumberger accelerates adoption, making the U.S. the most lucrative market in the region.

Europe Swellable Packers Market Insight

The Europe market is projected to grow steadily, supported by stringent energy regulations and the region’s focus on improving well integrity. Rising oil & gas recovery projects in the North Sea, coupled with the transition toward digitalized well monitoring, are spurring demand. The adaptability of swellable packers to high-pressure, high-temperature (HPHT) wells enhances their adoption across onshore and offshore fields.

U.K. Swellable Packers Market Insight

The U.K. is witnessing notable growth due to offshore drilling projects in the North Sea and a strong emphasis on enhancing production efficiency. Operators are increasingly deploying swellable packers to reduce intervention costs and improve zonal isolation in mature fields, which is sustaining demand across upstream activities.

Germany Swellable Packers Market Insight

Germany is expected to grow at a healthy pace, driven by technological innovation and rising investments in sustainable energy solutions. German oilfield suppliers emphasize advanced, eco-conscious well completion tools, boosting the adoption of swellable packers in both domestic and international projects.

Which Region is the Fastest Growing in the Swellable Packers Market?

Asia-Pacific (APAC) market is set to grow at the fastest CAGR of 7.9% during 2025–2032, fueled by rapid urbanization, increasing drilling activities, and the rising need for efficient well isolation solutions. Government-driven energy security initiatives, particularly in China and India, alongside the region’s role as a manufacturing hub for oilfield tools, are significantly enhancing affordability and accessibility.

Japan Swellable Packers Market Insight

Japan’s adoption is driven by its technological sophistication and the growing reliance on secure, automated well completion systems. With a strong focus on offshore exploration and high safety standards, Japan’s demand for swellable packers is rising steadily, particularly in deepwater projects.

China Swellable Packers Market Insight

China dominated the APAC region in 2024, propelled by its large-scale oilfield operations, shale gas projects, and expanding energy infrastructure. Domestic manufacturers are introducing cost-effective packers, while government-backed smart energy initiatives accelerate adoption. China’s strong production capacity ensures it remains a key growth engine within the global market.

Which are the Top Companies in Swellable Packers Market?

The swellable packers industry is primarily led by well-established companies, including:

- Halliburton Company (U.S.)

- Weatherford International plc (U.S.)

- Weir Group PLC (U.K.)

- Packers Plus Energy Services Inc. (U.A.E.)

- Schlumberger Limited (SLB) (France)

- TAM International Inc. (U.S.)

- Nine Energy Services (U.S.)

- Tendeka (Saudi Arabia)

- Swell X (U.S.)

- Reactive Downhole Tools Middle East Manufacturing LLC (U.A.E.)

What are the Recent Developments in Global Swellable Packers Market?

- In December 2023, RUMA, a swellable manufacturing company, successfully completed the installation of its swellable packer system, Aardyn. The assembly is engineered to ensure a dependable seal within the annular space between casing and formation, strengthening wellbore integrity. This installation highlights RUMA’s commitment to delivering precision-engineered completion solutions

- In November 2023, Halliburton Company and Oil States Industries, Inc. formed a strategic partnership to deliver advanced deepwater managed pressure drilling (MPD) solutions by integrating their award-winning technologies. This collaboration demonstrates both companies’ focus on innovation and expanding their offshore service capabilities

- In June 2022, Nine Energy Services successfully installed production casing for a monitor well in New Mexico, utilizing its Swell Tech 150 additive. The additive, made from naturally occurring minerals with surfactants, enhances cement flexibility, diffusion, and slurry mixability. This innovation reinforces Nine Energy’s role in advancing cementing solutions for large operators

- In February 2022, TAQA KSA acquired ENDEKA, a U.K.-based engineering and manufacturing company specializing in advanced completions and production technologies for the oil and gas sector. This acquisition expanded TAQA’s capabilities and strengthened its market position in completions services

- In April 2020, TAM International entered into an agreement with WellFirst to supply products and provide installation services in Alberta, Canada. The partnership enabled TAM to enhance tool availability across Alberta, while WellFirst broadened its product offerings for clients. This agreement marked a significant step in strengthening both companies’ regional presence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.