Global Swimming Sports Apparel Accessories Market

Market Size in USD Billion

CAGR :

%

USD

2.20 Billion

USD

3.31 Billion

2025

2033

USD

2.20 Billion

USD

3.31 Billion

2025

2033

| 2026 –2033 | |

| USD 2.20 Billion | |

| USD 3.31 Billion | |

|

|

|

|

Swimming Sports Apparel Accessories Market Size

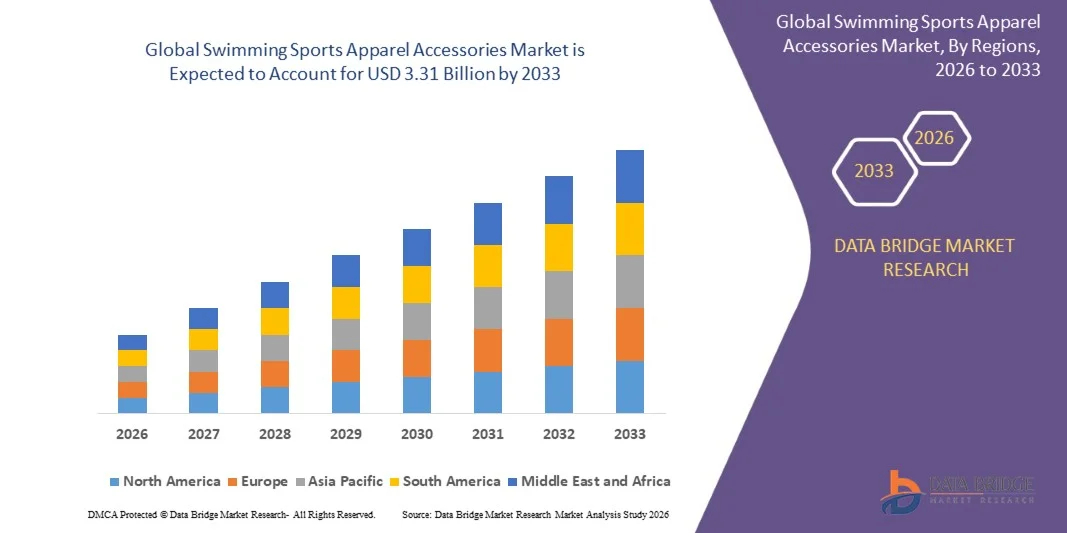

- The global swimming sports apparel accessories market size was valued at USD 2.20 billion in 2025 and is expected to reach USD 3.31 billion by 2033, at a CAGR of 5.20% during the forecast period

- The market growth is largely fueled by the rising participation in swimming as both a competitive sport and a recreational activity, along with increasing health and fitness awareness among consumers. The expansion of swimming clubs, school programs, and professional competitions is driving demand for high-quality swimwear, goggles, caps, and other accessories, thereby boosting overall market growth

- Furthermore, rising consumer preference for performance-enhancing, durable, and technologically advanced swimming apparel and accessories is establishing premium and specialized products as the modern choice for swimmers. For instance, brands such as Speedo and Arena are introducing innovative fabrics, smart goggles, and ergonomic designs, which are accelerating the adoption of advanced swimming products and significantly propelling market expansion

Swimming Sports Apparel Accessories Market Analysis

- Swimming sports apparel accessories, including swimwear, goggles, caps, fins, and training aids, are increasingly considered essential for both professional athletes and recreational swimmers due to their role in enhancing performance, comfort, and safety in the water. The integration of advanced materials, ergonomic designs, and smart technology is further strengthening product appeal and market relevance

- The escalating demand for these accessories is primarily fueled by growing fitness and wellness trends, the increasing popularity of swimming competitions, and the focus on athlete performance improvement. Consumers are prioritizing products that combine durability, style, and functionality, driving brands to innovate and expand their product portfolios to meet evolving market needs

- Europe dominated swimming sports apparel accessories market with a share of 36.6% in 2025, due to increasing participation in competitive swimming, rising awareness of health and fitness, and a well-established retail and sports infrastructure

- Asia-Pacific is expected to be the fastest growing region in the swimming sports apparel accessories market during the forecast period due to rising urbanization, growing disposable incomes, and increased interest in fitness and sports among young populations in countries such as China, Japan, and India

- Goggles & eyewear segment dominated the market with a market share of 38% in 2025, due to rising awareness of eye protection and the need for enhanced visibility during swimming. Swimmers prioritize high-quality goggles for comfort, anti-fog properties, and UV protection, making them an essential accessory for both competitive and recreational use. Goggles & eyewear are also widely integrated into professional swimwear kits, further boosting demand. Advanced designs and customizable fit options contribute to their sustained popularity across age groups. The market also witnesses strong demand due to the growth of swimming academies and professional clubs that emphasize safety and performance

Report Scope and Swimming Sports Apparel Accessories Market Segmentation

|

Attributes |

Swimming Sports Apparel Accessories Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Swimming Sports Apparel Accessories Market Trends

“Adoption of Performance-Enhancing and Tech-Driven Swimwear”

- The swimming sports apparel accessories market is witnessing a growing adoption of performance-enhancing products designed to improve swimmers' speed, comfort, and overall efficiency Advanced fabrics and hydrodynamic designs are becoming increasingly popular among athletes and recreational swimmers

- For instance, Speedo has launched its LZR Racer Elite swimsuit, which incorporates cutting-edge compression technology and water-repellent coatings to reduce drag and enhance swimmers’ performance in competitions This product exemplifies the market trend toward tech-driven swimwear that caters to high-performance needs

- Innovations such as UV protection fabrics and antibacterial materials are gaining traction as consumers seek added health and comfort benefits during prolonged water exposure These features address hygiene and skin protection concerns while maintaining athletic functionality

- Integration of smart wearable technology within swimming accessories, including sensors and trackers embedded in swim caps and goggles, is enhancing training precision and user experience These advancements are fostering a more data-driven approach to swimming performance improvement

- Sustainability is emerging as a vital trend, with manufacturers increasingly adopting eco-friendly materials and production methods to reduce environmental impact This trend aligns with the broader industry movement toward responsible consumerism and sustainable sportswear manufacturing

- The cumulative drive for innovation, comfort, sustainability, and technological integration is reshaping consumer expectations and pushing brands to develop advanced, multifunctional swimming apparel and accessories

Swimming Sports Apparel Accessories Market Dynamics

Driver

“Increasing Participation in Competitive and Recreational Swimming”

- The rising global interest in swimming as both a competitive sport and a recreational activity is a primary driver for the growing demand for swimming sports apparel accessories This surge reflects greater health awareness and the desire for active lifestyles among diverse age groups

- For instance, Arena, a leading swimwear brand, has partnered with major swimming events and training centers globally to offer specialized performance gear that caters to professional and amateur swimmers These strategic collaborations augment market penetration and consumer engagement

- Government and private sector investments in swimming facilities and programs encourage broader participation, boosting demand for appropriate swimwear and accessories The growth in swimming clubs and competitions across regions is fueling product adoption

- Increased awareness regarding water safety and the importance of appropriate swimming gear for young swimmers is further stimulating market growth Parents are investing in quality swim accessories that enhance safety and comfort for children learning to swim

- The convenience, comfort, and performance offered by advanced swimwear and accessories, coupled with the sport’s increasing popularity, are anticipated to sustain demand growth across global markets

Restraint/Challenge

“High Production Costs and Raw Material Fluctuations”

- The swimming sports apparel accessories market faces challenges due to the high production costs associated with advanced materials and specialized manufacturing processes Premium fabrics such as polyurethane and other hydrophobic textiles contribute to elevated prices, affecting affordability

- For instance, fluctuations in the prices of synthetic fibers such as polyester and nylon, crucial for swimwear, impact overall production costs, causing uncertainty for manufacturers such as TYR and Speedo These raw material price volatilities complicate supply chain management and pricing strategies

- Limited availability of sustainable materials that meet performance standards can lead to increased costs and manufacturing complexities The balance between sustainability goals and cost-effectiveness remains a significant hurdle for many producers

- In addition, stringent quality and performance requirements in competitive swimwear necessitate rigorous testing and certification, adding to production expenses This can restrict entry for smaller players and affect the pricing competitiveness in the market

- Managing production costs while maintaining advanced technological and sustainability standards constitutes a key challenge that market participants must navigate to ensure both profitability and market growth

Swimming Sports Apparel Accessories Market Scope

The market is segmented on the basis of product, use intent, end-user, price range, and distribution channel.

• By Product

On the basis of product, the swimming sports apparel & accessories market is segmented into goggles & eyewear, swim caps, training aids & equipment, safety & recreational accessories, and others. The goggles & eyewear segment dominated the market with the largest market revenue share of 37.5% in 2025, driven by rising awareness of eye protection and the need for enhanced visibility during swimming. Swimmers prioritize high-quality goggles for comfort, anti-fog properties, and UV protection, making them an essential accessory for both competitive and recreational use. Goggles & eyewear are also widely integrated into professional swimwear kits, further boosting demand. Advanced designs and customizable fit options contribute to their sustained popularity across age groups. The market also witnesses strong demand due to the growth of swimming academies and professional clubs that emphasize safety and performance.

The training aids & equipment segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, fueled by increasing adoption in professional training and amateur swimming programs. Equipment such as kickboards, pull buoys, and resistance bands supports technique improvement, endurance building, and skill development. Swimming coaches and academies are increasingly recommending specialized training aids for focused practice sessions. Technological enhancements, such as smart swim monitors and sensors, also drive the popularity of training equipment. In addition, growing awareness of proper training methods among youth and adults contributes to rapid market growth.

• By Use Intent

On the basis of use intent, the market is segmented into competitive/professional swimming, amateur/club swimming, recreational swimming, and triathlon & open-water swimming. The competitive/professional swimming segment dominated the market with the largest revenue share in 2025, driven by the growing number of swimming competitions and professional training programs globally. Swimmers in this segment prioritize performance-enhancing apparel and accessories that reduce drag, improve comfort, and provide precise fit. Professional clubs and academies heavily invest in specialized gear to meet regulatory standards and optimize athlete performance. Brand reputation and endorsements by professional athletes further fuel demand. The segment also benefits from collaborations between sports brands and training institutes to develop advanced swimming accessories.

The triathlon & open-water swimming segment is anticipated to witness the fastest CAGR of 18.5% from 2026 to 2033, driven by the rising popularity of endurance sports and adventure swimming events. Participants require multifunctional gear, including specialized swim caps, goggles, and wetsuits, designed to withstand varying water conditions. Brands are innovating products with enhanced durability, buoyancy, and thermal protection to cater to open-water athletes. Marketing campaigns targeting adventure sports enthusiasts also contribute to segment growth. In addition, the increasing number of international triathlon competitions is encouraging adoption of premium, performance-oriented accessories.

• By End-User

On the basis of end-user, the market is segmented into children/youth, adults, and seniors. The adults segment dominated the market with the largest revenue share in 2025, driven by higher participation rates in both recreational and competitive swimming. Adults often invest in performance-focused gear, including goggles, swim caps, and training equipment, to enhance skill development and safety. Fitness consciousness, health awareness, and swimming as a lifestyle activity are major contributing factors. The segment also benefits from corporate wellness programs and swimming clubs targeting adult participation. Premium and mid-range products are particularly popular among adult swimmers who seek durability and functionality. Partnerships between sports brands and professional trainers further enhance market penetration in this segment.

The children/youth segment is expected to witness the fastest CAGR of 20.1% from 2026 to 2033, driven by the growing emphasis on early skill development and safety in swimming activities. Parents increasingly prefer branded swim accessories that ensure comfort, fit, and protective features. Swimming academies and school programs promote structured training, encouraging the use of specialized gear. Rising awareness of drowning prevention and water safety among guardians also fuels demand. Product innovations, including adjustable goggles and ergonomically designed swim caps for children, support rapid adoption. In addition, targeted marketing campaigns for youth swimming programs enhance market growth prospects.

• By Price Range

On the basis of price range, the market is segmented into economy, mid-range, and premium. The mid-range segment dominated the market with the largest revenue share in 2025, driven by an optimal balance between affordability and product quality. Consumers in this segment prefer reliable, durable accessories that provide performance benefits without high investment. Mid-range products often include enhanced features, such as anti-fog goggles, ergonomic swim caps, and adjustable training aids, which appeal to both amateur and professional swimmers. Retailers and e-commerce platforms actively promote mid-range options due to their widespread consumer acceptance. The segment also benefits from promotional campaigns and bundle offers targeting frequent swimmers.

The premium segment is anticipated to witness the fastest CAGR of 17.6% from 2026 to 2033, fueled by rising demand for high-performance, technologically advanced gear among professional swimmers and enthusiasts. Premium accessories offer superior materials, ergonomic designs, and cutting-edge innovations, ensuring maximum comfort, safety, and durability. Athletes participating in competitive swimming or triathlon events often prefer premium products endorsed by top sports brands. Brand loyalty and aspirational consumer behavior contribute to sustained growth. In addition, limited edition and customizable premium accessories create differentiation and drive adoption in niche markets.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into specialty stores, supermarkets/hypermarkets, online/e-commerce, and others. The specialty stores segment dominated the market with the largest revenue share of 36.4% in 2025, driven by personalized customer service and availability of a wide range of specialized swimming accessories. Consumers often prefer specialty stores for in-store trials, fittings, and expert guidance, which enhances purchase confidence. The segment benefits from brand-exclusive outlets and strong relationships with professional swimming academies. Specialty stores also host promotional events and workshops that encourage the adoption of performance-oriented gear.

The online/e-commerce segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, fueled by growing internet penetration, smartphone usage, and digital shopping trends. Online platforms offer convenience, competitive pricing, and access to a wider variety of products, including premium and niche swimming accessories. Customer reviews, detailed product descriptions, and virtual sizing guides improve purchase decisions. In addition, targeted online marketing campaigns and partnerships with influencers boost segment growth. The increasing trend of home delivery and subscription-based offerings further drives adoption of online channels for swimming gear.

Swimming Sports Apparel Accessories Market Regional Analysis

- Europe dominated the swimming sports apparel accessories market with the largest revenue share of 36.6% in 2025, driven by increasing participation in competitive swimming, rising awareness of health and fitness, and a well-established retail and sports infrastructure

- Consumers in the region are highly inclined toward performance-enhancing and durable swimming apparel and accessories such as goggles, swim caps, and training equipment

- This widespread adoption is further supported by high disposable incomes, strong presence of international sports brands, and the growing preference for professional-grade gear among amateur and professional swimmers, establishing Europe as a key market for premium swimming sports products

U.K. Swimming Sports Apparel Accessories Market Insight

The U.K. market captured the largest revenue share in Europe in 2025, fueled by the growing popularity of swimming as a recreational and competitive activity. Consumers increasingly prioritize quality, comfort, and durability in swimming apparel and accessories. The rising trend of swim clubs, school-level competitions, and open-water swimming events is driving demand. Furthermore, the adoption of eco-friendly and technologically advanced fabrics such as chlorine-resistant and UV-protective materials is supporting market growth. Retail expansion through online channels and specialized sports stores is enhancing accessibility to premium swimming products.

Germany Swimming Sports Apparel Accessories Market Insight

Germany’s market is projected to expand at a robust CAGR during the forecast period, driven by increasing health-consciousness and fitness-oriented lifestyles. The presence of local and international sportswear brands offering high-performance swimming apparel and accessories is accelerating adoption. Consumers are inclined toward functional and ergonomic products that improve performance and comfort. Moreover, swimming schools, competitive events, and government-led fitness programs are fostering market growth. The integration of innovative materials and sustainable manufacturing practices is also influencing consumer preference.

France Swimming Sports Apparel Accessories Market Insight

France is witnessing steady market growth, fueled by strong interest in aquatic sports and competitive swimming at both amateur and professional levels. The country’s well-established sports clubs and fitness culture encourage regular swimming activities, driving demand for specialized apparel and accessories. Consumers are increasingly opting for branded products that offer performance, comfort, and style. For instance, companies such as Speedo and Arena are expanding product lines to cater to both professional athletes and recreational swimmers. The growing availability of online retail platforms is facilitating product accessibility across urban and semi-urban areas.

Asia-Pacific Swimming Sports Apparel Accessories Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising urbanization, growing disposable incomes, and increased interest in fitness and sports among young populations in countries such as China, Japan, and India. For instance, China’s government-led initiatives to promote sports participation and the expansion of competitive swimming events are boosting demand for swimwear and accessories. The region’s growing manufacturing capabilities and cost-effective production of high-quality swimming gear are also enhancing accessibility to a wider consumer base.

Japan Swimming Sports Apparel Accessories Market Insight

The Japan market is gaining momentum due to the country’s strong culture of technological innovation and health-conscious lifestyles. Swimming is increasingly adopted as a regular fitness activity, with consumers favoring products that offer advanced materials, durability, and ergonomic designs. The integration of smart fabrics and UV-protective swimwear is driving growth in both professional and recreational segments. Moreover, swimming competitions and school programs are encouraging consistent demand for specialized accessories such as goggles, swim caps, and fins.

China Swimming Sports Apparel Accessories Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle-class population, rising fitness awareness, and rapid urbanization. For instance, international brands such as Speedo and local manufacturers are increasingly targeting tier-1 and tier-2 cities with premium and mid-range products. The push for swimming as a part of educational curricula, growth of swimming clubs, and hosting of competitive events is stimulating demand for quality swimming apparel and accessories. Affordable manufacturing and local production are further supporting market expansion across residential and commercial aquatic facilities.

Swimming Sports Apparel Accessories Market Share

The swimming sports apparel accessories industry is primarily led by well-established companies, including:

- Pentland Group Ltd. (U.K.)

- Decathlon S.A. (France)

- Arena S.p.A. (Italy)

- TYR Sport, Inc. (U.S.)

- HEAD Sport GmbH (Austria)

- Zoggs International Ltd. (U.K.)

- FINIS, Inc. (U.S.)

- FORM Athletica Inc. (Canada)

- Mad Wave Ltd. (Finland)

- Mares S.p.A. (Italy)

- Speedo International (U.K.)

- Adidas AG (Germany)

- Nike, Inc. (U.S.)

- Dolfin Swimwear (U.S.)

- AgonSwim (U.S.)

- Orca (New Zealand)

Latest Developments in Global Swimming Sports Apparel Accessories Market

- In February 2025, Speedo launched its brand campaign, “Less Gym, More Swim,” positioning swimming as a full-body workout that combines fitness, recreation, and competitive training. This initiative is expected to influence consumer behavior by highlighting swimming as a holistic fitness activity, encouraging both amateur and professional swimmers to invest in performance-oriented swimwear and accessories. By emphasizing health and lifestyle benefits, the campaign strengthens Speedo’s brand presence, attracts new users to the swimming segment, and stimulates broader adoption of swim-related products in both retail and online channels

- In January 2025, Speedo launched the upgraded Vanquisher 3.0 training and racing goggles, featuring a 14% increase in field-of-view, improved fit, mirror lenses, and advanced anti-fog technology. The product addresses the growing demand for performance-enhancing swim accessories, catering to competitive athletes and serious recreational swimmers. Its launch is likely to drive replacement purchases, strengthen brand loyalty, and increase market share in the premium swim goggle segment, further positioning Speedo as an innovator in high-performance aquatic accessories

- In October 2024, Speedo entered a co-branded partnership with DMC Fins, introducing a range of fins using DMC’s proprietary “SILFORM” silicone technology. This collaboration enhances the technological sophistication of Speedo’s product offerings and targets competitive swimmers seeking optimized training equipment. By expanding its advanced accessory portfolio, Speedo strengthens its differentiation in the global swimming sports market and stimulates adoption of specialized gear among professional swimmers, swim clubs, and training facilities

- In April 2024, FORM launched next-generation smart swim goggles designed to elevate athletic swimming performance worldwide. These goggles integrate performance-tracking technology to monitor metrics such as stroke count, lap time, and efficiency, reflecting the increasing trend toward smart and connected swim accessories. The introduction drives market growth in the technologically advanced segment, attracts tech-savvy consumers and professional athletes, and fosters innovation-led differentiation within the swimming sports apparel and accessories industry

- In November 2023, Heritage Pool Supply Group, Inc. acquired Recreonics, Inc., a distributor of equipment and aquatic apparel accessories for institutional and commercial swimming facilities. This strategic acquisition strengthens Heritage Pool Supply’s omni-channel reach across the U.S., enhances distribution efficiency, and broadens product accessibility to commercial and recreational clients. By leveraging Recreonics’ established network, Heritage Pool Supply can increase market penetration, scale product offerings, and consolidate its position in the institutional and commercial swimming sports accessories sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.