Global Swine Automated Feeding Systems Market

Market Size in USD Billion

CAGR :

%

USD

4.98 Billion

USD

8.89 Billion

2025

2033

USD

4.98 Billion

USD

8.89 Billion

2025

2033

| 2026 –2033 | |

| USD 4.98 Billion | |

| USD 8.89 Billion | |

|

|

|

|

Swine Automated Feeding Systems Market Size

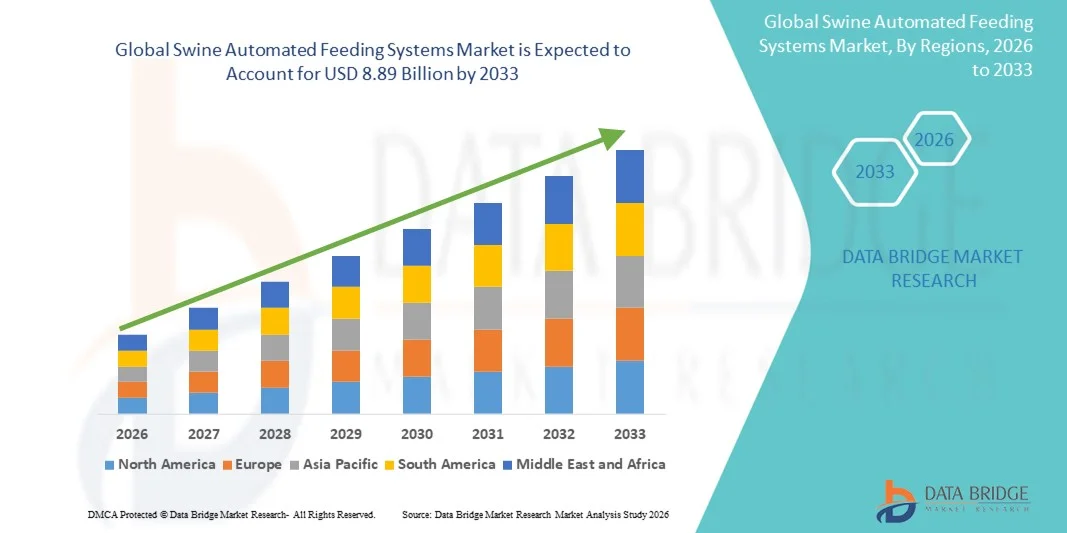

- The global swine automated feeding systems market size was valued at USD 4.98 billion in 2025 and is expected to reach USD 8.89 billion by 2033, at a CAGR of 7.50% during the forecast period

- The market growth is largely fueled by the increasing shift toward precision livestock farming, as swine producers adopt automation to improve feed accuracy, reduce labor dependency, and enhance overall farm efficiency driven by the need for consistent feeding cycles, optimized nutrition delivery, and better herd management outcomes

- Furthermore, rising demand for scalable, data-driven, and remotely operable feeding solutions is encouraging farms to transition from conventional feeding to automated systems, ensuring better productivity, cost savings, and improved swine health. These converging factors are accelerating the adoption of automated feeding technologies across both small and large-scale swine operations

Swine Automated Feeding Systems Market Analysis

- Swine automated feeding systems, designed to deliver precise feed portions, monitor consumption patterns, and support nutritional optimization, are becoming essential components of modern swine farming as producers focus on improving operational efficiency, animal welfare, and resource utilization through automation

- The escalating demand for these systems is primarily driven by the rising adoption of connected farm technologies, increasing labor shortages in livestock farming, and the growing preference for intelligent systems capable of real-time monitoring and automated decision-making, which enhance overall farm profitability and productivity

- Europe dominated the swine automated feeding systems market with a share of 33.7% in 2025, due to strong industrialized livestock farming practices, high adoption of precision feeding technologies, and a well-established swine production infrastructure

- North America is expected to be the fastest growing region in the swine automated feeding systems market during the forecast period due to rising adoption of sensor-enabled and data-driven feeding technologies, increasing focus on precision livestock farming, and high technological readiness among large swine farms

- Rail-guided feeding systems segment dominated the market with a market share of 48.1% in 2025, due to its ability to deliver consistent feeding routes with minimal manual supervision, supporting large-scale farms that prioritize uniform nutrition patterns. Producers continue to favor these systems because their tracked pathways reduce feeding variability and strengthen herd performance over long cycles. The segment’s reliability during continuous operation and its adaptability to multispecies layouts further reinforce its leadership in the market

Report Scope and Swine Automated Feeding Systems Market Segmentation

|

Attributes |

Swine Automated Feeding Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Swine Automated Feeding Systems Market Trends

Rising Integration of AI-Based Precision Feeding in Swine Farms

- A major trend in the swine automated feeding systems market is the increasing integration of AI-powered precision feeding technologies that optimize feed delivery based on real-time animal behavior and nutritional requirements. These systems help farmers enhance feed efficiency and improve herd health by ensuring accurate rationing and minimizing nutrient wastage

- For instance, Big Dutchman implements AI-enabled feeding modules that adjust feeding curves automatically based on weight-gain patterns, which enhances uniform growth across swine groups. Such advancements strengthen the adoption of next-generation automated systems across commercial farms

- AI-based precision feeding supports continuous monitoring of individual and group feeding patterns, allowing producers to detect irregularities early and take timely corrective actions. This drives improved herd productivity by enabling consistent feeding cycles and reducing labor dependency

- These intelligent systems also optimize feed conversion ratios by adjusting feed quantity and composition based on environmental conditions, growth stages, and performance trends. This creates a controlled and efficient feeding environment that supports long-term farm profitability

- The trend is further supported by rising interest in advanced automation platforms that integrate sensors, telemetry, and predictive analytics, enabling greater operational transparency. This helps farmers streamline farm management processes and maintain consistent production outcomes

- Overall, the growing emphasis on AI-driven precision feeding is reshaping modern swine farming by enabling data-backed control over nutrition and production efficiency, reinforcing the transition toward fully automated and intelligent feeding environments

Swine Automated Feeding Systems Market Dynamics

Driver

Growing Demand for Precision Feeding to Improve Swine Productivity

- The growing need to enhance feed utilization and improve productivity across swine farms is driving the adoption of automated precision feeding systems. These systems help maintain consistent feeding schedules, reduce feed wastage, and support healthier weight gain outcomes across herds

- For instance, Trioliet B.V. provides automated feeding systems designed to deliver precise feed portions based on swine growth stages, ensuring more controlled nutrition management. Such innovations strengthen producer confidence in precision feeding solutions

- Accurate feed dispensing helps farmers improve feed conversion ratios and supports more uniform herd development, which is essential for commercial swine operations targeting higher production efficiency. This directly contributes to better economic returns by lowering feed-related expenses

- In addition, the rising shift toward data-driven farming encourages producers to use automated systems that offer continuous feeding insights and performance analytics. These systems reduce human error and ensure reliable nutrition planning

- This growing dependence on automation ensures that producers can meet rising demand for high-quality pork while maintaining consistent productivity levels, making precision feeding a key driver for sustained market expansion

Restraint/Challenge

High Initial Installation Costs for Automated Feeding Infrastructure

- High upfront investment remains a major challenge for swine farms planning to adopt automated feeding systems, as advanced hardware, software, and structural components require considerable financial commitment. This is particularly restrictive for small and medium-scale farms

- For instance, fully integrated feeding systems offered by companies such as GEA Group require installation of specialized controllers, conveyors, and monitoring units, increasing the overall infrastructure expense

- The high cost of installation often delays adoption since farmers must allocate budgets for equipment, training, and long-term maintenance. These factors contribute to hesitation among cost-sensitive producers

- Furthermore, the expense of integrating advanced technologies such as robotics, sensors, and telemetry increases the financial burden, limiting accessibility for farms with lower operational margins

- This challenge highlights the need for cost-optimized solutions and financial support mechanisms to encourage broader adoption, as reducing installation-related barriers will be essential for expanding the use of automated feeding systems across the global swine industry

Swine Automated Feeding Systems Market Scope

The market is segmented on the basis of type, function, offering, technology, and integration.

- By Type

On the basis of type, the swine automated feeding systems market is segmented into rail-guided feeding systems, self-propelled feeding systems, and conveyor feeding systems. The rail-guided segment dominated the market with the largest share of 48.1% in 2025 due to its ability to deliver consistent feeding routes with minimal manual supervision, supporting large-scale farms that prioritize uniform nutrition patterns. Producers continue to favor these systems because their tracked pathways reduce feeding variability and strengthen herd performance over long cycles. The segment’s reliability during continuous operation and its adaptability to multispecies layouts further reinforce its leadership in the market.

The self-propelled feeding systems segment is anticipated to record the fastest growth from 2026 to 2033, supported by farms moving toward flexible automation that can adjust routes without fixed infrastructure. These systems appeal to producers who aim to optimize feeding precision across changing pen arrangements, allowing adjustments in herd size and layout without costly remodeling. Their mobility offers higher operational freedom, and their capability to integrate with advanced guidance controls positions them for sustained acceleration during the forecast period.

- By Function

On the basis of function, the swine automated feeding systems market is segmented into controlling, mixing, filling and screening, and others. The controlling segment dominated the market in 2025 due to its central role in regulating feed schedules, optimizing portions, and maintaining feeding consistency across all production stages. Farms rely heavily on calibrated control mechanisms to reduce waste, maintain predictable intake patterns, and improve overall feed conversion efficiency. As producers emphasize precision livestock farming, robust control features continue to anchor this segment’s leadership.

The mixing segment is projected to be the fastest-growing from 2026 to 2033, driven by rising demand for nutritionally balanced feed blends tailored to growth phases and health conditions. This segment benefits from the need to combine multiple feed components with accurate ratios, ensuring higher-quality nutrient delivery across herds. Its relevance rises as producers adopt more specialized diets, positioning advanced mixing functions for strong and sustained expansion.

- By Offering

On the basis of offering, the swine automated feeding systems market is segmented into hardware, software, and services. The hardware segment dominated the market in 2025 because automated feeders, sensors, control units, and machinery form the foundational infrastructure necessary for system operation. Producers consistently invest in durable hardware that guarantees operational continuity, ensuring reliable feed delivery even under stringent farm conditions. This dependency on physical components maintains the segment’s commanding position.

The software segment is projected to witness the fastest growth during 2026 to 2033 as farms increasingly prioritize data-driven feeding decisions supported by analytics, real-time monitoring, and automated alerts. Producers leverage software platforms to track feed intake, analyze feeding patterns, and optimize feeding cycles, enhancing productivity and reducing costs. The expanding role of digitalization in livestock management positions software as the most rapidly advancing offering.

- By Technology

On the basis of technology, the swine automated feeding systems market is segmented into guidance and remote sensing technology, robotics and telemetry, RFID technology, and others. The guidance and remote sensing technology segment dominated the market in 2025 due to its essential function in automating feeder movement, monitoring real-time conditions, and adjusting feeding patterns without human intervention. Precision navigation and environmental sensing strengthen system reliability, making this technology a cornerstone in large-scale automated barns. Its integration with farm-level automation platforms secures its leading position.

The robotics and telemetry segment is expected to grow the fastest from 2026 to 2033 as farms increasingly transition toward autonomous feeding routines that minimize labor dependency. Producers value robotic systems for their ability to navigate complex layouts, adapt feeding routes, and transmit continuous performance data that supports proactive herd management. The efficiency gains and labor savings associated with robotics ensure its rapid upward trajectory.

- By Integration

On the basis of integration, the swine automated feeding systems market is segmented into integrated automated feeding systems and non-integrated automated feeding systems. The integrated segment dominated the market in 2025 due to its ability to synchronize feeding operations with environmental controls, herd monitoring tools, and nutritional management platforms. Farms adopting integrated systems gain the advantage of streamlined operations, reduced errors, and unified decision-making across the production chain. This cohesive functionality maintains the segment’s dominant market position.

The non-integrated segment is expected to witness the fastest growth from 2026 to 2033 as smaller and mid-scale producers adopt modular solutions that offer automation benefits without requiring complete system overhauls. These systems attract farms seeking cost-effective automation with the flexibility to modernize gradually and upgrade components as needed. Their affordability and adaptable deployment patterns support their accelerating adoption across developing livestock operations.

Swine Automated Feeding Systems Market Regional Analysis

- Europe dominated the swine automated feeding systems market with the largest revenue share of 33.7% in 2025, driven by strong industrialized livestock farming practices, high adoption of precision feeding technologies, and a well-established swine production infrastructure

- The region’s emphasis on operational efficiency, strict animal welfare regulations, and advanced automation capabilities is reinforcing market leadership

- Increasing investments in smart farming solutions, rising focus on feed optimization, and expanding demand for automated systems in large-scale commercial farms are accelerating regional market growth

Germany Swine Automated Feeding Systems Market Insight

Germany held the largest share in the European market in 2025 owing to its highly developed livestock sector, strong inclination toward mechanized feeding solutions, and consistent integration of digital and sensor-based technologies in swine farms. The country’s commitment to high productivity, sustainability, and precision livestock management continues to influence the adoption of automated feeding systems. Rising use of software-enabled monitoring tools and resource-efficient feeding modules further drives market expansion.

U.K. Swine Automated Feeding Systems Market Insight

The U.K. market is expanding steadily, supported by the modernization of swine production facilities, increased focus on reducing manual feeding labor, and a shift toward automated solutions ensuring consistent feed delivery. Continuous improvements in farm-level digitalization, growing preference for real-time monitoring, and rising adoption of systems designed for efficient feed utilization contribute to market growth. Investments in animal welfare-driven automation technologies strengthen the U.K.'s position within Europe.

Asia-Pacific Swine Automated Feeding Systems Market Insight

Asia-Pacific is witnessing rapid growth, driven by rising modern swine farming practices, increasing integration of automated feeding modules, and expanding commercial livestock operations. Growing demand for swine meat, coupled with the need for enhanced feeding accuracy and productivity, supports market expansion across developing economies. Technological advancements in automated mixing, dispensing, and monitoring solutions further elevate system adoption.

China Swine Automated Feeding Systems Market Insight

China accounted for the largest share in Asia-Pacific in 2025 due to its massive swine population, strong industrial-scale farming systems, and continuous investment in smart agriculture technologies. Adoption of automated feeding systems is rising as farms increasingly shift toward improving feed efficiency, minimizing waste, and ensuring stable production. Integration of digital tools and remote monitoring platforms enhances farm productivity and strengthens the country’s market position.

India Swine Automated Feeding Systems Market Insight

India is projected to grow at the fastest rate in Asia-Pacific, fueled by transitioning livestock farms, rising awareness of automated feeding benefits, and increasing adoption among small and mid-sized commercial producers. Focus on improving feed management practices, reducing labor-intensive feeding tasks, and enhancing operational consistency supports system integration. Growing investments in livestock infrastructure and rising commercialization of farming operations contribute to strong market momentum.

North America Swine Automated Feeding Systems Market Insight

North America is expected to record the fastest CAGR from 2026 to 2033, supported by rising adoption of sensor-enabled and data-driven feeding technologies, increasing focus on precision livestock farming, and high technological readiness among large swine farms. Advancements in robotics, telemetry, and automated control software are accelerating system implementation. Rising emphasis on operational efficiency, feed cost management, and consistent animal nutrition further enhances market growth.

U.S. Swine Automated Feeding Systems Market Insight

The U.S. accounted for the largest share in North America in 2025, underpinned by large commercial swine operations, strong investment in farm automation, and widespread integration of cloud-based monitoring systems. The country’s focus on improving feeding consistency, optimizing feed conversion ratios, and adopting robotics-supported feeding modules drives system demand. A well-established precision farming ecosystem and presence of advanced automation suppliers strengthen the U.S.’s leadership in the region.

Swine Automated Feeding Systems Market Share

The swine automated feeding systems industry is primarily led by well-established companies, including:

- GEA Group Aktiengesellschaft (Germany)

- DeLaval Inc. (Sweden)

- BouMatic (U.S.)

- Fullwood Packo (U.K.)

- Trioliet B.V. (Netherlands)

- Afimilk Ltd. (Israel)

- Lely (Netherlands)

- VDL Agrotech BV (Netherlands)

- Pellon Group OY (Finland)

- DAIRYMASTER (Ireland)

- AGCO Corporation (U.S.)

- Sum-It (U.K.)

- Bucher Industries AG (Switzerland)

- Roxell (Belgium)

- Dhumal Industries (India)

- Valmetal (Canada)

- Big Dutchman (Germany)

- WEBER Schraubautomaten GmbH (Germany)

- GARTECH (India)

- Rovibec Agrisolutions (Canada)

Latest Developments in Global Swine Automated Feeding Systems Market

- In July 2025, Roxell launched its iQon Multifast Feed Delivery System, a high-precision automated solution enabling accurate feed mixing, distribution, and monitoring across farrowing and finishing units. The system enhances the performance of swine feeding lines by minimizing feed waste and ensuring consistent nutrition delivery, which significantly boosts production efficiency and reinforces Roxell’s position in advanced automated feeding infrastructure

- In March 2025, CTB Inc. introduced its upgraded Chore-Time Barn Management Control System designed to integrate feeding automation with climate and health monitoring across large-scale swine operations. This development strengthens CTB’s presence in precision livestock management and drives higher adoption of automated feeding by improving decision-making, reducing labor requirements, and enabling farms to optimize feed efficiency through real-time controlled adjustments

- In January 2025, Big Dutchman secured a major multi-site deployment contract to supply integrated automated feeding and housing systems for a large commercial herd of over 50,000 pigs. This expansion project strengthens Big Dutchman’s market dominance in industrial-scale swine facilities, as the installation of coordinated automated feeding solutions leads to improved operational uniformity, better herd management, and increased productivity across high-capacity pig farms

- In May 2024, Fancom introduced its SmartFeed Cloud platform, an advanced electronic sow feeding (ESF) management solution that incorporates cloud connectivity, AI-driven ration optimization, and remote performance monitoring. The platform encourages faster digital transformation in swine farms by enhancing precision feeding practices, supporting better sow welfare, and allowing operators to manage multi-farm feeding operations from a centralized digital interface

- In September 2023, Roxell released the Dos7 precision dispenser for sows, designed to automate individualized feeding with high accuracy across group-housing systems. This innovation increases feeding hygiene, reduces feed overconsumption, and improves reproductive health outcomes. Its adoption strengthened Roxell’s leadership in automated sow feeding solutions by offering farms a scalable and efficient method for achieving consistent nutritional control

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.