Global Swine Feed Additives Market

Market Size in USD Billion

CAGR :

%

USD

12.08 Billion

USD

20.00 Billion

2025

2033

USD

12.08 Billion

USD

20.00 Billion

2025

2033

| 2026 –2033 | |

| USD 12.08 Billion | |

| USD 20.00 Billion | |

|

|

|

|

Swine Feed Additives Market Size

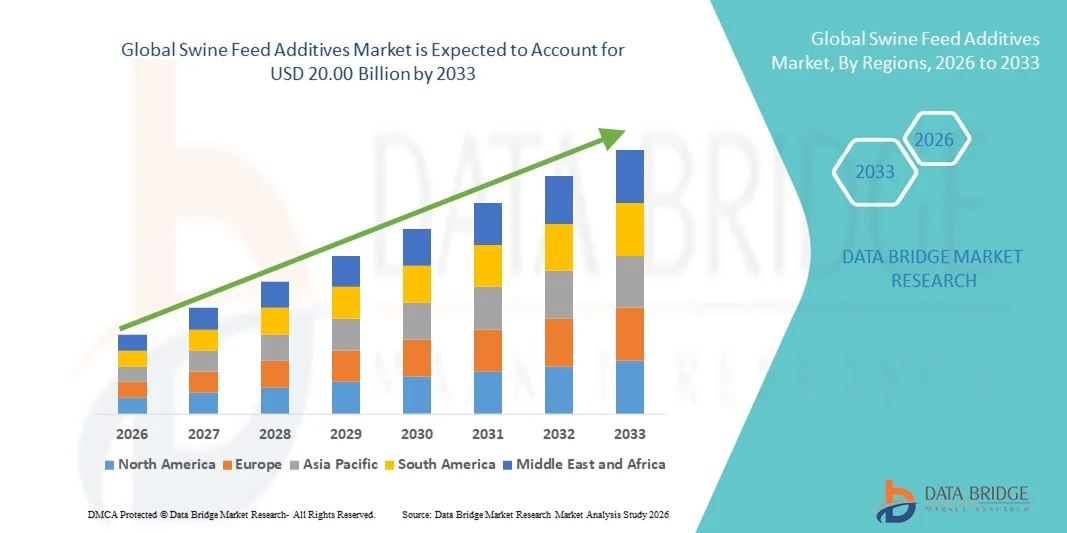

- The global swine feed additives market size was valued at USD 12.08 billion in 2025 and is expected to reach USD 20.00 billion by 2033, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the increasing focus on livestock productivity and animal health, leading to widespread adoption of functional and specialty feed additives in swine diets. Growing awareness among producers about optimized nutrition, gut health, and disease prevention is driving the integration of additives such as probiotics, amino acids, and mycotoxin detoxifiers across commercial and small-scale pig farming operations

- Furthermore, rising consumer demand for safe, high-quality, and antibiotic-free pork products is encouraging swine producers to incorporate natural and sustainable feed additives. These converging factors are accelerating the adoption of advanced swine feed solutions, thereby significantly boosting the overall growth and modernization of the swine feed additives industry

Swine Feed Additives Market Analysis

- Swine feed additives, including vitamins, antioxidants, enzymes, and acidifiers, are increasingly recognized as essential components for enhancing growth performance, feed efficiency, and overall herd health. The ability of these additives to improve nutrient absorption, support immune function, and reduce disease incidence is reinforcing their role as critical inputs in modern pig farming

- The escalating demand for feed additives is primarily fueled by advancements in feed formulation technologies, rising investments in livestock nutrition research, and regulatory encouragement for safe and functional feed solutions. Increasing use of gut-health enhancers, natural growth promoters, and precision nutrition strategies is contributing to the sustained growth of the market

- Asia-Pacific dominated the swine feed additives market with a share of 40.3% in 2025, due to rapid growth in pig farming, increasing demand for protein-rich feed, and a strong presence of commercial feed manufacturers

- North America is expected to be the fastest growing region in the swine feed additives market during the forecast period due to high adoption of functional feed additives, increasing demand for pork, and advancements in feed formulation technologies

- Antibiotics segment dominated the market with a market share of 39.1% in 2025, due to its long-standing role in enhancing growth performance, improving feed efficiency, and preventing bacterial infections in pigs. Farmers often prioritize antibiotic feed additives for their proven efficacy in reducing morbidity and mortality rates, ensuring healthier herds. The segment also benefits from extensive research, widespread regulatory acceptance in key regions, and compatibility with various swine production systems

Report Scope and Swine Feed Additives Market Segmentation

|

Attributes |

Swine Feed Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Swine Feed Additives Market Trends

Growth in Natural and Functional Swine Feed Additives

- A major trend driving the swine feed additives market is the growing transition toward natural and functional additives formulated to enhance animal health and nutrition without antibiotic dependence. Producers are increasingly adopting plant-based, probiotic, and enzyme-enriched additives to improve growth performance, digestive efficiency, and immunity in swine herds

- For instance, Cargill introduced a new line of phytogenic-based feed additives that support gut health and nutrient absorption in swine diets. These products utilize natural essential oils and herbal extracts to optimize feed conversion and reduce pathogen load, aligning with the trend toward antibiotic-free livestock production

- The emphasis on functional additives that promote intestinal health, protein utilization, and feed efficiency is intensifying as producers seek cost-effective alternatives to traditional antibiotic growth promoters. Natural prebiotics, probiotics, and organic acids are playing a vital role in maintaining microbial balance in animal intestines and enhancing nutrient uptake

- Consumer awareness regarding food safety and demand for naturally raised pork products are encouraging producers to adopt cleaner feed solutions. Feed manufacturers are focusing on integrating mineral chelates and enzyme complexes that boost metabolism and ensure better carcass quality while complying with safety standards

- Moreover, the growing integration of digital livestock management systems is enabling precision feeding strategies. This technological shift allows producers to optimize additive usage and reduces wastage while maximizing herd productivity through data-driven dietary formulations

- The continuous evolution toward sustainable, functional, and health-driven feed formulations signifies a transformation in the swine feed industry. This shift is strengthening the market for natural additives, ensuring a balance between productivity, animal welfare, and environmental sustainability

Swine Feed Additives Market Dynamics

Driver

Rising Demand for Antibiotic-Free, High-Quality Pork

- The increasing global demand for antibiotic-free, high-quality pork is a primary driver boosting the adoption of advanced feed additives in the swine industry. Growing consumer preference for safe and naturally raised meat products is pushing producers to replace antibiotic growth promoters with functional alternatives that maintain livestock health and productivity

- For instance, DSM Animal Nutrition developed a probiotic feed solution to replace antibiotic inputs while maintaining digestive efficiency and weight gain in swine. This innovation supports farmers aiming to comply with antibiotic reduction policies while sustaining production efficiency and meat quality

- Stringent regulatory restrictions on non-therapeutic antibiotic use in livestock have accelerated innovation in feed additive formulations. Manufacturers are investing in natural ingredients such as essential oils, organic acids, and yeast derivatives that provide immune-boosting and antimicrobial benefits without antibiotic application

- Expanding awareness among farmers regarding herd health management and the economic advantages of long-term sustainability is also driving the use of advanced nutrition-based additives. These solutions help reduce disease incidence and mortality rates while promoting consistent growth performance

- As global dietary patterns emphasize transparency and sustainability, antibiotic-free pork production has become a central goal for modern livestock systems. This ongoing shift supports the rising adoption of high-functionality feed additives that enhance animal productivity through nutritional innovation rather than pharmacological reliance

Restraint/Challenge

Strict Regulatory Compliance for Feed Additives

- Strict regulatory frameworks governing feed additive approval and usage represent a major challenge for the swine feed additives market. The lengthy evaluation processes and complex documentation requirements for ingredient validation increase time-to-market and discourage smaller producers from introducing innovative solutions

- For instance, companies such as Alltech and Evonik face stringent approvals in the European Union for new enzyme or probiotic formulations, requiring extensive safety and efficacy studies before commercial authorization. These processes, while essential for consumer protection, add considerable cost and delay product deployment

- Divergence in national and regional regulatory standards complicates global distribution strategies for feed additives. Manufacturers must customize formulations and labeling to satisfy varying chemical residue limits, microbial safety criteria, and permissible concentration levels in each jurisdiction

- In addition, maintaining compliance with evolving biosecurity, traceability, and labeling standards demands continuous monitoring and reformulation. These dynamics pose operational burdens on producers seeking to maintain consistency across multiple markets

- To overcome these challenges, companies are investing in transparent documentation systems, third-party ingredient validation, and collaborations with regulatory bodies to expedite approval processes. Streamlining compliance frameworks and adopting harmonized international standards will be vital for fostering research-driven growth in the swine feed additives market

Swine Feed Additives Market Scope

The market is segmented on the basis of additive type, form, product, source, and function.

- By Additive Type

On the basis of additive type, the swine feed additives market is segmented into antibiotics, vitamins, antioxidants, amino acids, enzymes, mycotoxin detoxifiers, prebiotics, probiotics, flavors and sweeteners, pigments, binders, acidifiers, and minerals. The antibiotics segment dominated the market with the largest revenue share 39.1% in 2025, driven by its long-standing role in enhancing growth performance, improving feed efficiency, and preventing bacterial infections in pigs. Farmers often prioritize antibiotic feed additives for their proven efficacy in reducing morbidity and mortality rates, ensuring healthier herds. The segment also benefits from extensive research, widespread regulatory acceptance in key regions, and compatibility with various swine production systems.

The amino acids segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the rising focus on precision nutrition and sustainable protein utilization in swine diets. Amino acids help optimize growth, reproduction, and overall performance while reducing nitrogen excretion, aligning with environmental sustainability goals. Increasing awareness among producers regarding cost-effective feed formulations and the adoption of amino acid supplements to replace protein-heavy feed sources further drives market expansion.

- By Form

On the basis of form, the swine feed additives market is segmented into pellets, crumbles, mash, and others. The pellets segment dominated the market with the largest revenue share in 2025, owing to its ease of handling, uniform nutrient distribution, and suitability for automated feeding systems. Pelletized feed ensures better feed conversion ratios and reduces wastage, which is critical for large-scale pig farming operations. Producers also prefer pellets due to their longer shelf life and stability of nutrient content.

The crumbles segment is expected to witness the fastest CAGR from 2026 to 2033, driven by its increasing use in weaning and starter feeds where small, easily consumable particles improve intake and growth performance. Crumbles also allow better blending of functional additives and feed supplements, supporting health and digestive performance in young pigs.

- By Product

On the basis of product, the swine feed additives market is segmented into starter feed, grower feed, sow feed, and others. The starter feed segment dominated the market with the largest revenue share in 2025, driven by the critical role of starter feed in supporting piglets’ early growth and immune system development. High nutrient density and the inclusion of specialized additives make starter feed essential for minimizing early-life mortality and optimizing long-term performance.

The grower feed segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the rising demand for efficient weight gain during the grower phase and increasing focus on cost-effective nutrition. Functional additives in grower feed enhance gut health, nutrient absorption, and overall growth performance, making it a high-priority product for commercial swine producers.

- By Source

On the basis of source, the swine feed additives market is segmented into synthetic and natural. The synthetic segment dominated the market with the largest revenue share in 2025, owing to its consistent quality, precise nutrient content, and cost-effectiveness. Synthetic additives are preferred for large-scale production due to ease of dosage control and proven efficacy in enhancing growth and health.

The natural segment is expected to witness the fastest CAGR from 2026 to 2033, driven by growing consumer demand for antibiotic-free and organic pork products. Natural additives such as plant extracts, probiotics, and enzymes support gut health and immunity while aligning with sustainable farming practices, boosting adoption among progressive swine producers.

- By Function

On the basis of function, the swine feed additives market is segmented into palatability enhancement, mycotoxin management, gut health and digestive performance, preservation of functional ingredients, and others. The gut health and digestive performance segment dominated the market with the largest revenue share in 2025, driven by the increasing emphasis on improving nutrient absorption, feed conversion efficiency, and overall animal well-being. Feed additives supporting gut health reduce disease incidence and enhance growth rates, which is critical for commercial operations.

The mycotoxin management segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising concerns over feed contamination and its impact on swine health and productivity. Mycotoxin detoxifiers and related additives mitigate toxin effects, ensuring consistent performance and aligning with stricter food safety and regulatory standards.

Swine Feed Additives Market Regional Analysis

- Asia-Pacific dominated the swine feed additives market with the largest revenue share of 40.3% in 2025, driven by rapid growth in pig farming, increasing demand for protein-rich feed, and a strong presence of commercial feed manufacturers

- The region’s cost-effective feed production, rising investments in animal nutrition, and adoption of advanced feed additive technologies are accelerating market expansion

- The availability of skilled labor, supportive government policies for livestock development, and rising awareness of animal health and productivity are contributing to increased consumption of feed additives across both large-scale and smallholder farms

China Swine Feed Additives Market Insight

China held the largest share in the Asia-Pacific swine feed additives market in 2025, owing to its position as a leading pork producer and high consumption of fortified feed. The country’s extensive livestock base, government initiatives supporting modern pig farming, and strong feed manufacturing infrastructure are major growth drivers. Demand is also boosted by increasing adoption of gut health enhancers, amino acids, and probiotics to improve growth performance and feed efficiency.

India Swine Feed Additives Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding commercial pig farming, rising protein consumption, and increasing focus on livestock productivity. Initiatives to improve animal health management, adoption of functional feed additives, and growing awareness of antibiotic alternatives are strengthening demand. In addition, rising investments in feed mills and supply chain modernization are supporting robust market expansion.

Europe Swine Feed Additives Market Insight

The Europe swine feed additives market is expanding steadily, supported by stringent animal health regulations, growing demand for antibiotic-free and functional feed, and increasing adoption of sustainable feed practices. The region places strong emphasis on product quality, feed safety, and environmental compliance. The increasing use of natural additives, enzymes, and mycotoxin detoxifiers is further enhancing market growth.

Germany Swine Feed Additives Market Insight

Germany’s market is driven by its advanced livestock farming infrastructure, focus on high-quality feed production, and strong R&D capabilities in animal nutrition. The country emphasizes sustainable feed solutions, innovation in functional additives, and compliance with strict EU regulations. Demand is particularly strong for probiotics, amino acids, and gut health-promoting additives.

U.K. Swine Feed Additives Market Insight

The U.K. market is supported by modern pig farming practices, rising adoption of functional and natural feed additives, and growing emphasis on antibiotic-free production. Investments in feed research, collaboration between academia and feed manufacturers, and development of specialized feed formulations are driving demand. The focus on animal welfare and sustainable production is encouraging the use of high-quality additives.

North America Swine Feed Additives Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by high adoption of functional feed additives, increasing demand for pork, and advancements in feed formulation technologies. Focus on gut health, mycotoxin management, and optimized nutrition is boosting demand. The trend toward antibiotic-free and clean-label production further supports market expansion.

U.S. Swine Feed Additives Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its large-scale commercial pig farming, strong feed additive manufacturing base, and extensive R&D infrastructure. Growing awareness of animal health, feed efficiency, and regulatory compliance is encouraging the use of functional and natural feed additives. Presence of key feed additive producers and well-established supply chains further strengthen the U.S.'s leading position in the region.

Swine Feed Additives Market Share

The swine feed additives industry is primarily led by well-established companies, including:

- Biomin (Austria)

- DSM (Netherlands)

- Evonik Industries AG (Germany)

- Impextraco NV (Belgium)

- Cargill, Incorporated (U.S.)

- BASF SE (Germany)

- NOVUS INTERNATIONAL (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Nutreco N.V. (Netherlands)

- Novozymes (Denmark)

- Alltech (U.S.)

- Adisseo (France)

- ADDCON GmbH (Germany)

- Kemin Industries, Inc. (U.S.)

- Lucta (Spain)

- Brookside Agra (India)

- MIAVIT GmbH (Germany)

- JH Biotech, Inc. (U.S.)

- DuPont (U.S.)

- ADM (U.S.)

- Chr. Hansen Holdings A/S (Denmark)

Latest Developments in Global Swine Feed Additives Market

- In September 2025, ADM and Alltech announced the formation of a North American animal‑feed joint venture aimed at combining their expertise and resources to provide a broader portfolio of feed‑additive solutions for swine producers. This strategic collaboration is expected to strengthen supply‑chain efficiency, expand access to advanced feed additives, and enhance R&D capabilities. By offering integrated solutions, the venture will enable producers to adopt high‑margin specialty additives, increase competitiveness, and stimulate growth in the North American swine feed additives market

- In January 2025, Layn Natural Ingredients introduced a line of water‑soluble polyphenol feed additives for swine and poultry, designed for administration via drinking water to allow precise dosing and rapid absorption during stress periods such as heat or mycotoxin exposure. This product launch provides a novel method for delivering functional additives, enhancing animal performance and health, and supports the shift toward natural and botanical feed solutions, increasing demand for innovative feed additives and driving overall market adoption

- In January 2025, Novus International, Inc. partnered with Resilient Biotics to develop a microbial feed solution targeting respiratory disease challenges in pigs, leveraging microbiome technology to strengthen immune response and overall performance. This collaboration emphasizes the growing importance of precision nutrition and functional feed solutions in swine production, and by addressing immune health and disease prevention, it is likely to accelerate adoption of microbial and biotech-based additives, enhancing market demand for advanced swine feed formulations

- In October 2024, Phibro Animal Health Corporation completed the acquisition of Zoetis Inc.’s medicated feed additive and water‑soluble product portfolio, comprising over 37 product lines across approximately 80 countries. The acquisition significantly expands Phibro’s global reach in swine feed additives, increasing product availability and distribution, strengthening competitive positioning, broadening the portfolio, and enabling access to new markets, thereby driving growth and market consolidation in the global swine feed additives sector

- In June 2024, Kemin Industries launched “FORMYL,” an advanced feed acidifier combining encapsulated calcium formate and citric acid, designed to support gut health, pathogen control, and reduced antibiotic usage in swine diets. This product introduction reflects the industry’s trend toward non-antibiotic growth promoters and gut-health-focused feed additives, encouraging adoption of functional, performance-enhancing ingredients in swine nutrition, increasing demand for specialty additives, and contributing to overall market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.